Measuring our performance - British American Tobacco

Measuring our performance - British American Tobacco

Measuring our performance - British American Tobacco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Measuring</strong> <strong>our</strong> <strong>performance</strong><br />

2008<br />

2009<br />

2010<br />

128.8p +19%<br />

153.0p +19%<br />

175.7p +15%<br />

(annual %)<br />

30<br />

10<br />

-10<br />

-30<br />

-50<br />

-70<br />

5<br />

-10<br />

-25<br />

Upper quartile Lower quartile<br />

(annual %)<br />

20<br />

Upper quartile Lower quartile<br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual Report 2010<br />

Business review<br />

We have a wide range of measures and indicators by which the Board assesses<br />

<strong>performance</strong> compared to the Group’s strategy. To ensure management’s focus<br />

is aligned with the interests of <strong>our</strong> shareholders, <strong>our</strong> KPIs are reflected in <strong>our</strong><br />

management incentive schemes. Although <strong>our</strong> other business measures are<br />

not directly included in management’s incentives, we believe they improve the<br />

quality of <strong>our</strong> business and contribute to shareholder value, particularly over<br />

the long term.<br />

Shareholder value<br />

Key <strong>performance</strong> indicators (KPIs)<br />

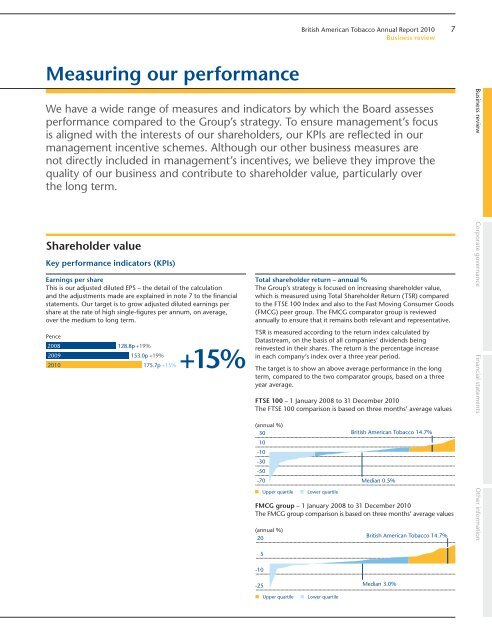

Earnings per share<br />

This is <strong>our</strong> adjusted diluted EPS – the detail of the calculation<br />

and the adjustments made are explained in note 7 to the financial<br />

statements. Our target is to grow adjusted diluted earnings per<br />

share at the rate of high single-figures per annum, on average,<br />

over the medium to long term.<br />

Pence<br />

+15%<br />

Total shareholder return – annual %<br />

The Group’s strategy is focused on increasing shareholder value,<br />

which is measured using Total Shareholder Return (TSR) compared<br />

to the FTSE 100 Index and also to the Fast Moving Consumer Goods<br />

(FMCG) peer group. The FMCG comparator group is reviewed<br />

annually to ensure that it remains both relevant and representative.<br />

TSR is measured according to the return index calculated by<br />

Datastream, on the basis of all companies’ dividends being<br />

reinvested in their shares. The return is the percentage increase<br />

in each company’s index over a three year period.<br />

The target is to show an above average <strong>performance</strong> in the long<br />

term, compared to the two comparator groups, based on a three<br />

year average.<br />

FTSE 100 – 1 January 2008 to 31 December 2010<br />

The FTSE 100 comparison is based on three months’ average values<br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> 14.7%<br />

Median 0.5%<br />

FMCG group – 1 January 2008 to 31 December 2010<br />

The FMCG group comparison is based on three months’ average values<br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> 14.7%<br />

Median 3.0%<br />

7<br />

Business review Corporate governance Financial statements Other information

8 <strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual Report 2010<br />

Business review<br />

<strong>Measuring</strong> <strong>our</strong> <strong>performance</strong> (continued)<br />

Growth<br />

Key <strong>performance</strong> indicators (KPIs)<br />

Revenue growth<br />

This figure is calculated as the revenue of the Group after the<br />

deduction of any duties, excise and other taxes, as published<br />

in the Group income statement.<br />

Our target is to grow revenue, on average over the medium<br />

to long term, by 3-4 per cent per annum.<br />

£ million %<br />

2008<br />

2009<br />

2010<br />

Billion<br />

2008<br />

2009<br />

2010<br />

%<br />

2009<br />

2010<br />

12,122 +21%<br />

14,208 +17%<br />

14,883 +5%<br />

187 +16%<br />

195 +4%<br />

208 +7%<br />

25.0<br />

25.3<br />

+5%<br />

Global Drive Brand (GDB) volume<br />

GDB volumes are calculated as the total volumes of the f<strong>our</strong> brands<br />

– Dunhill, Kent, Lucky Strike and Pall Mall – sold by <strong>our</strong> subsidiaries.<br />

Our target is to achieve high single-figure growth, on average, over<br />

the long term.<br />

+7%<br />

Group’s share of key subsidiary markets<br />

This is <strong>our</strong> retail market share in the Group’s Top 40 markets<br />

which covers around 80 per cent of the volumes of subsidiaries.<br />

The information used in this calculation is based on publicly<br />

available information and internal company analysis.<br />

Our target is to continue to grow market share.<br />

Business measures<br />

Share growth in key segments<br />

This is <strong>our</strong> overall share of volume in the Group’s Top 40 markets<br />

in three key segments: Adult Smokers Under 30 (ASU30), Premium<br />

and Fresh Taste.<br />

Our target is to maintain or grow <strong>our</strong> share of volume in each<br />

segment each year on an organic basis.<br />

2009<br />

ASU30<br />

2010<br />

2009<br />

Premium<br />

2010<br />

2009<br />

Fresh Taste<br />

2010<br />

2009<br />

ASU30<br />

2010<br />

2009<br />

Premium<br />

2010<br />

2009 29<br />

Fresh Taste<br />

2010 30<br />

25.2<br />

26.1<br />

26.5<br />

26.7<br />

25.9<br />

26.9<br />

Strategic segment volume<br />

This is <strong>our</strong> total volume sales in the Group’s Top 40 markets in three<br />

key segments: Adult Smokers Under 30 (ASU30), Premium and<br />

Fresh Taste.<br />

Our target is to maintain or grow total volume in each segment each<br />

year on an organic basis.<br />

Billion<br />

183<br />

179<br />

182<br />

177<br />

Our key strategic segments no longer include the Lights segment.<br />

Our Menthol segment has been renamed Fresh Taste and now includes<br />

Menthol and Mint, although this does not affect the reported share<br />

and volume figures for the segment and the comparisons with 2009.

Productivity<br />

Key <strong>performance</strong> indicators (KPIs)<br />

Adjusted profit from operations<br />

Profit used in this assessment is the adjusted profit from operations<br />

of the Group’s subsidiaries – adjusted for the items shown as<br />

memorandum information on the Group income statement.<br />

The Group’s target is to grow adjusted profit from operations on<br />

average by 6 per cent per annum.<br />

£ million %<br />

2008<br />

2009<br />

2010<br />

3,717 +24%<br />

4,461 +20%<br />

4,984 +12%<br />

Overheads and productivity savings<br />

Overheads are calculated as the total costs of all subsidiaries,<br />

less variable costs and less all marketing investment.<br />

Productivity savings are the savings in supply chain, overheads<br />

and indirect costs (anything other than leaf, wrapping materials,<br />

cigarette-making machinery and lab<strong>our</strong>).<br />

A specific target is set each year to contribute to the £800 million<br />

savings target set for 2012. The £800 million target was reached<br />

in 2010, two years ahead of plan.<br />

Cash flow – free cash flow<br />

Free cash flow is defined as net cash from operating activities<br />

(including dividends from associates, restructuring costs and<br />

taxation) less net interest, net capital expenditure and dividends<br />

to minorities.<br />

A specific target is set each year for free cash flow. The target for<br />

2010 was exceeded.<br />

£ million<br />

2008<br />

2009<br />

2010<br />

2,604 +52%<br />

2,630 +1%<br />

3,240 +23%<br />

+12%<br />

+23%<br />

Business measures<br />

2008<br />

2009<br />

2010<br />

2008<br />

2009<br />

2010<br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual Report 2010<br />

Business review<br />

Operating margin<br />

This is the percentage of adjusted profit from operations divided<br />

by revenue.<br />

Our target is to increase operating margin to at least 35 per cent<br />

by 2012.<br />

86<br />

30.7<br />

31.4<br />

92<br />

33.5<br />

Free cash flow as a percentage of adjusted earnings<br />

This measures <strong>our</strong> free cash flow as a ratio of the adjusted<br />

diluted earnings.<br />

Our target is to maintain the percentage figure in the mid-80s.<br />

%<br />

101<br />

9<br />

Business review Corporate governance Financial statements Other information

10 <strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual Report 2010<br />

Business review<br />

<strong>Measuring</strong> <strong>our</strong> <strong>performance</strong> (continued)<br />

Winning organisation<br />

Business measures<br />

‘Y<strong>our</strong> Voice’ employee opinion survey<br />

We collect views from employees through <strong>our</strong> ‘Y<strong>our</strong> Voice’<br />

survey once every two years to help us measure <strong>our</strong> progress<br />

in employee engagement.<br />

Our target is to achieve more positive scores than the other Fast<br />

Moving Consumer Goods (FMCG) companies in <strong>our</strong> comparator<br />

benchmark group in all areas. In 2010, scores in all categories were<br />

more positive than the FMCG benchmark, and we either maintained<br />

or improved on <strong>our</strong> 2008 score in eight of the 11 categories.<br />

Responsibility*<br />

Business measures<br />

Dow Jones Sustainability Indexes<br />

The Indexes track the economic, environmental and social<br />

<strong>performance</strong> of leading companies based on the integration<br />

of sustainability into their businesses.<br />

Our target is to achieve a higher score than the sector average in a<br />

minimum of 14 out of 18 categories. In 2010, we achieved a higher<br />

score in 17 categories.<br />

Group energy use<br />

This measure tracks Group energy use in gigajoules per million<br />

cigarettes equivalent.<br />

Our target is to reduce energy use by 6.7 per cent by 2012 from<br />

<strong>our</strong> 2007 base.<br />

2007 base<br />

2010<br />

11.82<br />

11.14<br />

Waste to landfill<br />

This measure tracks Group waste sent to landfill in tonnes per million<br />

cigarettes equivalent.<br />

Our target is to reduce waste sent to landfill in tonnes per million<br />

cigarettes equivalent by 12 per cent by 2012 from <strong>our</strong> 2007 base.<br />

2007 base<br />

2010<br />

0.018<br />

0.025<br />

2009<br />

2010<br />

2010<br />

2002 base<br />

2010<br />

2000 base<br />

Tonnes per million cigarettes equivalent Percentage of waste recycled<br />

2010<br />

2009<br />

2010<br />

0.85<br />

0.27**<br />

4.15<br />

0.37<br />

0.38*<br />

Water use<br />

This measure tracks Group water use in cubic metres per million<br />

cigarettes equivalent.<br />

Our target is to reduce water use by 48 per cent by 2012 from<br />

<strong>our</strong> 2002 base.<br />

Cubic metres per million cigarettes equivalent<br />

4.85<br />

Carbon dioxide equivalent (CO 2 e)<br />

CO 2 e is largely derived from energy consumption and we track this<br />

in tonnes per million cigarettes equivalent.<br />

Our target is to reduce Group CO 2 e by 50 per cent by 2030 from<br />

<strong>our</strong> 2000 base.<br />

Gigajoules per million cigarettes equivalent Tonnes CO 2 per million cigarettes equivalent<br />

* 2010 figures exclude <strong>performance</strong> data from <strong>our</strong> acquisition in Indonesia<br />

Lost Workday Case Incident Rate (LWCIR)<br />

The LWCIR is a standard health and safety measure that helps us<br />

measure working days lost through injury on a consistent basis<br />

year-on-year.<br />

Our global aim is to have an LWCIR of 0.2 by the end of 2012.<br />

The local target set for all of <strong>our</strong> companies is zero accidents.<br />

LWCIR: Lost workday cases through injury x 200,000 ÷ total h<strong>our</strong>s worked<br />

* Excludes Indonesia<br />

** Includes Indonesia<br />

1.38<br />

Recycling<br />

This measure tracks the total percentage of Group waste re-used<br />

or recycled against total waste generated.<br />

Our target is to recycle more than 85 per cent of waste generated<br />

in each year.<br />

83.3<br />

85.2<br />

For more information visit<br />

www.bat.com/sustainability