IIA April 2010.pdf - UAE IAA

IIA April 2010.pdf - UAE IAA

IIA April 2010.pdf - UAE IAA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Control: Internal audit should assist<br />

the organisation in maintaining effective<br />

controls by evaluating their effectiveness<br />

and efficiency and by promoting continuous<br />

improvement.<br />

Governance: Internal audit should assess<br />

and make appropriate recommendations<br />

for improving the governance process<br />

in its accomplishment of the following<br />

objectives:<br />

• Promoting appropriate ethics and values<br />

within the organisation.<br />

• Ensuring effective organisational<br />

performance management and<br />

accountability.<br />

• Effectively communicating risk and<br />

control information to appropriate<br />

areas of the organisation.<br />

• Effectively coordinating the activities and<br />

communicating information among the<br />

board, external and internal auditors<br />

and management.<br />

What type of work?<br />

So, what should be the range and type<br />

of work carried out by internal audit for<br />

an organisation? The <strong>IIA</strong> believes that the<br />

work and methods of internal audit should<br />

encompass:<br />

• Conducting enterprise risk assessment.<br />

• Utilizing risk and control selfassessment.<br />

• Using internal control processes based<br />

on COSO (Committee of Sponsoring<br />

Organisations) guidelines.<br />

• Partnering with management.<br />

• Integrating corporate governance into<br />

practice.<br />

• Increasing staff performance.<br />

• Communicating more effectively.<br />

• Developing staff, both personally and<br />

professionally.<br />

• Using technology to increase staff<br />

efficiency.<br />

• Establishing an assurance function.<br />

• Providing consulting services.<br />

• Conducting audits in emerging areas.<br />

• Utilizing performance measures.<br />

This leads to the types of internal audit<br />

provided by the internal audit function, which<br />

may include some or all of the following:<br />

Compliance audit: The review of both<br />

financial and operating controls and<br />

transactions to see how they conform to<br />

established laws, standards, regulations and<br />

procedures.<br />

Financial audit: The examination of the<br />

financial records and reports of a company<br />

to verify that the figures in the financial<br />

reports are relevant, accurate and complete.<br />

The general focus is on making sure that all<br />

assets and liabilities are properly recorded<br />

on the balance sheet and that the statement<br />

of income and expenses is correct.<br />

Information technology (IT) audit: A<br />

review of the controls within an entity’s<br />

technology infrastructure. These reviews<br />

are typically performed in conjunction<br />

with a financial statement audit, internal<br />

audit review, or other form of attestation<br />

engagement.<br />

On-demand audit: A request for an<br />

internal audit initiated by the board, audit<br />

committee, or management in response<br />

to their particular concerns, and which has<br />

not been scheduled in the internal audit<br />

plan of work. It may also be known as a<br />

management-initiated review.<br />

Operational audit: Sometimes called<br />

program or performance audits, these<br />

examine the use of resources to evaluate<br />

whether those resources are being used in<br />

the most efficient and effective way to fulfil<br />

an organisation’s objectives. An operational<br />

audit may include elements of a compliance<br />

audit, a financial audit and an information<br />

systems audit. This term is mainly used in<br />

the private sector.<br />

Performance audit: The independent and<br />

systematic examination of the management<br />

of an organisation, program, or function<br />

for the purpose of identifying whether<br />

the management is being carried out in<br />

an efficient and effective manner, and<br />

whether management practices promote<br />

improvement. This term is mainly used<br />

in the public sector, and a performance<br />

audit may be the same as or similar to an<br />

operational audit.<br />

and evaluation of all activities related to<br />

the quality of a product or service, to<br />

determine the suitability and effectiveness<br />

of the activities to meet quality goals.<br />

Value for money (VFM) audit: An<br />

examination of how resources are<br />

allocated and utilized. The audit is<br />

concerned with interrelated concepts of<br />

efficiency, effectiveness, economy, and<br />

organisational outcomes. VFM audits<br />

are more common in the public sector<br />

than the private sector since the profit<br />

criterion is lacking in the public sector, and<br />

they may be the same as or similar to a<br />

performance audit.<br />

What influences the type of work?<br />

The range and type of the internal auditor’s<br />

work depend on a number of factors:<br />

The mandate for internal audit<br />

contained in the internal audit<br />

charter: This is what the audit committee<br />

and the organisation want internal audit<br />

to do. Although ideally this should include<br />

both assurance services and consulting<br />

services, it is true to say that some audit<br />

committees and management believe that<br />

internal audit should not stray from its<br />

roots of providing assurance, so in some<br />

organisations the internal audit charter<br />

has focused only on the provision of<br />

assurance services. This attitude peaked<br />

following the corporate collapses of the<br />

1990s. However, more enlightened audit<br />

committees and management of today<br />

seek a more comprehensive internal<br />

auditing service for the organisation. This<br />

has the potential to add a lot of value,<br />

rather than just reporting what is wrong<br />

in compliance and financial areas.<br />

To whom the chief audit executive<br />

reports: The chief audit executive should<br />

report to the audit committee functionally<br />

and for operations, and to the chief<br />

executive officer for administration. Where<br />

a chief audit executive may have other<br />

reporting arrangements - for example to a<br />

chief executive officer for operations and<br />

administration, or worse, to a chief financial<br />

officer - there is a risk that internal audit<br />

may lose a measure of its independence.<br />

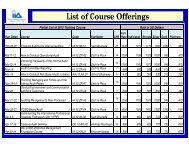

Table 4: The chief audit executive’s risk-based annual internal audit plan<br />

Compliance<br />

Assurance<br />

Consulting<br />

Financial<br />

Assurance<br />

Consulting<br />

IT<br />

Assurance<br />

Consulting<br />

Audit Type<br />

Cyclical 12<br />

months<br />

scheduled<br />

hours<br />

6,000<br />

0<br />

750<br />

250<br />

3,000<br />

3,000<br />

Rolling 6<br />

months<br />

scheduled<br />

hours<br />

0<br />

0<br />

2,500<br />

0<br />

0<br />

0<br />

Rolling 3<br />

months<br />

reserve hours<br />

0<br />

0<br />

1,000<br />

0<br />

0<br />

0<br />

This has a potential to impact negatively on<br />

the range and type of work to be performed<br />

by internal audit.<br />

The capability and skills of the internal<br />

auditors: As the work of internal audit<br />

moves toward more difficult methods<br />

of operating, the complexity of internal<br />

audit work increases. This means that the<br />

capability and skills of the internal auditor<br />

need to be greater, and many internal<br />

auditors see this as a quantum leap so great<br />

that they prefer to remain comfortable<br />

where they are.<br />

Any legislative or regulatory<br />

requirements of internal audit: The work<br />

of internal audit will nearly always have a<br />

role to provide assurance of legislative and<br />

regulatory compliance; this is an important<br />

role that should never be forgotten.<br />

Case Study<br />

Designing a Comprehensive Internal<br />

Audit Plan<br />

A large public sector organisation with<br />

Rolling 3<br />

months<br />

unassigned<br />

hours<br />

0<br />

0<br />

500<br />

0<br />

0<br />

0<br />

Annual total<br />

hours<br />

6,000<br />

0<br />

4,750<br />

250<br />

3,000<br />

3,000<br />

Operational / Performance<br />

Assurance / Consulting 500 2,500 1,000 1,000 5,000<br />

Internal audit planning 500 0 0 0 500<br />

Audit monitor and follow-up 500 0 0 0 500<br />

Audit committee 500 0 0 0 500<br />

External audit co-ordination 1,500 0 0 0 1,500<br />

Quality audit: The systematic examination<br />

Total 25,000<br />

18 <strong>April</strong> 2010 19 <strong>April</strong> 2010