Office Insight - Jones Lang LaSalle

Office Insight - Jones Lang LaSalle

Office Insight - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong> Americas Research • Boston <strong>Office</strong> <strong>Insight</strong> • Q2 2012 2<br />

Tenant perspective<br />

Rent growth continues to be relegated to key, hot submarkets like<br />

Cambridge and the Seaport District. Areas north of the city like Burlington<br />

that are in the high tech corridor are exhibiting rising rents and high levels<br />

of net absorption as well. The South continues to lag as it contends with<br />

large blocks of space once used as back office Financial Services space.<br />

Tenants are truly selecting space and submarkets that meet their<br />

objectives from a branding and talent attraction standpoint if they can<br />

afford the space. As vacancy drops in key submarkets, demand is spilling<br />

into neighboring areas but some tenants like State Street Bank, Liberty<br />

Mutual, Ironwood, Vertex and Biogen are all choosing to build their own<br />

space in tight submarkets versus occupying existing buildings in looser<br />

areas. We are also starting to see spec office space in the construction<br />

pipeline (fully financed by developer) but a testament to the belief that<br />

tenants will pay a premium for new space.<br />

Landlord perspective<br />

Asking rents rose only 0.5 percent in the second quarter but landlords in<br />

the various submarkets are exposed to very different set of dynamics.<br />

Landlords continue to play offensively in the healthiest submarkets like<br />

Cambridge and the Seaport District. In the suburbs, 128/Mass Pike and<br />

the high tech corridor in the north continues to exhibit landlord favorable<br />

conditions. The first speculative office space is being built in Burlington<br />

speaking to the bullish sentiment that tenants will chose location and<br />

newer space over older space in secondary or tertiary submarkets.<br />

Landlords in these outer suburbs are struggling to attract tenants and look<br />

to create an urban feel in a suburban environment wherever and<br />

whenever they can. Troubled assets are also an issue in the outer<br />

suburbs with almost 10 percent of the space in 495/Mass Pike for<br />

example (equaling over 1.3 million square feet) in some form of trouble.<br />

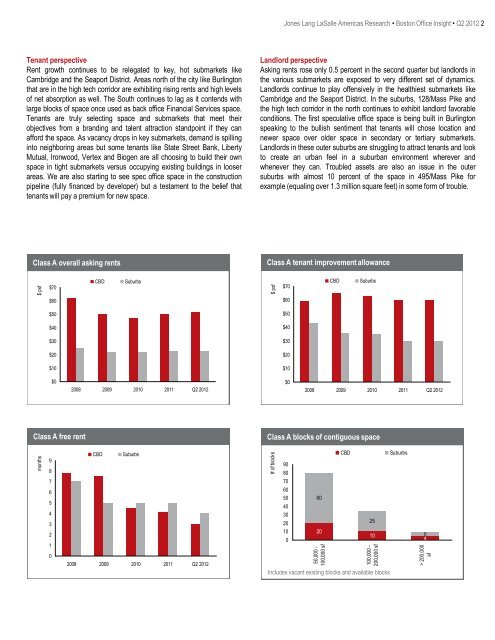

Class A overall asking rents<br />

Class A tenant improvement allowance<br />

$ psf<br />

$70<br />

CBD<br />

Suburbs<br />

$ psf<br />

$70<br />

CBD<br />

Suburbs<br />

$60<br />

$60<br />

$50<br />

$50<br />

$40<br />

$40<br />

$30<br />

$30<br />

$20<br />

$20<br />

$10<br />

$10<br />

$0<br />

2008 2009 2010 2011 Q2 2012<br />

$0<br />

2008 2009 2010 2011 Q2 2012<br />

Class A free rent<br />

Class A blocks of contiguous space<br />

months<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

CBD<br />

Suburbs<br />

2008 2009 2010 2011 Q2 2012<br />

# of blocks<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

60<br />

20<br />

50,000 -<br />

100,000 sf<br />

CBD<br />

25<br />

10<br />

100,000 -<br />

200,000 sf<br />

Includes vacant existing blocks and available blocks<br />

Suburbs<br />

5<br />

4<br />

> 200,000<br />

sf