Page 1 of 4 Medical Expense Reimbursement Plan Information ...

Page 1 of 4 Medical Expense Reimbursement Plan Information ...

Page 1 of 4 Medical Expense Reimbursement Plan Information ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

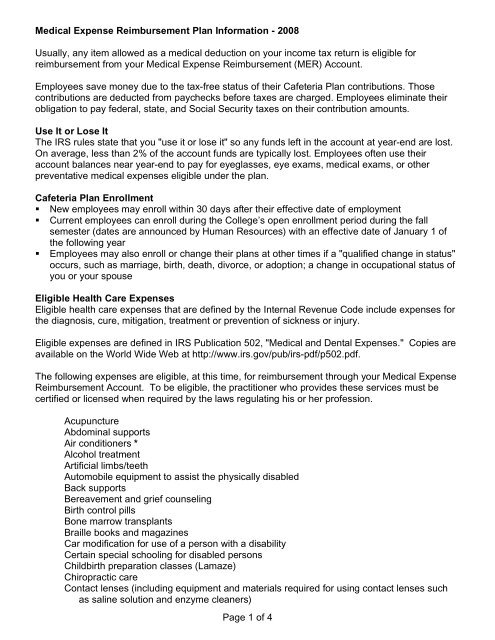

<strong>Medical</strong> <strong>Expense</strong> <strong>Reimbursement</strong> <strong>Plan</strong> <strong>Information</strong> - 2008<br />

Usually, any item allowed as a medical deduction on your income tax return is eligible for<br />

reimbursement from your <strong>Medical</strong> <strong>Expense</strong> <strong>Reimbursement</strong> (MER) Account.<br />

Employees save money due to the tax-free status <strong>of</strong> their Cafeteria <strong>Plan</strong> contributions. Those<br />

contributions are deducted from paychecks before taxes are charged. Employees eliminate their<br />

obligation to pay federal, state, and Social Security taxes on their contribution amounts.<br />

Use It or Lose It<br />

The IRS rules state that you "use it or lose it" so any funds left in the account at year-end are lost.<br />

On average, less than 2% <strong>of</strong> the account funds are typically lost. Employees <strong>of</strong>ten use their<br />

account balances near year-end to pay for eyeglasses, eye exams, medical exams, or other<br />

preventative medical expenses eligible under the plan.<br />

Cafeteria <strong>Plan</strong> Enrollment<br />

New employees may enroll within 30 days after their effective date <strong>of</strong> employment<br />

Current employees can enroll during the College’s open enrollment period during the fall<br />

semester (dates are announced by Human Resources) with an effective date <strong>of</strong> January 1 <strong>of</strong><br />

the following year<br />

Employees may also enroll or change their plans at other times if a "qualified change in status"<br />

occurs, such as marriage, birth, death, divorce, or adoption; a change in occupational status <strong>of</strong><br />

you or your spouse<br />

Eligible Health Care <strong>Expense</strong>s<br />

Eligible health care expenses that are defined by the Internal Revenue Code include expenses for<br />

the diagnosis, cure, mitigation, treatment or prevention <strong>of</strong> sickness or injury.<br />

Eligible expenses are defined in IRS Publication 502, "<strong>Medical</strong> and Dental <strong>Expense</strong>s." Copies are<br />

available on the World Wide Web at http://www.irs.gov/pub/irs-pdf/p502.pdf.<br />

The following expenses are eligible, at this time, for reimbursement through your <strong>Medical</strong> <strong>Expense</strong><br />

<strong>Reimbursement</strong> Account. To be eligible, the practitioner who provides these services must be<br />

certified or licensed when required by the laws regulating his or her pr<strong>of</strong>ession.<br />

Acupuncture<br />

Abdominal supports<br />

Air conditioners *<br />

Alcohol treatment<br />

Artificial limbs/teeth<br />

Automobile equipment to assist the physically disabled<br />

Back supports<br />

Bereavement and grief counseling<br />

Birth control pills<br />

Bone marrow transplants<br />

Braille books and magazines<br />

Car modification for use <strong>of</strong> a person with a disability<br />

Certain special schooling for disabled persons<br />

Childbirth preparation classes (Lamaze)<br />

Chiropractic care<br />

Contact lenses (including equipment and materials required for using contact lenses such<br />

as saline solution and enzyme cleaners)<br />

<strong>Page</strong> 1 <strong>of</strong> 4

Co-pays for prescription drugs, including birth control pills and insulin<br />

Cosmetic surgery or procedure for a deformity from congenital abnormality, an accident or<br />

trauma, or a disfiguring disease<br />

Crutches<br />

Deductibles (except for HDHP with HSA) and co-pays for health care and dental expenses<br />

Dental care, including orthodontia and implant expenses (unless it is for cosmetic purposes)<br />

Detoxification or drug abuse center care<br />

Diagnostic tests<br />

Diathermy<br />

Doctor's fees<br />

Doctor's <strong>of</strong>fice visits<br />

Drug addiction treatment<br />

Eyeglasses and fees for eye exams<br />

Guide or guide dogs for visually or hearing impaired<br />

Hearing aid exams, hearing aids, and supplies<br />

Hospital services<br />

Infertility treatment<br />

Insulin, syringes, test strips and bits<br />

In vitro fertilization<br />

Lab fees<br />

Lamaze classes<br />

Learning disability tuition *<br />

Massage therapy *<br />

<strong>Medical</strong> alert bracelet<br />

<strong>Medical</strong>ly necessary mattresses and boards *<br />

Mental health or substance abuse expenses<br />

Note-taker for hearing-impaired child in school<br />

Nursing services<br />

Optometrist fees<br />

Organ donation expenses<br />

Organ transplants<br />

Orthodontia (see Dental Care, above)<br />

Orthopedic shoes/inserts *<br />

Over-the-counter (OTC) drugs such as antacids, allergy medicine and pain relievers<br />

Physical therapy<br />

Physician examination<br />

Prescription drugs<br />

Psychiatrist/psychologist fees<br />

Psychoanalysis (unless required <strong>of</strong> students in psychoanalytic training institutions)<br />

Periodontal fees<br />

Radial Keratomy, RPK, or LASIK eye surgery<br />

Radiation treatments<br />

Remedial Reading *<br />

Rental <strong>of</strong> medical equipment<br />

Respirators<br />

Routine physical exams<br />

Sales tax and shipping and handling fees associated with an eligible expense<br />

Smoking cessation programs and prescription drugs<br />

Specialized equipment for disabled persons<br />

Speech therapy<br />

Sterilization surgery<br />

<strong>Page</strong> 2 <strong>of</strong> 4

Support hose *<br />

Surgery Therapy for mental/nervous disorders<br />

Travel allowance/lodging for out-<strong>of</strong>-town medical care<br />

Vaccinations<br />

Weight loss programs or medications *<br />

Well baby and well child care<br />

Wheelchairs<br />

Wigs for hair loss due to any disease *<br />

X-rays<br />

* <strong>Expense</strong>s must be accompanied by a physician's certification specifying the medical<br />

disorder, the treatment needed, and how the treatment will alleviate the condition.<br />

<strong>Expense</strong>s That Are Ineligible<br />

The following expenses are not eligible under any circumstances<br />

Deductibles that are covered by a High Deductible Health <strong>Plan</strong> with Health Savings Account<br />

<strong>Expense</strong>s that have been paid out <strong>of</strong> an individual’s Health Savings Account<br />

Cosmetic surgery or procedures<br />

Diaper service<br />

Ear piercing<br />

Electrolysis<br />

<strong>Expense</strong>s claimed on your income tax return<br />

<strong>Expense</strong>s not eligible to be claimed as an income tax deduction<br />

<strong>Expense</strong>s reimbursed by other services, such as insurance companies<br />

Facelifts<br />

Hair loss treatment, drugs or transplants<br />

Health care expenses paid under any health plan<br />

Household help, even if recommended by a physician<br />

Insurance premiums<br />

Illegal treatments, operations, or drugs<br />

Late payment fees<br />

Marriage counseling, unless performed for purpose <strong>of</strong> alleviating or preventing a physical<br />

or mental defect or illness<br />

Non-prescription supplements and herbal remedies<br />

Social activities, such as dance classes, even if recommended by a physician<br />

Teeth whitening<br />

Vitamins/nutritional supplements<br />

Weight reduction programs for general well being<br />

Filing Claims for <strong>Reimbursement</strong><br />

Services must be provided during the claim year. You incur an expense on the date the service is<br />

provided — not when you are billed or when you pay for it. You may file a claim for reimbursement<br />

only after you or your dependent receives the eligible health care services, even if you paid in<br />

advance. You may claim up to the full amount <strong>of</strong> your annual health care contribution at any time<br />

during the year, even if you have not yet contributed that amount to your account.<br />

Please submit a well-organized reimbursement claim to minimize the time spent auditing your<br />

claim. If your claim requires a significant amount <strong>of</strong> auditing, it may be returned to you with<br />

instructions to organize and resubmit for processing at a later date, and your reimbursement will be<br />

delayed. Turnaround time in January and February is longer due to the high volume <strong>of</strong> claims.<br />

<strong>Page</strong> 3 <strong>of</strong> 4

Filing a Claim<br />

(Note for employees with a Health Savings Account/High Deductible Health <strong>Plan</strong> (HSA/HDHP) -<br />

you will not be able to use your <strong>Medical</strong> <strong>Expense</strong> <strong>Reimbursement</strong> Account for your health plan<br />

deductible or for any purchases made with your health savings account and will need to include<br />

pro<strong>of</strong> that you have already paid your deductible to be reimbursed for items such as prescription<br />

co-pays)<br />

Complete and sign a <strong>Medical</strong> <strong>Expense</strong> <strong>Reimbursement</strong> form (you can print this form by going to<br />

www.kellogg.edu/hr/forms.html) and include with the form<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

for health and dental an itemized receipt from the service provider<br />

must show provider/address, date <strong>of</strong> service, patient name and charge for the service<br />

for health and dental an explanation <strong>of</strong> benefits (EOB) from your insurance company<br />

must show date <strong>of</strong> service and amount paid by the insurance company<br />

for prescription drugs receipts must show provider/address, date <strong>of</strong> service, patient name and<br />

charge for the prescription<br />

for vision services an itemized receipt from the service provider must show provider/address,<br />

date <strong>of</strong> service, patient name, total charge for the service, patient’s charge for the<br />

service and the insurance’s charge for the service (even if the insurance’s portion is $0)<br />

for OTC drugs, you must provide a store register receipt that shows the date <strong>of</strong><br />

purchase, name <strong>of</strong> the product, purchase price as well as a note stating who purchased<br />

the product, who the product was purchased for, and the reason for the purchase. The<br />

IRS will not allow payment for OTC expenses without the appropriate back up.<br />

please submit reimbursement requests in at least $50 amounts<br />

please keep your original invoices/EOBs – send us copies<br />

Documentation that does not contain all required information will be returned to you and may<br />

delay your reimbursement. Canceled checks and cash register receipts (except for OTC drugs,<br />

saline solution and enzyme cleaners), or statements showing only previous balances, or the<br />

amounts paid or balances due, are not acceptable documentation.<br />

You can submit claims for 2008 at any time during 2008 and until March 2, 2009.<br />

<strong>Reimbursement</strong>s will be paid no later than the end <strong>of</strong> the calendar month following the month in<br />

which the <strong>Reimbursement</strong> Form is properly submitted to Human Resources. However, when<br />

possible, Human Resources will try to process claims biweekly to ensure prompt reimbursement –<br />

please be sure that expenses are eligible and all necessary documentation has been provided with<br />

your claim form.<br />

If you receive a refund from your provider or insurance company after you have received<br />

reimbursement for an expense from your MER <strong>Plan</strong>, you must contact Human Resources to make<br />

arrangements to return the refund amount to your account. IRS regulations do not permit<br />

reimbursement for the same expense from two different sources.<br />

Since payments for orthodontia services are frequently spread over several years, claims for<br />

orthodontia expenses must be accompanied by documentation from your orthodontist stating what<br />

portion <strong>of</strong> your 2008 charges are for 2008 services.<br />

<strong>Page</strong> 4 <strong>of</strong> 4