IAG annual report—Concise

IAG annual report—Concise

IAG annual report—Concise

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended 30 June 2005<br />

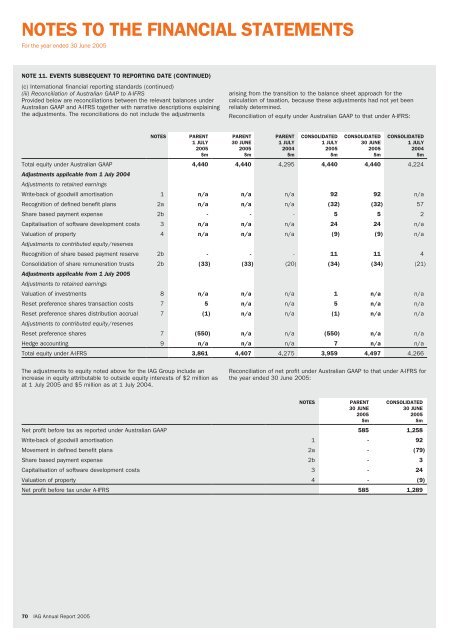

NOTE 11. EVENTS SUBSEQUENT TO REPORTING DATE (CONTINUED)<br />

(c) International financial reporting standards (continued)<br />

(iii) Reconciliation of Australian GAAP to A-IFRS<br />

Provided below are reconciliations between the relevant balances under<br />

Australian GAAP and A-IFRS together with narrative descriptions explaining<br />

the adjustments. The reconciliations do not include the adjustments<br />

arising from the transition to the balance sheet approach for the<br />

calculation of taxation, because these adjustments had not yet been<br />

reliably determined.<br />

Reconciliation of equity under Australian GAAP to that under A-IFRS:<br />

NOTES<br />

PARENT<br />

1 JULY<br />

2005<br />

$m<br />

PARENT<br />

30 JUNE<br />

2005<br />

$m<br />

PARENT<br />

1 JULY<br />

2004<br />

$m<br />

CONSOLIDATED<br />

1 JULY<br />

2005<br />

$m<br />

CONSOLIDATED<br />

30 JUNE<br />

2005<br />

$m<br />

CONSOLIDATED<br />

1 JULY<br />

2004<br />

$m<br />

Total equity under Australian GAAP 4,440 4,440 4,295 4,440 4,440 4,224<br />

Adjustments applicable from 1 July 2004<br />

Adjustments to retained earnings<br />

Write-back of goodwill amortisation 1 n/a n/a n/a 92 92 n/a<br />

Recognition of defined benefit plans 2a n/a n/a n/a (32) (32) 57<br />

Share based payment expense 2b - - - 5 5 2<br />

Capitalisation of software development costs 3 n/a n/a n/a 24 24 n/a<br />

Valuation of property 4 n/a n/a n/a (9) (9) n/a<br />

Adjustments to contributed equity / reserves<br />

Recognition of share based payment reserve 2b - - - 11 11 4<br />

Consolidation of share remuneration trusts 2b (33) (33) (20) (34) (34) (21)<br />

Adjustments applicable from 1 July 2005<br />

Adjustments to retained earnings<br />

Valuation of investments 8 n/a n/a n/a 1 n/a n/a<br />

Reset preference shares transaction costs 7 5 n/a n/a 5 n/a n/a<br />

Reset preference shares distribution accrual 7 (1) n/a n/a (1) n/a n/a<br />

Adjustments to contributed equity / reserves<br />

Reset preference shares 7 (550) n/a n/a (550) n/a n/a<br />

Hedge accounting 9 n/a n/a n/a 7 n/a n/a<br />

Total equity under A-IFRS 3,861 4,407 4,275 3,959 4,497 4,266<br />

The adjustments to equity noted above for the <strong>IAG</strong> Group include an<br />

increase in equity attributable to outside equity interests of $2 million as<br />

at 1 July 2005 and $5 million as at 1 July 2004.<br />

Reconciliation of net profit under Australian GAAP to that under A-IFRS for<br />

the year ended 30 June 2005:<br />

NOTES<br />

PARENT<br />

30 JUNE<br />

2005<br />

$m<br />

CONSOLIDATED<br />

30 JUNE<br />

2005<br />

$m<br />

Net profit before tax as reported under Australian GAAP 585 1,258<br />

Write-back of goodwill amortisation 1 - 92<br />

Movement in defined benefit plans 2a - (79)<br />

Share based payment expense 2b - 3<br />

Capitalisation of software development costs 3 - 24<br />

Valuation of property 4 - (9)<br />

Net profit before tax under A-IFRS 585 1,289<br />

70 <strong>IAG</strong> Annual Report 2005