Attentus CDO I Offering Circular - Irish Stock Exchange

Attentus CDO I Offering Circular - Irish Stock Exchange

Attentus CDO I Offering Circular - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

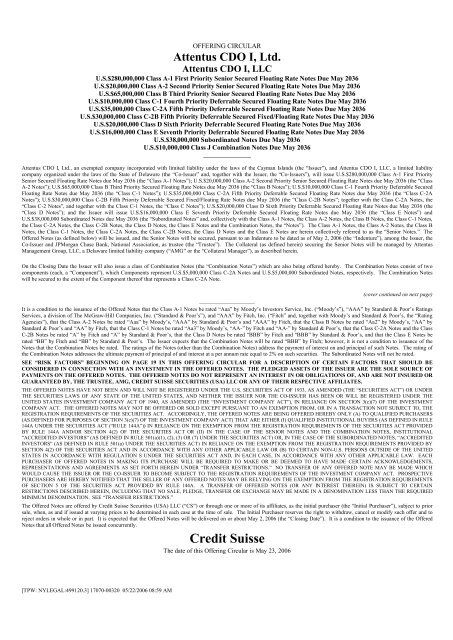

OFFERING CIRCULAR<br />

<strong>Attentus</strong> <strong>CDO</strong> I, Ltd.<br />

<strong>Attentus</strong> <strong>CDO</strong> I, LLC<br />

U.S.$280,000,000 Class A-1 First Priority Senior Secured Floating Rate Notes Due May 2036<br />

U.S.$20,000,000 Class A-2 Second Priority Senior Secured Floating Rate Notes Due May 2036<br />

U.S.$65,000,000 Class B Third Priority Senior Secured Floating Rate Notes Due May 2036<br />

U.S.$10,000,000 Class C-1 Fourth Priority Deferrable Secured Floating Rate Notes Due May 2036<br />

U.S.$35,000,000 Class C-2A Fifth Priority Deferrable Secured Floating Rate Notes Due May 2036<br />

U.S.$30,000,000 Class C-2B Fifth Priority Deferrable Secured Fixed/Floating Rate Notes Due May 2036<br />

U.S.$20,000,000 Class D Sixth Priority Deferrable Secured Floating Rate Notes Due May 2036<br />

U.S.$16,000,000 Class E Seventh Priority Deferrable Secured Floating Rate Notes Due May 2036<br />

U.S.$38,000,000 Subordinated Notes Due May 2036<br />

U.S.$10,000,000 Class J Combination Notes Due May 2036<br />

________________<br />

<strong>Attentus</strong> <strong>CDO</strong> I, Ltd., an exempted company incorporated with limited liability under the laws of the Cayman Islands (the “Issuer”), and <strong>Attentus</strong> <strong>CDO</strong> I, LLC, a limited liability<br />

company organized under the laws of the State of Delaware (the “Co-Issuer” and, together with the Issuer, the “Co-Issuers”), will issue U.S.$280,000,000 Class A-1 First Priority<br />

Senior Secured Floating Rate Notes due May 2036 (the “Class A-1 Notes”); U.S.$20,000,000 Class A-2 Second Priority Senior Secured Floating Rate Notes due May 2036 (the “Class<br />

A-2 Notes”); U.S.$65,000,000 Class B Third Priority Secured Floating Rate Notes due May 2036 (the “Class B Notes”); U.S.$10,000,000 Class C-1 Fourth Priority Deferrable Secured<br />

Floating Rate Notes due May 2036 (the “Class C-1 Notes”); U.S.$35,000,000 Class C-2A Fifth Priority Deferrable Secured Floating Rate Notes due May 2036 (the “Class C-2A<br />

Notes”); U.S.$30,000,000 Class C-2B Fifth Priority Deferrable Secured Fixed/Floating Rate Notes due May 2036 (the “Class C-2B Notes”; together with the Class C-2A Notes, the<br />

“Class C-2 Notes”, and together with the Class C-1 Notes, the “Class C Notes”); U.S.$20,000,000 Class D Sixth Priority Deferrable Secured Floating Rate Notes due May 2036 (the<br />

“Class D Notes”); and the Issuer will issue U.S.$16,000,000 Class E Seventh Priority Deferrable Secured Floating Rate Notes due May 2036 (the “Class E Notes”) and<br />

U.S.$38,000,000 Subordinated Notes due May 2036 (the “Subordinated Notes” and, collectively with the Class A-1 Notes, the Class A-2 Notes, the Class B Notes, the Class C-1 Notes,<br />

the Class C-2A Notes, the Class C-2B Notes, the Class D Notes, the Class E Notes and the Combination Notes, the “Notes”). The Class A-1 Notes, the Class A-2 Notes, the Class B<br />

Notes, the Class C-1 Notes, the Class C-2A Notes, the Class C-2B Notes, the Class D Notes and the Class E Notes are herein collectively referred to as the “Senior Notes.” The<br />

Offered Notes (as defined below) will be issued, and the Senior Notes will be secured, pursuant to an Indenture to be dated as of May 2, 2006 (the “Indenture”), among the Issuer, the<br />

Co-Issuer and JPMorgan Chase Bank, National Association, as trustee (the “Trustee”). The Collateral (as defined herein) securing the Senior Notes will be managed by <strong>Attentus</strong><br />

Management Group, LLC, a Delaware limited liability company (“AMG” or the “Collateral Manager”), as described herein.<br />

On the Closing Date the Issuer will also issue a class of Combination Notes (the “Combination Notes”) which are also being offered hereby. The Combination Notes consist of two<br />

components (each, a “Component”), which Components represent U.S.$5,000,000 Class C-2A Notes and U.S.$5,000,000 Subordinated Notes, respectively. The Combination Notes<br />

will be secured to the extent of the Component thereof that represents a Class C-2A Note.<br />

____________________<br />

(cover continued on next page)<br />

It is a condition to the issuance of the Offered Notes that the Class A-1 Notes be rated “Aaa” by Moody’s Investors Service, Inc. (“Moody’s”), “AAA” by Standard & Poor’s Ratings<br />

Services, a division of The McGraw-Hill Companies, Inc. (“Standard & Poor’s”), and “AAA” by Fitch, Inc. (“Fitch” and, together with Moody’s and Standard & Poor’s, the “Rating<br />

Agencies”), that the Class A-2 Notes be rated “Aaa” by Moody’s, “AAA” by Standard & Poor’s and “AAA” by Fitch, that the Class B Notes be rated “Aa2” by Moody’s, “AA” by<br />

Standard & Poor’s and “AA” by Fitch, that the Class C-1 Notes be rated “Aa3” by Moody’s, “AA-” by Fitch and “AA-” by Standard & Poor’s, that the Class C-2A Notes and the Class<br />

C-2B Notes be rated “A” by Fitch and “A” by Standard & Poor’s, that the Class D Notes be rated “BBB” by Fitch and “BBB” by Standard & Poor’s, and that the Class E Notes be<br />

rated “BB” by Fitch and “BB” by Standard & Poor’s. The Issuer expects that the Combination Notes will be rated “BBB” by Fitch; however, it is not a condition to issuance of the<br />

Notes that the Combination Notes be rated. The ratings of the Notes (other than the Combination Notes) address the payment of interest on and principal of such Notes. The rating of<br />

the Combination Notes addresses the ultimate payment of principal of and interest at a per annum rate equal to 2% on such securities. The Subordinated Notes will not be rated.<br />

SEE “RISK FACTORS” BEGINNING ON PAGE 19 IN THIS OFFERING CIRCULAR FOR A DESCRIPTION OF CERTAIN FACTORS THAT SHOULD BE<br />

CONSIDERED IN CONNECTION WITH AN INVESTMENT IN THE OFFERED NOTES. THE PLEDGED ASSETS OF THE ISSUER ARE THE SOLE SOURCE OF<br />

PAYMENTS ON THE OFFERED NOTES. THE OFFERED NOTES DO NOT REPRESENT AN INTEREST IN OR OBLIGATIONS OF, AND ARE NOT INSURED OR<br />

GUARANTEED BY, THE TRUSTEE, AMG, CREDIT SUISSE SECURITIES (USA) LLC OR ANY OF THEIR RESPECTIVE AFFILIATES.<br />

THE OFFERED NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR UNDER<br />

THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES, AND NEITHER THE ISSUER NOR THE CO-ISSUER HAS BEEN OR WILL BE REGISTERED UNDER THE<br />

UNITED STATES INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “INVESTMENT COMPANY ACT”), IN RELIANCE ON SECTION 3(c)(7) OF THE INVESTMENT<br />

COMPANY ACT. THE OFFERED NOTES MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE<br />

REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. ACCORDINGLY, THE OFFERED NOTES ARE BEING OFFERED HEREBY ONLY (A) TO QUALIFIED PURCHASERS<br />

(AS DEFINED FOR PURPOSES OF SECTION 3(c)(7) OF THE INVESTMENT COMPANY ACT) THAT ARE EITHER (I) QUALIFIED INSTITUTIONAL BUYERS (AS DEFINED IN RULE<br />

144A UNDER THE SECURITIES ACT (“RULE 144A”)) IN RELIANCE ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT PROVIDED<br />

BY RULE 144A AND/OR SECTION 4(2) OF THE SECURITIES ACT OR (II) IN THE CASE OF THE SENIOR NOTES AND THE COMBINATION NOTES, INSTITUTIONAL<br />

“ACCREDITED INVESTORS” (AS DEFINED IN RULE 501(a)(1), (2), (3) OR (7) UNDER THE SECURITIES ACT) OR, IN THE CASE OF THE SUBORDINATED NOTES, “ACCREDITED<br />

INVESTORS” (AS DEFINED IN RULE 501(a) UNDER THE SECURITIES ACT) IN RELIANCE ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS PROVIDED BY<br />

SECTION 4(2) OF THE SECURITIES ACT AND IN ACCORDANCE WITH ANY OTHER APPLICABLE LAW OR (B) TO CERTAIN NON-U.S. PERSONS OUTSIDE OF THE UNITED<br />

STATES IN ACCORDANCE WITH REGULATION S UNDER THE SECURITIES ACT AND, IN EACH CASE, IN ACCORDANCE WITH ANY OTHER APPLICABLE LAW. EACH<br />

PURCHASER OF OFFERED NOTES IN MAKING ITS PURCHASE WILL BE REQUIRED TO MAKE OR BE DEEMED TO HAVE MADE CERTAIN ACKNOWLEDGEMENTS,<br />

REPRESENTATIONS AND AGREEMENTS AS SET FORTH HEREIN UNDER “TRANSFER RESTRICTIONS.” NO TRANSFER OF ANY OFFERED NOTE MAY BE MADE WHICH<br />

WOULD CAUSE THE ISSUER OR THE CO-ISSUER TO BECOME SUBJECT TO THE REGISTRATION REQUIREMENTS OF THE INVESTMENT COMPANY ACT. PROSPECTIVE<br />

PURCHASERS ARE HEREBY NOTIFIED THAT THE SELLER OF ANY OFFERED NOTES MAY BE RELYING ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS<br />

OF SECTION 5 OF THE SECURITIES ACT PROVIDED BY RULE 144A. A TRANSFER OF OFFERED NOTES (OR ANY INTEREST THEREIN) IS SUBJECT TO CERTAIN<br />

RESTRICTIONS DESCRIBED HEREIN, INCLUDING THAT NO SALE, PLEDGE, TRANSFER OR EXCHANGE MAY BE MADE IN A DENOMINATION LESS THAN THE REQUIRED<br />

MINIMUM DENOMINATION. SEE “TRANSFER RESTRICTIONS.”<br />

The Offered Notes are offered by Credit Suisse Securities (USA) LLC (“CS”) or through one or more of its affiliates, as the initial purchaser (the “Initial Purchaser”), subject to prior<br />

sale, when, as and if issued at varying prices to be determined in each case at the time of sale. The Initial Purchaser reserves the right to withdraw, cancel or modify such offer and to<br />

reject orders in whole or in part. It is expected that the Offered Notes will be delivered on or about May 2, 2006 (the “Closing Date”). It is a condition to the issuance of the Offered<br />

Notes that all Offered Notes be issued concurrently.<br />

Credit Suisse<br />

The date of this <strong>Offering</strong> <strong>Circular</strong> is May 23, 2006<br />

[TPW: NYLEGAL:499120.3] 17070-00320 05/22/2006 08:59 AM

ii<br />

(cover continued)<br />

Subject in each case to the Priority of Payments, (a) Holders of the Class A-1 Notes will be entitled to<br />

receive interest at a floating rate per annum equal to the applicable London interbank offered rate in effect<br />

from time to time plus 0.37%, (b) Holders of the Class A-2 Notes will be entitled to receive interest at a<br />

floating rate per annum equal to the applicable London interbank offered rate in effect from time to time<br />

plus 0.46%, (c) Holders of the Class B Notes will be entitled to receive interest at a floating rate per<br />

annum equal to the applicable London interbank offered rate in effect from time to time plus 0.78%, (d)<br />

Holders of the Class C-1 Notes will be entitled to receive interest at a floating rate per annum equal to the<br />

applicable London interbank offered rate in effect from time to time plus 1.20%, (e) Holders of the Class<br />

C-2A Notes will be entitled to receive interest at a floating rate per annum equal to the applicable London<br />

interbank offered rate in effect from time to time plus 1.45%, (f) Holders of the Class C-2B Notes will be<br />

entitled to receive interest at a fixed rate of 6.707% per annum prior to and including the Distribution<br />

Date occurring in May 2011 and at a floating rate per annum equal to the applicable London interbank<br />

offered rate in effect from time to time plus 1.45% thereafter, (g) Holders of the Class D Notes will be<br />

entitled to receive interest at a floating rate per annum equal to the applicable London interbank offered<br />

rate in effect from time to time plus 2.75% and (h) Holders of the Class E Notes will be entitled to receive<br />

interest at a floating rate per annum equal to the applicable London interbank offered rate in effect from<br />

time to time plus 5.25%. The Combination Notes will be entitled only to the payments to which the Notes<br />

represented by its Components are entitled. The Subordinated Notes will not bear interest at a stated rate<br />

and will be entitled to distributions only to the extent funds are available therefor in accordance with the<br />

Priority of Payments.<br />

To the extent that funds are available on such Distribution Date in accordance with the Priority of<br />

Payments, interest on the Senior Notes and distributions on the Subordinated Notes will be payable in<br />

U.S. Dollars quarterly in arrears on November 10 th , February 10 th , May 10 th and August 10 th of each year<br />

commencing on August 10 th , 2006 (each, a “Distribution Date”); provided, that (i) the final Distribution<br />

Date with respect to the Offered Notes shall be the Distribution Date occurring in May 2036, and (ii) if<br />

any such date is not a Business Day, the relevant Distribution Date will be the next succeeding Business<br />

Day. Payments of principal of and interest on the Senior Notes and distributions in respect of the<br />

Subordinated Notes on any Distribution Date will be made if and to the extent that funds are available on<br />

such Distribution Date in accordance with the Priority of Payments. See “Description of the Offered<br />

Notes—Interest” and “Description of the Offered Notes—Principal.” The principal of each of the Class<br />

A-1 Notes, Class A-2 Notes, Class B Notes, Class C-1 Notes, Class C-2 Notes, Class D Notes and Class<br />

E Notes is payable on each Distribution Date and is required to be paid by their applicable Stated<br />

Maturity, unless redeemed or repaid prior thereto. See “Description of the Offered Notes—Principal.”<br />

The Class A-1 Notes, Class A-2 Notes, Class B Notes, Class C-1 Notes, Class C-2A Notes, Class C-2B<br />

Notes, Class D Notes, Class E Notes, Combination Notes and Subordinated Notes are each referred to<br />

herein as a “Class” of Notes.<br />

All of the Class A-1 Notes are entitled to receive payments pari passu among themselves, all of the Class<br />

A-2 Notes are entitled to receive payments pari passu among themselves, all of the Class B Notes are<br />

entitled to receive payments pari passu among themselves, all of the Class C-1 Notes are entitled to<br />

receive payments pari passu among themselves, all of the Class C-2 Notes are entitled to receive<br />

payments pari passu among themselves, all of the Class D Notes are entitled to receive payments pari<br />

passu among themselves, all of the Class E Notes are entitled to receive payments pari passu among<br />

themselves and all of the Subordinated Notes are entitled to receive payments pari passu among<br />

themselves. Except as otherwise described herein, the relative order of seniority of payment of the Notes<br />

on each Distribution Date is as follows: first, Class A-1 Notes, second, Class A-2 Notes, third, Class B<br />

Notes, fourth, Class C-1 Notes, fifth, Class C-2 Notes, sixth, Class D Notes, seventh, Class E Notes and<br />

eighth, the Subordinated Notes, with (a) each Class of Notes (other than the Subordinated Notes) in such<br />

list being “Senior” to each other Class of Notes that follows such Class of Notes in such list (e.g., the<br />

Class A-1 Notes are Senior to the Class A-2 Notes, the Class B Notes, the Class C-1 Notes, the Class C-2<br />

Notes, the Class D Notes, the Class E Notes and the Subordinated Notes) and (b) each Class of Notes

(other than the Class A-1 Notes) in such list being “Subordinate” to each other Class of Notes that<br />

precedes such Class of Notes in such list (e.g., the Subordinated Notes are Subordinate to the Class A-1<br />

Notes, the Class A-2 Notes, the Class B Notes, the Class C-1 Notes, the Class C-2 Notes, the Class D<br />

Notes and the Class E Notes). Except as otherwise described herein, no payment of interest on any Class<br />

of Notes or distribution on the Subordinated Notes will be made from Interest Proceeds or Principal<br />

Proceeds until all accrued and unpaid interest on the Notes of each Class that is Senior to such Class and<br />

that remains outstanding has been paid in full. Except as otherwise described herein (and as set forth in<br />

the Priority of Payments), no payment of principal of any Class of Notes will be made until all principal<br />

of, and accrued and unpaid interest on, the Notes of each Class that is Senior to such Class and that<br />

remains outstanding has been paid in full. See “Description of the Offered Notes—Priority of Payments.”<br />

Each Holder of a Combination Note will, to the extent of any Component constituting a portion of such<br />

Combination Note, be entitled to the same rights with respect to such Component as if such Holder<br />

directly held a Note of the Class represented by such Component in a principal amount equal to the<br />

amount of such Component. Each purchaser of a Combination Note should therefore carefully review<br />

each provision of this <strong>Offering</strong> <strong>Circular</strong> applicable to such Class of Notes before deciding whether or not<br />

to purchase a Combination Note containing a Component that represents a Note of such Class.<br />

The Offered Notes are subject to optional, mandatory, auction call and tax redemption under the<br />

circumstances described under “Description of the Offered Notes—Mandatory Redemption,” “—Optional<br />

Redemption and Tax Redemption,” “—Auction Call Redemption” and “—Priority of Payments.”<br />

On each Distribution Date, to the extent funds are available therefor in accordance with the Priority of<br />

Payments, Interest Proceeds will be paid to the Holders of the Subordinated Notes only after the payment<br />

of interest on the Senior Notes and certain other amounts in accordance with the Priority of Payments.<br />

Until the Senior Notes have been paid in full, Principal Proceeds will not be available to make<br />

distributions in respect of the Subordinated Notes. After the Senior Notes have been paid in full, Interest<br />

Proceeds and Principal Proceeds remaining after all other applications under the Priority of Payments will<br />

be paid to the Holders of the Subordinated Notes on each Distribution Date. Distributions will be made in<br />

cash.<br />

The Senior Notes (other than the Class E Notes) offered by the Co-Issuers and the Class E Notes,<br />

Combination Notes and Subordinated Notes offered by the Issuer will be offered in reliance on an<br />

exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.<br />

Senior Notes sold to Qualified Purchasers that are either Qualified Institutional Buyers or Institutional<br />

Accredited Investors in reliance on the exemption from the registration requirements of the Securities Act<br />

provided by Section 4(2) and/or Rule 144A thereof will be issued in the form of one or more permanent<br />

global notes in definitive, fully registered form without interest coupons (the “Restricted Global Senior<br />

Notes”), deposited with the Trustee as custodian for, and registered in the name of, DTC or its nominee.<br />

Interests in Restricted Global Senior Notes will be shown on, and transfers thereof will be effected only<br />

through, records maintained by DTC and its Participants and Indirect Participants. The Senior Notes<br />

offered to Non-U.S. Persons outside the United States will be offered in reliance upon Regulation S under<br />

the Securities Act and will be represented by one or more global notes (“Regulation S Global Senior<br />

Notes”) in fully registered form without interest coupons deposited with the Trustee as custodian for, and<br />

registered in the name of, DTC or its nominee. Except in the limited circumstances described herein,<br />

certificated Senior Notes will not be issued in exchange for beneficial interests in a global note. See<br />

“Description of the Offered Notes—Form, Denomination, Registration and Transfer.”<br />

The Subordinated Notes will be subject to certain restrictions on transfer and will bear a legend regarding<br />

such restrictions. Subordinated Notes sold to Qualified Purchasers that are either Qualified Institutional<br />

Buyers or Accredited Investors in reliance on the exemption from the registration requirements of the<br />

Securities Act provided by Section 4(2) and/ or Rule 144A thereof will be issued in fully registered<br />

definitive form registered in the name of the legal and beneficial owner thereof (“Restricted Subordinated<br />

Notes”). Subordinated Notes offered outside the United States to persons that are not U.S. Persons will<br />

iii

initially be represented by one or more permanent global notes in definitive, fully registered form<br />

(“Regulation S Global Subordinated Notes”), and deposited with the Trustee as custodian for, and<br />

registered in the name of, DTC or its nominee, initially for the accounts of Euroclear and Clearstream,<br />

Luxembourg. See “Description of the Subordinated Notes—Form, Denomination, Registration and<br />

Transfer.”<br />

The Combination Notes will be subject to certain restrictions on transfer and will bear a legend regarding<br />

such restrictions. Combination Notes sold to Qualified Purchasers that are either Qualified Institutional<br />

Buyers or Institutional Accredited Investors in reliance on the exemption from the registration<br />

requirements of the Securities Act provided by Section 4(2) and/ or Rule 144A thereof will be issued in<br />

fully registered definitive form registered in the name of the legal and beneficial owner thereof<br />

(“Restricted Combination Notes”). Combination Notes offered outside the United States to persons that<br />

are not U.S. Persons will initially be represented by one or more permanent global notes in definitive,<br />

fully registered form (“Regulation S Global Combination Notes”), and deposited with the Trustee as<br />

custodian for, and registered in the name of, DTC or its nominee, initially for the accounts of Euroclear<br />

and Clearstream, Luxembourg. See “The Combination Notes.”<br />

____________________<br />

NOTICE TO NEW HAMPSHIRE RESIDENTS<br />

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A<br />

LICENSE HAS BEEN FILED UNDER CHAPTER 421–B OF THE NEW HAMPSHIRE REVISED<br />

STATUTES (THE “RSA”) WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A<br />

SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF<br />

NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE OF NEW<br />

HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421–B IS TRUE, COMPLETE AND<br />

NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR<br />

EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE<br />

SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR<br />

QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON,<br />

SECURITY, OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO<br />

ANY PROSPECTIVE PURCHASER, CUSTOMER, OR CLIENT ANY REPRESENTATION<br />

INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.<br />

____________________<br />

NO PERSON IS AUTHORIZED IN CONNECTION WITH ANY OFFERING MADE HEREBY TO<br />

GIVE ANY INFORMATION OR MAKE ANY REPRESENTATION OTHER THAN AS CONTAINED<br />

HEREIN AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT<br />

BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE ISSUER, THE CO-ISSUER, THE<br />

COLLATERAL MANAGER, THE INITIAL PURCHASER OR ANY HEDGE COUNTERPARTY OR<br />

ANY OF THEIR RESPECTIVE AFFILIATES. THIS OFFERING CIRCULAR DOES NOT<br />

CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, (A) ANY<br />

SECURITIES OTHER THAN THE OFFERED NOTES OR (B) ANY OFFERED NOTE IN ANY<br />

JURISDICTION IN WHICH IT IS UNLAWFUL FOR SUCH PERSON TO MAKE SUCH AN OFFER<br />

OR SOLICITATION. THE DISTRIBUTION OF THIS OFFERING CIRCULAR AND THE<br />

OFFERING OF THE OFFERED NOTES IN CERTAIN JURISDICTIONS MAY BE RESTRICTED BY<br />

LAW. PERSONS INTO WHOSE POSSESSION THIS OFFERING CIRCULAR COMES ARE<br />

REQUIRED BY THE CO-ISSUERS AND THE INITIAL PURCHASER TO INFORM THEMSELVES<br />

ABOUT, AND TO OBSERVE, ANY SUCH RESTRICTIONS. IN PARTICULAR, THERE ARE<br />

RESTRICTIONS ON THE DISTRIBUTION OF THIS OFFERING CIRCULAR, AND THE OFFER<br />

AND SALE OF OFFERED NOTES, IN THE UNITED STATES OF AMERICA, THE UNITED<br />

KINGDOM AND THE CAYMAN ISLANDS. SEE “PLAN OF DISTRIBUTION.” NEITHER THE<br />

iv

DELIVERY OF THIS OFFERING CIRCULAR NOR THE SALE OF ANY OFFERED NOTE<br />

OFFERED HEREBY SHALL UNDER ANY CIRCUMSTANCES IMPLY THAT THERE HAS BEEN<br />

NO CHANGE IN THE AFFAIRS OF THE CO-ISSUERS OR THAT THE INFORMATION HEREIN IS<br />

CORRECT AS OF ANY DATE SUBSEQUENT TO THE DATE AS OF WHICH SUCH<br />

INFORMATION IS GIVEN HEREIN. THE CO-ISSUERS AND THE INITIAL PURCHASER<br />

RESERVE THE RIGHT, FOR ANY REASON, TO REJECT ANY OFFER TO PURCHASE IN<br />

WHOLE OR IN PART, TO ALLOT TO ANY OFFEREE LESS THAN THE FULL AMOUNT OF<br />

OFFERED NOTES SOUGHT BY SUCH OFFEREE OR TO SELL LESS THAN THE AGGREGATE<br />

STATED PRINCIPAL AMOUNT OF ANY CLASS OF NOTES.<br />

____________________<br />

THE OFFERED NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE<br />

SECURITIES ACT OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR<br />

ANY OTHER JURISDICTION. THE OFFERED NOTES ARE TO BE PURCHASED FOR<br />

INVESTMENT ONLY AND MAY NOT BE SOLD, PLEDGED OR OTHERWISE TRANSFERRED<br />

BY AN INVESTOR DIRECTLY OR INDIRECTLY EXCEPT PURSUANT TO AN EXEMPTION<br />

FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. PROSPECTIVE<br />

PURCHASERS ARE HEREBY NOTIFIED THAT THE SELLER OF ANY OFFERED NOTE MAY BE<br />

RELYING ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF SECTION 5<br />

OF THE SECURITIES ACT PROVIDED BY RULE 144A THEREUNDER (“RULE 144A”) OR<br />

ANOTHER EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES<br />

ACT. FOR CERTAIN RESTRICTIONS ON RESALE, SEE “DESCRIPTION OF THE OFFERED<br />

NOTES—FORM, DENOMINATION, REGISTRATION AND TRANSFER,” AND “TRANSFER<br />

RESTRICTIONS.” A TRANSFER OF OFFERED NOTES IS SUBJECT TO THE RESTRICTIONS<br />

DESCRIBED HEREIN, INCLUDING THAT NO SALE, PLEDGE, TRANSFER OR EXCHANGE<br />

MAY BE MADE OF AN OFFERED NOTE (1) EXCEPT AS PERMITTED UNDER (A) THE<br />

SECURITIES ACT PURSUANT TO AN EXEMPTION FROM REGISTRATION AS DESCRIBED<br />

HEREIN, (B) APPLICABLE STATE SECURITIES LAWS AND (C) APPLICABLE SECURITIES<br />

LAWS OF ANY OTHER JURISDICTION, (2) EXCEPT IN COMPLIANCE WITH THE<br />

CERTIFICATION AND OTHER REQUIREMENTS SET FORTH IN THE INDENTURE AND (3) IN<br />

A DENOMINATION LESS THAN THE REQUIRED MINIMUM DENOMINATION. THE OFFERED<br />

NOTES ARE SUBJECT TO FURTHER RESTRICTIONS ON TRANSFER. SEE “TRANSFER<br />

RESTRICTIONS.”<br />

NONE OF THE ISSUER, THE CO-ISSUER OR THE POOL OF COLLATERAL HAS BEEN<br />

REGISTERED UNDER THE U.S. INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE<br />

“INVESTMENT COMPANY ACT”), BY REASON OF THE EXEMPTION FROM REGISTRATION<br />

CONTAINED IN SECTION 3(c)(7) THEREOF. NO TRANSFER OF OFFERED NOTES WHICH<br />

WOULD HAVE THE EFFECT OF REQUIRING THE ISSUER, THE CO-ISSUER OR THE POOL OF<br />

COLLATERAL TO REGISTER AS AN INVESTMENT COMPANY UNDER THE INVESTMENT<br />

COMPANY ACT WILL BE PERMITTED. ANY TRANSFER OF A DEFINITIVE NOTE MAY BE<br />

EFFECTED ONLY ON THE NOTE REGISTER MAINTAINED BY THE NOTE REGISTRAR<br />

PURSUANT TO THE INDENTURE. ANY TRANSFER OF AN INTEREST IN A GLOBAL NOTE<br />

WILL BE SHOWN ON, AND TRANSFERS THEREOF WILL BE EFFECTED ONLY THROUGH,<br />

RECORDS MAINTAINED BY DTC AND ITS PARTICIPANTS AND INDIRECT PARTICIPANTS<br />

(INCLUDING, WITHOUT LIMITATION, IN THE CASE OF THE REGULATION S GLOBAL<br />

SENIOR NOTE OR REGULATION S GLOBAL SUBORDINATED NOTE, EUROCLEAR AND<br />

CLEARSTREAM, LUXEMBOURG).<br />

EACH PURCHASER AND TRANSFEREE OF A SENIOR NOTE (OTHER THAN A CLASS E NOTE<br />

OR A SENIOR NOTE IN THE FORM OF A SENIOR NOTE COMPONENT OF ANY<br />

COMBINATION NOTE) WILL BE REQUIRED TO REPRESENT AND WARRANT (OR, IN<br />

CERTAIN CIRCUMSTANCES, BE DEEMED TO REPRESENT AND WARRANT) EITHER THAT<br />

v

(A) IT IS NOT (AND FOR SO LONG AS IT HOLDS SUCH NOTE WILL NOT BE), AND IS NOT<br />

ACTING ON BEHALF OF (AND FOR SO LONG AS IT HOLDS SUCH NOTE WILL NOT BE<br />

ACTING ON BEHALF OF), AN “EMPLOYEE BENEFIT PLAN” AS DEFINED IN SECTION 3(3) OF<br />

THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974, AS AMENDED (“ERISA”),<br />

WHICH IS SUBJECT TO TITLE I OF ERISA, A “PLAN” DESCRIBED IN SECTION 4975(e)(1) OF<br />

THE U.S. INTERNAL REVENUE CODE OF 1986, AS AMENDED (THE “CODE”), AN ENTITY<br />

WHICH IS DEEMED TO HOLD THE PLAN ASSETS OF ANY OF THE FOREGOING BY REASON<br />

OF INVESTMENT BY AN “EMPLOYEE BENEFIT PLAN” OR “PLAN” IN THE ENTITY OR A<br />

GOVERNMENTAL PLAN WHICH IS SUBJECT TO ANY FEDERAL, STATE OR LOCAL LAW<br />

THAT IS SUBSTANTIALLY SIMILAR TO THE PROHIBITED TRANSACTION PROVISIONS OF<br />

SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE (“SIMILAR LAW”), OR (B) ITS<br />

PURCHASE AND OWNERSHIP OF SUCH NOTE WILL NOT RESULT IN A NON-EXEMPT<br />

PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR SECTION 4975 OF THE<br />

CODE (OR, IN THE CASE OF A GOVERNMENTAL PLAN, ANY SIMILAR LAW).<br />

THE ACQUISITION OF A RESTRICTED SUBORDINATED NOTE OR A CLASS E NOTE BY, OR<br />

ON BEHALF OF, OR WITH THE ASSETS OF (A) ANY “EMPLOYEE BENEFIT PLAN” AS<br />

DEFINED IN SECTION 3(3) OF THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF<br />

1974, AS AMENDED (“ERISA”), WHETHER OR NOT SUCH PLAN IS SUBJECT TO TITLE I OF<br />

ERISA, INCLUDING, WITHOUT LIMITATION, FOREIGN, CHURCH AND GOVERNMENTAL<br />

PLANS, (B) ANY “PLAN” DESCRIBED IN SECTION 4975(e)(1) OF THE INTERNAL REVENUE<br />

CODE OF 1986, AS AMENDED (THE “CODE”), (C) ANY ENTITY WHOSE UNDERLYING<br />

ASSETS WOULD BE DEEMED TO INCLUDE “PLAN ASSETS” BY REASON OF THE<br />

INVESTMENT BY AN EMPLOYEE BENEFIT PLAN OR OTHER PLAN IN THE ENTITY WITHIN<br />

THE MEANING OF 29 C.F.R. SECTION 2510.3-101 OR OTHERWISE (EACH OF THE<br />

FOREGOING, A “BENEFIT PLAN INVESTOR”), OR (D) THE ISSUER, THE INITIAL<br />

PURCHASER, THE COLLATERAL MANAGER OR ANY OTHER PERSON (OTHER THAN A<br />

BENEFIT PLAN INVESTOR) THAT HAS DISCRETIONARY AUTHORITY OR CONTROL WITH<br />

RESPECT TO THE ASSETS OF THE ISSUER OR A PERSON WHO PROVIDES INVESTMENT<br />

ADVICE FOR A FEE (DIRECT OR INDIRECT) WITH RESPECT TO THE ASSETS OF THE<br />

ISSUER, OR ANY “AFFILIATE” (AS DEFINED IN 29 C.F.R. SECTION 2510.3-101(f)(3)) OF ANY<br />

SUCH PERSON (EACH A “CONTROLLING PERSON”) WILL NOT BE EFFECTIVE, AND THE<br />

ISSUER, THE TRUSTEE, THE TRANSFER AGENT AND THE NOTE REGISTRAR WILL NOT<br />

RECOGNIZE SUCH ACQUISITION, IF SUCH ACQUISITION WOULD RESULT IN (1) BENEFIT<br />

PLAN INVESTORS OWNING 25% OR MORE OF ANY SUCH CLASS OF NOTES (INCLUDING<br />

THE SUBORDINATED NOTE COMPONENT OF ANY COMBINATION NOTE AND THE<br />

REGULATION S SUBORDINATED NOTES AND CLASS E NOTES ACQUIRED ON THE<br />

CLOSING DATE BY CERTAIN PLANS (“PERMITTED PLANS”) THAT OBTAINED THE PRIOR<br />

WRITTEN CONSENT OF THE ISSUER) OR (2) A NONEXEMPT PROHIBITED TRANSACTION<br />

UNDER SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE (OR, IN THE CASE OF A<br />

GOVERNMENTAL, FOREIGN OR CHURCH PLAN, ANY SUBSTANTIALLY SIMILAR FEDERAL,<br />

STATE, FOREIGN OR LOCAL LAW).<br />

NO REGULATION S SUBORDINATED NOTE OR CLASS E NOTE MAY BE ACQUIRED BY, OR<br />

ON BEHALF OF, OR WITH THE ASSETS OF, ANY BENEFIT PLAN INVESTOR OR<br />

CONTROLLING PERSON. NOTWITHSTANDING THE FOREGOING, PERMITTED PLANS THAT<br />

HAVE OBTAINED THE PRIOR WRITTEN CONSENT OF THE ISSUER WILL BE PERMITTED TO<br />

PURCHASE REGULATION S SUBORDINATED NOTES ON THE CLOSING DATE. EACH<br />

PERMITTED PLAN WILL BE DEEMED TO REPRESENT, WARRANT AND COVENANT THAT<br />

EITHER (I) ITS PURCHASE, HOLDING AND DISPOSITION OF SUCH NOTE WILL NOT RESULT<br />

IN A NONEXEMPT PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR<br />

SECTION 4975 OF THE CODE (OR, IN THE CASE OF A GOVERNMENTAL, FOREIGN OR<br />

CHURCH PLAN, ANY SUBSTANTIALLY SIMILAR FEDERAL, STATE, FOREIGN OR LOCAL<br />

LAW) OR (II) IT IS (A) AN EMPLOYEE BENEFIT PLAN MAINTAINED OUTSIDE OF THE<br />

vi

UNITED STATES PRIMARILY FOR THE BENEFIT OF PERSONS SUBSTANTIALLY ALL OF<br />

WHOM ARE NONRESIDENT ALIENS OF THE UNITED STATES AND NOT SUBJECT TO ERISA<br />

OR SECTION 4975 OF THE CODE AND (B) NOT SUBJECT TO ANY LAW, RULE OR<br />

REGULATION IN THE JURISDICTION IN WHICH SUCH EMPLOYEE BENEFIT PLAN WAS<br />

ESTABLISHED OR IS MAINTAINED THAT WOULD, AS A RESULT OF ITS PURCHASE,<br />

HOLDING OR DISPOSITION OF SUCH NOTE OR AN INTEREST THEREIN, SUBJECT THE<br />

ISSUER TO ANY OBLIGATION OR LIABILITY (OTHER THAN THOSE CONTEMPLATED BY<br />

THE INDENTURE), PENALTY OR TAX.<br />

EACH PURCHASER AND TRANSFEREE OF A COMBINATION NOTE WILL BE REQUIRED TO<br />

REPRESENT AND WARRANT THAT IT IS NOT (AND FOR SO LONG AS IT HOLDS SUCH<br />

COMBINATION NOTE OR AN INTEREST THEREIN WILL NOT BE), AND IS NOT ACTING ON<br />

BEHALF OF (AND FOR SO LONG AS IT HOLDS SUCH COMBINATION NOTE OR AN<br />

INTEREST THEREIN WILL NOT BE ACTING ON BEHALF OF) (A) AN “EMPLOYEE BENEFIT<br />

PLAN” AS DEFINED IN SECTION 3(3) OF ERISA, WHETHER OR NOT SUCH PLAN IS SUBJECT<br />

TO ERISA, INCLUDING, WITHOUT LIMITATION, FOREIGN AND GOVERNMENTAL PLANS,<br />

(B) A “PLAN” DESCRIBED IN SECTION 4975(e)(1) OF THE CODE, (C) AN ENTITY WHOSE<br />

UNDERLYING ASSETS WOULD BE DEEMED TO INCLUDE “PLAN ASSETS” BY REASON OF<br />

THE INVESTMENT BY AN EMPLOYEE BENEFIT PLAN OR OTHER PLAN IN THE ENTITY<br />

WITHIN THE MEANING OF 29 C.F.R. SECTION 2510.3-101 OR OTHERWISE (EACH OF THE<br />

FOREGOING A “BENEFIT PLAN INVESTOR”), OR (D) THE ISSUER, THE CO-ISSUER, THE<br />

INITIAL PURCHASER, THE COLLATERAL MANAGER OR ANY OTHER PERSON (OTHER<br />

THAN A BENEFIT PLAN INVESTOR) THAT HAS DISCRETIONARY AUTHORITY OR<br />

CONTROL WITH RESPECT TO THE ASSETS OF THE ISSUER OR THE CO-ISSUER OR A<br />

PERSON WHO PROVIDES INVESTMENT ADVICE FOR A FEE (DIRECT OR INDIRECT) WITH<br />

RESPECT TO THE ASSETS OF THE ISSUER OR THE CO-ISSUER, OR ANY “AFFILIATE” (AS<br />

DEFINED IN 29 C.F.R. SECTION 2510.3-101(f)(3)) OF ANY SUCH PERSON.<br />

____________________<br />

THE OFFERED NOTES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED<br />

STATES SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES<br />

COMMISSION OR OTHER REGULATORY AUTHORITY OF ANY STATE OR OTHER<br />

JURISDICTION, AND NONE OF THE FOREGOING AUTHORITIES HAS CONFIRMED THE<br />

ACCURACY OR DETERMINED THE ADEQUACY OF THIS OFFERING CIRCULAR. ANY<br />

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.<br />

____________________<br />

This <strong>Offering</strong> <strong>Circular</strong> (this “<strong>Offering</strong> <strong>Circular</strong>”) has been prepared by the Co-Issuers solely for use in<br />

connection with the offering of the Offered Notes described herein (the “<strong>Offering</strong>”) and for listing<br />

purposes. The Co-Issuers accept responsibility for the information contained in this <strong>Offering</strong> <strong>Circular</strong><br />

(excluding the information appearing in the section “The Collateral Manager” and “Risk Factors—<br />

Conflicts of Interest Involving the Collateral Manager”). To the best knowledge and belief of the Co-<br />

Issuers, the information contained herein is in accordance with the facts and does not omit anything likely<br />

to affect the import of such information. The Co-Issuers accept responsibility accordingly. The Co-<br />

Issuers disclaim any obligation to update such information and do not intend to do so. Neither the Initial<br />

Purchaser nor any of its affiliates makes any representation or warranty as to, or has independently<br />

verified or assumes any responsibility for, the accuracy or completeness of the information contained<br />

herein. Neither the Initial Purchaser nor any of its affiliates has independently verified any such<br />

information or assumes any responsibility for its accuracy or completeness. To the best knowledge and<br />

belief of the Collateral Manager, the information contained in the sections entitled “The Collateral<br />

Manager” and “Risk Factors—Conflicts of Interest Involving the Collateral Manager” are in accordance<br />

with the material facts and do not omit material facts likely to affect the import of such information.<br />

vii

Neither the Collateral Manager nor any of its affiliates makes any representation or warranty as to, or has<br />

independently verified or assumes any responsibility for, the accuracy and completeness of the<br />

information contained herein other than the information appearing in the sections entitled “The Collateral<br />

Manager” or “Risk Factors—Conflicts of Interest Involving the Collateral Manager.” The Collateral<br />

Manager disclaims any obligation to update such information and does not intend to do so. Neither the<br />

Hedge Counterparties nor any of their respective affiliates makes any representation or warranty as to, has<br />

independently verified or assumes any responsibility for, the accuracy and completeness of the<br />

information contained herein. Each Hedge Counterparty disclaims any obligation to update any<br />

information herein and does not intend to do so. Nothing contained in this <strong>Offering</strong> <strong>Circular</strong> is or should<br />

be relied upon as a promise or representation as to future results or events. The Trustee has not<br />

participated in the preparation of this <strong>Offering</strong> <strong>Circular</strong> and assumes no responsibility for its contents.<br />

This <strong>Offering</strong> <strong>Circular</strong> contains summaries of certain documents and of the terms of the Collateral Debt<br />

Securities. The summaries do not purport to be complete, contain generalizations and are qualified in<br />

their entirety by reference to such documents, copies of which will be made available to offerees upon<br />

request. Requests and inquiries regarding this <strong>Offering</strong> <strong>Circular</strong> or such documents should be directed to<br />

Credit Suisse Securities (USA) LLC, 11 Madison Avenue, New York, New York 10010, Attention: The<br />

<strong>CDO</strong> Group.<br />

The Co-Issuers will make available to any offeree of the Offered Notes, prior to the issuance thereof, the<br />

opportunity to ask questions of and to receive answers from the Co-Issuers or a person acting on their<br />

behalf concerning the terms and conditions of the <strong>Offering</strong>, the Co-Issuers or any other relevant matters<br />

and to obtain any additional information to the extent the Co-Issuers possess such information or can<br />

obtain it without unreasonable expense.<br />

Each purchaser of an Offered Note offered or sold in the United States or to a U.S. Person will be<br />

required (or, in certain circumstances relating to the offer and a sale of a Senior Note, deemed) to<br />

represent to the Issuer, the Co-Issuer (in the case of a Senior Note other than a Class E Note), the Trustee<br />

and the Initial Purchaser that it is a “qualified purchaser,” as such term is defined for purposes of Section<br />

3(c)(7) of the Investment Company Act (each, a “Qualified Purchaser”) that is either (a) a qualified<br />

institutional buyer, as defined in Rule 144A under the Securities Act (each, a “Qualified Institutional<br />

Buyer”), purchasing for its own account, to whom notice is given that the resale, pledge or other transfer<br />

is being made in reliance on the exemption from the registration requirements of the Securities Act<br />

provided by Rule 144A or (b) in the case of an initial purchaser of a Senior Note, an institutional<br />

“accredited investor” as defined in Rule 501(a)(1), (2), (3) or (7) of Regulation D under the Securities Act<br />

(each, an “Institutional Accredited Investor”) or in the case of a purchaser of a Subordinated Note, an<br />

“accredited investor” as defined in Rule 501(a) of Regulation D under the Securities Act (each, an<br />

“Accredited Investor”). Each purchaser of an Offered Note offered and sold in reliance on Regulation S<br />

will be required (or, in certain circumstances be deemed) to represent to the Issuer, the Co-Issuer (in the<br />

case of a Senior Note other than a Class E Note), the Trustee and the Initial Purchaser that it is not a U.S.<br />

Person, as such term is defined in Regulation S (a “U.S. Person”), and is acquiring the Offered Note in an<br />

offshore transaction in accordance with Regulation S, for its own account and not for the account or<br />

benefit of a U.S. Person. Each purchaser of an Offered Note will also be required (or, in certain<br />

circumstances, be deemed) to acknowledge that the Offered Notes have not been and will not be<br />

registered under the Securities Act and may not be reoffered, resold, pledged or otherwise transferred<br />

except (a) to (i) a Qualified Purchaser that the transferor reasonably believes is (1) a Qualified<br />

Institutional Buyer purchasing for its own account, to whom notice is given that the resale, pledge or<br />

other transfer is being made in reliance on the exemption from Securities Act registration provided by<br />

Rule 144A, or, in the case of the Subordinated Notes, (2) an Accredited Investor, purchasing for its own<br />

account, to whom notice is given that the transfer is being made in reliance on an exemption from the<br />

registration requirements of the Securities Act (subject to the delivery of such certifications, legal<br />

opinions or other information as the Issuer may reasonably require to confirm that such transfer of<br />

Restricted Subordinated Notes is being made pursuant to an exemption from, or in a transaction not<br />

subject to, the registration requirements of the Securities Act), or (ii) a person that is not a “U.S. person”<br />

viii

as defined in Regulation S under the Securities Act, and is acquiring the Offered Notes in reliance on the<br />

exemption from registration provided by Regulation S thereunder, (b) in compliance with the<br />

certification, if any, and other requirements set forth in the Indenture and (c) in accordance with any<br />

applicable securities laws of any state of the United States and any other relevant jurisdiction. For a<br />

description of these and certain other restrictions on offers and sales of the Offered Notes and distribution<br />

of this <strong>Offering</strong> <strong>Circular</strong>, see “Transfer Restrictions.”<br />

Although the Initial Purchaser may from time to time make a market in any Class of Notes, the Initial<br />

Purchaser is under no obligation to do so. In the event that the Initial Purchaser commences any marketmaking,<br />

the Initial Purchaser may discontinue such market-making at any time. There can be no<br />

assurance that a secondary market for any Class of Notes will develop, or if a secondary market does<br />

develop, that it will provide the Holders of such Class of Notes with liquidity of investment or that it will<br />

continue for the life of such Class of Notes.<br />

____________________<br />

THIS OFFERING CIRCULAR IS FOR INFORMATION PURPOSES ONLY AND IS NOT<br />

INTENDED TO BE RELIED UPON ALONE AS THE BASIS FOR AN INVESTMENT DECISION.<br />

IN MAKING AN INVESTMENT DECISION, PROSPECTIVE INVESTORS MUST RELY ON THEIR<br />

OWN EXAMINATION OF THE CO-ISSUERS AND THE TERMS OF THE OFFERING,<br />

INCLUDING THE MERITS AND RISKS INVOLVED AND MUST NOT RELY UPON<br />

INFORMATION PROVIDED BY OR STATEMENTS MADE BY THE INITIAL PURCHASER, THE<br />

COLLATERAL MANAGER OR ANY OF THEIR RESPECTIVE AFFILIATES. INVESTORS<br />

SHOULD BE AWARE THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF<br />

AN INVESTMENT IN OFFERED NOTES FOR AN INDEFINITE PERIOD OF TIME.<br />

NONE OF THE ISSUER, THE CO-ISSUER, THE COLLATERAL MANAGER, THE INITIAL<br />

PURCHASER OR THEIR RESPECTIVE AFFILIATES MAKES ANY REPRESENTATION TO ANY<br />

OFFEREE OR PURCHASER OF OFFERED NOTES REGARDING THE LEGALITY OF<br />

INVESTMENT THEREIN BY SUCH OFFEREE OR PURCHASER UNDER APPLICABLE LEGAL<br />

INVESTMENT OR SIMILAR LAWS OR REGULATIONS OR THE PROPER CLASSIFICATION OF<br />

SUCH AN INVESTMENT THEREUNDER.<br />

THE CONTENTS OF THIS OFFERING CIRCULAR ARE NOT TO BE CONSTRUED AS LEGAL,<br />

ACCOUNTING, BUSINESS OR TAX ADVICE. EACH PROSPECTIVE INVESTOR SHOULD<br />

CONSULT ITS OWN ATTORNEY, ACCOUNTANT, BUSINESS ADVISOR AND TAX ADVISOR<br />

AS TO LEGAL, ACCOUNTING, BUSINESS AND TAX ADVICE.<br />

____________________<br />

In this <strong>Offering</strong> <strong>Circular</strong>, references to “U.S. Dollars,” “Dollars” and “U.S.$” are to United States dollars.<br />

____________________<br />

This <strong>Offering</strong> <strong>Circular</strong> constitutes a prospectus (the “Prospectus”) for the purposes of Directive<br />

2003/71/EC (the “Prospectus Directive”). References throughout this document to the “<strong>Offering</strong> <strong>Circular</strong>”<br />

shall be taken to read “Prospectus” for such purpose. Application has been made to the <strong>Irish</strong> Financial<br />

Services Regulatory Authority (the “Financial Regulator in Ireland”), as competent authority under the<br />

Prospectus Directive, for the Prospectus to be approved. Application has been made to the <strong>Irish</strong> <strong>Stock</strong><br />

<strong>Exchange</strong> for the Offered Notes to be admitted to the Official List and to trading on its regulated market.<br />

There can be no assurance that such admission will be granted. No application will be made to list the<br />

Notes on any other stock exchange.<br />

ix

____________________<br />

Offers, sales and deliveries of the Offered Notes are subject to certain restrictions in the United States, the<br />

United Kingdom, the Cayman Islands and other jurisdictions. See “Plan of Distribution” and “Transfer<br />

Restrictions.”<br />

____________________<br />

No invitation may be made to the public in the Cayman Islands to subscribe for the Offered Notes.<br />

____________________<br />

NOTICE TO CONNECTICUT RESIDENTS<br />

THE OFFERED NOTES HAVE NOT BEEN REGISTERED UNDER THE CONNECTICUT<br />

SECURITIES LAW. THE OFFERED NOTES ARE SUBJECT TO RESTRICTIONS ON<br />

TRANSFERABILITY AND SALE.<br />

____________________<br />

NOTICE TO FLORIDA RESIDENTS<br />

THE OFFERED NOTES OFFERED HEREBY WILL BE SOLD TO, AND ACQUIRED BY, THE<br />

HOLDER IN A TRANSACTION EXEMPT UNDER SECTION 517.061 OF THE FLORIDA<br />

SECURITIES ACT (“FSA”). THE OFFERED NOTES HAVE NOT BEEN REGISTERED UNDER<br />

SAID ACT IN THE STATE OF FLORIDA. IN ADDITION, IF SALES ARE MADE TO FIVE OR<br />

MORE PERSONS IN FLORIDA, ALL FLORIDA PURCHASERS OTHER THAN EXEMPT<br />

INSTITUTIONS SPECIFIED IN SECTION 517.061(7) OF THE FSA SHALL HAVE THE PRIVILEGE<br />

OF VOIDING THE PURCHASE WITHIN THREE (3) DAYS AFTER THE FIRST TENDER OF<br />

CONSIDERATION IS MADE BY SUCH PURCHASER TO THE CO-ISSUERS, AN AGENT OF THE<br />

CO-ISSUERS, OR AN ESCROW AGENT.<br />

____________________<br />

NOTICE TO GEORGIA RESIDENTS<br />

THE OFFERED NOTES HAVE BEEN ISSUED OR SOLD IN RELIANCE ON PARAGRAPH (13) OF<br />

CODE SECTION 10-5-9 OF THE GEORGIA SECURITIES ACT OF 1973, AND MAY NOT BE SOLD<br />

OR TRANSFERRED EXCEPT IN A TRANSACTION WHICH IS EXEMPT UNDER SUCH ACT OR<br />

PURSUANT TO AN EFFECTIVE REGISTRATION UNDER SUCH ACT.<br />

____________________<br />

NOTICE TO RESIDENTS OF AUSTRALIA<br />

NO PROSPECTUS, DISCLOSURE DOCUMENT, OFFERING MATERIAL OR ADVERTISEMENT<br />

IN RELATION TO THE OFFERED NOTES HAS BEEN LODGED WITH THE AUSTRALIAN<br />

SECURITIES AND INVESTMENTS COMMISSION OR THE AUSTRALIAN STOCK EXCHANGE<br />

LIMITED. ACCORDINGLY, A PERSON MAY NOT (A) MAKE, OFFER OR INVITE<br />

APPLICATIONS FOR THE ISSUE, SALE OR PURCHASE OF THE OFFERED NOTES WITHIN, TO<br />

OR FROM AUSTRALIA (INCLUDING AN OFFER OR INVITATION WHICH IS RECEIVED BY A<br />

PERSON IN AUSTRALIA) OR (B) DISTRIBUTE OR PUBLISH THIS OFFERING CIRCULAR OR<br />

ANY OTHER PROSPECTUS, DISCLOSURE DOCUMENT, OFFERING MATERIAL OR<br />

ADVERTISEMENT RELATING TO THE OFFERED NOTES IN AUSTRALIA, UNLESS (I) THE<br />

MINIMUM AGGREGATE CONSIDERATION PAYABLE BY EACH OFFEREE IS THE U.S.<br />

x

DOLLAR EQUIVALENT OF AT LEAST A$500,000 (DISREGARDING MONEYS LENT BY THE<br />

OFFEROR OR ITS ASSOCIATES) OR THE OFFER OTHERWISE DOES NOT REQUIRE<br />

DISCLOSURE TO INVESTORS IN ACCORDANCE WITH PART 6D.2 OF THE CORPORATIONS<br />

ACT 2001 (CWLTH) OF AUSTRALIA; AND (II) SUCH ACTION COMPLIES WITH ALL<br />

APPLICABLE LAWS AND REGULATIONS.<br />

____________________<br />

NOTICE TO RESIDENTS OF AUSTRIA<br />

THIS OFFERING CIRCULAR IS CIRCULATED IN AUSTRIA FOR THE SOLE PURPOSE OF<br />

PROVIDING INFORMATION ABOUT THE OFFERED NOTES TO A LIMITED NUMBER OF<br />

SOPHISTICATED INVESTORS IN AUSTRIA. THIS OFFERING CIRCULAR IS MADE<br />

AVAILABLE ON THE CONDITION THAT IT IS SOLELY FOR THE USE OF THE RECIPIENT AS<br />

A SOPHISTICATED, POTENTIAL AND INDIVIDUALLY SELECTED INVESTOR AND MAY NOT<br />

BE PASSED ON TO ANY OTHER PERSON OR REPRODUCED IN WHOLE OR IN PART. THIS<br />

OFFERING CIRCULAR DOES NOT CONSTITUTE A PUBLIC OFFERING (ÖFFENTLICHES<br />

ANGEBOT) IN AUSTRIA AND MUST NOT BE USED IN CONJUNCTION WITH A PUBLIC<br />

OFFERING PURSUANT TO THE CAPITAL MARKET ACT (KAPITALMARKTGESETZ) AND/OR<br />

THE INVESTMENT FUND ACT (INVESTMENTFONDSGESETZ) IN AUSTRIA.<br />

CONSEQUENTLY, NO PUBLIC OFFERS OR PUBLIC SALES MUST BE MADE IN AUSTRIA IN<br />

RESPECT OF THE OFFERED NOTES. THE OFFERED NOTES ARE NOT REGISTERED IN<br />

AUSTRIA. IN CASE THE OFFERED NOTES ARE QUALIFIED AS SHARES IN A FOREIGN<br />

INVESTMENT FUND WITHIN THE MEANING OF THE INVESTMENT FUND ACT, THEY<br />

MIGHT BE SUBJECT TO A LESS FAVOURABLE TAX TREATMENT THAN SHARES IN<br />

INVESTMENT FUNDS ESTABLISHED IN AUSTRIA UNDER THE INVESTMENT FUND ACT.<br />

ALL PROSPECTIVE INVESTORS ARE URGED TO SEEK INDEPENDENT TAX ADVICE. THE<br />

INITIAL PURCHASER AND ITS AFFILIATES DO NOT GIVE TAX ADVICE.<br />

ANMERKUNG FÜR EINWOHNER VON ÖSTERREICH<br />

DIESER PROSPEKT WIRD IN ÖSTERREICH NUR ZU DEM ZWECK HERAUSGEGEBEN, UM<br />

EINER BESCHRÄNKTEN ANZAHL VON PROFESSIONELLEN MARKTTEILNEHMERN IN<br />

ÖSTERREICH INFORMATIONEN ÜBER DIE ANGEBOTENEN WERTPAPIERE ZU GEBEN.<br />

DIESER PROSPEKT WIRD UNTER DER BEDINGUNG ZUR VERFÜGUNG GESTELLT, DASS<br />

DIESER PROSPEKT AUSSCHLIESSLICH VOM EMPFÄNGER ALS EINEM PROFESSIONELLEN<br />

POTENTIELLEN UND EINZELN AUSGEWÄHLTEN ANLEGER VERWENDET WIRD UND ER<br />

DARF NICHT AN EINE ANDERE PERSON WEITERGEGEBEN ODER TEILWEISE ODER<br />

VOLLSTÄNDIG REPRODUZIERT WERDEN. DIESER PROSPEKT STELLT KEIN<br />

ÖFFENTLICHES ANGEBOT IN ÖSTERREICH DAR UND DARF NICHT IN ZUSAMMENHANG<br />

MIT EINEM ÖFFENTLICHEN ANGEBOT IN ÖSTERREICH IM SINNE DES<br />

KAPITALMARKTGESETZES UND/ODER DES INVESTMENTFONDSGESETZES VERWENDET<br />

WERDEN. FOLGLICH DÜRFEN IN ÖSTERREICH KEINE ÖFFENTLICHEN ANGEBOTE ODER<br />

VERKÄUFE DER ANGEBOTENEN WERTPAPIEREN DURCHGEFÜHRT WERDEN. DIE<br />

WERTPAPIERE SIND NICHT IN ÖSTERREICH ZUGELASSEN. SOLLTEN DIE WERTPAPIERE<br />

ALS ANTEILE AN EINEM AUSLÄNDISCHEN INVESTMENTFONDS QUALIFIZIERT WERDEN,<br />

KÖNNTEN SIE EINER UNGÜNSTIGEREN BESTEUERUNG ALS ANTEILE AN IN ÖSTERREICH<br />

GEMÄSS DEM INVESTMENTFONDSGESETZ ERRICHTETEN INVESTMENTFONDS<br />

UNTERLIEGEN. ALLE KÜNFTIGEN ANLEGER WERDEN DAHER AUFGEFORDERT,<br />

UNABHÄNGIGE STEUERBERATUNG EINZUHOLEN. DER ERSTKÄUFER UND DIE MIT IHM<br />

VERBUNDENEN UNTERNEHMEN ERTEILEN KEINE STEUERLICHE BERATUNG.<br />

xi

____________________<br />

NOTICE TO RESIDENTS OF BAHRAIN<br />

EACH OF THE CO–ISSUERS, THE COLLATERAL MANAGER AND THE INITIAL PURCHASER<br />

REPRESENTS AND WARRANTS THAT IT HAS NOT MADE AND WILL NOT MAKE ANY<br />

INVITATION TO THE PUBLIC IN THE STATE OF BAHRAIN TO SUBSCRIBE FOR THE<br />

OFFERED NOTES AND THAT THE DOCUMENT WILL NOT BE ISSUED, PASSED TO, OR<br />

MADE AVAILABLE TO THE PUBLIC GENERALLY.<br />

____________________<br />

NOTICE TO RESIDENTS OF BELGIUM<br />

THE OFFERED NOTES MAY NOT BE OFFERED, SOLD, TRANSFERRED OR DELIVERED IN OR<br />

FROM BELGIUM AS PART OF THEIR INITIAL DISTRIBUTION OR AT ANY TIME<br />

THEREAFTER, DIRECTLY OR INDIRECTLY, UNLESS THEY SHALL EACH HAVE A NOMINAL<br />

AMOUNT OF EUR 50,000 OR MORE.<br />

ANY OFFER TO SELL OR SALE OF OFFERED NOTES MUST BE MADE IN COMPLIANCE WITH<br />

THE PROVISIONS OF THE LAW OF JULY 14, 1991 ON CONSUMER PROTECTION AND TRADE<br />

PRACTICES (“SUR LES PRATIQUES DU COMMERCE ET SUR L'INFORMATION ET LA<br />

PROTECTION DU CONSOMMATEUR”/”BETREFFENDE DE HANDELSPRAKTIJKEN EN DE<br />

VOORLICHTING EN BESCHERMING VAN DE CONSUMENT”), TO THE EXTENT APPLICABLE<br />

PURSUANT TO THE ROYAL DECREE OF DECEMBER 5, 2000 “RENDANT APPLICABLES AUX<br />

INSTRUMENTS FINANCIERS ET AUX TITRES ET VALEURS CERTAINES DISPOSITIONS DE<br />

LA LOI DU 14 JUILLET 1991 SUR LES PRATIQUES DU COMMERCE ET SUR L'INFORMATION<br />

ET LA PROTECTION DU CONSOMMATEUR”/“WAARBIJ SOMMIGE BEPALINGEN VAN DE<br />

WET VAN 14 JULI 1991 BETREFFENDE DE HANDELSPRAKTIJKEN EN DE VOORLICHTING<br />

EN BESCHERMING VAN DE CONSUMENT, VAN TOEPASSING WORDEN VERKLAARD OP<br />

FINANCIËLE INSTRUMENTEN, EFFECTEN EN WAARDEN.”<br />

____________________<br />

NOTICE TO RESIDENTS OF CANADA<br />

(OFFERING IN THE PROVINCES OF BRITISH COLUMBIA, MANITOBA, ONTARIO AND<br />

QUEBEC ONLY)<br />

THIS DOCUMENT PROVIDES INFORMATION ON AN OFFERING OF THE SECURITIES<br />

DESCRIBED HEREIN ONLY IN THOSE JURISDICTIONS AND TO THOSE PERSONS WHERE<br />

AND TO WHOM THEY MAY BE LAWFULLY OFFERED FOR SALE, AND THEREIN ONLY BY<br />

PERSONS PERMITTED TO SELL SUCH SECURITIES. THIS DOCUMENT IS NOT, AND UNDER<br />

NO CIRCUMSTANCES IS TO BE CONSTRUED AS, AN ADVERTISEMENT OR A PUBLIC<br />

OFFERING OF THE SECURITIES REFERRED TO HEREIN IN CANADA. NO SECURITIES<br />

COMMISSION OR SIMILAR AUTHORITY IN CANADA HAS REVIEWED OR IN ANY WAY<br />

PASSED UPON THIS DOCUMENT OR THE MERITS OF THE SECURITIES DESCRIBED HEREIN<br />

AND ANY REPRESENTATION TO THE CONTRARY IS AN OFFENCE.<br />

THE DISTRIBUTION OF THE OFFERED NOTES IN CANADA WILL BE MADE ONLY ON A<br />

PRIVATE PLACEMENT BASIS AND WILL BE EXEMPT FROM THE REQUIREMENT THAT THE<br />

ISSUER PREPARE AND FILE A PROSPECTUS WITH THE RELEVANT CANADIAN SECURITIES<br />

REGULATORY AUTHORITIES. ACCORDINGLY, ANY RESALE OF THE OFFERED NOTES<br />

MUST BE MADE IN ACCORDANCE WITH APPLICABLE SECURITIES LAWS, WHICH WILL<br />

xii

VARY DEPENDING ON THE RELEVANT JURISDICTION, AND WHICH MAY REQUIRE<br />

RESALES TO BE MADE IN ACCORDANCE WITH EXEMPTIONS FROM REGISTRATION AND<br />

PROSPECTUS REQUIREMENTS. CANADIAN PURCHASERS (“PURCHASERS”) ARE ADVISED<br />

TO SEEK LEGAL ADVICE PRIOR TO ANY RESALE OF THE OFFERED NOTES.<br />

EACH PURCHASER WHO RECEIVES A PURCHASE CONFIRMATION REGARDING THE<br />

OFFERED NOTES WILL BE DEEMED TO HAVE REPRESENTED TO THE ISSUER, THE CO-<br />

ISSUER OR THE INITIAL PURCHASER, AS APPLICABLE, AND ANY DEALER FROM WHOM<br />

SUCH CONFIRMATION IS RECEIVED THAT (I) SUCH PURCHASER IS ENTITLED UNDER<br />

APPLICABLE CANADIAN PROVINCIAL SECURITIES LAWS TO PURCHASE SUCH<br />

SECURITIES WITHOUT THE BENEFIT OF A PROSPECTUS QUALIFIED UNDER SUCH<br />

SECURITIES LAWS, (II) SUCH PURCHASER HAS REVIEWED THE RESALE RESTRICTIONS IN<br />

THE DEFINITIVE OFFERING MEMORANDUM, (III) WHERE REQUIRED BY LAW, SUCH<br />

PURCHASER IS PURCHASING AS PRINCIPAL AND NOT AS AGENT, (IV) THE AGGREGATE<br />

ACQUISITION COST OF PURCHASING THE OFFERED NOTES FOR SUCH PURCHASER IS AT<br />

LEAST CDN $500,000 AND, IF PURCHASING AS AGENT IN THE PROVINCES OF MANITOBA<br />

OR ONTARIO, AT LEAST CDN $500,000 PER ACCOUNT ON BEHALF OF WHICH SUCH<br />

PURCHASE IS EFFECTED, (V) IF SUCH PURCHASER IS LOCATED IN MANITOBA, SUCH<br />

PURCHASER IS NOT AN INDIVIDUAL AND IS PURCHASING FOR INVESTMENT ONLY AND<br />

NOT WITH A VIEW TO RESALE OR DISTRIBUTION, (VI) IF SUCH PURCHASER IS LOCATED<br />

IN ONTARIO, A DEALER REGISTERED AS AN INTERNATIONAL DEALER IN ONTARIO MAY<br />

SELL SECURITIES TO SUCH PURCHASER, AND (VII) IF SUCH PURCHASER IS LOCATED IN<br />

QUEBEC, SUCH PURCHASER IS A “SOPHISTICATED PURCHASER” WITHIN THE MEANING<br />

OF SECTION 43 OF THE SECURITIES ACT (QUEBEC).<br />

CONTRACTUAL RIGHT OF ACTION FOR RESCISSION OR DAMAGES<br />

(OFFERING IN ONTARIO)<br />

THE SECURITIES WHICH WILL BE OFFERED ARE THOSE OF FOREIGN ISSUERS, AND<br />

ONTARIO PURCHASERS WILL NOT RECEIVE THE CONTRACTUAL RIGHT OF ACTION<br />

PRESCRIBED BY SECTION 32 OF THE REGULATION UNDER THE SECURITIES ACT<br />

(ONTARIO). AS A RESULT, ONTARIO PURCHASERS MUST RELY ON OTHER REMEDIES<br />

THAT MAY BE AVAILABLE, INCLUDING COMMON LAW RIGHTS OF ACTION FOR<br />

DAMAGES OR RESCISSION OR RIGHTS OF ACTION UNDER THE CIVIL LIABILITY<br />

PROVISIONS OF THE U.S. FEDERAL SECURITIES LAWS.<br />

THE ISSUER AND THE CO-ISSUER AS WELL AS THE OTHER PERSONS NAMED HEREIN<br />

MAY BE LOCATED OUTSIDE OF CANADA AND, AS A RESULT, IT MAY NOT BE POSSIBLE<br />

FOR ONTARIO PURCHASERS TO EFFECT SERVICE OF PROCESS WITHIN CANADA UPON<br />

THE ISSUER AND THE CO-ISSUER OR SUCH OTHER PERSONS. ALL OR A SUBSTANTIAL<br />

PORTION OF THE ASSETS OF THE ISSUER, THE CO-ISSUER AND SUCH OTHER PERSONS<br />

MAY BE LOCATED OUTSIDE OF CANADA AND, AS A RESULT, IT MAY NOT BE POSSIBLE<br />

TO SATISFY A JUDGMENT AGAINST THE ISSUER, THE CO-ISSUER OR SUCH OTHER<br />

PERSONS IN CANADA OR TO ENFORCE A JUDGMENT OBTAINED IN CANADIAN COURTS<br />

AGAINST SUCH ISSUER, CO-ISSUER OR OTHER PERSONS OUTSIDE OF CANADA.<br />

THE FOREGOING SUMMARY IS SUBJECT TO THE EXPRESS PROVISIONS OF THE<br />

SECURITIES ACT (ONTARIO), AND THE REGULATIONS THEREUNDER AND REFERENCE IS<br />

MADE THERETO FOR THE COMPLETE TEXT OF SUCH PROVISIONS. SUCH PROVISIONS<br />

MAY CONTAIN LIMITATIONS AND STATUTORY DEFENSES ON WHICH THE ISSUER AND<br />

THE CO-ISSUER MAY RELY.<br />

xiii

THE RIGHTS DISCUSSED ABOVE ARE IN ADDITION TO AND WITHOUT DEROGATION<br />

FROM ANY OTHER RIGHT OR REMEDY WHICH INVESTORS MAY HAVE AT LAW.<br />

LANGUAGE OF DOCUMENTS<br />

EACH INVESTOR ACKNOWLEDGES THAT ITS EXPRESS WISH IS THAT ALL DOCUMENTS<br />

EVIDENCING OR RELATING IN ANY WAY TO THE SALE OF THE OFFERED NOTES BE<br />

DRAWN UP IN THE ENGLISH LANGUAGE ONLY. VOUS RECONNAISSEZ PAR LES<br />

PRÉSENTES QUE C’EST PAR VOTRE VOLONTÉ EXPRESSE QUE TOUS LES DOCUMENTS<br />

FAISANT FOI OU SE RAPPORTANT DE QUELQUE MANIÈRE QUE CE SOIT Á LA VENTE DES<br />

VALEURS MOBILIÈRES DÈCRITES AUX PRÉSENTES SOIENT RÉDIGÉS EN ANGLAIS<br />

SEULEMENT.<br />

____________________<br />

NOTICE TO RESIDENTS OF THE CAYMAN ISLANDS<br />

SECTION 194 OF THE COMPANIES LAW (2004 REVISION) OF THE CAYMAN ISLANDS<br />

PROVIDES THAT AN EXEMPTED COMPANY (SUCH AS THE ISSUER) THAT IS NOT LISTED<br />

ON THE CAYMAN ISLANDS STOCK EXCHANGE IS PROHIBITED FROM MAKING ANY<br />

INVITATION TO THE PUBLIC IN THE CAYMAN ISLANDS TO SUBSCRIBE FOR ANY OF ITS<br />

SECURITIES. EACH PURCHASER OF THE OFFERED NOTES AGREES THAT NO INVITATION<br />

MAY BE MADE TO THE PUBLIC IN THE CAYMAN ISLANDS TO SUBSCRIBE FOR THE<br />

SECURITIES.<br />

____________________<br />

NOTICE TO RESIDENTS OF DENMARK<br />

THE INITIAL PURCHASER AND THE CO-ISSUERS HAVE EACH AGREED THAT IT HAS NOT<br />

OFFERED OR SOLD AND WILL NOT OFFER, SELL OR DELIVER ANY OFFERED NOTES IN<br />

THE KINGDOM OF DENMARK, DIRECTLY OR INDIRECTLY, BY WAY OF PUBLIC OFFER,<br />

UNLESS SUCH OFFER, SALE OR DELIVERY IS, OR WAS, IN COMPLIANCE WITH THE<br />

DANISH ACT NO. 1072 OF DECEMBER 20, 1995 ON SECURITIES TRADING, CHAPTER 12 ON<br />

PROSPECTUSES ON FIRST PUBLIC OFFER OF CERTAIN EXECUTIVE SECURITIES AND ANY<br />

EXECUTIVE ORDERS ISSUED IN PURSUANT THEREOF.<br />

____________________<br />

NOTICE TO RESIDENTS OF FINLAND<br />

THIS DOCUMENT HAS BEEN PREPARED FOR PRIVATE INFORMATION PURPOSES OF<br />

INTERESTED INVESTORS ONLY. IT MAY NOT BE USED FOR AND SHALL NOT BE DEEMED<br />

A PUBLIC OFFERING OF THE OFFERED NOTES. THE FINNISH FINANCIAL SUPERVISION<br />

AUTHORITY (RAHOITUSTARKASTUS) HAS NOT APPROVED THIS DOCUMENT AND HAS<br />

NOT AUTHORIZED ANY OFFERING OF THE SUBSCRIPTION OF THE SECURITIES;<br />

ACCORDINGLY, THE OFFERED NOTES MAY NOT BE OFFERED OR SOLD IN FINLAND OR<br />

TO RESIDENTS THEREOF EXCEPT AS PERMITTED BY FINNISH LAW. THIS DOCUMENT IS<br />

STRICTLY FOR PRIVATE USE BY ITS HOLDER AND MAY NOT BE PASSED ON TO THIRD<br />

PARTIES.<br />

xiv

____________________<br />

NOTICE TO RESIDENTS OF FRANCE<br />

NO OFFERING CIRCULAR (INCLUDING ANY AMENDMENT, SUPPLEMENT OR<br />

REPLACEMENT THERETO) HAS BEEN PREPARED IN CONNECTION WITH THE OFFERING<br />

OF THE OFFERED NOTES THAT HAS BEEN APPROVED BY THE AUTORITÉ DES MARCHÉS<br />

FINANCIERS OR BY THE COMPETENT AUTHORITY OF ANOTHER STATE THAT IS A<br />

CONTRACTING PARTY TO THE AGREEMENT ON THE EUROPEAN ECONOMIC AREA THAT<br />

HAS BEEN RECOGNIZED IN FRANCE; NO OFFERED NOTES HAVE BEEN OFFERED OR SOLD<br />

AND WILL BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, TO THE PUBLIC IN FRANCE<br />

EXCEPT TO QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS) AND/OR TO A LIMITED<br />

CIRCLE OF INVESTORS (CERCLE RESTREINT D’INVESTISSEURS) ACTING FOR THEIR OWN<br />

ACCOUNT AS DEFINED IN ARTICLE L. 411-2 OF THE FRENCH CODE MONÉTAIRE ET<br />

FINANCIER AND APPLICABLE REGULATIONS THEREUNDER; NONE OF THIS OFFERING<br />

CIRCULAR OR ANY OTHER MATERIALS RELATED TO THE OFFERING OR INFORMATION<br />

CONTAINED THEREIN RELATING TO THE OFFERED NOTES HAS BEEN RELEASED, ISSUED<br />

OR DISTRIBUTED TO THE PUBLIC IN FRANCE EXCEPT TO QUALIFIED INVESTORS<br />

(INVESTISSEURS QUALIFIÉS) AND/OR TO A LIMITED CIRCLE OF INVESTORS (CERCLE<br />

RESTREINT D’INVESTISSEURS) MENTIONED ABOVE; AND THE DIRECT OR INDIRECT<br />

RESALE TO THE PUBLIC IN FRANCE OF ANY OFFERED NOTES ACQUIRED BY ANY<br />

QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS) AND/OR ANY INVESTORS<br />

BELONGING TO A LIMITED CIRCLE OF INVESTORS (CERCLE RESTREINT<br />

D’INVESTISSEURS) MAY BE MADE ONLY AS PROVIDED BY ARTICLES L. 412-1 AND L. 621-<br />

8 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER AND APPLICABLE REGULATIONS<br />

THEREUNDER.<br />

____________________<br />

NOTICE TO RESIDENTS OF GERMANY<br />

THE OFFERED NOTES MAY ONLY BE ACQUIRED IN ACCORDANCE WITH THE GERMAN<br />

WERTPAPIERPROSPEKTGESETZ (SECURITIES PROSPECTUS ACT) AND THE<br />

INVESTMENTGESETZ (INVESTMENT ACT). THE OFFERED NOTES ARE NOT REGISTERED<br />

OR AUTHORIZED FOR DISTRIBUTION UNDER THE INVESTMENT ACT AND MAY NOT BE,<br />

AND ARE NOT BEING OFFERED OR ADVERTISED PUBLICLY OR OFFERED SIMILARLY<br />

UNDER THE INVESTMENT ACT OR THE SECURITIES PROSPECTUS ACT. THEREFORE, THIS<br />

OFFER IS ONLY BEING MADE TO RECIPIENTS TO WHOM THIS DOCUMENT IS<br />

PERSONALLY ADDRESSED AND DOES NOT CONSTITUTE AN OFFER OR ADVERTISEMENT<br />

TO THE PUBLIC. THE OFFERED NOTES CAN ONLY BE ACQUIRED FOR A MINIMUM<br />

PURCHASE PRICE OF AT LEAST € 50,000 (EXCLUDING COMMISSIONS AND OTHER FEES)<br />

PER PERSON. ALL PROSPECTIVE INVESTORS ARE URGED TO SEEK INDEPENDENT TAX<br />

ADVICE. NONE OF THE CO-ISSUERS, THE TRUSTEE, THE COLLATERAL MANAGER, THE<br />

INITIAL PURCHASER OR ANY OF THEIR RESPECTIVE AFFILIATES GIVES ANY TAX<br />

ADVICE.<br />

____________________<br />

NOTICE TO RESIDENTS OF GREECE<br />

THIS DOCUMENT AND THE SECURITIES TO WHICH IT RELATES AND ANY OTHER<br />

MATERIAL RELATED THERETO MAY NOT BE ADVERTISED, DISTRIBUTED OR OTHERWISE<br />

MADE AVAILABLE TO THE PUBLIC IN GREECE. THE GREEK CAPITAL MARKET<br />

COMMITTEE HAS NOT AUTHORISED ANY PUBLIC OFFERING OF THE SUBSCRIPTION OF<br />

xv

THE OFFERED NOTES. ACCORDINGLY, THE OFFERED NOTES MAY NOT BE ADVERTISED,<br />

DISTRIBUTED OR IN ANY WAY OFFERED OR SOLD IN GREECE OR TO RESIDENTS<br />

THEREOF EXCEPT AS PERMITTED BY GREEK LAW.<br />

____________________<br />

NOTICE TO RESIDENTS OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION<br />

THE OFFERED NOTES MAY NOT BE OFFERED OR SOLD IN HONG KONG, BY MEANS OF<br />

ANY DOCUMENT OTHER THAN TO PERSONS WHOSE ORDINARY BUSINESS IT IS TO BUY<br />

OR SELL SHARES OR DEBENTURES (WHETHER AS PRINCIPAL OR AGENT) OR IN<br />

CIRCUMSTANCES WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE<br />

MEANING OF THE COMPANIES ORDINANCE (CAP 32). UNLESS PERMITTED TO DO SO<br />

UNDER THE SECURITIES LAWS OF HONG KONG, YOU MAY NOT ISSUE OR HAVE IN YOUR<br />

POSSESSION FOR THE PURPOSES OF ISSUE, AND WILL NOT ISSUE, OR HAVE IN YOUR<br />

POSSESSION FOR THE PURPOSES OF ISSUE, ANY ADVERTISEMENT, INVITATION OR<br />

DOCUMENT RELATING TO THE OFFERED NOTES OTHER THAN WITH RESPECT TO<br />

OFFERED NOTES INTENDED TO BE DISPOSED OF TO PERSONS OUTSIDE OF HONG KONG<br />

OR TO BE DISPOSED OF IN HONG KONG ONLY TO PERSONS WHOSE BUSINESS INVOLVES<br />

THE ACQUISITION, DISPOSAL OR HOLDING OF SECURITIES, WHETHER AS PRINCIPAL OR<br />

AGENT OR IN CIRCUMSTANCES WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC.<br />

____________________<br />

NOTICE TO RESIDENTS OF INDONESIA<br />

THE OFFERED NOTES HAVE NOT BEEN AND WILL NOT BE OFFERED, TRANSFERRED OR<br />

SOLD, DIRECTLY OR INDIRECTLY, IN INDONESIA, OR TO ANY INDONESIAN RESIDENTS<br />

OR CITIZENS IN A MANNER WHICH CONSTITUTES A PUBLIC OFFERING UNDER THE LAWS<br />

AND REGULATIONS OF INDONESIA.<br />

____________________<br />

NOTICE TO RESIDENTS OF ISRAEL<br />

THIS DOCUMENT WILL BE DISTRIBUTED TO ISRAELI RESIDENTS ONLY IN A MANNER<br />

THAT WILL NOT CONSTITUTE AN “OFFER TO THE PUBLIC” IN ACCORDANCE WITH<br />

SECTIONS 15 AND 15A OF THE SECURITIES LAW 1968. SPECIFICALLY, THIS DOCUMENT<br />

MAY ONLY BE DISTRIBUTED TO INVESTORS OF THE TYPES LISTED IN THE FIRST<br />

ADDENDUM OF THE SECURITIES LAW 1968 AND IN ADDITION TO NOT MORE THAN 35<br />

OTHER INVESTORS RESIDENT IN ISRAEL DURING ANY GIVEN 12 MONTH PERIOD.<br />

____________________<br />

NOTICE TO RESIDENTS OF ITALY<br />

THIS DOCUMENT MAY NOT BE DISTRIBUTED TO MEMBERS OF THE PUBLIC IN ITALY.<br />

THE ITALIAN COMMISSIONE NAZIONALE PER LA SOCIETA E LA BORSA HAS NOT<br />

AUTHORIZED ANY OFFERING OF THE SUBSCRIPTION OF THE OFFERED NOTES;<br />

ACCORDINGLY, THE OFFERED NOTES MAY NOT BE OFFERED OR SOLD IN ITALY OR TO<br />

RESIDENTS THEREOF EXCEPT AS PERMITTED BY ITALIAN LAW.<br />

xvi

____________________<br />

NOTICE TO RESIDENTS OF JAPAN<br />

THE OFFERED NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE<br />

SECURITIES AND EXCHANGE LAW OF JAPAN (THE “SEL”), AND THE OFFERED NOTES<br />

MAY NOT BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR<br />

THE BENEFIT OF, ANY RESIDENT OF JAPAN (INCLUDING JAPANESE CORPORATIONS) OR<br />

TO OTHERS FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO<br />

ANY RESIDENT OF JAPAN, EXCEPT THAT THE OFFER AND SALE OF THE OFFERED NOTES<br />

IN JAPAN MAY BE MADE ONLY THROUGH PRIVATE PLACEMENT SALE IN JAPAN IN<br />

ACCORDANCE WITH AN EXEMPTION AVAILABLE UNDER THE SEL AND WITH ALL OTHER<br />

APPLICABLE LAWS AND REGULATIONS OF JAPAN. IN THIS CLAUSE, “A<br />

RESIDENT/RESIDENTS OF JAPAN” SHALL HAVE THE MEANING AS DEFINED UNDER THE<br />

FOREIGN EXCHANGE AND FOREIGN TRADE LAW OF JAPAN.<br />

____________________<br />

NOTICE TO RESIDENTS OF KOREA<br />

NEITHER THE ISSUER NOR THE CO-ISSUER IS MAKING ANY REPRESENTATION, EXPRESS<br />

OR IMPLIED, WITH RESPECT TO THE QUALIFICATION OF THE RECIPIENTS OF THESE<br />

MATERIALS FOR THE PURPOSE OF INVESTING IN THE OFFERED NOTES UNDER THE LAWS<br />

OF KOREA, INCLUDING AND WITHOUT LIMITATION THE FOREIGN EXCHANGE<br />

MANAGEMENT LAW AND REGULATIONS THEREUNDER. THE OFFERED NOTES HAVE NOT<br />

BEEN REGISTERED UNDER THE SECURITIES AND EXCHANGE LAW OF KOREA AND NONE<br />

OF THE OFFERED NOTES MAY BE OFFERED OR SOLD OR DELIVERED, DIRECTLY OR<br />

INDIRECTLY, IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO<br />

APPLICABLE LAWS AND REGULATIONS OF KOREA.<br />

____________________<br />

NOTICE TO RESIDENTS OF LUXEMBOURG<br />

IN RELATION TO THE GRAND DUCHY OF LUXEMBOURG (LUXEMBOURG) AND THE LAW<br />

OF 10 JULY 2005 RELATING TO PROSPECTUSES FOR SECURITIES (THE LAW OF 10 JULY<br />

2005), THE OFFERED NOTES MAY ONLY BE OFFERED:<br />

(A) TO LEGAL ENTITIES WHICH ARE AUTHORISED OR REGULATED TO<br />

OPERATE IN THE FINANCIAL MARKETS (INCLUDING, CREDIT INSTITUTIONS,<br />

INVESTMENT FIRMS, OTHER AUTHORISED OR REGULATED FINANCIAL INSTITUTIONS,<br />

INSURANCE COMPANIES, UNDERTAKINGS FOR COLLECTIVE INVESTMENT AND THEIR<br />

MANAGEMENT COMPANIES, PENSION AND RETIREMENT FUNDS AND THEIR<br />

MANAGEMENT COMPANIES, COMMODITY DEALERS AS WELL AS ENTITIES NOT SO<br />

AUTHORISED OR REGULATED WHOSE CORPORATE PURPOSE IS SOLELY TO INVEST IN<br />

SECURITIES); OR<br />

(B) TO NATIONAL AND REGIONAL GOVERNMENTS, CENTRAL BANKS,<br />

INTERNATIONAL AND SUPRANATIONAL INSTITUTIONS (SUCH AS THE INTERNATIONAL<br />

MONETARY FUND, THE EUROPEAN CENTRAL BANK, THE EUROPEAN INVESTMENT BANK<br />

AND OTHER SIMILAR INTERNATIONAL ORGANISATIONS); OR<br />

(C) TO ANY LEGAL ENTITIES WHICH HAVE TWO OR MORE OF (I) AN AVERAGE<br />

NUMBER OF EMPLOYEES DURING THE FINANCIAL YEAR OF AT LEAST 250, (II) A TOTAL<br />

xvii

BALANCE SHEET OF MORE THAN €43,000,000 AND (III) AN ANNUAL NET TURNOVER OF<br />

MORE THAN €50,000,000, AS SHOWN IN THEIR LAST ANNUAL OR CONSOLIDATED<br />

ACCOUNTS; OR<br />

(D) TO CERTAIN NATURAL PERSONS OR SMALL AND MEDIUM-SIZED<br />

ENTERPRISES (AS DEFINED IN THE LAW OF 10 JULY 2005) RECORDED IN THE REGISTER<br />

OF NATURAL PERSONS AND SMALL OR MEDIUM-SIZED ENTERPRISES CONSIDERED AS<br />

QUALIFIED INVESTORS AS HELD BY THE COMMISSION DE SURVEILLANCE DU SECTEUR<br />

FINANCIER (THE CSSF); OR<br />

(E) IN ANY OTHER CIRCUMSTANCES WHICH DO NOT REQUIRE THE<br />

PUBLICATION OF A PROSPECTUS PURSUANT TO ARTICLE 5 OF THE LAW OF 10 JULY 2005.<br />

____________________<br />

NOTICE TO RESIDENTS OF MALAYSIA<br />

PLEASE NOTE THAT THERE ARE RESTRICTIONS AS TO THE PERSONS WHO MAY HOLD<br />

THE OFFERED NOTES. THE OFFERED NOTES MAY NOT BE OFFERED OR SOLD DIRECTLY<br />

OR INDIRECTLY NOR MAY ANY DOCUMENT OR OTHER MATERIAL IN CONNECTION<br />

THEREWITH BE DISTRIBUTED IN MALAYSIA OTHER THAN TO PERSONS WHOSE<br />

ORDINARY BUSINESS IS TO BUY AND SELL SHARES OR DEBENTURES WHETHER AS<br />

PRINCIPAL OR AGENT, OR IN CIRCUMSTANCES WHICH DO NOT FALL WITHIN DIVISION 1<br />

OF PART IV OF THE MALAYSIAN COMPANIES ACT, 1965. NOTWITHSTANDING THE<br />

FOREGOING, ANY PROPOSAL TO OFFER FOR SUBSCRIPTION OR PURCHASE ANY OF THE<br />

OFFERED NOTES REQUIRES THE APPROVAL OF THE MALAYSIAN SECURITIES<br />

COMMISSION ACT 1993.<br />

____________________<br />

NOTICE TO RESIDENTS OF THE NETHERLANDS<br />

THE OFFERED NOTES MAY NOT BE OFFERED, DIRECTLY OR INDIRECTLY, IN THE<br />

NETHERLANDS EXCEPT TO INDIVIDUALS OR ENTITIES WHO OR WHICH TRADE OR<br />

INVEST IN SECURITIES IN THE CONDUCT OF A PROFESSION OR BUSINESS WITHIN THE<br />

MEANING OF ARTICLE 1 OF THE EXEMPTION REGULATION OF 9 OCTOBER 1990 ISSUED<br />

PURSUANT TO ARTICLE 14 OF THE INVESTMENT INSTITUTION SUPERVISION ACT (WET<br />

TOEZICHT BELEGGINGSINSTELLINGEN OF 27 JUNE 1990) WHICH INCLUDES BANKS,<br />

BROKERS, SECURITIES INSTITUTIONS, INSURANCE COMPANIES, PENSION FUNDS,<br />

INVESTMENT INSTITUTIONS, OTHER INSTITUTIONAL INVESTORS AND OTHER PARTIES,<br />

INCLUDING TREASURY DEPARTMENTS OF COMMERCIAL ENTERPRISES AND FINANCE<br />

COMPANIES WHICH ARE REGULARLY ACTIVE IN THE FINANCIAL MARKETS IN A<br />

PROFESSIONAL MANNER.<br />

____________________<br />

NOTICE TO RESIDENTS OF NEW ZEALAND<br />

THE OFFERED NOTES HAVE NOT BEEN AND MAY NOT BE OFFERED OR SOLD TO ANY<br />

PERSONS IN NEW ZEALAND WHOSE PRINCIPAL BUSINESS IS NOT THE INVESTMENT OF<br />

MONEY OR WHO, IN THE COURSE OF AND FOR THE PURPOSES OF THEIR BUSINESS, DO<br />

NOT HABITUALLY INVEST MONEY, IN EACH CASE WITHIN THE MEANING OF SECTION<br />

3(2)(A)(III) OF THE SECURITIES ACT 1978.<br />

xviii

____________________<br />

NOTICE TO RESIDENTS OF NORWAY<br />

EACH OF THE INITIAL PURCHASER, THE ISSUER AND THE CO-ISSUER REPRESENTS AND<br />

AGREES THAT IT WILL COMPLY WITH CHAPTER 5 OF THE NORWEGIAN ACT NO. 79 OF<br />

JUNE 19, 1997 ON SECURITIES TRADING (SECURITIES TRADING ACT) AND EACH OF THE<br />

INITIAL PURCHASER, THE ISSUER AND THE CO-ISSUER EACH ADDITIONALLY<br />

REPRESENTS AND AGREES THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR<br />

SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL IN THE KINGDOM OF<br />

NORWAY OR TO INVESTORS IN THE NORWEGIAN SECURITIES MARKET ANY OFFERED<br />

NOTES OTHER THAN TO PERSONS WHO ARE REGISTERED WITH THE OSLO STOCK<br />

EXCHANGE AS PROFESSIONAL INVESTORS.<br />

____________________<br />

NOTICE TO RESIDENTS OF OMAN<br />

THE OFFERED NOTES CANNOT BE OFFERED, MARKETED OR SOLD IN THE SULTANATE OF<br />

OMAN, WITHOUT THE APPROVAL OF THE CAPITAL MARKET AUTHORITY, AND SUBJECT<br />

TO ANY CONDITIONS OR RESTRICTIONS THAT MAY BE IMPOSED BY THAT BODY, AND IF<br />

OFFERED, MARKETED OR SOLD THROUGH A BANK LICENSED TO DO INVESTMENT<br />

BANKING BUSINESS IN OMAN, THEN WITHOUT THE APPROVAL OF THE CENTRAL BANK<br />

OF OMAN AND THE CAPITAL MARKET AUTHORITY, AND SUBJECT TO ANY CONDITIONS<br />

AND RESTRICTIONS THAT MAY BE IMPOSED BY THOSE BODIES.<br />

____________________<br />

NOTICE TO RESIDENTS OF THE PHILIPPINES<br />

THE OFFERED NOTES HAVE NOT BEEN AND ARE NOT INTENDED TO BE REGISTERED<br />

UNDER THE PHILIPPINE REVISED SECURITIES ACT (THE “PHILIPPINE ACT”), AND SUCH<br />

SECURITIES MAY NOT BE SOLD OR OFFERED FOR SALE OR DISTRIBUTION TO THE<br />

PUBLIC WITHIN THE PHILIPPINES UNLESS THE SAME ARE SOLD IN A TRANSACTION<br />

EXEMPT UNDER THE PROVISIONS OF THE PHILIPPINE ACT. THE PHILIPPINE SECURITIES<br />

AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THE OFFERED<br />

NOTES NOR PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE<br />

ACCURACY OR ADEQUACY OF THIS DOCUMENT. EACH HOLDER BY ITS ACCEPTANCE OF<br />

THE OFFERED NOTES WILL REPRESENT THAT IT UNDERSTANDS AND AGREES TO THE<br />

FOREGOING RESTRICTIONS.<br />

____________________<br />

NOTICE TO RESIDENTS OF QATAR<br />

THE ISSUER IS NOT AN INVESTMENT COMPANY AUTHORISED TO CONDUCT<br />

INVESTMENT BUSINESSES IN THE STATE OF QATAR AS REQUIRED BY QATAR CENTRAL<br />

BANK RESOLUTION NO. (15) “SUPERVISION RULES AND EXECUTIVE INSTRUCTIONS FOR<br />

INVESTMENT COMPANIES.” ACCORDINGLY, THE ISSUER WARRANTS AND REPRESENTS<br />

THAT IT HAS NOT MADE AND WILL NOT MAKE ANY INVITATIONS TO THE PUBLIC IN THE<br />

STATE OF QATAR, AND NEITHER THIS OFFERING CIRCULAR NOR ANY OTHER OFFERING<br />

MATERIAL RELATING TO THE OFFERED NOTES WILL BE ISSUED OR MADE AVAILABLE<br />

TO THE PUBLIC GENERALLY.<br />

xix

____________________<br />

NOTICE TO RESIDENTS OF THE KINGDOM OF SAUDI ARABIA<br />

THE OFFERING OF THE OFFERED NOTES HAS NOT BEEN APPROVED BY THE MINISTRY OF<br />

COMMERCE, THE MINISTRY OF FINANCE OR THE SAUDI ARABIAN MONETARY AGENCY.<br />