GHANZI SHOW - Ministry of Agriculture

GHANZI SHOW - Ministry of Agriculture

GHANZI SHOW - Ministry of Agriculture

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Whatever the sector in<br />

the economy, financing<br />

r e m a i n s a h u g e<br />

determinant <strong>of</strong> success and growth.<br />

The agricultural sector is not an<br />

exception. Over the years, the<br />

country’s agricultural sector has<br />

been a victim <strong>of</strong> poor financing.<br />

Financial institutions regarded<br />

agriculture as a high risk business,<br />

therefore avoided talking business<br />

with the farming community.<br />

Reasons included interrelated<br />

production risks such as unreliable<br />

rainfall, pests and diseases (outbreaks<br />

<strong>of</strong> Foot and Mouth Diseases), and<br />

high costs incurred when servicing<br />

remote areas.<br />

However, the country’s agricultural<br />

sector has fundamentally changed<br />

over the past few years, a change<br />

that has affected financing. Most<br />

commercial banks have come on<br />

board and identified agriculture as<br />

an area with huge potential.<br />

As a result, agribusinesses are<br />

becoming financially powerful<br />

and bigger.The challenge though<br />

is that most <strong>of</strong> the farmers are<br />

doing subsistence farming rather<br />

than commercial. It is therefore<br />

important for financial institutions to<br />

venture into agriculture to promote<br />

commercialization.<br />

For the beef farming sector, this<br />

will create major opportunities that<br />

can allow it to grow. Currently the<br />

<strong>of</strong>f-take rates <strong>of</strong> South Africa and<br />

Namibia stand at 17% and 14%<br />

respectively while for Botswana is<br />

merely 13%. Botswana’s average<br />

carcass weight is only 175kg while<br />

those <strong>of</strong> our neighboring countries<br />

such as S.A and Nambia is 220kg<br />

and 180kg respectively. The new<br />

focus by banks will benefit the<br />

beef industry substantially as there<br />

will be pressure for consistency<br />

in application <strong>of</strong> sound farming<br />

practices like vaccination,<br />

deworming and supplementary<br />

feeding.<br />

Therefore, effective management<br />

becomes essential to the farmer.<br />

The same goes for arable farming;<br />

nowadays, farming has become<br />

highly capital intensive. Production<br />

inputs have become expensive<br />

and lack <strong>of</strong> proper farming<br />

implements like tractors, planters<br />

and ploughs could hamper efforts<br />

to commercialize. Therefore, banks’<br />

appetite for agriculture is a very<br />

much welcome development by<br />

farmers and the government.<br />

Banks as financiers have taken<br />

a step forward by participating<br />

in the agricultural space through<br />

implementing agribusiness. Stanbic<br />

Bank has developed funding models<br />

that would give small-scale farmers<br />

access to credit.<br />

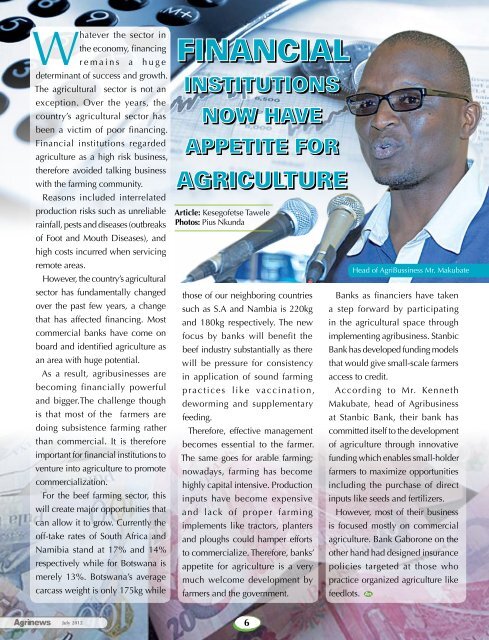

According to Mr. Kenneth<br />

Makubate, head <strong>of</strong> Agribusiness<br />

at Stanbic Bank, their bank has<br />

committed itself to the development<br />

<strong>of</strong> agriculture through innovative<br />

funding which enables small-holder<br />

farmers to maximize opportunities<br />

including the purchase <strong>of</strong> direct<br />

inputs like seeds and fertilizers.<br />

However, most <strong>of</strong> their business<br />

is focused mostly on commercial<br />

agriculture. Bank Gaborone on the<br />

other hand had designed insurance<br />

policies targeted at those who<br />

practice organized agriculture like<br />

feedlots.<br />

July 2012 6