January 2004 - Association of Dutch Businessmen

January 2004 - Association of Dutch Businessmen

January 2004 - Association of Dutch Businessmen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL INSIGHT<br />

China: Threat or engine <strong>of</strong> growth?<br />

Jan Lambregts<br />

Economist / Strategist<br />

Rabobank<br />

A number <strong>of</strong> threats are supposed to originate from China. Flying accusations include the<br />

export <strong>of</strong> deflation, responsibility for manufacturing employment losses in the rest <strong>of</strong><br />

the world and manipulation <strong>of</strong> its currency for unfair trade advantages, much to the<br />

detriment <strong>of</strong> the US trade balance. Should the world be worried?<br />

China’s export <strong>of</strong> deflation just one <strong>of</strong> many deflationary forces in play<br />

China’s labor cost advantage over most other countries in the world is substantial. In an attempt to retain<br />

high levels <strong>of</strong> pr<strong>of</strong>itability, many Western and Japanese companies have tried to winter the economic downturn<br />

by aggressively cutting costs through a shift <strong>of</strong> (part <strong>of</strong>) their production facilities into China. The resulting<br />

downwards pressure on global prices compounded to the weak price environment <strong>of</strong> the economic downturn,<br />

which was in turn largely the result <strong>of</strong> the investment boom that preceded it. The spectre <strong>of</strong> a liquidity trap<br />

surfaced, but appears to have passed. While it is true that the China factor added to the risk <strong>of</strong> a liquidity<br />

trap at an unfortunate time, its cost deflation would normally be considered benign to consumers and<br />

overall was a relatively limited factor compared to other deflationary forces in play.<br />

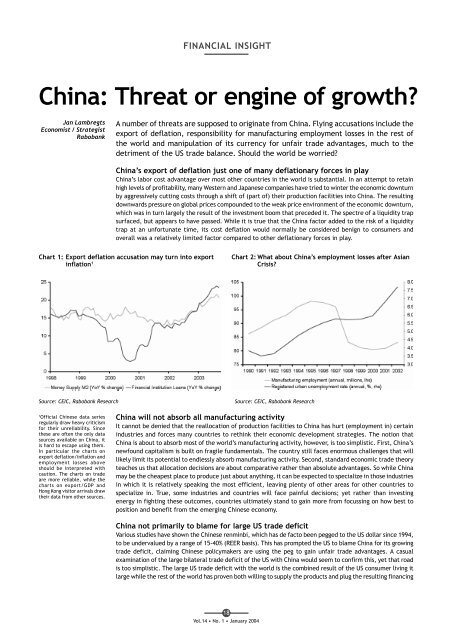

Chart 1: Export deflation accusation may turn into export<br />

inflation 1<br />

Chart 2: What about China’s employment losses after Asian<br />

Crisis?<br />

Source: CEIC, Rabobank Research<br />

Source: CEIC, Rabobank Research<br />

1<br />

Official Chinese data series<br />

regularly draw heavy criticism<br />

for their unreliability. Since<br />

these are <strong>of</strong>ten the only data<br />

sources available on China, it<br />

is hard to escape using them.<br />

In particular the charts on<br />

export deflation/inflation and<br />

employment losses above<br />

should be interpreted with<br />

caution. The charts on trade<br />

are more reliable, while the<br />

charts on export/GDP and<br />

Hong Kong visitor arrivals draw<br />

their data from other sources.<br />

China will not absorb all manufacturing activity<br />

It cannot be denied that the reallocation <strong>of</strong> production facilities to China has hurt (employment in) certain<br />

industries and forces many countries to rethink their economic development strategies. The notion that<br />

China is about to absorb most <strong>of</strong> the world’s manufacturing activity, however, is too simplistic. First, China’s<br />

newfound capitalism is built on fragile fundamentals. The country still faces enormous challenges that will<br />

likely limit its potential to endlessly absorb manufacturing activity. Second, standard economic trade theory<br />

teaches us that allocation decisions are about comparative rather than absolute advantages. So while China<br />

may be the cheapest place to produce just about anything, it can be expected to specialize in those industries<br />

in which it is relatively speaking the most efficient, leaving plenty <strong>of</strong> other areas for other countries to<br />

specialize in. True, some industries and countries will face painful decisions; yet rather than investing<br />

energy in fighting these outcomes, countries ultimately stand to gain more from focussing on how best to<br />

position and benefit from the emerging Chinese economy.<br />

China not primarily to blame for large US trade deficit<br />

Various studies have shown the Chinese renminbi, which has de facto been pegged to the US dollar since 1994,<br />

to be undervalued by a range <strong>of</strong> 15-40% (REER basis). This has prompted the US to blame China for its growing<br />

trade deficit, claiming Chinese policymakers are using the peg to gain unfair trade advantages. A casual<br />

examination <strong>of</strong> the large bilateral trade deficit <strong>of</strong> the US with China would seem to confirm this, yet that road<br />

is too simplistic. The large US trade deficit with the world is the combined result <strong>of</strong> the US consumer living it<br />

large while the rest <strong>of</strong> the world has proven both willing to supply the products and plug the resulting financing<br />

18<br />

Vol.14 • No. 1 • <strong>January</strong> <strong>2004</strong>