Summer - InsideOutdoor Magazine

Summer - InsideOutdoor Magazine

Summer - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

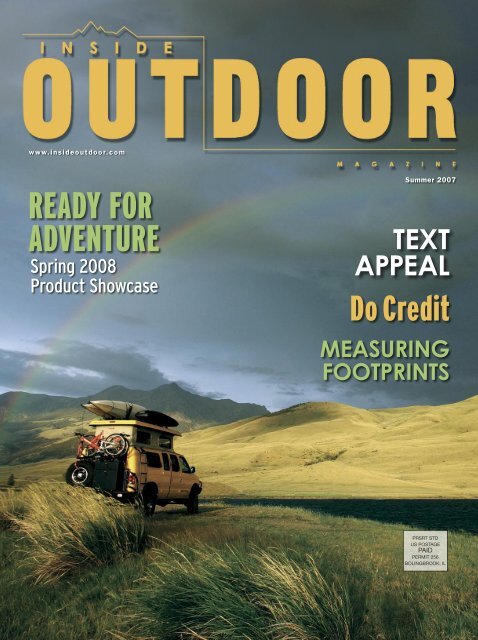

www.insideoutdoor.com<br />

<strong>Summer</strong> 2007<br />

READY FOR<br />

ADVENTURE<br />

Spring 2008<br />

Product Showcase<br />

TEXT<br />

APPEAL<br />

Do Credit<br />

MEASURING<br />

FOOTPRINTS<br />

PRSRT STD<br />

US POSTAGE<br />

PAID<br />

PERMIT 256<br />

BOLINGBROOK, IL

Clearly Accurate<br />

Clear Viewpoint<br />

The new Habicht PVI-2 HIGH GRID gives hunters the opportunity for an amazing hunting<br />

experience. A selection of three innovative reticles in the second image plane, so when the<br />

magnification is changed only the target is magnified and not the reticle. The new PVI-2<br />

HIGH GRID riflescopes are all equipped with the new BE4 Digital Illumination unit, for<br />

maximum brightness during the day and finely tuned light intensity at twilight.<br />

Swarovski Optik North America, 2 Slater Road, Cranston, Rhode Island, 02920, Phone: 401 734 1800, email: info@swarovskioptik.us<br />

www.swarovskioptik.com

During the “Golden Age” of<br />

North American mountaineering,<br />

when the classic rock walls and<br />

technical routes were being<br />

pioneered, Ed Cooper was one<br />

of the climbers in the forefront.<br />

His daring climbing accomplishments<br />

in Canada, the North Cascades, and<br />

Yosemite have become legendary. And<br />

he continued to pursue the great peaks<br />

of North America for many years, with<br />

camera in hand, producing awe-inspiring<br />

mountain photographs which are in<br />

league with the works of Ansel Adams<br />

and Bradford Washburn.<br />

Check out the<br />

premier outdoor<br />

online community<br />

at FALCON.COM<br />

To order call 800-243-0495 or visit falcon.com.<br />

VISIT US AT BOOTH #33035 AT OUTDOOR RETAILER<br />

SUMMER MARKET TO WIN YOUR FREE COPY AND<br />

FOR A FREE SIGNED POSTER

C O N T E N T S<br />

<strong>Summer</strong> 2007<br />

34 MINORITY REPORT<br />

The Hispanic community is 44 million strong<br />

and about to reach $1 trillion in spending power.<br />

But for all its intrigue as a market segment, this<br />

complex and diverse population group continues<br />

to confound and elude mainstream marketers,<br />

including the outdoor industry.<br />

By Tony Jones<br />

DEPARTMENTS<br />

GAS<br />

12 NEWS & BRIEFS<br />

Outdoor sales, JanSport mourns, Searchandising<br />

20 DATA POINTS<br />

Wishy-washy consumers, Cali flexes<br />

22<br />

GEAR<br />

38 SPRING/SUMMER 2008 PRODUCT SHOWCASE<br />

<strong>Summer</strong> sizzles with green shields, helmet cams,<br />

modular packs and shades you can tie in a knot<br />

FEATURES<br />

34<br />

22 WORD UP<br />

Moosejaw Mountaineering did a text blast and yielded a 66<br />

percent response rate. By those numbers, it would be risky to<br />

write off text messaging as simply a nascent technology. It’s<br />

time to start considering how mobile messaging fits into your<br />

marketing strategy.<br />

By Martin Vilaboy<br />

28 GIVING CREDIT<br />

Small specialty retailers need every advantage in carving<br />

points of differentiation from their competitors. GE Money<br />

has made it possible for small stores to extend lines of<br />

credit to their customers and step into the world of<br />

promotional financing.<br />

By Tony Jones<br />

BACK OFFICE<br />

70 LIFE CYCLE ASSESSMENT MEETS WEB 2.0<br />

Earthster is making it possible for organizations<br />

to measure their sustainable processes as well<br />

as estimate the potential life cycle benefits of<br />

changes in product design, manufacturing and<br />

suppliers. For free.<br />

By Greg Norris<br />

72 SUPREME DECISION<br />

The Supreme Court has ruled that minimum price<br />

sale agreements are allowable as long as they<br />

stimulate competition. The decision is likely to<br />

ignite an explosion of litigation.<br />

By Philip Josephson<br />

GORP<br />

74 OUTDOOR 3.0<br />

A better examination of consumers might just<br />

reveal the industry’s killer app<br />

By Stuart Craig<br />

6 Letter from the Editor<br />

8 Retailers Report<br />

77 Ad and Edit Indexes<br />

4 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

Editor’s Letter<br />

Inside the Big Box<br />

THE HALLMARK OF SUCCESS for many retailers is when a store becomes a<br />

bonafide destination. When consumers seek out a location not only for its mix of<br />

products, service, knowledge and promotions but specifically for the in-store experience,<br />

that is tantamount to star power.<br />

The outdoor world has a few destination retailers. On a grand scale, Bass Pro<br />

Shops open to much fanfare and news coverage when they enter a market for the<br />

first time, as does Cabela’s. Locals line up for hours and brave thick crowds just to<br />

get a glimpse inside these cavernous outlets. The average visit to some Bass Pro<br />

Shops is reportedly as much as three hours.<br />

For some, it’s like visiting the Monterey Bay Aquarium, apparently.<br />

Similarly, REI’s 55-foot climbing wall outside its Bloomington, Minn., store certainly<br />

has been a curiosity and side trip for many of the thousands who have made the pilgrimage<br />

to Mall of America (itself, perhaps, the destination of all retail destinations).<br />

But one retailer is taking the idea of destination to a whole new level. Swedish<br />

home furnishings icon Ikea not only wants its customers to come to its stores to<br />

shop and wind through the labyrinth lined with space-saving concoctions and funky<br />

furniture, it wants some select customers to spend the night.<br />

In what was dubbed the “Ikea Hostel,” customers entered a contest in which they<br />

had to explain why they wanted to sleep at Ikea. From July 23-27, one of Ikea’s Oslo,<br />

Norway, warehouses became a kind of fantasy camp for 150 Ikea diehards.<br />

While some patrons slept in a dormitory setting, with beds stacked up together,<br />

others were privy to a bridal suite (complete with round bed and chandelier) and a<br />

luxury suite that included breakfast in bed, according to news reports. In addition,<br />

family rooms were also set up for parents and their children.<br />

There was no cost for customers to participate, and each night, the 30 patrons<br />

selected for the sleepover that day were treated to a free dinner of Ikea fare. A free<br />

breakfast followed in the morning, and the overnighters walked out of the store with<br />

their bed sheets as a souvenir, along with bathrobes adorned with an Ikea Hostel<br />

logo and slippers.<br />

I can’t decide if this promotion was sheer lunacy or genius or both. The only thing<br />

seemingly missing was a screening of Mannequin and a personal appearance by<br />

Andrew McCarthy.<br />

I shudder to think what the risks and liabilities might be to have 150 people spend<br />

the night inside your store.<br />

Regardless, you have to give Ikea props for creativity. What more captive audience<br />

can you have?<br />

If you think about it, the stunt wasn’t that far removed from a glorified demo day,<br />

guided outing or even the ancillary intent of some retailers that took part in the Great<br />

American Backyard Campout.<br />

Happy customers tend to be repeat customers, and if you provide them with<br />

rewarding retail experiences, they will likely recommend you to friends. If you go the<br />

extra mile and provide a once-in-a-lifetime retail experience, you’ll likely wind up with<br />

extensive free marketing and branding through local media.<br />

If nothing else, the Ikea Hostel promotion is a good reminder to think unconventionally<br />

but strategically in how you can best serve your customers and your business.<br />

Sometimes the journey is every bit as rewarding as the final destination.<br />

– TJ<br />

Tony C. Jones<br />

Editor-in-Chief<br />

tony@bekapublishing.com<br />

Percy Zamora<br />

Art Director<br />

outdoor@bekapublishing.com<br />

Ernest Shiwanov<br />

Editor at Large<br />

ernest@bekapublishing.com<br />

Editorial Contributors:<br />

R.J. Anderson, Stuart Craig,<br />

Philip Josephson,<br />

Martin Vilaboy<br />

Berge Kaprelian<br />

Group Publisher<br />

berge@bekapublishing.com<br />

Jennifer Vilaboy<br />

Production Director<br />

jen@bekapublishing.com<br />

Suzanne Urash<br />

Ad Creative Designer<br />

suzanne@cre8groupinc.com<br />

Beka Publishing<br />

Berge Kaprelian<br />

President and CEO<br />

Philip Josephson<br />

General Counsel<br />

Jim Bankes<br />

Business Accounting<br />

Corporate Headquarters<br />

745 N. Gilbert Road<br />

Suite 124, PMB 303<br />

Gilbert, AZ 85234<br />

Voice: 480.503.0770<br />

Fax: 480.503.0990<br />

Email: berge@bekapublishing.com<br />

© 2007 Beka Publishing, All rights reserved.<br />

Reproduction in whole or in any form or<br />

medium without express written permission<br />

of Beka Publishing, is prohibited. Inside<br />

Outdoor and the Inside Outdoor logo are<br />

trademarks of Beka Publishing<br />

Member<br />

6 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

Retailers Report<br />

Text Talk<br />

Compiled by R.J. Anderson<br />

This month we ask: How often do you use e-mail or text messaging as direct marketing tools to your customers?<br />

What kind of response do you get using these methods compared to direct marketing mailers and other traditional<br />

modes of marketing?<br />

NORTHEAST<br />

John Durrua, owner of The Jersey<br />

Paddler, says his shop does mass e-mailings<br />

about once a month, but has not done<br />

any text messaging. “The e-mail is a lot less<br />

expensive, but it’s a little harder to measure,”<br />

says Durrua. “I think attaching coupons is the only<br />

way you can really quantify how effective it is.”<br />

Durrua doesn’t yet include coupons with his<br />

e-mails, but he anticipates doing so as his shop gets<br />

more comfortable with the technology. “All of that kind of marketing<br />

is done in-house,” he says. “As I hire more technologysavvy<br />

people to work here, we’ll do more with it.”<br />

Citing time, effort and customer desire not to be inundated<br />

with excess messages, Al Saracene, owner of Nordic Sports<br />

in Cortland, N.Y., says he doesn’t use text messaging or e-mail<br />

for direct marketing.<br />

“I put my own numbers on a no-call list because I don’t want<br />

to be called or texted and then get charged extra on my cell<br />

phone bill for it,” says Saracene. “I think my customers feel the<br />

same way. I just don’t think specialty outdoor customers are<br />

the right target for that kind of marketing.<br />

“Our best message platform is direct mail because it’s easier<br />

to track,” he adds.<br />

Bill Cury, one of the owners of Cury’s Sport Shop, a 76-<br />

year-old specialty retail store that has been in his family for three<br />

generations, sends his customers an e-newsletter whenever the<br />

store hosts a major sale — typically every one or two months.<br />

“It’s still new to us because we’ve been doing it for less than<br />

a year, and it’s only a small part of our marketing efforts,” says<br />

Cury. “We also do coupons on our Web site, which people print<br />

out and bring in. Those have been effective for us. Our e-mail<br />

directs them to the site where they find the coupons.”<br />

SOUTHEAST<br />

In the coming months Black Creek Outfitters,<br />

a specialty retailer in Jacksonville, Fla., says it will<br />

add e-mail to its direct marketing mix. Marketing<br />

Manager Michelle Vieira says the store is taking<br />

its time to implement the technology in an effort to<br />

make sure they do it right the first time around.<br />

“It seems like a really good tool for advertising sales to a specific<br />

client list that you know is already interested in the store<br />

and that is going to be attracted to specific sales or specials,”<br />

says Vieira, adding that the store sends out a direct mailer with<br />

coupons twice a year to promote spring and fall sales events.<br />

“We send out e-mails pretty frequently, a couple times a month<br />

at least,” says Kelley Darnell at River Sports Outfitters in Knoxville,<br />

Tenn. “We’ve had an e-mail list for quite some time. It’s an<br />

inexpensive, fairly quick way to reach a large group of people.”<br />

Barbara Burch, owner of Quest Outdoors, a two-store operation<br />

in Louisville, Ky., says she has a relatively small list<br />

of names for her store’s e-newsletter, but that she regularly<br />

e-mails those folks to announce sales and in-store speakers<br />

or presentations.<br />

“We haven’t been real successful increasing the names on<br />

our e-mail list, and it’s not a huge priority,” says Burch, who also<br />

has a large direct mail list that she distributes to several times<br />

a year. “It’s kind of tough because our POS system is 12 years<br />

old and collects phone numbers, not e-mail addresses, when<br />

ringing up customers.”<br />

SOUTHWEST<br />

Liz Aldrich, a senior staffer at the<br />

Arizona Hiking Shack in Phoenix,<br />

says it’s difficult as a small retailer<br />

with a diverse product mix to find the time and<br />

resources to facilitate technology-based direct<br />

marketing efforts. However, it is part of the store’s<br />

long-term goals.<br />

“We just installed a new computer system and POS that<br />

allows us to collect e-mails and phone numbers,” says Aldrich.<br />

“We’d like to get an e-mail list together soon so we can announce<br />

our seasonal sales.”<br />

“We don’t really use those kinds of tools yet,” says John<br />

Fairchild, a department manager at Reno Mountain Sports in<br />

Reno, Nev., adding that direct mailers are his store’s primary<br />

marketing tool. “Our current infrastructure isn’t really set up to<br />

allow for those technology-based marketing tools right now,<br />

though we do plan on doing some stuff with it down the road.<br />

We are building an e-mail database, but we just haven’t used<br />

it yet.”<br />

At Sporting Rage in Carson, Nev., Dave Goodwin, one<br />

of three former employees who bought the store two and a<br />

half years ago, says he does not use technology-based direct<br />

marketing tools.<br />

“In fact, we don’t really do any marketing,” says Goodwin.<br />

“Advertising is very expensive and we don’t get any return on it.<br />

The shop has been here for 19 years and word of mouth is our<br />

best advertising — it’s accurate and free. We’ve tried everything<br />

over the years and found them to be a big waste of money. We<br />

advertise in the Yellow Pages and that’s it.”<br />

8 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

PLAN NOW<br />

TO ATTEND<br />

THE LARGEST<br />

TECHNICAL<br />

TEXTILES<br />

TRADE SHOW<br />

IN THE<br />

AMERICAS.<br />

3–5 October 2007 | Las Vegas, USA<br />

IFAI Expo 2007 will host more than 8,000 visitors from<br />

60 countries.<br />

If you supply fabric, hardware, equipment or services<br />

to the technical textiles industry, IFAI Expo 2007 is an<br />

unparalleled business opportunity for your company.<br />

To exhibit or attend visit our Web site:<br />

www.ifaiexpo.com

Retailers Report<br />

ROCKY MOUNTAINS<br />

Bob Groesbeck, a long-time staffer at<br />

Backcountry Escape in Longmont, Colo.,<br />

says his store has an e-mail list and that he<br />

has investigated text messaging for direct<br />

marketing. “I’ve looked into doing text messaging<br />

but that technology seems intrusive.<br />

With our customer demographic, I think it<br />

would miss the point,” says Groesbeck. “We’ve done some e-<br />

mail stuff in the past with mixed results. Aside from notifying<br />

customers of sales and clinics, we haven’t found any groundbreaking<br />

uses for it.”<br />

Groesbeck says one of the technology’s drawbacks is that<br />

it’s tough to quantify responses. “A lot of people come in and<br />

say, ‘Yeah I got your e-mail,’ but those are usually our frequent<br />

customers who are in the shop all the time and would have<br />

known about the event anyway,” he says.<br />

Instead, the store prefers participating in community coupon<br />

books, which Groesbeck says has provided as good a response<br />

as direct mailers, for less cost. “Plus, it’s a more flooded technique,<br />

where we’re drawing in a broader audience who a lot of<br />

times have never heard of us.”<br />

Bob Pult, who co-owns Boulder Mountaineering with his<br />

son, says his young store hasn’t yet explored technology-based<br />

direct marketing tactics. Based on the responses he’s had with<br />

other marketing tools, he’s in no hurry to give mass texting and<br />

e-mailing a try.<br />

“In the past, when we’ve done other forms of marketing and<br />

advertising we’ve gotten no response,” says Pult.<br />

NORTHWEST<br />

Base Gear LLC, a five-year-old retail operation<br />

in Portland, Ore., just started using<br />

e-mail in June for direct marketing. Owner<br />

Won Chang says the store started<br />

by distributing an e-mail to about<br />

50 customers.<br />

“We don’t do any other marketing like<br />

mailers or print ads so this was our first attempt at marketing,”<br />

says Chang. “It’s attractive because it’s easy and inexpensive<br />

and reaches our target audience who has visited our Web site<br />

and been in our store.”<br />

Norway Pinnick, who recently bought Mountain Supply, an<br />

outdoor specialty retailer in Bend, Ore., says he has no plans<br />

to use technology-based direct marketing. “It goes against the<br />

culture of our business because we don’t want to clutter everybody<br />

with marketing gimmicks and junk mail,” says Pinnick.<br />

“We have a Web site, do some radio and TV advertising and rely<br />

heavily on word of mouth. We’re a core local shop and people<br />

know us here.”<br />

SKUs in the View<br />

A forecast of top sellers for Q307, as seen by the folks at Liberty Mountain<br />

Northeast<br />

1. CampSuds<br />

2. Hennesy Expedition Asym hammocks<br />

3. GSI Lexan 33-ounce Java Press<br />

4. The Bowls by Guyot Designs<br />

5. Leatherman Juice S2 multitools<br />

6. Garmin eTrex Vista CX GPS units<br />

7. Pieps Free Rider<br />

8. Nalgene Wide Mouth 1-quart colored bottles<br />

9. Black Diamond Gizmo headlamps<br />

10. Nite Ize Illuminated Flying Discs<br />

Northwest<br />

1. The Bowls by Guyot Designs<br />

2. Nalgene Tumblers<br />

3. 40-ounce Klean Kanteens<br />

4. Garmin Nuvi systems<br />

5. Edelweiss Ally rope<br />

6. Vaude Accept 55+10 II backpacks<br />

7. Black Diamond Gizmo headlamps<br />

8. Trangia Spirit burners<br />

9. Leatherman Juice S2 multitools<br />

10. Vaude Cimone backpacks<br />

Rocky Mountains<br />

1. Travel Hammock single hammocks<br />

2. All Terrain Herbal Armor Lotion/SPF<br />

3. Faders SUM belay devices<br />

4. Nalgene Tumblers<br />

5. Cat Strap Earth Tones sunglass retention<br />

6. Trangia Spirit burners<br />

7. Markill Devil stoves<br />

8. AMK Weekender first-aid kits<br />

9. Vaude Cimone backpacks<br />

10. Outdoor Designs Torlo gaiters<br />

Southwest<br />

1. Edelweiss Ally rope<br />

2. Edelrid Eddy belay devices<br />

3. Vaude Aracanda 30 backpacks<br />

4. The Bowls by Guyot Designs<br />

5. Princeton Tec Switchback headlights<br />

6. Garmin Edge 305 bike GPS units<br />

7. Vaude Accept 55+10 II backpacks<br />

8. Personal Mosquito Repeller<br />

9. Terramar men’s gray boxer briefs<br />

10. Omega Pacific link cams<br />

Southeast<br />

1. Travel Hammock single hammocks<br />

2. Black Diamond Gizmo Chili Pepper<br />

headlamps<br />

3. Katadyn Micropur tablets (30 pack)<br />

4. Katadyn Hiker Pro water filters<br />

5. Guyot Designs lime bowl sets<br />

6. AMK light and fast adventurers first-aid kits<br />

7. Nalgene Sprint reservoirs<br />

8. Edelrid Eddy belay devices<br />

9. 40-ounce Klean Kanteens<br />

10. Omega Pacific link cams<br />

Midwest<br />

1. Travel Hammock single hammocks<br />

2. Guyot Designs Firefly lanterns<br />

3. Garmin Nuvi systems<br />

4. Elete Tablytes<br />

5. Vaude Aracanda 30 backpacks<br />

6. The Bowls by Guyot Designs<br />

7. All Terrain Herbal Armor<br />

8. Faders SUM belay devices<br />

9. Omega Pacific link cams<br />

10. Edelweiss Ally rope<br />

Source: Liberty Mountain. Projections are based on a synthesis of top-selling SKU data, by account and state reports, for the<br />

same period in 2006, similar data from the previous quarter for non-seasonal items and an analysis of new items available for<br />

Q3 that have quickly established momentum. For more information, write to sales@libertymountain.com.<br />

10 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

Retailers Report<br />

ROCKY MOUNTAINS<br />

Bob Groesbeck, a long-time staffer at<br />

Backcountry Escape in Longmont, Colo.,<br />

says his store has an e-mail list and that he<br />

has investigated text messaging for direct<br />

marketing. “I’ve looked into doing text messaging<br />

but that technology seems intrusive.<br />

With our customer demographic, I think it<br />

would miss the point,” says Groesbeck. “We’ve done some e-<br />

mail stuff in the past with mixed results. Aside from notifying<br />

customers of sales and clinics, we haven’t found any groundbreaking<br />

uses for it.”<br />

Groesbeck says one of the technology’s drawbacks is that<br />

it’s tough to quantify responses. “A lot of people come in and<br />

say, ‘Yeah I got your e-mail,’ but those are usually our frequent<br />

customers who are in the shop all the time and would have<br />

known about the event anyway,” he says.<br />

Instead, the store prefers participating in community coupon<br />

books, which Groesbeck says has provided as good a response<br />

as direct mailers, for less cost. “Plus, it’s a more flooded technique,<br />

where we’re drawing in a broader audience who a lot of<br />

times have never heard of us.”<br />

Bob Pult, who co-owns Boulder Mountaineering with his<br />

son, says his young store hasn’t yet explored technology-based<br />

direct marketing tactics. Based on the responses he’s had with<br />

other marketing tools, he’s in no hurry to give mass texting and<br />

e-mailing a try.<br />

“In the past, when we’ve done other forms of marketing and<br />

advertising we’ve gotten no response,” says Pult.<br />

NORTHWEST<br />

Base Gear LLC, a five-year-old retail operation<br />

in Portland, Ore., just started using<br />

e-mail in June for direct marketing. Owner<br />

Won Chang says the store started<br />

by distributing an e-mail to about<br />

50 customers.<br />

“We don’t do any other marketing like<br />

mailers or print ads so this was our first attempt at marketing,”<br />

says Chang. “It’s attractive because it’s easy and inexpensive<br />

and reaches our target audience who has visited our Web site<br />

and been in our store.”<br />

Norway Pinnick, who recently bought Mountain Supply, an<br />

outdoor specialty retailer in Bend, Ore., says he has no plans<br />

to use technology-based direct marketing. “It goes against the<br />

culture of our business because we don’t want to clutter everybody<br />

with marketing gimmicks and junk mail,” says Pinnick.<br />

“We have a Web site, do some radio and TV advertising and rely<br />

heavily on word of mouth. We’re a core local shop and people<br />

know us here.”<br />

SKUs in the View<br />

A forecast of top sellers for Q307, as seen by the folks at Liberty Mountain<br />

Northeast<br />

1. CampSuds<br />

2. Hennesy Expedition Asym hammocks<br />

3. GSI Lexan 33-ounce Java Press<br />

4. The Bowls by Guyot Designs<br />

5. Leatherman Juice S2 multitools<br />

6. Garmin eTrex Vista CX GPS units<br />

7. Pieps Free Rider<br />

8. Nalgene Wide Mouth 1-quart colored bottles<br />

9. Black Diamond Gizmo headlamps<br />

10. Nite Ize Illuminated Flying Discs<br />

Northwest<br />

1. The Bowls by Guyot Designs<br />

2. Nalgene Tumblers<br />

3. 40-ounce Klean Kanteens<br />

4. Garmin Nuvi systems<br />

5. Edelweiss Ally rope<br />

6. Vaude Accept 55+10 II backpacks<br />

7. Black Diamond Gizmo headlamps<br />

8. Trangia Spirit burners<br />

9. Leatherman Juice S2 multitools<br />

10. Vaude Cimone backpacks<br />

Rocky Mountains<br />

1. Travel Hammock single hammocks<br />

2. All Terrain Herbal Armor Lotion/SPF<br />

3. Faders SUM belay devices<br />

4. Nalgene Tumblers<br />

5. Cat Strap Earth Tones sunglass retention<br />

6. Trangia Spirit burners<br />

7. Markill Devil stoves<br />

8. AMK Weekender first-aid kits<br />

9. Vaude Cimone backpacks<br />

10. Outdoor Designs Torlo gaiters<br />

Southwest<br />

1. Edelweiss Ally rope<br />

2. Edelrid Eddy belay devices<br />

3. Vaude Aracanda 30 backpacks<br />

4. The Bowls by Guyot Designs<br />

5. Princeton Tec Switchback headlights<br />

6. Garmin Edge 305 bike GPS units<br />

7. Vaude Accept 55+10 II backpacks<br />

8. Personal Mosquito Repeller<br />

9. Terramar men’s gray boxer briefs<br />

10. Omega Pacific link cams<br />

Southeast<br />

1. Travel Hammock single hammocks<br />

2. Black Diamond Gizmo Chili Pepper<br />

headlamps<br />

3. Katadyn Micropur tablets (30 pack)<br />

4. Katadyn Hiker Pro water filters<br />

5. Guyot Designs lime bowl sets<br />

6. AMK light and fast adventurers first-aid kits<br />

7. Nalgene Sprint reservoirs<br />

8. Edelrid Eddy belay devices<br />

9. 40-ounce Klean Kanteens<br />

10. Omega Pacific link cams<br />

Midwest<br />

1. Travel Hammock single hammocks<br />

2. Guyot Designs Firefly lanterns<br />

3. Garmin Nuvi systems<br />

4. Elete Tablytes<br />

5. Vaude Aracanda 30 backpacks<br />

6. The Bowls by Guyot Designs<br />

7. All Terrain Herbal Armor<br />

8. Faders SUM belay devices<br />

9. Omega Pacific link cams<br />

10. Edelweiss Ally rope<br />

Source: Liberty Mountain. Projections are based on a synthesis of top-selling SKU data, by account and state reports, for the<br />

same period in 2006, similar data from the previous quarter for non-seasonal items and an analysis of new items available for<br />

Q3 that have quickly established momentum. For more information, write to sales@libertymountain.com.<br />

10 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

Gas<br />

Outdoor Specialty Retail Business Tops $7.5 Billion<br />

Retail sales for outdoor specialty stores hit $7.62 billion in<br />

2006, according to the U.S. Outdoor Market Retailer Distribution<br />

Study released by the Outdoor Industry Association and<br />

Leisure Trends Group. Retailer response indicated that sales<br />

were up 11.3 percent last year compared to 2005, and the optimism<br />

has carried into this year, with retailers forecasting 11.9<br />

percent growth for 2007.<br />

Outdoor specialty stores were credited with generating<br />

34.3 percent of total sales, amassing more than $2.6 billion<br />

at the register. National outdoor and sporting goods chains<br />

reached $2.1 billion in sales.<br />

Geographically, retailers in the West and South experienced<br />

strong growth last year, increasing sales 16.8 percent and 14<br />

percent respectively. The two regions also contributed the<br />

most to overall sales figures, with retailers in the West contributing<br />

39.2 percent of total sales and stores in the South<br />

contributing 24.4 percent.<br />

Interestingly, sales from retailers out West increased 7.7<br />

percent from 2000 sales figures, while the Northeast showed<br />

only a modest gain in overall contribution (2.5 percent). Overall<br />

percentage contributions from retailers in the Midwest and<br />

South declined 14.8 percent and 2.8 percent, respectively, between<br />

2000 and 2006.<br />

The bump out West and slide in the Midwest is likely attributable<br />

to store openings and closings. The number of outdoor<br />

and paddlesports specialty stores increased 15 percent across<br />

the nation between 2000 and 2006, with the majority of the<br />

increase attributed to the western states.<br />

In fact, the West contains 35.7 percent of outdoor specialty<br />

storefronts, according to the report. That’s a 17 percent<br />

increase over the six-year period. The overall percentage of<br />

storefronts declined in each of the other regions, with the biggest<br />

downturn occurring in the Midwest (18.6 percent of total<br />

storefronts), falling 19.5 percent.<br />

Year-over-year sales figures for Midwest outdoor specialty<br />

retailers weren’t that dire, however, increasing 4.4 percent<br />

year-over-year in 2006.<br />

In all, outdoor specialty channel stores represent 62 percent<br />

of total storefronts in the industry, with chains representing<br />

48 percent.<br />

Broken down by product category, apparel garnered $3.49<br />

billion in sales, 46 percent of total sales for the industry. Equipment<br />

tallied $2.76 billion, including paddlesports ($2.36 billion<br />

without), representing 36 percent of overall sales. Footwear<br />

sales reached $1.36 billion.<br />

Internet sales continue to increase but perhaps at the peril<br />

of some catalog business. Some 8.8 percent of sales are<br />

generated online compared to 5.2 percent in 2000, but the<br />

Internet/Catalog category generated the same percentage of<br />

overall sales (10 percent) last year as it did in 2000, suggesting<br />

a wash with catalog declines (1.4 percent of total sales).<br />

By itself, Internet sales have increased nearly 150 percent since<br />

2000, totaling $670 million in 2006. That’s a 16.5 percent average<br />

annualized growth rate. Keep in mind, that that figure would be<br />

much larger if all Internet sales of outdoor product were included.<br />

The OIA/Leisure Trends study notes that Internet/Catalog<br />

sales in the report do not include figures from sporting goods<br />

chain stores or national outdoor chains. It also does not include<br />

general or discount e-tailers, like eBay, Amazon and Wal-Mart,<br />

or account for Internet sales by outdoor manufacturers selling<br />

directly to consumers.<br />

Nevertheless, it is interesting to note that 89.8 percent of<br />

specialty outdoor retail business is still generated by in-store<br />

purchases. Although 81 percent of stores say they have a Web<br />

presence, just 37 percent sell product online. And 53.4 percent<br />

of those stores sell only a portion of their available product.<br />

JanSport President Killed in Car Crash<br />

Michael Corvino, president of JanSport, was killed July 14 in<br />

a solo car crash near his home in Danville, Calif. He was 46.<br />

Corvino was driving a 1970 Dodge Charger around 5:30 p.m.<br />

when he apparently accelerated and lost control of the vehicle,<br />

striking a tree, according to the California Highway Patrol. Corvino<br />

was pronounced dead at the scene. An autopsy was scheduled.<br />

Also in the car were Corvino’s 16-year-old daughter Alexandra<br />

and John Shaner, 16. Both were taken to John Muir Medical<br />

Center in Walnut Creek and treated for minor injuries.<br />

All three were wearing seat belts, according to the CHP.<br />

“We are deeply saddened by the loss of our friend and colleague,”<br />

said Mackey J. McDonald, chairman and CEO of VF<br />

Corp., JanSport’s parent company. “Mike was a talented and<br />

passionate leader and inspired everyone around him. Mike had<br />

an infectious smile and laugh, and was a dear friend to many at<br />

VF. We will miss him more than words can convey.”<br />

Corvino was named president of JanSport in December<br />

2004. Prior to the appointment, he held several sales and merchandising<br />

positions with VF Imagewear in Nashville, Tenn. and<br />

Tampa, Fla., including vice president of sales and merchandising.<br />

In all, Corvino spent 15 years at VF.<br />

A native of Philadelphia, Corvino attended the University of<br />

Maryland at College Park, where he was a standout linebacker<br />

from 1979-1982, earning All-ACC honors. He played professionally<br />

for the Washington Federals of the USFL from 1983-85.<br />

He is survived by his wife, Joyce, and their two daughters,<br />

Elizabeth, 18, and Alexandra.<br />

Memorial services were scheduled in Pennsylvania and<br />

California. The Corvino family announced plans for a memorial<br />

scholarship fund at Pius the X High School in Bangor, Pa., Michael<br />

Corvino’s alma mater. Interested parties should write to:<br />

Pius the X High School, 560 3rd Ave., Bangor, PA, 18013.<br />

Dave Gatto, president of VF’s Outdoor Coalition, will oversee<br />

the JanSport business until a successor is named, VF reported.<br />

12 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

Gas<br />

OR Exhibitors Targeted by Advertising Scam<br />

An Austrian-based company continues to target Outdoor<br />

Retailer exhibitors with solicitations that trade show officials<br />

across multiple industries have termed unethical and misleading.<br />

Construct Data Verlag AG offers advertising space and a<br />

free listing in an online directory called Fair Guide. The company<br />

sends exhibitors a form that references the trade show<br />

for which an exhibitor is registered, inviting them to sign and<br />

return the form for an entry in its online directory.<br />

“Exhibitors who sign and return the form are then bound to<br />

a non-terminable agreement at significant cost for a period of at<br />

least three years and automatically renewing thereafter at the same<br />

cost, unless cancelled by registered letter within the appropriate<br />

period,” says a warning posted on an Outdoor Retailer website.<br />

In fact, without any further communication with exhibitors<br />

beyond the form submission, Construct Data winds up<br />

charging $981 per year for an ambiguous directory listing on<br />

its website, when it receives back a signed form.<br />

The form is misleading in that it tells exhibitors that they will<br />

receive a free listing, “even if you don’t place a binding order<br />

as below.” The problem is, if a company fills out the form and<br />

signs it, it will be charged the advertising fee.<br />

The situation is troubling for trade shows because unless<br />

exhibitors read the form carefully, particularly the fine print,<br />

some may assume the form was sent from show organizers.<br />

“Outdoor Retailer has no relationship with Construct Data<br />

Verlag AG, Fair Guide or any of its many other brands, and they<br />

have no right to use Nielsen Business Media’s show names<br />

and brands on information they send out to exhibitors,” says<br />

OR’s online disclaimer.<br />

According to Baltic Business News, Construct Data activities<br />

have been documented since 2002, spawning some litigation.<br />

Online Retailers ‘Searchandising’<br />

Online retailers are quickly discovering that a website’s<br />

search function can be a key tool to effective merchandising<br />

and online conversion rates. Some 70 percent of leading online<br />

retailers report that visitors who use their site’s search tools<br />

are more likely to convert from browsers to buyers, according<br />

to Aberdeen Group.<br />

The problem is that 67 percent of the online merchants surveyed<br />

say that producing search results that meet customer<br />

needs is a challenge.<br />

Currently, 54 percent of “best-in-class” retailers use search<br />

as a merchandising tool, the research company reports.<br />

The most successful retailers use faceted search capabilities,<br />

described by Aberdeen Group as “the way metadata is tagged<br />

and associated throughout the site to produce search results<br />

that facilitate product discovery or additional drilling to reveal<br />

more choices.”<br />

Approximately 50 percent of best-in-class retailers currently<br />

use this approach, but Aberdeen Group argues that in the next<br />

24 months 92 percent of best-in-class retailers will do so. One<br />

14 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007<br />

The company appears to have expanded its U.S. targets in recent<br />

years. Trade show organizers and industry associations as<br />

varied as Interbuild, the Craft & Hobby Association, the International<br />

Association of Amusement Parks and Attractions, the<br />

International Laser Display Association (ILDA), and the Global<br />

Association of the Exhibition Industry have issued warnings on<br />

their websites.<br />

There is an informational website, www.stopecg.org, dedicated<br />

to tracking Construct Data and its many brands. The site<br />

was created for international users opposing the company’s<br />

European City Guide.<br />

According to Stopecg.org, Construct Data signed a settlement<br />

Feb. 13 before the Austrian courts, agreeing to “cease<br />

the mailing of misleading contracts” to 30 nations, including<br />

Austria, Germany, Netherlands, Poland, Spain, Switzerland and<br />

the United Kingdom. The list is European based and does not<br />

include the United States. According to the website, Construct<br />

Data agreed to “cancel their demands for money against companies<br />

who signed in error and dispute the contracts.”<br />

In light of its legal problems in Europe, Construct Data could<br />

increase its efforts in North America. The Austrian embassy in<br />

Washington, D.C., reportedly has made available a cancellation<br />

form letter for companies that have unwittingly signed up<br />

for Construct Data’s services and are being sent invoices. The<br />

form is available for download by the ILDA at www.laserist.<br />

org/Conference/index.htm.<br />

The Austrian embassy also reportedly has urged affected<br />

companies to file complaints with the Federal Trade Commission.<br />

A request by Inside Outdoor to receive information<br />

from the FTC about any filed complaints was not fulfilled<br />

by press time.<br />

of the benefits of a faceted search approach is that it can segregate<br />

query matches by attributes, thereby avoiding searches<br />

that provide too many responses or irrelevant returns.<br />

“These metrics show that leading companies are thinking<br />

about their search tools as a way to serve up products and<br />

inextricably link their merchandising processes to their product<br />

discovery tools,” say Aberdeen Group analysts.<br />

The better the search function, the more useful the information<br />

it can provide. Aberdeen Group says 65 percent of best-inclass<br />

retailers use search analytics to build customer profiles,<br />

evaluate buying patterns and identify successful keywords and<br />

conversion paths.<br />

Examining how online shoppers search and shop for merchandise<br />

may also be helpful to in-store merchandising and<br />

promotions. If trends appear in how customers bundle related<br />

merchandise or in the paths they take when viewing various<br />

products online, retailers can potentially use that information to<br />

more effectively present or position product within their brickand-mortar<br />

stores.

Pada

Gas<br />

The Zip Line<br />

BIG PICTURE<br />

Consumer purchases of used sporting goods equipment hit<br />

$1.01 billion in 2006, with outdoor sports registering as the single<br />

largest category, according to a report released by the National<br />

Sporting Goods Association (NSGA). Sales of used outdoor<br />

equipment, which includes camping, fishing and shooting sports,<br />

grew 19 percent from last year, totaling $602 million.<br />

Most other categories showed only modest changes, NSGA<br />

reported. By comparison to outdoor equipment, used exercise<br />

equipment (the second largest category) had purchases of just<br />

over $196 million, about the same as last year.<br />

This is the ninth used equipment study done by the NSGA<br />

and the first time used equipment purchases have exceeded<br />

$1 billion. In 2005, consumers indicated they had purchased<br />

almost $885 million in used sports equipment.<br />

The report was based on a survey of 60,000 households in<br />

which 39 products were surveyed regarding purchases during<br />

2006. Because of the limited number of products surveyed, the<br />

total used equipment market is actually much larger than the $1<br />

billion reported in the study, NSGA said.<br />

FINANCES<br />

VF Corp. saw second-quarter revenues rise a record 12 percent<br />

to more than $1.5 billion, compared to $1.35 billion in the<br />

second quarter last year. The company attributed the increase<br />

to higher revenues across its Outdoor, Jeanswear, Sportswear<br />

and Imagewear businesses. Second quarter revenues for VF’s<br />

outdoor brands were up 20 percent to $446.8 million.<br />

Domestic revenues grew 10 percent in the quarter, driven<br />

by double-digit growth for The North Face and Reef, and<br />

continued strong growth by Vans, the company reported.<br />

JanSport’s brand revenues declined in the quarter, due primarily<br />

to a shift in the timing of product shipments into the<br />

third quarter, VF said. The acquisition of Eagle Creek added<br />

$10 million to revenues in the quarter.<br />

VF said a key growth strategy is to expand its direct-to-consumer<br />

business primarily through retail store expansion. VF<br />

ended the quarter with 544 owned retail stores, up from 533<br />

at the end of the first quarter. Retail revenues grew 22 percent<br />

in the quarter, with strong growth from Vans, Nautica and The<br />

North Face brand stores, the company reported …<br />

Liberty Mountain and Equinox signed an agreement June<br />

27 to merge their distribution businesses. The transaction is<br />

expected to be completed after the conclusion of Outdoor<br />

Retailer <strong>Summer</strong> Market. Financial terms were not disclosed.<br />

Under the terms of the agreement, Liberty Mountain President<br />

Gary Heward will be president and owner of the newly<br />

combined company. Robert (Robbie) Cross, Equinox president,<br />

will retain control and ownership of Equinox Ltd. and continue<br />

as president of the Equinox manufacturing operation.<br />

Liberty Mountain/Equinox will be the exclusive distributor<br />

of the Equinox brand in the outdoor industry and will continue<br />

to operate warehouses in both Salt Lake City and Williamsport,<br />

Pa. ...<br />

The economic impact of the five-day Teva Mountain Games<br />

festival generated more than $4.6 million in incremental revenue<br />

for the Vail, Colo., local economy, festival organizers said.<br />

The sixth-annual event drew more than 1,600 registered, competing<br />

athletes and an estimated 30,000 spectators. The economic<br />

impact study determined that 58 percent of attendees<br />

came specifically to attend the Mountain Games, and that half<br />

of them were overnight visitors...<br />

Johnson Outdoors will issue a one-time payment of $4.4 million<br />

to Confluence Holdings Corp., as part of a settlement agreement<br />

that will end a long-standing intellectual property dispute. No<br />

other terms of the settlement were made public; however, Johnson<br />

Outdoors issued a statement saying the agreement does not<br />

constitute an admission of wrongdoing by either company.<br />

Johnson Outdoors filed suit against Confluence<br />

more than five years ago alleging violation of its Old Town<br />

Canoe “Discovery” patent in an attempt to protect its rotomolding<br />

process.<br />

The $4.4 million payment will likely have a negative impact<br />

on Johnson Outdoors’ third-quarter earnings, the company<br />

said. Johnson Outdoors was scheduled to report its third-quarter<br />

results July 26.<br />

In addition, the company indicated it has filed an insurance<br />

claim to recover the loss but does not expect a resolution during<br />

the current fiscal year.<br />

MARKETING MOVES<br />

Outdoor Retailer announced it will move the starting date<br />

of its 2009 <strong>Summer</strong> Market to July 21-24. The decision was<br />

made to meet the market needs of many exhibitors and to<br />

more closely align with earlier buying cycles faced by retailers,<br />

trade show officials announced.<br />

<strong>Summer</strong> Market will continue with its scheduled August<br />

dates this year (Aug. 9-12) and next (Aug. 7-10) at the Salt Palace<br />

Convention Center in Salt Lake City. The show is committed<br />

to Salt Lake City and the Salt Palace through 2010. Winter<br />

Market dates are not affected.<br />

While comfort ranks high by consumers when shopping for<br />

a backpack, suspension is often an afterthought. In an attempt<br />

to rectify the discrepancy, Gregory announced it will rebrand<br />

its pack categories for 2008 based on the company’s different<br />

suspension systems.<br />

When Gregory introduces its new Response CFS (Custom<br />

Fit Suspension) system for 2008, the company will define most<br />

of its new packs in three categories, each tied to the specific<br />

suspension systems used in that category...<br />

16 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

the original warmth without bulk<br />

pioneer<br />

trailblazer<br />

3M and Thinsulate are trademarks of 3M. © 3M 2007<br />

The brand you can count on<br />

Thinsulate TM Insulation from 3M delivers proven high performance<br />

and the power of trusted, well-known brand. Add value to your<br />

products and gain meaningful differentiation where it counts:<br />

at the point of sale.<br />

To have a sales representative contact you,<br />

call 800-831-0658 or visit thinsulate.com<br />

OFFICIAL SUPPLIER

Gas<br />

An estimated 60,000 people turned out for the Great American<br />

Backyard Campout (GABC) June 23, according to the<br />

Outdoor Industry Foundation. The annual, nationwide event<br />

promotes close-to-home recreation, using basic camping as a<br />

gateway activity.<br />

The Campout encourages families and communities to increase<br />

their participation in outdoor recreation, with the hope of<br />

inspiring new campers, lapse campers and children to develop<br />

a love for the outdoors.<br />

This year, three-fourths of the participants were children, said<br />

OIF, which cosponsored the campaign with the National Wildlife<br />

Federation. The Campout was supported by more than 500<br />

outdoor retailers, and an estimated 4,500 campsites registered<br />

for the event, representing all 50 states, the OIF reported.<br />

Although the success of the event fell well short of the<br />

stated goal of 150,000 participants, the number of campers<br />

increased 42.9 percent from the 42,000 that registered last<br />

year. Next year’s Great American Backyard Campout is scheduled<br />

for June 28.<br />

THREADS & SPINS<br />

The Industrial Fabrics Association International (IFAI) is<br />

organizing a business fact-finding mission to China for interested<br />

companies. The trip, scheduled for Nov. 5-15, is limited<br />

to 10 people in order to maximize the networking experience,<br />

IFAI said.<br />

Participants will be privy to high-level meetings with government<br />

and textile association executives, including the leaders<br />

of the China National Textile & Apparel Council, the highest<br />

ranking organization for the Chinese textile industry. In addition,<br />

the trip features tours of six end-product factories and textile<br />

coating operations, including a visit to the HaiNing Industrial<br />

Park, one of only four specialty fabrics industrial park clusters<br />

located in China.<br />

There also will be market intelligence meetings and presentations,<br />

and special match-making meetings will be arranged<br />

for each delegation member according to the specific interests<br />

of the participant, IFAI said.<br />

The application deadline is Sept. 15 …<br />

Bemis has added custom printing capabilities to its line of<br />

heat sealing tapes. Customer-specified patterns, logos and<br />

designs can be applied to any Bemis seam tape to deliver a<br />

higher level of customization to technical outerwear garments,<br />

the company said. Bemis said it developed the capability in response<br />

to customer requests for a way to easily differentiate<br />

products and tailor designs to meet market needs. Only nonsolvent,<br />

UV-cured and water-based inks are used for printing,<br />

the company reported.<br />

“These improved methods for customization are aligned<br />

with the aesthetic evolution that began with our Sewfree line<br />

of adhesive films for apparel. The design possibilities are truly<br />

endless,” said Chris Parlee, marketing and promotions manager<br />

for Bemis. “This is yet another capability that we believe is helping<br />

to advance the waterproof apparel market.” …<br />

Concept III has introduced a group of scored grid fleeces<br />

from Kingwhale. Aimed for product inclusion in Fall 2008, the<br />

18 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007<br />

grid construction of the fabrics helps channel moisture during<br />

evaporation, while the air spaces between the tiny grid blocks<br />

help maintain warmth, the company said. In addition, the scored<br />

construction helps keep the fabrics lightweight and drapeable.<br />

Available in several weights, the new fleece fabrics are intended<br />

for next-to-skin, mid-layer and outerwear applications.<br />

In addition, Concept III says it has developed featherweight<br />

grid-to-fleece and grid-to-soft shell laminates.<br />

COMINGS & GOINGS<br />

Nielsen Sports Group appointed Kenji Haroutunian as<br />

show director for the Outdoor Retailer <strong>Summer</strong> Market and<br />

Winter Market trade shows. Haroutunian will manage strategic<br />

planning, staff, sales, marketing and budgeting for the biannual<br />

event. He fills the vacant position most recently held<br />

by Peter Devin.<br />

Haroutunian has been a member of the Nielsen Sports Group<br />

since 1999, most recently serving as senior account executive<br />

for the Outdoor Retailer and FlyFishing Retailer trade shows.<br />

He was instrumental in producing the Backcountry Base Camp<br />

event at Winter Market and also helped develop OR’s Green<br />

Steps program …<br />

Kelty has hired Russell Rowell as director of product development<br />

and merchandising. Rowell will supervise all aspects<br />

of Kelty’s new product development efforts and work with the<br />

company’s product management team to strategically identify<br />

and develop new outdoor equipment and categories that support<br />

Kelty’s current and future vision.<br />

Rowell has worked extensively in the outdoor industry,<br />

including employment as a retail buyer and outdoor store<br />

manager. He was most recently head of product development<br />

with backpack manufacturer Gregory, where he had<br />

worked since 1998 …<br />

Polartec LLC has hired Steve Cuthbert as director of sales,<br />

North America. Cuthbert previously had worked as an account<br />

manager for Malden Mills from 1997 to 2004. He most recently<br />

was national sales manager for PrimaLoft’s Yarn and Fabrics<br />

Group, a subsidiary of Albany International.<br />

Former Director of Sales Jim Allen will continue as sales<br />

manager for the western region and serve as an advisor to<br />

Cuthbert …<br />

eVent fabrics announced that Robert “Bob” Muscat has joined<br />

the team as general manager. Muscat comes to eVent from Rock-<br />

Tenn Co., a manufacturer of paperboard, packaging and display<br />

products, where he was vice president of marketing. Prior to<br />

Rock-Tenn, Muscat was a strategic marketing leader within the<br />

Industrial Products Division at W. L. Gore and Associates...<br />

VAS Entertainment, headquartered in San Luis Obispo,<br />

Calif., has opened a second branch office in Seattle. Dan Strickland,<br />

formerly vice president of Ally Distribution and Champion<br />

Visions, will lead operations at the new office as northwest regional<br />

director.<br />

The expansion will enable VAS to better serve Northwestbased<br />

action sports producers, retailers, media providers and<br />

related brands, and provide increased interfacing with Japanese<br />

clientele and Asian media markets, the company said.

Count on Serious Traction.<br />

serious<br />

traction<br />

gear<br />

Whatever the winter activity STABILicers provide the ice traction product you need.<br />

Quick and easy on and off and performance-designed for durability and comfort.<br />

Aggressive cleats bite into ice, rock, snow and pavement, providing unbeatable<br />

traction with every STABILicers product.<br />

800-782-2423<br />

www.32north.com

Gas<br />

Data Points<br />

NUMBERS WORTH NOTING<br />

CONFIDENT BUT WORRIED<br />

Consumers are an interesting bunch. Nearly half (47.8<br />

percent) of those surveyed in July contend they are very<br />

confident/confident in the chances for a strong economy, rising<br />

four points from June (43.9 percent) and more than eight points<br />

from 2006 (39.5 percent), according to BIGresearch.<br />

How do you feel about the following statement?<br />

“I am saving enough to meet my future needs.”<br />

All<br />

HH Income<br />

Less Than<br />

$49,999<br />

HH<br />

Income<br />

$50,000<br />

or More<br />

At the same time, 40.4 percent assert that personal finances<br />

cause them the most stress. Just over a third (33.8 percent)<br />

say they will focus on reducing debt in the next three months,<br />

BIGresearch reports. Those planning to increase their savings is<br />

26.9 percent, while those planning to decrease overall spending<br />

is just 29.3 percent. Fewer than one in five (19.7 percent) plan<br />

to pay with cash more often.<br />

With gas prices on the decline since spiking in May, 26.1<br />

percent say that prices at the pump aren’t affecting their spending.<br />

However, 39.7 percent say they are defraying fuel costs by driving<br />

less, 36.9 percent are shopping closer to home, and 31 percent<br />

are comparison shopping for sales more often, BIGresearch says.<br />

TCB WITH PCS<br />

Teenage spending is expected to increase from $189.7<br />

billion in 2006 to $208.7 billion in 2011, despite an estimated 3<br />

percent decline in the number of youths 12 to 17 years old over<br />

the same time period, according to Packaged Facts.<br />

20 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007<br />

Males<br />

How will these teens be spending their money? Largely<br />

online. Most of today’s teenagers do not know life without a<br />

PC and their dependence on it will continue to grow as the Web<br />

becomes more interactive and integrated with other devices.<br />

The Business Software Alliance and Harris Interactive<br />

reported in March that 41 percent of teens consider the home<br />

computer the most important consumer electronic<br />

device used on a regular basis. Cell phones ranked<br />

second at 29 percent, and television barely resonated<br />

at all, with just 8 percent of teens naming it most<br />

important.<br />

Those numbers are in sharp contrast to tweens<br />

(kids aged 8-12), whose preferences are more evenly<br />

distributed. The home computer also ranked number<br />

one with tweens, but just 27 percent ranked it most<br />

important — the same number who ranked the home<br />

video game system number one. Television, likely<br />

behind the strength of Disney programming, still<br />

resonates with this group, as well, with 22 percent<br />

ranking the TV most important.<br />

Females<br />

Strongly Agree 7.8% 5.5% 9.8% 9.0% 6.6%<br />

Agree 23.0% 15.5% 29.6% 27.2% 19.0%<br />

Uncertain 28.5% 28.2% 28.3% 28.2% 28.9%<br />

Disagree 19.2% 20.3% 18.7% 17.6% 20.7%<br />

Strongly Disagree 21.5% 30.4% 13.6% 17.9% 24.8%<br />

Source: BIGresearch<br />

Most Important Consumer Electronic Device Used on<br />

a Regular Basis (Internet Users)<br />

Tweens Teens Total<br />

Home computer 27% 41% 35%<br />

Cell phone 8% 29% 20%<br />

Video game system 27% 9% 17%<br />

TV 22% 8% 14%<br />

iPod or other MP3 player - - 8%<br />

Source: Business Software Alliance/Harris Interactive; eMarketer<br />

E-SPENDING<br />

According to a recent survey by Internet Retailer, 78.2 percent<br />

of respondents plan to increase their spending on e-commerce<br />

applications and services this year. The poll surveyed 195 chain<br />

retailers, catalog companies, virtual merchants and consumer<br />

brand manufacturers. Among store-based merchants, the top<br />

replacement priority this year is a new e-commerce platform<br />

(32.7 percent), followed by new site search software, order<br />

management software and a content management system,<br />

each at 11.5 percent.<br />

Among all respondents, 51 percent ranked adding customer<br />

reviews as a top priority this year, and one-third of respondents<br />

indicated a desire to add functionality to their websites that allows<br />

shoppers to see information when they “mouse over” an image.<br />

Which of the following are your new e-commerce<br />

technology priorities for this year?<br />

Mobile commerce 15.1%<br />

Video casts 27.6%<br />

Customer reviews/ratings 51.0%<br />

Content delivery network 30.2%<br />

Links to more shopping comparison sites or portals 29.7%<br />

The ability to display information when a shopper “mouses”<br />

over an image<br />

Source: Internet Retailer<br />

33.3%

Gas<br />

CALIFORNIA GOLDEN<br />

Not surprisingly, the nation’s three most populous states<br />

were in the top three in 2006 specialty outdoor retail sales,<br />

with California ranking first in both sales ($960.4 million) and<br />

population. In terms of regions, the West contributed 39.2<br />

percent of overall retail sales in 2006 at $2.7 billion, followed<br />

by the South at 24.4 percent, or $1.68 billion. Total specialty<br />

outdoor retail sales for the nation was $7.62 billion, according to<br />

the Outdoor Industry Association.<br />

The West produced four of the top six states, nationally,<br />

with Washington, Colorado and Oregon showing their outdoor<br />

recreation muscle behind outstanding per capita figures.<br />

All three states contributed sales disproportionate to their<br />

total populations, suggesting gear purchases across multiple<br />

categories by the local population, as well as gear purchased<br />

in-state by visitors seeking quality outdoor experiences across<br />

multiple pursuits.<br />

Top 10 Contributing States to Overall Specialty<br />

Outdoor Retail Sales<br />

% of<br />

U.S. Population<br />

State $M National<br />

Rank<br />

Sales<br />

California $960.4 13.9% 1<br />

New York $423.8 6.1% 3<br />

Texas $362.9 5.3% 2<br />

Washington $347.4 5.0% 14<br />

Colorado $308.1 4.5% 22<br />

Oregon $292.9 4.2% 27<br />

Pennsylvania $267.3 3.9% 6<br />

Florida $259.2 3.8% 4<br />

North Carolina $247.7 3.6% 10<br />

Michigan $227.5 3.3% 8<br />

Source: Outdoor Industry Association, Leisure Trends Group; U.S. Census Bureau<br />

LOW RATE E-MAIL<br />

While a recent Internet Retailer survey indicates that<br />

merchants are working to improve the effectiveness of their<br />

e-mail marketing campaigns, many apparently are not paying<br />

close enough attention to conversion rates. Nearly a third (29.5<br />

percent) of survey respondents said they don’t know their<br />

conversion rates from e-mails.<br />

E-Mail Open Rate<br />

And of those that do, just 4.5 percent of retailers have an<br />

e-mail conversion rate of more than 10 percent. The majority<br />

(53.3 percent) have conversion rates of less than 4 percent,<br />

with 27.9 percent of those under 1 percent.<br />

Part of the problem could be mass e-mailings rather than<br />

strategically segmented and targeted e-mails that offer specific<br />

incentives to particular groups. According to the survey, 56.6<br />

percent of retailers segment their e-mail lists into groups, such<br />

as age, sex, annual income and past purchase histories.<br />

E-Mail Click Through Rate<br />

SNOW IN JULY<br />

The Pacific states, led by California, had the highest dollar<br />

totals in retail sales of snowsports equipment and apparel,<br />

totaling more than $541 million during the 2006-07 U.S.<br />

winter sports season, according to SnowSports Industries<br />

America. The Mountain region followed closely with about<br />

$502 million in retail receipts.<br />

2006-07 Snowsports Retail Sales by Region<br />

Region Total $<br />

Pacific<br />

Mountain<br />

Middle Atlantic<br />

East North Central<br />

New England<br />

South Atlantic<br />

West North Central<br />

West South Central<br />

East South Central<br />

All Regions<br />

All respondents<br />

1-2.5% 10.3% 12.1%<br />

2.51-5% 23.0% 15.5%<br />

5.1-10% 19.2% 17.2%<br />

10.1-15% 9.6% 5.2%<br />

15.1-25% 8.2% 8.6%<br />

19.1-25% 12.8% 13.8%<br />

>25% 8.9% 17.2%<br />

Don’t know 20.8% 24.2%<br />

Source: Internet Retailer<br />

Store-based merchants<br />

$541.9 million<br />

$501.9 million<br />

$291.1 million<br />

$269.0 million<br />

$225.3 million<br />

$205.3 million<br />

$133.7 million<br />

$127.4 million<br />

$35.4 million<br />

$2.33 billion<br />

All respondents<br />

Store-based merchants<br />

Source: SnowSports Industries America<br />

< 1% 2.8% 1.7%<br />

1-5% 11.4% 12.1%<br />

5.1-10% 8.3% 5.2%<br />

10.1-15% 9.0% 8.6%<br />

15.1-19% 13.5% 13.8%<br />

19.1-25% 12.8% 13.8%<br />

>25% 24.2% 24.1%<br />

Don’t know 18.0% 20.7%<br />

Source: Internet Retailer<br />

Late snowfall helped keep New England behind this<br />

season, with total sales dropping about 20 percent to $225<br />

million. Nationally, the snowsports market was fairly neutral,<br />

gaining 1.8 percent thanks to robust apparel sales and the<br />

Mountain and Pacific regions making up for New England’s<br />

losses, reports SIA.<br />

In all, total snowsports retail sales for the season topped<br />

$2.33 billion.<br />

<strong>Summer</strong> 2007 | <strong>InsideOutdoor</strong> | 21

Word Up<br />

IT’S TIME TO CONSIDER HOW TEXT MESSAGING<br />

FITS INTO YOUR MARKETING STRATEGY<br />

When Moosejaw Mountaineering recently<br />

blasted out a simple “Rock,<br />

Paper or Scissors” text message, the<br />

electronic variation of the old hand<br />

game awarded players store membership points for<br />

text messaging back the right choice. The intent was<br />

simply to continue the retailer’s tradition of relating<br />

to customers in ways that go way beyond product.<br />

Fully aware that customers can buy a jacket from<br />

anywhere, Moosejaw’s marketing efforts have always<br />

been based on building loyalty through<br />

fun interactions and entertainment.<br />

by Martin Vilaboy<br />

When all was said and done, the simple Rock,<br />

Paper or Scissors mobile marketing campaign<br />

yielded an amazing 66 percent response rate. “We<br />

had no idea it would be so successful,” says Robert<br />

Wolfe, Moosejaw president and CEO.<br />

Wolfe and his team did suspect, however,<br />

that a good portion of its customer base, when<br />

given the choice, would be very receptive to interactions<br />

via short messaging service (SMS),<br />

more commonly known in the U.S. as text messaging.<br />

The campaign’s success confirmed<br />

those suspicions.<br />

22 | <strong>InsideOutdoor</strong> | <strong>Summer</strong> 2007

It didn’t dissuade matters either when 20 percent of buyers<br />

to Moosejaw’s website selected the option to receive order status<br />

notification on their cell phones rather than via e-mail.<br />

Of course, it would be foolish for anyone to expect such stellar<br />

response rates. But the numbers do serve as a type of wakeup<br />

call for any business that utilizes direct response or e-mail<br />

marketing to drive sales or loyalty — at least those who like to<br />

think of their efforts as anywhere near the swift blade of the<br />

“cutting edge.”<br />

The message is rather simple: if you haven’t started considering<br />

how mobile messaging fits into your marketing strategy,<br />

it’s time to start. Not next year, more like next quarter.<br />

“Start slow, but start now. Start figuring out how it applies,”<br />

says Steven Kelley, CEO of MESSAGEbuzz, which provides<br />

Moosejaw’s managed messaging solution. “Start working with<br />

someone to test certain elements. If things aren’t quite clear as<br />

to what is going to work, start exploring why.”<br />

One might expect such rhetoric from a messaging solutions<br />

vendor executive, but Kelley is among many who are banking<br />

on a boom in mobile messaging. Just about every contestant<br />

playing in the communications, media and Internet businesses<br />

has a shared enthusiasm for mobility and is heavily involved<br />

or seriously examining wireless technologies and the concept<br />

of the “anywhere consumer.” And keep in mind, things move<br />

very fast within these segments.<br />

MARKET READY<br />

Consider, for example, that it took about 125 years to reach<br />

the first billion fixed communications lines across the world<br />

(1876 to 2001), whereas mobile telephony reached its first billion<br />

subscribers in just 21 years (1981 to 2002). Reaching the second<br />

billion users took just three years (2002 to 2005).<br />

Here in the United States, the wireless market is nearing<br />

saturation, recently surpassing 230<br />

million individual subscribers. By comparison,<br />

that’s already more than double<br />

the 111 million occupied households in<br />

the U.S., which effectively represent the<br />

total base for consumer wireline Internet<br />

access services (not necessarily the<br />

number of e-mail identities but of connected<br />

homes). And about 13 percent of<br />

U.S. households already are wirelessonly<br />

homes, says mobile industry association<br />

CTIA.<br />

What’s more, it’s estimated that more<br />

than a third of U.S. cell phone users already<br />

utilize the SMS functionality on<br />

their phones. Usage is especially heavy<br />

among younger subscribers, for sure.<br />

Industry estimates are that as much<br />

as six in 10 users between the ages of<br />

18 and 34 send or receive text messages<br />

during any 30-day period, and according to Yankee Group surveys,<br />

49 percent of U.S. teens rank text messaging as the one<br />

application they are most interested in using.<br />

“If your customers are college age,” says Wolfe, “you have to<br />

be embracing this technology.”<br />

Still, it’s risky to write off texting as simply a nascent technology.<br />

Researchers at Frost & Sullivan, for example, expect that<br />

35.9 million Americans will participate in mobile marketing<br />

campaigns this year. In December 2006, 18.7 billion text messages<br />

were sent in the U.S., an increase of 92 percent from 9.7<br />

billion messages in December 2005, says CTIA. In the second<br />

<strong>Summer</strong> 2007 | <strong>InsideOutdoor</strong> | 23

Wireless in the U.S., December 2006<br />

Topic<br />

Statistic<br />

Wireless Subscribers at Year-End 2006<br />

Wireless Penetration<br />

Wireless-Only Households<br />

Wireless Providers<br />

233 million U.S. Subscribers<br />

More than 76 percent of total U.S. population<br />

12.8 percent of U.S. Households<br />

About 160 facilities-based carriers<br />

Monthly SMS Messages 18.7 billion messages in the month of December 2006, up 92% from 9.7 billion messages in December 2005<br />

Six Month SMS Messages 93.8 billion SMS messages during the latter six months of 2006, up 93% from 48 billion in the second six months of 2005<br />

Wireless Data Revenues $8.7 billion for the latter six months of 2006, up 82% from $4.8 billion in the latter half of 200.<br />

Source: CTIA<br />

six months of last year, 93.8 billion SMS messages crossed U.S.<br />

networks, a 93 percent jump year over year.<br />

Recent surveys of instant messaging users by AOL found that<br />

more than one-third of respondents send mobile instant messages<br />

or text messages from their cell phones at least once a week.<br />

This is a dramatic increase from 2004, when just 19 percent said<br />

they did so, and 2003, when the figure was 10 percent.<br />

A large part of text messaging’s rapid ascent can be attributed<br />

to the fact that most cell phone users aren’t required to<br />

upgrade a device, sign up for a new plan, significantly change<br />

behavior or download any type of software or application in<br />

order to adopt the service.<br />

The same thing cannot be said for most new or emerging communications<br />

or consumer technologies. But already more than 90<br />

percent of the mobile phones currently in the hands of users, for<br />

example, came pre-installed with full SMS capabilities.<br />

And the recent release of the iPhone, along with its wave of<br />

imitators, is expected to usher in a new stage in the way mobile<br />

services are viewed and used.<br />

TEXT FRESH<br />

At the same time, e-mail usage is flattening, even declining,<br />

many surveys suggest, and e-mail read and click-through rates<br />

aren’t fairing any better, says e-marketing services provider<br />

eROI. Citing increased use of anti-spam and filtering software<br />

and “images off” default settings in e-mail clients, eROI expects<br />

read and click rates to continue to slide moving forward.<br />

E-Mail Click-Through Rate (% of respondents)<br />

All respondents<br />

Store-based<br />

merchants<br />

Catalog<br />

Virtual<br />

Merchant<br />

1-2.5% 10.3% 12.1% 11.9% 9.1% 6.1%<br />

There’s no question that e-mail is losing some flavor<br />

with younger consumers, who increasingly prefer IM, social<br />

networking sites and SMS for keeping in contact with friends<br />

and social contacts. E-mail, on the other hand, is viewed as a<br />

tool for working or a way to keep up with distant relatives.<br />

In 2004, 89 percent of online teens responding to the Pew<br />

Internet & American Life Project sent or received an e-mail. By<br />

2007, a Yankee Group survey revealed that e-mailing was still<br />

the top online activity among teens, but only 80 percent of respondents<br />

sent or received an e-mail.<br />

And by the way, as much as 94 percent of text messages are<br />

read, while average SMS response rates are about 18 percent,<br />

says Kelley. E-mail read rates currently tend to hover around 20<br />

percent, while response rates tend to range between 2 percent<br />

and 5 percent, suggest eROI figures.<br />

Think of it this way. For lots of folks, in about a decade’s<br />

time, e-mail has gone from a must-have “productivity-enhancing<br />

tool,” complete with its own cute “You got mail,” catch<br />

phrase, to being perceived by many as a “time sink,” or a chore,<br />

loaded with spam and threats of viruses. “Cleaning out my<br />