The India opportunity in Food and Agribusiness Final ... - Efresh India

The India opportunity in Food and Agribusiness Final ... - Efresh India

The India opportunity in Food and Agribusiness Final ... - Efresh India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess<br />

F<strong>in</strong>al Report<br />

prepared by<br />

Rabo <strong>India</strong> F<strong>in</strong>ance Ltd<br />

(a 100% subsidiary of Rabobank International)<br />

March 2010<br />

<strong>The</strong> <strong>in</strong>formation conta<strong>in</strong>ed <strong>in</strong> this publication has been compiled, from sources which Rabo <strong>India</strong> F<strong>in</strong>ance Limited, its<br />

associates <strong>and</strong> other legal entities to which it belongs (Rabo) believes to be reliable, <strong>and</strong> Rabo does not guarantee its<br />

accuracy or completeness. This publication is for private circulation <strong>and</strong> for the exclusive <strong>and</strong> confidential use of<br />

addressee(s) only. Any other distribution, use or reproduction without Rabo’s prior consent is unauthorized <strong>and</strong> strictly<br />

prohibited. Rabo does not accept any liability whatsoever direct or <strong>in</strong>direct that may arise from the use of the <strong>in</strong>formation<br />

here<strong>in</strong>. Op<strong>in</strong>ions expressed <strong>in</strong> this document are subject to change without notice. Rabo <strong>and</strong> its subsidiaries, associates,<br />

agents, assigns, related parties, directors or employees may from time to time have <strong>in</strong>terests <strong>in</strong> the securities or companies<br />

mentioned <strong>in</strong> this document <strong>and</strong> / or <strong>in</strong>vestment bank<strong>in</strong>g or other professional relationship with such companies.<br />

Materials <strong>and</strong> <strong>in</strong>formation provided dur<strong>in</strong>g this presentation may conta<strong>in</strong> ‘forward‐look<strong>in</strong>g statements’. <strong>The</strong>se statements<br />

are based on current expectation, forecasts <strong>and</strong> assumptions that are subject to risks <strong>and</strong> uncerta<strong>in</strong>ties which would cause<br />

actual outcomes <strong>and</strong> results to differ materially from these statements. Rabo disclaims any <strong>in</strong>tention or obligation to<br />

update or revise any forward‐look<strong>in</strong>g statements whether as a result of new <strong>in</strong>formation, future events or otherwise.

----------------------------------------------------------------------------------<br />

Executive summary<br />

<strong>The</strong> team from Rabo <strong>India</strong> undertook a detailed study for the Embassy of the K<strong>in</strong>gdom of the<br />

Netherl<strong>and</strong>s (RNE) <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess (F&A) sectors <strong>in</strong> <strong>India</strong>. This was with the objective<br />

of strengthen<strong>in</strong>g the F&A corridor between <strong>India</strong> <strong>and</strong> the Netherl<strong>and</strong>s by identify<strong>in</strong>g mutually<br />

beneficial opportunities for <strong>in</strong>dustry players as well as other stakeholders <strong>in</strong> both countries. <strong>The</strong> four<br />

specific sectors of <strong>in</strong>terest <strong>in</strong>clude Dairy <strong>and</strong> Dairy equipments, Fresh Produce Supply cha<strong>in</strong>,<br />

Floriculture, <strong>and</strong> Bakery equipments.<br />

<strong>The</strong> summary of the f<strong>in</strong>d<strong>in</strong>gs <strong>and</strong> opportunities <strong>in</strong> various sectors are highlighted below.<br />

Dairy <strong>and</strong> Dairy equipments<br />

Milk production <strong>in</strong> <strong>India</strong> currently st<strong>and</strong>s at 108.5 million tonnes <strong>and</strong> is grow<strong>in</strong>g at 4% per annum for<br />

the last one decade. <strong>India</strong> has the largest population of bov<strong>in</strong>e animals <strong>in</strong> the world. <strong>The</strong> productivity<br />

of <strong>India</strong>n cattle (944 kg/annum) is low as compared to that of the EU. This is ma<strong>in</strong>ly because of the<br />

poor feed<strong>in</strong>g of milch animals at farm level. Also, the average size of herd <strong>in</strong> <strong>India</strong> is 3‐4 milch<br />

animals as compared to 70‐80 <strong>in</strong> Netherl<strong>and</strong>s. Lack of transport <strong>in</strong>frastructure, cold cha<strong>in</strong> facilities<br />

(bulk coolers, chill<strong>in</strong>g centres) <strong>and</strong> refrigerated vehicles has restricted the reach of quality dairy<br />

products to larger towns. Pric<strong>in</strong>g the milk <strong>and</strong> giv<strong>in</strong>g due weightage to fat, SNF <strong>and</strong> also to the<br />

bacteriological quality is essential for atta<strong>in</strong><strong>in</strong>g good end product quality. Low productivity <strong>and</strong><br />

fragmented dairy farms open up <strong>opportunity</strong> for sett<strong>in</strong>g up of <strong>in</strong>tegrated dairy farms. Players from<br />

the Netherl<strong>and</strong>s can enter <strong>in</strong>to a Jo<strong>in</strong>t Venture with an <strong>India</strong>n company to improve farm<br />

management practices.<br />

<strong>India</strong> is one of the fastest grow<strong>in</strong>g markets for milk <strong>and</strong> milk products. <strong>The</strong> market size for milk <strong>and</strong><br />

milk products (formal + <strong>in</strong>formal sector) is INR 2000 bn (EUR 30.8 bn). <strong>The</strong> organized market is<br />

grow<strong>in</strong>g at nearly 10 percent <strong>in</strong> value terms annually. With <strong>in</strong>creas<strong>in</strong>g urbanization, dem<strong>and</strong> for<br />

value‐added products is <strong>in</strong>creas<strong>in</strong>g. Some product segments like UHT milk, yoghurt etc are still a<br />

nascent category cater<strong>in</strong>g largely to the high <strong>in</strong>come households. Product <strong>in</strong>novation <strong>and</strong> pric<strong>in</strong>g<br />

holds the key <strong>in</strong> this market.<br />

<strong>The</strong>re are very few br<strong>and</strong>s <strong>in</strong> the <strong>India</strong>n dairy sector with a pan‐<strong>India</strong> reach. <strong>The</strong>re is immense scope<br />

for br<strong>and</strong>ed players, particular <strong>in</strong>ternational br<strong>and</strong>s, <strong>in</strong> the <strong>India</strong>n market. Products of <strong>in</strong>ternational<br />

br<strong>and</strong>s have entered the <strong>India</strong>n market either through importers or through grey market channels.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 2

----------------------------------------------------------------------------------<br />

<strong>The</strong> high prices of these products restrict their consumption largely to high <strong>in</strong>come households.<br />

Opportunities exist to jo<strong>in</strong> h<strong>and</strong>s with a local manufacturer <strong>in</strong> production for mak<strong>in</strong>g value‐added<br />

products.<br />

<strong>The</strong> <strong>in</strong>crease <strong>in</strong> process<strong>in</strong>g levels <strong>in</strong> the organized market from 20% (of total milk produced) to 30%<br />

<strong>in</strong> the next 5 years should lead to build<strong>in</strong>g up of new capacities. <strong>India</strong> has made considerable<br />

progress <strong>in</strong> the manufacture of dairy equipments with the emergence of several equipment<br />

manufacturers. Some of them have exclusive tie‐ups with foreign players for provid<strong>in</strong>g advanced<br />

dairy equipments. <strong>The</strong> <strong>in</strong>dustry is show<strong>in</strong>g growth <strong>in</strong> certa<strong>in</strong> categories such as bulk milk coolers,<br />

small homogenizes, milk pasteurizers, milk vend<strong>in</strong>g mach<strong>in</strong>e <strong>and</strong> liquid milk packag<strong>in</strong>g system etc.<br />

<strong>The</strong>re is ample scope for manufactur<strong>in</strong>g equipments for basic products like paneer, khoa etc. Further<br />

value added products like ice cream, cheese, yoghurt, UHT milk plants (Tetrapak) require specific<br />

equipments <strong>and</strong> mach<strong>in</strong>eries for sett<strong>in</strong>g up of the plant. However, the entry of foreign player is<br />

dependent on the price competitiveness with the local manufacturers. A JV with an exist<strong>in</strong>g player is<br />

recommended for gett<strong>in</strong>g a foothold <strong>in</strong> this market.<br />

<strong>India</strong> is currently an <strong>in</strong>significant player <strong>in</strong> the <strong>in</strong>ternational market ow<strong>in</strong>g to poor quality of products<br />

as compared to Oceania, EU <strong>and</strong> USA. Also, there has been a policy pursued by the Government of<br />

<strong>India</strong> to ban exports of dairy products from time to time. <strong>The</strong>re is huge dem<strong>and</strong> for milk powder <strong>and</strong><br />

butter oil <strong>in</strong> lean season. <strong>The</strong>re exists an <strong>opportunity</strong> to export these products from the Netherl<strong>and</strong>s,<br />

provided the price is competitive vis‐à‐vis countries such as New Zeal<strong>and</strong> <strong>and</strong> Australia.<br />

F<strong>in</strong>ally, the key to success of any jo<strong>in</strong>t venture <strong>in</strong> <strong>India</strong> lies <strong>in</strong> the ability to procure milk. It is<br />

therefore essential to have a local partner to enter <strong>India</strong> to ensure consistent supply of raw milk.<br />

Companies from the Netherl<strong>and</strong>s could also <strong>in</strong>vest <strong>in</strong> the supply cha<strong>in</strong> <strong>in</strong>frastructure to ensure<br />

availability of high quality milk on a susta<strong>in</strong>able basis.<br />

Fresh produce supply cha<strong>in</strong><br />

<strong>India</strong> is the world’s second largest producer of fruits <strong>and</strong> vegetables. It is bestowed with favourable<br />

agro‐climatic conditions for grow<strong>in</strong>g a large variety of fruits <strong>and</strong> vegetables. <strong>India</strong> is the largest<br />

producer of several fruit crops such as mango, banana, sapota <strong>and</strong> acid lime. Among vegetables,<br />

<strong>India</strong> is a large producer of tomato, onion, br<strong>in</strong>jal, cabbage, cauliflower, okra <strong>and</strong> pea. Increas<strong>in</strong>g<br />

<strong>in</strong>come <strong>and</strong> the growth of organised food retail holds promise for the fresh produce <strong>in</strong>dustry <strong>in</strong> the<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 3

----------------------------------------------------------------------------------<br />

future. Nevertheless, despite a huge planted base for horticulture, <strong>India</strong> lags beh<strong>in</strong>d <strong>in</strong> several areas<br />

such as yields, pre <strong>and</strong> post harvest practices as well as cold cha<strong>in</strong> <strong>in</strong>frastructure.<br />

<strong>The</strong>re are clear opportunities for <strong>in</strong>creas<strong>in</strong>g farm productivity through develop<strong>in</strong>g high yield<strong>in</strong>g<br />

varieties, replacement of old <strong>and</strong> uneconomical orchards, high density plant<strong>in</strong>g (HDP), protected<br />

cultivation <strong>and</strong> low cost green house technology, adoption of improved technologies <strong>in</strong> orchard<br />

management <strong>and</strong> tra<strong>in</strong><strong>in</strong>g <strong>in</strong> good agriculture practices. Also, there are opportunities to develop<br />

process<strong>in</strong>g varieties with high shelf life. <strong>India</strong> offers a seasonal w<strong>in</strong>dow of <strong>opportunity</strong> for imports of<br />

fruits such as apples <strong>and</strong> pears <strong>in</strong>to <strong>India</strong>. Separately, there exists a strong export potential for<br />

several fruits such as grapes, pomegranates <strong>and</strong> bananas. In fact, the export <strong>opportunity</strong> has<br />

<strong>in</strong>creased the need for implementation of quality st<strong>and</strong>ards <strong>and</strong> cold cha<strong>in</strong>.<br />

Players from the Netherl<strong>and</strong>s can also collaborate/<strong>in</strong>vest <strong>in</strong> the development of fresh produce retail<br />

cha<strong>in</strong>s <strong>in</strong> backend aggregation, cold cha<strong>in</strong> logistics, dem<strong>and</strong> forecast<strong>in</strong>g, resource plann<strong>in</strong>g <strong>and</strong><br />

advanced management systems. In fact, the required <strong>in</strong>frastructure <strong>in</strong> the fresh produce supply<br />

cha<strong>in</strong> is estimated at EUR 1211 million. This covers term<strong>in</strong>al markets, <strong>in</strong>tegrated pack houses, cold<br />

storage/controlled atmosphere technology <strong>and</strong> <strong>in</strong>stallations, ripen<strong>in</strong>g chambers, refrigerated<br />

transport <strong>and</strong> multimodal logistics network. Also collaboration opportunities exist with various<br />

government <strong>in</strong>stitutions spann<strong>in</strong>g the entire value cha<strong>in</strong> <strong>in</strong> terms tra<strong>in</strong><strong>in</strong>g, technology transfer <strong>and</strong><br />

advisory opportunities. For <strong>in</strong>stance, Research <strong>and</strong> Development assistance could be explored to<br />

State Agricultural Universities (SAUs) <strong>and</strong> other reputed <strong>in</strong>stitutions<br />

Floriculture<br />

Cut flowers <strong>and</strong> ornamental plants play an important role <strong>in</strong> the floriculture <strong>in</strong>dustry. <strong>The</strong> wide range<br />

of climatic conditions <strong>in</strong> <strong>India</strong> makes it a suitable dest<strong>in</strong>ation for production of flowers throughout<br />

the year. <strong>The</strong> domestic flower production (loose, cut <strong>and</strong> dried) as well as consumption is <strong>in</strong>creas<strong>in</strong>g<br />

year on year. <strong>The</strong> area under cultivation of flowers is at 160,700 ha (2007‐08) <strong>and</strong> has grown at an<br />

average of close to eight percent per year over the last fourteen years.<br />

<strong>The</strong> Government of <strong>India</strong> has recently undertaken a lot of steps to encourage further growth <strong>in</strong> the<br />

floriculture sector. Apart from open<strong>in</strong>g of flower auction centre <strong>and</strong> market facilitation centre, it has<br />

provided cold storage related <strong>in</strong>frastructure at key airports <strong>in</strong> <strong>India</strong>. While <strong>India</strong> has a negligible<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 4

----------------------------------------------------------------------------------<br />

share of global exports, there has been a shift towards grow<strong>in</strong>g cut flowers for exports. <strong>India</strong>’s<br />

exports <strong>in</strong> the floriculture sector are at EUR 56.7 million <strong>in</strong> 2008‐09. EU rema<strong>in</strong>s an important<br />

dest<strong>in</strong>ation for <strong>India</strong>’s cut flowers which is evident from the fact that Europe together with Japan,<br />

accounts for 76% of the total <strong>India</strong>n cut flower export realizations. Floriculture exports are likely to<br />

rise at a CAGR of 15% over the next 5 years. Trade liberalization has not only facilitated imports of<br />

latest technology, but also encouraged <strong>and</strong> enhanced import of <strong>in</strong>ternationally acclaimed plant<strong>in</strong>g<br />

material of different varieties. Along with the export <strong>in</strong>dustry, the dem<strong>and</strong> <strong>in</strong> the domestic market is<br />

also enormous <strong>and</strong> holds promise for the future. <strong>The</strong> present market is estimated at EUR 154 million<br />

(2007‐08) <strong>and</strong> grow<strong>in</strong>g at 21 percent per year.<br />

<strong>The</strong>re are many opportunities <strong>in</strong> floriculture sector <strong>in</strong> <strong>India</strong> where players <strong>in</strong> the Netherl<strong>and</strong>s can<br />

collaborate besides fresh cut flower exports from <strong>India</strong>. For <strong>in</strong>stance, there are significant<br />

opportunities <strong>in</strong> the production <strong>and</strong> market<strong>in</strong>g of dry flowers <strong>and</strong> the production of high‐value oil<br />

extracts <strong>and</strong> perfumes, dyes <strong>and</strong> other products, such as rose water etc. In fact, dry flowers already<br />

form a sizeable chunk of <strong>India</strong>n floriculture exports. In addition, as the cost of production <strong>in</strong> <strong>India</strong> is<br />

comparatively lower than that <strong>in</strong> other developed countries, outsourc<strong>in</strong>g flower production to <strong>India</strong><br />

could be a good bus<strong>in</strong>ess model for Netherl<strong>and</strong>s. <strong>The</strong>re is also an <strong>opportunity</strong> for us<strong>in</strong>g <strong>India</strong> as a<br />

production base for cactus. <strong>The</strong>re is also an <strong>opportunity</strong> to explore an association of <strong>India</strong>n <strong>in</strong>stitutes<br />

with the universities <strong>in</strong> the Netherl<strong>and</strong>s to cater to these needs for the <strong>in</strong>dustry <strong>in</strong> the areas of<br />

variety development, best practices for cultivation etc. Companies from the Netherl<strong>and</strong>s can also<br />

explore provid<strong>in</strong>g end to end solutions to the floriculture players i.e. from selection of l<strong>and</strong>,<br />

<strong>in</strong>frastructure development (green house structures etc), tra<strong>in</strong><strong>in</strong>g, plant<strong>in</strong>g material, project<br />

management <strong>and</strong> customers.<br />

Bakery equipments<br />

<strong>The</strong> bakery market <strong>in</strong> <strong>India</strong> is estimated at more than EUR 3.2 billion (INR 210 billion). <strong>India</strong> is the<br />

second largest producer of biscuits after the U.S. <strong>The</strong> two major bakery <strong>in</strong>dustries, viz. bread <strong>and</strong><br />

biscuit account for about 90 percent of the total bakery products. <strong>The</strong> estimated size of organised<br />

bread <strong>in</strong>dustry is about EUR 0.77 billion (INR 50 billion). In volume terms bread is projected to grow<br />

at 1.9 percent where as value added breads are expected to grow at 18‐20 percent. In biscuit<br />

segment, organized sector accounts for almost 50% of the production. <strong>The</strong> estimated size of<br />

organized biscuit <strong>in</strong>dustry is about EUR 1.1 billion (INR 69 billion). It is estimated that the biscuit<br />

market would grow at 8 percent per annum over the next five years. Other bakery products such as<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 5

----------------------------------------------------------------------------------<br />

breakfast cereals, cakes <strong>and</strong> pastries are grow<strong>in</strong>g at around 8‐11 percent annually. <strong>The</strong>se products<br />

are largely limited to urban areas.<br />

With <strong>in</strong>creas<strong>in</strong>g number urbanisation <strong>and</strong> need for sheer convenience has resulted <strong>in</strong> <strong>India</strong>n breads<br />

ga<strong>in</strong><strong>in</strong>g market share. Consumers are upgrad<strong>in</strong>g from unpacked/artisanal cake to packed <strong>in</strong>dustrial<br />

alternatives. Increas<strong>in</strong>g health awareness is giv<strong>in</strong>g a push to consumption of healthier options like<br />

brown bread, multigra<strong>in</strong> bread, whole wheat bread, multivitam<strong>in</strong> bread etc. Also, modern<br />

supermarkets are <strong>in</strong>strumental <strong>in</strong> bakery growth <strong>in</strong> <strong>India</strong>. Also, the organized food service sector <strong>in</strong><br />

<strong>India</strong> is grow<strong>in</strong>g at 12‐15% annually. International cha<strong>in</strong>s such as Subway, Dom<strong>in</strong>os, Pizza Hut are<br />

exp<strong>and</strong><strong>in</strong>g their franchise to Tier‐II cities. <strong>The</strong> growth of fast food/café cha<strong>in</strong>s would result <strong>in</strong><br />

<strong>in</strong>creased consumption of baked products across the country.<br />

<strong>The</strong> <strong>India</strong>n bakery equipments <strong>in</strong>dustry, estimated at EUR 23 million, can be divided <strong>in</strong>to <strong>in</strong>dustrial<br />

l<strong>in</strong>e (required by bread <strong>and</strong> biscuit companies for mass production) <strong>and</strong> non‐<strong>in</strong>dustrial l<strong>in</strong>es<br />

(required by <strong>in</strong>dividual bakeries). About 85% of the bakers use domestic made low‐end equipments.<br />

<strong>The</strong>se equipments are of average quality <strong>and</strong> priced lower than imported equipments from<br />

developed countries. After sales service is one of the biggest h<strong>in</strong>drances <strong>in</strong> the success of imported<br />

mach<strong>in</strong>eries.<br />

Most of the foreign players prefer to use exist<strong>in</strong>g manufacturers or traders network as the cost of<br />

sett<strong>in</strong>g up own dealer network is high. In <strong>India</strong>, bakery equipments are largely imported from EU,<br />

South Africa, Ch<strong>in</strong>a <strong>and</strong> Taiwan. Shift from h<strong>and</strong>made to mechanization‐technology is yet to make a<br />

big impact <strong>in</strong> the bakery <strong>in</strong>dustry. Dem<strong>and</strong> is ris<strong>in</strong>g for equipments that can produce convenient high<br />

quality bakery products. Consumers have started to appreciate quality.<br />

Organized players, modern retail <strong>and</strong> food service cha<strong>in</strong>s would be key targets for equipment<br />

manufacturer. Consider<strong>in</strong>g the growth rate of various segments of bakery <strong>in</strong>dustry it is estimated<br />

that besides the current market there is a potential new market for equipment capacity equivalent<br />

to 1.2 million tonnes of baked product over the next 5 years. In order to penetrate the <strong>India</strong> market,<br />

it is extremely important for equipment suppliers to provide excellent after sales service. In fact, the<br />

<strong>in</strong>itial cost of mach<strong>in</strong>e is not such a big factor as is the after sales service. S<strong>in</strong>ce hav<strong>in</strong>g their own set<br />

up <strong>in</strong> <strong>India</strong> may require a certa<strong>in</strong> scale, foreign companies should have JVs with some of the <strong>India</strong>n<br />

players with proper focus on the after sales service.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 6

----------------------------------------------------------------------------------<br />

Chapter 1<br />

Background<br />

<strong>The</strong> Embassy of the K<strong>in</strong>gdom of the Netherl<strong>and</strong>s (RNE) has sought assistance from Rabo <strong>India</strong><br />

F<strong>in</strong>ance Ltd (RIF), a 100% subsidiary of Rabobank International, to provide strategic advice perta<strong>in</strong><strong>in</strong>g<br />

to the food <strong>and</strong> agribus<strong>in</strong>ess l<strong>and</strong>scape <strong>in</strong> <strong>India</strong> <strong>and</strong> to identify mutually beneficial opportunities for<br />

companies <strong>in</strong> <strong>India</strong> as well as the Netherl<strong>and</strong>s. <strong>The</strong> four specific sectors of <strong>in</strong>terest <strong>in</strong>clude Fresh<br />

Produce Supply cha<strong>in</strong>, Floriculture, Dairy <strong>and</strong> Dairy equipments as well as Bakery equipments.<br />

This study entails a detailed supply cha<strong>in</strong> analysis of the selected sectors <strong>in</strong> <strong>India</strong>, with focus on the<br />

gaps <strong>and</strong> opportunities <strong>in</strong> the sector. <strong>The</strong> sector studies have been conducted through secondary<br />

data research, meet<strong>in</strong>gs <strong>and</strong> discussions with stakeholders, some of whom <strong>in</strong>clude food process<strong>in</strong>g<br />

companies, technology providers / equipment suppliers, <strong>in</strong>dustry associations, importers/exporters<br />

as well as various government bodies.<br />

A focused workshop was also organized by RNE <strong>in</strong> the Netherl<strong>and</strong>s to share the f<strong>in</strong>d<strong>in</strong>gs of the draft<br />

study <strong>and</strong> validate the opportunities identified <strong>in</strong> the sectors. Lead<strong>in</strong>g <strong>in</strong>dustry players <strong>and</strong><br />

companies/organizations with <strong>in</strong>terests <strong>in</strong> the above sectors were <strong>in</strong>vited for this workshop. Based<br />

on the feedback received at the workshop, this f<strong>in</strong>al report has been prepared, which documents the<br />

f<strong>in</strong>d<strong>in</strong>gs of the supply cha<strong>in</strong> analysis <strong>and</strong> the identified opportunities across the four sectors of study.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 7

----------------------------------------------------------------------------------<br />

Chapter 2<br />

Dairy <strong>and</strong> Dairy Equipments<br />

2.1 Introduction<br />

Milk production <strong>in</strong> <strong>India</strong> currently st<strong>and</strong>s at 108.5 million tonnes <strong>and</strong> is grow<strong>in</strong>g at 3.5% per annum<br />

over the last eight years. <strong>India</strong> ranks second <strong>in</strong> terms of milk production after EU‐ 27 <strong>and</strong> accounts<br />

for c. 16% of global production. <strong>The</strong> average size of herd <strong>in</strong> <strong>India</strong> is 2‐3 milch animals compared to<br />

70‐80 <strong>in</strong> Netherl<strong>and</strong>s. For a subsistence farmer, milch animals have multipurpose utility: draught<br />

animal, fuel provider (dried manure) etc.<br />

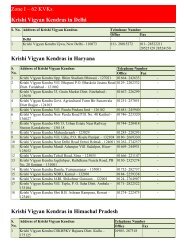

Exhibit 2.1 Milk Production <strong>in</strong> <strong>India</strong> (million tonnes)<br />

Source: National Dairy Development Board, <strong>India</strong><br />

S<strong>in</strong>ce <strong>India</strong> is a tropical country, climate has an effect on the production pattern of milk <strong>in</strong> <strong>India</strong>.<br />

<strong>The</strong>re are two seasons for milk production viz. the lean (from April to September) <strong>and</strong> flush season<br />

(from October to March). Milk production is higher <strong>in</strong> flush season <strong>and</strong> lower (~60% of flush season)<br />

<strong>in</strong> lean season. <strong>The</strong> market for milk <strong>and</strong> milk products are still largely dom<strong>in</strong>ated by the <strong>in</strong>formal<br />

sector. Most of the milk produced <strong>in</strong> <strong>India</strong> is still reta<strong>in</strong>ed by the producers.<br />

Exhibit 2.2 : Milk Process<strong>in</strong>g <strong>in</strong> <strong>India</strong> (2009‐10)<br />

Degree of Process<strong>in</strong>g Type % milk h<strong>and</strong>led<br />

Raw Retention by rural consumers / sale to rural non‐producers 41<br />

Sold as loose milk <strong>in</strong> urban areas 17<br />

Processed (formal) Packed liquid milk 15<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 8

----------------------------------------------------------------------------------<br />

Degree of Process<strong>in</strong>g Type % milk h<strong>and</strong>led<br />

Processed (<strong>in</strong>formal)<br />

Value‐added milk products 5<br />

Value‐added milk products<br />

22<br />

(mostly traditional <strong>India</strong>n milk products)<br />

Total 100<br />

Source: Rabobank Analysis<br />

2.2 Milk Production<br />

Three tier system of dairy/Amul 1 Model<br />

<strong>India</strong> has a unique pattern of milk production <strong>and</strong> collection – the three tier system/Amul model<br />

followed by the dairy cooperatives. <strong>The</strong> Dairy Cooperatives have been organised <strong>in</strong>to a three‐tier<br />

structure with the Dairy Cooperative Societies (DCS) at the village level com<strong>in</strong>g under a Milk Union or<br />

District Union at the district level <strong>and</strong> a Federation of member Unions at the state level. <strong>The</strong> 13.41<br />

million farmer members of the dairy cooperative societies at the village level are a part of 128,799<br />

villages Dairy Cooperative Societies (DCS) also known as Primary Milk Producer Societies (about 130<br />

farmers per DCS) which are connected to 180 district milk cooperatives (Milk Union) <strong>and</strong> 17 State<br />

Federations. DCS h<strong>and</strong>les about 27 million kg of milk per day. Presently the co‐operatives h<strong>and</strong>le c.<br />

10% of the total milk produced <strong>in</strong> the country. <strong>The</strong> cooperatives form part of a national milk grid that<br />

l<strong>in</strong>ks milk producers throughout <strong>India</strong> with consumers <strong>in</strong> more than 800 towns <strong>and</strong> cities <strong>and</strong> bridges<br />

seasonal <strong>and</strong> regional variations <strong>in</strong> the availability of milk.<br />

<strong>The</strong> activities of the DCS <strong>in</strong>clude:<br />

‣ Milk collection, test<strong>in</strong>g quality of raw milk <strong>and</strong> fat <strong>and</strong> solid non fat (SNF) content determ<strong>in</strong>ation<br />

‣ Sale of cattle feed<br />

‣ Provide micro‐level <strong>in</strong>puts such as Artificial Insem<strong>in</strong>ation (AI) service <strong>and</strong> Veter<strong>in</strong>ary First Aid<br />

(VFA) to the members’ animals.<br />

‣ <strong>The</strong> DCS also markets nutritionally balanced compounded cattle feed produced by the cattle<br />

feed plant owned <strong>and</strong> operated by the District Union as well as fodder seeds.<br />

In general the Union carries out four important functions:<br />

‣ Milk procurement<br />

1 Amul is the largest co‐operative movement <strong>in</strong> <strong>India</strong> with 2.8 million milk producers organized <strong>in</strong> 13,328 co‐operative societies <strong>in</strong> 2008‐<br />

2009. Amul follows a bus<strong>in</strong>ess model, which aims at provid<strong>in</strong>g 'value for money' products to its consumers, while protect<strong>in</strong>g the <strong>in</strong>terests<br />

of the milk‐produc<strong>in</strong>g farmers who are its suppliers as well as its owners.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 9

----------------------------------------------------------------------------------<br />

‣ Milk process<strong>in</strong>g <strong>and</strong> market<strong>in</strong>g<br />

‣ Provid<strong>in</strong>g technical <strong>in</strong>puts <strong>and</strong> extension services for enhanc<strong>in</strong>g milk production <strong>and</strong> productivity<br />

‣ Strengthen<strong>in</strong>g the milk cooperative movement<br />

<strong>The</strong> Federations are responsible for:<br />

‣ Evolv<strong>in</strong>g <strong>and</strong> implement<strong>in</strong>g policies on cooperative market<strong>in</strong>g of member Unions’ milk <strong>and</strong> milk<br />

products<br />

‣ Decid<strong>in</strong>g the products‐price mix<br />

‣ Manag<strong>in</strong>g centralized <strong>in</strong>put services (artificial <strong>in</strong>sem<strong>in</strong>ation, breed<strong>in</strong>g) on behalf of the Union<br />

Milk procurement by private players<br />

<strong>The</strong> three tier system followed by the cooperatives is quite different from the milk procurement<br />

structure followed by the private players. <strong>The</strong> private dairies have a loose arrangement for<br />

procurement of milk where<strong>in</strong> the milk is procured from the agents/contractors who <strong>in</strong> turn procure<br />

milk from the producers. Each agent typically would procure from 20‐25 producers. Some milk is also<br />

procured from the DCS of the co‐operative structure. In northern <strong>India</strong>, the use of<br />

agents/contractors is more prevalent than <strong>in</strong> other parts of <strong>India</strong> largely as the cooperative system is<br />

not that strong <strong>in</strong> this region. <strong>The</strong> agents are responsible for guarantee<strong>in</strong>g the quality of milk given<br />

to the private dairies. <strong>The</strong> private dairies h<strong>and</strong>le c.10% of the total milk produced <strong>in</strong> the country.<br />

2.3 Market Potential<br />

<strong>India</strong> is one of the fastest grow<strong>in</strong>g markets for milk <strong>and</strong> milk products. <strong>The</strong> market size for milk <strong>and</strong><br />

milk products (formal + <strong>in</strong>formal sector) is INR 2000 bn (EUR 30.8 bn). <strong>The</strong> organized market is<br />

grow<strong>in</strong>g at nearly 10 percent <strong>in</strong> value terms annually. <strong>The</strong> dem<strong>and</strong> for value added milk products viz.<br />

cheese, dahi (<strong>India</strong>n yoghurt); probiotic dr<strong>in</strong>ks etc. is <strong>in</strong>creas<strong>in</strong>g at a double digit rate.<br />

At present <strong>India</strong> seems to be largely self sufficient <strong>in</strong> its requirement for milk <strong>and</strong> milk products.<br />

However, given that dem<strong>and</strong> <strong>in</strong> organized dairy segment is grow<strong>in</strong>g faster than growth <strong>in</strong> milk<br />

production, there could be issues with respect to self sufficiency <strong>in</strong> the medium to long term.<br />

Focused efforts would be required on two fronts viz. <strong>in</strong>creas<strong>in</strong>g farm size (currently the average size<br />

of animal per producer is 2‐3) <strong>and</strong> <strong>in</strong>creas<strong>in</strong>g productivity of milch animals so as to catch up with the<br />

<strong>in</strong>creas<strong>in</strong>g dem<strong>and</strong> of milk <strong>and</strong> milk products.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 10

----------------------------------------------------------------------------------<br />

Liquid milk<br />

<strong>The</strong> packed liquid milk constitutes the largest segment <strong>in</strong> dairy, followed by ghee 2 <strong>in</strong> value terms.<br />

<strong>India</strong>n consumers prefer fresh milk which is sold <strong>in</strong> pouches with a shelf life close to two days. Safety<br />

<strong>and</strong> quality concerns have prompted urban consumers to shift from loose liquid milk to pasteurized<br />

packaged milk. Dairy co‐operatives have a major presence <strong>in</strong> this segment <strong>in</strong> their respective state of<br />

operation e.g. ‘Amul’ <strong>in</strong> Gujarat, ‘Verka’ <strong>in</strong> Punjab, ‘N<strong>and</strong><strong>in</strong>i’ <strong>in</strong> Karnataka, ‘Aav<strong>in</strong>’ <strong>in</strong> Tamilnadu,<br />

‘Saras’ <strong>in</strong> Rajasthan. Private players like Hatsun Agro, Creaml<strong>in</strong>e Dairy are also hav<strong>in</strong>g a sizeable<br />

market share <strong>in</strong> liquid milk. Some of the domestic corporates such as Reliance, DSCL <strong>and</strong> Cav<strong>in</strong>Kare<br />

have also started their milk operations recently.<br />

Exhibit 2.3 : Organized market size <strong>and</strong> growth rates for various dairy products (2008‐09)<br />

Organized market<br />

value (EUR Mn)<br />

Growth rate<br />

(%)<br />

Liquid Milk 5,000 20<br />

Butter 200 8<br />

Ice‐cream 246 20<br />

Cheese (<strong>in</strong>cl. cheese spread) 85 25<br />

Ghee (Anhydrous Milk Fat) 538 8‐10<br />

Dahi (Yoghurt) 100 20<br />

Paneer (<strong>India</strong>n soft cheese) 38 10‐12<br />

Flavoured Milk 92 20<br />

Dairy whitener /Milk powder /UHT /sweets etc 577 10‐15<br />

Source : Rabobank estimates<br />

Butter<br />

This is used ma<strong>in</strong>ly for traditional food preparations. Amul is the market leader <strong>in</strong> this segment with<br />

a market share of c.80%. Growth <strong>in</strong> food services sector is key to <strong>in</strong>creas<strong>in</strong>g dem<strong>and</strong> for this product.<br />

Other strong regional players <strong>in</strong> the market <strong>in</strong>clude Mother Dairy, Parag Dairy (Gowardhan), Verka,<br />

Vijaya etc.<br />

Ice‐cream<br />

This is one of the fastest grow<strong>in</strong>g segments <strong>in</strong> dairy with a CAGR of c. 20% <strong>in</strong> the last five years.<br />

Around 70% of the total ice‐cream sold <strong>in</strong> <strong>India</strong> is through organized format <strong>and</strong> the rest is sold<br />

through unorganised formats. GCMMF (Amul) is the market leader <strong>in</strong> ice cream with 25% of market<br />

share followed by Kwality Walls (HUL) <strong>and</strong> Vadilal at 15% <strong>and</strong> 10% respectively. Other players<br />

2 clarified butter<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 11

----------------------------------------------------------------------------------<br />

manufactur<strong>in</strong>g ice‐cream <strong>in</strong>clude Mother Dairy <strong>and</strong> Hatsun Dairy, D<strong>in</strong>shaw etc. <strong>The</strong>re are many small<br />

players manufactur<strong>in</strong>g ice‐cream <strong>in</strong> <strong>India</strong> cater<strong>in</strong>g ma<strong>in</strong>ly to the needs of the local market. Product<br />

<strong>in</strong>novation <strong>and</strong> pric<strong>in</strong>g holds the key <strong>in</strong> this market. Basic flavors like vanilla, butterscotch <strong>and</strong><br />

chocolate sell the most. Cold cha<strong>in</strong> distribution along with product <strong>in</strong>novation is key to future<br />

growth of the ice‐cream market. Ice cream consumption is cyclical <strong>in</strong> nature <strong>and</strong> peaks around<br />

summer season.<br />

Cheese<br />

Cheese is the fastest grow<strong>in</strong>g market among milk products. Traditionally <strong>India</strong> has been a paneer<br />

(soft cheese) consum<strong>in</strong>g market which is dom<strong>in</strong>ated by unorganised players. Rise <strong>in</strong> food service<br />

outlets (e.g. Pizza Hut, Dom<strong>in</strong>o’s etc.) across the country <strong>and</strong> chang<strong>in</strong>g food habits has triggered the<br />

<strong>in</strong>crease <strong>in</strong> dem<strong>and</strong> for this product. <strong>The</strong> various varieties of cheese available <strong>in</strong> this segment <strong>in</strong>clude<br />

cheddar, mozzarella, gouda, piccolo <strong>and</strong> processed cheese. Different variants of cheese spread<br />

(estimated market size EUR 16 mn) like pla<strong>in</strong>, garlic, pepper etc. are also available <strong>in</strong> the market.<br />

Processed cheese has around 70% market share of the total cheese sold <strong>in</strong> the country. GCMMF<br />

(‘Amul’) is the market leader <strong>in</strong> this segment with c. 70% of market share. Bongra<strong>in</strong> (from France) is<br />

also present <strong>in</strong> this sector through their <strong>India</strong>n subsidiary Dabon International Pvt. Ltd. It is sell<strong>in</strong>g<br />

basic <strong>and</strong> premium cheese variants of cheese <strong>and</strong> cheese spreads under their <strong>in</strong>ternational br<strong>and</strong><br />

Milkana ‐ though their presence is currently restricted to metropolitan cities.<br />

Ghee<br />

Ghee is the largest consumed item among milk <strong>and</strong> milk products after liquid milk. Ghee has been<br />

traditionally used for cook<strong>in</strong>g purposes <strong>in</strong> <strong>India</strong>n households. Traditional <strong>India</strong>n sweets like Peda,<br />

Gulabjamun etc. are made us<strong>in</strong>g ghee as a cook<strong>in</strong>g medium. ‘Amul’ <strong>and</strong> ‘Sagar’ are two well known<br />

br<strong>and</strong>s (both from GCMMF) <strong>in</strong> this category with pan‐<strong>India</strong>n footpr<strong>in</strong>ts. Other strong regional br<strong>and</strong>s<br />

<strong>in</strong>clude ‘Saras’, ‘Verka’, ‘N<strong>and</strong><strong>in</strong>i’, <strong>and</strong> ‘Madhusudhan’ etc.<br />

Curd (‘dahi’)<br />

Curd (<strong>India</strong>n yoghurt) is one of the fastest grow<strong>in</strong>g milk product segments <strong>in</strong> <strong>India</strong>. It is a traditional<br />

home made product but with <strong>in</strong>creas<strong>in</strong>g urbanization, dem<strong>and</strong> for packaged curd is <strong>in</strong>creas<strong>in</strong>g. In<br />

most parts of <strong>India</strong> the local name for curd is ‘dahi’. This product is available <strong>in</strong> two forms viz. set<br />

dahi <strong>in</strong> plastic cups <strong>and</strong> stirred dahi <strong>in</strong> plastic pouches. In North <strong>India</strong>, mostly set dahi is consumed<br />

while <strong>in</strong> South <strong>India</strong> stirred dahi is a bigger market. Karnataka Dairy Co‐operative (br<strong>and</strong> ‘N<strong>and</strong><strong>in</strong>i’) is<br />

the market leader <strong>in</strong> pouch dahi sell<strong>in</strong>g close to 100000 litres of pouch curd daily. Amul is the leader<br />

<strong>in</strong> set curd segment with pan‐<strong>India</strong> presence. Mother Dairy <strong>and</strong> private players like Nestle, Britannia<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 12

----------------------------------------------------------------------------------<br />

<strong>and</strong> regional players like Parag (‘Gowardhan’) are aggressively market<strong>in</strong>g their products <strong>in</strong> the<br />

market.<br />

Paneer<br />

Paneer (<strong>India</strong>n soft cheese) is a traditional product consumed largely <strong>in</strong> northern <strong>and</strong> western parts<br />

of <strong>India</strong>. This product is very similar to cottage cheese <strong>and</strong> is manufactured us<strong>in</strong>g acid coagulant<br />

(lemon juice). In the past, dem<strong>and</strong> for this product was catered mostly by the unorganised sector.<br />

However, s<strong>in</strong>ce 2000, many organized players like GCMMF, Mother Dairy <strong>and</strong> Punjab MilkFed have<br />

started focus<strong>in</strong>g on this product. <strong>The</strong> market share of GCMMF (br<strong>and</strong> ‘Amul’) is close to 50% while<br />

Mother Dairy <strong>and</strong> MilkFed (br<strong>and</strong> ‘Verka’) have 20% share each. Recently, Reliance Industries, <strong>India</strong>’s<br />

largest private sector company, has also entered this category.<br />

Flavoured Milk<br />

Flavored milk has the fastest grow<strong>in</strong>g market among various milk products. This product is ma<strong>in</strong>ly<br />

consumed as a beverage <strong>and</strong> competes with other beverages <strong>in</strong>clud<strong>in</strong>g the carbonated ones. <strong>The</strong><br />

product is consumed more <strong>in</strong> the summer. Flavored milk is mostly sold <strong>in</strong> sterilized glass bottles.<br />

Other forms of packag<strong>in</strong>g <strong>in</strong>clude polythene pouches <strong>and</strong> tetrapak <strong>and</strong> t<strong>in</strong> cans. GCMMF (br<strong>and</strong><br />

‘Amul’) is the market leader <strong>in</strong> this category with close to 75% market share. Other br<strong>and</strong>s <strong>in</strong>clude<br />

Mother Dairy (7%), Verka, N<strong>and</strong><strong>in</strong>i, Vijaya, Saras etc<br />

UHT milk<br />

At present, UHT milk is a nascent category cater<strong>in</strong>g largely to the high <strong>in</strong>come households. It is<br />

grow<strong>in</strong>g at a robust growth rate of 25% per annum. It is ma<strong>in</strong>ly promoted on the platform of safety,<br />

health <strong>and</strong> convenience. At present, UHT milk directly competes with loose / fresh pouch milk which<br />

is an extremely price sensitive category.<br />

Khoa<br />

Khoa is a traditional <strong>India</strong>n product made by heat desiccation of milk. In ancient times the pric<strong>in</strong>g of<br />

milk was done based on the quantity of khoa produced from milk. An estimated 7% of the total milk<br />

produced <strong>in</strong> the country goes for preparation of khoa, which forms a base for many traditional<br />

<strong>India</strong>n sweets such as Gulabjamun, peda, kalak<strong>and</strong> etc. Currently there are no organized players<br />

manufactur<strong>in</strong>g khoa due to lack of appropriate technologies for manufactur<strong>in</strong>g at a cont<strong>in</strong>uous level.<br />

Probiotic products<br />

With health consciousness ga<strong>in</strong><strong>in</strong>g ground among consumers, the dem<strong>and</strong> for probiotic products is<br />

<strong>in</strong>creas<strong>in</strong>g. For example, GCMMF has launched a range of probiotic products (‘Amul Prolife’). <strong>The</strong><br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 13

----------------------------------------------------------------------------------<br />

acceptability of probiotic product is well supported by the fact that fermented <strong>and</strong> cultured dairy<br />

products are traditionally consumed <strong>in</strong> <strong>India</strong>. However, the challenge for probiotic products lies <strong>in</strong><br />

distribution as the product carries live organisms that have to be preserved <strong>in</strong> specific numbers till<br />

f<strong>in</strong>al consumption. Yakult (from Japan) <strong>and</strong> Danone (from France) have jo<strong>in</strong>ed h<strong>and</strong>s to market<br />

probiotic fermented milk dr<strong>in</strong>ks <strong>in</strong> <strong>India</strong>.<br />

<strong>The</strong>re is also a grow<strong>in</strong>g dem<strong>and</strong> for dairy products as <strong>in</strong>gredients for pharmaceutical <strong>and</strong> allied<br />

<strong>in</strong>dustries. Indigenous milk products like shrikh<strong>and</strong>, gulab jamun, rassogulla, paneer, peda etc have a<br />

market worth INR 5 billion (EUR 77 mn) <strong>in</strong> North America, Canada, Europe <strong>and</strong> Middle East. <strong>The</strong>se<br />

<strong>in</strong>digenous products offer scope for <strong>in</strong>tervention of right technology <strong>and</strong> pack<strong>in</strong>g for longer shelf life.<br />

2.4 Export market<br />

<strong>India</strong> has been self sufficient <strong>in</strong> milk production <strong>and</strong> consumption. <strong>The</strong> exports of milk <strong>and</strong> milk<br />

products from <strong>India</strong> form less than 1% of the total <strong>in</strong>ternational trade. Also, exports account for less<br />

than 1% of the total milk produced <strong>in</strong> <strong>India</strong>. <strong>The</strong> export market used to be mostly concentrated <strong>in</strong><br />

Asia <strong>and</strong> more to neighbour<strong>in</strong>g countries <strong>and</strong> Middle East primarily due to low cost of end products.<br />

Concentrated milk products (skim milk powder) form bulk of exports from <strong>India</strong> (78%).<br />

<strong>India</strong> has failed to become a major player <strong>in</strong> the <strong>in</strong>ternational market ow<strong>in</strong>g to poor quality products<br />

as compared to Oceania, EU <strong>and</strong> USA. Also, lately there has been a decl<strong>in</strong>e <strong>in</strong> export competitiveness<br />

ow<strong>in</strong>g to higher farm gate prices (especially aga<strong>in</strong>st New Zeal<strong>and</strong> <strong>and</strong> Australia). Moreover, the<br />

<strong>in</strong>creas<strong>in</strong>g dem<strong>and</strong> of milk <strong>and</strong> milk products <strong>in</strong> <strong>India</strong> has resulted <strong>in</strong> <strong>in</strong>creased domestic prices of<br />

SMP <strong>and</strong> butter. However, <strong>India</strong> is surrounded by countries/regions which are gross milk deficient<br />

viz. Middle East, Ch<strong>in</strong>a, South Asia, South East Asia etc. <strong>The</strong>re is still some scope for exports of value<br />

added milk products viz. skim milk powder, whole milk powder, butter etc. <strong>in</strong> these regions.<br />

In recent years there has been a policy pursued by the Government of <strong>India</strong> to ban exports of skim<br />

milk powder <strong>and</strong> whole milk powder. This was <strong>in</strong>tended to discourage exports of milk powder so as<br />

to reduce domestic <strong>in</strong>flationary pressures. However, export of milk by‐products like case<strong>in</strong>, whey<br />

prote<strong>in</strong>, lactose etc. were not banned dur<strong>in</strong>g this period, thereby offer<strong>in</strong>g a small w<strong>in</strong>dow of<br />

<strong>opportunity</strong>.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 14

----------------------------------------------------------------------------------<br />

2.5 Challenges <strong>in</strong> dairy sector<br />

<strong>India</strong> has the largest population of bov<strong>in</strong>e animals <strong>in</strong> the world. <strong>India</strong> has 57% of world buffalo<br />

population <strong>and</strong> 16% of world cattle population. <strong>The</strong> productivity of <strong>India</strong>n cattle (980 kg/annum) is<br />

low as compared to that of European Countries <strong>and</strong> USA (approx. 8000 kg/annum). This is ma<strong>in</strong>ly<br />

because of the poor feed<strong>in</strong>g of milch naimals at farm level. Cattle feed <strong>and</strong> concentrates are rarely<br />

fed to animals. It is green fodder, dry fodder <strong>and</strong> left over of household foods that is given to the<br />

animals. Also, the logistics cost of h<strong>and</strong>l<strong>in</strong>g milk is high ow<strong>in</strong>g to fragmented farm size. <strong>The</strong> <strong>in</strong>crease<br />

<strong>in</strong> average size of herd <strong>and</strong> productivity would help <strong>in</strong> reduc<strong>in</strong>g logistic costs <strong>and</strong> provide good<br />

quality raw milk on a consistent basis to the dairy plants.<br />

Cattle rear<strong>in</strong>g <strong>and</strong> breed<strong>in</strong>g techniques<br />

<strong>The</strong> ma<strong>in</strong> technical constra<strong>in</strong>ts to <strong>in</strong>creas<strong>in</strong>g milk yields are the <strong>in</strong>ability of dairy farmers to feed<br />

cattle adequately throughout the year coupled with poor quality of dairy animals. Artificial<br />

Insem<strong>in</strong>ation services for breed<strong>in</strong>g better cattle breed also has a limited reach with current coverage<br />

of bov<strong>in</strong>es at only 34%. Moreover milk producers <strong>in</strong> <strong>India</strong> do not follow good hygienic practices while<br />

milk<strong>in</strong>g. Milch animals are milked us<strong>in</strong>g h<strong>and</strong>s <strong>in</strong> more than 95% of cases <strong>in</strong>stead of a milk<strong>in</strong>g<br />

mach<strong>in</strong>e. This result <strong>in</strong> poor quality of raw milk received at the dairy plant.<br />

Fragmented farm size<br />

<strong>The</strong> average size of milch animals per producer <strong>in</strong> <strong>India</strong> is 2‐3 as compared to 35 for EU 15. H<strong>and</strong>l<strong>in</strong>g<br />

<strong>and</strong> manag<strong>in</strong>g logistics of fragmented farms is quite costly <strong>and</strong> complex. Due to tropical climate <strong>in</strong><br />

<strong>India</strong>, the raw milk quality is also not so good. Moreover due to the bottlenecks <strong>in</strong> <strong>in</strong>frastructure;<br />

milk collection is undertaken twice a day. This makes it difficult to manage the entire back end of the<br />

supply cha<strong>in</strong>. Milk is transported both <strong>in</strong> chilled <strong>and</strong> raw form to the dairy plant.<br />

Poor state of <strong>in</strong>frastructure<br />

Poor roads <strong>and</strong> <strong>in</strong>efficient transport <strong>in</strong>frastructure has led to an <strong>in</strong>efficient procurement system.<br />

Moreover, the present distribution network has its limitation both <strong>in</strong> terms of reach <strong>and</strong> capacity.<br />

Lack of transport <strong>in</strong>frastructure, cold cha<strong>in</strong> facilities (bulk coolers, chill<strong>in</strong>g centres) <strong>and</strong> refrigerated<br />

vehicles have restricted the reach of quality dairy products to larger towns. <strong>The</strong> percentage of milk<br />

h<strong>and</strong>led by the organized sector can be improved further if these bottle necks are resolved.<br />

However, dairy companies are reluctant to make upfront <strong>in</strong>vestments <strong>in</strong> <strong>in</strong>frastructure ow<strong>in</strong>g to<br />

concerns on return on <strong>in</strong>vestments.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 15

----------------------------------------------------------------------------------<br />

Adulteration of milk<br />

At many places milk is subjected to adulteration before it reaches the dairy. Though the figures are<br />

not too high (

----------------------------------------------------------------------------------<br />

2.6 Legal <strong>and</strong> Taxation Issues<br />

<strong>The</strong>re are no excise duties on any of the dairy products manufactured <strong>in</strong> <strong>India</strong>. <strong>The</strong>re are state‐level<br />

taxes for <strong>in</strong>ter‐state movement of milk <strong>and</strong> milk products which are levied only on the organized<br />

players. This creates a non‐level play<strong>in</strong>g field vis‐a‐vis the unorganized players, who <strong>in</strong> turn can price<br />

their products lower s<strong>in</strong>ce there is no outflow on account of such levies. <strong>The</strong>re is high level of<br />

taxation on dairy equipment <strong>and</strong> mach<strong>in</strong>ery with the exception of a few products which are exempt.<br />

This is primarily done by the government to encourage the domestic equipment manufactur<strong>in</strong>g<br />

<strong>in</strong>dustry.<br />

2.7 Dairy Equipment Sector<br />

Of late, <strong>India</strong> has made considerable progress <strong>in</strong> the manufacture of dairy equipments with the<br />

emergence of several euipment manufacturers. Some of them have exclusive tie‐ups with foreign<br />

equipment players for provid<strong>in</strong>g advanced dairy equipment for the <strong>India</strong>n dairy <strong>in</strong>dustry. <strong>The</strong> growth<br />

of the dairy equipment sector has picked up ma<strong>in</strong>ly because of growth <strong>in</strong> the organized dairy sector<br />

over the last decade. <strong>The</strong> <strong>in</strong>dustry is show<strong>in</strong>g growth <strong>in</strong> certa<strong>in</strong> categories such as road tankers,<br />

storage tanks, bulk milk coolers, small homogenizes, milk pasteurizers, milk vend<strong>in</strong>g mach<strong>in</strong>e <strong>and</strong><br />

liquid milk packag<strong>in</strong>g system etc. Equipments for packag<strong>in</strong>g of butter, cheese, paneer <strong>and</strong> other<br />

traditional products needs focused attention for tapp<strong>in</strong>g small <strong>and</strong> medium scale operations.<br />

Milk Collection <strong>and</strong> logistics (upto milk plant)<br />

Milk<strong>in</strong>g mach<strong>in</strong>es<br />

A large percentage of dairy farmers still do manual milk<strong>in</strong>g with h<strong>and</strong>s. Mach<strong>in</strong>e milk<strong>in</strong>g is slowly<br />

pick<strong>in</strong>g up due to some <strong>in</strong>herent advantages over manual milk<strong>in</strong>g. Mach<strong>in</strong>e milk<strong>in</strong>g scores over<br />

manual mik<strong>in</strong>g as it reduces cost of labour <strong>and</strong> ensures complete milk<strong>in</strong>g of cattle. Many domestic<br />

companies as well as a few MNC players like Delaval, Westfalia operate <strong>in</strong> this space. <strong>The</strong> MNC<br />

players offer better quality products as compared to domestic products, albeit at a premium pric<strong>in</strong>g.<br />

Automatic Milk Collection Unit (AMCU)<br />

AMCU is a comb<strong>in</strong>ation of software <strong>and</strong> applications <strong>and</strong> allied components such as PC, UPS system,<br />

pr<strong>in</strong>ter, <strong>and</strong> milk tester automation unit. AMCU is used for collect<strong>in</strong>g milk, captur<strong>in</strong>g the data<br />

(quantity, fat%, SNF% <strong>and</strong> other additional <strong>in</strong>formation per transaction), whenever a farmer delivers<br />

the raw milk at the village pool<strong>in</strong>g po<strong>in</strong>t (VPP). AMCU helps <strong>in</strong> mak<strong>in</strong>g the overall transaction process<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 17

----------------------------------------------------------------------------------<br />

more transparent <strong>and</strong> trustworthy as it reduces human errors, transaction time <strong>and</strong> wastage as<br />

compared to the traditional manual way of collection, record<strong>in</strong>g <strong>and</strong> bill<strong>in</strong>g. Imported products<br />

would not have a major technological advantage, given that they would be significantly costlier. A<br />

tie‐up with a local manufacturer can be the best option for a player from the Netherl<strong>and</strong>s.<br />

Milk test<strong>in</strong>g equipments<br />

Milk analyzer is used to measure % fat content <strong>in</strong> the milk at village pool<strong>in</strong>g po<strong>in</strong>t level. <strong>The</strong><br />

electronic milkotester which has been developed by <strong>India</strong>n Dairy Equipment Company Ltd. is widely<br />

used. <strong>The</strong> lactometer is used for solid non fat content test<strong>in</strong>g <strong>in</strong> the milk. <strong>The</strong>re are many companies<br />

<strong>in</strong> <strong>India</strong> which are manufactur<strong>in</strong>g milk analyzer <strong>in</strong>struments e.g. milkotester, milkoscan etc. <strong>The</strong>re<br />

are also a few companies which sell these products under a technical collaboration with a foreign<br />

company, but the market for such products is negligible. <strong>The</strong>re is limited scope for foreign players <strong>in</strong><br />

this segment. However a tie‐up with a local manufacturer might work.<br />

Weigh<strong>in</strong>g scales<br />

<strong>The</strong>re are no <strong>in</strong>herent advantages <strong>in</strong> this segment for any foreign player over <strong>in</strong>digenously made<br />

weigh<strong>in</strong>g mac<strong>in</strong>es. Local companies manufactur<strong>in</strong>g weigh<strong>in</strong>g scales are fairly accurate <strong>and</strong> rigid to<br />

<strong>India</strong>n conditions. <strong>The</strong>re is no technological advantage attached ‐ hence limited scope for players<br />

from the Netherl<strong>and</strong>s.<br />

Milk transportation vehicles/milk cans<br />

Milk is transported <strong>in</strong> milk cans of 20 or 40 litre capacity from farm to Bulk cool<strong>in</strong>g po<strong>in</strong>t. <strong>The</strong>se are<br />

made of alum<strong>in</strong>um or sta<strong>in</strong>less steel. <strong>The</strong>re are many private players manufactur<strong>in</strong>g cans <strong>in</strong> <strong>India</strong>.<br />

<strong>The</strong> market leader is Khambete Kothari Cans <strong>and</strong> Allied Products Pvt. Ltd (KKCAP), the largest<br />

manufacturer of alum<strong>in</strong>ium alloy milk cans <strong>in</strong> <strong>India</strong>. <strong>The</strong>re are a number of small private players<br />

sell<strong>in</strong>g alum<strong>in</strong>ium, plastic <strong>and</strong> sta<strong>in</strong>less steel (SS) cans. No foreign player is present <strong>in</strong> this bus<strong>in</strong>ess.<br />

Milk tankers / Bulk Milk coolers<br />

Milk is transported to the dairy plant either <strong>in</strong> the form of raw milk (us<strong>in</strong>g cans) or raw chilled milk<br />

(us<strong>in</strong>g milk tankers). Also processed milk is transported us<strong>in</strong>g milk tankers. <strong>The</strong> milk tankers used <strong>in</strong><br />

<strong>India</strong> are all <strong>in</strong>sulated ones. Refrigerated tankers are still not used <strong>in</strong> <strong>India</strong>. This is because the time<br />

of transit generally varies from 1 hr to 2 hr <strong>in</strong> case of raw milk <strong>and</strong> the cost attached with<br />

refrigeration does not make a bus<strong>in</strong>ess case to move raw milk <strong>in</strong> refrigerated tankers. <strong>The</strong>se milk<br />

tankers are made of sta<strong>in</strong>less steel ma<strong>in</strong>ly <strong>and</strong> are manufactured by local fabricators <strong>in</strong> <strong>India</strong>.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 18

----------------------------------------------------------------------------------<br />

Bulk milk coolers are used <strong>in</strong> the supply cha<strong>in</strong> ma<strong>in</strong>ly if the distance between Village Pool<strong>in</strong>g Po<strong>in</strong>t<br />

(VPP) <strong>and</strong> MCC is very large as transport<strong>in</strong>g cans over large distance under ambient temperature<br />

would lead to deterioration or spoilage of milk. Bulk milk coolers used <strong>in</strong> <strong>India</strong> vary from 1 kl to 5 kl<br />

capacity. Both local <strong>and</strong> foreign manufacturers are present <strong>in</strong> the market for bulk milk coolers. <strong>The</strong><br />

local manufacturers dom<strong>in</strong>ate bulk of the market (around 90%). <strong>The</strong> difference <strong>in</strong> price between<br />

local <strong>and</strong> foreign players is the ma<strong>in</strong> reason for higher market share of local manufacturers. <strong>The</strong><br />

market for bulk milk is expected to grow at the rate of 25% every year for the next five years. This is<br />

also facilitated by the <strong>in</strong>itiatives taken by dairy co‐operatives of several states like Gujarat, Punjab,<br />

Karnataka, Tamil Nadu, Rajasthan etc. to <strong>in</strong>stall bulk milk coolers at strategic locations.<br />

Entry of foreign player is dependent on the price competitiveness with the local manufacturers.<br />

Option of sett<strong>in</strong>g up own plant or a JV with an exist<strong>in</strong>g player would help <strong>in</strong> gett<strong>in</strong>g a foothold <strong>in</strong> this<br />

market.<br />

Process<strong>in</strong>g equipments<br />

<strong>India</strong> has made considerable progress <strong>in</strong> the manufactur<strong>in</strong>g of dairy equipments <strong>in</strong> last decade. <strong>The</strong><br />

<strong>in</strong>crease <strong>in</strong> process<strong>in</strong>g levels <strong>in</strong> the organized sector from 20% currently to 30% <strong>in</strong> the next 5 years<br />

should lead to build<strong>in</strong>g up of new capacities. <strong>The</strong>re is ample scope for manufactur<strong>in</strong>g equipments for<br />

basic products like ghee, paneer, <strong>in</strong>digenous sweets (khoa, peda) etc. Further value added products<br />

like ice cream, cheese, powder, yoghurt, UHT milk plants require specific equipments <strong>and</strong><br />

mach<strong>in</strong>eries for sett<strong>in</strong>g up of the plant.<br />

Also, the dairy equipment sector <strong>in</strong> <strong>India</strong> is highly protected with customs duty of 7.5% along with<br />

counter veil<strong>in</strong>g duty <strong>and</strong> SAD (Special Additional Duty) on almost all dairy equipments (other than<br />

milk clarifiers). Clarifiers are exempted from import duty with an <strong>in</strong>tention to boost clean milk<br />

production <strong>in</strong> the country. <strong>The</strong> fresh packed liquid milk requires basic process<strong>in</strong>g <strong>and</strong> pack<strong>in</strong>g<br />

technology at plant level. Cost of the equipments <strong>and</strong> after sales ma<strong>in</strong>tenance service will rema<strong>in</strong><br />

key drivers for future growth.<br />

<strong>The</strong> range of equipments presently manufactured by the <strong>in</strong>digenous manufacturers <strong>in</strong>clude sta<strong>in</strong>less<br />

steel dairy equipments, evaporators, milk refrigerators <strong>and</strong> storage tanks, centrifuges, clarifiers,<br />

homogenisers, spray dryers <strong>and</strong> heat exchangers (tubular <strong>and</strong> plate type) etc. In recent years many<br />

dairy plants have been commissioned by NDDB <strong>and</strong> the majority of equipments have been supplied<br />

by <strong>in</strong>digenous manufacturers. Advanced equipment like spray dryers, plate type heat exchanger <strong>and</strong><br />

other core equipments require advanced technology to manufacture a good quality product<br />

bacteriologically.<br />

----------------------------------------------------------------------------------------------------------------<br />

<strong>The</strong> <strong>India</strong> <strong>opportunity</strong> <strong>in</strong> select <strong>Food</strong> <strong>and</strong> Agribus<strong>in</strong>ess sectors 19

----------------------------------------------------------------------------------<br />

Technology <strong>in</strong>novations<br />

<strong>The</strong> process<strong>in</strong>g technology for manufacture of yoghurt <strong>and</strong> traditional <strong>India</strong>n sweets plant<br />

equipment is deficient. <strong>The</strong> high speed mach<strong>in</strong>es for ice‐cream manufactur<strong>in</strong>g are also not presently<br />

manufactured <strong>in</strong> <strong>India</strong>. <strong>The</strong> modernization of the manufactur<strong>in</strong>g process of traditional dairy products<br />

is long overdue. However, there is no need to re<strong>in</strong>vent the wheel because some of the food<br />

process<strong>in</strong>g methods available <strong>in</strong> the developed nations can be usefully adapted to mass produce<br />

traditional products. Some process modifications may, however, become necessary.<br />

<strong>The</strong> production of traditional products through modern technology can ensure utiliz<strong>in</strong>g larger<br />

quantities of milk dur<strong>in</strong>g the flush season, thus help<strong>in</strong>g <strong>in</strong> stabiliz<strong>in</strong>g farmer prices. <strong>The</strong> technology of<br />

recomb<strong>in</strong><strong>in</strong>g milk constituents can also help <strong>in</strong> mak<strong>in</strong>g these products available <strong>in</strong> the lean season<br />

<strong>and</strong> <strong>in</strong> far‐off places. Shrikh<strong>and</strong> 3 is be<strong>in</strong>g manufactured <strong>in</strong> the w<strong>in</strong>ter for consumption <strong>in</strong> the summer<br />

months, reduc<strong>in</strong>g the pressure on limited milk supplies dur<strong>in</strong>g the lean period. <strong>The</strong> advent of<br />

convenience foods <strong>and</strong> their <strong>in</strong>creased acceptability will further support the modernization <strong>in</strong> this<br />

sector.<br />

While some of the basic products like khoa 4 based sweets (burfi, kalak<strong>and</strong>, <strong>and</strong> peda etc.) have huge<br />

volume sales <strong>in</strong> <strong>India</strong>n market, the presence of loose products at cheaper price limits the<br />

<strong>opportunity</strong> for development of high technology products. Khoa based sweets are available <strong>in</strong> <strong>India</strong>n<br />

streets where local halwais (sweet‐mart shop) make it an open kadhaai (kettle), employ little or<br />

negligible process<strong>in</strong>g cost except heat<strong>in</strong>g <strong>and</strong> labour. Cont<strong>in</strong>uous khoa mak<strong>in</strong>g mach<strong>in</strong>e has been<br />

developed <strong>in</strong> <strong>India</strong> <strong>and</strong> some dairy plants have started us<strong>in</strong>g the same. However, a huge potential<br />

exists <strong>in</strong> this segment s<strong>in</strong>ce there is a lot of adulteration of this product to reduce the price.<br />

Export Potential <strong>in</strong> dairy equipments<br />

While most of the equipment manufactur<strong>in</strong>g companies <strong>in</strong> developed countries focus on the needs<br />

of large dairy units, <strong>India</strong>n companies are target<strong>in</strong>g the small <strong>and</strong> midsize operations <strong>in</strong> the US,<br />

Canada <strong>and</strong> other countries. <strong>India</strong>n companies export equipments <strong>and</strong> accessories like cream<br />

separators <strong>and</strong> milk cans <strong>and</strong> also work on turnkey projects. <strong>The</strong>y are specifically target<strong>in</strong>g small<br />

farmers <strong>and</strong> dairy units <strong>in</strong> the US, Europe <strong>and</strong> also the neighbor<strong>in</strong>g countries <strong>in</strong> South Asia. <strong>India</strong>n<br />

companies are also explor<strong>in</strong>g opportunities <strong>in</strong> Africa <strong>and</strong> the Middle East. <strong>India</strong>’s dairy equipment<br />

exports are estimated at around INR 1 billion (EUR 14.3 million).<br />

3<br />

<strong>India</strong>n sweet dish made of stra<strong>in</strong>ed yogurt<br />

4<br />

is a milk food, made of either dried whole milk or milk thickened by heat<strong>in</strong>g <strong>in</strong> an open iron pan<br />