NEWGATE FUNDING PLC - Irish Stock Exchange

NEWGATE FUNDING PLC - Irish Stock Exchange

NEWGATE FUNDING PLC - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Level: 8 – From: 8 – Wednesday, December 19, 2007 – 9:34 pm – mac8 – 3894 Section 11 : 3894 Section 11<br />

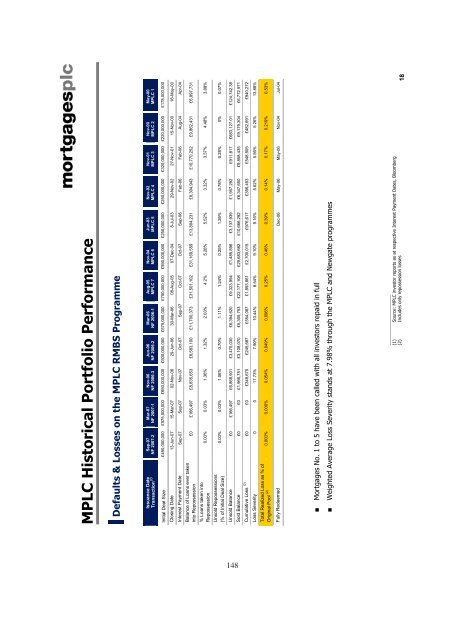

M<strong>PLC</strong> Historical Portfolio Performance<br />

Defaults & Losses on the M<strong>PLC</strong> RMBS Programme<br />

Issuance Date<br />

Sep-07<br />

Transaction (1) NF 2007-2<br />

Mar-07<br />

NF 2007-1<br />

Nov-06<br />

NF 2006-3<br />

Jun-06<br />

NF 2006-2<br />

Mar-06<br />

NF 2006-1<br />

Aug-05<br />

M<strong>PLC</strong> 7<br />

Nov-04<br />

M<strong>PLC</strong> 6<br />

Jun-03<br />

M<strong>PLC</strong> 5<br />

Nov-02<br />

M<strong>PLC</strong> 4<br />

Nov-01<br />

M<strong>PLC</strong> 3<br />

Nov-00<br />

M<strong>PLC</strong> 2<br />

May-00<br />

M<strong>PLC</strong> 1<br />

Initial Deal Size £450,000,000 £575,000,000 £650,000,000 £500,000,000 £575,000,000 £750,000,000 £590,000,000 £250,000,000 £250,000,000<br />

£320,000,000 £220,000,000 £178,000,000<br />

Closing Date 13-Jun-07 15-Mar-07 02-Nov-06 29-Jun-06 30-Mar-06 08-Aug-05 07-Dec-04 8-Jul-03 29-Nov-02 27-Nov-01 15-Nov-00 16-May-00<br />

Interest Payment Date Sep-07 Sep-07 Nov-07 Oct-07 Sep-07 Oct-07 Oct-07 Sep-06 Feb-06 Feb-06 Aug-04 Apr-04<br />

Balance of Loans ever taken<br />

into Repossession<br />

% Loans taken into<br />

Repossession<br />

Unsold Repossessions<br />

(% of Initial Deal Size)<br />

£0 £166,497 £8,835,653 £6,583,100 £11,700,373 £31,501,102 £31,169,559 £13,804,231 £8,304,943 £10,770,252 £9,862,431 £6,897,731<br />

0.00% 0.03% 1.36% 1.32% 2.03% 4.2% 5.28% 5.52% 3.32% 3.37% 4.48% 3.88%<br />

0.00% 0.03% 1.06% 0.70% 1.11% 1.24% 0.25% 1.26% 0.78% 0.28% 0% 0.07%<br />

Unsold Balance £0 £166,497 £6,868,901 £3,475,030 £6,394,620 £9,323,994 £1,485,896 £3,137,939 £1,957,292 £911,817 £683,127.01 £124,742.38<br />

Sold Balance £0 £0 £1,966,751 £3,108,070 £5,305,753 £22,177,108 £29,683,662 £10,666,292 £6,347,650 £9,858,435 £9,179,304 £6,772,971<br />

Cumulative Loss (2) £0 £0 £348,675 £245,687 £554,067 £1,893,861 £2,700,015 £976,617 £356,453 £548,505 £482,691 £940,272<br />

Loss Severity 0 0 17.73% 7.90% 10.44% 8.54% 9.10% 9.16% 5.62% 5.56% 5.26% 13.88%<br />

Total Realized Loss as % of<br />

(2) 0.000% Original Pool<br />

0.000% 0.054% 0.049% 0.096% 0.25% 0.46% 0.39% 0.14% 0.17% 0.219% 0.53%<br />

Fully Redeemed Dec-06 May-06 May-06 Nov-04 Jul-04<br />

Mortgages No. 1 to 5 have been called with all investors repaid in full<br />

Weighted Average Loss Severity stands at 7.98% through the M<strong>PLC</strong> and Newgate programmes<br />

____________________<br />

(1) Source: M<strong>PLC</strong> investor reports as at respective Interest Payment Dates, Bloomberg<br />

(2) Includes only repossession losses<br />

18<br />

148