Sept 2005 - Association of Dutch Businessmen

Sept 2005 - Association of Dutch Businessmen

Sept 2005 - Association of Dutch Businessmen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

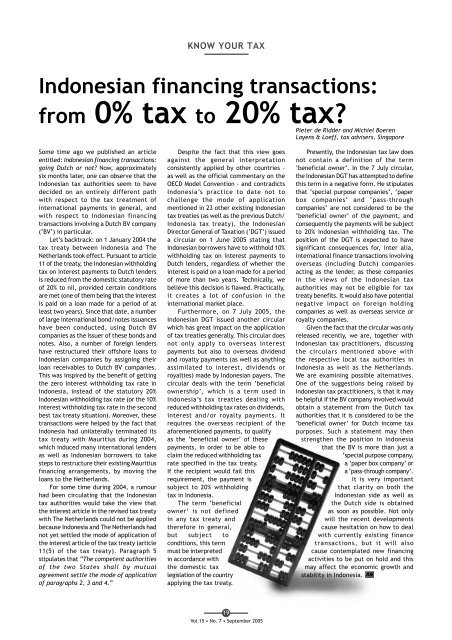

KNOW YOUR TAX<br />

Indonesian financing transactions:<br />

from 0% tax to 20% tax?<br />

Pieter de Ridder and Michiel Boeren<br />

Loyens & Loeff, tax advisers, Singapore<br />

Some time ago we published an article<br />

entitled: Indonesian financing transactions:<br />

going <strong>Dutch</strong> or not? Now, approximately<br />

six months later, one can observe that the<br />

Indonesian tax authorities seem to have<br />

decided on an entirely different path<br />

with respect to the tax treatment <strong>of</strong><br />

international payments in general, and<br />

with respect to Indonesian financing<br />

transactions involving a <strong>Dutch</strong> BV company<br />

(‘BV’) in particular.<br />

Let’s backtrack: on 1 January 2004 the<br />

tax treaty between Indonesia and The<br />

Netherlands took effect. Pursuant to article<br />

11 <strong>of</strong> the treaty, the Indonesian withholding<br />

tax on interest payments to <strong>Dutch</strong> lenders<br />

is reduced from the domestic statutory rate<br />

<strong>of</strong> 20% to nil, provided certain conditions<br />

are met (one <strong>of</strong> them being that the interest<br />

is paid on a loan made for a period <strong>of</strong> at<br />

least two years). Since that date, a number<br />

<strong>of</strong> large international bond/notes issuances<br />

have been conducted, using <strong>Dutch</strong> BV<br />

companies as the issuer <strong>of</strong> these bonds and<br />

notes. Also, a number <strong>of</strong> foreign lenders<br />

have restructured their <strong>of</strong>fshore loans to<br />

Indonesian companies by assigning their<br />

loan receivables to <strong>Dutch</strong> BV companies.<br />

This was inspired by the benefit <strong>of</strong> getting<br />

the zero interest withholding tax rate in<br />

Indonesia, instead <strong>of</strong> the statutory 20%<br />

Indonesian withholding tax rate (or the 10%<br />

interest withholding tax rate in the second<br />

best tax treaty situation). Moreover, these<br />

transactions were helped by the fact that<br />

Indonesia had unilaterally terminated its<br />

tax treaty with Mauritius during 2004,<br />

which induced many international lenders<br />

as well as Indonesian borrowers to take<br />

steps to restructure their existing Mauritius<br />

financing arrangements, by moving the<br />

loans to the Netherlands.<br />

For some time during 2004, a rumour<br />

had been circulating that the Indonesian<br />

tax authorities would take the view that<br />

the interest article in the revised tax treaty<br />

with The Netherlands could not be applied<br />

because Indonesia and The Netherlands had<br />

not yet settled the mode <strong>of</strong> application <strong>of</strong><br />

the interest article <strong>of</strong> the tax treaty (article<br />

11(5) <strong>of</strong> the tax treaty). Paragraph 5<br />

stipulates that “The competent authorities<br />

<strong>of</strong> the two States shall by mutual<br />

agreement settle the mode <strong>of</strong> application<br />

<strong>of</strong> paragraphs 2, 3 and 4.”<br />

Despite the fact that this view goes<br />

against the general interpretation<br />

consistently applied by other countries -<br />

as well as the <strong>of</strong>ficial commentary on the<br />

OECD Model Convention - and contradicts<br />

Indonesia’s practice to date not to<br />

challenge the mode <strong>of</strong> application<br />

mentioned in 23 other existing Indonesian<br />

tax treaties (as well as the previous <strong>Dutch</strong>/<br />

Indonesia tax treaty), the Indonesian<br />

Director General <strong>of</strong> Taxation (‘DGT’) issued<br />

a circular on 1 June <strong>2005</strong> stating that<br />

Indonesian borrowers have to withhold 10%<br />

withholding tax on interest payments to<br />

<strong>Dutch</strong> lenders, regardless <strong>of</strong> whether the<br />

interest is paid on a loan made for a period<br />

<strong>of</strong> more than two years. Technically, we<br />

believe this decision is flawed. Practically,<br />

it creates a lot <strong>of</strong> confusion in the<br />

international market place.<br />

Furthermore, on 7 July <strong>2005</strong>, the<br />

Indonesian DGT issued another circular<br />

which has great impact on the application<br />

<strong>of</strong> tax treaties generally. This circular does<br />

not only apply to overseas interest<br />

payments but also to overseas dividend<br />

and royalty payments (as well as anything<br />

assimilated to interest, dividends or<br />

royalties) made by Indonesian payers. The<br />

circular deals with the term ‘beneficial<br />

ownership’, which is a term used in<br />

Indonesia’s tax treaties dealing with<br />

reduced withholding tax rates on dividends,<br />

interest and/or royalty payments. It<br />

requires the overseas recipient <strong>of</strong> the<br />

aforementioned payments, to qualify<br />

as the ‘beneficial owner’ <strong>of</strong> these<br />

payments, in order to be able to<br />

claim the reduced withholding tax<br />

rate specified in the tax treaty.<br />

If the recipient would fail this<br />

requirement, the payment is<br />

subject to 20% withholding<br />

tax in Indonesia.<br />

The term ‘beneficial<br />

owner’ is not defined<br />

in any tax treaty and<br />

therefore in general,<br />

but subject to<br />

conditions, this term<br />

must be interpreted<br />

in accordance with<br />

the domestic tax<br />

legislation <strong>of</strong> the country<br />

applying the tax treaty.<br />

Presently, the Indonesian tax law does<br />

not contain a definition <strong>of</strong> the term<br />

‘beneficial owner’. In the 7 July circular,<br />

the Indonesian DGT has attempted to define<br />

this term in a negative form. He stipulates<br />

that ‘special purpose companies’, ‘paper<br />

box companies’ and ‘pass-through<br />

companies’ are not considered to be the<br />

‘beneficial owner’ <strong>of</strong> the payment, and<br />

consequently the payments will be subject<br />

to 20% Indonesian withholding tax. The<br />

position <strong>of</strong> the DGT is expected to have<br />

significant consequences for, inter alia,<br />

international finance transactions involving<br />

overseas (including <strong>Dutch</strong>) companies<br />

acting as the lender, as these companies<br />

in the views <strong>of</strong> the Indonesian tax<br />

authorities may not be eligible for tax<br />

treaty benefits. It would also have potential<br />

negative impact on foreign holding<br />

companies as well as overseas service or<br />

royalty companies.<br />

Given the fact that the circular was only<br />

released recently, we are, together with<br />

Indonesian tax practitioners, discussing<br />

the circulars mentioned above with<br />

the respective local tax authorities in<br />

Indonesia as well as the Netherlands.<br />

We are examining possible alternatives.<br />

One <strong>of</strong> the suggestions being raised by<br />

Indonesian tax practitioners, is that it may<br />

be helpful if the BV company involved would<br />

obtain a statement from the <strong>Dutch</strong> tax<br />

authorities that it is considered to be the<br />

‘beneficial owner’ for <strong>Dutch</strong> income tax<br />

purposes. Such a statement may then<br />

strengthen the position in Indonesia<br />

that the BV is more than just a<br />

‘special purpose company,<br />

a ‘paper box company’ or<br />

a ‘pass-through company’.<br />

It is very important<br />

that clarity on both the<br />

Indonesian side as well as<br />

the <strong>Dutch</strong> side is obtained<br />

as soon as possible. Not only<br />

will the recent developments<br />

cause hesitation on how to deal<br />

with currently existing finance<br />

transactions, but it will also<br />

cause contemplated new financing<br />

activities to be put on hold and this<br />

may affect the economic growth and<br />

stability in Indonesia.<br />

19<br />

Vol.15 • No. 7 • <strong>Sept</strong>ember <strong>2005</strong>