LNG TODAY - King & Spalding

LNG TODAY - King & Spalding

LNG TODAY - King & Spalding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

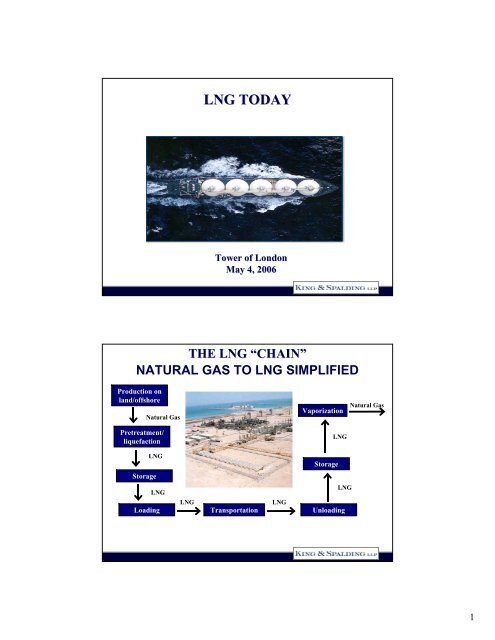

<strong>LNG</strong> <strong>TODAY</strong><br />

Tower of London<br />

May 4, 2006<br />

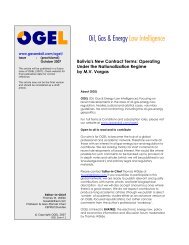

THE <strong>LNG</strong> “CHAIN”<br />

NATURAL GAS TO <strong>LNG</strong> SIMPLIFIED<br />

Production on<br />

land/offshore<br />

Natural Gas<br />

Pretreatment/<br />

liquefaction<br />

Vaporization<br />

<strong>LNG</strong><br />

Natural Gas<br />

<strong>LNG</strong><br />

Storage<br />

Storage<br />

<strong>LNG</strong><br />

<strong>LNG</strong><br />

<strong>LNG</strong><br />

<strong>LNG</strong><br />

Loading Transportation Unloading<br />

1

WHAT IS <strong>LNG</strong>?<br />

• NOT LPG OR NGL<br />

• NATURAL GAS THAT HAS BEEN COOLED<br />

UNTIL IT LIQUEFIES (-160°C)<br />

• VOLUME IS REDUCED 600 TIMES<br />

• LIGHTER THAN AIR WHEN VAPORIZED<br />

• NOT UNDER PRESSURE<br />

• COLORLESS, ODORLESS<br />

AND NON-TOXIC<br />

• STORED COLD<br />

• CAN BE HEATED AND VAPORIZED AGAIN<br />

WHEN NEEDED<br />

<strong>LNG</strong> IS SIMPLY ANOTHER METHOD TO<br />

TRANSPORT GAS TO MARKET<br />

2

Proved Natural Gas Reserves (2004)<br />

Source: BP<br />

<strong>LNG</strong> VERSUS PIPELINE GAS<br />

• Pipelines have point-to-point rigidity<br />

• <strong>LNG</strong> May Allow Better Price<br />

Competition<br />

• <strong>LNG</strong> may be a better option<br />

than pipeline if:<br />

– long distance<br />

– buyer has security of supply<br />

concerns<br />

– borders to be crossed; and/or<br />

– single buyer cannot support<br />

purchase alone<br />

3

SAMPLE <strong>LNG</strong> - PNG COST COMPARISON<br />

Singapore Study (Oct 2005)<br />

<strong>LNG</strong> TRADE CHARACTERISTICS<br />

• <strong>LNG</strong> is not a commodity business -- no spot<br />

market or in transit sales like for oil or LPG<br />

• “Baseload” sales of <strong>LNG</strong> are long term: 20-25<br />

years<br />

• Long term contracts are take-or-pay<br />

• <strong>LNG</strong> projects are capital intensive<br />

• Fully dedicated shipping often required<br />

• Project financing depends on players,<br />

creditworthy buyers, agreements and reliable<br />

<strong>LNG</strong> chain<br />

4

<strong>LNG</strong> PROJECT HISTORY<br />

KENAI ALASKA<br />

STARTED ASIAN <strong>LNG</strong> TRADE<br />

<strong>LNG</strong> Export Projects<br />

History<br />

USA, Alaska<br />

Norway<br />

(2006)<br />

Russia (2008)<br />

Trinidad<br />

Libya<br />

Algeria<br />

Malaysia<br />

Egypt (2)<br />

Indonesia (2)<br />

EG<br />

UAE<br />

Brunei<br />

(2007) Qatar<br />

Nigeria<br />

Indonesia –<br />

Oman<br />

Tangguh<br />

(2008)<br />

Yemen (2008-9) Australia (2)<br />

5

EXAMPLE PLANNED GREENFIELD<br />

<strong>LNG</strong> EXPORT PLANTS<br />

Egypt<br />

Russia<br />

Venezuela<br />

Nigeria<br />

Iran<br />

Indonesia<br />

Planned<br />

Peru<br />

Angola<br />

Australia<br />

6

Conventional Example: Darwin <strong>LNG</strong> (2006)<br />

Several Import Terminals under Construction<br />

7

Terminal Technology:<br />

Italy’s s Adriatic <strong>LNG</strong> - 1 st Gravity Based Offshore<br />

Sponsor’s Claim:<br />

“<br />

”<br />

• Constructing in Spain<br />

• May, 2008 Start-Up<br />

(17 Km offshore Italy)<br />

<strong>LNG</strong> SHIPPING TRENDS<br />

• 200 vessel milestone just<br />

reached; more than 25 on<br />

order<br />

• Ahead of supply?<br />

• Ship size growing (>150)<br />

• Capital / operating costs<br />

increasing<br />

• Effect of China?<br />

• Shipbuilding / charter<br />

terms evolving,<br />

depending on leverage<br />

8

Types of Terminals: Energy Bridge On-Board<br />

Regasification Terminal (2005 - 1 st Cargo)<br />

<strong>LNG</strong> Tanks<br />

Traction Winch<br />

Boiler<br />

HP Pumps<br />

Vaporizers<br />

Turret & Buoy<br />

<strong>LNG</strong> FINANCING TRENDS<br />

• “Current and upcoming<br />

liquefied natural gas<br />

projects in the Gulf are<br />

soaking up huge amounts<br />

of available global project<br />

finance liquidity.<br />

• Last year's Qatargas 2 deal<br />

broke all project financing<br />

records. The overall deal,<br />

totalling $10.65 billion,<br />

involved 57 major lenders<br />

an unprecedented number.”<br />

Qatar: Wednesday, March 22, 2006<br />

9

Major natural gas trade movements<br />

BP Statistical Review of World Energy June 2005<br />

MAJOR TRADE ROUTES 2004<br />

10

<strong>LNG</strong> TRENDS<br />

• <strong>LNG</strong> supply issues, yet to<br />

meet <strong>LNG</strong> demand<br />

• NOC strength - market entry<br />

upstream is difficult<br />

• Liberalization vs.<br />

Nationalization in Upstream<br />

• Regasification boom on both<br />

sides of Atlantic<br />

• Terminal capacity has been<br />

taken to support race for<br />

upstream projects<br />

11

Value Chain Integration – Ownership Flows<br />

QP/EM<br />

gas assets<br />

BG/Petronas<br />

gas assets<br />

Power<br />

assets<br />

UF/ENI<br />

Liquefaction<br />

Qatar<br />

(Ras Laffan/<br />

Qatargas)<br />

Liquefaction<br />

Egypt<br />

(E<strong>LNG</strong>)<br />

Receiving<br />

terminal<br />

UF<br />

South<br />

Hook<br />

<strong>LNG</strong><br />

(UK)<br />

QP/EM<br />

Rovigo<br />

<strong>LNG</strong><br />

(Italy)<br />

QP/EM<br />

Brindisi<br />

<strong>LNG</strong><br />

(Italy)<br />

BG / ?<br />

Dragon<br />

<strong>LNG</strong><br />

(UK)<br />

BG/<br />

Petronas<br />

Segas<br />

(Egypt)<br />

UF/<br />

ENI<br />

Oman<br />

<strong>LNG</strong><br />

UF<br />

Supply<br />

Side<br />

Power<br />

assets<br />

(Edison)<br />

Power<br />

assets<br />

(Enel)<br />

Gas<br />

assets<br />

Buy<br />

Side<br />

#6656<br />

OTHER <strong>LNG</strong> TRENDS<br />

• Some gas markets liberalizing<br />

(e.g. EU 2 nd Gas Directive)<br />

• Who will build / use needed<br />

downstream pipeline / storage?<br />

• North America / UK a special<br />

focus due to expected high<br />

demand<br />

• However, will high <strong>LNG</strong> prices<br />

cause gas demand<br />

destruction?<br />

• Threats to <strong>LNG</strong> - coal, nuclear<br />

and GTL<br />

12

NO SHORTAGE OF ISSUES…<br />

US AND UK GAS SECURITY - THEIR DEPENDENCY ON<br />

IMPORTS NOW MORE LIKE JAPAN’S?<br />

13

POLITICS - UPSTREAM<br />

Larges Gas Reserves (2005)<br />

Rank Country Proved reserves (TCF)<br />

1. Russia 1,680 [Sakhalin issues]<br />

2. Iran 940 [Project stalled?]<br />

3. Qatar 910 Ras Laffan<br />

4. Saudi Arabia 235 None<br />

5. UAE 212 Das Island (at max?)<br />

6. United States 189<br />

7. Nigeria 176 N<strong>LNG</strong>; Brass; OK<br />

8. Algeria 160 4 Projects (--Skikda)<br />

9. Venezuela 151 [2 Projects stalled]<br />

10. Iraq 110 None<br />

SUPPLIES TAKE TIME TO DEVELOP….<br />

EVEN IF PARTIES AGREE UPSTREAM TERMS<br />

14

CONSTRUCTION COSTS ON THE RISE<br />

CONSTRUCTION COSTS - NORWAY<br />

15

<strong>LNG</strong> PRICING - OPPORTUNITIES FOR TRADERS….<br />

IF THEY COULD FIND AVAILABLE <strong>LNG</strong><br />

THE CASE OF <strong>LNG</strong><br />

Contractual Overview<br />

Memorandum of Understanding<br />

Memorandum of Understanding<br />

Investor<br />

Investor<br />

Investor/<br />

Operator<br />

Investor/<br />

Operator<br />

Investor<br />

Investor<br />

Financing<br />

Agreement<br />

EPC <strong>LNG</strong> Plant<br />

Contractor Construction<br />

Agreement<br />

Feedstock<br />

Gas Supply<br />

Agreement<br />

Lender<br />

Shareholder<br />

Agreement<br />

<strong>LNG</strong><br />

EXPORTING<br />

PROJECT<br />

COMPANY<br />

State-Owned<br />

Energy<br />

Company<br />

Tech. Serv.<br />

Agreem.<br />

PSC / <strong>LNG</strong><br />

Project<br />

Agreement<br />

Host<br />

Government<br />

Operation & Maintenance<br />

Contract<br />

<strong>LNG</strong> Sales and<br />

Purchase Contract<br />

Time charter or<br />

ship building<br />

agreements and<br />

ship operating<br />

agreements<br />

Shipping<br />

Company<br />

Shareholder<br />

Agreement<br />

Host<br />

Government<br />

Lender<br />

Financing<br />

Agreement<br />

<strong>LNG</strong><br />

IMPORTING<br />

PROJECT<br />

COMPANY<br />

Government<br />

agreements<br />

Tech. Serv.<br />

Agreem.<br />

Fuel Supply<br />

Agreement<br />

Receiving<br />

Terminal<br />

Construction<br />

Agreement<br />

EPC<br />

Contractor<br />

Power<br />

Plant<br />

Power<br />

Purchase<br />

Agreement<br />

Electricity<br />

Buyers<br />

16

<strong>King</strong> & <strong>Spalding</strong><br />

Key Areas of <strong>LNG</strong> Expertise<br />

• In-depth Industry Experience<br />

Worldwide:<br />

– Export Terminals and Upstream<br />

Development<br />

– Import Terminals<br />

– <strong>LNG</strong> and Gas Sales Agreements<br />

– Shipping Contracts and Maritime<br />

Issues<br />

– Construction and Other Major<br />

Project Contracts<br />

• US and English Law Capability<br />

17

THANK YOU<br />

<strong>King</strong> & <strong>Spalding</strong><br />

Key Areas of <strong>LNG</strong> Expertise<br />

18

Key Issues for <strong>LNG</strong> Export Developers and Recent<br />

Developments in <strong>LNG</strong> Sale and Purchase Agreements<br />

Kenneth S. Culotta<br />

The Tower of London<br />

May 4, 2006<br />

Focus on the Changing Marketplace<br />

• Key Issues for <strong>LNG</strong> Export Developers<br />

– Evolving Role of State Partner<br />

– Relevant US Regulatory Issue: <strong>LNG</strong>/Gas Quality and<br />

Interchangeability<br />

• <strong>LNG</strong> SPAs: the Trend Toward Complexity Continues<br />

– <strong>LNG</strong> Pricing and Price Revision<br />

– Diversion Clauses<br />

– Relevant EU Regulatory Issue: Profit Sharing Mechanisms<br />

1

Key Issues for <strong>LNG</strong> Export Developers:<br />

Role of State Partner<br />

• To Netbacks -- and Beyond!<br />

– Traditional <strong>LNG</strong> pricing: State Partner as Supply<br />

Utility<br />

• 1960s - largely fixed pricing<br />

• 1970s - linkage to oil export prices (transportation adder)<br />

• 1980s - increasing resort to price reviews (mostly on “agree<br />

to agree” basis)<br />

– Liquid Market Pricing: State Partners Protect<br />

Revenue Share<br />

• 1990s/2000s: US market began to revive: upside available<br />

on a new scale<br />

• Variable costs shifted to buyers -- or limited<br />

• Netback pricing increasingly becoming the rule: gas-on-gas<br />

• Price reviews increasingly “binding”<br />

How Do You Know if the Market is Liquid?<br />

“I I know it when I see it!”<br />

2

Key Issues for <strong>LNG</strong> Export Developers:<br />

Role of State Partner<br />

• To Netbacks -- and Beyond!<br />

– Transatlantic Arbitrage Appears: State Partners Yearn for<br />

Upside<br />

• Spanish contracts…US deliveries! US contracts … Spanish<br />

deliveries!<br />

• Death of destination restrictions?<br />

• Diversion and profit sharing arrives<br />

– The Next Generation: State Partners as Market Partners<br />

• Direct-to-market sales by state partners<br />

• Terminal capacity by state partners<br />

• Downstream gas marketing organizations<br />

– What’s next?<br />

• Eliminating the middleman?<br />

Key Issues for <strong>LNG</strong> Export Developers:<br />

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability<br />

• NEWS FLASH! U.S. domestic gas supplies<br />

declining!<br />

• EXTRA! EXTRA! Up to 90% of world <strong>LNG</strong> supplies<br />

are incompatible with the US pipeline system!<br />

• AES Ocean Express v. Florida Gas Transmission,<br />

107 FERC 61,276 (2004)<br />

– Stems from a complaint by AES regarding FGT’s tariff standards<br />

– Numerous intervenors on the quality / interchangeability issue<br />

3

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability (cont.)<br />

• Issue: What are the correct<br />

standards for gas<br />

composition/quality in FGT’s<br />

system?<br />

– By implication, what will US<br />

pipeline standards be in the<br />

“<strong>LNG</strong> Age”?<br />

– Who pays any costs needed to<br />

make <strong>LNG</strong> compatible with US<br />

pipes and appliances?<br />

• Conflicting imperatives<br />

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability (cont.)<br />

• Positions of the Parties:<br />

– <strong>LNG</strong> Suppliers (NGC + Work Group):<br />

• Uniform national standard needed<br />

• Each party that benefits from <strong>LNG</strong> supply<br />

should pays its costs (<strong>LNG</strong> suppliers<br />

already bear plenty!)<br />

– NGC+ Work Group was formed at<br />

request of FERC. It recommended:<br />

» upper Wobbe limit of 1400<br />

» minimal constituent limits<br />

– Emphasis on need to persuade<br />

exporters to consider the US market<br />

• NGC+ Guidelines would accommodate over<br />

65% of all world <strong>LNG</strong><br />

4

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability (cont.)<br />

• Positions of the Parties:<br />

– FGT:<br />

• Heat content: 1,025 Btu to 1,110 Btu<br />

• Wobbe range: 1,340 to 1,396<br />

• Wobbe fluctuation tolerance: +/- 2% within 6<br />

minutes<br />

• Max temperature: 120º F<br />

• Detailed constituents limits<br />

– Emphasis on protecting Dry-low-NOx<br />

turbines (and manufacturer warranties)<br />

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability (cont.)<br />

• Positions of the Parties:<br />

– Utilities (generators):<br />

• Standards should be conservative,<br />

accommodate local requirements, costs should<br />

be borne by upstream pipes or <strong>LNG</strong> projects<br />

– Pipelines:<br />

• Somewhere in-between; emphasis on pipeline<br />

operational concerns (Washington Gas Light);<br />

allocation of costs to those who benefit<br />

– FERC:<br />

• Supported modified FGT standards w/deferred<br />

implementation and further empirical testing,<br />

“socialization” of costs<br />

5

U.S. Regulatory Issues: Gas Quality /<br />

Interchangeability (cont.)<br />

• Current status:<br />

• ALJ adopted FGT’s revised position in 11 April<br />

preliminary decision<br />

• ALJ determined that potential costs for testing,<br />

remediation, and repair were speculative, and<br />

were not appropriately considered in the<br />

context of the proceeding -- this issue still<br />

outstanding<br />

• Briefs on exceptions due in May; if none filed,<br />

this decision becomes a final agency decision<br />

– Critical fact:<br />

• AES v FGT only directly affects FGT’s markets<br />

(including Alabama-Florida border area); many<br />

battles yet to be fought<br />

How Will the Principles of AES v FGT Be<br />

Applied in Future Cases?<br />

US East Coast: the<br />

Holy Grail?<br />

California - another<br />

area of marginal<br />

liquidity<br />

Florida - not the most<br />

liquid US market!<br />

6

Focus on the Changing Marketplace:<br />

<strong>LNG</strong> Sales and Purchase Agreements<br />

• <strong>LNG</strong> SPAs: The Trend<br />

Toward Complexity<br />

Continues<br />

– <strong>LNG</strong> pricing<br />

– Price Revision<br />

– Diversion Clauses<br />

<strong>LNG</strong> SPAs: the Trend Toward Complexity<br />

Continues… <strong>LNG</strong> Pricing<br />

• Index pricing anticipates<br />

arbitrage<br />

– For US destinations: monthly<br />

Henry Hub<br />

– For UK destinations: National<br />

Balancing Point<br />

– For European destinations:<br />

often still “oil” based, but<br />

nuanced:<br />

• E.g., for 85% of quantities,<br />

monthly average of prices for Gas<br />

Oil and Fuel Oil; for 15%, tied to<br />

index for power prices<br />

• E.g., tied to indexed power pool<br />

prices in destination market<br />

7

U.S. Pricing - Netback to Producer<br />

Hub<br />

Sales Price<br />

Index<br />

NYMEX<br />

Receiving<br />

Terminal X<br />

Transport<br />

Pipelines<br />

Shipping<br />

Liquefaction<br />

Gas<br />

Producer<br />

Hub Price 7.50<br />

Less Transport Cost Terminal to Hub (0.25)<br />

Gas Price Out of Terminal 7.25<br />

Less Terminal Cost (0.35)<br />

Ex-ship <strong>LNG</strong> Price 6.95<br />

Less Shipping Cost (0.50)<br />

FOB <strong>LNG</strong> Price 6.45<br />

Less Liquefaction Cost(s) (1.25)<br />

Gas Producer Netback 5.20<br />

<strong>LNG</strong> SPAs: The Trend Continues…<br />

<strong>LNG</strong> Pricing<br />

• Netback Pricing becoming more complex<br />

– “Per terminal” pricing (multiple destination terminals<br />

contemplated)<br />

• Index-based (gas, oil or mixed fuel)<br />

• Pool-based (gas sales by buyer and affiliates within defined<br />

period and at a defined liquid trading point)<br />

– Annual Election<br />

• Who gets to make the election?<br />

• Maximizes opportunity to anticipate annual price trends on a<br />

per market basis -- or to anticipate one’s market position!<br />

8

<strong>LNG</strong> SPAs: The Trend Continues…<br />

<strong>LNG</strong> Pricing<br />

• Netbacks becoming more aggressive<br />

– Then: obligation to maximize Buyer’s US<br />

sales:<br />

• “Buyer shall…diligently seek to maximize the<br />

net proceeds from its sales of Regasified<br />

<strong>LNG</strong>…to ensure that the amount paid to<br />

Seller…reflects the fair market value to<br />

Buyer’s…<strong>LNG</strong> customers.”<br />

– Now: downstream market “adder”<br />

• Based on deemed or actual net revenues from<br />

buyer’s (or its buyers’) gas marketing activities<br />

<strong>LNG</strong> SPAs: The Trend Continues…<br />

<strong>LNG</strong> Pricing<br />

• Price Revision:<br />

– Contract silent? Increasingly rare!<br />

– Triggered if the index by which price is determined exceeds, or<br />

falls below, certain thresholds<br />

– Review triggered if either party believes contract price no longer<br />

represents a “fair market price”<br />

– Review triggered if a party believes contract price fails to achieve<br />

“optimal market value”, taking into account market points<br />

accessible from relevant terminal<br />

• Practical Issues:<br />

– When is the change effective?<br />

– How far back in time does it apply?<br />

• Failure to Agree? How to resolve?<br />

9

<strong>LNG</strong> SPAs: The Trend Toward<br />

Complexity Continues…Diversion<br />

Clauses<br />

• Why Divert?<br />

– Increasingly market-sensitive pricing is developing<br />

– Different market sensitivities drive price differentials, e.g.:<br />

• Seasonal differentials<br />

– UK’s NBP and Nymex diverge in winter<br />

» Winter 2005-6: shortage of gas supplies to UK<br />

– Summer 2003: Nymex and Spanish power pool prices diverge<br />

» BP-Repsol netbacks follow<br />

– Winter 2003-4:Nymex surges<br />

» Spanish gas diverted to US East Coast markets<br />

• Short-term spikes<br />

– Hurricanes Rita and Katrina result in shut-ins<br />

– March 2003: cold weather froze wells<br />

– OFO’s<br />

<strong>LNG</strong> SPAs: The Trend Continues…<br />

Diversion Clauses<br />

• The Lessons of Early Diversions<br />

– Sellers saw the upside possibilities<br />

– Sellers also saw the lack of transparency in the<br />

netback pricing<br />

– Governments saw what they were missing!<br />

10

<strong>LNG</strong> SPAs: The Trend Continues…<br />

Diversion Clauses<br />

• How do diversion clauses work? Some conceptual<br />

issues:<br />

– Title and risk transfer: FOB v DES<br />

• FOB: free on board at loading port. Implies:<br />

– buyer ownership and control of cargo<br />

– buyer responsibility for/control of shipping fleet<br />

• DES: delivered ex-ship at unloading port or edge of international<br />

waters. Implies:<br />

– seller continuing ownership and control of cargo<br />

– shipper responsibility for/control of shipping fleet<br />

– Who controls regasification capacity? Market pipeline capacity?<br />

Downstream gas customer relationships?<br />

<strong>LNG</strong> SPAs: The Trend Continues…<br />

Diversion Clauses<br />

• Underlying economic consideration: cost of the<br />

use of the “diversion option”:<br />

• Covering the downstream gas buyer<br />

• Shipping cost differentials<br />

• Firm terminal use/payment obligations<br />

• Unwinding market hedges<br />

• Conceptual Conclusions<br />

– The party with most control over cargo, shipping and<br />

regas capacity is best positioned to manage the risks<br />

and efficiencies of diversions.<br />

– The party that does not control diversions seeks<br />

coverage of its risks associated with diversions.<br />

11

<strong>LNG</strong> SPAs: The Trend Continues…<br />

Diversion Clauses<br />

• Examples:<br />

– FOB sale:<br />

• Buyer is best positioned to make diversion decisions<br />

(controls shipping, regas and downstream marketing risks)<br />

• Seller’s concern: will the price obtained at the diversion<br />

delivery point exceed the price that would be obtained at the<br />

originally intended delivery point?<br />

– DES sale:<br />

• Seller controls certain risks relevant to diversion decisions<br />

(controls shipping)<br />

• Buyer controls certain risks relevant to diversion decisions<br />

(controls regas and downstream markets)<br />

• Buyer’s concern: how will regas and market exposure be<br />

covered?<br />

<strong>LNG</strong> SPAs: The Trend Continues…<br />

Diversion Clauses<br />

• Mechanics of Diversion Rights<br />

– Mutual agreement?<br />

– Automatic upon occurrence of triggering event, e.g.,<br />

pricing divergence from index?<br />

– One party decides; the other complies?<br />

– How much discussion of the matter?<br />

• Destination of Diverted Cargo<br />

– A specifically designated alternative receiving<br />

terminal at which buyer has rights?<br />

– A terminal (specified or not) at which buyer does not<br />

have rights?<br />

12

Diversion Clauses<br />

• Mechanics of Typical Diversion Clause<br />

– Before or after Annual Delivery Program established?<br />

– One Party exercises right to propose diversion:<br />

• Other party estimates costs/losses associated with diversion<br />

• Other party proposes any mitigating techniques to reduce<br />

such costs:<br />

– Other party’s recovery of costs may be limited to<br />

estimate<br />

– If Buyer diversion:<br />

• What if diversion sales result in less than originally<br />

contemplated netback?<br />

• Seller typically does not accept additional risk/cost<br />

Diversion Clauses<br />

• Mechanics of Typical Diversion Clause<br />

– Buyer diversion rights (continued):<br />

• More common in FOB contracts<br />

• Also sometimes permitted in DES contracts where:<br />

– Buyer can show Seller that Seller revenues will be<br />

enhanced<br />

– Buyer unable to take at intended receiving terminal<br />

– Seller unable to deliver to intended receiving terminal<br />

• Except in the last case, Seller typically doesn’t accept more<br />

risk or cost than in case of delivery to intended terminal<br />

13

Diversion Clauses - PSMs<br />

• Splitting the “Upside”: Contractual and<br />

Legal Considerations of Profit-Sharing<br />

Mechanisms (PSMs)<br />

– Contractual Mechanics:<br />

• Older contracts:<br />

– no mention in some (all risk and reward to<br />

buyer)<br />

– floor is contract price, with any higher price split<br />

equally (all risk and some reward to buyer)<br />

• Newer contracts:<br />

– Seller keeps all upside, covers buyer costs<br />

» costs are actual or fixed<br />

– floor is contract price, with any higher price split<br />

in agreed ratio after deduction of additional<br />

costs (some risk and some reward to buyer)<br />

Diversion Clauses and Profit Sharing<br />

Mechanisms<br />

– Destination Restrictions, Diversions, PSMs and the<br />

EU: What is the Legal Effect of a Diversion Clause?<br />

• Is a PSM a per se restriction on trade (like destination<br />

restrictions)?<br />

– Nigeria case, 2002: “Both the so-called territorial sales<br />

restrictions and profit splitting mechanism violate<br />

European Union competition rules.”<br />

– Is a diversion clause a “destination restriction”?<br />

– In fact, the Nigerian case apparently did not involve a<br />

profit-sharing clause. N<strong>LNG</strong> merely confirmed that “none<br />

of its existing gas supply contracts contained so-called<br />

profit splitting mechanisms effecting [sic] the EU markets<br />

and that it would not introduce these in future contracts.”<br />

• This Texas lawyer is not giving an opinion!<br />

14

Diversion Clauses - PSMs<br />

• Splitting the “Upside”: Contractual and<br />

Legal Considerations of Profit-Sharing<br />

Mechanisms<br />

– Legal Effects (EU):<br />

• Theory: price differentials at different delivery<br />

points within the market should encourage<br />

arbitrage<br />

– Arbitrage should tend to equalize prices across<br />

the market<br />

– Competition between supplies should drive<br />

prices closer to costs<br />

• This is why destination restrictions are prohibited<br />

within the EU under Art. 81(1) of the EU Treaty;<br />

they discourage arbitrage<br />

• How does this principle apply to splitting of upside<br />

on sales?<br />

Diversion Clauses - PSMs<br />

• Splitting the “Upside”: Contractual and<br />

Legal Considerations of Profit-Sharing<br />

Mechanisms<br />

– Legal Effects (EU):<br />

• Theory: behavior which restricts buyers/resellers of<br />

a commodity from arbitrage in response to market<br />

signals is anticompetitive<br />

– If a buyer wants to make a diversion from the<br />

originally intended destination in order to take<br />

advantage of market arbitrage, any clause<br />

which would discourage this behavior is<br />

anticompetitive<br />

– Likewise, a levy on resales that discourages<br />

this behavior is anticompetitive. Does that<br />

include all PSMs?<br />

• EU Law? No clear guidance, but…..<br />

15

Diversion Clauses - PSMs<br />

• Splitting the “Upside”: Contractual and Legal<br />

Considerations of Profit-Sharing Mechanisms<br />

– Legal Effects (EU):<br />

• Article in Spring 2005 Competition Policy Newsletter offers<br />

compelling reasoning:<br />

– In context of DES deviations: deviation is a change in the<br />

contractual relationship that occurs before buyer takes<br />

title, thus by definition does not interfere with buyer’s<br />

right to resell.<br />

– In context of FOB deviations: deviation obliges buyer to<br />

pay seller a PSM, essentially an obligation triggered by<br />

the use made of product after delivery to buyer, thus<br />

clearly a restriction on buyer’s freedom and prima facie a<br />

violation of Art 81(1)<br />

Diversion Clauses - PSMs<br />

• Splitting the “Upside”: Contractual and<br />

Legal Considerations of Profit-Sharing<br />

Mechanisms<br />

– Legal Effects (EU):<br />

• Whether PSM violates Art. 81(1) may depend on<br />

method of clause<br />

– “Raw” PSM: splits entire difference between,<br />

on one hand, upstream price between seller<br />

and buyer and, on other hand, price obtained<br />

by buyer when reselling at alternative<br />

destination<br />

– “Net” PSM: splits incremental profit differential<br />

between, on one hand, the downstream profit<br />

expected by buyer at original intended<br />

destination and, on other hand, profit made at<br />

alternative destination (i.e., split of profits after<br />

deduction of incremental costs)<br />

16

PSMs: “Raw” v “Net” Example<br />

Alternative Destination:<br />

Downstream wholesale price = 130<br />

Costs = 10<br />

Original Intended Destination:<br />

Downstream wholesale price = 120<br />

Costs = 10<br />

Seller Upstream<br />

Price to Buyer: 100<br />

Profit Sharing: 50/50<br />

DIVERSION<br />

Raw PSM: at alternative destination, difference<br />

between final price (130) and initial price (100)<br />

is 30. Thus:<br />

• 15 goes to seller<br />

• 5 goes to buyer (after deduct buyer<br />

costs of 10)<br />

If sold at original destination, difference<br />

between final price (120) and initial price (100)<br />

is 20. Deducting buyer costs of 10, buyer nets<br />

10<br />

Net PSM: at alternative destination:<br />

• incremental profit is 10<br />

• 5 goes to seller (half of incremental<br />

profit)<br />

• 15 goes to buyer (all original profit, half<br />

of incremental profit)<br />

Diversion Clauses - PSMs<br />

• PSMs may be illegal per se in the EU, but the Nigeria<br />

<strong>LNG</strong> case was 2002 and no offense committed (on this<br />

count, anyway)<br />

• Other markets are not so restrictive:<br />

– US competition law applies “rule of reason” test<br />

– A struggle between market liberalization and security<br />

of supply?<br />

• EU policy wonks have rethought the issue as recently as<br />

Spring 2005<br />

• The June 2005 Gazprom/E.ON decision presaged the<br />

next engagement: the Sonatrach <strong>LNG</strong> contracts<br />

17

Thank You!<br />

18

<strong>LNG</strong> Terminals and the Impact on the<br />

Downstream Market<br />

Ned Crady<br />

Elba, USA berth (opened 2005)<br />

1<br />

THE <strong>LNG</strong> “CHAIN”<br />

Production<br />

Field<br />

Development<br />

Liquefaction Shipping Regas<br />

Power<br />

Generation &<br />

Gas Distribution<br />

2

TERMINAL GAS CONTRACTUAL SCHEME<br />

<strong>LNG</strong><br />

Transporter<br />

FOB<br />

Charter<br />

Port Liability<br />

Agreement<br />

Terminal<br />

Operator<br />

Receiving<br />

Terminal<br />

Construction<br />

EPC<br />

Contractor<br />

Ex ship Charter<br />

<strong>LNG</strong><br />

Seller(s)<br />

<strong>LNG</strong><br />

Sales<br />

Contract<br />

<strong>LNG</strong><br />

Buyer<br />

Terminal Use<br />

Agreement<br />

Gas Sales<br />

Agreement<br />

Gas<br />

Buyer(s)<br />

Fuel Supply<br />

Agreement<br />

Power<br />

Plant<br />

Gas<br />

Transporter<br />

Gas Transportation<br />

Agreement<br />

Electricity<br />

Buyers<br />

Power<br />

Purchase<br />

Agreements<br />

Pipeline<br />

Construction<br />

EPC<br />

Contractor<br />

3<br />

KEY PURCHASE CONTRACT DRIVERS<br />

• Long term contract (20+ years)<br />

• Buyer has Take-or-Pay Obligation<br />

• US$ <strong>LNG</strong> Sales Price that supports Seller’s upstream<br />

development, <strong>LNG</strong> infrastructure, cost of shipping (if exship)<br />

and return on investments<br />

• Sufficient annual volume (allowing optimized shipping<br />

capacity)<br />

• Creditworthy buyer(s)<br />

• Assurance of adequate gas reserves<br />

• Destination restrictions (except in Europe)<br />

• “Bankable” terms (supports financing of infrastructure)<br />

• Sound contractual basis governed by NY or English law.<br />

Disputes resolved by international arbitration.<br />

4

LINKS IN THE <strong>LNG</strong> CHAIN<br />

• Each link must meet its<br />

contractual obligations<br />

• Failure of one link of <strong>LNG</strong><br />

chain affects other key<br />

links<br />

• Contracts must set forth<br />

integrated responsibilities<br />

• Long-term nature<br />

requires joint planning<br />

and flexible relationships<br />

5<br />

<strong>LNG</strong> EXPORT “PLAYERS”<br />

GOVERNMENTAL<br />

• Sonatrach (Algeria)<br />

• PERTAMINA (Indonesia)<br />

• Petronas (Malaysia)<br />

• Qatar General Petroleum Corp.<br />

• Abu Dhabi National Oil Corp.<br />

• Oman Government<br />

• Brunei Government<br />

• Nigeria National Petroleum Corp.<br />

• National Gas Company of Trinidad & Tobago<br />

• Sirte Oil (Libya)<br />

• Egypt Government Petroleum Corp.<br />

• Statoil<br />

6

<strong>LNG</strong> EXPORT “PLAYERS”<br />

NON-GOVERNMENTAL<br />

• Shell<br />

• ExxonMobil<br />

• Mitsubishi<br />

• JILCO ( Japan)<br />

• Total<br />

• BP<br />

• Mitsui<br />

• Unocal<br />

• BG<br />

• Woodside<br />

• BHP<br />

• ChevronTexaco<br />

• ConocoPhillips<br />

• Korea <strong>LNG</strong><br />

• Repsol<br />

• Agip<br />

• Suez/Tractebel<br />

• Marubeni<br />

• Marathon<br />

• Itochu<br />

• Nissho Iwai<br />

• Partex (Oman)<br />

• Gaz de France<br />

• Hess<br />

• Hunt Oil<br />

7<br />

<strong>LNG</strong> IMPORT “PLAYERS”<br />

• Statoil<br />

• Cabot<br />

• BG<br />

• Gazprom<br />

• Gaz de France<br />

• Distrigaz<br />

• Centrica<br />

• Total<br />

• Eni<br />

• Edison<br />

• Enagas<br />

• Gas Natural<br />

• Endesa<br />

• Union Fenosa<br />

• CMS Energy<br />

• Coral (Shell)<br />

• Suez<br />

• BP<br />

• Botas<br />

• Petronas<br />

• Sonatrach<br />

• Exxon<br />

• Other National Oil Companies?<br />

• Trading Companies?<br />

• Large LDC’s<br />

• YOUR LOGO HERE<br />

8

Overview of Typical<br />

Contract Mismatches<br />

• Volume & Scheduling Mismatches<br />

• Force Majeure Issues and Mismatches<br />

• Pricing Mismatches<br />

• Credit Support Mismatches<br />

• Physical Mismatches<br />

9<br />

Volume and Scheduling Mismatches<br />

• <strong>LNG</strong> Supply Contracts<br />

– Annual Contract Quantities & Adjustments<br />

– Annual / Quarterly Take or Pay Obligations<br />

– Annual Delivery Program / 90 Day Program / Ratable<br />

Deliveries<br />

– Delivery in ‘Standard Cargo Lots’<br />

– Physical Storage & Vaporization / Send-out Constraints<br />

– Non-availability of “Cover <strong>LNG</strong>” in Event of Seller’s<br />

Delivery Failure<br />

– Buyer’s “Reasonable Efforts” Undertaking to Receive<br />

Off-Specification <strong>LNG</strong><br />

– <strong>LNG</strong> boil-off during loading, transportation and<br />

discharge operations<br />

10

Volume and Scheduling Mismatches (continued)<br />

• North American Gas Marketing Contracts<br />

– Monthly / Daily / Hourly Delivery Send-out / Delivery<br />

Quantities & Adjustments<br />

– Monthly “Take or Pay” Obligations<br />

– Pipeline Takeaway Constraints & Imbalance Charges<br />

– Availability of Cover Gas or Alternative Fuel in Event<br />

of Delivery Failures<br />

– Buyer’s Right to Reject Off-Specification Gas (UCC<br />

Article 2)<br />

11<br />

TAKE-OR-PAY MISMATCH<br />

• Multiple delivery destinations adding to complexity.<br />

TOP adjustments increasing, such as:<br />

– buyer’s “Upward” or “Downward” flexibility<br />

– seller’s diversion rights<br />

– major scheduled maintenance of facilities or<br />

terminal “operational constraints”<br />

– cancel right if buyer unable to schedule for<br />

delivery<br />

– if inadequate gas reserves or deliverability<br />

12

Force Majeure Mismatches<br />

• Typical Force Majeure Clauses in <strong>LNG</strong> SPAs<br />

– Scope of Coverage<br />

• “Traditional” Force Majeure Events<br />

• Upstream Reservoir, Production & Liquefaction Facility<br />

Events<br />

• Marine Transportation Events<br />

• Downstream Customer Facility Events<br />

– Import Terminal and Trunkline<br />

– Coverage for Downstream Customer Facilities?<br />

• Construction-Related Events<br />

• Political Events<br />

13<br />

Force Majeure Mismatches (cont’d)<br />

– North American Natural Gas Sales Contracts<br />

• Typical U.S. gas market contract forms (ex.<br />

NAESB) do not cover upstream <strong>LNG</strong> production<br />

and transportation risks<br />

– Language is broadly drafted, but intention of<br />

drafters was to cover domestic gas field and<br />

pipeline transportation – related events<br />

– No mention of <strong>LNG</strong> Vessels, Terminals, etc.<br />

• May also be limited as to duration during which<br />

force majeure relief may be sought<br />

• Excuse for non-performance due to political events<br />

is often covered<br />

• <strong>LNG</strong> Sector is aggressively lobbying NAESB to<br />

extend Force Majeure to cover <strong>LNG</strong> Vessels and<br />

Import Terminals but the Market wants no part of<br />

upstream liquefaction or well head risk.<br />

14

Pricing Mismatches<br />

• Choice of Pricing Index<br />

– Traditional <strong>LNG</strong> supply contracts use oil-based pricing<br />

indexes (JCC, ICP, etc).<br />

– Newer North America-oriented <strong>LNG</strong> supply contracts<br />

are using NYMEX / Henry Hub index<br />

– Basis differential risk may be allocated to either Seller<br />

or Buyer or split<br />

• <strong>LNG</strong> Sellers frequently view basis risk as being<br />

Buyer’s problem<br />

• Depending upon the market, timing and amount of<br />

<strong>LNG</strong> delivered may itself have an impact on local<br />

basis differential<br />

15<br />

Pricing Mismatches (continued)<br />

• Invoicing and Payment Mismatches<br />

– Even with the use of a common pricing index,<br />

mismatches in the applicable index may occur due to<br />

invoicing and payment timing mismatches<br />

• FOB <strong>LNG</strong> purchases are usually invoiced at or shortly<br />

after loading and can become payable before the cargo<br />

is even discharged (on longer voyages)<br />

• Ex-ship <strong>LNG</strong> purchases are usually invoiced at or shortly<br />

after discharge and can become payable before sendout<br />

of the vaporized <strong>LNG</strong> is completed<br />

16

Pricing Mismatches (continued)<br />

• Invoicing and payment under many gas marketing<br />

contracts is set on a monthly basis for delivered<br />

quantities<br />

• Index reference that applies on the date of invoicing<br />

in the above settings may be different due to<br />

passage of time<br />

• <strong>LNG</strong> vessel timecharter contracts typically require<br />

payment of charter hire monthly in advance,<br />

regardless of volume of <strong>LNG</strong> commodity actually<br />

transported<br />

• <strong>LNG</strong> vessel voyage charters typically require<br />

payment of freight rate upon completion of voyage /<br />

discharge of cargo<br />

17<br />

Credit Support Mismatches<br />

• <strong>LNG</strong> Supply and Transportation Contracts<br />

– Many ‘traditional’ <strong>LNG</strong> supply and transportation<br />

contracts do not require the Seller / Transporter to<br />

provide credit support in the event of an unexcused<br />

Seller / Transporter performance failure<br />

– Of those <strong>LNG</strong> supply and transportation contracts that<br />

do, typical Seller’s / Transporter’s credit support is in<br />

the form of a corporate guarantee<br />

– Often no credit support default provision or credit<br />

support replacement obligation<br />

18

Credit Support Mismatches (continued)<br />

• North American Gas Marketing & Transportation<br />

Contracts<br />

– Fairly detailed credit support obligations applicable to<br />

both Seller / Transporter and Buyer / Shipper<br />

– Fairly easy and quick recourse to available credit<br />

support<br />

– Clear guidelines as to credit support defaults and<br />

credit support replacement obligations<br />

– Fairly “light” triggers to require additional credit<br />

support<br />

19<br />

Physical Impact<br />

• Increased Supply of Natural Gas<br />

• Increased Need for Storage<br />

20

Proposed European <strong>LNG</strong> Import Terminals<br />

21<br />

Proposed European <strong>LNG</strong> Import Terminals (cont’d)<br />

22

Proposed European <strong>LNG</strong> Import Terminals (cont’d)<br />

23<br />

Regional <strong>LNG</strong> Imports at New Terminals,<br />

2010, 2015, 2020, and 2025 (billion cubic feet)<br />

2010<br />

2015<br />

2020<br />

2025<br />

WA/OR<br />

Mountain<br />

West<br />

North<br />

Central<br />

2008<br />

East<br />

North<br />

Central<br />

114 128<br />

New<br />

England (2020)<br />

New England<br />

Mid<br />

256<br />

Atlantic<br />

128<br />

(2020)<br />

Middle Atlantic<br />

CA<br />

AZ/NM<br />

West<br />

South<br />

Central<br />

1086<br />

1551<br />

East<br />

South<br />

Central<br />

930 930<br />

807<br />

South<br />

Atlantic<br />

188<br />

413<br />

(2016)<br />

South Atlantic<br />

183183183 244 Florida<br />

293 293 293<br />

(2007)<br />

Mexico into US<br />

615<br />

310<br />

FL<br />

146<br />

(2010)<br />

(20xx) – Start year of first new terminal<br />

(2010)<br />

(2006) East South Central<br />

West South Central<br />

Annual Energy Outlook 2005<br />

24

But What does <strong>LNG</strong> Have to Do With Natural Gas<br />

Storage?<br />

• <strong>LNG</strong> will go into storage pending alignment of credit<br />

worthy, baseload gas purchasers who can take 100% of<br />

terminal send out capacity<br />

• <strong>LNG</strong> will require cover gas in the event of:<br />

• production and liquefaction outages/shipping delays<br />

• Force Majeure, quality issues<br />

• Make up <strong>LNG</strong> will in turn be vaporized and swapped into<br />

storage to replace cover gas<br />

• Natural Gas Storage Facilities<br />

• are cheaper than another <strong>LNG</strong> tank<br />

• provide more pipeline alternatives (hub services)<br />

25<br />

Underground Gas Storage Facilities in Europe (end of 1999)<br />

26

Proposed New European Storage Facilities (cont’d)<br />

27<br />

Proposed New European Storage Facilities<br />

28

29<br />

Source: FERC Website (04/27/06)<br />

30

Source: FERC Website (04/27/06)<br />

31<br />

Not All Storage is Equal:<br />

Pad Gas Requirements and<br />

Cycling Capability Differ<br />

Source: FERC Staff Report (9/30/2004)<br />

32

Not All Storage is Equal:<br />

Development Costs Vary<br />

Source: FERC Staff Report (9/30/2004)<br />

33<br />

Not All Storage is Equal:<br />

<strong>LNG</strong> Storage Versus Salt Storage<br />

34

THANK YOU!<br />

Ned Crady<br />

Partner, Global Transactions<br />

(w) 713-751-3203<br />

NCrady@KSLaw.com<br />

35

STRUCTURING A<br />

BANKABLE<br />

<strong>LNG</strong> PROJECT<br />

SCOTT SAMUEL AND DANIEL R. ROGERS<br />

The Tower of London<br />

May 4, 2006<br />

<strong>LNG</strong> PROJECT FINANCING<br />

2<br />

1

OVERVIEW OF PRESENTATION<br />

• Import Terminal Financing Needs<br />

• <strong>LNG</strong> Gas Supply Chain<br />

• Possible <strong>LNG</strong> Structures<br />

• Project Structuring Fundamentals<br />

• Some Common Impediments to Project<br />

Financing <strong>LNG</strong> Facilities<br />

3<br />

IMPORT TERMINAL FINANCING NEEDS<br />

4<br />

2

IMPORT TERMINAL FINANCING NEEDS<br />

• Current European landscape:<br />

– Over 25 <strong>LNG</strong> import terminal projects planned or announced for<br />

Europe<br />

– 6-10 new <strong>LNG</strong> import terminals likely to be developed in<br />

Europe/Mediterranean basin<br />

– Capital costs likely to be similar<br />

• Current U.S. landscape:<br />

– Over 50 <strong>LNG</strong> import terminal projects planned or announced for US<br />

– Approximately 6-10 new <strong>LNG</strong> import terminals predicted for US by<br />

2010<br />

– Estimated capital cost per facility is $500 to $750 million<br />

– Expansions underway at existing terminals<br />

• Result: Approx. $6 – 15 billion in capital needed for import terminal<br />

infrastructure (excluding new pipelines)<br />

5<br />

<strong>LNG</strong> Gas Supply Chain<br />

Upstream Gas Field<br />

Pipeline<br />

Liquefaction Plant<br />

<strong>LNG</strong> Tankers<br />

Import Terminal<br />

6<br />

3

Possible <strong>LNG</strong> Structures<br />

• Import Terminals<br />

• Upstream development and liquefaction plant<br />

• <strong>LNG</strong> Tankers<br />

7<br />

UNIFIED (INTEGRATED) FINANCING<br />

STRUCTURE<br />

Government<br />

Production Sharing Agreement<br />

Upstream<br />

Gas Producers<br />

On-loans<br />

Financiers<br />

Loan Agreement<br />

Downstream<br />

<strong>LNG</strong><br />

Company<br />

Shareholders<br />

Ownership<br />

Financiers’ security package<br />

8<br />

4

SALE AND PURCHASE STRUCTURE<br />

Government<br />

Production Sharing Agreement<br />

Upstream<br />

Gas Producers<br />

GAS<br />

Gas Sales Agreement<br />

Financiers<br />

Loan Agreement<br />

<strong>LNG</strong><br />

Downstream<br />

<strong>LNG</strong><br />

Company<br />

Shareholders<br />

Ownership<br />

Offtakers<br />

9<br />

TOLLING STRUCTURE<br />

Government<br />

Production Sharing Agreement<br />

Upstream<br />

Gas Producers<br />

<strong>LNG</strong> Sale and Purchase<br />

Agreements<br />

Offtakers<br />

GAS<br />

Tolling Agreement<br />

<strong>LNG</strong><br />

Financiers<br />

Loan Agreement<br />

Downstream<br />

<strong>LNG</strong> Company<br />

Shareholders<br />

Ownership<br />

10<br />

5

SALE AND PURCHASE STRUCTURE<br />

Government<br />

Production Sharing Agreement<br />

Financiers<br />

Loan Agreement<br />

Upstream<br />

Gas Producers<br />

GAS<br />

Gas Sales Agreement<br />

Financiers<br />

Loan Agreement<br />

Downstream<br />

<strong>LNG</strong> Company<br />

Shareholders<br />

<strong>LNG</strong><br />

Ownership<br />

Offtakers<br />

11<br />

UNIFIED (INTEGRATED) FINANCING<br />

STRUCTURE<br />

Government<br />

Production Sharing Agreement<br />

Upstream<br />

Gas Producers<br />

On-loans<br />

Financiers<br />

Loan Agreement<br />

Downstream<br />

<strong>LNG</strong> Company<br />

Shareholders<br />

Financiers’ security package<br />

12<br />

6

KEY CONSIDERATIONS<br />

• Structuring for expansions<br />

– Same or new entity for expansion?<br />

– Project-on-project financing issues<br />

– Collateral allocation & priority issues<br />

– Shared facilities<br />

– Liability insulation<br />

– Effects on available financing sources<br />

13<br />

KEY CONSIDERATIONS<br />

• Contract chain risk allocation and mitigation<br />

– Structural and contract mitigants<br />

– Contract alignment<br />

– Focus on the “revenue contracts”<br />

• Off-taker / capacityholder credit is critical<br />

– Credit “pressure points” are a big factor in level of lender<br />

recourse to sponsors<br />

14<br />

7

PROJECT FINANCING IMPEDIMENTS<br />

15<br />

SOME IMPEDIMENTS TO FINANCING<br />

• Common financing impediments<br />

– Sponsor credit and performance concerns<br />

– Contract price / volume risk volatility<br />

– Construction and completion risks<br />

– Misalignment of key revenue contract terms<br />

• Term mismatches<br />

• Unhedged pricing index mismatches<br />

• Volume & scheduling mismatches<br />

• Force majeure mismatches<br />

• Quality specification mismatches<br />

16<br />

8

SOME IMPEDIMENTS TO FINANCING<br />

(continued)<br />

• Some more common financing impediments<br />

– Contract default and damage / remedy mismatches<br />

– Payment timing and currency mismatches<br />

– Credit support mismatches<br />

– Conditions precedent (CP) mismatches<br />

• How many of these impediments are addressed will impact<br />

on available financing sources and terms<br />

17<br />

POLITICAL RISK MITIGANTS<br />

FOR <strong>LNG</strong> PROJECTS<br />

• External<br />

– Investment protection treaties<br />

– Private political risk insurance<br />

– Political risk insurance from multilateral and export<br />

credit agencies<br />

• Internal<br />

– Legislative protection<br />

– Stabilisation clauses<br />

– Externalisation of governing law and venue for dispute<br />

resolution<br />

18<br />

9

PARTING COMMENTS<br />

• Parting comments:<br />

– Up-front project structuring and risk analysis<br />

is key<br />

– Keep risk-sharing expectations realistic<br />

– Keep execution timing expectations realistic<br />

– Keep financing expectations realistic<br />

– Look at all financing alternatives, including<br />

the less traditional financing sources and<br />

structures<br />

19<br />

Thank You!<br />

20<br />

10

<strong>LNG</strong> IMPORT TERMINALS:<br />

CHALLENGES AND OPPORTUNITIES<br />

Philip Weems & Susan Beck<br />

London<br />

4 May 2006<br />

THE “<strong>LNG</strong> CHAIN”<br />

AND COST DISTRIBUTION<br />

Field<br />

Development<br />

10-20%<br />

Liquefaction<br />

25-35%<br />

Shipping<br />

15-25%<br />

Receiving<br />

Terminal<br />

5-15%<br />

Power<br />

Generation &<br />

Gas Distribution<br />

25-35%<br />

1

IMPORT STATISTICS 2004<br />

51 EXISTING ONSHORE TERMINALS (+ 1<br />

OFFSHORE) (14 COUNTRIES)<br />

United <strong>King</strong>dom 1<br />

Belgium 1<br />

France 2<br />

Turkey 2<br />

Japan 25<br />

United States 5*<br />

Portugal 1<br />

Korea 4<br />

Puerto Rico and DR 2<br />

Spain 4<br />

Italy 1<br />

Greece 1<br />

India 2<br />

Taiwan 1<br />

• Terminals opened during 2004-2005: Japan, U.S., India, and UK<br />

2

IMPORT TERMINALS<br />

Elba, USA berth (opened 2005)<br />

40+ PROPOSED <strong>LNG</strong> TERMINALS<br />

Poland<br />

Canada<br />

Netherlands<br />

Romania<br />

United States<br />

United <strong>King</strong>dom<br />

Germany<br />

France<br />

Cyprus<br />

China<br />

Taiwan<br />

Thailand<br />

Mexico<br />

Spain<br />

El Salvador<br />

Italy<br />

Brazil<br />

India<br />

Singapore<br />

Chile<br />

Indonesia<br />

* Terminals under construction: Mexico, China, US, UK, etc.<br />

New Zealand<br />

3

PROPOSED TERMINALS<br />

FREEPORT <strong>LNG</strong>, TEXAS<br />

4

PROPOSED TERMINALS:<br />

LARGE ONSHORE IN LOUISIANA<br />

(CHENIERE)<br />

PROPOSED TERMINALS<br />

FREEPORT <strong>LNG</strong>, TEXAS<br />

5

OFFSHORE <strong>LNG</strong> TECHNOLOGY<br />

OPTIONS<br />

• Regasification vessels (e.g. “Energy<br />

Bridge”)<br />

– typical <strong>LNG</strong> carrier modified to enable<br />

vessel to discharge regasified <strong>LNG</strong> into<br />

a subsea pipeline, via an internal turret<br />

connected to offshore mooring buoy<br />

• Platform based import terminals -<br />

– converting existing oil and gas platform<br />

structures to accommodate <strong>LNG</strong><br />

deliveries, along with other berthing<br />

OFFSHORE <strong>LNG</strong> TECHNOLOGY<br />

OPTIONS<br />

• Offshore gravity based structures (GBS)<br />

– - concrete or steel caissons located on the<br />

seabed. Self-supporting infrastructure (e.g.<br />

operation, utilities and power generation)<br />

• Floating storage regas units (FSRU) -<br />

– purpose built, permanently moored structure<br />

with <strong>LNG</strong> vessels shuttling between loading<br />

port and import terminal<br />

6

TYPES OF PROPOSED TERMINALS:<br />

ENERGY BRIDGE ON-BOARD<br />

REGASIFICATION TERMINAL<br />

<strong>LNG</strong> Tanks<br />

Traction Winch<br />

Boiler<br />

HP Pumps<br />

Vaporizers<br />

Turret & Buoy<br />

TYPES OF PROPOSED TERMINALS:<br />

OFFSHORE MASSACHUSETTS (HOEGH(<br />

-<br />

SUEZ)<br />

7

TYPES OF PROPOSED TERMINALS: BHP<br />

BILLITON’S<br />

FLOATING OFFSHORE STORAGE AND<br />

UNLOADING VESSEL<br />

TYPES OF PROPOSED TERMINALS:<br />

HILOAD OFFSHORE<br />

8

<strong>LNG</strong> SAFETY ISSUES<br />

<strong>LNG</strong> SAFETY ISSUES<br />

• At first, some critics claimed <strong>LNG</strong> is “Frozen<br />

Fire” - a “lethal gamble” capable of destroying<br />

an entire city<br />

9

LOCAL ISSUES<br />

EXAMPLE OF ANTI-<strong>LNG</strong> LOBBY<br />

• http://www.timrileylaw.com/<strong>LNG</strong>.htm<br />

<strong>LNG</strong><br />

DANGER To our Communities<br />

ALERT . . .<br />

“<strong>LNG</strong> has tried locating in the City of Oxnard,<br />

California, before, so we already know how massive its<br />

destruction can be. In 1977, Oxnard opposed an <strong>LNG</strong><br />

project after the city’s Environmental Impact Report<br />

(EIR) showed up to 70,000 casualties resulting from an<br />

offshore <strong>LNG</strong> tanker accident.”<br />

10

ANTI-<strong>LNG</strong> LOBBY<br />

(www.lngwatch.com)<br />

<strong>LNG</strong> IS POTENTIALLY DANGEROUS Fiery <strong>LNG</strong> disasters in Algeria (2004) and<br />

Cleveland (1944) are real examples of the potential for death and injury in the vicinity of<br />

<strong>LNG</strong> facilities. No telling what a major storm or tsunami will do to the planned floating<br />

terminal, it will be the first of its kind in the world.<br />

THREAT TO OUR COAST Importing <strong>LNG</strong> would require a large industrial facility off the<br />

coast and a pipeline to carry the gas to shore. Coastal <strong>LNG</strong> terminals will lead to the<br />

continued industrialization of an already crowded coastline.<br />

A DANGER TO OUR COMMUNITIES Maryland began importing <strong>LNG</strong> three years ago,<br />

where the gas is eroding pipeline seals, causing dangerous leaks and $144 million in<br />

damage. Now Maryland ratepayers are being asked to foot the bill to fix the damage.<br />

A TERRORIST TARGET Anti-terrorist experts, like former national security advisor<br />

Richard Clarke, say <strong>LNG</strong> tankers and facilities are major terrorist targets.<br />

WE DON'T NEED IT The US Department of Energy says we have adequate domestic<br />

natural gas supplies to meet current demand for at least the next 60 years.<br />

IT CONTRIBUTES TO GLOBAL WARMING Because of processing and transportation,<br />

<strong>LNG</strong> produces 20% to 40% more greenhouse gases than domestic natural gas. California<br />

should invest in clean, renewable energy — not more polluting, expensive fossil fuels.<br />

<strong>LNG</strong> IS SAFE AND RELIABLE<br />

• But, to date:<br />

– 45,000+ <strong>LNG</strong> cargoes<br />

– almost 100 million<br />

miles<br />

with no fatalities or<br />

serious incidents<br />

• 40+ years of experience<br />

• Proven technical designs<br />

and high standards of<br />

operation and<br />

maintenance (supported<br />

by SIGTTO)<br />

Fujian, China<br />

11

LESSONS FROM HISTORY<br />

• Two examples<br />

show major impacts<br />

on <strong>LNG</strong> trade<br />

caused by approval<br />

failures<br />

• 1970s and 1980s in<br />

California<br />

• 1990s in Italy<br />

TERMINAL REJECTION - CALIFORNIA<br />

• 1973 Indonesian contract to supply Western <strong>LNG</strong><br />

terminal sites near Los Angeles<br />

• Environmental / safety / economic reviews led to<br />

differing views from State/Federal agencies<br />

• 1977 California <strong>LNG</strong> Terminal Siting Act gave<br />

authority to only one State agency<br />

• 82 sites found, but 81 eliminated for military,<br />

population, weather or other reasons<br />

• U.S. court rejected last site for seismic reasons<br />

• By 1981 W<strong>LNG</strong> abandoned the proposal, but<br />

Indonesia found alternative market in Japan<br />

• Fortunately, no contractual dispute occurred<br />

12

TERMINAL APPROVAL - ITALY<br />

• Nigerian contract to supply ENEL Tuscany terminal<br />

• 1996 ENEL canceled contract claiming force majeure<br />

due to withdrawal of approval by newly-elected<br />

“greener” Italian government<br />

• Nigeria filed $13 billion claim, reportedly largest ever<br />

brought under English law<br />

• Case settled, with settlement calling for shipment of<br />

<strong>LNG</strong> to France in exchange for Russian gas diverted<br />

by French buyers to Italy<br />

AGREEMENTS FOR <strong>LNG</strong> TERMINAL<br />

SERVICES:<br />

13

<strong>LNG</strong> TERMINAL DEVELOPMENT<br />

• Historically <strong>LNG</strong> terminals have been developed<br />

by and for the end-user<br />

• Third party access to terminal capacity either not<br />

relevant or not permitted<br />

• If available, third party access allowed where<br />

user did not compete in downstream gas market<br />

with terminal owner<br />

A MULTITUDE OF NAMES….<br />

• Terminal Use Agreement (“TUA”)<br />

• Terminal Services Agreement<br />

• Firm Service Agreement<br />

• Tolling Services Agreement<br />

• Firm Storage Services Agreement<br />

• <strong>LNG</strong> Terminalling Capacity Subscription Agreement<br />

• Specific Terms Agreement<br />

• Throughput Agreement<br />

14

ADVANTAGES/DISADVANTAGES OF<br />

<strong>LNG</strong> TERMINAL MODELS<br />

100% Owner - 100% User Terminal<br />

Maximum operating flexibility within<br />

terminal’s capacity to co-ordinate<br />

<strong>LNG</strong> sales volumes and deliveries<br />

Flexibility for expansions<br />

BUT<br />

• Responsibility for 100% funding<br />

• No third party user to mitigate financial risk<br />

• Operating costs may be very expensive<br />

100% THIRD PARTY USER TERMINAL<br />

• Third party user’s financial risk only linked to its<br />

contracted capacity<br />

• Its capacity portfolio should be easier to manage - will<br />

only contract for what it needs at one or more <strong>LNG</strong><br />

terminals<br />

• Should be able to agree favourable terms for its use of<br />

capacity if too much terminal capacity in the market<br />

BUT<br />

• Competing with capacity with other users<br />

• Full access to ship berthing facilities at <strong>LNG</strong> terminal<br />

may be difficult<br />

• Commercial viability of <strong>LNG</strong> terminal may be dependent<br />

on financial creditworthiness of a number of unrelated<br />

companies<br />

15

MIXED OWNER - THIRD PARTY USE<br />

• Owner’s do not have 100% of the financial risk - terminal<br />

use charge should reduce owner’s operating costs<br />

• Third party user’s financial risk likely to be limited to its<br />

contracted capacity - no up front capital payments.<br />

• Third party can obtain comfort from owner’s<br />

creditworthiness.<br />

• No one entity will have complete flexibility regarding<br />

capacity use<br />

• Reduced flexibility if expansions are needed<br />

• Reduced access to ship berthing facilities<br />

TREND IN EUROPE AND US IS FOR SEPARATE<br />

TERMINAL OWNER TO PROVIDE TERMINAL<br />

SERVICES TO MULTIPLE PARTIES<br />

Transporter<br />

Terminal<br />

Owner<br />

Ex Ship<br />

FOB<br />

Terminal Use Agreement(s)<br />

<strong>LNG</strong><br />

Seller(s)<br />

<strong>LNG</strong> Sales<br />

Contract<br />

<strong>LNG</strong><br />

Buyer<br />

Gas Sales<br />

Agreement<br />

Gas<br />

Buyer(s)<br />

Sole Use Terminal<br />

16

TYPICAL DEAL STRUCTURE<br />

• Fee structure supporting financing (e.g. need rated<br />

customer), with Terminal not exposed to volume / price risk<br />

• Typical service fee components:<br />

– Reservation – fixed, with portion perhaps tied to index<br />

– Operating Costs – fixed or actual<br />

– Retainage for Fuel – fixed or actual (with cap?)<br />

• Few fee adjustments if services unavailable (i.e. “hell or<br />

high water” basis)<br />

• “Use-it-or-lose it” basis (e.g. Customer bears upstream risk)<br />

• Termination right if extended FM or services unavailability<br />

• Terminal Owner enjoys limited liability<br />

• 20+ year term, with possible extension rights and options<br />

TUA BASICS<br />

• Regulations may affect approach<br />

• Traditional TUA services:<br />

– Vessel berthing and unloading<br />

– <strong>LNG</strong> storage<br />

– Regasification of <strong>LNG</strong><br />

– Transportation to redelivery point<br />

(with redelivery of gas on a<br />

commingled stream basis)<br />

• Example models:<br />

–3 rd party usage only<br />

– Mixed 3 rd party / terminal owner<br />

usage<br />

17

SOME KEY TUA ISSUES<br />

• Scheduling of vessel berthing and<br />

gas offtake<br />

– especially if owner is also a<br />

terminal user<br />

• Inventory management (including<br />

effects of using larger vessels)<br />

• Assignment and subletting of<br />

services (especially re financing)<br />

• Remedies for:<br />

– owner’s failure to provide<br />

services; and / or<br />

– damage to <strong>LNG</strong> terminal<br />

SCHEDULING – A FOCUS OF DISCUSSION<br />

• Scheduling is a major customer<br />

focus<br />

– though almost every terminal has<br />

multiple <strong>LNG</strong> suppliers<br />

• Grant one customer a priority over<br />

other customers? Examples:<br />

– Establishing or changing <strong>LNG</strong><br />

berthing schedule<br />

– Force majeure or other terminal<br />

shutdown<br />

• If a priority given, how determined?<br />

– Contracted services<br />

– Duration of TUA<br />

18

RECENT EUROPEAN TUAs<br />

1. Fluxys <strong>LNG</strong>: (Belgium)<br />

‣ Qatar / Exxon (2004)<br />

‣ Distrigas (2004)<br />

2. Dragon <strong>LNG</strong>: (UK)<br />

‣ BG (2004)<br />

‣ Petronas (2004)<br />

3. Grain <strong>LNG</strong> (National Grid Transco): (UK)<br />

‣ BP / Sonatrach (2004)<br />

‣ Gaz de France (2005)<br />

‣ Centrica plc (2005)<br />

RECENT NORTH AMERICAN TUAs<br />

4. Sabine Pass [Cheniere]: (Louisiana)<br />

‣ Total (2004)<br />

‣ Chevron (2004)<br />

5. Freeport <strong>LNG</strong>: (Texas)<br />

‣ Dow Chemical (2004)<br />

‣ ConocoPhillips (2004)<br />

‣ Mitsubishi (2005)<br />

6. Energía Costa Azul: (Mexico)<br />

‣ Shell (2004)<br />

‣ Sempra (2004)<br />

7. Sempra - Cameron (Louisiana) - ENI (2005)<br />

19

ACCESS TO <strong>LNG</strong> TERMINALS<br />

IN EUROPE<br />

SECOND GAS DIRECTIVE<br />

• Second Gas Directive recognised importance of<br />

effective national regulation in guaranteeing<br />

non-discriminatory access<br />

• Regulator’s competence to fix/approve tariffs (or<br />

the calculation methodology) for access to <strong>LNG</strong><br />

facilities<br />

• Tariffs should be published to avoid uncertainty<br />

and costly disputes<br />

ACCESS TO <strong>LNG</strong> TERMINALS<br />

IN EUROPE<br />

SECOND GAS DIRECTIVE<br />

European Commission introduced number of<br />

directives designed to facilitate competition and<br />

create a single gas market in Europe<br />

From 1 st July 2004 Second Gas Directive<br />

(2003/55/EC) requires open access to gas<br />

storage, transmission and distribution (this<br />

includes <strong>LNG</strong> terminals)<br />

Access should be “Non-discriminatory transparent<br />

and fairly priced”<br />

20

ACCESS TO <strong>LNG</strong> TERMINALS<br />

IN EUROPE<br />

Exemptions from third party access provisions may be<br />

given for new gas infrastructure if:<br />

• the investment enhances competition in gas supply and<br />

security of gas supply<br />

• risk attached to investment is such that there would be<br />

no investment without exemption<br />

• legal entity owning infrastructure separate from system<br />

operator<br />

• charges levied on infrastructure users<br />

• exemption not detrimental to competition or effective<br />

functioning of internal gas market or applicable regulated<br />

system<br />

<strong>LNG</strong> TERMINAL ACCESS IN BRITAIN<br />

SECOND GAS DIRECTIVE<br />

OFGEM (Office for Gas and Electricity Markets)<br />

is the regulator for Britain’s gas and electricity<br />

industries.<br />

OFGEM’s role is to promote effective competition<br />

and to regulate the gas and electricity industries<br />

to ensure adequate investment in the networks.<br />

OFGEM’s responsibility to grant exemptions on a<br />

case by case basis pursuant to Gas (Third Party<br />

Access) Regulations 2004.<br />

21

<strong>LNG</strong> TERMINAL ACCESS IN BRITAIN<br />

SECOND GAS DIRECTIVE<br />

• Third party exemption may cover all or part of the<br />

new infrastructure.<br />

• Exemption may be subject to conditions relating to<br />

term of exemption depending on:<br />

- duration of contracts<br />

- additional capacity to be built/modification of<br />

existing capacity<br />

- term of the project<br />

- national circumstances<br />

• OFGEM may decide upon the rules and<br />

mechanisms for managing and allocating capacity<br />

<strong>LNG</strong> TERMINAL ACCESS IN BRITAIN<br />

Ofgem obliged to notify Commission of all relevant<br />

information regarding exemption decision.<br />

- Within 2 months of notification, Commission may<br />

request amendment/ withdrawal of decision to grant<br />

exemption.<br />

- Commission has veto rights.<br />

In Britain, 3 <strong>LNG</strong> terminals have been granted an<br />

exemption - Grain <strong>LNG</strong>, Dragon <strong>LNG</strong> and South Hook<br />

<strong>LNG</strong>.<br />

22

CONCLUSION<br />

• US / European terminals are<br />

offering services to their sponsor<br />

companies and 3 rd parties<br />

• Experience shows TUAs can raise<br />

challenging issues; in particular,<br />

if:<br />

– multiple customers are users,<br />

especially if they have differing<br />

rights of service; or<br />

– regulatory regime overlooks<br />

unique needs of the <strong>LNG</strong> trade<br />

• Contract form continues to evolve<br />

as we learn from more experience<br />

23

Islamic Finance<br />

An additional source of finance in<br />

<strong>LNG</strong> Projects<br />

May 4, 2006<br />

Jawad I. Ali<br />

Contents<br />

• Islamic Finance at a Glance<br />

• Islamic Finance tranches in Gas and <strong>LNG</strong> Projects<br />

• Islamic Financing structures utilized in <strong>LNG</strong> projects<br />

• The main difference between Conventional Finance and<br />

Islamic Finance<br />

• Enforceability of Islamic Finance documents and<br />

governing law issues<br />

• The reasons for the late arrival of Islamic tranches in<br />

Gas & <strong>LNG</strong> project financing & new trends<br />

1<br />

1

Islamic Finance at a glance<br />

What is Islamic Finance?<br />

• Islamic finance is any financing that is compliant with the<br />

principles of Islamic Shari’ah.<br />

2<br />

Islamic Finance at a glance.. (cont’d)<br />

What is Islamic Shari’ah?<br />

• The principles of Islamic Shari’ah derive from five<br />

sources:<br />

‣ Qur’an -- the holy book revered by Muslims;<br />

‣ Sunna -- the practice and traditions of the prophet<br />

Muhammad;<br />

3<br />

2

Islamic Finance at a glance.. (cont’d)<br />

‣ Qiyas -- a comparison, used to make a judgement on<br />

issues which have no clear-cut ruling in the Qur’an or the<br />

Sunna, by consideration of similar issues which do have<br />

clear ruling;<br />

‣ Ijtehad -- the diligent judgement of the scholars through<br />

reasoning and logic; and<br />

‣ Ijmaa -- a consensus or agreement used for issues which<br />

require Ijtehad.<br />

4<br />

Islamic Finance at a glance.. (cont’d)<br />

Who decides that a financing structure and the<br />

documentation effecting the same are Shari’ahcompliant?<br />

• The Shari’ah board or Supervisory committee<br />

• Review of the structure and documentation<br />

• Issuance of the fatwa<br />

• Fatwa’s (persuasive not binding).<br />

5<br />

3

Islamic Finance at a glance.. (cont’d)<br />

Who populates the Shari’ah boards/supervisory<br />

committees?<br />

• Religious scholars, lawyers, economists and others.<br />

• A Shari’ah board/supervisory committee is more akin to<br />

a compliance officer of a banking institution as opposed<br />

to member of corporate board.<br />

6<br />

Islamic finance tranches in Gas and <strong>LNG</strong><br />

Projects<br />

• The Dolphin Gas Project -- Closed September 2005<br />

‣ Project description: Gas Extraction and processing in<br />

Qatar and the construction of a pipeline to the UAE.<br />

‣ Financing: $3.45 billion, $1.0 billion of which was financed<br />

on a Shari’ah-compliant basis utilizing an Istisna’a-Ijara<br />

financing structure.<br />

‣ Tenor: 4 years<br />

‣ Islamic Mandated lead arrangers: ABN Amro, BNP<br />

Paribas, Citibank, Dubai Islamic Bank and Gulf<br />

Investment Bank.<br />

7<br />

4

Islamic finance tranches in <strong>LNG</strong> Projects<br />

• Qatargas II <strong>LNG</strong> -- Closed December 2004<br />

‣ Project Description: Upstream infrastructure<br />

development, including offshore gas platforms and a twotrain<br />

onshore <strong>LNG</strong> processing facility.<br />

‣ Financing: $4.5 billion, $530 million of which was financed<br />