Icelandair Group Annual Report 2007

Icelandair Group Annual Report 2007

Icelandair Group Annual Report 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes, contd.:<br />

83<br />

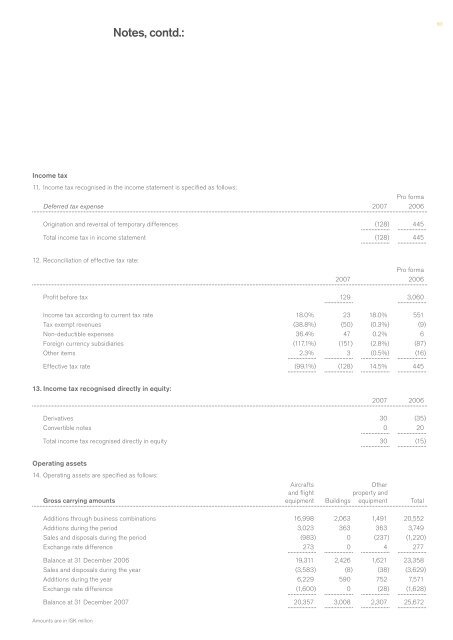

Income tax<br />

11. Income tax recognised in the income statement is specified as follows:<br />

Pro forma<br />

Deferred tax expense <strong>2007</strong> 2006<br />

Origination and reversal of temporary differences (128 ) 445<br />

Total income tax in income statement (128 ) 445<br />

12. Reconciliation of effective tax rate:<br />

Pro forma<br />

<strong>2007</strong> 2006<br />

Profit before tax 129 3,060<br />

Income tax according to current tax rate 18.0% 23 18.0% 551<br />

Tax exempt revenues (38.8%) (50) (0.3%) (9)<br />

Non-deductible expenses 36.4% 47 0.2% 6<br />

Foreign currency subsidiaries (117.1% ) (151 ) (2.8%) (87)<br />

Other items 2.3% 3 (0.5%) (16 )<br />

Effective tax rate (99.1% ) (128 ) 14.5% 445<br />

13. Income tax recognised directly in equity:<br />

<strong>2007</strong> 2006<br />

Derivatives 30 (35 )<br />

Convertible notes 0 20<br />

Total income tax recognised directly in equity 30 (15 )<br />

Operating assets<br />

14. Operating assets are specified as follows:<br />

Aircrafts<br />

Other<br />

and flight<br />

property and<br />

Gross carrying amounts equipment Buildings equipment Total<br />

Additions through business combinations 16,998 2,063 1,491 20,552<br />

Additions during the period 3,023 363 363 3,749<br />

Sales and disposals during the period (983) 0 (237) (1,220 )<br />

Exchange rate difference 273 0 4 277<br />

Balance at 31 December 2006 19,311 2,426 1,621 23,358<br />

Sales and disposals during the year (3,583) (8) (38) (3,629)<br />

Additions during the year 6,229 590 752 7,571<br />

Exchange rate difference (1,600 ) 0 (28) (1,628 )<br />

Balance at 31 December <strong>2007</strong> 20,357 3,008 2,307 25,672<br />

Amounts are in ISK million