I. Multiple Choice Section (30 points).

I. Multiple Choice Section (30 points).

I. Multiple Choice Section (30 points).

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

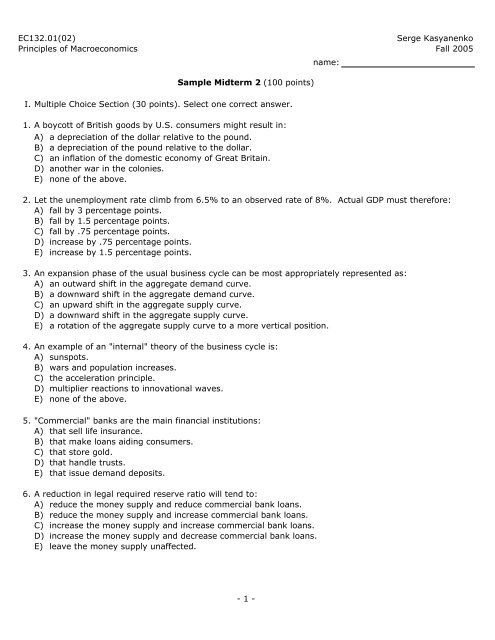

EC132.01(02)<br />

Serge Kasyanenko<br />

Principles of Macroeconomics Fall 2005<br />

Sample Midterm 2 (100 <strong>points</strong>)<br />

I. <strong>Multiple</strong> <strong>Choice</strong> <strong>Section</strong> (<strong>30</strong> <strong>points</strong>). Select one correct answer.<br />

1. A boycott of British goods by U.S. consumers might result in:<br />

A) a depreciation of the dollar relative to the pound.<br />

B) a depreciation of the pound relative to the dollar.<br />

C) an inflation of the domestic economy of Great Britain.<br />

D) another war in the colonies.<br />

E) none of the above.<br />

name:<br />

2. Let the unemployment rate climb from 6.5% to an observed rate of 8%. Actual GDP must therefore:<br />

A) fall by 3 percentage <strong>points</strong>.<br />

B) fall by 1.5 percentage <strong>points</strong>.<br />

C) fall by .75 percentage <strong>points</strong>.<br />

D) increase by .75 percentage <strong>points</strong>.<br />

E) increase by 1.5 percentage <strong>points</strong>.<br />

3. An expansion phase of the usual business cycle can be most appropriately represented as:<br />

A) an outward shift in the aggregate demand curve.<br />

B) a downward shift in the aggregate demand curve.<br />

C) an upward shift in the aggregate supply curve.<br />

D) a downward shift in the aggregate supply curve.<br />

E) a rotation of the aggregate supply curve to a more vertical position.<br />

4. An example of an "internal" theory of the business cycle is:<br />

A) sunspots.<br />

B) wars and population increases.<br />

C) the acceleration principle.<br />

D) multiplier reactions to innovational waves.<br />

E) none of the above.<br />

5. "Commercial" banks are the main financial institutions:<br />

A) that sell life insurance.<br />

÷ B) that make loans aiding consumers.<br />

C) that store gold.<br />

D) that handle trusts.<br />

E) that issue demand deposits.<br />

6. A reduction in legal required reserve ratio will tend to:<br />

A) reduce the money supply and reduce commercial bank loans.<br />

B) reduce the money supply and increase commercial bank loans.<br />

C) increase the money supply and increase commercial bank loans.<br />

÷ D) increase the money supply and decrease commercial bank loans.<br />

E) leave the money supply unaffected.<br />

- 1 -

7. If all commercial banks were forced to keep 100 percent reserves on checking and saving accounts:<br />

A) no financial institution would make loans.<br />

B) multiple money creation would not be possible.<br />

÷ C) people could not have the modern convenience of check writing.<br />

D) all of the above would be true.<br />

E) none of the above would be true.<br />

8. Demand deposits are included as a form of money because:<br />

A) the government or central bank authorizes their use.<br />

B) there is gold to back them.<br />

C) people believe there is gold to back them.<br />

D) people can buy goods with them.<br />

E) people are ordered to accept them.<br />

9. The money-supply multiplier assumes that:<br />

A) all new money is deposited in checking accounts.<br />

B) individuals do not retain cash balances.<br />

C) banks do not hold excess reserves.<br />

D) all of the above.<br />

÷ E) none of the above.<br />

10. The real rate of interest is the rate of interest:<br />

A) paid on a loan after all other bank fees have been deducted.<br />

B) paid on a loan inclusive of all other bank fees and charges.<br />

C) banks charge their largest and most credit-worthy customers.<br />

÷ D) banks pay on deposits over $100,000.<br />

E) found by subtracting the inflation rate from the nominal rate.<br />

11. A Fed open-market purchase:<br />

A) increases only banks' liabilities.<br />

B) increases only banks' assets.<br />

÷ C) increases banks' assets and reduces their liabilities.<br />

D) increases banks' assets and liabilities together.<br />

E) has no effect banks' balance sheets.<br />

12. The link from monetary policy to changes in real macroeconomic variables is one that:<br />

A) depends not at all on the interest rate.<br />

B) depends only upon the sensitivity of investment to changes in the interest rate.<br />

C) depends only upon the sensitivity of demand for money to changes in the interest rate.<br />

÷ D) depends upon the sensitivity of both investment and the demand for<br />

money to changes in the interest rate.<br />

E) is direct, and works automatically within the walls of American banks.<br />

13. Required reserve ratios:<br />

A) exist primarily to ensure that deposits are safe.<br />

B) exist to penalize banks that are members of the Federal Reserve System.<br />

C) exist primarily to help the Fed control the money supply.<br />

D) exist for all of the above reasons.<br />

E) exist for none of the above reasons.<br />

- 2 -

14. In the official statistics, a worker who is so discouraged that he has<br />

stopped looking for employment is counted as:<br />

A) unemployed.<br />

÷ B) underemployed.<br />

C) in the labor force but not employed.<br />

D) not in the labor force in exactly the same way as a woman who works<br />

÷ exclusively at keeping house.<br />

E) none of the above.<br />

15. A reduction in reserve requirements of member banks tends to counter a recession by:<br />

A) raising interest rates.<br />

B) reducing excess reserves.<br />

C) increasing excess reserves.<br />

÷ D) decreasing outstanding loans.<br />

E) decreasing aggregate demand.<br />

- 3 -

II. True/False <strong>Section</strong> (20 <strong>points</strong>)<br />

For each question provide a short explanation (no more than 1-2 sentences) of your<br />

answer. Use equations if necessary<br />

1. (True/False)<br />

An increase in the discount rate would be a signal of a<br />

tightening in the money supply.<br />

2. (True/False)<br />

Growth in the labor force is the only identified source of<br />

growth in potential GDP.<br />

3. (True/False)<br />

If the Federal Reserve buys bonds, and the sellers prefer to<br />

keep the proceeds in currency, then the potential increase in<br />

the total money supply will be smaller than if they keep the<br />

proceeds in banks.<br />

4. (True/False)<br />

If the reserve requirement were 100%, then the money<br />

multiplier would equal 0.<br />

- 4 -

III. Definitions (20 <strong>points</strong>)<br />

For every question, give a short definition of all three terms and explain the link between<br />

the first two terms and the third one, shown in bold.<br />

1. (i) Open Market Operations, (iii) Money Supply, (iii) Interest Rate:<br />

2. (i) Nominal Interest Rate, (ii) Inflation Rate, (iii) Real Interest Rate:<br />

- 5 -

IV. Graphs (15 <strong>points</strong>)<br />

Use a separate diagram to answer each question. Label all axes, indicate initial equilibrium<br />

and show the direction of a change. Label the final state of the economy. If necessary,<br />

provide a short description for each graph.<br />

1.<br />

Show the effect of the higher government<br />

expenditure on the current account of an<br />

open economy.<br />

2.<br />

Show the effect of the higher reserve<br />

requirement on the interest rate in the<br />

economy.<br />

3.<br />

Show the effect of the higher minimum<br />

wage on the number of unemployed<br />

workers in the economy.<br />

- 6 -

V. Essay (15 <strong>points</strong>)<br />

The Fed is concerned with rising unemployment in the economy and is trying to design<br />

measures to mitigate economic slowdown.<br />

a.<br />

Briefly describe what policies the Fed can implement to achieve this target.<br />

b. Choose one of the policies, you suggested in the previous question, and track its effect on<br />

the financial system, given that the initial state of the Fed and commercial banks is<br />

described as:<br />

(Use the same steps as in the problem set)<br />

Reserve Requirement 10%<br />

Federal Reserve Balance Sheet<br />

Balance Sheet of Commercial Banks<br />

Assets<br />

Liabilities<br />

Assets<br />

Liabilities<br />

Securities <strong>30</strong>0 Currency 250 Reserves 50 Dem. Dep. 500<br />

Reserves 50 Loans 450<br />

Total <strong>30</strong>0 Total <strong>30</strong>0 Total 500 Total 500<br />

Policy description:<br />

Instrument Chosen:<br />

Size of the Instrument:<br />

(i) Immediate Change<br />

Federal Reserve Balance Sheet<br />

Balance Sheet of Commercial Banks<br />

Assets Liabilities Assets Liabilities<br />

Securities Currency Reserves Dem. Dep.<br />

Reserves<br />

Loans<br />

Total Total Total Total<br />

(ii) Final Adjustment<br />

Federal Reserve Balance Sheet<br />

Balance Sheet of Commercial Banks<br />

Assets Liabilities Assets<br />

Liabilities<br />

Securities Currency Reserves Dem. Dep.<br />

Reserves<br />

Loans<br />

Total Total Total Total<br />

- 7 -

. Using graphs, show the effect of this policy on the interest rates, prices and output. If<br />

necessary, provide a short description of your graphs.<br />

- 8 -