TC SUNY VDC April Webinar PPT - The State University of New York

TC SUNY VDC April Webinar PPT - The State University of New York

TC SUNY VDC April Webinar PPT - The State University of New York

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

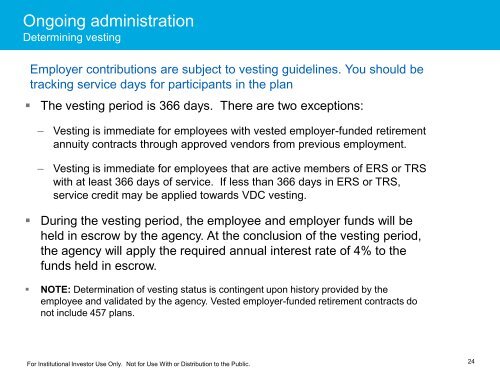

Ongoing administration<br />

Determining vesting<br />

Employer contributions are subject to vesting guidelines. You should be<br />

tracking service days for participants in the plan<br />

• <strong>The</strong> vesting period is 366 days. <strong>The</strong>re are two exceptions:<br />

– Vesting is immediate for employees with vested employer-funded retirement<br />

annuity contracts through approved vendors from previous employment.<br />

– Vesting is immediate for employees that are active members <strong>of</strong> ERS or TRS<br />

with at least 366 days <strong>of</strong> service. If less than 366 days in ERS or TRS,<br />

service credit may be applied towards <strong>VDC</strong> vesting.<br />

• During the vesting period, the employee and employer funds will be<br />

held in escrow by the agency. At the conclusion <strong>of</strong> the vesting period,<br />

the agency will apply the required annual interest rate <strong>of</strong> 4% to the<br />

funds held in escrow.<br />

• NOTE: Determination <strong>of</strong> vesting status is contingent upon history provided by the<br />

employee and validated by the agency. Vested employer-funded retirement contracts do<br />

not include 457 plans.<br />

For Institutional Investor Use Only. Not for Use With or Distribution to the Public.<br />

24