Executive summary - Imperial College London

Executive summary - Imperial College London

Executive summary - Imperial College London

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

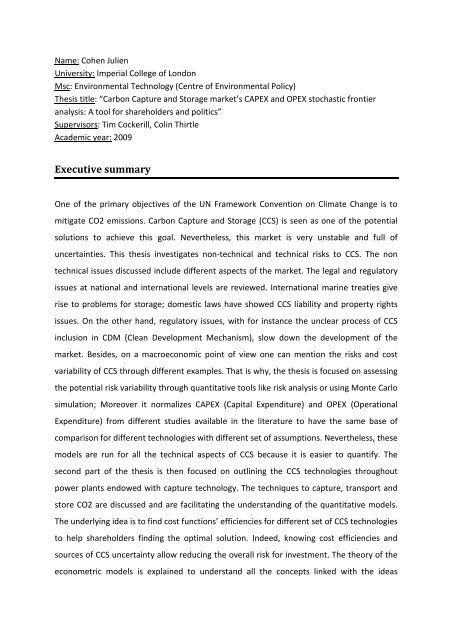

Name: Cohen Julien<br />

University: <strong>Imperial</strong> <strong>College</strong> of <strong>London</strong><br />

Msc: Environmental Technology (Centre of Environmental Policy)<br />

Thesis title: “Carbon Capture and Storage market’s CAPEX and OPEX stochastic frontier<br />

analysis: A tool for shareholders and politics”<br />

Supervisors: Tim Cockerill, Colin Thirtle<br />

Academic year: 2009<br />

<strong>Executive</strong> <strong>summary</strong><br />

One of the primary objectives of the UN Framework Convention on Climate Change is to<br />

mitigate CO2 emissions. Carbon Capture and Storage (CCS) is seen as one of the potential<br />

solutions to achieve this goal. Nevertheless, this market is very unstable and full of<br />

uncertainties. This thesis investigates non-technical and technical risks to CCS. The non<br />

technical issues discussed include different aspects of the market. The legal and regulatory<br />

issues at national and international levels are reviewed. International marine treaties give<br />

rise to problems for storage; domestic laws have showed CCS liability and property rights<br />

issues. On the other hand, regulatory issues, with for instance the unclear process of CCS<br />

inclusion in CDM (Clean Development Mechanism), slow down the development of the<br />

market. Besides, on a macroeconomic point of view one can mention the risks and cost<br />

variability of CCS through different examples. That is why, the thesis is focused on assessing<br />

the potential risk variability through quantitative tools like risk analysis or using Monte Carlo<br />

simulation; Moreover it normalizes CAPEX (Capital Expenditure) and OPEX (Operational<br />

Expenditure) from different studies available in the literature to have the same base of<br />

comparison for different technologies with different set of assumptions. Nevertheless, these<br />

models are run for all the technical aspects of CCS because it is easier to quantify. The<br />

second part of the thesis is then focused on outlining the CCS technologies throughout<br />

power plants endowed with capture technology. The techniques to capture, transport and<br />

store CO2 are discussed and are facilitating the understanding of the quantitative models.<br />

The underlying idea is to find cost functions’ efficiencies for different set of CCS technologies<br />

to help shareholders finding the optimal solution. Indeed, knowing cost efficiencies and<br />

sources of CCS uncertainty allow reducing the overall risk for investment. The theory of the<br />

econometric models is explained to understand all the concepts linked with the ideas

developed above. The cost efficiencies’ findings are found through a stochastic frontier<br />

analysis along with the findings of CAPEX and OPEX production functions. For a specific type<br />

of power plant endowed with capture technology, the econometric models provide the<br />

associated cost efficiency (i.e. are investors minimizing their costs?) and uncertainties (the<br />

objective is to know which parameters can vary a lot in terms of costs from one power plant<br />

to another); the latter is given to help investors to improve the CCS plant’s efficiency. Once<br />

this is done, the “learning by doing” principle (using learning curve theory) allows in a<br />

different way to know which investment is going to be the more successful on a long term<br />

basis. Nevertheless, non-technical aspects, once quantified, can give a different insight on<br />

the market because of its impact compared to the models run with only the technical<br />

parameters. This other kind of work is also performed in order to issue policy implications<br />

and is a method to clarify and improve the development of the CCS market. A numerous<br />

numbers of assumptions were necessary to develop and find relevant results. Nevertheless,<br />

it has also introduced a bias which is considered all along the thesis and lead to some model<br />

limitations. This is also through this entire set of models that risks can be reduced. In other<br />

words, all the models work hand in hand and are not independent to each other. The main<br />

conclusions of these models can be summarized as follows and are discussed at the same<br />

time:<br />

As a matter of efficiencies, it seems that through the literature (46 studies in that case) IGCC<br />

(Integrated Gas Combined Cycle) plants even with different set of technologies (different<br />

capture methods, different gasifiers, retrofitted or not on an existing power plant) are the<br />

most cost efficient ones. It means that in terms of CAPEX and OPEX it better minimizes their<br />

cost than any other plant. Then, there are NGCC (Natural Gas Combined Cycle), PC<br />

(Pulverized Coal) and the less efficient and more risky one, OXYFUEL (pure oxygen<br />

combustion) plants. Indeed, even if it is the less effective one, it also has the highest<br />

standard deviation relative to its peer. This means that OXYFUEL cost efficiencies vary a lot<br />

from one study to another and on average remain low. The risk analysis and the Monte<br />

Carlo simulation show the same results that for the stochastic frontier analysis (cost<br />

efficiency analysis) which confirms the previous conclusion. Another interesting finding is<br />

that the bigger is the power plant the bigger is the uncertainty with an important rise of risk<br />

for investors. It again proves that the market is unstable and needs small CCS plants for now,<br />

bigger one are not mastered in terms of technologies. Interestingly enough, on a long term

asis (based on the “learning by doing” principle), IGCC seems one more time to be the<br />

better option followed by PC and then NGCC and OXYFUEL. One can say that the general<br />

trends found are supported by the different models run. Besides, policy implications<br />

showed that quantifying qualitative issues and introduce it into the models could entirely<br />

change the results found in this study and then draw different trends and conclusions.<br />

Nevertheless, it has been demonstrated throughout few examples that if non technical<br />

issues were solved in order to facilitate CCS’ development, trends should be quite the same<br />

with less risk and better cost minimization; but, for now, a lack of transparency and hurdles<br />

at different levels prevent the full development of this market (non technical issues<br />

developed earlier). At least, it is slowed down and deters stakeholders and/or investors to<br />

be part of the market. Nevertheless, the results presented above shows that no general<br />

trends are easy to draw especially because of the number of assumptions made. A different<br />

strategy should be used. Each technology having its strengths and weaknesses, investors<br />

should then carry a step by step analysis and be focused on the weaknesses of each<br />

technology to make it stronger without removing the established strengths. Some trends<br />

associated with sometimes strong assumptions have been drawn but the market is still too<br />

uncertain for only one technology to be trusted. The recommendation here is for example<br />

to take IGCC plant with business plan’s set of assumptions and to conduct all the different<br />

analysis carried in this study and draw at each step conclusions. Finally, every investor with<br />

a specific case (a certain power plant with a certain set of technologies) can rank its cost<br />

strategy among competitors (represented here by the 46 studies) and minimize its risk if<br />

each one of them accepts the models’ assumptions.