PROSPECTUS ARLO II Limited - Irish Stock Exchange

PROSPECTUS ARLO II Limited - Irish Stock Exchange

PROSPECTUS ARLO II Limited - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

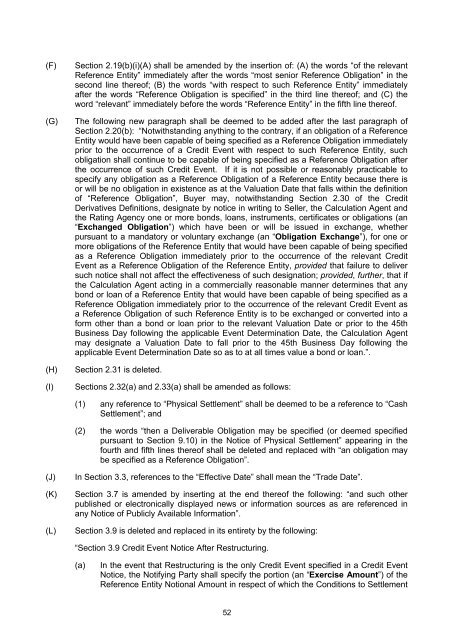

(F)<br />

(G)<br />

(H)<br />

(I)<br />

Section 2.19(b)(i)(A) shall be amended by the insertion of: (A) the words “of the relevant<br />

Reference Entity” immediately after the words “most senior Reference Obligation” in the<br />

second line thereof; (B) the words “with respect to such Reference Entity” immediately<br />

after the words “Reference Obligation is specified” in the third line thereof; and (C) the<br />

word “relevant” immediately before the words “Reference Entity” in the fifth line thereof.<br />

The following new paragraph shall be deemed to be added after the last paragraph of<br />

Section 2.20(b): “Notwithstanding anything to the contrary, if an obligation of a Reference<br />

Entity would have been capable of being specified as a Reference Obligation immediately<br />

prior to the occurrence of a Credit Event with respect to such Reference Entity, such<br />

obligation shall continue to be capable of being specified as a Reference Obligation after<br />

the occurrence of such Credit Event. If it is not possible or reasonably practicable to<br />

specify any obligation as a Reference Obligation of a Reference Entity because there is<br />

or will be no obligation in existence as at the Valuation Date that falls within the definition<br />

of “Reference Obligation”, Buyer may, notwithstanding Section 2.30 of the Credit<br />

Derivatives Definitions, designate by notice in writing to Seller, the Calculation Agent and<br />

the Rating Agency one or more bonds, loans, instruments, certificates or obligations (an<br />

“<strong>Exchange</strong>d Obligation”) which have been or will be issued in exchange, whether<br />

pursuant to a mandatory or voluntary exchange (an “Obligation <strong>Exchange</strong>”), for one or<br />

more obligations of the Reference Entity that would have been capable of being specified<br />

as a Reference Obligation immediately prior to the occurrence of the relevant Credit<br />

Event as a Reference Obligation of the Reference Entity, provided that failure to deliver<br />

such notice shall not affect the effectiveness of such designation; provided, further, that if<br />

the Calculation Agent acting in a commercially reasonable manner determines that any<br />

bond or loan of a Reference Entity that would have been capable of being specified as a<br />

Reference Obligation immediately prior to the occurrence of the relevant Credit Event as<br />

a Reference Obligation of such Reference Entity is to be exchanged or converted into a<br />

form other than a bond or loan prior to the relevant Valuation Date or prior to the 45th<br />

Business Day following the applicable Event Determination Date, the Calculation Agent<br />

may designate a Valuation Date to fall prior to the 45th Business Day following the<br />

applicable Event Determination Date so as to at all times value a bond or loan.”.<br />

Section 2.31 is deleted.<br />

Sections 2.32(a) and 2.33(a) shall be amended as follows:<br />

(1) any reference to “Physical Settlement” shall be deemed to be a reference to “Cash<br />

Settlement”; and<br />

(2) the words “then a Deliverable Obligation may be specified (or deemed specified<br />

pursuant to Section 9.10) in the Notice of Physical Settlement” appearing in the<br />

fourth and fifth lines thereof shall be deleted and replaced with “an obligation may<br />

be specified as a Reference Obligation”.<br />

(J)<br />

(K)<br />

(L)<br />

In Section 3.3, references to the “Effective Date” shall mean the “Trade Date”.<br />

Section 3.7 is amended by inserting at the end thereof the following: “and such other<br />

published or electronically displayed news or information sources as are referenced in<br />

any Notice of Publicly Available Information”.<br />

Section 3.9 is deleted and replaced in its entirety by the following:<br />

“Section 3.9 Credit Event Notice After Restructuring.<br />

(a)<br />

In the event that Restructuring is the only Credit Event specified in a Credit Event<br />

Notice, the Notifying Party shall specify the portion (an “Exercise Amount”) of the<br />

Reference Entity Notional Amount in respect of which the Conditions to Settlement<br />

52