PROSPECTUS DATED 13 JULY 2007 Eurosail-UK 2007-3BL PLC ...

PROSPECTUS DATED 13 JULY 2007 Eurosail-UK 2007-3BL PLC ...

PROSPECTUS DATED 13 JULY 2007 Eurosail-UK 2007-3BL PLC ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

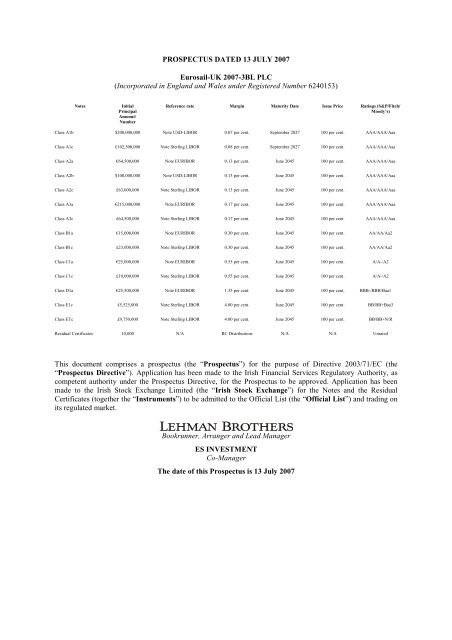

<strong>PROSPECTUS</strong> <strong>DATED</strong> <strong>13</strong> <strong>JULY</strong> <strong>2007</strong><br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> <strong>PLC</strong><br />

(Incorporated in England and Wales under Registered Number 6240153)<br />

Notes<br />

Initial<br />

Principal<br />

Amount/<br />

Number<br />

Reference rate Margin Maturity Date Issue Price Ratings (S&P/Fitch/<br />

Moody’s)<br />

Class A1b $200,000,000 Note USD-LIBOR 0.07 per cent. September 2027 100 per cent. AAA/AAA/Aaa<br />

Class A1c £102,500,000 Note Sterling LIBOR 0.08 per cent. September 2027 100 per cent. AAA/AAA/Aaa<br />

Class A2a €64,500,000 Note EURIBOR 0.<strong>13</strong> per cent. June 2045 100 per cent. AAA/AAA/Aaa<br />

Class A2b $100,000,000 Note USD-LIBOR 0.<strong>13</strong> per cent. June 2045 100 per cent. AAA/AAA/Aaa<br />

Class A2c £63,000,000 Note Sterling LIBOR 0.<strong>13</strong> per cent. June 2045 100 per cent. AAA/AAA/Aaa<br />

Class A3a €215,000,000 Note EURIBOR 0.17 per cent. June 2045 100 per cent. AAA/AAA/Aaa<br />

Class A3c £64,500,000 Note Sterling LIBOR 0.17 per cent. June 2045 100 per cent. AAA/AAA/Aaa<br />

Class B1a €15,000,000 Note EURIBOR 0.30 per cent. June 2045 100 per cent. AA/AA/Aa2<br />

Class B1c £23,000,000 Note Sterling LIBOR 0.30 per cent. June 2045 100 per cent. AA/AA/Aa2<br />

Class C1a €25,000,000 Note EURIBOR 0.55 per cent. June 2045 100 per cent. A/A-/A2<br />

Class C1c £10,000,000 Note Sterling LIBOR 0.55 per cent. June 2045 100 per cent. A/A-/A2<br />

Class D1a €25,500,000 Note EURIBOR 1.35 per cent. June 2045 100 per cent. BBB-/BBB/Baa1<br />

Class E1c £5,525,000 Note Sterling LIBOR 4.00 per cent. June 2045 100 per cent. BB/BB+Baa3<br />

Class ETc £9,750,000 Note Sterling LIBOR 4.00 per cent. June 2045 100 per cent. BB/BB+N/R<br />

Residual Certificates 10,000 N/A RC Distributions N/A N/A Unrated<br />

This document comprises a prospectus (the “Prospectus”) for the purpose of Directive 2003/71/EC (the<br />

“Prospectus Directive”). Application has been made to the Irish Financial Services Regulatory Authority, as<br />

competent authority under the Prospectus Directive, for the Prospectus to be approved. Application has been<br />

made to the Irish Stock Exchange Limited (the “Irish Stock Exchange”) for the Notes and the Residual<br />

Certificates (together the “Instruments”) to be admitted to the Official List (the “Official List”) and trading on<br />

its regulated market.<br />

Bookrunner, Arranger and Lead Manager<br />

ES INVESTMENT<br />

Co-Manager<br />

The date of this Prospectus is <strong>13</strong> July <strong>2007</strong>

The Instruments have not been and will not be registered under the United States Securities Act of 1933,<br />

as amended (the “Securities Act”) or the securities laws of any state of the United States or any other<br />

relevant jurisdiction. The Instruments are being offered solely (a) outside the United States to non-U.S.<br />

Persons in offshore transactions (as defined in Regulation S under the Securities Act (“Regulation S”)) in<br />

reliance on Regulation S and (b) other than in the case of the E Notes and the Residual Certificates within<br />

the United States in reliance on Rule 144A under the Securities Act (“Rule 144A”) to persons who are<br />

qualified institutional buyers as defined in Rule 144A (“Qualified Institutional Buyers”). For certain<br />

restrictions on resales, see “Transfer Restrictions”.<br />

A “Risk Factors” section is included in this Prospectus. Prospective Instrumentholders should be aware<br />

of the aspects of the issues that are summarised in that section.<br />

The Issuer (the “Responsible Person”) accepts responsibility for the information contained in this<br />

Prospectus. To the best of the knowledge and belief of the Issuer (who has taken all reasonable care to<br />

ensure that such is the case) the information contained in this Prospectus is in accordance with the facts<br />

and does not omit anything likely to affect the import of such information.<br />

The Instruments will be obligations solely of the Issuer and will not be guaranteed by, or be the<br />

responsibility of, any other entity. In particular, the Instruments will not be obligations of, and will not<br />

be guaranteed by, <strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> Parent Limited (the “Parent”) Preferred Mortgages Limited,<br />

Southern Pacific Personal Loans Limited, Southern Pacific Mortgage Limited, Alliance & Leicester plc,<br />

Amber Homeloans Limited, Matlock London Limited (formerly Matlock Bank Limited), Langersal No. 2<br />

Limited, any Correspondent Lender, any Branded Lender, any Remote Processor, Preferred Mortgages<br />

Collections Limited (“PMCL”), the Collection Account Banks, Vertex Mortgage Services Limited,<br />

Lightfoots Solicitors, Capstone Mortgage Services Limited (in its capacities as the Cash/Bond<br />

Administrator and the Mortgage Administrator), Homeloan Management Limited (in its capacities as the<br />

Standby Cash/Bond Administrator and the Standby Mortgage Administrator) and each other<br />

Transaction Party (as defined under “Summary Information” below), Lehman Brothers International<br />

(Europe) (the “Lead Manager”) and Banco Espirito Santo de Investimento SA (“ES Investment” or the<br />

“Co-Manager” and, together with the Lead Manager, the “Managers”).<br />

PROSPECTIVE PURCHASERS ARE HEREBY NOTIFIED THAT THE SELLER OF ANY<br />

INSTRUMENTS (OTHER THAN IN RELATION TO THE E NOTES AND THE RESIDUAL<br />

CERTIFICATES) MAY BE RELYING ON THE EXEMPTION FROM THE REGISTRATION<br />

REQUIREMENTS OF SECTION 5 OF THE SECURITIES ACT PROVIDED BY RULE 144A.<br />

The information contained in this document with respect to each Transaction Party (other than the<br />

Issuer) relates to and has been obtained from each of them and the Issuer accepts responsibility for the<br />

accurate reproduction of this information. As far as the Issuer is aware, and has been able to ascertain<br />

from information published by each such party, no facts have been omitted which would render the<br />

reproduced information inaccurate or misleading. The delivery of this Prospectus shall not create any<br />

implication that there has been no change in the affairs of each Transaction Party (other than the Issuer)<br />

since the date of this Prospectus, or that the information contained or referred to in this Prospectus is<br />

correct as of any time subsequent to its date. The Instrumentholders will not have any right to proceed<br />

directly against each Transaction Party (other than the Issuer) in respect of their respective obligations<br />

under any of the agreements to which they are a party.<br />

EACH PURCHASER OF INSTRUMENTS OFFERED HEREBY WILL BE DEEMED TO HAVE<br />

MADE CERTAIN ACKNOWLEDGEMENTS, REPRESENTATIONS AND AGREEMENTS AS SET<br />

FORTH HEREIN UNDER “TRANSFER RESTRICTIONS” AND “CERTAIN ERISA<br />

CONSIDERATIONS”. THE INSTRUMENTS ARE NOT TRANSFERABLE EXCEPT IN<br />

ACCORDANCE WITH THE RESTRICTIONS DESCRIBED HEREIN UNDER “TRANSFER<br />

RESTRICTIONS” AND “CERTAIN ERISA CONSIDERATIONS”.<br />

THE INSTRUMENTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED<br />

STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), ANY STATE SECURITIES<br />

COMMISSION OR ANY OTHER UNITED STATES REGULATORY AUTHORITY, NOR HAVE<br />

ii

ANY OF THE FOREGOING AUTHORITIES PASSED UPON THE ACCURACY OR ADEQUACY OF<br />

THIS <strong>PROSPECTUS</strong>. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.<br />

NONE OF THE E NOTES OR THE RESIDUAL CERTIFICATES, OR ANY INTEREST THEREIN,<br />

ARE DESIGNED FOR, OR MAY BE PURCHASED OR HELD BY, ANY EMPLOYEE BENEFIT<br />

PLAN (AS DEFINED IN SECTION 3(3) OF THE UNITED STATES EMPLOYEE RETIREMENT<br />

INCOME SECURITY ACT OF 1974, AS AMENDED (“ERISA”)) WHICH IS SUBJECT THERETO,<br />

OR ANY PLAN (AS DEFINED IN SECTION 4975 OF THE UNITED STATES INTERNAL REVENUE<br />

CODE OF 1986, AS AMENDED (THE “CODE”)) OR BY ANY PERSON ANY OF THE ASSETS OF<br />

WHICH ARE, OR ARE DEEMED FOR PURPOSES OF ERISA OR SECTION 4975 OF THE CODE<br />

TO BE, ASSETS OF SUCH EMPLOYEE BENEFIT PLAN OR PLAN, AND EACH PURCHASER OF<br />

AN E NOTE OR A RESIDUAL CERTIFICATE, OR ANY INTEREST THEREIN, PURSUANT TO<br />

REGULATION S WILL BE DEEMED TO HAVE REPRESENTED, WARRANTED AND AGREED<br />

THAT IT IS NOT, AND FOR SO LONG AS IT HOLDS AN E NOTE OR A RESIDUAL<br />

CERTIFICATE ISSUED PURSUANT TO REGULATION S WILL NOT BE, SUCH EMPLOYEE<br />

BENEFIT PLAN OR PLAN OR A PERSON DEEMED TO HOLD ASSETS OF SUCH EMPLOYEE<br />

BENEFIT PLAN OR PLAN. SEE FURTHER “CERTAIN ERISA CONSIDERATIONS”.<br />

The Instruments will be in fully registered form and in the case of the Notes without interest coupons<br />

attached.<br />

This Prospectus does not constitute an offer of, or an invitation by or on behalf of, the Issuer or the<br />

Managers to subscribe for or purchase any of the Instruments. No action has been taken by the Issuer or<br />

the Managers other than as set out in the cover page of this Prospectus that would permit a public<br />

offering of the Instruments or the distribution of this Prospectus in any country or jurisdiction where<br />

action for that purpose is required. The distribution of this Prospectus and the offering of the<br />

Instruments in certain jurisdictions may be restricted by law. Persons into whose possession this<br />

Prospectus comes are required by the Issuer and the Managers to inform themselves about, and to<br />

observe, such restrictions. For a description of certain further restrictions on offers and sales of<br />

Instruments and distribution of this Prospectus, see “Subscription and Sale” below.<br />

No person has been authorised to give any information or to make any representation concerning the<br />

issue of the Instruments other than those contained in this Prospectus. Nevertheless, if any such<br />

information is given by any broker, seller or any other person, it must not be relied upon as having been<br />

authorised by the Issuer or the Managers. Neither the delivery of this Prospectus nor any offer, sale or<br />

solicitation made in connection herewith shall, in any circumstances, imply that the information<br />

contained herein is correct at any time subsequent to the date of this Prospectus.<br />

An investment in the Instruments is only suitable for financially sophisticated investors who are capable<br />

of evaluating the merits and risk of such investment and who have sufficient resources to be able to bear<br />

any losses which may result from such an investment.<br />

References in this Prospectus to “£”, “pounds”, “pounds sterling” or “sterling” are to the lawful currency<br />

for the time being of the United Kingdom of Great Britain and Northern Ireland. References in this<br />

Prospectus to “€”or “euro” are references to the single currency introduced at the start of the third stage<br />

of European Economic and Monetary Union pursuant to the Treaty of Rome of 25 March 1957, as<br />

amended from time to time. References in this Prospectus to “$”, “U.S.$”, “U.S. Dollar” or “dollars” are<br />

to the lawful currency for the time being of the United States of America.<br />

In connection with the issue of any class of the Notes, the Lead Manager (in such capacity, the “Stabilising<br />

Manager”) or any person acting for the Stabilising Manager may over-allot the Notes (provided that the<br />

aggregate principal amount of Notes allotted does not exceed 105 per cent. of the aggregate principal amount of<br />

the relevant class of Notes) or effect transactions with a view to supporting the market prices of the Notes (or<br />

any class of them) at a level higher than that which might otherwise prevail. However, there is no assurance that<br />

the Stabilising Manager (or persons acting on behalf of the Stabilising Manager) will undertake stabilising<br />

action. Any stabilising action may begin on or after the date on which adequate public disclosure of the terms of<br />

the offer of the Notes is made and, if begun, may be ended at any time, but it must end no later than the earlier<br />

iii

of 30 days after the Closing Date and 60 days after the date of allotment of the relevant class of the Notes. For a<br />

description of these activities, see “Subscription and Sale” below.<br />

The Instruments (a) will be represented by the Reg S Global Notes or the Global Residual Certificate which are<br />

expected to be deposited with The Bank of New York, London Branch, as common depositary (the “Common<br />

Depositary”) for Euroclear Bank S.A./N.V. (“Euroclear”) and Clearstream Banking, société anonyme<br />

(“Clearstream, Luxembourg”) and (b) other than the E Notes and the Residual Certificates, will be represented<br />

by the Rule 144A Global Notes which are expected to be deposited with The Bank of New York, New York<br />

Branch, as custodian (the “Custodian”) for The Depository Trust Company (“DTC”) and registered in the name<br />

of DTC or its nominee, in each case, on the date of issue of the Notes (the “Closing Date”).<br />

Capitalised terms used in this Prospectus, unless otherwise indicated, have the meanings set out in this<br />

Prospectus. An index of defined terms used in this Prospectus appears on pages 2<strong>13</strong> to 222.<br />

iv

NOTICE TO NEW HAMPSHIRE RESIDENTS<br />

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE<br />

HAS BEEN FILED UNDER CHAPTER 421-B OF THE STATE OF NEW HAMPSHIRE REVISED<br />

STATUTES ANNOTATED (“RSA 421-B”) WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT<br />

THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF<br />

NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY<br />

DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER<br />

ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A<br />

SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE OF NEW HAMPSHIRE<br />

HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR<br />

GIVEN APPROVAL TO, ANY PERSON, SECURITY OR TRANSACTION. IT IS UNLAWFUL TO MAKE,<br />

OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY<br />

REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.<br />

INFORMATION AS TO PLACEMENT WITHIN THE UNITED STATES<br />

This Prospectus has been prepared by the Issuer solely for use in connection with the offering of the Notes. This<br />

Prospectus is personal to each potential investor to whom it has been delivered by the Issuer, the Lead Manager,<br />

the other Managers or any of their respective affiliates and does not constitute an offer to any other person or to<br />

the public generally to subscribe for or otherwise acquire the Notes. Distribution of this Prospectus in the<br />

United States to any persons other than the potential investors and those persons, if any, retained to advise such<br />

offeree with respect thereto is unauthorised, and any disclosure of any of its contents, without the prior written<br />

consent of the Issuer, is prohibited.<br />

Additionally, each purchaser of the Notes will be deemed to have made the representations, warranties and<br />

acknowledgements that are described in this Prospectus on pages 198 to 207 below.<br />

ENFORCEABILITY OF JUDGMENTS<br />

The Issuer is a public limited company registered in England and Wales. All of the Issuer’s assets are located<br />

outside the United States. None of the officers and directors of the Issuer are residents of the United States. As<br />

a result, it may not be possible for investors to effect service of process within the United States upon the Issuer<br />

or such persons not residing in the United States with respect to matters arising under the federal or state<br />

securities laws of the United States, or to enforce against them judgments of the courts of the United States<br />

predicated upon the civil liability provisions of such securities laws. There is doubt as to the enforceability in<br />

the United Kingdom, in original actions or in actions for the enforcement of judgments of U.S. courts, of civil<br />

liabilities predicated solely upon such securities laws.<br />

FORWARD-LOOKING STATEMENTS<br />

This Prospectus contains statements which constitute forward-looking statements within the meaning of the<br />

United States Private Securities Litigation Reform Act of 1995. Such statements appear in a number of places<br />

in this Prospectus, including with respect to assumptions on prepayment and certain other characteristics of the<br />

Loans, and reflect significant assumptions and subjective judgements by the Issuer that may or may not prove to<br />

be correct. Such statements may be identified by reference to a future period or periods and the use of forwardlooking<br />

terminology such as “may”, “will”, “could”, “believes”, “expects”, “anticipates”, “continues”,<br />

“intends”, “plans”, or similar terms. Consequently, future results may differ from the Issuer’s expectations due<br />

to a variety of factors, including (but not limited to) the economic environment and regulatory changes in the<br />

residential mortgage industry in the United Kingdom. Moreover, past financial performance should not be<br />

considered a reliable indicator of future performance and prospective purchasers of the Notes are cautioned that<br />

any such statements are not guarantees of performance and involve risks and uncertainties, many of which are<br />

beyond the control of the Issuer. The Managers have not attempted to verify any such statements, nor do they<br />

make any representations, express or implied, with respect thereto. All written and oral forward-looking<br />

statements attributable to the Issuer or persons acting on the Issuer’s behalf are expressly qualified in their<br />

entirety by the cautionary statements set forth in this paragraph. The Issuer will not undertake any obligation to<br />

publish any revisions to these forward-looking statements to reflect circumstances or events occurring after the<br />

date of this Prospectus.<br />

v

AVAILABLE INFORMATION<br />

To permit compliance with Rule 144A in connection with the sale of the Rule 144A Notes, the Issuer will be<br />

required to furnish, upon request of a holder of such Note, or any beneficial owner thereof, to such holder or<br />

beneficial owner and a prospective purchaser designated by such holder or beneficial owner the information<br />

required to be delivered under Rule 144A(d)(4) under the Securities Act if, at the time of the request, the Issuer<br />

is neither a reporting company under Section <strong>13</strong> or Section 15(d) of the United States Securities Exchange Act<br />

of 1934, as amended (the “Exchange Act”) nor exempt from reporting pursuant to Rule 12g3-2(b) under the<br />

Exchange Act.<br />

CIRCULAR 230 NOTICE<br />

To ensure compliance with requirements imposed by the U.S. Internal Revenue Service (the “IRS”), we<br />

inform you that any tax discussion herein was not written and is not intended to be used and cannot be<br />

used by any taxpayer for purposes of avoiding United States federal tax penalties that may be imposed on<br />

the taxpayer. Any such tax discussion was written to support the promotion or marketing of the Notes to<br />

be issued pursuant to this Prospectus. Each taxpayer should seek advice based on the taxpayer’s<br />

particular circumstances from an independent tax adviser.<br />

Notwithstanding any provision herein and the otherwise confidential nature of this Prospectus and its contents,<br />

and effective from the date of commencement of discussion concerning this offering of Notes, each party hereto<br />

(and each employee, representative, or other agent of such party) may disclose to any and all persons, without<br />

limitation of any kind, the tax treatment and tax structure of this transaction and all materials of any kind<br />

(including opinions of other tax analyses) that are provided to it relating to such tax treatment and tax structure,<br />

except to the extent that any such disclosure could reasonably be expected to cause this offering not be in<br />

compliance with securities laws. In addition, no person may disclose the name of or identifying information<br />

with respect to any party identified herein or other non-public business or financial information that is unrelated<br />

to the tax treatment or tax structure of this transaction without the prior consent of the Issuer. For purposes of<br />

this paragraph, the tax treatment of this transaction is the purported or claimed U.S. federal income tax treatment<br />

of this transaction, and the tax structure of this transaction is any fact that may be relevant to understanding the<br />

purported or claimed U.S. federal income tax treatment of this transaction.<br />

vi

TABLE OF CONTENTS<br />

Page<br />

TRANSACTION OVERVIEW.............................................................................................................................1<br />

SUMMARY INFORMATION..............................................................................................................................2<br />

RISK FACTORS .................................................................................................................................................20<br />

CREDIT STRUCTURE ......................................................................................................................................33<br />

THE SELLERS AND ORIGINATORS ..............................................................................................................53<br />

THE ISSUER.......................................................................................................................................................55<br />

THE MORTGAGE ADMINISTRATOR AND THE CASH/BOND ADMINISTRATOR................................57<br />

THE STANDBY MORTGAGE ADMINISTRATOR AND THE STANDBY CASH/BOND<br />

ADMINISTRATOR..............................................................................................................................59<br />

THE ACCOUNT BANK AND THE GIC PROVIDER......................................................................................60<br />

THE LIQUIDITY FACILITY PROVIDER ........................................................................................................61<br />

THE CURRENCY SWAPS COUNTERPARTY, THE CURRENCY SWAPS GUARANTOR, THE<br />

BULLET CAP COUNTERPARTY, THE BULLET CAP GUARANTOR, THE<br />

FIXED/FLOATING SWAP COUNTERPARTY, THE FIXED/FLOATING SWAP<br />

GUARANTOR, THE BBR SWAP COUNTERPARTY AND THE BBR SWAP<br />

GUARANTOR......................................................................................................................................62<br />

THE TRUSTEE...................................................................................................................................................63<br />

THIRD PARTY INFORMATION ......................................................................................................................64<br />

THE MORTGAGE POOL ..................................................................................................................................65<br />

CHARACTERISTICS OF THE PROVISIONAL MORTGAGE POOL............................................................88<br />

TITLE TO THE MORTGAGE POOL ................................................................................................................98<br />

REGULATION OF THE <strong>UK</strong> RESIDENTIAL MORTGAGE MARKET........................................................115<br />

USE OF PROCEEDS ........................................................................................................................................124<br />

WEIGHTED AVERAGE LIVES OF THE NOTES .........................................................................................125<br />

DESCRIPTION OF THE INSTRUMENTS......................................................................................................127<br />

TERMS AND CONDITIONS OF THE NOTES ..............................................................................................<strong>13</strong>4<br />

TERMS AND CONDITIONS OF THE RESIDUAL CERTIFICATES...........................................................170<br />

UNITED KINGDOM TAXATION...................................................................................................................191<br />

UNITED STATES TAXATION .......................................................................................................................193<br />

SUBSCRIPTION AND SALE ..........................................................................................................................198<br />

TRANSFER RESTRICTIONS..........................................................................................................................203<br />

CERTAIN ERISA CONSIDERATIONS..........................................................................................................208<br />

GENERAL INFORMATION............................................................................................................................210<br />

GLOSSARY ......................................................................................................................................................2<strong>13</strong><br />

vii

TRANSACTION OVERVIEW<br />

OWNERSHIP STRUCTURE<br />

SHARE TRUSTEE<br />

Wilmington Trust SP<br />

Services (London) Limited<br />

PARENT<br />

100%<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> Parent<br />

Limited<br />

ISSUER<br />

100%<br />

(beneficial)<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> plc<br />

TRANSACTION<br />

STRUCTURE<br />

SOUTHERN PACIFIC<br />

PERSONAL LOANS<br />

LIMITED<br />

SELLERS<br />

Sale of Loans<br />

BULLET CAP<br />

COUNTERPARTY<br />

BBR SWAP<br />

COUNTERPARTY<br />

Payments under<br />

Bullet Cap<br />

Transaction<br />

PREFERRED<br />

MORTGAGES<br />

LIMITED<br />

SOUTHERN<br />

PACIFIC<br />

MORTGAGE<br />

LIMITED<br />

AUTHORISED<br />

INVESTMENTS<br />

FIXED/FLOATING<br />

SWAP<br />

COUNTERPARTY<br />

Payments under<br />

BBR Swap<br />

Transaction<br />

Payments under<br />

Fixed/Floating Swap<br />

Transaction<br />

Consideration (including<br />

Residual Certificates)<br />

ISSUER<br />

Sale of<br />

Mortgage Pool<br />

Interest of, and<br />

Interest on,<br />

Funds<br />

Principal<br />

and Interest<br />

GIC ACCOUNT<br />

LIQUIDITY FACILITY<br />

CURRENCY SWAPS<br />

COUNTERPARTY<br />

Payments under Currency<br />

Swap Transactions<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> plc<br />

Liquidity<br />

Drawings<br />

Security for<br />

Secured<br />

Creditors<br />

Notes<br />

Issue<br />

Proceeds<br />

Principal and<br />

Interest on<br />

Notes<br />

TRUSTEE<br />

THE NOTES<br />

1

SUMMARY INFORMATION<br />

The information set out below is a summary of the principal features of the issue of the Instruments. This<br />

summary should be read in conjunction with, and is qualified in its entirety by reference to, the detailed<br />

information presented elsewhere in this Prospectus.<br />

1. THE PARTIES<br />

Issuer, Sellers and Originators:<br />

The Issuer has been established to acquire a portfolio of<br />

residential mortgage loans (individually the “Loans”, collectively<br />

and, together with the Collateral Security (as defined in Condition<br />

2 (Status, Security and Administration)) relating thereto, the<br />

“Mortgage Pool”):<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

(vii)<br />

(viii)<br />

originated by Matlock London Limited (formerly<br />

Matlock Bank Limited) (“Matlock”) trading as London<br />

Mortgage Company (by itself or in association with a<br />

Remote Processor (as defined under “Title to the<br />

Mortgage Pool” below)) and acquired by Southern<br />

Pacific Mortgage Limited (“SPML”);<br />

originated by Langersal No.2 Limited (formerly London<br />

Personal Loans Limited) (“Langersal”) and acquired by<br />

SPML;<br />

originated by SPML by itself or trading as the London<br />

Mortgage Company or in association with a Branded<br />

Lender or a Remote Processor (each as defined under<br />

“Title to the Mortgage Pool” below);<br />

originated by one of the Correspondent Lenders (as<br />

defined under “Title to the Mortgage Pool” below) and<br />

acquired by SPML;<br />

originated by Southern Pacific Personal Loans Limited<br />

(“SPPL”) by itself or trading as London Personal Loans;<br />

originated by Preferred Mortgages Limited (“PML”) by<br />

itself or in association with a Branded Lender or a<br />

Remote Processor;<br />

originated by Amber Homeloans Limited (“Amber”)<br />

and acquired by SPML; and<br />

originated by Alliance & Leicester plc (“A&L”) and<br />

acquired by SPML.<br />

In this Prospectus:<br />

(i)<br />

(ii)<br />

each of SPML and PML, in their respective capacities as<br />

sellers of the Loans to the Issuer are referred to as a<br />

“Seller” and together the “Sellers”; and<br />

each of SPML, SPPL, PML, each Correspondent Lender,<br />

Amber, A&L, Matlock and Langersal (in their respective<br />

capacities as an originator of the Loans), are referred to<br />

as an “Originator” and together the “Originators”.<br />

The acquisition of the Mortgage Pool by the Issuer will be<br />

2

financed by the issue of the Notes.<br />

Parent and Share Trustee:<br />

Corporate Services Provider:<br />

The Issuer’s entire issued share capital is held by <strong>Eurosail</strong>-<strong>UK</strong><br />

<strong>2007</strong>-<strong>3BL</strong> Parent Limited (the “Parent”) except for one share<br />

held by Wilmington Trust SP Services (London) Limited (the<br />

“Share Trustee”) as nominee of the Parent under the terms of a<br />

share trust dated 24 May <strong>2007</strong> (the “Share Trust”). The entire<br />

issued share capital of the Parent is held by the Share Trustee<br />

under the terms of a trust established under English law by a<br />

declaration of trust dated 24 May <strong>2007</strong> (the “Charitable Share<br />

Trust”) for the benefit of certain charitable purposes.<br />

Wilmington Trust SP Services (London) Limited (in such<br />

capacity, the “Corporate Services Provider”) will be appointed<br />

as corporate services provider to the Issuer under the terms of an<br />

accession agreement to the Corporate Services Agreement.<br />

OptionCo: <strong>Eurosail</strong> Options Limited (registered number 4071454)<br />

(“OptionCo”) will be appointed as the company with the benefit<br />

of the Post-Enforcement Call Option.<br />

Mortgage Administrator:<br />

Standby Mortgage Administrator:<br />

Cash Bond Administrator:<br />

Capstone Mortgage Services Limited (“Capstone”) will be<br />

appointed as mortgage administrator (in such capacity, the<br />

“Mortgage Administrator”, which expression includes any other<br />

mortgage administrator appointed in respect of the Instruments)<br />

under the terms of the Master Securitisation Agreement (as<br />

defined below) and the mortgage administration agreement set out<br />

in schedule 3 of the Master Securitisation Agreement (the<br />

“Mortgage Administration Agreement”) as agent for the Issuer<br />

to administer the Mortgage Pool on behalf of the Issuer (see “The<br />

Mortgage Administrator” below). Under the terms of the<br />

Delegation Agreements, Capstone will delegate certain of its<br />

duties under the Mortgage Administration Agreement to Vertex<br />

Mortgage Services Limited (“Vertex”), to Lightfoots Solicitors<br />

(“Lightfoots”) and to Homeloan Management Limited (“HML”).<br />

HML will be appointed as standby mortgage administrator (in<br />

such capacity, the “Standby Mortgage Administrator”, which<br />

expression includes any other standby mortgage administrator<br />

appointed in respect of the Instruments) under the terms of the<br />

Mortgage Administration Agreement, such that HML will assume<br />

the mortgage administration functions if the appointment of the<br />

Mortgage Administrator is terminated in certain circumstances set<br />

out in the Mortgage Administration Agreement (see “The Standby<br />

Mortgage Administrator and the Standby Cash/Bond<br />

Administrator” below).<br />

Capstone (in such capacity, the “Cash/Bond Administrator”,<br />

which expression includes any other cash/bond administrator<br />

appointed in respect of the Instruments) will be appointed under<br />

the terms of the Master Securitisation Agreement and the<br />

cash/bond administration agreement set out in schedule 4 of the<br />

Master Securitisation Agreement (the “Cash/Bond<br />

Administration Agreement”) to manage all cash transactions<br />

and maintain all cash management ledgers as agent for the Issuer<br />

and the Trustee (see “The Cash/Bond Administrator” below).<br />

Under the terms of the Delegation Agreements, Capstone will<br />

delegate certain of its duties under the Cash/Bond Administration<br />

Agreement to Wells Fargo Securitisation Services Limited<br />

3

(“Wells Fargo”).<br />

Standby Cash/Bond Administrator:<br />

Trustee:<br />

Principal Paying Agent, Exchange Agent<br />

and Agent Bank:<br />

Irish Paying Agent:<br />

U.S. Paying Agent:<br />

Registrar and Transfer Agent:<br />

HML will be appointed as standby cash/bond administrator (in<br />

such capacity, the “Standby Cash/Bond Administrator”, which<br />

expression includes any other standby cash/bond administrator<br />

appointed in respect of the Instruments) under the terms of the<br />

Cash/Bond Administration Agreement, such that, if the<br />

appointment of the Cash/Bond Administrator is terminated in<br />

certain circumstances set out in the Cash/Bond Administration<br />

Agreement, the Standby Cash/Bond Administrator will assume<br />

the cash/bond administration functions (see “The Standby<br />

Mortgage Administrator and the Standby Cash/Bond<br />

Administrator” below).<br />

BNY Corporate Trustee Services Limited (whose registered office<br />

is at One Canada Square, London E14 5AL) will be appointed as<br />

trustee for the Noteholders and as trustee for the Residual<br />

Certificateholders in relation to their entitlement to RC<br />

Distributions (in such capacity, the “Trustee”) pursuant to a trust<br />

deed (the “Trust Deed”) to be entered into on or about the<br />

Closing Date between the Issuer and the Trustee. The Trustee<br />

will hold the security granted by the Issuer under the Deed of<br />

Charge for the benefit of, among others, the Instrumentholders.<br />

The Bank of New York, London Branch (whose registered office<br />

is at One Canada Square, London E14 5AL) will be appointed as<br />

principal paying agent (in such capacity, the “Principal Paying<br />

Agent”, which expression includes any other principal paying<br />

agent appointed in respect of the Instruments), as currency<br />

exchange agent (in such capacity, the “Exchange Agent”, which<br />

expression includes any other currency exchange agent appointed<br />

in respect of the Instruments) and as agent bank (in such capacity,<br />

the “Agent Bank”, which expression includes any other agent<br />

bank appointed in respect of the Instruments) in respect of the<br />

Instruments under the terms of the Master Securitisation<br />

Agreement and the paying agency agreement set out in schedule 8<br />

of the Master Securitisation Agreement (the “Paying Agency<br />

Agreement”).<br />

BNY Financial Services <strong>PLC</strong> (whose address is at 70 Sir John<br />

Rogerson’s Quay, Dublin 2, Ireland) will be appointed as Irish<br />

paying agent in respect of the Instruments (in such capacity, the<br />

“Irish Paying Agent”, which expression includes any other Irish<br />

paying agent appointed in respect of the Instruments) pursuant to<br />

the Paying Agency Agreement. The Irish Paying Agent will<br />

make payments to the Instrumentholders in certain circumstances<br />

where such Instrumentholders are situate in Ireland.<br />

The Bank of New York, New York Branch (whose address is at<br />

101 Barclay Street, New York, NY 10286, U.S.A.) will be<br />

appointed as U.S. paying agent in respect of the Instruments (in<br />

such capacity, the “U.S. Paying Agent”, which expression<br />

includes any other U.S. paying agent appointed in respect of the<br />

Instruments) pursuant to the Paying Agency Agreement.<br />

The Bank of New York (Luxembourg) S.A. (whose address is at<br />

Aerogolf Center, 1A Hoehenhof, L-1736 Senningerberg,<br />

Luxembourg) will be appointed as registrar (in such capacity, the<br />

“Registrar”, which expression includes any other registrar<br />

appointed in respect of the Instruments) and as transfer agent (in<br />

4

such capacity, the “Transfer Agent”, which expression includes<br />

any other transfer agent appointed in respect of the Instruments)<br />

in respect of the Instruments pursuant to the Paying Agency<br />

Agreement.<br />

Account Bank:<br />

GIC Provider:<br />

Investment Administrator:<br />

Liquidity Facility Provider:<br />

Bullet Cap Counterparty and Bullet Cap<br />

Guarantor:<br />

Fixed/Floating Swap Counterparty and<br />

Fixed/Floating Swap Guarantor:<br />

Danske Bank A/S, London Branch whose address is at 75 King<br />

William Street, London EC4N 7DT will be appointed as Account<br />

Bank (the “Account Bank”) under the terms of the Master<br />

Securitisation Agreement and the bank agreement set out in<br />

schedule 5 of the Master Securitisation Agreement (the “Bank<br />

Agreement”).<br />

Danske Bank A/S, London Branch whose address is at 75 King<br />

William Street, London EC3N 7DT will be appointed as GIC<br />

provider (the “GIC Provider”) under the terms of the Master<br />

Securitisation Agreement and the guaranteed investment contract<br />

set out in schedule 6 of the Master Securitisation Agreement (the<br />

“GIC”).<br />

Subject to certain conditions, including each of the Rating<br />

Agencies confirming that the then-current ratings of the Notes<br />

would not be downgraded as a result, the Issuer will enter into an<br />

investment administration agreement (the “Investment<br />

Administration Agreement”) with Lehman Brothers Asset<br />

Management (Europe) Limited (whose registered office is at 25<br />

Bank Street, London E14 5LE) (the “Investment<br />

Administrator”) which will determine from time to time, in<br />

accordance with certain agreed criteria, the investments in which<br />

cash from time to time standing to the credit of the Transaction<br />

Account and/or the GIC Account should be invested.<br />

Lloyds TSB Bank plc acting through its offices at 10 Gresham<br />

Street, London EC2V 7AE will be appointed as Liquidity Facility<br />

Provider (the “Liquidity Facility Provider”) pursuant to the<br />

terms of the Master Securitisation Agreement and the liquidity<br />

facility agreement set out in schedule 7 of the Master<br />

Securitisation Agreement (the “Liquidity Facility Agreement”).<br />

Lehman Brothers Special Financing Inc. (whose address is at<br />

2711 Centerville Road, Suite 400, Wilmington, Delaware, 19808,<br />

USA) will be appointed as the Bullet Cap Counterparty (the<br />

“Bullet Cap Counterparty”) under the terms of the Bullet Cap<br />

Agreement (as defined in “The Bullet Cap Agreement” below).<br />

Lehman Brothers Holdings Inc. (the “Bullet Cap Guarantor”)<br />

will, on or about the Closing Date, enter into a guarantee in<br />

respect of the Bullet Cap Agreement. The Bullet Cap Guarantor<br />

will not be a party to the Bullet Cap Agreement.<br />

Lehman Brothers Special Financing Inc. (whose registered<br />

address is at 2711 Centerville Road, Suite 400, Wilmington,<br />

Delaware, 19808, USA) will be appointed as the fixed/floating<br />

swap counterparty (the “Fixed/Floating Swap Counterparty”,<br />

under the terms of the Fixed/Floating Swap Agreement (as<br />

defined in “The Fixed Floating Swap Agreement” below).<br />

Lehman Brothers Holdings Inc. (the “Fixed/Floating Swap<br />

Guarantor”) will, on or about the Closing Date, enter into a<br />

guarantee in respect of the Fixed/Floating Swap Agreement (the<br />

“Fixed/Floating Swap Guarantee”). The Fixed/Floating Swap<br />

Guarantor will not be a party to the Fixed/Floating Swap<br />

5

Agreement.<br />

BBR Swap Counterparty and BBR<br />

Swap Guarantor:<br />

Lehman Brothers Special Financing Inc. (whose registered<br />

address is at 2711 Centerville Road, Suite 400, Wilmington,<br />

Delaware, 19808, USA) will be appointed as the BBR swap<br />

counterparty (the “BBR Swap Counterparty”, and, together with<br />

the Bullet Cap Counterparty and the Fixed/Floating Swap<br />

Counterparty, the “Hedge Counterparties” and each a “Hedge<br />

Counterparty”) under the terms of the BBR Swap Agreement (as<br />

defined in “The BBR Swap Agreement” below). Lehman Brothers<br />

Holdings Inc. (the “BBR Swap Guarantor”) will enter into on or<br />

about the Closing Date a guarantee in respect of the BBR Swap<br />

Agreement (the “BBR Swap Guarantee”) in relation to the<br />

obligations of the BBR Swap Counterparty under the BBR Swap<br />

Agreement. The BBR Swap Guarantor will not be party to the<br />

BBR Swap Agreement.<br />

Each of the BBR Swap Guarantor, the Bullet Cap Guarantor and<br />

the Fixed/Floating Swap Guarantor is a “Hedge Guarantor”.<br />

Currency Swaps Counterparty and<br />

Currency Swaps Guarantor:<br />

Transaction Parties:<br />

Lehman Brothers Special Financing Inc. (whose registered office<br />

is at 2711 Centerville Road, Suite 400, Wilmington, Delaware,<br />

19808, USA) will be appointed as the currency swaps<br />

counterparty (the “Currency Swaps Counterparty”) under the<br />

terms of each of the Currency Swap Agreements (as defined in<br />

“The Currency Swap Agreements” below). Lehman Brothers<br />

Holdings Inc. (the “Currency Swaps Guarantor”) will, on or<br />

about the Closing Date, enter into a guarantee in respect of each<br />

of the Currency Swap Agreements. The Currency Swaps<br />

Guarantor will not be a party to the Currency Swap Agreements.<br />

The Issuer, the Sellers, the OptionCo, the Corporate Services<br />

Provider, the Mortgage Administrator, the Standby Mortgage<br />

Administrator, the Cash/Bond Administrator, the Standby<br />

Cash/Bond Administrator, the Trustee, the Paying Agents, the<br />

Exchange Agent, the Agent Bank, the Registrar, the Transfer<br />

Agents, the Account Bank, the GIC Provider, the Investment<br />

Administrator, the Liquidity Facility Provider, the Bullet Cap<br />

Counterparty, the Bullet Cap Guarantor, the Fixed/Floating Swap<br />

Counterparty, the Fixed/Floating Swap Guarantor, the BBR Swap<br />

Counterparty, the BBR Swap Guarantor, the Currency Swaps<br />

Counterparty and the Currency Swaps Guarantor are together the<br />

“Transaction Parties” and each a “Transaction Party”.<br />

2. THE TRANSACTION DOCUMENTS<br />

Corporate Services Agreement:<br />

Pursuant to an accession agreement (to be dated the Closing Date)<br />

to a corporate services agreement dated 19 December 2001 (the<br />

“Corporate Services Agreement”), the Corporate Services<br />

Provider will agree to provide certain administrative services to<br />

the Issuer. The Issuer will pay a fee to the Corporate Services<br />

Provider for the provision of such services. Either the Corporate<br />

Services Provider or the Trustee on behalf of the Issuer may, upon<br />

the giving of notice and the expiration of the relevant notice<br />

period (if applicable), terminate the appointment of the Corporate<br />

Services Provider under the Corporate Services Agreement. Any<br />

substitute corporate services provider shall be appointed by, inter<br />

alios, the Issuer. No termination of the appointment of the<br />

Corporate Services Provider shall take effect until a successor<br />

6

corporate services provider has been appointed.<br />

Master Securitisation Agreement:<br />

Mortgage Administration Agreement<br />

and Cash/Bond Administration<br />

Agreement:<br />

To facilitate the administration and servicing of the Mortgage<br />

Pool, the Issuer and the Trustee, inter alios, will enter into a<br />

master securitisation agreement (the “Master Securitisation<br />

Agreement”) to be dated on or about the Closing Date, the<br />

schedules to which will contain the following agreements, all of<br />

which come into effect on the date of the Master Securitisation<br />

Agreement: the Paying Agency Agreement, the Cash/Bond<br />

Administration Agreement, the Mortgage Administration<br />

Agreement, the Liquidity Facility Agreement, the Post<br />

Enforcement Call Option Agreement, the Bank Agreement and<br />

the GIC (each as defined herein).<br />

The Mortgage Administrator and the Cash/Bond Administrator<br />

will be obliged to report on a regular basis to the Trustee and the<br />

Issuer on the performance and status of the Mortgage Pool, the<br />

administration of the Mortgage Pool and other matters relating to<br />

their respective administrative functions as described herein.<br />

Neither the Mortgage Administrator nor the Cash/Bond<br />

Administrator will be responsible for payment of principal or<br />

interest on the Notes, or for payment of the RC Distributions in<br />

respect of the Residual Certificates.<br />

The Issuer is obliged to establish and maintain a system of cash<br />

ledgers (each, a “Ledger” and, together, the “Ledgers”) to<br />

record, allocate and disburse its funds for particular purposes. The<br />

Cash/Bond Administrator will, pursuant to the terms of the<br />

Cash/Bond Administration Agreement, maintain such Ledgers on<br />

the Issuer’s behalf. The amounts standing to the credit, at any<br />

time, of the Ledgers will, together, represent all sums standing to<br />

the credit of the Bank Accounts or invested in Authorised<br />

Investments.<br />

The Issuer will also establish and maintain a provisioning ledger<br />

(the “Principal Deficiency Ledger”) comprised of five subledgers<br />

(respectively the “A Principal Deficiency Ledger”, the<br />

“B Principal Deficiency Ledger”, the “C Principal Deficiency<br />

Ledger”, the “D Principal Deficiency Ledger” and the “E1c<br />

Principal Deficiency Ledger”) to record certain amounts (for<br />

example, losses incurred in respect of the Loans) which, at certain<br />

times, need to be taken into account and provided for in allocating<br />

and disbursing the Issuer’s funds (see further under “Credit<br />

Structure – Principal Deficiency Ledger”).<br />

The Ledgers will be used to monitor the receipt and subsequent<br />

utilisation of cash available to the Issuer from time to time and,<br />

along with the Principal Deficiency Ledger, will be credited and<br />

debited in the manner described under Condition 2(g) (Status,<br />

Security and Administration) and “Credit Structure” below.<br />

7

Delegation Agreements:<br />

Capstone and Wells Fargo have entered into a delegation<br />

agreement (the “Wells Fargo Delegation Agreement”). On or<br />

after the Closing Date, a supplement to the Wells Fargo<br />

Delegation Agreement will be entered into by Capstone and Wells<br />

Fargo pursuant to which Capstone will delegate certain of its<br />

obligations under the Cash/Bond Administration Agreement to<br />

Wells Fargo.<br />

Capstone and Vertex have entered into a delegation agreement<br />

(the “Vertex Delegation Agreement”). On or after the Closing<br />

Date, a supplement to the Vertex Delegation Agreement will be<br />

entered into by Capstone and Vertex pursuant to which Capstone<br />

will delegate certain of its obligations under the Mortgage<br />

Administration Agreement to Vertex.<br />

Capstone and HML will, on or after the Closing Date, enter into a<br />

delegation agreement (the “HML Delegation Agreement”)<br />

pursuant to which Capstone will delegate certain of its obligations<br />

under the Mortgage Administration Agreement to HML.<br />

Capstone and Lightfoots have entered into a servicing agreement<br />

(the “Lightfoots Delegation Agreement” and together with the<br />

Wells Fargo Delegation Agreement, the Vertex Delegation<br />

Agreement and the HML Delegation Agreement, the “Delegation<br />

Agreements”) pursuant to which certain obligations of Capstone<br />

under the Mortgage Administration Agreement will be undertaken<br />

by Lightfoots.<br />

Liquidity Facility Agreement:<br />

Bank Agreement:<br />

The Issuer will make drawings under the Liquidity Facility on any<br />

Interest Payment Date in order to meet certain shortfalls on<br />

interest payments due under the Notes. See “Credit Structure –<br />

Liquidity Facility” below.<br />

Payments by Borrowers in respect of amounts due:<br />

(i)<br />

(ii)<br />

under the SPML Loans and the A&L Loans will be paid<br />

into: (A) an account held by SPML with Barclays Bank<br />

<strong>PLC</strong> (whose registered office is at 1 Churchill Place,<br />

London E14 5HP) (“Barclays”) and designated as the<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> SPML Trust Collection Account<br />

(the “<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> SPML Trust Collection<br />

Account”); or (B) an account held by SPPL with<br />

Barclays and designated as the <strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong><br />

SPPL Trust Collection Account (the “<strong>Eurosail</strong>-<strong>UK</strong><br />

<strong>2007</strong>-<strong>3BL</strong> SPPL Trust Collection Account”); (C) an<br />

account held by SPML t/a London Mortgage Company<br />

with HSBC Bank plc (whose registered office is at 8<br />

Canada Square, London E14 5HQ) (“HSBC”) and<br />

designated as the First Mortgage Collection Account (the<br />

“First Mortgage Collection Account”) or (D) an<br />

account held by SPML t/a London Personal Loans with<br />

HSBC and designated the Second Mortgage Collection<br />

Account (the “Second Mortgage Collection Account”);<br />

under the PML Loans will be paid into the collection<br />

accounts in the name of PMCL (the “PMCL Collection<br />

Accounts”) and held at Barclays; and<br />

8

(iii)<br />

under the Amber Loans will be paid into the collection<br />

account in the name of SPML (the “Amber Collection<br />

Account”) and held at Barclays,<br />

in each case, as described further under “Credit Structure –<br />

Collection Accounts”.<br />

Cleared amounts received into the First Mortgage Collection<br />

Account and the Second Mortgage Collection Account will be<br />

transferred by a nightly automatic transfer into an account held by<br />

SPML t/a London Mortgage Company with HSBC and<br />

designated the First Mortgage Redemption Account (the “First<br />

Mortgage Redemption Account” and, together with the<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> SPML Trust Collection Account, the<br />

<strong>Eurosail</strong>-<strong>UK</strong> <strong>2007</strong>-<strong>3BL</strong> SPPL Trust Collection Account, the First<br />

Mortgage Collection Account, the Second Mortgage Collection<br />

Account, the SPML Collection Sweep Account, the Amber<br />

Collection Account and the PMCL Collection Accounts, the<br />

“Collection Accounts”, and each a “Collection Account”).<br />

Cleared amounts received into any of the Collection Accounts<br />

(other than the First Mortgage Collection Account, the Second<br />

Mortgage Collection Account and the SPML Collection Sweep<br />

Account) which relate to amounts due under the Loans will be<br />

transferred daily into the Transaction Account (as defined and<br />

further described under “Credit Structure - Transaction Account,<br />

Euro Account and Dollar Account”) of the Issuer held at the<br />

Account Bank.<br />

The Issuer will also maintain a Euro Account (as defined and<br />

further described under “Credit Structure - Transaction Account,<br />

Euro Account and Dollar Account”) for holding funds in euro in<br />

connection with the Euro Notes and a Dollar Account (as defined<br />

and further described under “Credit Structure - Transaction<br />

Account, Euro Account and Dollar Account”) for holding funds in<br />

dollars in connection with the Dollar Notes.<br />

GIC:<br />

Bullet Cap Agreement:<br />

Amounts standing to the credit of the Transaction Account will, to<br />

the extent not invested in Authorised Investments pursuant to the<br />

Investment Administration Agreement, be transferred on a daily<br />

basis into accounts in the name of the Issuer maintained with the<br />

GIC Provider (all such accounts, the “GIC Account”). See<br />

“Credit Structure - GIC Account” below.<br />

The Bullet Cap Counterparty and the Issuer will enter into the<br />

Bullet Cap Transaction (as defined in “Credit Structure - Bullet<br />

Cap Transaction” below) which will be subject to the terms of an<br />

agreement entered into between the Bullet Cap Counterparty and<br />

the Issuer in the form of the International Swaps and Derivatives<br />

Association, Inc. (“ISDA”) 1992 Master Agreement<br />

(Multicurrency - Cross Border) together with the schedules<br />

thereto and the confirmations thereunder (the “Bullet Cap<br />

Agreement”).<br />

The Bullet Cap Transaciton will be entered into under the same<br />

ISDA 1992 Master Agreement and Schedule as the<br />

Fixed/Floating Swap Transaction, the BBR Swap Transaction and<br />

the Currency Swap Transactions and references in this Prospectus<br />

to the Bullet Cap Agreement, the Fixed/Floating Swap<br />

Agreement, the BBR Swap Agreement and/or the Currency Swap<br />

Agreements shall be to the same ISDA 1992 Master Agreement<br />

9

and Schedule.<br />

The Bullet Cap Guarantor will enter into a guarantee in respect of<br />

the Bullet Cap Agreement (a “Bullet Cap Guarantee”) in favour<br />

of the Issuer, on or about the Closing Date in relation to the<br />

obligations of the Bullet Cap Counterparty under the Bullet Cap<br />

Agreement.<br />

The interest rate payable under the LIBOR Linked Loans is<br />

calculated by reference to Loan LIBOR and the interest rate<br />

payable under the BBR Linked Loans is calculated by reference<br />

to Loan BBR. The Issuer may be subject to a higher risk of<br />

default in payment by a Borrower under a LIBOR Linked Loan or<br />

a BBR Linked Loan due to an increase in Loan LIBOR or Loan<br />

BBR (as applicable). The purpose of the Bullet Cap Agreement is<br />

to allow the Issuer to mitigate its exposure to such potential<br />

default under a LIBOR Linked Loan due to an increase in Loan<br />

LIBOR and/or under a BBR Linked Loan due to an increase in<br />

Loan BBR.<br />

Fixed/Floating Swap Agreement:<br />

The Issuer and the Fixed/Floating Swap Counterparty will enter<br />

into the Fixed/Floating Swap Transaction (as defined in “Credit<br />

Structure - Fixed/Floating Swap Transaction” below) which will<br />

be subject to the terms of an agreement entered into between the<br />

Fixed/Floating Swap Counterparty and the Issuer in the form of<br />

an ISDA 1992 Master Agreement (Multicurrency - Cross Border)<br />

together with the schedules thereto and the confirmations<br />

thereunder (the “Fixed/Floating Swap Agreement”).<br />

The Fixed/Floating Swap Transaction will be entered into under<br />

the same ISDA 1992 Master Agreement and Schedule as the<br />

Bullet Cap Transaction, the BBR Swap Transaction and the<br />

Currency Swap Transactions and references in this Prospectus to<br />

the Bullet Cap Agreement, the Fixed/Floating Swap Agreement,<br />

the BBR Swap Agreement and/or the Currency Swap Agreements<br />

shall be to the same ISDA 1992 Master Agreement and Schedule.<br />

The Fixed/Floating Swap Guarantor will enter into a guarantee<br />

(the “Fixed/Floating Swap Guarantee”) in favour of the Issuer<br />

on or about the Closing Date in relation to the obligations of the<br />

Fixed/Floating Swap Counterparty under the Fixed/Floating Swap<br />

Agreement.<br />

Under the Fixed/Floating Swap Transaction, on each Interest<br />

Payment Date from and including the Interest Payment Date<br />

falling in December <strong>2007</strong>:<br />

(a)<br />

(b)<br />

the Issuer will make a payment to the Fixed/Floating<br />

Swap Counterparty calculated by applying the Weighted<br />

Average Fixed Rate to the Fixed/Floating Notional<br />

Amount; and<br />

the Fixed/Floating Swap Counterparty will make<br />

payments to the Issuer calculated by applying Note<br />

Sterling LIBOR in respect of the immediately preceding<br />

Interest Period and a margin to the Fixed/Floating<br />

Notional Amount.<br />

BBR Swap Agreement:<br />

The Issuer and the BBR Swap Counterparty will enter into the<br />

BBR Swap Transaction (as defined in “Credit Structure - BBR<br />

10

Swap Transaction” below) which will be subject to the terms of<br />

an agreement entered into between the BBR Swap Counterparty<br />

and the Issuer in the form of an ISDA 1992 Master Agreement<br />

(Multicurrency - Cross Border) together with the schedules<br />

thereto and confirmations thereunder (the “BBR Swap<br />

Agreement”).<br />

The BBR Swap Transaction will be entered into under the same<br />

ISDA 1992 Master Agreement and Schedule as the Bullet Cap<br />

Transaction, the Fixed/Floating Swap Transaction and the<br />

Currency Swap Transactions and references in this Prospectus to<br />

the Bullet Cap Agreement, the Fixed/Floating Swap Agreement,<br />

the BBR Swap Agreement and/or the Currency Swap Agreements<br />

shall be to the same ISDA 1992 Master Agreement and Schedule.<br />

The interest rate payable under the BBR Linked Loans is<br />

calculated by reference to Loan BBR whilst the interest rate<br />

payable on the Notes is calculated by reference to the London<br />

interbank offered rate (“LIBOR”) for three month sterling<br />

deposits (or, in the case of the first Interest Period, the linear<br />

interpolation of LIBOR for one month and two month sterling<br />

deposits). There may be a discrepancy between Loan BBR and<br />

LIBOR for three month sterling deposits. The purpose of the BBR<br />

Swap Agreement is to allow the Issuer to mitigate its exposure to<br />

such potential discrepancy between Loan BBR and LIBOR for<br />

three month sterling deposits.<br />

Under the BBR Swap Transaction, on each Interest Payment Date<br />

from and including the Interest Payment Date falling in<br />

September <strong>2007</strong>:<br />

(a)<br />

(b)<br />

the Issuer will make a payment to the BBR Swap<br />

Counterparty calculated by applying the aggregate of the<br />

Weighted Average BBR Rate and a margin to the BBR<br />

Notional Amount; and<br />

the BBR Swap Counterparty will make a payment to the<br />

Issuer calculated by applying Note Sterling LIBOR in<br />

respect of the immediately preceding Interest Period to<br />

the BBR Notional Amount.<br />

The BBR Swap Guarantor will enter into a guarantee (the “BBR<br />

Swap Guarantee”) in favour of the Issuer on or about the<br />

Closing Date in relation to the obligations of the BBR Swap<br />

Counterparty under the BBR Swap Agreement.<br />

Currency Swap Agreements:<br />

The Currency Swaps Counterparty will provide the Issuer with<br />

the benefit of swap transactions in relation to each Class of Euro<br />

Notes (the “Euro Currency Swap Transactions”) and each<br />

Class of Dollar Notes (the “Dollar Currency Swap<br />

Transactions” and, together with the Euro Currency Swap<br />

Transactions, the “Currency Swap Transactions”). The<br />

Currency Swap Transactions will be subject to the terms of<br />

separate agreements to be entered into between the Currency<br />

Swaps Counterparty and the Issuer on or before the Closing Date<br />

in the form of an ISDA 1992 Master Agreement (Multicurrency –<br />

Cross Border) together with the schedules thereto and<br />

confirmations thereunder (respectively, the “A Currency Swap<br />

Agreement”, the “B Currency Swap Agreement”, the “C<br />

Currency Swap Agreement” and the “D Currency Swap<br />

11

Agreement” and collectively referred to as the “Currency Swap<br />

Agreements”).<br />

The Currency Swap Transactions will be entered into under the<br />

same ISDA 1992 Master Agreement and Schedule as the Bullet<br />

Cap Transaction, the Fixed/Floating Swap Transaction and the<br />

BBR Swap Transaction and references in this Prospectus to the<br />

Bullet Cap Agreement, the Fixed/Floating Swap Agreement, the<br />

BBR Swap Agreement and/or the Currency Swap Agreements<br />

shall be to the same ISDA 1992 Master Agreement and Schedule.<br />

The Currency Swaps Guarantor will enter into a guarantee (the<br />

“Currency Swap Guarantee”) in favour of the Issuer on or<br />

about the Closing Date in relation to the obligations of the<br />

Currency Swaps Counterparty under the Currency Swap<br />

Agreements.<br />

Payments made by Borrowers under the Loans will be made to<br />

the Issuer in sterling. The purpose of the Currency Swap<br />

Agreements is to protect the Issuer against currency risk as a<br />

result of the amounts due under the Euro Notes being payable in<br />

euro and the amounts due under the Dollar Notes being payable in<br />

dollars.<br />

Post Enforcement Call Option:<br />

Pursuant to the terms of the Master Securitisation Agreement and<br />

the post enforcement call option agreement set out in schedule 9<br />

of the Master Securitisation Agreement (the “Post Enforcement<br />

Call Option Agreement”), the Trustee will, on or about the<br />

Closing Date, grant to OptionCo an option (the “Post<br />

Enforcement Call Option”) to acquire all (but not some only) of<br />

the A Notes, the B Notes, the C Notes, the D Notes and the E<br />

Notes (plus accrued interest thereon) for a consideration of one<br />

euro cent per Euro Note outstanding, one dollar cent per Dollar<br />

Note outstanding and one penny per Sterling Note outstanding<br />

(and for these purposes, each Global Note will be one Note)<br />

following any enforcement of the Security (as described in<br />

Condition 2(h) (Status, Security and Administration)) for the<br />

Notes, after the date on which the Trustee determines that the<br />

proceeds of such enforcement are insufficient, after payment of<br />

all other claims ranking higher in priority to the A Notes, the B<br />

Notes, the C Notes, the D Notes and the E Notes and pro rata<br />

payment of all claims ranking in equal priority to the A Notes, the<br />

B Notes, the C Notes, the D Notes and the E Notes and after the<br />

application of any such proceeds to the A Notes, the B Notes, the<br />

C Notes, the D Notes and the E Notes (in accordance with<br />

Condition 2 (Status, Security and Administration)), to pay any<br />

further amounts due in respect of the A Notes, the B Notes, the C<br />

Notes, the D Notes and the E Notes.<br />

The A Noteholders, the B Noteholders, the C Noteholders, the D<br />

Noteholders and the E Noteholders will be bound by, and the<br />

relevant Notes will be issued subject to, the terms of the Post<br />

Enforcement Call Option granted to the OptionCo pursuant to the<br />

terms and conditions of the Trust Deed and by Condition 5(j)<br />

(Post Enforcement Call Option) and the Trustee will be<br />

irrevocably authorised to enter into the Post Enforcement Call<br />

Option Agreement with the OptionCo on behalf of the A<br />

Noteholders, the B Noteholders, the C Noteholders, the D<br />

Noteholders and the E Noteholders.<br />

12

3. THE LOANS<br />

The Mortgage Pool: The section of this Prospectus headed “The Mortgage Pool -<br />

Characteristics of the Provisional Mortgage Pool” contains<br />

information relating to a portfolio of loans, from which will be<br />

selected the Loans which the Issuer will acquire on the Closing<br />

Date. This information has been prepared in relation to a sample<br />

of Loans and their related Collateral Security with aggregate<br />

Principal Balance as at 30 April <strong>2007</strong> of £685,224,182.60 (the<br />

“Provisional Mortgage Pool”). The portfolio of Loans and their<br />

related Collateral Security to be purchased by the Issuer from the<br />

Sellers on the Closing Date is referred to as the “Initial Mortgage<br />

Pool” and will be selected from the Provisional Mortgage Pool.<br />

Furthermore, Substitute Loans, Ported Loans, Newly-Originated<br />

Loans and Prefunded Loans may, subject to certain conditions, be<br />

acquired by the Issuer from the Sellers after the Closing Date.<br />

As more particularly described under “The Mortgage Pool”<br />

below, Loans within the Mortgage Pool from time to time will<br />

consist of:<br />

(a)<br />

Loans originated by:<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

Matlock, trading as London Mortgage Company<br />

(by itself or in association with a Remote<br />

Processor) and acquired by SPML;<br />

PML (by itself or in association with a Branded<br />

Lender or a Remote Processor);<br />

SPML (by itself or trading as London Mortgage<br />

Company or in association with a Branded<br />

Lender or a Remote Processor);<br />

Correspondent Lenders and acquired by SPML;<br />

A&L and acquired by SPML; and<br />

Amber and acquired by SPML,<br />

and in each case, secured (in England and Wales and Northern<br />

Ireland) by a first ranking mortgage or charge or (in Scotland) by<br />

a first ranking standard security on the relevant Property<br />

(collectively, the “First Loans”); and<br />

(b)<br />

Loans originated by:<br />

(i)<br />

(ii)<br />

(iii)<br />

Langersal and acquired by SPML;<br />

SPPL (by itself or trading as London Personal<br />

Loans) and acquired by SPML; and<br />

PML (by itself or in association with a Branded<br />

Lender or a Remote Processor),<br />

and in each case, are intended for the Borrowers’ general<br />

personal use and secured by a second ranking mortgage<br />

(in England and Wales) or by a second ranking standard<br />

security (in Scotland) on the relevant Property where a<br />

single lender holds all prior ranking mortgages or, as the<br />

<strong>13</strong>

case may be, standard securities in respect of the relevant<br />

Property (the “Second Loans”).<br />

4. THE INSTRUMENTS<br />

Notes:<br />

In this document, the A1b Notes and the A1c Notes are<br />

collectively referred to as the “A1 Notes”. The A2a Notes, the<br />

A2b Notes and the A2c Notes are collectively referred to as the<br />

“A2 Notes”. The A3a Notes and the A3c Notes are collectively<br />

referred to as the “A3 Notes” and the A1 Notes, the A2 Notes and<br />

the A3 Notes shall be together referred to as the “A Notes”. The<br />

B1a Notes and the B1c Notes are collectively referred to as the “B<br />

Notes”. The C1a Notes and the C1c Notes are collectively<br />

referred to as the “C Notes”. The D1a Notes are also referred to<br />

as the “D Notes”. The E1c Notes and the ETc Notes are<br />

collectively referred to as the “E Notes”. The A2a Notes, the A3a<br />

Notes, the B1a Notes, the C1a Notes and the D1a Notes are<br />

collectively referred to as the “Euro Notes”. The A1b Notes and<br />

the A2b Notes are collectively referred to as the “Dollar Notes”.<br />

The A1c Notes, the A2c Notes, the A3c Notes, the B1c Notes, the<br />

C1c Notes and the E Notes are collectively referred to as the<br />

“Sterling Notes”. The Dollar Notes, the Sterling Notes and the<br />

Euro Notes are together referred to as the “Notes” and the holders<br />

thereof the “Noteholders”.<br />

The B Notes, C Notes, D Notes and the E Notes are referred to as<br />

the “Junior Notes”.<br />

The ETc Notes are also referred to as the “Revenue Backed<br />

Notes” and all Notes other than the Revenue Backed Notes are<br />

referred to as the “Collateral Backed Notes”.<br />

The Residual Certificates and the Notes together are referred to as<br />

the “Instruments”. The Noteholders and the Residual<br />

Certificateholders are together, the “Instrumentholders”.<br />

Prior to enforcement: (a) payments of interest on the Notes will be<br />

payable in arrear as described in Condition 4 (Interest) and from<br />

the Available Revenue Fund in accordance with the Pre-<br />

Enforcement Priority of Payments as set out in Condition 2(g)<br />

(Status, Security and Administration) and (b) principal on the<br />

Collateral Backed Notes will be payable from the Actual<br />

Redemption Funds and, in the case of the Revenue Backed Notes<br />

from the Available Revenue Fund.<br />

Residual Certificates:<br />

The Residual Certificates representing deferred consideration for<br />

the acquisition of the Initial Mortgage Pool, are constituted by the<br />

Trust Deed and have the benefit of Security but rank subordinate<br />

to the Notes (other than in respect of their entitlement to<br />

Prepayment Charges Receipts (which do not form part of the<br />

Available Revenue Fund) and in their entitlement to RC Senior<br />

Distributions (which rank senior to payments of principal on the<br />

ETc Notes both pre and post enforcement)). Following<br />

redemption of all of the Notes or an enforcement of the Notes<br />

pursuant to Condition 10 (Enforcement of Notes) and disposal of<br />

the Loans in the Mortgage Pool no termination payment or other<br />

amount (other than amounts then payable in respect of the<br />

Residual Revenue) will be payable in respect of the Residual<br />

Certificates and, following the payment of any amounts then<br />

payable in respect of the Residual Revenue, the Residual<br />

14

Certificates shall no longer constitute a claim against the Issuer.<br />

(See “Risk Factors – Residual Certificates” and “Terms and<br />

Conditions of the Residual Certificates” below).<br />

The Residual Certificates represent amounts payable to the<br />

holders thereof in respect of the Residual Revenue received in<br />

respect of the Mortgage Pool.<br />

Form, registration and transfer of<br />

Instruments:<br />

The A Notes, the B Notes, the C Notes and the D Notes to be sold<br />

within the United States to Qualified Institutional Buyers in<br />

reliance on Rule 144A (the “Rule 144A Notes”) will each be<br />

represented by a global note in fully registered form without<br />

coupons attached (the “Rule 144A Global Notes”). It is expected<br />

that the Rule 144A Global Notes will be deposited with the<br />

Custodian and registered in the name of DTC or its nominee on or<br />

about the Closing Date. For the avoidance of doubt, the E Notes<br />

and the Residual Certificates will not be sold within the United<br />

States to Qualified Institutional Buyers in reliance on Rule 144A.<br />

The Notes to be sold in reliance on Regulation S (the “Reg S<br />

Notes”) will each be represented by a global note in fully<br />

registered form without coupons attached (the “Reg S Global<br />

Notes”). The Reg S Global Notes, together with the Rule 144A<br />

Global Notes, are referred to as the “Global Notes”.<br />

It is expected that the Reg S Global Notes will be deposited with<br />

the Common Depositary for Euroclear and Clearstream,<br />

Luxembourg on or about the date of issue of the Notes.<br />

Transfers of interests in the Global Notes will be subject to<br />

certain restrictions. In addition, transferees of Global Notes<br />

and the Residual Certificates will be deemed to have made<br />

certain representations relating to compliance with all<br />

applicable securities, ERISA and tax laws. See further<br />

“Transfer Restrictions”.<br />

A beneficial interest in a Reg S Global Note (other than the E<br />

Notes) may be transferred to a person who takes delivery in the<br />

form of a beneficial interest in the corresponding Rule 144A<br />

Global Note only upon receipt by the Registrar of a written<br />

certificate from the transferor (in the form provided in the Trust<br />