The China Monitor - The Centre for Chinese Studies

The China Monitor - The Centre for Chinese Studies

The China Monitor - The Centre for Chinese Studies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Photo: Wordpress.com<br />

Photo: commons.wikimedia.org<br />

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

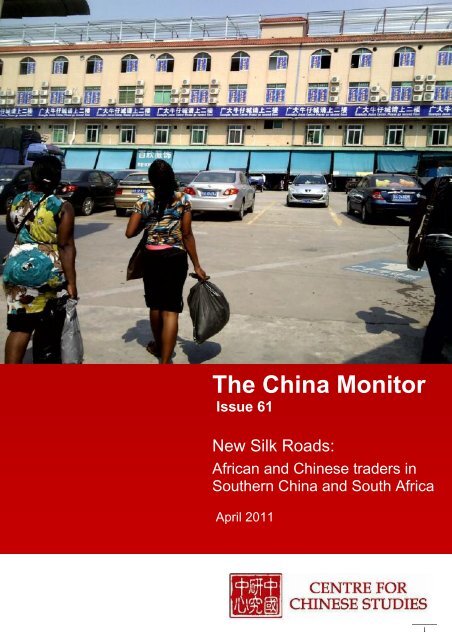

Issue 61<br />

New Silk Roads:<br />

African and <strong>Chinese</strong> traders in<br />

Southern <strong>China</strong> and South Africa<br />

April 2011<br />

1

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Contents<br />

Editorial 3<br />

Dr. Sven Grimm, Director,<br />

<strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong><br />

Policy Watch 4<br />

A New Silk Road: African Traders in South <strong>China</strong><br />

By Yang Yang with research assistance from: Noah Altman<br />

Commentary 8<br />

A Social Survey in Johannesburg<br />

By Chen Fenglan<br />

Briefing Round-up 12<br />

A Round-up of the top <strong>China</strong>-Africa news from the last month<br />

<strong>The</strong> <strong>China</strong> Forum<br />

Recent Events at the <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong> 14<br />

Contact Us 15<br />

A Publication of:<br />

<strong>The</strong> <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong><br />

Faculty of Arts and Social Sciences, Stellenbosch University<br />

Cover Photo: Chen Fenglang<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

2

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Editorial<br />

Dear Reader,<br />

<strong>China</strong>‟s Africa policy is often suspected to be following a „great plan‟ and<br />

observers tend to speak of „the <strong>Chinese</strong>‟ as if everyone was following one<br />

strategy. Trade with <strong>China</strong> is often a matter of state-to-state deals providing a<br />

framework in which companies can operate, as highlighted in last month‟s <strong>China</strong><br />

<strong>Monitor</strong>. Yet, there is another side of the story that we would like to highlight this<br />

month. <strong>The</strong> discussion on the „macro‟ element of relations is incomplete without<br />

the „micro‟ level of individual decisions and actions.<br />

<strong>The</strong>re are general guidelines and basic policies, such as <strong>China</strong>‟s Africa policy of<br />

2006 or the „Going Out‟ Strategy of 2001. However, many interactions are based<br />

on individuals making use of opportunities, leading to „grassroot globalisation‟,<br />

as our author Yang Yang calls it. <strong>The</strong>se actions might be within the confines of<br />

policies <strong>for</strong>mulated in Beijing and in bi-national commissions – or they might go<br />

beyond it. Seeing „all <strong>Chinese</strong>‟ strive <strong>for</strong> the same thing is naïve and as wrong<br />

as the Western assumption that globalisation is simply „happening to‟ Africans.<br />

Small trader migration is arguably one of the issues that is beyond state<br />

command (or control) in <strong>China</strong>, too, as illustrated by the second piece, an<br />

account of joint research between Xiamen and Stellenbosch Universities. Some<br />

people simply grasp opportunities where they present themselves, irrespective<br />

of whether they are induced by Beijing or whichever their capital city might be. It<br />

is much rather a matter of personal risk calculations and entrepreneurship if<br />

these opportunities are sought within one‟s community or beyond – at times<br />

even in communities whose language and habit are <strong>for</strong>eign.<br />

It is intriguing to see how similar patterns <strong>for</strong> migration are between those<br />

African that seek opportunities in <strong>China</strong> and those <strong>Chinese</strong> that seek<br />

opportunities in (South) Africa. On both sides, determining factors are family<br />

bonds, loyalties to the own group, and rational considerations of where<br />

opportunities are. It is only in the latter point that state policies come into the<br />

picture when Africans or <strong>Chinese</strong> are taking individual decisions on their lives.<br />

<strong>The</strong>y are an obvious – if not THE most obvious – element in Sino-African<br />

relations that needs to be researched and understood.<br />

Yours sincerely,<br />

Dr. Sven Grimm<br />

Director, <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong><br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

3

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Policy Watch<br />

A New Silk Road: African Traders in South <strong>China</strong><br />

`<br />

By Yang Yang<br />

<strong>The</strong> <strong>Chinese</strong> University of Hong Kong, Hong Kong<br />

with research assistance from: Noah Altman<br />

Florida Institute of Technology, USA<br />

In the past decade, tens of thousands of African traders have arrived in Guangzhou,<br />

the centre of <strong>China</strong>'s “world factory” and a neighbouring city of Hong Kong. It is<br />

estimated that in 2009 there were about 20,000 Africans living long-term in<br />

Guangzhou and thousands of more visiting the city regularly <strong>for</strong> visits 1 . <strong>The</strong>y gather<br />

around several major wholesale markets near the old railway station in the city and<br />

purchase <strong>Chinese</strong> manufactured goods in bulk <strong>for</strong> shipping back to West Africa.<br />

Many traders manage to open their own shops and become middlemen in the<br />

lucrative global business. Due to the large African population, districts of Sanyuanli<br />

and Xiaobei have become known as “Chocolate City” and “Little Africa”.<br />

“<strong>The</strong> DRC may still be<br />

plagued by disease and<br />

absolute poverty and in the<br />

Eastern parts ravaged by<br />

war, but its mining sector is<br />

booming.”<br />

“…individual traders remain<br />

an important conduit between<br />

buyers and producers. This is<br />

especially true between<br />

<strong>China</strong> and Africa.”<br />

Having been the norm of the business model <strong>for</strong> centuries be<strong>for</strong>e the emergence of<br />

the industrial revolution and economic tycoons, individual traders remain an<br />

important conduit between buyers and producers. This is especially true between<br />

<strong>China</strong> and Africa, where the African traders are today‟s Arabs on the new “silk road”,<br />

with cotton or synthetic clothes in the stead of silk, and freight services in the place<br />

of camels. <strong>The</strong> African traders in south <strong>China</strong> mainly come from Nigeria, Ghana,<br />

Mali, Cameroon, Senegal, Kenya, and Tanzania. <strong>The</strong> majority are identified as<br />

Nigerian Igbo, who are mainly Christians from Nigeria‟s eastern regions. <strong>The</strong> most<br />

traded items are clothes and T-shirts, which draws parallels to the ancient Eurasian<br />

Silk Road. In many African countries, the population of <strong>Chinese</strong> migrants is much<br />

bigger than the African population in <strong>China</strong>, according to the author‟s in<strong>for</strong>mants.<br />

Some <strong>Chinese</strong> business returnees from Africa said one could find business<br />

opportunities everywhere on that continent. It is said that a <strong>Chinese</strong> can become a<br />

millionaire just by bringing a soya milk machine and selling drinks in Africa. “But we<br />

are coming to <strong>China</strong> too,” a trader said, “We bring the goods from <strong>China</strong> to Africa to<br />

compete with the <strong>Chinese</strong> in my country.” It is becoming a cut-throat competition, in<br />

which the traders either have to lower the selling price or trade alternative goods that<br />

are not available in those “<strong>China</strong>towns”.<br />

<strong>China</strong>-Africa trade relations were established as the PRC government was founded.<br />

However, from 1949 to 1977, the relationship was political and <strong>China</strong> assisted Africa<br />

with food, money, living necessities, and military training to fight against colonialism<br />

and hegemony 2 . After the 1978 re<strong>for</strong>ms in <strong>China</strong>, more emphasis has been put on<br />

economic cooperation: <strong>China</strong> seeks to obtain from African countries raw materials<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

4

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

such as crude oil, iron, cotton, and diamonds; African imports from <strong>China</strong> include<br />

electrical appliances, textiles, machinery, and chemicals, among others 3 . It was also<br />

after the Re<strong>for</strong>m that <strong>China</strong> embraced a more liberal economy and its manufacturing<br />

industry became increasingly privatized and deregulated. Guangzhou became<br />

known as the “world's factory” as the private manufacturers flourished in southern<br />

<strong>China</strong>, where cheap goods are produced en masse with low labour cost. Around the<br />

same time, market demand in the populous regions of West Africa underwent a<br />

rapid expansion. For instance, the Nigerian markets rely heavily on imports, earning<br />

Nigeria a reputation as the “cargo economy”, and it is described that “ships laden<br />

with containers dock at Nigeria‟s ports and return almost empty to their places of<br />

origin, as Nigeria does not have much to export” 4 . <strong>The</strong> local market has been<br />

dependent on <strong>for</strong>eign imported goods, especially from <strong>China</strong> in the last few decades.<br />

In the 1980s and the 1990s, large numbers of African merchants were seen in the<br />

Canton Fair in Guangzhou. <strong>The</strong> Canton Fair is the largest international trade fair in<br />

<strong>China</strong> which happens twice every year since 1957. It is a main expo event where<br />

<strong>Chinese</strong>-made goods are displayed and ordered <strong>for</strong> export to different corners of the<br />

world. <strong>The</strong> African markets found their “gold mine” in the east here and their needs<br />

could be met by inexpensive means. In the late 1990s, many more individual African<br />

dealers travelled from Sub-Saharan countries to Guangzhou to order goods other<br />

than fair seasons. <strong>The</strong>se petty traders are different from the Canton Fair traders in<br />

several aspects:<br />

1. they do not own or represent <strong>for</strong> any firm back in their countries 5 , nor do<br />

they have considerable funds <strong>for</strong> placing substantial orders;<br />

2. instead of attending the Canton Fair held in officially built expo halls, the<br />

petty traders gather around the old railway station where shops are sub-let<br />

to <strong>Chinese</strong> and African migrants, who are often selling fake goods and<br />

participate in semi-legal activities;<br />

3. instead of getting official invitation letter to stay in <strong>China</strong> <strong>for</strong> three months,<br />

the traders find their way to “buy” invitation letters 6 from <strong>Chinese</strong> whom they<br />

do not even know and, if they need to, overstay their appointed stay period<br />

to continue business;<br />

4. instead of staying in nice starred hotels, these traders find almost free<br />

accommodation through network or they stay at special discounted rooms in<br />

cheap hostels;<br />

5. instead of having guarantees such as institutional organisation and<br />

certificate that their goods are in good condition, the traders may have<br />

nothing more than a spoken promise or a hand-written receipt that is kept<br />

off-book.<br />

“<strong>The</strong> traders near the railway<br />

station and Canton Fair<br />

traders are at two opposite<br />

ends, as semi-legality versus<br />

legality, in<strong>for</strong>mal economy<br />

versus <strong>for</strong>mal economy.”<br />

<strong>The</strong> traders near the railway station and Canton Fair traders are at two opposite<br />

ends, as semi-legality versus legality, in<strong>for</strong>mal economy versus <strong>for</strong>mal economy,<br />

globalisation from below versus globalisation from above. It is a “globalisation from<br />

below” where the lower strata of the society attempts to participate and benefit from<br />

the world economy 7 . By all means, the African traders as well as the local business<br />

partners in Guangzhou are a mobilizing <strong>for</strong>ce that is not only self-interested but also<br />

symbolically grassroot globalization.<br />

<strong>The</strong> most frequently traded clothes (Polo shirt and T-shirt) in the African market in<br />

Guangzhou are made of cotton. <strong>The</strong> cotton agriculture is mainly located in the<br />

northern <strong>Chinese</strong> provinces, such as Hebei, Henan, Shanxi, Shandong, Hubei,<br />

Xinjiang and so on. <strong>The</strong> cotton farmers pick the ripe cotton and sell it to the textile<br />

factories, which process the raw material. <strong>The</strong>y developed the cotton into cotton<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

5

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

```<br />

yarn and then weave the cotton yarn into cloth, which is followed by bleaching,<br />

dyeing, and printing. <strong>The</strong> clothes factories in the Yangtze River Delta and Pearl<br />

River Delta buy the cloth and apply various fashion designs on it and produce a<br />

large quantity of clothes and pants. <strong>The</strong>se clothes stocks are then sold through the<br />

agencies at the wholesale markets, like Guangda. <strong>The</strong> retailers from all over <strong>China</strong><br />

and western African countries come to the wholesale markets and purchase bulks<br />

of clothes of various designs. <strong>The</strong> Africans who have their own stores in<br />

Guangzhou will then divide the bulks of clothes into even smaller shares to sell to<br />

short-term African traders, as in the case of Sanyuanli market. <strong>The</strong> traders then<br />

ship the goods they bought by air/sea back home, where they sell the goods in<br />

their family-run stores or to other African local retailers.<br />

It is risky <strong>for</strong> a trader to purchase large quantities of clothes within a short period,<br />

because he may have no buyers at all when fashions in Africa change. Compared<br />

to electronics and mobile phones, the clothing business is much more fickle in<br />

terms of style. <strong>The</strong> fashion in the Sanyuanli clothing market changes on weekly<br />

basis and sometimes even more quickly. One can simply record the different<br />

arrangement of clothes on display on the shop fronts to understand the changing<br />

fashions of distant Sub-Saharan markets. <strong>The</strong> clothes sold from <strong>China</strong> and the<br />

African local fashion trends have a mutual influence on each other. A Nigerian<br />

trader said, “I ask my brothers in Nigeria to tell me what design is popular there.<br />

But sometimes when every trader sells certain kinds of clothes from here, it will<br />

<strong>for</strong>m a trend in Nigeria.” African shop owners in this sense are better positioned<br />

that their <strong>Chinese</strong> competitors not only because they share a common language<br />

with their African clients, but also because they can better understand fashion<br />

trends back home.<br />

It is also an art <strong>for</strong> the smart entrepreneurs to transport their resources and goods<br />

between <strong>China</strong> and Africa. International money transfer service is operated often<br />

by logistics companies rather than the <strong>Chinese</strong> underground banks. <strong>The</strong> logistics<br />

firms transport money, goods, samples, and sometimes gifts <strong>for</strong> mostly African<br />

clients. Since they are handling large sums of cash and goods and crossing the<br />

national borders, every logistics company has to be trustworthy and they spread<br />

networks in the area of flight and freight. <strong>The</strong>y have branches in Guangzhou, Yiwu,<br />

Hong Kong, Lagos international airport, Abidjan, Beira, Cape Town, Lome, and<br />

many other major African ports. <strong>The</strong> containers and boxes of goods are transported<br />

through several employees who connect to the local cargo business. Small items<br />

such as money envelope and product samples are usually handled by many flight<br />

attendants that these firms employ. <strong>The</strong> flight attendants are ideal <strong>for</strong> this profitable<br />

part-time job because of their frequent international travel agenda and their free<br />

luggage allowance. Branch employees at destination pick up the items at <strong>Chinese</strong><br />

airports and then sent to the clients who are supposed to receive the money.<br />

“Family members and relatives<br />

are often crucial human<br />

resources to handle the goods<br />

the traders send back to Africa.”<br />

Family members and relatives are often crucial human resources to handle the<br />

goods the traders send back to Africa. <strong>The</strong> main responsibilities <strong>for</strong> their family<br />

members are to store and distribute goods in the communities. Part of the profit<br />

margin is used to pay the relatives and expenses such as shop rent, which is easily<br />

manageable because the living expense in West Africa is comparatively low. Many<br />

African traders in <strong>China</strong> have shops in their home countries where they support a<br />

network of relatives through the trade.<br />

<strong>The</strong> African traders are street-smart petty entrepreneurs, who utilize relatively small<br />

amounts of capital, human networks, and wisdom in dealing with local politics to<br />

make a <strong>for</strong>tune. Better opportunities to make money are available to these Africans<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

6

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

since they can now travel half a world away, to <strong>China</strong>‟s “world factory” in the Pearl<br />

River Delta and profit in the trade of cheap goods. Like small-scale carpet producers<br />

in Nepal, garment manufacturers in Mexico and Hong Kong, small investors in<br />

mainland <strong>China</strong>, the African traders in <strong>China</strong> can be seen as petty capitalists: they<br />

“regularly operate in the ambiguous boundaries between capital and labour,<br />

cooperation and exploitation, family and economy, tradition and modernity, friends<br />

and competitors” 8 . Both in the markets of south <strong>China</strong> and back in their home<br />

countries, the traders incorporate friends, family members, and business<br />

connections into their entrepreneurship. Such kind of globalization from below can<br />

also be found among the <strong>Chinese</strong> traders who are involved in the retail/wholesale<br />

business in many African countries. <strong>The</strong> small traders in today's global market have<br />

more opportunities to move upward than ever be<strong>for</strong>e.<br />

End Notes<br />

1 South <strong>China</strong> Morning Post (SCMP). 2009. “Guangzhou's African Bind”. 29 November,<br />

p. 12.<br />

2 Li, Anshan. 2008. “<strong>China</strong>‟s New Policy toward Africa.” In Robert Rotberg, ed., <strong>China</strong><br />

into Africa: Trade, Aid, and Influence, pp.21-48. Washington D.C.: Brookings<br />

Institution Press.<br />

3<br />

Ampiah, Kweku, and Sanusha Naidu. 2008. “Introduction: Africa and <strong>China</strong> in the<br />

Post-Cold-War Era.” In Kweku Ampiah and Snusha Naidu, eds., Crouching Tiger,<br />

Hidden Dragon?: Africa and <strong>China</strong>, pp.3-19. Scottsville: University of KwaZulu-Natal<br />

Press.<br />

4<br />

Ogunsano, Alaba. 2008. “A Tale of Two Giants: Nigeria and <strong>China</strong>”. In Kweku Ampiah<br />

and Snusha Naidu, eds., Crouching Tiger, Hidden Dragon?: Africa and <strong>China</strong>, pp. 192-<br />

207. Scottsville: University of KwaZulu-Natal Press.<br />

5 <strong>The</strong> petty traders may manage small retail shops together with their families or<br />

master, but they do not own or are employed by registered companies. As a result,<br />

they usually purchase goods by cash rather than by credit.<br />

Yang Yang is a Master of<br />

Philosophy student at the<br />

<strong>Chinese</strong> University of Hong<br />

Kong ` and also the editor of <strong>The</strong><br />

Hong Kong Anthropologist. She<br />

is currently researching on<br />

African trading diasporas in<br />

<strong>China</strong>.<br />

Research assistance <strong>for</strong> this<br />

piece provided by Noah Altman<br />

Florida Institute of Technology,<br />

USA<br />

6 Travel-type visa to <strong>China</strong> only grant one month of stay, so the traders usually try to<br />

get a business visa to stay <strong>for</strong> 3 months or even 1 year. Business visa requires the<br />

applicants to have an invitation letter from a registered company in <strong>China</strong>. Since the<br />

petty traders are not affiliated with any <strong>Chinese</strong> company, they usually pay agencies<br />

who “issue” such letters.<br />

7 For more academic references on low-end globalization, please refer to: Falk,<br />

Richard. 1999. Predatory Globalization: A Critique. Cambridge: Polity Press, Blackwell,<br />

and Mathews, Gordon. 2007. “Chungking Mansions: A Center of „Low-End<br />

Globalization‟.” Ethnology 46(2):169-183.<br />

8 Smart, Alan, and Josephine Smart. 2005. “Introduction.” In Alan Smart and<br />

Josephine Smart, eds., Petty Capitalists and Globalization: Flexibility,<br />

Entrepreneurship, and Economic Development, pp. 1-22. Albany: <strong>The</strong> State University<br />

of New York Press.<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

7

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Commentary<br />

<strong>China</strong>town in Johannesburg - A Social Survey 1<br />

By Chen Fenglan<br />

Fuzhou University, <strong>China</strong><br />

Johannesburg has the largest population and highest density of <strong>Chinese</strong> in South<br />

Africa. It is estimate that there are about 300,000 <strong>Chinese</strong> migrants in South Africa,<br />

and more than 200,000 <strong>Chinese</strong> migrants do business in Johannesburg.<br />

<strong>The</strong> new <strong>Chinese</strong> migrants tend to sell a wide range of cheap <strong>Chinese</strong>-made textiles,<br />

often to the lowest end of the consumer market in South Africa. <strong>The</strong> „<strong>China</strong> shop‟ will<br />

include leather and imitation leather goods (shoes, belts, handbags); clothing (men‟s,<br />

women‟s, and children‟s under and outerwear); scarves, shawls, hats and wigs;<br />

sports bags and luggage; bicycles, toys and other items <strong>for</strong> babies and small<br />

children (strollers, playpens, etc.); costume jewellery; mattresses, blankets, towels,<br />

rugs and linoleum flooring; and small household appliances and electronic goods.<br />

In addition to these retail <strong>China</strong> shops and businesses, several larger South African<br />

cities have become home to <strong>Chinese</strong> wholesale traders, such as Johannesburg,<br />

Cape Town, and Durban. <strong>The</strong> largest of these are in Johannesburg and include<br />

<strong>China</strong> City, <strong>China</strong> Mart, Hong Kong City, African Trade <strong>Centre</strong>, and Bruma Orient<br />

City. <strong>The</strong>se <strong>for</strong>m a regional shopping hub which provides goods not just <strong>for</strong> South<br />

Africans but also to retailers and consumers in neighbouring countries (Botswana,<br />

Lesotho, Zimbabwe, and Angola) and from across Africa.<br />

Our research was conducted by visiting the shopping malls during work hours, and<br />

interviewing more than 700 <strong>Chinese</strong> migrants in the field. Of these, about 200 people<br />

refused to answer our questionnaire. Some claimed to be too busy doing business,<br />

possibly as they thought the research was irrelevant to them. Others among those<br />

who refused the interview obviously were lacking trust, with one of the interviewees<br />

even asking the interviewer if she was a business spy. Generally, however, people<br />

who accepted the questions were friendly and shared their stories about their life in<br />

South Africa. <strong>The</strong>y, however, became more hesitant to answer questions on the<br />

number of their clients, their income, or where they live.<br />

Earlier waves of migration – pre-2000<br />

“<strong>Chinese</strong> migrants arrived in<br />

South Africa at different periods,<br />

though most of them entered<br />

pre-2000.”<br />

<strong>Chinese</strong> migrants arrived in South Africa at different periods, though most of them<br />

entered pre-2000. During that time, as South Africa ended its official relationship with<br />

Taiwan and established diplomatic ties with the People‟s Republic of <strong>China</strong> (PRC),<br />

the <strong>Chinese</strong> state-owned enterprises that came to do business in South Africa<br />

typically sent their staff to their operations. Most of the pre-2000 migrants from<br />

<strong>China</strong>‟s mainland were from Beijing and Shanghai. Many of them worked in the<br />

state-owned enterprises. At the end of their two to three years contract periods some<br />

of these <strong>Chinese</strong> decided to stay in South Africa. Often, the reason given <strong>for</strong> staying<br />

on in South Africa was that income in South Africa was higher than what they<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

8

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

received in <strong>China</strong>. Amongst those who chose to remain in South Africa, most are<br />

educated professionals, and are now some of the most successful business people<br />

in their communities with established extensive business networks throughout the<br />

southern Africa region and in <strong>China</strong>. <strong>The</strong> majority of them entered into import, retail<br />

and wholesale trading as well as manufacturing of consumer products.<br />

Other in this early group (pre-2000) were migrants from Jiangsu and Zhejiang<br />

provinces; two provinces that have become famous <strong>for</strong> their manufacturing capacity,<br />

particularly in textiles, shoes, bags, and other light industrial products. Entrepreneurs<br />

from these regions identified the business opportunities in Africa and saw South<br />

Africa as their entry point to other neighbouring African countries. <strong>The</strong>y came with<br />

capital and other business resources and many of them had family connections to<br />

factories in <strong>China</strong> that gave them competitive advantages to go into import,<br />

wholesale, and distribution abroad. Many have now expanded beyond their initial<br />

trading businesses into other local industrial fields, including mining, manufacturing,<br />

and property development, and a few have made enough in profits to invest back<br />

into <strong>China</strong>. In part, they were able to achieve this business success because of the<br />

opportunities available to them at the time of South Africa‟s newly<br />

independent/democratic status and their business connections in a rapidly<br />

expanding <strong>Chinese</strong> manufacturing sector.<br />

Fujian migrant community – post-2000<br />

<strong>The</strong> post-2000 wave of <strong>Chinese</strong> migration, which continues today, is comprised<br />

predominantly of small traders and/or peasants from Fujian province. Based on our<br />

research it would appear that many entered the country illegally from neighbouring<br />

African countries and subsequently applied <strong>for</strong> asylum-seeker status and work<br />

permits. Due to their limited English, low levels of education, and their lack of<br />

extensive business networks and social capital, they tend to run small shops in the<br />

remote towns across South Africa.<br />

Fujian is the author‟s hometown; and so a focus on this community during the<br />

research came naturally. Fujian located in the south east of <strong>China</strong>; it is an area with<br />

a history of interaction with the West since the 19th century and a much longer<br />

practice of overseas migration, beginning with migration to South Asia be<strong>for</strong>e further<br />

migration to European colonies in the Atlantic. Together with an existing emigrant<br />

culture and strong networks with overseas <strong>Chinese</strong>, it has been estimated that over<br />

5 million Fujianese left the province and resettled in over 160 countries over time.<br />

Fujian province has an emigrant culture, and in this area people prefer to lend<br />

money to those who want to go abroad, but not to those who want to do business<br />

domestically.<br />

“South Africa‟s opening up<br />

process through the mid 1990s<br />

provided tremendous<br />

investment and business<br />

opportunities.”<br />

Traditionally, Fujianese emigrated to South Asia, America, Japan and Britain. But in<br />

recent years, the pattern has changed. Traditional Western host countries continue<br />

to implement more restrictive immigration laws and tighten control of their borders<br />

through new surveillance technology. In South Asia, the economies‟ per<strong>for</strong>mances<br />

were declining. Consequently, Fujianese sought alternative destinations, such as<br />

Russia, Argentina and South Africa. South Africa‟s opening up process through the<br />

mid-1990s and its renewed diplomatic relationship with the People‟s Republic of<br />

<strong>China</strong> in 1998 provided tremendous investment and business opportunities. With its<br />

established business and physical infrastructure and its lower threshold <strong>for</strong> entry,<br />

South Africa has become an attractive migration destination, particularly <strong>for</strong> those<br />

with insufficient qualifications or insufficient capital to qualify <strong>for</strong> entry to North<br />

America, Europe, or Australia.<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

9

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

It is said that if a Fujianese wanted to go to America, he or she would spend more<br />

than 400 000 RMB (approx. US$ 60 000) to go there. To enter South Africa, the<br />

amount of 40 000 RMB (just over US$ 6000) is enough. Similarly, if a Fujian peasant<br />

arrived at America, they might find it very difficult to do business there. Perhaps they<br />

might work in the restaurant industry <strong>for</strong> several years, and wait <strong>for</strong> the chance to run<br />

a small shop. But in South Africa, the perception is that there are plenty of<br />

opportunities; if one has enough capital, one can run a shop or starts other types of<br />

business easily. Consequently, in Fujian province especially in Fuqing city, more and<br />

more people made the choice to immigrate to South Africa instead of other<br />

countries.<br />

Fujianese are the largest segment of the overseas <strong>Chinese</strong> population in South<br />

Africa. Because many of the Fujianese lacked sufficient capital to live and operate<br />

businesses in the more developed and expensive cities in South Africa, the vast<br />

majority of these newest <strong>Chinese</strong> migrants have been <strong>for</strong>ced out of urban,<br />

cosmopolitan centres to the rural parts of the country. <strong>The</strong>se Fujianese settled in<br />

small towns and villages throughout the South Africa. Many of the Fujianese face a<br />

variety of challenges: they struggle to make money, necessary to repay the loans<br />

they took out to immigrate; they struggle to communicate in the local languages; and<br />

they struggle with the loneliness of life in remote places. Many of them expressed<br />

longings <strong>for</strong> “home”. If they were wealthier, they would prefer to move to<br />

Johannesburg to do the wholesale business. <strong>The</strong> majority of those we interviewed in<br />

Johannesburg sent their young children to live with relatives in <strong>China</strong>, and they also<br />

send money to invest in houses in their hometown. It is questionable, how many of<br />

them will ultimately find the resources and will to go home. Yet, building a big house<br />

increases their – and their family‟s – reputation at home by displaying to their<br />

communities that they have become wealthy abroad.<br />

Push and pull factors in migration from <strong>China</strong><br />

As mentioned, <strong>Chinese</strong> migrants are neither homogenous nor from a single place in<br />

<strong>China</strong>. <strong>The</strong> new migrants to South Africa differ in terms of place of origin, home<br />

language, level of education, business experience, and capital. <strong>The</strong> timing of their<br />

migration, in relation to what is occurring in <strong>China</strong>, in South Africa, and in the world<br />

economy, together with their individual differences have an impact on their ability to<br />

adapt to their adopted homes and succeed in business. South Africa has <strong>Chinese</strong><br />

home province associations reflecting at least two-thirds of <strong>China</strong>‟s provinces; the<br />

largest is the Fujian Association, which claims to have 100,000 members across<br />

southern Africa, makes up the largest proportion of <strong>Chinese</strong> migrants in South<br />

Africa.<br />

<strong>The</strong> vast majority of new <strong>Chinese</strong> migrants to South Africa have made personal (and<br />

family) decisions to leave their homes in search of greener pastures and<br />

opportunities to improve their lives and the lives of their children. Newer migrants<br />

tend to follow paths cut by those who came earlier. <strong>The</strong> migrants from <strong>China</strong><br />

mainland are affected by the rise of <strong>China</strong>; the liberalization of <strong>China</strong>‟s policies; the<br />

nature of bilateral relations between <strong>China</strong> and South Africa; the social, political and<br />

economic circumstances in South Africa; or the media portrayals of <strong>China</strong>, the<br />

environment in which <strong>Chinese</strong> migrants live and work.<br />

“<strong>The</strong> migrants from <strong>China</strong><br />

mainland are affected by the<br />

rise of <strong>China</strong>.”<br />

In some villages in Fujian province, over 80% of the people have migrated over the<br />

past three to four centuries; these areas are „characterized by a long-standing<br />

tradition of emigration that has gained self-sustaining momentum.‟ It has become a<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

10

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

rite of passage <strong>for</strong> the men (and increasingly women as well) of these villages to<br />

spend at least some time overseas. <strong>The</strong>y choose to immigrate and try their luck<br />

overseas. Young people from these areas are under social pressure to go out into<br />

the world and return successful. Migration, then, becomes a measure of one‟s<br />

courage, worth, and success; it has become culturally valued.<br />

`<br />

<strong>The</strong> growth of overseas <strong>Chinese</strong> enterprises in South Africa actually creates a<br />

demand <strong>for</strong> labour and thus encourages, via social and economic networks, further<br />

labour migration from <strong>China</strong>. <strong>The</strong> <strong>Chinese</strong> practice of hiring other <strong>Chinese</strong> nationals<br />

has to do with trust rather than pure ethnicity; in other words, workers are recruited<br />

amongst relatives or family friends who are known and trusted. <strong>The</strong>ir <strong>Chinese</strong><br />

nationality is not the key factor. It is said that in rural South Africa, almost 80% of the<br />

more recent <strong>Chinese</strong> migrants are from the Fuqing region of Fujian province. Many<br />

of the Fujianese businessmen rather encourage their children to do the business<br />

than asking them to go to college.<br />

Despite huge risks and challenges increasing numbers of <strong>Chinese</strong> migrant are<br />

choosing to cover long distances <strong>for</strong> various African destinations. Potential short and<br />

medium-term financial gains appear to outweigh very real dangers and difficulties.<br />

Areas of origin within <strong>China</strong>, types of migrant, migration patterns, and migration<br />

paths are increasingly diverse.<br />

Perceived challenges to <strong>Chinese</strong> migrants in South Africa<br />

Policeman and the security problem in South Africa are the most serious problem<br />

the <strong>Chinese</strong> business had to face. <strong>Chinese</strong> of the latest wave of migrants report bad<br />

relation with the local police. One of the reasons is that some of the <strong>Chinese</strong><br />

migrants are illegal entrants to South Africa; they have not identified nor do they<br />

have a work permit. Consequently, they became an object of extortion. Almost every<br />

<strong>Chinese</strong> businessman interviewed has experienced extortion from Johannesburg<br />

police. Over 90% <strong>Chinese</strong> migrants thought that police have a negative impact on<br />

their business, including those who have received their South African<br />

documentation.<br />

Chen Fenglan is a researcher<br />

from Fuzhou University, <strong>China</strong>.<br />

She recently participated in a<br />

joint research project between<br />

Stellenbosch University’s <strong>Centre</strong><br />

<strong>for</strong> Regional and Urban<br />

Innovation and Statistical<br />

Exploration (CRUISE), the CCS<br />

and Xiamen University, looking<br />

at <strong>Chinese</strong> migrant populations<br />

in Johannesburg<br />

Another big challenge to <strong>Chinese</strong> migrant is the feeling or experience of insecurity.<br />

Many of the interviewees mentioned <strong>Chinese</strong> experiences with robbery in South<br />

Africa. More than fifty <strong>Chinese</strong> migrants were killed during armed robberies between<br />

2007 and 2010. Some <strong>Chinese</strong> stated that “South Africa is a heaven except <strong>for</strong> the<br />

crime”. Numerous earlier <strong>Chinese</strong> migrants have left South Africa due to security<br />

concerns; some have returned to <strong>China</strong> while others have migrated further to<br />

Canada, Australia, and other developed Western countries. <strong>The</strong> more recent<br />

migrants, <strong>for</strong> their part, seem to increasingly adapt to local circumstances; some<br />

have learnt local languages and have begun to adopt local customs. <strong>The</strong>se adaptive<br />

strategies combined with hard work might help them overcome local barriers to<br />

economic and social success.<br />

End Notes<br />

1 This paper is drawn from field research undertaken by researchers from Fuzhou<br />

University and Stellenbosch University‟s <strong>Centre</strong> <strong>for</strong> Regional and Urban Innovation<br />

and Statistical Exploration (CRUISE), facilitated by the CCS, between December<br />

2010 and January 2011. <strong>The</strong> social survey covered <strong>Chinese</strong> populations in various<br />

parts of Johannesburg, namely: Cyrildene, Dragon City, <strong>China</strong> Mart, <strong>China</strong> City,<br />

Bruma Oriental City, Omendo City and African Trade City. Researchers completed<br />

502 questionnaires in total.<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

11

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

Briefing Round-Up<br />

A Round-Up of all the top stories drawn from our Weekly Briefings over the previous month<br />

<strong>China</strong> and Africa to deepen<br />

cooperation on intellectual<br />

property <strong>China</strong>'s State<br />

Administration <strong>for</strong> Industry and<br />

Commerce and the African<br />

Intellectual Property Organization<br />

(OAPI) recently signed a<br />

memorandum of cooperation and<br />

understanding in Cameroon's capital Yaounde to<br />

strengthen the bilateral cooperation in the field of<br />

intellectual property. Under the memorandum of<br />

cooperation and understanding, the two countries will<br />

establish a basic framework <strong>for</strong> bilateral cooperation and<br />

launch joint activities.<br />

Sudan secures US$360 million loan to build new<br />

dams and airport Cash-strapped Sudan secured a<br />

US$360 million loan recently to help finance a new<br />

airport in the capital and two dams in the east of the<br />

country that will boost power supplies and irrigate<br />

farmland. U.S. sanctions, dwindling <strong>for</strong>eign reserves and<br />

a crippling debt burden of around US$38 billion, have<br />

hampered Sudan's ability to secure external financing <strong>for</strong><br />

new projects.<br />

Trade between <strong>China</strong> and<br />

Portuguese-speaking countries<br />

totals US$14.96 billion Trade<br />

between <strong>China</strong> an d the eight<br />

Portuguese-speaking countries in<br />

the first two months of the year<br />

totalled US$14.96 billion, which<br />

was a year on year rise of 40%,<br />

according to figures from <strong>China</strong>‟s Customs Bureau<br />

published in Macau. In the period, <strong>China</strong> imported goods<br />

from the eight Portuguese-speaking countries worth<br />

US$10.17 billion (44% more) and exported goods worth<br />

US$4.78 billion (31.16%), generating a trade deficit of<br />

US$5.39 billion.<br />

WTO official: <strong>China</strong> imports threaten Brazilian<br />

industry as bilateral trade grows Brazil‟s growing<br />

reliance on imported <strong>Chinese</strong> manufactured goods is<br />

threatening producers in Latin America‟s biggest<br />

economy, said James Bacchus, a <strong>for</strong>mer U.S.<br />

congressman and World Trade Organization official.<br />

<strong>Chinese</strong> demand <strong>for</strong> Brazilian raw materials such as iron<br />

ore and soybeans enabled the Asian nation to overtake<br />

the U.S. as Brazil‟s biggest trading partner in 2009.<br />

<strong>China</strong> may double solar goal after Japan nuclear leak<br />

<strong>China</strong> may double its target <strong>for</strong> photovoltaic power<br />

capacity over the next five years in the wake of Japan's<br />

nuclear crisis, the official <strong>China</strong> Securities Journal<br />

reported on Wednesday. Citing unnamed sources, the<br />

newspaper said the government may be looking at a new<br />

target of having installed capacity of 10 gigawatts (GW)<br />

of photovoltaic power by 2015, up from its existing target<br />

of 5 GW.<br />

Zambian study: <strong>Chinese</strong> investments boost nation's<br />

economy <strong>Chinese</strong> Foreign Direct Investment (FDI) into<br />

Zambia has boosted the Zambian economy and helped<br />

create more employment <strong>for</strong> the people, argues a study<br />

by the University of Zambia (UNZA). <strong>The</strong> study by the<br />

School of Social Science and Research <strong>for</strong> 2007 says<br />

the investment <strong>China</strong> has brought into Zambia has done<br />

more good than harm as it has helped to develop the<br />

mining sector.<br />

<strong>Chinese</strong> bid <strong>for</strong> uranium<br />

shares in Namibia Finance is<br />

sought to unearth the large<br />

uranium funds discovered in<br />

Namibia, with partners said to<br />

be preferably Namibian.<br />

Nevertheless, shareholders<br />

are also engaging in<br />

negotiations over a bid by a <strong>Chinese</strong> company to buy up<br />

43% of Kalahari Minerals in Extract Resources. Kalahari<br />

Miner-als is the largest shareholder in the mine, and is<br />

favouring the cash offer from <strong>China</strong> Guangdong Nuclear<br />

Uranium Resources Company.<br />

Nigeria-<strong>China</strong> trade hits US$7.76 billion Trade<br />

between Nigeria and <strong>China</strong> has reached a historic new<br />

high of US$7.76 billion, the Chi-nese Ambassador to<br />

Nigeria, HE Deng Boqing stated. According to him<br />

Nigeria has become the fourth largest trade partner and<br />

the second largest export market of <strong>China</strong> in Africa. <strong>The</strong><br />

envoy spoke during a one day seminar on <strong>China</strong>-Nigeria<br />

Trade Promotion, in Lagos.<br />

Rise in fuel prices in <strong>China</strong><br />

after crude climbs to 30-<br />

month high <strong>China</strong> raised retail<br />

fuel prices <strong>for</strong> the second time<br />

this year after oil‟s advance to<br />

a 30-month high undermined<br />

the government‟s ef<strong>for</strong>ts to cap<br />

costs and cool inflation in the<br />

world‟s second-largest economy. Prices rose by as much<br />

as 5.8%, with gasoline increasing by US$ 76 a metric ton<br />

and diesel by US$ 61.13, the National Development and<br />

Re<strong>for</strong>m Commission said in a statement re-cently.<br />

Ecobank opens '<strong>China</strong> desk' to manage Africa loans<br />

Pan-African bank Ecobank Transnational Inc will open a<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

12

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

<strong>China</strong> desk next week aimed at easing the flow of<br />

<strong>Chinese</strong> loans <strong>for</strong> African infrastructure projects, a bank<br />

official said. <strong>The</strong> desk will be located in Accra and<br />

include two Ecobank employees and two senior staff<br />

from the Bank of <strong>China</strong>.<br />

BRICS issue Sanya<br />

Declaration <strong>The</strong> BRICS<br />

(Brazil, Russia, India, <strong>China</strong>,<br />

South Africa) released a<br />

declaration at the conclusion<br />

of their two day summit in<br />

Hainan, <strong>China</strong>, pledging<br />

coordination and support on a<br />

range of issues including financial re<strong>for</strong>m and an<br />

establishment of an international reserve currency<br />

system. <strong>The</strong> summit, chaired by <strong>Chinese</strong> President Hu<br />

Jintao was the third meeting of BRICS leaders and the<br />

first <strong>for</strong> South Africa since it joined the group in<br />

December 2010.<br />

Dangote, Sinoma in US$ 3.9 billion African cement<br />

deal Dangote Group and <strong>Chinese</strong> firm Sinoma have<br />

jointly entered into a US$ 3.9 billion contract set to be<br />

executed in six African nations. <strong>The</strong> contract was signed<br />

by the President of Dangote Group, Alhaji Aliko Dangote,<br />

and President of Sinoma, Mr. Wu Shoufu, and will see<br />

Dangote cement‟s output across Africa rise to about 50<br />

million metric tonnes per annum in two and a half years.<br />

Dangote said the move is in line with the company‟s<br />

overall objective of boosting cement production and<br />

supply within the African continent.<br />

<strong>Chinese</strong> manufacturers go<br />

local in battle <strong>for</strong> Kenya’s<br />

consumers In a market<br />

previously dominated by direct<br />

imports,<br />

<strong>Chinese</strong><br />

manufacturers in Kenya are<br />

bucking the trend and setting<br />

up local production plants in a<br />

renewed bid to dominate Kenya‟s consumer markets.<br />

<strong>The</strong> <strong>Chinese</strong> have established a strong presence in<br />

Kenya‟s telecoms infrastructure, automobile, battery,<br />

food and beverage markets in the last five years.<br />

<strong>Chinese</strong> firm elates Zambian mine suppliers<br />

Luanshya-based mine suppliers have praised the <strong>China</strong><br />

Non-Ferrous Metal Corporation‟s Luanshya Copper<br />

Mine (CLM) <strong>for</strong> coming up with a policy to give 75% of<br />

the contracts involving locally sourced goods to local<br />

companies. CLM public relations officer Sydney Chileya<br />

confirmed that Luanshya-based mine suppliers were<br />

already enjoying the benefits of the policy.<br />

other BRICS nations will continue to grow because of<br />

rising <strong>Chinese</strong> domestic demand, but warned that trade<br />

among the bloc faces uncertainty also. <strong>China</strong>'s imports<br />

from South Africa surged by 172% year-on-year in the<br />

first quarter of 2011, while exports grew 24.1%.<br />

Huawei reports sharp rise in profit<br />

and reveals new details Huawei<br />

Technologies, <strong>China</strong>‟s top<br />

telecommunications equipment<br />

maker, reported an impressive<br />

increase in profits in its annual report<br />

which released new details about<br />

the privately held company. Huawei, which competes<br />

with Ericsson, Nokia Siemens Networks and <strong>Chinese</strong><br />

rival ZTE Corporation, reported a 30% rise in last year‟s<br />

net profit. Huawei is South African company Telkom‟s<br />

only strategic partner <strong>for</strong> its 21NC integrated access<br />

network, providing an access plat<strong>for</strong>m integrating voice,<br />

internet protocol and video.<br />

<strong>Chinese</strong> Yuan set to be international currency, say<br />

analysts <strong>China</strong> is set to designate one bank in<br />

Singapore to take on the role of clearing Yuan trades as<br />

it gradually moves to internationalise its currency. It is<br />

believed that either the Bank of <strong>China</strong> or the Industrial<br />

and Commercial Bank of <strong>China</strong> will be the clearing bank,<br />

according to analysts. Some analysts see this as a move<br />

by <strong>China</strong> to reduce its reliance on the greenback as a<br />

reserve currency.<br />

Sourced from: Iol, All Africa.com; BBC, Bloomberg; Engineering News;<br />

<strong>China</strong> Daily; Google; Wall Street Journal, Lusaka Times, Zambia Post;<br />

Timeslive; CRI.net; Reuters; Business Week; FT.com; Afrik.com;<br />

Xinhuanet<br />

For more of the <strong>China</strong><br />

Briefings we have<br />

collected in the last<br />

month, please see our<br />

Weekly Briefings,<br />

which can be<br />

accessed via our<br />

website:<br />

www.sun.ac.za/ccs<br />

<strong>China</strong>'s imports from emerging markets surge<br />

<strong>China</strong>'s imports from emerging countries, especially<br />

South Africa and Brazil, grew dramatically in the first<br />

quarter of the year. Analysts predict <strong>China</strong>'s trade with<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

13

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

April 2011<br />

<strong>The</strong> <strong>China</strong> Forum - Recent Events<br />

African scholars on <strong>China</strong> meet in Nairobi, Kenya - 28-29 March 2011<br />

Nairobi, Kenya Photo:<br />

Africafreak.com<br />

CCS Director Sven Grimm participated in a conference organised by African<br />

Research Institutions and Think Tanks (including the CSS) with the title “Toward a<br />

New Africa-<strong>China</strong> Partnership”. <strong>The</strong> meeting comprised over 50 researchers and<br />

intellectuals from across Africa, including representative from five South African<br />

institutions from research and civil society. In order to strengthen research on<br />

<strong>China</strong>-Africa cooperation, the participants decided on the creation of an African<br />

Forum <strong>for</strong> Study and Research on <strong>China</strong> and Africa-<strong>China</strong> Relations; CCS Director<br />

Sven Grimm is member of the Steering Committee. <strong>The</strong> communiqué of the<br />

conference can be found on the CODESRIA website<br />

(http://www.codesria.org/spip.php?article1283).<br />

Association <strong>for</strong> Asian <strong>Studies</strong> (AAS) and the International Convention of Asia<br />

Scholars (ICAS) in Honolulu, Hawaii – 31 March to 3 April 2011<br />

CCS Research Analyst Sanne van der Lugt attended a conference organized<br />

jointly by the AAS and ICAS in order to celebrate the 70th anniversary of the AAS.<br />

<strong>The</strong> conference was the largest ever gathering of Asian studies scholars and<br />

students with over 760 panels, roundtables, and workshops addressing a wide<br />

range of topics and issues, as well as exhibits, a video program, music and theatre<br />

per<strong>for</strong>mances. Sanne presented a paper on: “Triple-S development cooperation:<br />

creating a win-win-win situation <strong>for</strong> emerging and developing countries?”<br />

<strong>China</strong>-Africa Migration panel discussion at Wits University - 7 April 2011<br />

On April 7 CCS Research Assistant Elizabeth Schickerling attended a panel<br />

discussion in Johannesburg regarding <strong>China</strong>-Africa Migration: Contemporary<br />

movement and socio economic change. <strong>The</strong> event was hosted by the African<br />

<strong>Centre</strong> <strong>for</strong> Migration and Society of University of the Witwatersrand and Open<br />

Society Initiative. <strong>The</strong> three panellists were journalist and author Howard French,<br />

founder and editor of "<strong>The</strong> Zimbabwean" Wilf Mbanga and author Sanusha Naidu.<br />

CCS launches new Policy Briefing publication – 20 April 2011<br />

<strong>The</strong> CCS is proud to present the first edition of a new publication: Policy Briefing.<br />

<strong>The</strong>se papers are condensed reports drawn from existing CCS research studies<br />

and reports which are designed to highlight the essential findings and<br />

recommendations in the parent material. Policy-makers and decision-makers will<br />

find the Policy Briefing effective, useful and insightful guides to the conclusions and<br />

recommendations of our larger and more extensive reports.<br />

<strong>The</strong> premier CCS Policy Briefing „<strong>The</strong> Management of <strong>Chinese</strong> Foreign Direct<br />

Investment‟ draws from the recently published CCS Report, Assessing <strong>China</strong>’s<br />

Role in Foreign Direct Investment in Southern Africa. Both the final report and the<br />

Policy Briefing can be downloaded from the CCS website [here].<br />

© <strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong>, Stellenbosch University; All Rights Reserved<br />

14

<strong>The</strong> <strong>China</strong> <strong>Monitor</strong><br />

Editorial Team<br />

Matthew April 2011 McDonald<br />

Meryl Burgess<br />

Design & Layout<br />

<strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong><br />

<strong>Studies</strong><br />

Contact Us<br />

<strong>Centre</strong> <strong>for</strong> <strong>Chinese</strong> <strong>Studies</strong><br />

Stellenbosch University<br />

T: +27 21 808 2840<br />

F: +27 21 808 2841<br />

E: ccsinfo@sun.ac.za<br />

W: www.sun.ac.za/ccs<br />

15