S. NARAYANAN - Agent Portal

S. NARAYANAN - Agent Portal

S. NARAYANAN - Agent Portal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

Oct 20, 2010<br />

Dear Colleagues,<br />

1. I write this message to you with a sense of satisfaction. We are making steady progress both in<br />

growth of business as well as profitability.<br />

Business growth<br />

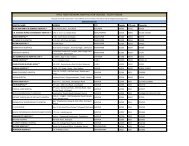

2. For the period Apr – Sep 2010, we have completed a GWP of Rs 897.30 cr. a growth of 19.49 % over<br />

the same period last year. This growth rate is well above the target growth rate. However I have a few<br />

words of caution against complacency. In the second half of the year we have definite loss of some<br />

major premiums amounting to almost ` 40 crores. Further despite our good growth rate we are well<br />

behind both Industry average and Pvt. sector average. It is therefore essential that we keep up the<br />

tempo and try to be close to the Pvt. Sector average.<br />

3. As I write this message the festive season is in full swing. Traditionally the period commencing from the<br />

Navratra has been very productive. This year the daily premium inflow till now has been below<br />

expectation. I am informed that in many SBUs all the premium collections are still being booked. I am<br />

hopeful the backlog of entries will soon be completed and the growth rate for October will be good<br />

Profitability / Loss Ratio<br />

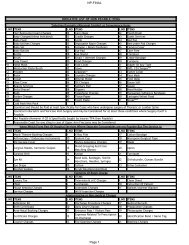

4. On the profitability side we are just about OK. The overall EILR is 0.8 % lower than the level on the<br />

same date last year. In order to achieve our profitability target at the end of the year we have to reduce<br />

the EILR by at least 4 %. I would request the CSCs to concentrate on better efficiency especially on TP<br />

claims and try to dispose of as many as possible at amounts less than the provisions.<br />

5. The final figures for the half year will be available after a few days. From the provisional results it<br />

appears that the PBT is likely improve slightly from the August level.<br />

Business process<br />

6. We embarked on a new business process initiative a couple of years back. I am very glad with the<br />

progress over the last few months. The usage of Siebel CRM for policy issue is at a steady 90% +<br />

for Motor. The online escalation system for risk acceptance is working well. Three other products<br />

viz Act + Fire /theft, short period policies and endorsement module for all motor policy endorsements<br />

are likely to be introduced in Siebel very shortly.<br />

7. The improvement in terms of data quality and underwriting control is remarkable. I am informed<br />

that over 85% of the documents are now compliant with the vehicle particulars viz. Regn. Number /<br />

engine and chassis number. At the end of last financial year this was hovering at just under 50%.<br />

Similarly the underwriting controls relating to declined models, low IDV and rampant premium rate<br />

reductions are well under control. It is very satisfying to note that these improvements have been<br />

achieved without dampening the growth rate which continues to be quite good.

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

8. The high CRM usage has greatly reduced the vulnerability and misuse of P - 400 and dependence on<br />

cover notes. The dependency on cover notes has come down from 76% in 2009-10 to 56% in Sep<br />

2010. Some of our units particularly in South India have made a remarkable effort and are shining<br />

examples. At the same time some other areas need to convince themselves and then our business<br />

partners that improvements in business process are possible without affecting the momentum of<br />

business.<br />

In fact the introduction of CRM and withdrawal of cover notes is being used as a USP by our<br />

offices in South India to improve our business and also to get better terms. I am hopeful that our<br />

other offices will get inspiration from the achievements of our offices in Tamil Nadu and Andhra and<br />

replicate the success.<br />

Ethical Issues.<br />

9. Recently a few cases have surfaced in some centers relating to unreasonable work practices,<br />

deliberate non observance of specific underwriting instructions, financial misconduct etc.<br />

10. We had to take stringent action on some of our employees for these irregularities including separation<br />

from service. Such tough actions will send a strong message to the unruly and will restore the<br />

confidence of the diligent employees. Nevertheless it is a cause of immense pain and unpleasantness<br />

for the management and for the other colleagues.<br />

Forthcoming events<br />

11. In the month of December we shall completing ten years of our operation. We shall shortly come out<br />

with the details of activities to commemorate the happy occasion.<br />

12. Also in December ICMIF (International Cooperative and Mutual Insurers Federation) will be holding<br />

their Development Workshop on “Improving access to Insurance” at Gurgaon. Around forty International<br />

delegates are expected to participate. As a member of ICMIF it will be our privilege to be the host of this<br />

program.<br />

The usual charts are enclosed.<br />

With Best Wishes<br />

S Narayanan

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

250<br />

Rs Cr<br />

Growth for the month<br />

Monthly GWP Comparisons<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

GWP 2009-10 169.58 117.37 141.76 127.06 91.16 104.04 124.92 109.67 106.69 139.27 108.11 173.95<br />

GWP 2010-11 209.01 124.85 148.76 158.44 128.36 127.88<br />

Growth for the Month % 23.25% 6.37% 4.94% 24.70% 40.81% 22.91%<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

GWP 2009-10 GWP 2010-11 Growth for the Month %<br />

1,600<br />

1,400<br />

1,200<br />

Up to the Month GWP in Rs Cr<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

2008-09 169.58 286.95 428.71 555.77 646.93 750.97 875.89 985.56 1,092.2 1,231.5 1,339.6 1,513.5<br />

2009-10 209.01 333.86 482.62 641.06 769.42 897.30

Axis Title<br />

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

85.00<br />

Overall EILR %<br />

(without Motor Pool & IBNR)<br />

83.00<br />

81.00<br />

79.00<br />

77.00<br />

75.00<br />

73.00<br />

71.00<br />

69.00<br />

67.00<br />

65.00<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

2009-10 70.71 77.91 78.53 77.94 76.95 73.00 72.39 72.33 71.94 72.75 71.56 71.15<br />

2010- 11 75.76 80.70 78.80 74.80 73.79 72.12<br />

80<br />

75<br />

Motor EILR %<br />

before pool & IBNR<br />

70<br />

65<br />

60<br />

67.72<br />

62.94<br />

67.53<br />

65.74<br />

69.83<br />

65.49<br />

66.06<br />

65.24<br />

62.78 60.72 62.21<br />

62.44 61.61<br />

61.15 61.74 61.20 61.15<br />

60.48<br />

55<br />

50<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

2009-10 2010-11

% UTILIZATION<br />

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

130<br />

Health EILR %<br />

120<br />

110<br />

111.75<br />

113.63<br />

112.78<br />

117.81<br />

123.83<br />

122.07<br />

110.62<br />

117.55<br />

110.34<br />

113.90<br />

119.04 117.39<br />

118.17<br />

110.80 109.73<br />

100<br />

102.92<br />

97.56<br />

102.09<br />

90<br />

80<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

2009-10 2010-11 (overall)<br />

95%<br />

85%<br />

75%<br />

65%<br />

55%<br />

45%<br />

35%<br />

25%<br />

Covernote & CRM Usage<br />

84%<br />

88% 90%<br />

76%<br />

67% 66%<br />

75%<br />

59% 63%<br />

60%<br />

59%<br />

46%<br />

56%<br />

38%<br />

09-10' For April'10 For May'10 For June'10 For July'10 For Aug'10 For Sep'10<br />

Covernote % utilization<br />

CRM % Usage

S. <strong>NARAYANAN</strong><br />

Managing Director & C.E.O<br />

30%<br />

Upto the Month GWP Growth rates<br />

25%<br />

PVT SECTOR<br />

INDUSTRY AVG<br />

20%<br />

IFFCO TOKIO<br />

15%<br />

10%<br />

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar<br />

Major Marketing Breakthroughs<br />

CLIENT<br />

SBU<br />

Annual Premium<br />

Potential (In Rs.<br />

Lacs)<br />

ACHEIVEMENT<br />

(Breakthrough /<br />

Increase in share)<br />

Policies in which<br />

ITGI participates<br />

Premium<br />

amount (In Rs.<br />

Lacs)<br />

Haldia Petrochemicals Ltd Kolkata Commercial Rs 4000 lacs Increase in share MEG Rs 229.21 lacs<br />

Mani Group Rs 50 lacs Breakthrough IFR Rs 6.25 lacs<br />

ITC Infotech India Ltd Bangalore CommercialRs 350 lacs Breakthrough GMC Rs 21.6 lacs<br />

Sattva Hi Tech & Conware Pvt Ltd Chennai Rs 60 lacs Breakthrough Fire & Burglary Rs 28 lacs<br />

TIMDAA and TIML (BCCL Group Cos) Delhi C Kailash BuildingRs 1800 lacs Increase in Share Fire, FLOP, LiabilityRs 13.5 lacs<br />

RITES Ltd. Rs 50 Lac Breakthrough Professional Indemnity Rs 6.74 lacs<br />

APOLLO TYRES Delhi C Narain ManzilRs 250 lacs Increase in Share Workers Compensation Rs 15.36 Lacs<br />

Haridwar Highways Project Ltd. Delhi R Faridabad Rs 100 lacs Breakthrough CAR Rs 41 lacs<br />

Dehradun Highways Project Ltd. Rs 80 lacs Breakthrough CAR Rs 47 lacs<br />

Tie up<br />

SBU<br />

Annual<br />

Premium Projected<br />

(in Rs. Lacs)<br />

Chotosso Motors Patiala Rs.150 Lacs<br />

Sparsh Automobiles Pvt Ltd Raipur Rs.400 lacs<br />

SAS HYUNDAI Lucknow Rs.125 Lacs