ICMF 375 Multinational Corporate Finance - KEI

ICMF 375 Multinational Corporate Finance - KEI

ICMF 375 Multinational Corporate Finance - KEI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

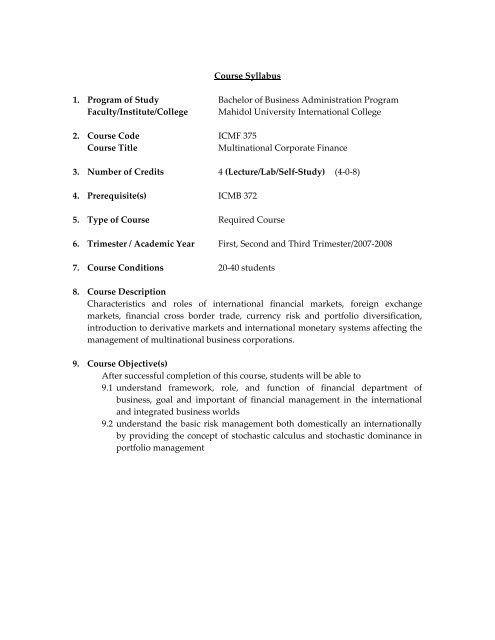

Course Syllabus<br />

1. Program of Study Bachelor of Business Administration Program<br />

Faculty/Institute/College Mahidol University International College<br />

2. Course Code <strong>ICMF</strong> <strong>375</strong><br />

Course Title<br />

<strong>Multinational</strong> <strong>Corporate</strong> <strong>Finance</strong><br />

3. Number of Credits 4 (Lecture/Lab/Self‐Study) (4‐0‐8)<br />

4. Prerequisite(s) ICMB 372<br />

5. Type of Course Required Course<br />

6. Trimester / Academic Year First, Second and Third Trimester/2007‐2008<br />

7. Course Conditions 20‐40 students<br />

8. Course Description<br />

Characteristics and roles of international financial markets, foreign exchange<br />

markets, financial cross border trade, currency risk and portfolio diversification,<br />

introduction to derivative markets and international monetary systems affecting the<br />

management of multinational business corporations.<br />

9. Course Objective(s)<br />

After successful completion of this course, students will be able to<br />

9.1 understand framework, role, and function of financial department of<br />

business, goal and important of financial management in the international<br />

and integrated business worlds<br />

9.2 understand the basic risk management both domestically an internationally<br />

by providing the concept of stochastic calculus and stochastic dominance in<br />

portfolio management

10. Course Outline<br />

Week<br />

Course Outline<br />

Topics Lecture Lab Self‐Study<br />

Instructor<br />

‣ Introduction “foundations of<br />

1<br />

International financial<br />

4 0 8 JNS<br />

Management.”<br />

‣ International Monetary<br />

JNS<br />

2<br />

System.<br />

‣ Balance of Payment.<br />

4 0 8<br />

3<br />

‣ The market for Foreign<br />

JNS<br />

4 0 8<br />

Exchange.<br />

‣ International Parity<br />

4<br />

Relationships.<br />

JNS<br />

4 0 8<br />

‣ Forecasting Foreign Exchange<br />

Rates “Hedging Instrument”<br />

‣ Futures and Options on<br />

JNS<br />

5<br />

Foreign Exchange<br />

‣ Reviews<br />

4 0 8<br />

6 Midterm Examination 4 0 8 JNS<br />

7<br />

‣ Currency and Interest Rate<br />

Swaps “Foreign Exchange 4 0 8 JNS<br />

Exposure and Management.”<br />

8<br />

‣ Management of Economic<br />

JNS<br />

4 0 8<br />

Exposure.<br />

9<br />

‣ Management of Transaction<br />

JNS<br />

4 0 8<br />

Exposure.<br />

‣ Management of Transaction<br />

10<br />

Exposure. “Financial<br />

JNS<br />

4 0 8<br />

Management of the<br />

<strong>Multinational</strong> Firm.”<br />

11<br />

‣ International Capital<br />

JNS<br />

4 0 8<br />

budgeting<br />

Total 44 0 88<br />

11. Teaching Method(s)<br />

Lecture

12. Teaching Media<br />

PowerPoint base, handout material and cases<br />

13. Measurement and Evaluation of Student Achievement<br />

Students achievement is measured and evaluated by<br />

13.1 The ability in understanding framework, role, and function of<br />

financial department of business, goal and important of financial<br />

management in the international and integrated business worlds.<br />

13.2 The ability in understanding the basic risk management both<br />

domestically an internationally by providing the concept of stochastic<br />

calculus and stochastic dominance in portfolio management.<br />

Student’s achievement will be graded according to the faculty and university<br />

standard using the symbols: A, B+, B, C+, C, D+, D, and F.<br />

Student must have attended at least 80% of the total class hours of this course.<br />

Ratio of mark<br />

1. Midterm 50%<br />

2. Final 50%<br />

14. Course Evaluation<br />

14.1 Students’ achievement as indicated in number 13 above.<br />

14.2 Students’ satisfaction towards teaching and learning of the course using<br />

questionnaires.<br />

15. Reference(s)<br />

Eun, C. S. and Resnick, B. G. (2007). International Financial Management, 3 rd<br />

Edition, McGraw Hill.<br />

16. Instructor(s)<br />

Dr. Jiranart Sutthirat<br />

17. Course Coordinator<br />

Program Director of <strong>Finance</strong> Major