Tax Avoidance as an Ethical Issue for Business - Institute of ...

Tax Avoidance as an Ethical Issue for Business - Institute of ...

Tax Avoidance as an Ethical Issue for Business - Institute of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 4<br />

<strong>Tax</strong> avoid<strong>an</strong>ce <strong>as</strong> <strong>an</strong> ethical issue <strong>for</strong> business<br />

that avoid paying UK taxes.<br />

In the UK there is the proposed introduction <strong>of</strong> a General Anti-Abuse Rule (GAAR) intended to prevent<br />

those tax schemes that the government deems to be ‘abusive’ <strong>an</strong>d which David Cameron h<strong>as</strong><br />

described <strong>as</strong> “morally wrong”. However, some argue that the new legislation should be a wider <strong>an</strong>tiavoid<strong>an</strong>ce<br />

rule, though that raises difficulties over what is ‘re<strong>as</strong>onable’ behaviour, being subjective,<br />

not e<strong>as</strong>y to define <strong>an</strong>d creating too much uncertainty <strong>for</strong> business.<br />

M<strong>an</strong>y investing firms with a socially responsible m<strong>an</strong>date say they take account <strong>of</strong> comp<strong>an</strong>ies' tax<br />

practices when deciding where to invest but few actually screen out comp<strong>an</strong>ies over tax issues. One<br />

exception is the FTSE Group which h<strong>as</strong> said it w<strong>as</strong> looking into excluding comp<strong>an</strong>ies with what it called<br />

“overly aggressive tax reduction policies” from its ethical index, FTSE4Good. No timings have been<br />

confirmed on this move but the FTSE’s st<strong>an</strong>ce may reflect a future trend.<br />

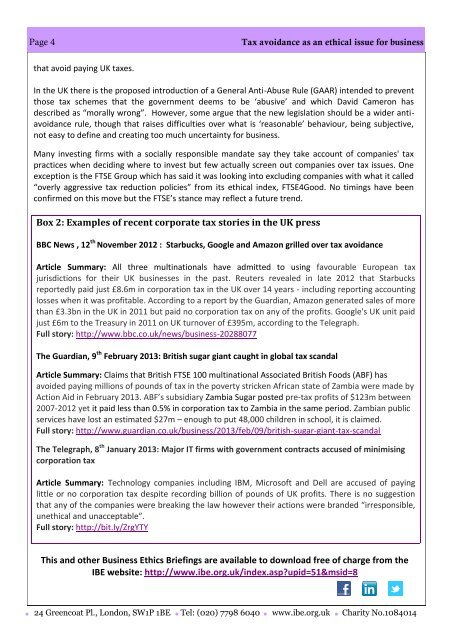

Box 2: Examples <strong>of</strong> recent corporate tax stories in the UK press<br />

BBC News , 12 th November 2012 : Starbucks, Google <strong>an</strong>d Amazon grilled over tax avoid<strong>an</strong>ce<br />

Article Summary: All three multinationals have admitted to using favourable Europe<strong>an</strong> tax<br />

jurisdictions <strong>for</strong> their UK businesses in the p<strong>as</strong>t. Reuters revealed in late 2012 that Starbucks<br />

reportedly paid just £8.6m in corporation tax in the UK over 14 years - including reporting accounting<br />

losses when it w<strong>as</strong> pr<strong>of</strong>itable. According to a report by the Guardi<strong>an</strong>, Amazon generated sales <strong>of</strong> more<br />

th<strong>an</strong> £3.3bn in the UK in 2011 but paid no corporation tax on <strong>an</strong>y <strong>of</strong> the pr<strong>of</strong>its. Google's UK unit paid<br />

just £6m to the Tre<strong>as</strong>ury in 2011 on UK turnover <strong>of</strong> £395m, according to the Telegraph.<br />

Full story: http://www.bbc.co.uk/news/business-20288077<br />

The Guardi<strong>an</strong>, 9 th February 2013: British sugar gi<strong>an</strong>t caught in global tax sc<strong>an</strong>dal<br />

Article Summary: Claims that British FTSE 100 multinational Associated British Foods (ABF) h<strong>as</strong><br />

avoided paying millions <strong>of</strong> pounds <strong>of</strong> tax in the poverty stricken Afric<strong>an</strong> state <strong>of</strong> Zambia were made by<br />

Action Aid in February 2013. ABF’s subsidiary Zambia Sugar posted pre-tax pr<strong>of</strong>its <strong>of</strong> $123m between<br />

2007-2012 yet it paid less th<strong>an</strong> 0.5% in corporation tax to Zambia in the same period. Zambi<strong>an</strong> public<br />

services have lost <strong>an</strong> estimated $27m – enough to put 48,000 children in school, it is claimed.<br />

Full story: http://www.guardi<strong>an</strong>.co.uk/business/2013/feb/09/british-sugar-gi<strong>an</strong>t-tax-sc<strong>an</strong>dal<br />

The Telegraph, 8 th J<strong>an</strong>uary 2013: Major IT firms with government contracts accused <strong>of</strong> minimising<br />

corporation tax<br />

Article Summary: Technology comp<strong>an</strong>ies including IBM, Micros<strong>of</strong>t <strong>an</strong>d Dell are accused <strong>of</strong> paying<br />

little or no corporation tax despite recording billion <strong>of</strong> pounds <strong>of</strong> UK pr<strong>of</strong>its. There is no suggestion<br />

that <strong>an</strong>y <strong>of</strong> the comp<strong>an</strong>ies were breaking the law however their actions were br<strong>an</strong>ded “irresponsible,<br />

unethical <strong>an</strong>d unacceptable”.<br />

Full story: http://bit.ly/ZrgYTY<br />

This <strong>an</strong>d other <strong>Business</strong> Ethics Briefings are available to download free <strong>of</strong> charge from the<br />

IBE website: http://www.ibe.org.uk/index.<strong>as</strong>p?upid=51&msid=8<br />

24 Greencoat Pl., London, SW1P 1BE Tel: (020) 7798 6040 www.ibe.org.uk Charity No.1084014