Self Assessment Form

Self Assessment Form

Self Assessment Form

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

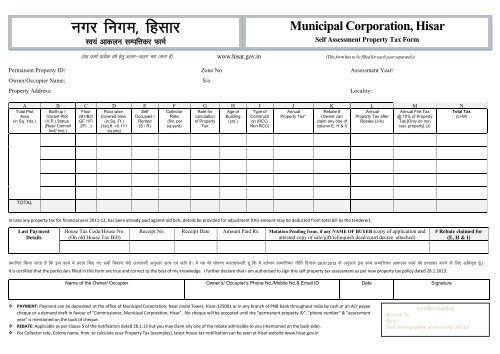

uxj fuxe] fglkj<br />

Lo;a vkdyu lEifÙkdj QkeZ<br />

Municipal Corporation, Hisar<br />

<strong>Self</strong> <strong>Assessment</strong> Property Tax <strong>Form</strong><br />

¼;g QkeZ izR;sd o’kZ gsrw vyx&vyx Hkjk tkuk gS½ www.hisar.gov.in (This form has to be filled for each year separately)<br />

Permanent Property ID: Zone No. <strong>Assessment</strong> Year:<br />

Owner/Occupier Name:<br />

Property Address:<br />

S/o<br />

A B C D E F G H I J K L M N<br />

Total Plot<br />

Area<br />

(in Sq. Yds.)<br />

Built-up /<br />

Vacant Plot<br />

(V.P.) Status<br />

(Resi/ Comml/<br />

Indl/ Inst.)<br />

Floor<br />

(B1/B2/<br />

GF /1F/<br />

2F/…)<br />

Floor wise<br />

Covered area<br />

(in Sq. Ft.)<br />

[1sq.ft. =0.111<br />

sq.yds]<br />

<strong>Self</strong><br />

Occupied /<br />

Rented<br />

(S / R)<br />

Collector<br />

Rate<br />

(Rs. per<br />

sq.yard)<br />

Rate for<br />

calculation<br />

of Property<br />

Tax<br />

Age of<br />

Building<br />

(yrs.)<br />

Type of<br />

Constructi<br />

on (RCC/<br />

Non RCC)<br />

Annual<br />

Property Tax*<br />

Rebate #<br />

(Owner can<br />

claim any one of<br />

column E, H & I)<br />

Locality:<br />

Annual<br />

Property Tax after<br />

Rebate (J-K)<br />

Annual Fire Tax<br />

@ 10% of Property<br />

Tax [Only on non<br />

resi. property] (J)<br />

Total Tax<br />

(L+M)<br />

TOTAL<br />

In case any property tax for financial year 2011-12, has been already paid against old bills, details be provided for adjustment (this amount may be deducted from total bill by the tenderer).<br />

Last Payment<br />

Details<br />

House Tax Code/House No.<br />

(On old House Tax Bill)<br />

Receipt No. Receipt Date Amount Paid Rs. Mutation Pending Issue, if any NAME OF BUYER (copy of application and<br />

attested copy of sale/gift/relinquish deed/court decree attached)<br />

# Rebate claimed for<br />

(E, H & I)<br />

izekf.kr fd;k tkrk gS fd bl QkeZ esa iznku fd, x, lHkh fooj.k esjh tkudkjh vuqlkj lR; ,oa lgh gSA eS ;g Hkh ?kks’k.kk djrk/djrh gw a fd eS orZeku lEifÙkdj uhfr fnukad 28-01-2013 ds vuqlkj bl Lo;a lEifÙkdj vkdyu QkEkZ dks gLrk{kj djus ds fy, vf/kd`r gw¡A<br />

It is certified that the particulars filled in this form are true and correct to the best of my knowledge. I further declare that I am authorised to sign this self property tax assessment as per new property tax policy dated 28.1.2013.<br />

Name of the Owner/ Occupier Owner’s/ Occupier’s Phone No./Mobile No.& Email ID Date Signature<br />

PAYMENT: Payment can be deposited at the office of Municipal Corporation, Near Jindal Tower, Hisar-125001 or in any branch of PNB bank throughout India by cash or an A/c payee<br />

cheque or a demand draft in favour of "Commissioner, Municipal Corporation, Hisar". No cheque will be accepted until the "permanent property ID", “phone number" & "assessment<br />

year" is mentioned on the back of cheque.<br />

REBATE: Applicable as per clause 5 of the notification dated 28.1.13 but you may claim any one of the rebate admissible to you (mentioned on the back side).<br />

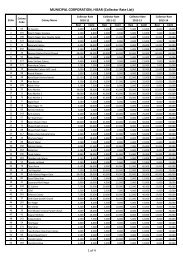

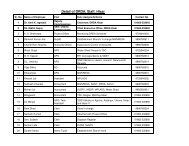

For Collector rate, Colony name, How to calculate your Property Tax (examples), latest house tax notification can be seen at Hisar website www.hisar.gov.in<br />

For Office Use Only<br />

Receipt No<br />

Date<br />

Seal and signature of receiving official

gfj;k.kk ljdkj }kjk tkjh vf/klwpuk la[;k 31&HLA of 2012/59 fnukad<br />

25-08-2012 ,oa S.O./H.A./ 16/1994/S. 87/2013 fnukad 28-01-2013 ds<br />

vuqlkj ubZ lEifÙkdj uhfr fuEu izdkj gS%&<br />

1- fjgk;”kh IykVksa@x`gksa ij lEifÙkdj %<br />

(i) 250 oxZ xt rd vkdkj ds IykV lfgr x`g ¼Lo;a jgus okys½ vkSj 500<br />

oxZ QqV rd ds vkdkj ds ySV ¼Lo;a jgus okys½ ij j 1-00 izfr oxZ<br />

xt(<br />

(ii) ¼d½ 100 oxZ xt ls vf/kd fdUrq 250 oxZ xt rd dh ¼100 oxZ xt<br />

rd ds vkdkj ds IykV dks NwV gksxh½ [kkyh fjgk;”kh Hkwfe dh n”kk esa<br />

dj j 0-50 izfr oxZ xt gksxk(<br />

¼[k½ 250 oxZ xt ls vf/kd [kkyh fjgk;”kh Hkwfe dh n”kk esa] dj<br />

dySDVj nj izfr oxZ xt x 0-00015 x oxZ xt es IykV dk vkdkj<br />

gksxk(<br />

(iii) 250 oxZ xt ls vf/kd vkdkj ds IykV pkgs Lo;a jg jgs gksa ;k fdjk;s<br />

ij fn;s gks] ij fufeZRk x`gksa rFkk 500 oxZ QqqqV ls vf/kd ds ySV~l ds<br />

fy, lEifÙk dj dySDVj nj izfr oxZ xt x 0-00075 x oxZ xt es<br />

fufeZr {ks= gksxk rFkk x.kuk iz;kstuks ds fy, fufeZr Hkkx oxZ xt esa<br />

ekuk tk;sxkA rFkkfi IykV dks [kkyh :Ik esa fopkjrs gq, bl izdkj<br />

laxf.kr dj nkf;Ro IykV dh laxf.kr jkf”k ls de ugha gksxk(<br />

(iv) 250 oxZ xt ls de rFkk 500 oxZ QqV rd ds ySV dh fdjk;s dh<br />

fjgk;”kh lEifÙk dh n”kk esa] nj mDr [k.M ¼iii½ ds vuqlkj laxf.kr dh<br />

tk;sxhA<br />

2- lEifÙkdj ¼okf.kfT;d½%<br />

(i) [kkyh okf.kfT;d IykVksa dh n”kk esa] IykV ds vkdkj dks fopkjk esa yk;s<br />

fcuk dj dySDVj nj izfr oxZ xt x 0-000375 x oxZ xt es IykV dk<br />

vkdkj gksxk(<br />

(ii) vU; okf.kfT;d lEifÙk;ksa ds fy, lEifÙkdj pkgs fdjk;s ij nh xbZ gks<br />

;k ugh dySDVj nj izfr oxZ xt x 0-001875 x lEifÙk ds fufeZr Hkkx<br />

dk vkdkj oXkZ xt esa gksxkA x.kuk iz;kstuksa ds fy, fufeZr Hkkx dk<br />

vkdkj oxZ xt esa<br />

ekuk tk;sxkA rFkkfi] IykV dks [kkyh ds :Ik esa<br />

fopkjrs gq, bl izdkj laxf.kr dj nkf;Ro [kkyh IYkkV dh laxf.kr<br />

jkf”k ls de ugh gksxk%<br />

ijUrq 50 oxZ xt rd dh okf.kfT;d lEifÙk;ksa ds fy, dj<br />

dySDVj nj x 0-001125 x lEifÙk ds fufeZr Hkkx dk vkdkj oXkZ xt esa<br />

gksxk rFkk x.kuk izk;kstuks ds fy, fufEkZr Hkkx izfr oxZ xt esa ekuk<br />

tk;sxkA<br />

3- lEifÙkdj ¼laLFkkxr rFkk vkS|ksfxd½%<br />

(i) [kkyh laLFkkxr rFkk vkS|ksfxd IykVksa dh n”kk esa IykV ds vkdkj dks<br />

fopkj esa yk;s fcuk dj dySDVj nj izfr oxZ xt x 0-00020 x oxZ xt<br />

es IykV dk vkdkj gksxk( rFkk<br />

(ii) laLFkkxr rFkk vkS|ksfxd lEifÙk;ksa ij lEifÙkdj pkgs fdjk;s ij nh xbZ<br />

gks ;k Lo;a jg jgs gksa] dySDVj nj izfr oxZ xt x 0-001 x lEifÙk ds<br />

fufeZr Hkkx dk vkdkj oXkZ xt esa gksxkA x.kuk izk;kstuks ds fy, fufEkZr<br />

Hkkx izfr oxZ xt esa ekuk tk;sxkA rFkkfi] IykV dks [kkyh ds :Ik esa<br />

fopkjrs gq, bl izdkj laxf.kr dj nkf;Ro mDr [kkyh IYkkV dh<br />

laxf.kr jkf”k ls de ugh gksxk%<br />

4- lEifÙkdj ¼ lEifÙk dk fefJr iz;ksx½%<br />

ifjljksa ds fefJr iz;ksx dh n”kk esa] dj dk nkf;Ro fofHkUu iz;ksx ds<br />

v/khu {ks= ds vuqlkj gksxk] rFkk rnkuqlkj ?kksf’kr@laxf.kr fd;k<br />

tk;sxkA<br />

5- NwV%<br />

(i) xSj-vkj0lh0lh0 fuekZ.k dks 25% dh NwV nh tk;sxh(<br />

(ii) 25 o’kZ ls vf/kd iqjkuh lEifÙk dks 25% dh NwV nh tk;sxh(<br />

(iii) 250 oxZ xt ls vf/kd vkdkj ds IykV rFkk 500 oxZ QqV ls vf/kd ds<br />

ySV dh Lo;a vf/kHkksx okyh fjgk;”kh lEifÙk;ksa dh n”kk esa fj;k;r<br />

lEcaf/kr uxj fuxe }kjk 50 izfr”kr rd nh tk;sxh(<br />

(iv) /kkfeZd lEifÙk;ksa ¼dsoy okLrfod /kkfeZd lajpukvksa ij½ vukFkky;ksa]<br />

fHk{kqdx`gksa] uxj ifydk Hkoukss] ”e”kku@dfczLrkuksa ij 100 izfr”kr NwV<br />

nh tk;sxh(<br />

(v) Hkwr iwoZ lSfudksa ;k e`rd lSfudks ds ifjokjks] HkwriwoZ lSfudksa rFkk<br />

HkwriwoZ dsUnzh; iSjklSfud cy dfeZdksa }kjk LokfeRok/khu 250 oxZ xt rd<br />

lHkh fjgk;”kh fuekZ.kks dks 100 izfr”kr NwV nh tk;sxh(<br />

ijUrq os gfj;k.kk jkT; esa dksbZ vU; fjgk;”kh edku ugh j[krs<br />

gks rFkk blesa Lo;a fuokl dj jgsa gksa vkSj edku dk dksbZ Hkkx fdjk;ss<br />

ij ugh ns j[kk gks%<br />

ijUrq ;g vkSj gS fd edku dks fdjk;s ij nsus dh “krZ mu ij<br />

ykxw ugh gksxh tks izfr ekl ,d gtkj nks lkS ipgÙkj #i;s ;k de<br />

isa”ku jkf”k izkIr dj jgs gS(<br />

(vi) ;q) fo/kokvksa }kjk LokfeRok/khu lHkh fjgk;”kh fuekZ.kksa dks 100 izfr”kr<br />

NwV nh tk,xh%<br />

ijUrq os gfj;k.kk jkT; esa dksbZ vU; fjgk;”kh edku ugh j[krh<br />

gks rFkk blesa fuokl dj jgh gksa vkSj edku dk dksbZ Hkkx fdjk;ss ij<br />

(vii)<br />

ugh ns j[kk gks(<br />

dsoy ckxokuh rFk d`f’k iz;kstuksa ds fy, ,d ,dM+ RkFkk vf/kd ds<br />

[kkyh IykV ij dksbZ lEifÙkdj ugh gksxk%<br />

ijUrq Lokeh mijksDr NwV esa ls fdlh ,d NwV dk p;u dj<br />

ldrk gS tks vuqKs; gSA<br />

uksV% lEifÙk ekfyd dks mijksDr NwVksa esa ls fdlh ,d izdkj dh NwV dk<br />

YkkHk izkIr djus dk fodYi gSA<br />

6- laxzg oxhZdj.k%& bl dj dk Hkqxrku dk;kZy; uxj fuxe] fu;j<br />

ftUny Vkoj fglkj&125001] vFkok ih-,u-ch] cSd dh fdlh Hkh 'kk[kk esa<br />

tek djok;k tk ldrk gSA pSd ds ihNs ekfyd dk uke] Qksu ua0]<br />

ijekusa ZV izksiVhZ vkbZ- Mh-] rFkk vkadyu dk o"kZ fy[kuk vfuok;Z gSA<br />

7- iqjkuk dj laxzg.k%<br />

(i) djk/kku rFkk njksa dh ubZ iz.kkyh foÙk o’kZ 2010&11 ls vkxs bl “krZ<br />

lfgr ykxw gksxh fd vf/klwpuk ls iwoZ vof/k ds fy, lEifÙk ekfyd dks<br />

ubZ vFkok iqjkuh uhfr tks mu }kjk pquh tkrh gS] ds vuqlkj Hkqxrku<br />

djus dk fodYi gksxk(<br />

(ii)<br />

iwoZ o’kksZ ds yfEcr cdk;kss a@ns;ksa@fooknksa ftlesa U;k;ky; ekeys “kkfey<br />

gS] ftlds lEcU/k esa uksfVl@fcy tkjh fd;s x;s gksa vFkok ugh] lEifÙk<br />

ekfyd dks orZeku njksa ¼vFkkZr~ o’kZ 2012&2013 ds dySDVj jsV ½ ij ubZ<br />

iz.kkyh ds vuqlkj dj dk Hkqxrku djus ds fy, fodYi gksxk rFkk<br />

mldk Hkqxrku lHkh ,sls fooknksa@ns;ksa@cdk;ksa dks Hkqxrku ds :Ik esa<br />

ekuk tk;sxkA dksbZ Hkh C;kt vFkok “kkfLr mn~x`fgr ugh dh tk;sxhA ;g<br />

fodYi dsoy 30 twu 2013 rd {kek ;kstuk ds :Ik esa miyC/k gksxkA<br />

8- “kkfLr;ka%<br />

(i) xyr ?kks’k.kk@xSj&vnk;xh dh n”kk esa] dj vioapu dh jkf”k ds led{k<br />

“kkfLr mn~x`fgr dh tk,xh] tks U;wure 100 #i;s ds v/;/khu gksxh(<br />

(ii) nsjh ls vnk;xh dh n”kk esa] 1-5 izfr”kr izfr ekl ;k mlds Hkkx dh nj<br />

ls C;kt izHkkfjr fd;k tk;sxk(<br />

(iii) ;g C;kt “kkfLr ds vfrfjDr xSj vnk;xh dk irk yxkus dh n”kk ess a Hkh<br />

izHkkfjr fd;k tk;sxk(<br />

(iv) C;kt@”kkfLr ¼i`Fkd :Ik ls½ izkjfEHkd nkf;Ro ls vf/kd ugh gksxkA<br />

vfZXu dj% xSj fjgk;'kh Hkouksa ij lEifÙkdj dk nl izfr'kr dh nj ls vfZXu<br />

dj gksxkA vf/klwpuk la[;k S.O.48/H.A. 12/2009/S. 35/2012.dt.<br />

21.06.2012.<br />

New policy for Property Tax circulated by Haryana Govt. vide<br />

notification no. 31-HLA of 2012/59 dated 25.08.2012 & notification<br />

No. S.O. 14/H.A. 16/1994/S. 87/2013 dated 28-01-2013 is as<br />

under:-<br />

1. Property tax on residential plots/houses:<br />

(i) Rs. 1.00 per square yard on houses (self occupied) with plot<br />

sizes upto 250 square yards and flat sizes up to 500 square feet<br />

(self occupied);<br />

(ii) (a) in the case of vacant residential land more than 100 sq yds.<br />

and up to 250 square yards (plot size up to 100 square yards<br />

shall be exempted), the tax shall be Rs. 0.50 per square yard;<br />

(b) in case of vacant residential land, more than 250 square<br />

yards, the tax shall be collector rate x 0.00015 x size of the plot<br />

in square yards;<br />

(iii) for constructed houses whether self occupied or rented on<br />

plot size of more than 250 square yards and flats of more than<br />

500 square feet, property tax shall be collector rate per square<br />

yard x 0.00075 and for calculation purposes, the constructed<br />

portion in square yards shall be taken. However, the tax<br />

liability shall not be less than one if it is calculated by<br />

considering the plot as vacant one;<br />

(iv) in case of rented residential properties even under 250 square<br />

yards and flats upto 500 square feet, the rate shall be<br />

calculated as per clause (iii) above.<br />

2. Property tax (Commercial):<br />

(i) in case of vacant commercial plots irrespective of the size of<br />

the plot, the tax shall be collector rate per square yard x<br />

0.000375 x size of the plots in square yards.<br />

(ii) property tax for other commercial properties shall be at<br />

collector rate x 0.001875 x size of constructed portion of<br />

property in square yards and for calculation purposes, the<br />

constructed portion in square yards shall be taken. However,<br />

the tax liability so calculated shall not be less than one if it is<br />

calculated by considering the plots as vacant one:<br />

Provided that for commercial properties upto 50 sq.<br />

yards, the tax shall be collector rate x 0.001125 size of<br />

constructed portion of property in square yards and for<br />

calculation purposes, the constructed portion in square yards<br />

shall be taken;<br />

3. Property tax (Institutional and Industrial):<br />

(i) in case of vacant institutional and industrial plots irrespective<br />

of the size of the plot, the tax shall be collector rate per square<br />

yard x 0.00020 x size of the plots in square yards; and<br />

(ii) property tax on institutional and industrial property whether<br />

rented or self occupied shall be at collector rate x 0.001 x size<br />

of the constructed portion of property in square yards and for<br />

calculation purposes, the constructed portion in square yards<br />

shall be taken. However, the tax liability shall not be less than<br />

one if it is calculated by considering the plots as vacant one;<br />

4. Property tax (Mixed Use of Property):<br />

in case of mixed use of premises the liability of tax shall be as<br />

per area under different use, and shall be declared accordingly.<br />

5. Rebate:<br />

(i) 25% rebate shall be given to non-RCC construction;<br />

(ii) 25% rebate shall be given to property more than 25 years old;<br />

(iii) in case of self occupied residential properties of plot size of<br />

more than 250 square yard and flats of more than 500 Square<br />

feet, the concession up to 50 % will be given by the respective<br />

Municipal Corporation;<br />

(iv) 100% rebate shall be given on religious properties (only of<br />

real religious structures), Orphanages, Alm Houses,<br />

Municipal Buildings, Cremation/Burial grounds;<br />

(v) 100% rebate shall be given to all residential buildings upto<br />

250 square yards owned by ex-servicemen or families of<br />

deceased soldiers, ex-servicemen and ex-central<br />

paramilitary force personnel;<br />

Provided that they have no other residential house<br />

in Haryana State and are residing in it themselves and have<br />

not let out any portion of the house;<br />

Provided further that the condition of letting out of<br />

the house shall not apply to those who are in receipt of<br />

pension amounting to rupees one thousand two hundred<br />

and seventy-five per month or less.<br />

(vi) 100% rebate shall be given to all residential buildings<br />

owned by war widows:<br />

Provided they have no other residential house in<br />

Haryana State and are residing in it and have not let out<br />

any portion of the house;<br />

(vii) there shall be no property tax on vacant plot of one acre<br />

and above for Horticulture and Agriculture, purposes only.<br />

Note: The owner may choose any one of the above rebates<br />

which are admissible to him.<br />

6. Collection methodology: Payment can be deposited at<br />

the office of Municipal Corporation, Near Jindal tower,<br />

Hisar- 125001, or in any branch of PNB bank throughout<br />

India. No cheque will be accepted until the "owner name”,<br />

“phone number", "unique property ID" & "assessment<br />

year" is mentioned on the back of cheque.<br />

7. Old tax collection:<br />

(i) The new system of taxation and rates shall be applicable<br />

for the entire financial year 2010-11, with the stipulation<br />

that for the period prior to notification, the property<br />

owners shall have the option to pay as per the new or old<br />

policy, whichever is opted by them.<br />

(ii) In case of pending arrears/dues/dispute including court<br />

case, of previous years, in respect of which notice/bills<br />

have been issued or not, the property owners shall have<br />

the option to pay tax as per the new system at current<br />

rates (i.e. Collector Rates for the year 2012-13) and<br />

payment of the same shall be considered as settlement of<br />

all such disputes/dues/arrears. No interest or penalty shall<br />

be leviable. This option shall be available as amnesty<br />

scheme only up to 30th June, 2013.<br />

8. Penalties:<br />

(i) In case of mis-declaration/non-payment, penalty equal to<br />

the amount of the tax evaded shall be leviable, subject to a<br />

minimum of Rs.100;<br />

(ii) In case of late payment, interest @1.5% per month or part<br />

thereof shall be charged;<br />

(iii) This interest shall also be charged in case of detected nonpayment<br />

in addition to the penalty;<br />

(iv) The interest penalty (separately) shall not exceed the initial<br />

liability.<br />

Fire Tax: Fire Tax @ 10% of the property tax on non-residential<br />

buildings. Notification no. S.O.48/H.A. 12/2009/S. 35/2012.<br />

dt. 21.06.2012.<br />

All notifications are also available on MCH website<br />

www.hisar.gov.in