IAG annual report—Concise

IAG annual report—Concise

IAG annual report—Concise

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

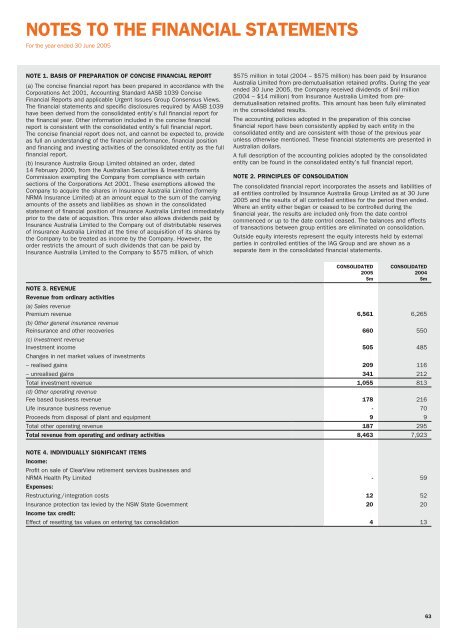

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended 30 June 2005<br />

NOTE 1. BASIS OF PREPARATION OF CONCISE FINANCIAL REPORT<br />

(a) The concise financial report has been prepared in accordance with the<br />

Corporations Act 2001, Accounting Standard AASB 1039 Concise<br />

Financial Reports and applicable Urgent Issues Group Consensus Views.<br />

The financial statements and specific disclosures required by AASB 1039<br />

have been derived from the consolidated entity’s full financial report for<br />

the financial year. Other information included in the concise financial<br />

report is consistent with the consolidated entity’s full financial report.<br />

The concise financial report does not, and cannot be expected to, provide<br />

as full an understanding of the financial performance, financial position<br />

and financing and investing activities of the consolidated entity as the full<br />

financial report.<br />

(b) Insurance Australia Group Limited obtained an order, dated<br />

14 February 2000, from the Australian Securities & Investments<br />

Commission exempting the Company from compliance with certain<br />

sections of the Corporations Act 2001. These exemptions allowed the<br />

Company to acquire the shares in Insurance Australia Limited (formerly<br />

NRMA Insurance Limited) at an amount equal to the sum of the carrying<br />

amounts of the assets and liabilities as shown in the consolidated<br />

statement of financial position of Insurance Australia Limited immediately<br />

prior to the date of acquisition. This order also allows dividends paid by<br />

Insurance Australia Limited to the Company out of distributable reserves<br />

of Insurance Australia Limited at the time of acquisition of its shares by<br />

the Company to be treated as income by the Company. However, the<br />

order restricts the amount of such dividends that can be paid by<br />

Insurance Australia Limited to the Company to $575 million, of which<br />

$575 million in total (2004 – $575 million) has been paid by Insurance<br />

Australia Limited from pre-demutualisation retained profits. During the year<br />

ended 30 June 2005, the Company received dividends of $nil million<br />

(2004 – $14 million) from Insurance Australia Limited from predemutualisation<br />

retained profits. This amount has been fully eliminated<br />

in the consolidated results.<br />

The accounting policies adopted in the preparation of this concise<br />

financial report have been consistently applied by each entity in the<br />

consolidated entity and are consistent with those of the previous year<br />

unless otherwise mentioned. These financial statements are presented in<br />

Australian dollars.<br />

A full description of the accounting policies adopted by the consolidated<br />

entity can be found in the consolidated entity’s full financial report.<br />

NOTE 2. PRINCIPLES OF CONSOLIDATION<br />

The consolidated financial report incorporates the assets and liabilities of<br />

all entities controlled by Insurance Australia Group Limited as at 30 June<br />

2005 and the results of all controlled entities for the period then ended.<br />

Where an entity either began or ceased to be controlled during the<br />

financial year, the results are included only from the date control<br />

commenced or up to the date control ceased. The balances and effects<br />

of transactions between group entities are eliminated on consolidation.<br />

Outside equity interests represent the equity interests held by external<br />

parties in controlled entities of the <strong>IAG</strong> Group and are shown as a<br />

separate item in the consolidated financial statements.<br />

CONSOLIDATED<br />

2005<br />

$m<br />

CONSOLIDATED<br />

2004<br />

$m<br />

NOTE 3. REVENUE<br />

Revenue from ordinary activities<br />

(a) Sales revenue<br />

Premium revenue 6,561 6,265<br />

(b) Other general insurance revenue<br />

Reinsurance and other recoveries 660 550<br />

(c) Investment revenue<br />

Investment income 505 485<br />

Changes in net market values of investments<br />

– realised gains 209 116<br />

– unrealised gains 341 212<br />

Total investment revenue 1,055 813<br />

(d) Other operating revenue<br />

Fee based business revenue 178 216<br />

Life insurance business revenue - 70<br />

Proceeds from disposal of plant and equipment 9 9<br />

Total other operating revenue 187 295<br />

Total revenue from operating and ordinary activities 8,463 7,923<br />

NOTE 4. INDIVIDUALLY SIGNIFICANT ITEMS<br />

Income:<br />

Profit on sale of ClearView retirement services businesses and<br />

NRMA Health Pty Limited - 59<br />

Expenses:<br />

Restructuring / integration costs 12 52<br />

Insurance protection tax levied by the NSW State Government 20 20<br />

Income tax credit:<br />

Effect of resetting tax values on entering tax consolidation 4 13<br />

63