2102 Cheat Sheets and Help Sheets - Workers' Compensation ...

2102 Cheat Sheets and Help Sheets - Workers' Compensation ...

2102 Cheat Sheets and Help Sheets - Workers' Compensation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

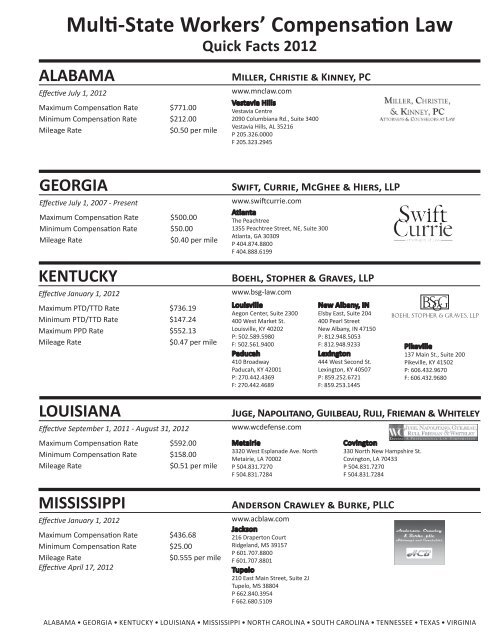

Multi-State Workers’ <strong>Compensation</strong> Law<br />

Quick Facts 2012<br />

ALABAMA<br />

Effective July 1, 2012<br />

Maximum <strong>Compensation</strong> Rate $771.00<br />

Minimum <strong>Compensation</strong> Rate $212.00<br />

Mileage Rate<br />

$0.50 per mile<br />

Miller, Christie & Kinney, PC<br />

www.mnclaw.com<br />

Vestavia Hills<br />

Vestavia Centre<br />

2090 Columbiana Rd., Suite 3400<br />

Vestavia Hills, AL 35216<br />

P 205.326.0000<br />

F 205.323.2945<br />

GEORGIA<br />

Effective July 1, 2007 - Present<br />

Maximum <strong>Compensation</strong> Rate $500.00<br />

Minimum <strong>Compensation</strong> Rate $50.00<br />

Mileage Rate<br />

$0.40 per mile<br />

KENTUCKY<br />

Effective January 1, 2012<br />

Maximum PTD/TTD Rate $736.19<br />

Minimum PTD/TTD Rate $147.24<br />

Maximum PPD Rate $552.13<br />

Mileage Rate<br />

$0.47 per mile<br />

LOUISIANA<br />

Effective September 1, 2011 - August 31, 2012<br />

Maximum <strong>Compensation</strong> Rate $592.00<br />

Minimum <strong>Compensation</strong> Rate $158.00<br />

Mileage Rate<br />

$0.51 per mile<br />

MISSISSIPPI<br />

Effective January 1, 2012<br />

Maximum <strong>Compensation</strong> Rate $436.68<br />

Minimum <strong>Compensation</strong> Rate $25.00<br />

Mileage Rate<br />

$0.555 per mile<br />

Effective April 17, 2012<br />

Swift, Currie, McGhee & Hiers, LLP<br />

www.swiftcurrie.com<br />

Atlanta<br />

The Peachtree<br />

1355 Peachtree Street, NE, Suite 300<br />

Atlanta, GA 30309<br />

P 404.874.8800<br />

F 404.888.6199<br />

Boehl, Stopher & Graves, LLP<br />

www.bsg-law.com<br />

Louisville<br />

Aegon Center, Suite 2300<br />

400 West Market St.<br />

Louisville, KY 40202<br />

P: 502.589.5980<br />

F: 502.561.9400<br />

Paducah<br />

410 Broadway<br />

Paducah, KY 42001<br />

P: 270.442.4369<br />

F: 270.442.4689<br />

New Albany, IN<br />

Elsby East, Suite 204<br />

400 Pearl Street<br />

New Albany, IN 47150<br />

P: 812.948.5053<br />

F: 812.948.9233<br />

Lexington<br />

444 West Second St.<br />

Lexington, KY 40507<br />

P: 859.252.6721<br />

F: 859.253.1445<br />

Pikeville<br />

137 Main St., Suite 200<br />

Pikeville, KY 41502<br />

P: 606.432.9670<br />

F: 606.432.9680<br />

Juge, Napolitano, Guilbeau, Ruli, Frieman & Whiteley<br />

www.wcdefense.com<br />

Metairie<br />

3320 West Esplanade Ave. North<br />

Metairie, LA 70002<br />

P 504.831.7270<br />

F 504.831.7284<br />

www.acblaw.com<br />

Jackson<br />

216 Draperton Court<br />

Ridgel<strong>and</strong>, MS 39157<br />

P 601.707.8800<br />

F 601.707.8801<br />

Tupelo<br />

210 East Main Street, Suite 2J<br />

Tupelo, MS 38804<br />

P 662.840.3954<br />

F 662.680.5109<br />

Covington<br />

330 North New Hampshire St.<br />

Covington, LA 70433<br />

P 504.831.7270<br />

F 504.831.7284<br />

Anderson Crawley & Burke, PLLC<br />

Alabama • Georgia • KENTUCKY • louisiana • Mississippi • North Carolina • South Carolina • Tennessee • Texas • VIRGINIA

Multi-State Workers’ <strong>Compensation</strong> Law<br />

Quick Facts 2012<br />

NORTH CAROLINA<br />

Effective January 1, 2012<br />

Maximum <strong>Compensation</strong> Rate $862.00<br />

Minimum <strong>Compensation</strong> Rate $30.00<br />

Mileage Rate<br />

$0.55 per mile<br />

SOUTH CAROLINA<br />

Effective January 1, 2012<br />

Maximum <strong>Compensation</strong> Rate $725.47<br />

Minimum <strong>Compensation</strong> Rate $75.00<br />

Mileage Rate<br />

$0.555 per mile<br />

Effective July 1, 2012<br />

McAngus Goudelock & Courie<br />

www.mgclaw.com<br />

Columbia<br />

1320 Main Street, 10th Floor<br />

Columbia, SC 29201<br />

P 803.779.2300<br />

F 803.748.0526<br />

Charleston<br />

735 Johnnie Dodds Blvd., Suite 200<br />

Mt. Pleasant, SC 29464<br />

P 843.576.2900<br />

F 843.534.0605<br />

Raleigh<br />

5400 Glenwood Avenue, Suite 100<br />

Raleigh, NC 27612<br />

P 919.719.8200<br />

F 919.510.9825<br />

Charlotte<br />

6302 Fairview Road, Suite 700<br />

Charlotte, NC 28210<br />

P 704.643.6303<br />

F 704.643.2376<br />

Greenville<br />

75 Beattie Place, Suite 300<br />

Greenville, SC 29601<br />

P 864.239.4000<br />

F 864.242.3199<br />

Myrtle Beach<br />

2411 North Oak Street, Suite 401<br />

Myrtle Beach, SC 29577<br />

P 843.848.6000<br />

F 843.449.2306<br />

TENNESSEE<br />

Effective July 1, 2012 - June 30, 2013<br />

Maximum Permanent Partial Disability $806.00<br />

Maximum Temporary Total Disability $886.60<br />

TTD/PPD Minimum Weekly Benefit $120.90<br />

Mileage Rate<br />

$0.47 per mile<br />

Effective August 1, 2011<br />

Manier & Herod<br />

www.manierherod.com<br />

Nashville<br />

One Nashville Place, Suite 2200<br />

150 Fourth Avenue North<br />

Nashville, Tennessee 37219<br />

P 615.244.0030<br />

F 615.242.4203<br />

TEXAS<br />

Effective October 1, 2011 - September 30, 2012<br />

Maximum Temporary Income $787.00<br />

Benefits & Lifetime Income Benefits<br />

Maximum Impairment Income $551.00<br />

Benefits & Supplemental Income Benefits<br />

Minimum <strong>Compensation</strong> Rate $118.00<br />

Mileage Rate<br />

$0.555 per mile<br />

Effective January 1, 2012<br />

VIRGINIA<br />

Effective July 1, 2012<br />

Maximum <strong>Compensation</strong> Rate $935.00<br />

Minimum <strong>Compensation</strong> Rate $233.75<br />

Mileage Rate<br />

$0.555 per mile<br />

Effective October 1, 2011<br />

Flahive, Ogden & Latson, PC<br />

www.fol.com<br />

Austin<br />

8911 Capital of Texas Hwy.<br />

Building 3, Suite 3300<br />

Austin, TX 78759<br />

P 512.477.4405<br />

F 512.867.1700<br />

Midkiff, Muncie & Ross, PC<br />

www.midkifflaw.com<br />

Richmond<br />

300 Arboretum Place, Suite 420<br />

Richmond, VA 23236<br />

P 804.560.9600<br />

F 804.560.5997<br />

Oakton<br />

10461 White Granite Dr., Suite 225<br />

Oakton, VA 22124<br />

P 703.938.5989<br />

F 703.938.5980<br />

Bristol<br />

110 Piedmont Ave., Suite 202<br />

Bristol, VA 24201<br />

P 276.644.9600<br />

F 276.644.4679<br />

Alabama • Georgia • KENTUCKY • louisiana • Mississippi • North Carolina • South Carolina • Tennessee • Texas • VIRGINIA

ALABAMA<br />

St<strong>and</strong>ard <strong>Help</strong> Topics by State<br />

These Jurisdictional <strong>Help</strong> Screens are for informational purposes only. They should not be construed as a definitive synopsis of any state's laws, rules,<br />

or procedures. You should contact your legal counsel or Human Resources Department prior to the development of any internal policy, procedure or<br />

work rule.<br />

Topics Related to Indemnity Rates<br />

How is AWW calculated? Please include<br />

1 information regarding the earning types used to Take the 52 weeks earnings <strong>and</strong> divide by 52. You include the amount the employer pays for fringe<br />

§25‐5‐57(b) derive the AWW (i.e.: regular wages, tips,<br />

vacation, overtime, etc.).<br />

benefits if the employer stops paying for the fringe benefits. You include all wages including overtime.<br />

1.1 How is the weekly TTD rate calculated? AWW x 66 2/3% = TTD. This TTD amount is subject to the maximum <strong>and</strong> minimums set by the state.<br />

1.2 Maximum weekly TTD rate 2012 $771.00<br />

1.3 Minimum weekly TTD rate 2012 $212.00<br />

1.4<br />

How is the daily TTD calculated? Please indicate<br />

whether your state uses a 7‐day work week, a 5‐ TTD/7 = TTD Daily<br />

day work week, or something else.<br />

1.5<br />

1.6<br />

Is the employer required to continue health<br />

insurance while the employee is receiving<br />

indemnity benefits? If benefits can be<br />

terminated, does it increase the TTD rate? By<br />

how much?<br />

Does this jurisdiction use scheduled PPD ratings,<br />

unscheduled PPD ratings, or a combination of<br />

these?<br />

No. If the employer stops the health insurance, then the amount the employer paid per week is added<br />

to the AWW <strong>and</strong> therefore increases the TTD rate.<br />

Both scheduled <strong>and</strong> unscheduled.<br />

1.7 Maximum weekly PPD rate 2011 $220.00 for body as a whole<br />

1.8 Minimum weekly PPD rate 2011 No minimum<br />

1.9<br />

Is there a specific statutory rule which requires<br />

payment of PPD at a given point in the claim? If<br />

so, please describe the general provisions of the<br />

rule.<br />

No. You do not owe PPD unless a judge rules at a trial. However, you can settle <strong>and</strong> pay them.<br />

1.10<br />

Who determines the final PPD rating? Is it a<br />

physician, a judge, or someone else?<br />

Judge<br />

1.11<br />

Are there any other critical issues related to the<br />

benefit rates for this jurisdiction? If so, please<br />

describe.<br />

1.12 Benefit Offset No<br />

1.13 Cost of Living Adjustment No

2.0<br />

How is the waiting period defined? Please<br />

include information regarding the number of<br />

days, <strong>and</strong> whether these are work or calendar<br />

days.<br />

Topics Related to Initial Indemnity Payments<br />

3 calendar days<br />

2.1 Are there any “Pay without Prejudice” periods? Payment of medical benefits is not an admission of liability<br />

2.2<br />

Does the waiting period include the date of<br />

injury?<br />

Yes<br />

2.3<br />

At what point do we make a retroactive<br />

payment for the waiting period?<br />

7 days<br />

2.4 When is the first TTD payment due? 10 days<br />

2.5<br />

Can benefits be denied if light duty is refused?<br />

What must we do to document our position?<br />

Medical benefits can not. Employer does not have to pay indemnity to employee if employee refuses to<br />

return on light duty.<br />

2.6<br />

Are there any other critical issues related to the<br />

initial benefit payment for this jurisdiction? If<br />

so, please describe.<br />

Other Topics Related to Indemnity Payments<br />

3.0<br />

How often are indemnity payments issued?<br />

(weekly, biweekly, etc.)<br />

Pay based on how employee was paid.<br />

3.1<br />

Is there a statutory cap on the number of weeks<br />

paid for TTD? If so, please provide the details.<br />

No limit on weeks for TTD. PPD weeks are limited at 300 for a body as a whole, <strong>and</strong> the weeks for a<br />

scheduled member are set for thin the code. There is no limit on weeks for a PT claim as benefits are<br />

owed for life.<br />

3.2<br />

Is global settlement of both medical & indemnity<br />

Yes. However, the settlement must be court approved, <strong>and</strong> the judge has to agree.<br />

allowed? Under what conditions?<br />

3.3<br />

What are the ball park PPD ratings for soft<br />

tissue, fracture, or surgery on neck, shoulder,<br />

lumbar spine, or knees?<br />

Soft tissue 0‐5%. Fracture 0‐5%. Surgery on neck 5‐20%. Surgery on shoulder 10‐25%. Surgery on lumbar<br />

spine 0‐PTD%. Surgery on knees 10‐30%.<br />

3.4<br />

Can we settle before MMI is reached? If so,<br />

what is the criteria?<br />

No. Claimant must be at MMI before you can settle.<br />

3.5<br />

Can a voluntary resignation be obtained as part<br />

of the settlement agreement?<br />

Yes<br />

3.6<br />

Are there any other critical issues related to<br />

indemnity payments for this jurisdiction? If so,<br />

please describe.<br />

3.7<br />

What are the state rules regarding the carrier<br />

reimbursing the employer for a salary<br />

continuation program?<br />

N/A. State has nothing to do with employer <strong>and</strong> insurance company.<br />

3.8 Can indemnity checks be sent to the employer? Yes, if employee wants to pick them up at work.

Topics Related to Compensability<br />

4.0<br />

What is the statute of limitations for filing a<br />

workers’ compensation claim?<br />

2 years from date of injury or if TTD is paid from date of last payment.<br />

4.1<br />

4.2<br />

If a prospective employee is training <strong>and</strong> is<br />

injured before a formal employment agreement<br />

has been consummated, is the injury<br />

compensable?<br />

Yes, if the employer has right of control over employee.<br />

What is the Compensability Test? Please<br />

indicate whether the test is AOE <strong>and</strong> COE, versus The injury must arise out of <strong>and</strong> in the course of employment.<br />

AOE or COE.<br />

4.3<br />

Please describe any statutory deadlines for<br />

making a compensability decision.<br />

No specific timeframe. It is a reasonableness st<strong>and</strong>ard.<br />

4.4<br />

Please describe briefly any statutory defenses to<br />

a workers’ compensation claim.<br />

Wilfull misconduct, suicide/self injury, intoxication or drug impairment, preexisting, statute of<br />

limitations, notice<br />

4.5 Are volunteer workers covered?<br />

4.6<br />

Are illegal aliens covered? If not, what is needed<br />

Yes<br />

to support denial?<br />

4.7<br />

Are there special rules regarding coverage for<br />

independent contractors?<br />

Independent contractors are not covered.<br />

4.8<br />

Are cumulative trauma claims compensable? If<br />

so, under what circumstances are they<br />

compensable?<br />

Yes, must arise out of <strong>and</strong> in the course of the employment.<br />

4.9<br />

Are psychological stress claims compensable? If<br />

so, what are the rules regarding mental/mental,<br />

mental/physical, physical/mental origin?<br />

Psychological claims are compensable only if there is a physical injury.<br />

4.10<br />

Are there any other critical issues related to<br />

compensability for this jurisdiction? If so, please<br />

describe.<br />

4.11<br />

Can benefits be denied if the employee was<br />

under the influence of drugs or alcohol when<br />

injured? What levels are required (BAC) to<br />

support denial? What must we obtain to<br />

support a denial?<br />

Indemnity benefits can be denied but employer has to prove that drugs or alcohol were proximate<br />

cause of injury. Medical benefits are probably owed (no case law has ever decided).<br />

4.12 Compensability for Recreational Activities<br />

Topics Related to Death Claims<br />

5.0 What is the maximum statutory death benefit? Not to exceed 500 weeks.<br />

5.1 What is the allowance for burial expenses? $3,000<br />

5.2<br />

Describe any specific rules regarding<br />

dependency.<br />

Children (adoptive <strong>and</strong> illegitimate) are dependents until they reach majority. Spouse is dependent. If<br />

spouse remarries, they are no longer a dependent.

5.3<br />

If there are no dependents, are death benefits<br />

paid to another entity, such as a state fund?<br />

$7,500 to estate<br />

5.4<br />

Are there any other critical issues related to<br />

death benefits for this jurisdiction? If so, please<br />

describe.<br />

Topics Related to Vocational Rehabilitation<br />

6.0<br />

Is vocational rehabilitation compulsory in this<br />

jurisdiction?<br />

No, employer can compel employee to submit to retraining if plaintiff is suited for retraining.<br />

6.1<br />

Under what conditions is a claimant eligible for<br />

vocational rehabilitation?<br />

Employee unable to return to prior job because of injury. Age, pre‐injury occupation <strong>and</strong> aptitude are all<br />

considered. Need testimony from doctor <strong>and</strong> vocational expert that claimant can be retrained.<br />

6.2<br />

Generally, what types of benefits are paid for<br />

vocational rehabilitation? Are these provided by Vocational retraining is at expense of the employer.<br />

the carrier or by the state?<br />

6.3<br />

What is the exposure for terminating an<br />

You would owe TTD benefits for time from TTD stopped until claimant is at MMI.<br />

employee before they reach RTW or reach MMI?<br />

Topics Related to Financial Recoveries<br />

7.0<br />

Describe the rules for regarding the type of cases<br />

which are eligible for a second injury fund No secondary trust fund in Alabama.<br />

recovery.<br />

7.1<br />

7.2<br />

What is the statute of limitations with reference<br />

to pursuing a subrogation recovery?<br />

If the claimant does not bring a claim within the applicable statue of limitations then once the statute<br />

runs, the employer has 6 months to file the lawsuit.<br />

Describe the statute regarding our right to<br />

pursue a subrogation recovery. Does the statute The claimant does not have an obligation to protect your subrogation. You need to have in writing that<br />

give preference to our lien when a third party claimant will protect or intervene in third party case.<br />

case is resolved?<br />

7.3<br />

What formula is used to determine the amount<br />

of our recovery?<br />

For detailed answer, please contact the attorneys at Miller, Christie & Kinney at www.mnclaw.com.<br />

7.4<br />

Are there any other critical issues related to<br />

subrogation or other recoveries for this<br />

jurisdiction? If so, please describe.<br />

Topics Related to Medical Control<br />

8.0<br />

Describe the jurisdictional rules regarding<br />

employer/carrier medical control.<br />

Employer picks initial authorized doctor. If employee is dissatisfied <strong>and</strong> further treatment is necessary,<br />

then employee can request a panel of 4 to choose a new doctor from.<br />

8.1<br />

Are there restrictions regarding the scheduling of<br />

No IME unless claimant agrees, or if not, employer has to show to court that IME likely to improve<br />

an Independent Medical Exam? Does an IME<br />

medical condition.<br />

have to be authorized by a judge?<br />

8.2<br />

Are there any instances where surveillance<br />

footage is legally prohibited from being<br />

forwarded to the treating or IME doctors?<br />

No<br />

8.3<br />

Are there any other critical issues related to<br />

medical benefits for this jurisdiction? If so,<br />

please describe.<br />

8.4 IME Generalized Rules<br />

No IME unless claimant agrees, or if not, employer has to show to court that IME likely to improve<br />

medical condition.

8.5 Medical Privacy Rules<br />

Miscellaneous Topics<br />

9.0 Extraterritorial Coverage Claim can be brought in Alabama if injury in Alabama or contract for hire in Alabama.<br />

9.1 WC Jurisdictional Link(s)<br />

9.2 Sole Remedy Alabama has an exclusivity provision.<br />

9.3 Does the jurisdiction allow medical discovery? Yes<br />

9.4 Adjuster residency requirement? Must be licensed in Alabama.<br />

9.5<br />

Is there a Bad Faith cause of action available for<br />

a claimant <strong>and</strong> what is recoverable?<br />

No

GEORGIA<br />

St<strong>and</strong>ard <strong>Help</strong> Topics by State<br />

These Jurisdictional <strong>Help</strong> Screens are for informational purposes only. They should not be construed as a definitive synopsis of any State's laws, rules,<br />

or procedures. You should contact your legal counsel or Human Resources Department prior to the development of any internal policy, procedure or<br />

work rule.<br />

Topics Related to Indemnity Rates<br />

The average weekly wage is computed in accordance with O.C.G.A. § 34‐9‐260, which outlines three<br />

distinct methods of computation. The most common method is the 13‐week wage basis. If the employee<br />

has worked substantially the whole of the 13 weeks immediately preceding the date of accident, the<br />

average weekly wage is calculated averaging these weeks. Second, if the employee was not working<br />

substantially the whole of the 13 weeks preceding the date of the accident, the average weekly wage<br />

How is AWW calculated? Please include<br />

may be calculated using the 13 weeks of a similarly situated employee. Such an employee will be one<br />

1 information regarding the earning types used to<br />

who is not necessarily in the precise same job classification <strong>and</strong> pay scale as the injured employee but<br />

§25‐5‐57(b) derive the AWW (i.e.: regular wages, tips,<br />

who at least performs a similar‐type job for the same employer. The last method used to calculate the<br />

vacation, overtime, etc.).<br />

average weekly wage is the full‐time weekly wage method. This simply means that the average weekly<br />

wage will be calculated by using the hourly wage rate paid to the employee multiplied by the number of<br />

hours the employee was normally scheduled to work in a full‐time week. In Georgia, the average weekly<br />

wage basis includes tips, meal, lodging <strong>and</strong> clothing allowances, <strong>and</strong> year‐end benefits. The wage basis<br />

does not include health insurance payments by the employer.<br />

1.1 How is the weekly TTD rate calculated?<br />

TTD is calculated by taking two‐thirds of the employee's gross average weekly wage, not to exceed<br />

$500.00 per week for injuries occurring on or after July 1, 2007.<br />

1.2 Maximum weekly TTD rate 2012<br />

The maximum weekly benefits a claimant may receive for an injury occurring on or after July 1, 2007, is<br />

$500.00.<br />

1.3 Minimum weekly TTD rate 2012 The minimum weekly benefits a claimant may receive is $50.00.<br />

1.4<br />

How is the daily TTD calculated? Please indicate<br />

Unless the contrary appears, it is assumed that a normal work week is five days, that the normal work<br />

whether your state uses a 7‐day work week, a 5‐<br />

day is eight hours, <strong>and</strong> that the employee's daily wages is one‐fifth of the weekly pay.<br />

day work week, or something else.<br />

1.5<br />

1.6<br />

Is the employer required to continue health<br />

insurance while the employee is receiving<br />

indemnity benefits? If benefits can be<br />

terminated, does it increase the TTD rate? By<br />

how much?<br />

Does this jurisdiction use scheduled PPD ratings,<br />

unscheduled PPD ratings, or a combination of<br />

these?<br />

No.<br />

Georgia uses scheduled PPD ratings in accordance with O.C.G.A. § 34‐9‐263.<br />

1.7 Maximum weekly PPD rate 2012 The maximum weekly PPD rate in Georgia is $500.00 for an injury occurring on or after July 1, 2007.<br />

1.8 Minimum weekly PPD rate 2012 The minimum weekly PPD rate in Georgia is $50.00.<br />

1.9<br />

Is there a specific statutory rule which requires<br />

payment of PPD at a given point in the claim? If<br />

so, please describe the general provisions of the<br />

rule.<br />

The payment of PPD benefits are due when the claimant is no longer receiving TTD or TPD benefits for<br />

his on the job injury. O.C.G.A. § 34‐9‐263(b)(3).<br />

1.10<br />

Who determines the final PPD rating? Is it a<br />

physician, a judge, or someone else?<br />

PPD ratings are to be determined by the authorized treating physician in accordance with the Guides to<br />

the Evaluation of Permanent Impairment , Fifth Edition, published by the American Medical Association.

1.11<br />

Are there any other critical issues related to the<br />

benefit rates for this jurisdiction? If so, please<br />

describe.<br />

The maximum compensation rate is determined by the date of injury.<br />

1.12 Benefit Offset<br />

An employer/insurer may be entitled to a credit for unemployment compensation <strong>and</strong>/or weekly<br />

income benefits made on behalf of an employee pursuant to a disability plan, a wage continuation plan,<br />

or a disability insurance pollicy. Additionally, employer/insurer may be entitled to a benefit offset based<br />

on benefits paid from other jurisdication.<br />

1.13 Cost of Living Adjustment No cost of living adjustment.<br />

2.0<br />

How is the waiting period defined? Please<br />

include information regarding the number of<br />

days, <strong>and</strong> whether these are work or calendar<br />

days.<br />

Topics Related to Initial Indemnity Payments<br />

An employee is not entitled to indemnity benefits for the first seven calendar days of incapacity<br />

resulting from an on‐the‐job accident until the employee has been disabled for at least twenty‐one<br />

consecutive days. O.C.G.A. § 34‐9‐220. The day, or days, considered lost because of disability to work<br />

shall be counted from the first seven calendar days of disability even though the days may not be<br />

consecutive.<br />

2.1 Are there any “Pay without Prejudice” periods? No.<br />

2.2<br />

Does the waiting period include the date of<br />

injury?<br />

The waiting period commences on the first day the employee is unable to work a full day as a result of<br />

his on‐the‐job injury. If the employee is paid in full for the date upon which the injury occurred, the<br />

waiting period begins on the next day following the day of the injury. Board Rule 220(a).<br />

2.3<br />

At what point do we make a retroactive<br />

payment for the waiting period?<br />

An employee is entitled to payment for the first seven days of disability once he has been disabled as a<br />

result of the on‐the‐job injury for twenty‐one consecutive days. O.C.G.A. § 34‐9‐220.<br />

2.4 When is the first TTD payment due?<br />

The first payment of income benefits shall be due on the 21st day after the employer has knowledge of<br />

injury or death. O.C.G.A. § 34‐9‐221(b).<br />

2.5<br />

Can benefits be denied if light duty is refused?<br />

What must we do to document our position?<br />

O.C.G.A. § 34‐9‐240 provides: “If an employee refuses employment procured for him or her <strong>and</strong> suitable<br />

to his or her capacity, such employee shall not be entitled to any compensation, except PPD benefits, as<br />

long as such refusal continues or unless the State Board opines such refusal was justified.” An employer<br />

can show their employment opportunity is appropriately suitable to the claimant's work duty<br />

restrictions by getting written approval of the essential job duties by the authorized treating physician<br />

pursuant to a WC‐240a, executed by the authorized treating physician. See Board Rule 240.<br />

2.6<br />

Are there any other critical issues related to the<br />

initial benefit payment for this jurisdiction? If<br />

so, please describe.<br />

Not applicable.<br />

3.0<br />

How often are indemnity payments issued?<br />

(weekly, biweekly, etc.)<br />

Other Topics Related to Indemnity Payments<br />

Income benefits shall be due <strong>and</strong> payable in weekly installments <strong>and</strong> are considered paid when due<br />

when mailed from within the State of Georgia to the address specified by the employee or the address<br />

on record with the State Board. For payments mailed from outside the state of Georgia, weekly<br />

payments will be considered paid when due no later than three days prior to the due date to the<br />

claimant's specified address or address on record with the State Board. O.C.G.A. § 34‐9‐221(b).<br />

3.1<br />

3.2<br />

Is there a statutory cap on the number of weeks<br />

paid for TTD? If so, please provide the details.<br />

Pursuant to O.C.G.A. § 34‐9‐261, the statutory cap for the payment of TTD benefits is 400 weeks, unless<br />

the claimant's injury is deemed catastrophic according to O.C.G.A. § 34‐9‐200.1. There is no statutory<br />

cap on catastrophic injury claims.<br />

Yes, global settlement of both medical <strong>and</strong> indemnity benefits is allowed. Stipulations <strong>and</strong> settlement<br />

Is global settlement of both medical & indemnity agreements must be approved by the State Board. Approval by the State Board constitutes complete<br />

allowed? Under what conditions?<br />

<strong>and</strong> final disposition of the claim on account of the incident, injury or injuries referred to in the<br />

agreement. O.C.G.A. § 34‐9‐15.

3.3<br />

What are the ball park PPD ratings for soft<br />

tissue, fracture, or surgery on neck, shoulder,<br />

lumbar spine, or knees?<br />

PPD ratings are determined by a schedule that lists various portions of the body <strong>and</strong> provides a certain<br />

number of weeks of disability benefits for which the claimant will be entitled for the total loss, or total<br />

loss of use, of each portion of the body in question. O.C.G.A. § 34‐9‐263(c). Impairment ratings for the<br />

neck, back or spine are required to be whole‐person impairment ratings, according to the American<br />

Medical Association's Guides to the Evaluation of Permanent Impairment, Fifth Edition. Ratings of<br />

course vary depending on the facts of each case. Generally, the estimated PPD rating for a neck or<br />

lumbar spine surgery, for instance a single‐level fusion, is 15%‐18% to the body as a whole. As for knee<br />

surgery, the schedule provides a maximum of 225 weeks of additional disability benefits. Common knee<br />

surgeries, like repair of the MCL or ACL, should be afforded no more than a 15% to the lower extremity.<br />

Shoulder injuries <strong>and</strong> resulting surgery are considered part of the upper extremity <strong>and</strong> are to be rated as<br />

such. Therefore, a claimant may be entitled to disability benefits up to an additional 225 weeks.<br />

Common shoulder surgeries, such as rotator cuff surgery, usually warrant no more than a 5 to 15%<br />

upper extremity rating. Of course, soft tissue injuries or fractures not requiring extensive surgical<br />

procedures to repair, usually warrant significantly lower impairment ratings.<br />

3.4<br />

Can we settle before MMI is reached? If so,<br />

what is the criteria?<br />

Yes, a case may be settled before MMI is reached.<br />

3.5<br />

Can a voluntary resignation be obtained as part<br />

of the settlement agreement?<br />

Yes, voluntary resignation can be obtained as part of the settlement agreement.<br />

3.6<br />

Are there any other critical issues related to<br />

indemnity payments for this jurisdiction? If so,<br />

please describe.<br />

Not applicable.<br />

3.7<br />

What are the state rules regarding the carrier<br />

reimbursing the employer for a salary<br />

continuation program?<br />

There is no specific rule for such.<br />

3.8 Can indemnity checks be sent to the employer? No. Payment shall be made to the address of record or account specified by the claimant.<br />

Topics Related to Compensability<br />

4.0<br />

What is the statute of limitations for filing a<br />

workers’ compensation claim?<br />

A claim for workers' compensation benefits, medical <strong>and</strong>/or indemnity, must be filed within one year of<br />

the alleged date of injury. If a payment of weekly benefits has been made or remedial treatment has<br />

been furnished by the employer on account of the injury, then a claim must be filed within one year<br />

after the date of the last remedial treatment, or two years after the date of the last payment of weekly<br />

benefits. O.C.G.A. § 34‐9‐82(a).<br />

4.1<br />

If a prospective employee is training <strong>and</strong> is<br />

injured before a formal employment agreement<br />

has been consummated, is the injury<br />

compensable?<br />

An injury sustained while a person is in training prior to the execution of a formal employment<br />

agreement will most likely be compensable. According to O.C.G.A. § 34‐9‐1, an “employee” includes<br />

every person in service of another under any contract of hire or apprenticeship except a person whose<br />

employment is not in the usual course of trade, business, occupation or profession of the employer.<br />

However, a written contract is not necessary, as an implied employer‐employee relationship is<br />

sufficient. There are two controlling factors in determining whether an employer‐employee relationship<br />

exists: 1) a person is in the service of another; <strong>and</strong> 2) a person is under any contract of hire or<br />

apprenticeship. Payment of wages or compensation is not dispositive as to whether an employeremployee<br />

relationship exists.<br />

4.2<br />

What is the Compensability Test? Please<br />

In Georgia, an injury is compensable if the claimant is able to show his injury “arose out of” <strong>and</strong> “in the<br />

indicate whether the test is AOE <strong>and</strong> COE, versus<br />

course of” his employment.<br />

AOE or COE.<br />

4.3<br />

Please describe any statutory deadlines for<br />

making a compensability decision.<br />

According to O.C.G.A. § 34‐9‐221, the first payment of benefits is due within the first twenty‐one days<br />

following the alleged injury. If the employer controverts the claim, it must file a Notice to Controvert<br />

(State Board form WC‐3) with the State Board on or before the twenty‐first day after knowledge of the<br />

alleged injury or death. O.C.G.A. § 34‐9‐221(d). Further, where compensation is being paid without an<br />

award, a controvert may be filed within 81 days based on a change in condition or newly discovered<br />

evidence.

4.4<br />

Please describe briefly any statutory defenses to<br />

a workers’ compensation claim.<br />

The Georgia <strong>Workers'</strong> <strong>Compensation</strong> Act bars an employee's entitlement to workers' compensation benefits when<br />

the employee's injury or death is a result of the employee's willful misconduct. O.C.G.A. § 34‐9‐17(a). “Willful<br />

misconduct” includes conscious or intentional violations of definite laws or rules of conduct, as opposed to<br />

inadvertent or involuntary violations. See Liberty Mutual Ins. Co. v. Perry , 53 Ga. App. 527, 186 S.E. 576 (1936).<br />

False statements in an employment application will bar benefits if the following factors are present: 1) the<br />

employee must have knowingly <strong>and</strong> willfully made false representations as to his physical condition; 2) the<br />

employer must have relied upon the false representation <strong>and</strong> this reliance must have been a substantial factor in<br />

the hiring; <strong>and</strong> 3) there must have been a causal connection between the false representation <strong>and</strong> the injury.<br />

Georgia Electric Co. v. Rycroft , 259 Ga. 155, 378 S.E.2d 111 (1989). O.C.G.A. § 34‐9‐17 bars recovery of workers'<br />

compensation benefits if the employee's injury or death is caused by intoxication due to alcohol, marijuana or other<br />

controlled substances not legally prescribed by a physician or not taken in accordance with a prescription. A<br />

rebuttable presumption arises in favor of the employer that the death or injury was caused by the employee's<br />

ingestion of alcohol, marijuana or a controlled<br />

substance if: 1) .08 grams of alcohol is determined to be in the employee's body within three hours of the time of<br />

accident; or 2) any amount of marijuana or a controlled substance is found in the employee's body within eight<br />

hours of the time of accident. In addition, no compensation shall be allowed for an injury or death due to the<br />

refusal of the employee to perform a duty required by statute. O.C.G.A. § 34‐9‐17(a). An employee is barred from<br />

workers' compensation benefits for injuries resulting from his willful failure or refusal to use safety appliances, as<br />

long as the employee had knowledge of the requirement to utilize the safety device. Liberty Mutual Ins. Co. v.<br />

Perry , 53 Ga. App. 527, 186 S.E. 576 (1936); Herman v. Aetna Casualty & Surety Co. , 71 Ga. App. 464, 31 S.E.2d 100<br />

(1944). The burden is on the employer to show the following: 1) that the failure was willful; 2) that the device was<br />

available <strong>and</strong> accessible; 3) that the employee was aware of the necessity to utilize the safety appliance; 4) that the<br />

employee recognized the danger of not using the appliance; 5) that the willful failure to use the safety appliance<br />

was intentional <strong>and</strong> not merely inadvertent or in response to an emergency; <strong>and</strong> 6) that such failure was the<br />

proximate cause the employee's injuries. Id.<br />

4.5 Are volunteer workers covered?<br />

Volunteers, or persons who perform a gratuitous service for another, are not employees or a servant of<br />

the person for whom the service is being performed. Therefore, usually volunteers are not entitled to<br />

workers' compensation benefits for injuries sustained while in the performance of such service. Jones v.<br />

Lumbermens Mut. Cas. Co. , 58 Ga. App. 713 199 S.E. 832 (1938). However, some exceptions apply to this<br />

rule. County or municipality volunteer firefighters, law enforcement personnel, volunteer emergency<br />

rescue workers <strong>and</strong> volunteer first responder workers are considered “employees” <strong>and</strong> entitled to<br />

workers' compensation benefits. O.C.G.A. § 34‐9‐1.<br />

4.6<br />

4.7<br />

Are illegal aliens covered? If not, what is needed<br />

to support denial?<br />

Are there special rules regarding coverage for<br />

independent contractors?<br />

Yes, illegal aliens are covered by the <strong>Workers'</strong> <strong>Compensation</strong> Act of Georgia. See Wet Walls, Inc. v.<br />

Ledezma , 266 Ga. App. 685, 598 S.E.2d 60 (2004) (holding a finding of fact of total disability for an illegal<br />

worker entitles the worker to continued TTD benefits); Continental PET Technologies v. Palacias , 269<br />

Ga. App. 561, 604 S.E.2d 627 (2004) (holding the broad definition of “employee” set forth in O.C.G.A. §<br />

34‐9‐1(2) includes “every person in the service of another under any contract of hire or apprenticeship,”<br />

including illegal aliens).<br />

Yes. O.C.G.A. § 34‐9‐1(2) states: “A person shall be an independent contractor <strong>and</strong> not an employee if<br />

such person has a written contract as an independent contractor <strong>and</strong> such person otherwise qualifies as<br />

an independent contractor.” There is plenty of case law dealing with the test to determine whether an<br />

employee is an independent contractor.<br />

4.8<br />

Are cumulative trauma claims compensable? If<br />

so, under what circumstances are they<br />

compensable?<br />

Cumulative traumas, or gradually acquired injuries, are compensable in Georgia. Where a disability<br />

results that is objectively physiologically ascertainable, it is compensable, although the onset of<br />

disability is not distinguishable day‐to‐day <strong>and</strong> there is no specific injury or accident. Thomas v. Ford<br />

Motor Co. , 123 Ga. App. 512, 181 S.E.2d 874 (1971). The date of accident with regards to a cumulative<br />

trauma is the date the injury prevents the claimant from going to work. See Employers Mut. Liab. Ins.<br />

Co. v. Shipman , 108 Ga. App. 184, 132 S.E.2d 568 (1963). A cumulative trauma injury may be established<br />

by providing evidence indicating an employee's injury was caused by <strong>and</strong> further aggravated by the<br />

performance of his work duties. See D.W. Adcock v. Adcock , 257 Ga. App. 700, 572 S.E.2d 45 (2002).<br />

4.9<br />

Are psychological stress claims compensable? If<br />

so, what are the rules regarding mental/mental,<br />

mental/physical, physical/mental origin?<br />

In Georgia, where a psychological or emotional stimulus on the job produces a physical injury, the injury<br />

is usually compensable. See City Council of Augusta v. Williams , 137 Ga. App. 177, 223 S.E.2d 227 (1976).<br />

In a 2008 decision from the Court of Appeals, the court ruled “In order for a psychological injury to be<br />

compensable, it must satisfy two conditions precedent: 1) it must arise out of an accident in which a<br />

compensable injury is sustained; <strong>and</strong> 2) while the physical injury may not be the precipitating cause of<br />

the psychological condition or problems, at a minimum, the physical injury must contribute to the<br />

continuation of the psychological trauma.” DeKalb County Bd. of Educ. v. Singleton , 294 Ga. App. 96, 668<br />

S.E.2d 767 (2008). Further, the court noted the psychic trauma is compensable if the physical injury<br />

merely contributes to its continuation. Id.<br />

4.10<br />

Are there any other critical issues related to<br />

compensability for this jurisdiction? If so, please<br />

describe.<br />

Not applicable.

4.11<br />

Can benefits be denied if the employee was<br />

under the influence of drugs or alcohol when<br />

injured? What levels are required (BAC) to<br />

support denial? What must we obtain to<br />

support a denial?<br />

<strong>Workers'</strong> compensation benefits can be denied if an injury is proximately caused by being under the<br />

influence of alcohol, marijuana or a controlled substance. O.C.G.A. § 34‐9‐17. For alcohol, if the amount<br />

of alcohol within three hours of the the alleged accident is .08 grams or greater, there is a rebuttable<br />

presumption the injury/death was caused by the consumption of alcohol. O.C.G.A. § 34‐9‐17(b)(1).<br />

Regarding marijuana or improper ingestion of a “controlled substance,” there is a rebuttable<br />

presumption the injury was caused by the use of the controlled substance or marijuana if any amount of<br />

such is shown to be in the employee's blood, urine, breath or other bodily substance within eight hours<br />

of the time of the alleged accident. O.C.G.A. § 34‐9‐17(b)(2).<br />

4.12 Compensability for Recreational Activities No compensability for recreational activities.<br />

5.0 What is the maximum statutory death benefit?<br />

Topics Related to Death Claims<br />

<strong>Compensation</strong> shall only be paid out to dependents during their dependency. Therefore, when a child<br />

reaches 18 <strong>and</strong> is not enrolled in post‐secondary education, marries, or turns 22, their dependency has<br />

terminated, along with their entitlement to compensation. See O.C.G.A. § 34‐9‐265(c). However, in<br />

cases where the surviving spouse is the sole dependent at the time of death <strong>and</strong> no other dependent<br />

exists for one year or less after the decedent's death, current law is that total compensation shall not<br />

exceed $150,000. O.C.G.A. § 34‐9‐265(d).<br />

5.1 What is the allowance for burial expenses?<br />

5.2<br />

Describe any specific rules regarding<br />

dependency.<br />

Currently, if the employee has no dependents at the time of his death, the employer/insurer is only<br />

responsible for the reasonable expenses of the employee’s burial, up to $7,500. O.C.G.A. § 34‐9‐<br />

265(b)(1).<br />

There are two classes of dependents established by the Act: 1) “primary beneficiaries who were totally<br />

dependent on the decedent; <strong>and</strong> 2) “secondary beneficiaries” who were partially dependent on the<br />

decedent. O’Steen v. Florida Ins. Exch., 118 Ga. App. 562, 164 S.E.2d 512 (1953). Individuals who are<br />

wholly dependent upon the deceased employee’s earnings at the time of the injury are entitled to<br />

regular weekly indemnity benefits pursuant to O.C.G.A. § 34‐9‐261. Only a “child” of the deceased<br />

employee or, under certain circumstances, a surviving spouse of the same, is eligible for “primary<br />

beneficiary” status. Id. A wholly dependent beneficiary, i.e., a minor child, precludes a partially<br />

dependent beneficiary, like the child’s mother, from recovering even a portion of the decedent’s weekly<br />

benefits while he remains totally dependent. There is a presumption of total dependency for children of<br />

the decedent <strong>and</strong> the spouse of the decedents. O.C.G.A. § 34‐9‐13(b). Children of the decedents must be<br />

either: 1) under 18 years of age or enrolled full‐time in high school; 2) over 18 <strong>and</strong> physically or mentally<br />

incapable of earning a livelihood; or 3) under the age of 22 <strong>and</strong> a full‐time student or the equivalent in<br />

good st<strong>and</strong>ing enrolled in a post‐secondary institution of higher learning. For partial dependency, no<br />

such presumption exists, so the determination of partial dependency is determined based on the facts<br />

at the time of the decedent’s accident. Factors to consider include the amounts, frequency <strong>and</strong><br />

continuity of actual contributions of money or supplies,<br />

the needs of the claimant <strong>and</strong> the legal <strong>and</strong> moral obligation of the employee. O.C.G.A. § 34‐9‐13(d). A<br />

dependent cannot change from a partial dependent to a total dependent, or vice versa, because<br />

dependency status is determined at the time of the accident. Spousal dependency may be terminated,<br />

however, by cohabitation in a meretricious relationship. O.C.G.A. § 34‐9‐13(e).<br />

5.3<br />

If there are no dependents, are death benefits<br />

paid to another entity, such as a state fund?<br />

Employer/insurer is obligated to pay the State Board either: 1) one‐half of the dependency benefits that<br />

would have been payable to a dependent; or 2) $10,000, whichever is less. O.C.G.A. § 34‐9‐358(a). These<br />

funds will be deposited into a general fund of the state treasury. O.C.G.A. § 34‐9‐265(f). If a dependent<br />

who would be entitled to benefits is discovered after the employer/insurer has made the<br />

aforementioned payments, the insurer or self‐insurer will be entitled to reimbursement. Id.<br />

5.4<br />

Are there any other critical issues related to<br />

death benefits for this jurisdiction? If so, please<br />

describe.<br />

Not applicable.<br />

6.0<br />

6.1<br />

Is vocational rehabilitation compulsory in this<br />

jurisdiction?<br />

Under what conditions is a claimant eligible for<br />

vocational rehabilitation?<br />

Topics Related to Vocational Rehabilitation<br />

Vocational rehabilitation is compulsory for those individuals who have sustained compensable<br />

“catastrophic injuries.” Providing vocational rehabilitation for non‐catastrophic injuries is voluntary.<br />

O.C.G.A. § 34‐9‐200.1.<br />

Generally, in non‐catastrophic cases, vocational rehabilitation is provided to claimants who have no<br />

suitable employment, but the State Board has the discretion to award vocational rehabilitation services<br />

even to claimants who have suitable employment opportunities available to them. See Jackson v.<br />

Peachtree Hous. Div. of C.O. Smith Indus. , 187 Ga. App. 612, 371 S.E.2d 112 (1988). Those with<br />

compensable catastrophic injuries must be provided vocational rehabilitation services. O.C.G.A. § 34‐9‐<br />

200.1.

6.2<br />

6.3<br />

Rehabilitation services includes goods <strong>and</strong> services necessary for vocational assessment, vocational<br />

evaluation, guidance, counseling, vocational planning, vocational training <strong>and</strong> vocational placement. In<br />

Generally, what types of benefits are paid for<br />

addition, providing home or vehicle modifications, training or self‐employment arrangements is<br />

vocational rehabilitation? Are these provided by<br />

considered “rehabilitation benefits.” See Ranger Ins. Co. v. Speck , 145 Ga. App. 327, 243 S.E.2d 593<br />

the carrier or by the state?<br />

(1978); Georgia State Bd. of <strong>Workers'</strong> <strong>Compensation</strong>, Procedures Manual (July 2001). These benefits are<br />

provided by the carrier.<br />

If the employee who is out of work completely is terminated before being returned to work by his<br />

authorized treating physician, he will remain entitled to his weekly TTD benefits. If the employee has<br />

been returned to work at light duty <strong>and</strong> terminated for cause, he has the burden to prove he has<br />

What is the exposure for terminating an performed a diligent, but unsuccessful, job search <strong>and</strong> is unable to find gainful employment as a result<br />

employee before they reach RTW or reach MMI? of his on‐the‐job injury. Upon sufficient showing of a diligent but unsuccessful job search, the claimant<br />

will be entitled to TTD benefits. Maloney v. Gordon Farms , 265 Ga. 825, 462 S.E.2d 606 (1995). If the<br />

claimant is returned to work at light duty <strong>and</strong> then terminated due to the employer having no work<br />

suited to his restrictions, the claimant will be entitled to TTD benefits.<br />

Topics Related to Financial Recoveries<br />

7.0<br />

Describe the rules for regarding the type of cases<br />

which are eligible for a second injury fund<br />

recovery.<br />

The Subsequent Injury Trust Fund shall not reimburse a self‐insured employer or an insurer for a<br />

subsequent injury for which a claim is made for an injury occurring after June 30, 2006. Reimbursement<br />

is still available for qualifying claims for injuries occurring on or prior to June 30, 2006. O.C.G.A. § 34‐9‐<br />

368(a). A licensed workers' compensation insurance carrier or an approved self‐insurer is eligible for<br />

reimbursement as long as: 1) the employee has a preexisting permanent impairment; 2) the employer<br />

had knowledge of the preexisting permanent impairment before the subsequent injury occurred; 3) a<br />

compensable, subsequent on‐the‐job injury has occurred; <strong>and</strong> 4) there is a “merger” between the<br />

preexisting permanent impairment <strong>and</strong> the subsequent compensable on‐the‐job injury. O.C.G.A. § 34‐9‐<br />

350. The employer/insurer is entitled to 50% reimbursement of all medical <strong>and</strong> rehabilitation expenses<br />

paid which exceed $5,000, but do not exceed $10,000. The employer/insurer is entitled to 100%<br />

reimbursement of all medical <strong>and</strong> rehabilitation expenses paid which exceed $10,000. O.C.G.A. § 34‐9‐<br />

360(b). Further, the employer/insurer shall be reimbursed from the Subsequent Injury Trust Fund for all<br />

weekly income benefits payments payable after 104 weeks of payment. O.C.G.A. § 34‐9‐360(a).<br />

7.1<br />

What is the statute of limitations with reference<br />

to pursuing a subrogation recovery?<br />

O.C.G.A. § 34‐9‐11.1(b) provides for a subrogation lien in favor of the employer/insurer against the<br />

recovery from a third‐party tortfeasor. The employer/insurer has the right to intervene in any action to<br />

enforce the lien. Should the employee not file his right of action within one year of the date of injury,<br />

then the employer/insurer has the right for the following year to enforce the claim in the name of the<br />

employee. If the employer/insurer make such a filing, then the employee has a right to intervene.<br />

7.2<br />

If an employee has a right of action against a third party <strong>and</strong> the employer's liability under this has been<br />

fully or partially paid, the employer/insurer shall have a subrogation lien for an amount up to the<br />

Describe the statute regarding our right to amount of compensation the employer/insurer paid against such recovery. O.C.G.A. § 34‐9‐11.1(b). If an<br />

pursue a subrogation recovery. Does the statute employee has settled his personal injury suit against a third‐party tortfeasor without filing suit, <strong>and</strong> the<br />

give preference to our lien when a third party tortfeasor had no knowledge of the workers' compensation claim, the employer may not have any right<br />

case is resolved?<br />

against the tortfeasor to bring suit, but retains the employer's lien on recovery. Rowl<strong>and</strong> v. Department<br />

of Admin. Servs., 219 Ga. App. 899, 466 S.E.2d 923 (1996). The employer may bring suit against a thirdparty<br />

tortfeasor if the employee has not brought suit within one year after the date of injury.<br />

7.3<br />

7.4<br />

What formula is used to determine the amount<br />

of our recovery?<br />

Are there any other critical issues related to<br />

subrogation or other recoveries for this<br />

jurisdiction? If so, please describe.<br />

An employer may recover up to the amount paid out in compensation, <strong>and</strong> the excess of the award will<br />

be paid to the injured employee. O.C.G.A. § 34‐9‐11.1. However, the statute requires that the employee<br />

first be fully <strong>and</strong> completely compensated for all economic <strong>and</strong> non‐economic loses caused by the<br />

injury.<br />

Not applicable.<br />

Topics Related to Medical Control<br />

8.0<br />

Describe the jurisdictional rules regarding<br />

employer/carrier medical control.<br />

According to O.C.G.A. § 34‐9‐200, the employer/insurer are required to provide an employee with a<br />

compensable injury “such medical, surgical, <strong>and</strong> hospital care <strong>and</strong> other treatment, items, <strong>and</strong> services<br />

which are prescribed by a licensed physician, including medical <strong>and</strong> surgical supplies, artificial members,<br />

<strong>and</strong> prosthetic devices <strong>and</strong> aids damaged or destroyed in a compensable accident, which in the<br />

judgment of the State Board of <strong>Workers'</strong> <strong>Compensation</strong> shall be reasonably required <strong>and</strong> appear likely<br />

to effect a cure, give relief, or restore the employee to suitable employment.”

8.1<br />

Upon the request of the employer/insurer, an employee is required to submit himself to an examination<br />

by a duly qualified physician/surgeon of the employer/insurer's choosing, who will be paid by the<br />

employer/insurer or the State Board, as long as the employee claims workers' compensation benefits.<br />

O.C.G.A. § 34‐9‐202(a). This examination must be at a reasonable time <strong>and</strong> place. In addition, an<br />

Are there restrictions regarding the scheduling of<br />

employee is entitled to one IME at a reasonable time <strong>and</strong> place by a duly qualified physician/surgeon of<br />

an Independent Medical Exam? Does an IME<br />

the employee's choosing, who is to be paid by the employer. This right must be exercised within 120<br />

have to be authorized by a judge?<br />

days of receipt of any income benefits <strong>and</strong> must be in the state of Georgia or within 50 miles of the<br />

employee's residence, at a reasonable time <strong>and</strong> place. O.C.G.A. § 34‐9‐202(e). An employee‐requested<br />

IME does not require authorization by a judge. The employee has no right to an IME at the employer’s<br />

expense in a “medical only” claim.<br />

8.2<br />

Are there any instances where surveillance<br />

footage is legally prohibited from being<br />

forwarded to the treating or IME doctors?<br />

No.<br />

8.3<br />

Are there any other critical issues related to<br />

medical benefits for this jurisdiction? If so,<br />

please describe.<br />

Not applicable.<br />

8.4 IME Generalized Rules See 8.1<br />

8.5 Medical Privacy Rules<br />

9.0 Extraterritorial Coverage<br />

9.1 WC Jurisdictional Link(s)<br />

When an employee has submitted a claim for workers' compensation benefits or is receiving payment of<br />

weekly income benefits or the employer has paid medical expenses, that employee shall be deemed to<br />

have waived any privilege or confidentiality concerning any communications related to the claim or<br />

history or treatment of an injury arising from the incident that the employee has had with any physician,<br />

including, but not limited to, communications with psychiatrists or psychologists.<br />

Miscellaneous Topics<br />

Jurisdiction of the board over accidents occurring outside the state is controlled by O.C.G.A.§ 34‐9‐242,<br />

which reads, in part: "In the event an accident occurs while the employee is employed elsewhere than in<br />

this state, which accident would entitle him or his dependents to compensation if it had occurred in this<br />

state, the employee...shall be entitled to compensation if the contract of employment was made in this<br />

state <strong>and</strong> if the employer's place of business or the residence of the employee was expressly for service<br />

exclusively outside of this state."<br />

http://www.swiftcurrie.com<br />

http://sbwc.georgia.gov/portal/site/SBWC/<br />

9.2 Sole Remedy Yes.<br />

9.3 Does the jurisdiction allow medical discovery? Yes.<br />

9.4 Adjuster residency requirement? No.<br />

9.5<br />

Is there a Bad Faith cause of action available for<br />

a claimant <strong>and</strong> what is recoverable?<br />

No, as the exclusive remedy precludes this cause of action but attorney fees can be assessed.

KENTUCKY<br />

St<strong>and</strong>ard <strong>Help</strong> Topics by State<br />

These Jurisdictional <strong>Help</strong> Screens are for informational purposes only. They should not be construed as a definitive synopsis of any State's laws,<br />

rules, or procedures. You should contact your legal counsel or Human Resources Department prior to the development of any internal policy,<br />

procedure or work rule.<br />

Topics Related to Indemnity Rates<br />

1.0<br />

How is AWW calculated? Please include<br />

Wage most favorable to the employee computed by dividing by 13, the wages the employee earned in<br />

information regarding the earning types used to<br />

the first, second, third, or fourth period of 13 consecutive calendar weeks in the 52 weeks<br />

derive the AWW (i.e.: regular wages, tips,<br />

immediately preceding the injury.<br />

vacation, overtime, etc.).<br />

1.1 How is the weekly TTD rate calculated?<br />

66 2/3% of the employee's average weekly wage subject to the maximum <strong>and</strong> minimum rates for the<br />

year of injury.<br />

1.2 Maximum weekly TTD rate $721.97<br />

1.3 Minimum weekly TTD rate $144.40<br />

1.4<br />

How is the daily TTD calculated? Please indicate<br />

whether your state uses a 7‐day work week, a 5‐ Weekly TTD rate / 7 = daily temporary total disability rate<br />

day work week, or something else.<br />

1.5<br />

1.6<br />

Is the employer required to continue health<br />

insurance while the employee is receiving<br />

indemnity benefits? If benefits can be<br />

terminated, does it increase the TTD rate? By<br />

how much?<br />

Does this jurisdiction use scheduled PPD ratings,<br />

unscheduled PPD ratings, or a combination of<br />

these?<br />

No<br />

Unscheduled<br />

1.7 Maximum weekly PPD rate $541.47<br />

1.8 Minimum weekly PPD rate None<br />

1.9<br />

Is there a specific statutory rule which requires<br />

payment of PPD at a given point in the claim? If<br />

so, please describe the general provisions of the<br />

rule.<br />

No<br />

1.10<br />

Who determines the final PPD rating? Is it a<br />

physician, a judge, or someone else?<br />

Administrative Law Judge<br />

1.11<br />

Are there any other critical issues related to the<br />

benefit rates for this jurisdiction? If so, please<br />

describe.<br />

Concurrent employment; seasonal employees<br />

1.12 Benefit Offset<br />

Temporary total disability benefits or permanent total disability benefits are offset by unemployment<br />

compensation benefits <strong>and</strong> exclusively funded employer disability plan that does not contain internal<br />

offset for workers' compensation benefits.<br />

1.13 Cost of Living Adjustment No

2.0<br />

How is the waiting period defined? Please<br />

include information regarding the number of<br />

days, <strong>and</strong> whether these are work or calendar<br />

days.<br />

Topics Related to Initial Indemnity Payments<br />

Seven (7) calendar days<br />

2.1 Are there any “Pay without Prejudice” periods? No<br />

2.2<br />

Does the waiting period include the date of<br />

injury?<br />

Only if not paid wages for day of injury.<br />

2.3<br />

At what point do we make a retroactive<br />

payment for the waiting period?<br />

15 days<br />

2.4 When is the first TTD payment due? 8th day<br />

2.5<br />

Can benefits be denied if light duty is refused?<br />

What must we do to document our position?<br />

Yes, if temporary total disability benefits are being voluntarily paid.<br />

2.6<br />

Are there any other critical issues related to the<br />

initial benefit payment for this jurisdiction? If<br />

so, please describe.<br />

Forms must be filed with Department of <strong>Workers'</strong> Claims when benefit payments are initiated <strong>and</strong>/or<br />

terminated.<br />

Other Topics Related to Indemnity Payments<br />

3.0<br />

How often are indemnity payments issued?<br />

(weekly, biweekly, etc.)<br />

Semi‐monthly<br />

3.1<br />

Is there a statutory cap on the number of weeks<br />

paid for TTD? If so, please provide the details.<br />

No, except if temporary total disability is paid after the worker reaches "normal" old‐age retirement.<br />

3.2<br />

Is global settlement of both medical & indemnity<br />

Yes, with approval of Administrative Law Judge.<br />

allowed? Under what conditions?<br />

3.3<br />

What are the ball park PPD ratings for soft<br />

tissue, fracture, or surgery on neck, shoulder,<br />

lumbar spine, or knees?<br />

Functional impairment ratings found in 5th Edition of American Medical Association Guidelines to<br />

Evaluation of Permanent Impairment .<br />

3.4<br />

Can we settle before MMI is reached? If so,<br />

what is the criteria?<br />

Yes, if both parties are agreeable <strong>and</strong> approved by the Administrative Law Judge.<br />

3.5<br />

Can a voluntary resignation be obtained as part<br />

of the settlement agreement?<br />

No<br />

3.6<br />

Are there any other critical issues related to<br />

indemnity payments for this jurisdiction? If so,<br />

please describe.<br />

Income benefits terminate when worker reaches "normal" old‐age retirement except if injury occurs<br />

after such age.<br />

3.7<br />

What are the state rules regarding the carrier<br />

reimbursing the employer for a salary<br />

continuation program?<br />

None<br />

3.8 Can indemnity checks be sent to the employer? Yes, with consent of employee.<br />

Topics Related to Compensability

4.0<br />

What is the statute of limitations for filing a<br />

workers’ compensation claim?<br />

Two years from date of injury or two years from last voluntary payment of temporary total disability<br />

benefits, which ever occurs last.<br />

4.1<br />

4.2<br />

If a prospective employee is training <strong>and</strong> is<br />

injured before a formal employment agreement<br />

has been consummated, is the injury<br />

compensable?<br />

Yes<br />

What is the Compensability Test? Please<br />

indicate whether the test is AOE <strong>and</strong> COE, versus Injury must arise out of <strong>and</strong> in the course of employment.<br />

AOE or COE.<br />

4.3<br />

Please describe any statutory deadlines for<br />

making a compensability decision.<br />

No specific deadline unless there is a request for payment of medical expenses <strong>and</strong>/or preauthorization<br />

for medical treatment.<br />

4.4<br />

Please describe briefly any statutory defenses to<br />

a workers’ compensation claim.<br />

Statute of Limitations, unreasonable failure to follow medical advice, failure to comply with safety<br />

laws, false statement on employment application, voluntary rejection of Act, voluntary intoxication or<br />

self infliction of injury, <strong>and</strong> refusal to accept rehabilitation services.<br />

4.5 Are volunteer workers covered? Yes. If a fireman, police officer, EMS worker or member of National Guard.<br />

4.6<br />

Are illegal aliens covered? If not, what is needed<br />

Yes.<br />

to support denial?<br />

4.7<br />

Are there special rules regarding coverage for<br />

independent contractors?<br />

Not covered under Act.<br />

4.8<br />

Are cumulative trauma claims compensable? If<br />

so, under what circumstances are they<br />

compensable?<br />

Yes, if cumulative trauma arises out of <strong>and</strong> in the course of employment.<br />

4.9<br />

Are psychological stress claims compensable? If<br />

so, what are the rules regarding mental/mental,<br />

mental/physical, physical/mental origin?<br />

Only if associated with physical injury.<br />

4.10<br />

Are there any other critical issues related to<br />

compensability for this jurisdiction? If so, please No<br />

describe.<br />

4.11<br />

Can benefits be denied if the employee was<br />

under the influence of drugs or alcohol when<br />

injured? What levels are required (BAC) to<br />

support denial? What must we obtain to<br />

support a denial?<br />

Yes, if intoxication was proximate cause of injury.<br />

4.12 Compensability for Recreational Activities Yes, if company sponsored <strong>and</strong>/or attendance is m<strong>and</strong>atory.<br />

Topics Related to Death Claims<br />

5.0 What is the maximum statutory death benefit?<br />

$70,916.46 <strong>and</strong> weekly benefit payments to dependents of one‐half of the deceased workers' rate up<br />

until spouse reaches age 62.<br />

5.1 What is the allowance for burial expenses? Included in $70,916.46 lump sum death payment.<br />

5.2<br />

Describe any specific rules regarding<br />

dependency.<br />

Spouse remains a dependent until such time as she remarries. Children are dependents up until age<br />

18 or, if in school, up to age 23.<br />

5.3<br />

If there are no dependents, are death benefits<br />

paid to another entity, such as a state fund?<br />

$70,916.46 lump sum death payment would be payable to deceased workers' estate.

5.4<br />

Are there any other critical issues related to<br />

death benefits for this jurisdiction? If so, please<br />

describe.<br />

No<br />

Topics Related to Vocational Rehabilitation<br />

6.0<br />

Is vocational rehabilitation compulsory in this<br />

jurisdiction?<br />

No, unless ordered by Administrative Law Judge.<br />

6.1<br />

Under what conditions is a claimant eligible for<br />

vocational rehabilitation?<br />

Worker cannot return to regular employment for which he has previous training <strong>and</strong>/or experience.<br />

6.2<br />

Generally, what types of benefits are paid for<br />

Job retraining <strong>and</strong>/or job placement not to exceed 52 weeks <strong>and</strong> increase in weekly income disability<br />

vocational rehabilitation? Are these provided by<br />

benefits paid to the worker. All rehabilitation expenses <strong>and</strong>/or benefits are paid by the employer.<br />

the carrier or by the state?<br />

6.3<br />

Temporary total disability benefits can be awarded by the Administrative Law Judge until the worker<br />

What is the exposure for terminating an<br />

reaches maximum medical improvement or returns to work. Unfair Claims Settlement Practices<br />

employee before they reach RTW or reach MMI?<br />

Complaint can be filed with the Commissioner of the Department of <strong>Workers'</strong> Claims.<br />

Topics Related to Financial Recoveries<br />

7.0<br />

Describe the rules for regarding the type of cases<br />

which are eligible for a second injury fund No second injury fund for injuries occurring after December 1996.<br />

recovery.<br />

7.1<br />

What is the statute of limitations with reference<br />

to pursuing a subrogation recovery?<br />

Five years from date of injury.<br />

7.2<br />

Describe the statute regarding our right to<br />

pursue a subrogation recovery. Does the statute Right to pursue subrogation recovery is the responsibility of the employer. No preference is given to<br />

give preference to our lien when a third party workers' compensation claim.<br />

case is resolved?<br />

7.3<br />

What formula is used to determine the amount<br />

of our recovery?<br />

Can recover only from amount of settlement or award after deduction of legal fee <strong>and</strong> expenses, pain<br />

<strong>and</strong> suffering, <strong>and</strong> after the worker has been made "whole."<br />

7.4<br />

8.0<br />

Are there any other critical issues related to<br />

subrogation or other recoveries for this<br />

jurisdiction? If so, please describe.<br />

Describe the jurisdictional rules regarding<br />

employer/carrier medical control.<br />

Subrogation recoveries are rare in Kentucky <strong>Workers'</strong> <strong>Compensation</strong> claims.<br />

Topics Related to Medical Control<br />

Unless employer has a managed care program approved by the Department of <strong>Workers'</strong> Claims,<br />

worker has sole discretion to chose first two doctors for treatment. Selection of a third physician for<br />

treatment must be approved by employer.<br />

8.1<br />

Are there restrictions regarding the scheduling of<br />

an Independent Medical Exam? Does an IME No, as long as "reasonable" <strong>and</strong> does not need approval of Administrative Law Judge.<br />

have to be authorized by a judge?<br />

8.2<br />

Are there any instances where surveillance<br />

footage is legally prohibited from being<br />

forwarded to the treating or IME doctors?<br />

No<br />

8.3<br />

Are there any other critical issues related to<br />

medical benefits for this jurisdiction? If so,<br />

please describe.<br />

There are medical, hospital <strong>and</strong> pharmacy fee schedules.<br />

8.4 IME Generalized Rules None<br />

8.5 Medical Privacy Rules Need signed release for medical records.<br />

Miscellaneous Topics

9.0 Extraterritorial Coverage Yes<br />

9.1 WC Jurisdictional Link(s)<br />

(1) If worker's employment is principally localized in Kentucky or; (2) worker is working under a<br />

contract of hire made in this state in employment not principally localized in any state or; (3) worker is<br />

working under a contract of hire made in this state in employment principally localized in another<br />

state whose workers' compensation law is not applicable to his employer or; (4) worker is working<br />

under a contract of hire made in this state for employment outside the United States <strong>and</strong> Canada.<br />

9.2 Sole Remedy<br />

Exclusive remedy except if employer has failed to secure payment of workers' compensation coverage<br />

as required by Act or where injury or death is proximately caused by the willful intention of the<br />

employer. Exclusive remedy is slowly but surely being eroded by the Courts.<br />

9.3 Does the jurisdiction allow medical discovery? Yes<br />

9.4 Adjuster residency requirement? Adjuster must be licensed in Kentucky.<br />

9.5<br />

Is there a Bad Faith cause of action available for<br />

a claimant <strong>and</strong> what is recoverable?<br />

None available but worker can bring Unfair Claims Practices Action before Commissioner or<br />

Department of <strong>Workers'</strong> Claims who has authority to impose fines on employer <strong>and</strong>/or insurance<br />

carrier.

LOUISIANA<br />

St<strong>and</strong>ard <strong>Help</strong> Topics by State<br />

These Jurisdictional <strong>Help</strong> Screens are for informational purposes only. They should not be construed as a definitive synopsis of any State's laws, rules,<br />

or procedures. You should contact your legal counsel or Human Resources Department prior to the development of any internal policy, procedure or<br />

work rule.<br />

Topics Related to Indemnity Rates<br />

1.0<br />

Sect. 1021(12) hourly workers: average of 4 full weeks prior to accident; commission or unit workers:<br />

How is AWW calculated? Please include<br />

average of 26 weeks prior to accident; salary workers convert to weekly; include OT if earned in 4 weeks<br />

information regarding the earning types used to<br />

prior to accident; separate tips from hourly wages <strong>and</strong> add average of tips for 26 weeks to 4 week<br />

derive the AWW (i.e.: regular wages, tips,<br />

average of hourly wages; full‐time hourly workers entitled to 40 hour average minimum if average drops<br />

vacation, overtime, etc.).<br />

below 40 hour due to no fault of worker; only taxable wages included in calculations.<br />

1.1 How is the weekly TTD rate calculated? 2/3rds of AWW<br />

1.2 Maximum weekly TTD rate<br />

1.3 Minimum weekly TTD rate<br />