PROSPECTUS ARLO II Limited - Irish Stock Exchange

PROSPECTUS ARLO II Limited - Irish Stock Exchange

PROSPECTUS ARLO II Limited - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

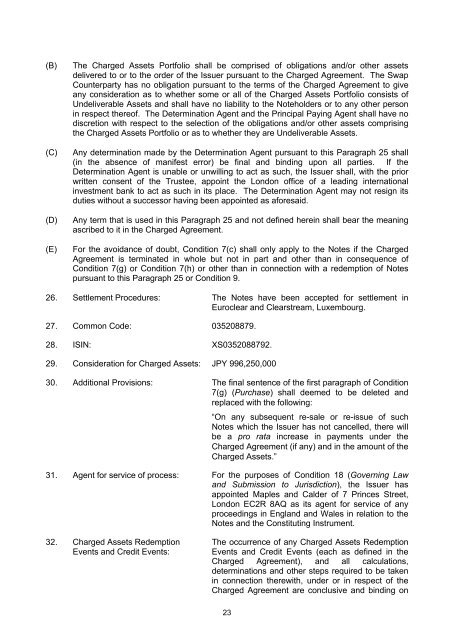

(B)<br />

(C)<br />

(D)<br />

(E)<br />

The Charged Assets Portfolio shall be comprised of obligations and/or other assets<br />

delivered to or to the order of the Issuer pursuant to the Charged Agreement. The Swap<br />

Counterparty has no obligation pursuant to the terms of the Charged Agreement to give<br />

any consideration as to whether some or all of the Charged Assets Portfolio consists of<br />

Undeliverable Assets and shall have no liability to the Noteholders or to any other person<br />

in respect thereof. The Determination Agent and the Principal Paying Agent shall have no<br />

discretion with respect to the selection of the obligations and/or other assets comprising<br />

the Charged Assets Portfolio or as to whether they are Undeliverable Assets.<br />

Any determination made by the Determination Agent pursuant to this Paragraph 25 shall<br />

(in the absence of manifest error) be final and binding upon all parties. If the<br />

Determination Agent is unable or unwilling to act as such, the Issuer shall, with the prior<br />

written consent of the Trustee, appoint the London office of a leading international<br />

investment bank to act as such in its place. The Determination Agent may not resign its<br />

duties without a successor having been appointed as aforesaid.<br />

Any term that is used in this Paragraph 25 and not defined herein shall bear the meaning<br />

ascribed to it in the Charged Agreement.<br />

For the avoidance of doubt, Condition 7(c) shall only apply to the Notes if the Charged<br />

Agreement is terminated in whole but not in part and other than in consequence of<br />

Condition 7(g) or Condition 7(h) or other than in connection with a redemption of Notes<br />

pursuant to this Paragraph 25 or Condition 9.<br />

26. Settlement Procedures: The Notes have been accepted for settlement in<br />

Euroclear and Clearstream, Luxembourg.<br />

27. Common Code: 035208879.<br />

28. ISIN: XS0352088792.<br />

29. Consideration for Charged Assets: JPY 996,250,000<br />

30. Additional Provisions: The final sentence of the first paragraph of Condition<br />

7(g) (Purchase) shall deemed to be deleted and<br />

replaced with the following:<br />

“On any subsequent re-sale or re-issue of such<br />

Notes which the Issuer has not cancelled, there will<br />

be a pro rata increase in payments under the<br />

Charged Agreement (if any) and in the amount of the<br />

Charged Assets.”<br />

31. Agent for service of process: For the purposes of Condition 18 (Governing Law<br />

and Submission to Jurisdiction), the Issuer has<br />

appointed Maples and Calder of 7 Princes Street,<br />

London EC2R 8AQ as its agent for service of any<br />

proceedings in England and Wales in relation to the<br />

Notes and the Constituting Instrument.<br />

32. Charged Assets Redemption<br />

Events and Credit Events:<br />

The occurrence of any Charged Assets Redemption<br />

Events and Credit Events (each as defined in the<br />

Charged Agreement), and all calculations,<br />

determinations and other steps required to be taken<br />

in connection therewith, under or in respect of the<br />

Charged Agreement are conclusive and binding on<br />

23