Then check out Credit Suisse First Boston. - Gymkhana

Then check out Credit Suisse First Boston. - Gymkhana

Then check out Credit Suisse First Boston. - Gymkhana

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong><br />

2005 Edition<br />

WetFeet Insider Guide

The WetFeet Research Methodology<br />

You hold in your hands a copy of the best-quality research available for job seekers. We have<br />

designed this Insider Guide to save you time doing your job research and to provide highly<br />

accurate information written precisely for the needs of the job-seeking public. (We also hope<br />

that you’ll enjoy reading it, because, believe it or not, the job search doesn’t have to be a pain<br />

in the neck.)<br />

Each WetFeet Insider Guide represents hundreds of hours of careful research and writing. We<br />

start with a review of the public information available. (Our writers are also experts in reading<br />

between the lines.) We augment this information with dozens of in-depth interviews of people<br />

who actually work for each company or industry we cover. And, although we keep the identity of<br />

the rank-and-file employees anonymous to encourage candor, we also interview the company’s<br />

recruiting staff extensively, to make sure that we give you, the reader, accurate information ab<strong>out</strong><br />

recruiting, process, compensation, hiring targets, and so on. (WetFeet retains all editorial control<br />

of the product.) We also regularly survey our members and customers to learn ab<strong>out</strong> their<br />

experiences in the recruiting process. Finally, each Insider Guide goes through an editorial review<br />

and fact-<strong>check</strong>ing process to make sure that the information and writing live up to our exacting<br />

standards before it goes <strong>out</strong> the door.<br />

Are we perfect? No—but we do believe that you’ll find our content to be the highest-quality<br />

content of its type available on the Web or in print. (Please see our guarantee below.) We also are<br />

eager to hear ab<strong>out</strong> your experiences on the recruiting front and your feedback (both positive and<br />

negative) ab<strong>out</strong> our products and our process. Thank you for your interest.<br />

The WetFeet Guarantee<br />

You’ve got enough to worry ab<strong>out</strong> with your job search. So, if you don’t like this Insider Guide,<br />

send it back within 30 days of purchase and we’ll refund your money. Contact us at<br />

1-800-926-4JOB or www.wetfeet.com/ab<strong>out</strong>/contactus.asp.

Insider Guide<br />

<strong>Credit</strong> <strong>Suisse</strong><br />

<strong>First</strong> <strong>Boston</strong><br />

2005 Edition<br />

Helping you make smarter career decisions.

WetFeet, Inc.<br />

609 Mission Street<br />

Suite 400<br />

San Francisco, CA 94105<br />

Phone: (415) 284-7900 or 1-800-926-4JOB<br />

Fax: (415) 284-7910<br />

E-mail: info@wetfeet.com<br />

Website: www.wetfeet.com<br />

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong><br />

ISBN: 1-58207-435-6<br />

Photocopying Is Prohibited<br />

Copyright 2004 WetFeet, Inc. All rights reserved. This publication is protected by<br />

the copyright laws of the United States of America. No copying in any form is<br />

permitted. It may not be reproduced, distributed, stored in a retrieval system, or<br />

transmitted in any form or by any means, in part or in whole, with<strong>out</strong> the express<br />

written permission of WetFeet, Inc.

Table of Contents<br />

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong> at a Glance . . . . . . . . . . . . . . . . . . . . . . 1<br />

The Firm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7<br />

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8<br />

The Bottom Line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12<br />

Industry Position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13<br />

Organization of the Firm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15<br />

On the Job . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21<br />

Investment Banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22<br />

Trading. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27<br />

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29<br />

Research. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30<br />

The Workplace . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35<br />

Lifestyle and Hours . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36<br />

Culture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38<br />

Workplace Diversity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40<br />

Civic Involvement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42<br />

Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46<br />

Training . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47<br />

Career Path. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49<br />

Insider Scoop . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52<br />

Getting Hired. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55<br />

The Recruiting Process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56<br />

Interviewing Tips. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61<br />

Grilling Your Interviewer. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63<br />

For Your Reference . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65<br />

Recommended Reading . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66<br />

The Numbers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69<br />

Key People. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong><br />

at a Glance<br />

At a Glance<br />

North American Headquarters<br />

11 Madison Avenue<br />

New York, NY 10010<br />

Phone: 212-325-2000<br />

Fax: 212-325-6665<br />

www.csfb.com<br />

Major Lines of Business<br />

Investment banking with strengths in M&A; sales, trading, and research;<br />

leveraged and private equity finance; derivatives; equity underwriting; and<br />

project finance. Serves institutional, government, corporate, and high-networth<br />

clients.<br />

Primary Competitors<br />

Bear Stearns, Deutsche Bank, Goldman Sachs, Merrill Lynch, J.P. Morgan<br />

H&Q, Morgan Stanley, Lehman Brothers, Citigroup Global Markets, UBS<br />

Financial Services.<br />

Key Differentiating Factors<br />

• <strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong> is 100 percent owned by <strong>Credit</strong> <strong>Suisse</strong> Group, a<br />

European financial services holding company with interests in commercial<br />

and private banking, investment banking, asset management, and insurance.<br />

• As of the first quarter of 2004, CSFB handled 15.9 percent of initial public<br />

offerings, ranking second among investment banks, according to Investment<br />

Dealers’ Digest.<br />

• CSFB ranked number one in global high-yield corporate debt, according to<br />

Investment Dealers’ Digest.<br />

1

At a Glance<br />

In the Recruiter’s Words<br />

“For entry-level positions we’re not expecting [candidates] to have expertise. Do<br />

they have problem-solving skills? What type of activities do they participate in?<br />

Are they well-rounded? Being an analyst means basically your life. It takes that<br />

kind of juggling ability to be successful here.”<br />

“An internship can be extremely important. It can be [conducted] at another<br />

bank or with private client or wealth management firms. The internships show<br />

an interest in financial services. It’s important for us to see an interest in that<br />

area.”<br />

“What we don’t look for is the stereotypical . . . banker. We look for people<br />

who are independent thinkers, because we believe that to have individual ideas<br />

we need individual minds. Of our incoming class, 35 percent have never taken<br />

an accounting class in college. We look for people who have the ability to learn.<br />

We have one person who just graduated with a degree in theology. The reason<br />

we hired him is his original approach to what we do. He hasn’t been focused on<br />

being a banker his entire career.”<br />

“We’re looking for players who can come up with creative ideas, people who<br />

are self-starters and innovators.”<br />

“We’re looking for people who are smart, diligent, team players. We want to see<br />

evidence that you can be a strong leader and that you’re comfortable in a highrisk,<br />

high-pressure, competitive environment.”<br />

“In sales and trading, teamwork is essential, so we look for past team<br />

experience. If you were part of an athletic team versus an individual sport,<br />

that’s a big plus.”<br />

“In IBD, we look at a balance of academic credentials—what school you<br />

attended, your GPA, and the kind of coursework you took—along with a<br />

finance background and leadership and teamwork experience through clubs,<br />

school government, and jobs held.”<br />

“We hire a fair number of people with liberal arts backgrounds because we<br />

believe we can train them here. For all candidates, however, you’ve got to<br />

demonstrate strong quantitative skills.”<br />

“We hire students other than on the campuses where we actively recruit. In<br />

fact, we look at every resume that comes in. Of course, it helps if you know<br />

someone here and have a great-looking resume.”<br />

2

In the Interview<br />

• Know why CSFB is the right place for you. You should be able to articulate<br />

why you want to work for this bank and not another.<br />

• Be prepared to think quickly. Near the end of an interview, one CSFB<br />

interviewer asks job seekers to solve a mental puzzle. He wants to see how<br />

candidates will respond to a challenge under pressure. “Our interviews are<br />

more behavioral interviewing,” says a recruiter. “Candidates can show<br />

creativity in how they answer a question. For example, we might ask them to<br />

show how they brought a new idea to a team and changed the way a team<br />

thought ab<strong>out</strong> an issue.”<br />

• Don’t overdo it. “One thing I dislike is someone who’s too rehearsed, who is<br />

unwilling to veer off in the direction that the interviewer would like to go,”<br />

says one insider. “There’s a level of due diligence, but you can overdo it.”<br />

• Be articulate, but succinct. The three Cs—calm, cool, and collected—are key.<br />

• Know what’s happening in the world and how it might affect the economy.<br />

• Ask questions. “If someone doesn’t ask a question, you wonder how much<br />

thought they’ve put into the interview,” says one recruiter. “Questions show<br />

they’ve read up on the firm.”<br />

• Show your enthusiasm for the markets. Demonstrate your passion with<br />

intelligent discussion of current economic events. “You’ve got to be<br />

passionate ab<strong>out</strong> it,” says one recruiter, “because if you aren’t, you will fail.”<br />

• Make it clear that you know the company and understand where you see<br />

yourself at CSFB.<br />

• Demonstrate the points you want to make by giving examples. If you say<br />

you’re a team player, be ready to back that up with some real-life evidence.<br />

At a Glance<br />

What Insiders Say<br />

“It’s a place where people are willing to help you grow. People here care ab<strong>out</strong><br />

you succeeding. It’s team-oriented, a fun atmosphere.”<br />

“There are people who made silly decisions here in the past and it harmed the<br />

go-getting attitude. But the firm has done a good job (more recently) of<br />

looking forward. The firm has learned from its mistakes and put the past<br />

behind it.”<br />

3

At a Glance<br />

“The people here are very smart and aggressive, and they’re really willing to<br />

teach. You will find the people at other firms are reluctant to share knowledge.<br />

But at CSFB, it’s not at all competitive in that way.”<br />

“As with any investment bank, there are bound to be egos, but on the whole,<br />

it’s not a strict hierarchical structure.”<br />

“It’s extremely entrepreneurial at CSFB. I was given a huge chance to go <strong>out</strong> on<br />

my own and do something. And yet, it’s also supportive. I’ve got buddies in all<br />

parts of the company. I definitely don’t feel alone.”<br />

“[I came to CSFB last year] because I liked that it wasn’t the incumbent number<br />

one. I like that we’re trying to do something different. It seems younger here—<br />

not in terms of age, but in terms of excitement.”<br />

“I’ve been pleasantly surprised by the people. Of course there are egos. But for<br />

example, there’s great participation in community service programs. This<br />

stresses that these are real people who want to help other people.”<br />

Career Ladder<br />

• MBAs enter as associates and typically make VP after 3 1 /2 to 4 years.<br />

• Undergrads in investment banking are hired as analysts for a 2-year period<br />

with the possibility of a third-year offer based on performance.<br />

• Undergrads in the equity division are hired into the STAR (sales, trading, and<br />

research) program. This 3-year program allows <strong>out</strong>standing performers to<br />

become associates in the fourth year.<br />

• Undergrads in fixed income, sales, trading, and research are hired as analysts<br />

for a 3-year period with the potential for advancement.<br />

• Undergrads in technology are hired for an indefinite period.<br />

Personnel Highlights<br />

Number of professionals worldwide, 2004: approximately 19,000<br />

1-yr. growth rate: approximately 3.5 percent<br />

CSFB has not released official hiring projections for 2004 to 2005. Graduates<br />

of the 2004 summer intern program will fill some positions.<br />

4

Estimated Compensation, 2004–2005<br />

MBAs and JDs<br />

Estimated starting salary: $85,000<br />

Signing bonus: $20,000<br />

Performance bonus (July to January):<br />

discretionary<br />

Relocation: $10,000<br />

Undergraduates<br />

Estimated starting salary: $55,000<br />

Performance bonus (July to July):<br />

competitive with the market<br />

Signing/relocation bonus: $8,000<br />

At a Glance<br />

Note: Compensation numbers are estimates. CSFB does not release this information.<br />

5

The Firm<br />

• Overview<br />

The Firm<br />

• The Bottom Line<br />

• Industry Position<br />

• Organization of the Firm<br />

7

Overview<br />

The Firm<br />

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong> combines Swiss dependability with American<br />

ingenuity. In January 1997, CSFB was fully integrated into Switzerland’s <strong>Credit</strong><br />

<strong>Suisse</strong> Group (CSG), consummating a relationship that had begun with a<br />

minority investment by <strong>Credit</strong> <strong>Suisse</strong> nearly 20 years before. The integration<br />

gave CSFB a new client base and line of products and services that have<br />

allowed it to become one of the leading bulge-bracket firms in the United<br />

States and a prominent fixture on the global financial scene. As recently as<br />

1999, the International Financing Review called it the Best Bank and Best Bond<br />

House of the last 25 Years. Business fell from 2001 to 2003 amidst the<br />

economic slump, and the firm was forced to cut more than a third of its<br />

workforce. But CSFB has continued to win kudos for its prowess in mergers<br />

and acquisitions, equity underwriting, sales and trading, I-banking, and<br />

investment research, both in and <strong>out</strong>side the United States.<br />

CSFB operates in 34 countries across five continents and has power bases in<br />

New York and London. More than 50 percent of its total revenue comes from<br />

<strong>out</strong>side the United States. Acquisitions in the go-go late 1990s made it an<br />

investment banking leader in Brazil and the United Kingdom and increased its<br />

presence in the United States.<br />

CSFB was a dominant force in international mergers and acquisitions through<br />

the late 1990s and early 2000s. It played a leading role in the France Telecom<br />

purchase of Orange from Vodafone in 2000 and high-profile deals between<br />

Bayer and Aventis CropScience in 2001 and between Phillips Petroleum and<br />

Conoco in 2002.<br />

8

Economic woes, a few missteps, and increased<br />

“ ”<br />

regulatory oversight slowed the company over the<br />

past 3 years; CSFB dropped market share in several<br />

categories used to measure investment banks. Still,<br />

the company remained more active than many of<br />

its competitors. In 2002, it played a key role in<br />

Northrop Grumman’s acquisition of TRW and the<br />

$10.6 billion restructuring of NTL, Europe’s largest<br />

cable TV and broadband company.<br />

The best part [ab<strong>out</strong><br />

working at CSFB] is<br />

that I get to be<br />

involved in the kind<br />

of issues that<br />

require a CEO’s or<br />

COO’s attention.<br />

And I am directly<br />

interfacing with<br />

these types of<br />

people.<br />

Among CSFB’s 2003 deals were General Electric’s<br />

acquisition of entertainment giant Vivendi<br />

Universal Entertainment for $14 billion and Silver<br />

SpA’s $6 billion purchase of SEAT’s directories and<br />

directories assistance business. It advised Hughes Electronic Corp. on the sale<br />

of 34 percent of its interest in Rupert Murdoch’s News Corp. and its split-off<br />

from General Motors Corp. More recently, the company has been advising<br />

Oracle in its hostile takeover bid of PeopleSoft.<br />

The Firm<br />

CSFB also featured one of the world’s most dynamic equity underwriting<br />

practices in the technology sector, led by the dashing Frank Quattrone. From<br />

1999 to 2000, CSFB took a record 29 technology companies public, with<br />

combined earnings of $718 million. That said, the group saw business fade<br />

when the technology bubble burst. Problems with regulatory agencies sullied<br />

the firm’s reputation and hurt morale. In 2002, CSFB agreed to pay $100<br />

million to settle charges—while admitting no wrongdoing—that the firm<br />

improperly split IPO profits with clients. <strong>Then</strong> later in the year, CSFB was one<br />

of several high-profile Wall Street firms that agreed to pay a total of $1.4<br />

billion to settle charges that its analysts had reported favorably on poorly<br />

performing companies.<br />

9

The Firm<br />

Quattrone had his own troubles: He was charged with obstructing justice and<br />

witness tampering. He was convicted on three counts earlier this year ab<strong>out</strong> the<br />

time CSFB was selected as one of the two lead underwriters—along with<br />

Morgan Stanley—in one of 2004’s hottest deals: search-engine Google’s IPO.<br />

The much-anticipated offering, which will make shares available to a wider<br />

audience, has heartened CSFB employees. Morale has improved noticeably, say<br />

insiders. One insider says the deal indicates that the IPO market is reviving and<br />

that CSFB’s warts won’t prevent it from competing on even terms with other<br />

heavy hitters in the investment banking industry.<br />

The Google deal also figures to be a boon to CSFB’s retail brokerage operations.<br />

“It’s hard to turn around an image when the person at the forefront is going<br />

through an investigation,” says one insider, who adds, “Things are looking a lot<br />

better. The attitude is more positive. People are more willing than before to put<br />

in the extra hours. They’re not as stressed ab<strong>out</strong> the company’s future. People<br />

have put the past behind them.”<br />

In late June, CSFB’s CEO John Mack resigned suddenly. Mr. Mack was also co-<br />

CEO with Oswald Grubel of CSFB’s parent, <strong>Credit</strong> <strong>Suisse</strong> Group. Mr. Grubel<br />

became sole CEO of CSG. Brady Dougan, a 14-year veteran of the firm,<br />

replaced Mr. Mack as CEO of CSFB. Mr. Dougan is reportedly considered a<br />

possible successor for Mr. Grubel.<br />

Mr. Mack’s departure caught the firm off-guard and reportedly stemmed from<br />

disagreements over the company’s future. The Wall Street Journal reported that<br />

Mr. Mack wanted to explore the possibility of merging with another major<br />

financial services firm. Many investment banking observers expect consolidation<br />

among European banks, which have resisted making deals over fears that<br />

these deals would be unnecessarily difficult to complete and wouldn’t be<br />

successful.<br />

10

Senior leaders at CSG reportedly preferred following a safer strategy of<br />

improving the firm’s core banking and investment banking businesses. They<br />

see significant room for revenue growth in these areas as the economy<br />

continues its recovery.<br />

The Mack Attack Ends<br />

John Mack took over for the ousted Allen Wheat in July 2001. At the time, the<br />

company was staggering under the weight of one of the banking industry’s<br />

most inflated cost structures and several poor business decisions, among them,<br />

paying $12.4 billion for the investment bank Donaldson, Lufkin & Jenrette. The<br />

acquisition was meant to catapult CSFB into a lead spot in junk bonds and<br />

merchant banking and give it a retail online-brokerage business and strong<br />

back-office business in clearing stock trades. But industry observers say CSFB<br />

misjudged the market and made a serious error in guaranteeing bonuses to top<br />

DLJ performers, while not ensuring that other key bankers remained.<br />

The Firm<br />

If it had remained a bull market, the bloated operating budget and mistakes<br />

would not have been so serious. But the economy took a sharp downturn.<br />

Enter Mack—known as Mack the Knife for his cost-cutting ways at Morgan<br />

Stanley. By the end of 2002, he had surpassed his stated goal of cutting a<br />

whopping billion dollars from the unit’s annual costs. Over the past 3 years, he<br />

chopped the workforce from ab<strong>out</strong> 28,000 to 19,000.<br />

Mack’s changes seem to be paying off. The company has kept expenses under<br />

control and done a good job of putting its problems behind it. With the<br />

economy improving, business is also on an upward trajectory. In the first<br />

quarter of 2004, revenues rose 26 percent year-over-year to roughly $3.9 billion,<br />

while profits spiked a whopping 39 percent from $436 million to $607 million.<br />

Morale has improved significantly and CSFB has even increased compensation<br />

for some employees.<br />

11

The Bottom Line<br />

The Firm<br />

CSFB is an ideal place for candidates who seek the range of opportunities that a<br />

large, established organization affords but possesses the entrepreneurial excitement<br />

of a smaller, newer firm. CSFB offers new employees the resources of a<br />

huge financial powerhouse and the chance to learn their craft from some of the<br />

world’s most successful bankers in a company culture that isn’t stuffy or<br />

regimented.<br />

Morgan Stanley and Goldman, among others, are well known for their<br />

structured environments, where roles and responsibilities are clearly defined.<br />

Young bankers at CSFB have a remarkable amount of responsibility and client<br />

and international exposure—more so than some rivals. “It’s a structure where<br />

there are no barriers to how far you can advance through the firm,” says one<br />

young analyst. “There are no tier levels that, for example, after 2 years you have<br />

to be at a certain point. One of the great things ab<strong>out</strong> working at CSFB is the<br />

responsibility that is expected of the analyst. You’re an intricate part of the<br />

process. Not only does your team trust you, but the company learns to trust<br />

you as well.”<br />

To succeed at CSFB, you need to be the type of person who gets along with<br />

people and will pitch in on short notice to help complete a job. “Overall, it’s a<br />

fairly friendly work environment,” says one insider. “Most coworkers get along.<br />

It’s a good environment to get involved in when you get <strong>out</strong> of college.” The<br />

insider adds that you have to be able to handle stressful, fast-paced situations<br />

and a high volume of work. “Things need to get done quickly and well, and<br />

there’s not a lot of down time,” the insider says. “If that’s not your preferred<br />

work environment, this isn’t the place for you.”<br />

12

Industry Position<br />

CSFB improved or held its position in most categories of Investment Dealers’<br />

Digest’s league table rankings for the first 3 months of 2004, compared to the<br />

same period in 2003. Overall, it remained in the top six in most categories. On<br />

the whole, CSFB maintains its stronghold in high-yield corporate debt. The<br />

firm’s strong showing in the IPO market also continues.<br />

The Firm<br />

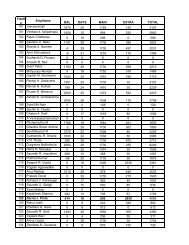

CSFB’s <strong>First</strong>-Quarter Industry Rankings<br />

Rank 2004<br />

2004 2003 Amount ($M) Market Share (%) Top Firm<br />

Debt & equity 6 7 62,396.8 6.9 Citigroup<br />

Common stock 5 6 3,302.8 8.7 Morgan Stanley<br />

Debt 6 7 57,842.2 6.9 Citigroup<br />

High-grade debt 6 9 15,064.8 7.6 Citigroup<br />

High-yield corporate debt 1 1 5,721.8 13.8 CSFB<br />

Mortgage-backed securities 7 7 8,507.2 6.1 UBS<br />

Asset-backed securities 6 6 12,834.7 7.3 Citigroup<br />

Equity—U.S. 6 7 4,554.6 7.4 Morgan Stanley<br />

IPOs 2 1 2,671.2 15.9 Morgan Stanley<br />

Convertibles 10 8 867.3 4.7 Morgan Stanley<br />

Follow-on offerings (non-IPOs) 6 6 2,376.3 6.9 Morgan Stanley<br />

Source: Investment Dealers’ Digest, June 4, 2004.<br />

13

More Rankings<br />

CSFB’s Rank<br />

2003 2002 2003 Top Firm<br />

The Firm<br />

All-America Fixed-Income Research Team 2 2 Lehman Brothers<br />

All-Europe Fixed-Income Research Team 8 7 J.P. Morgan<br />

Global Research Team 6 1 UBS<br />

All-America Research Team 6 4 Lehman Brothers<br />

All-Asia Research Team 2 2 UBS Warburg<br />

All-Europe Research Team 4 2 UBS Warburg<br />

All-Japan Research Team 6 9 Nikko Citigroup<br />

Latin American Research Team 2 1 UBS Warburg<br />

Loan Market Week’s Best Overall Trading Desk* 2 2 J.P. Morgan<br />

*Derived from the rankings of CSFB’s par and distressed desks.<br />

Source: Institutional Investor, 2004.<br />

14

Organization of the Firm<br />

View from the Top<br />

<strong>Credit</strong> <strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong> is part of the Zurich-based holding company <strong>Credit</strong><br />

<strong>Suisse</strong> Group (CSG). CSG, one of the world’s largest financial services firms,<br />

operates on five continents and has a presence in all of the world’s major<br />

financial centers. CSG streamlined its structure in January 2002 to create <strong>Credit</strong><br />

<strong>Suisse</strong> <strong>First</strong> <strong>Boston</strong>, which includes institutional securities and wealth and<br />

management divisions, and <strong>Credit</strong> <strong>Suisse</strong> Financial Services, which has<br />

corporate, retail, and private banking and insurance arms.<br />

The Firm<br />

Revenues at the insurance unit, Winterthur, tumbled in 2001 but have improved<br />

more recently, contributing to CSG’s better bottom line. Last year, CSG’s gross<br />

profits rose by 65 percent over 2002.<br />

CSFB lists corporate headquarters in Zurich, New York, and London. It<br />

operates in ab<strong>out</strong> 80 locations worldwide and has approximately 60,000<br />

employees.<br />

View from the Middle<br />

CSFB’s businesses include securities underwriting, sales and trading, investment<br />

banking, private equity, financial advisory services, investment research, venture<br />

capital, and asset management. An information technology group provides<br />

technical expertise and training across all divisions.<br />

15

Institutional Securities Division<br />

The institutional securities division comprises CSFB’s equity and fixed income<br />

groups. Both groups provide cross-functional expertise.<br />

The Firm<br />

Equity. CSFB’s huge institutional equities sales force has a top-six market share<br />

position in equities trading in the United States and Europe. In equity research<br />

alone, CSFB’s analysts follow approximately 2,500 companies worldwide.<br />

Equity specialty areas include:<br />

• Coverage Sales<br />

- Listed Coverage Sales<br />

- NASDAQ Coverage Sales<br />

- International Sales Trading<br />

• Equity Cash Trading<br />

- Listed Block Trading<br />

- NASDAQ Trading<br />

- International Trading<br />

• Equity Derivatives and Convertibles Unit<br />

- Convertible Sales and Trading<br />

- Derivatives and Convertible Research<br />

- Derivatives Structuring<br />

- Equity Finance<br />

- Index Arbitrage<br />

- Options (OTC & Listed) Sales & Trading<br />

- Program Trading<br />

- Statistical Arbitrage<br />

• Equity Sales<br />

- U.S. Portfolio Sales<br />

- International Sales<br />

• Equity Research<br />

16

Fixed income. CSFB ranks among the leaders in underwriting volume and in<br />

arranging leveraged loans. It’s also near the top in fixed income, research, and<br />

high-yield research.<br />

Fixed income programs include:<br />

• Asset Finance<br />

• Corporate Sales and Trading<br />

• Debt Capital Markets<br />

• Derivatives Sales and Trading<br />

• Emerging Markets Sales and Trading<br />

• Global Foreign Exchange Sales and Trading<br />

• Interest Rate Products Sales and Trading<br />

• Leveraged Finance<br />

• Liability Management<br />

• Real Estate Finance and Securitization<br />

• Short-Term Generalist Sales and Trading<br />

• Structured <strong>Credit</strong> Products<br />

• Structured Products Sales and Trading<br />

The Firm<br />

Investment Banking Division<br />

CSFB’s I-banking division (IBD) has earned high rankings in almost all of the<br />

investment banking league-table categories. Included in the investment banking<br />

division are CSFB’s private equity banking business and its asset management<br />

group.<br />

IBD’s industry groups include:<br />

• Financial Institutions<br />

• Global Energy<br />

• Global Industrial Services (GIS)<br />

17

The Firm<br />

• Health Care<br />

• Media and Telecommunications<br />

• Real Estate<br />

• Retail and Consumer Products<br />

• Technology<br />

IBD’s product/coverage groups include:<br />

• CSFB HOLT Group<br />

• Corporate Banking<br />

• Distressed Finance<br />

• Emerging Markets Coverage Group—Latin America<br />

• Equity Capital Markets<br />

• Financial Strategy<br />

• Private Fund Group<br />

• Private Placement<br />

• Real Estate Private Funds<br />

• Structured Products<br />

Private equity investments focus on the following areas:<br />

• Domestic and international leveraged buy<strong>out</strong>s<br />

• Structured equity investments<br />

• Mezzanine investments<br />

• Corporate joint ventures and off-balance sheet financings<br />

• Real estate investments<br />

• Venture capital<br />

• Growth capital investments<br />

• Investments in other leveraged buy<strong>out</strong>, venture capital, and mezzanine funds<br />

18

Wealth and Asset Management Division<br />

The wealth and asset management division comprises all of CSFB’s assetgathering<br />

businesses: <strong>Credit</strong> <strong>Suisse</strong> asset management (CSAM), with expertise in<br />

asset management services to institutional and mutual fund investors; the<br />

private client services group, which offers wealth management advisory services<br />

to families and high-net-worth individuals; and Pershing, which offers<br />

brokerage execution, clearance, and data processing to financial organizations.<br />

The Firm<br />

Information Technology<br />

The global team of IT professionals develops and implements technology<br />

solutions to support projects and initiatives across divisions. Such initiatives<br />

range from providing technological infrastructure and support across the<br />

organization to setting and maintaining security standards and developing<br />

information management systems.<br />

View from the Bottom<br />

After 3 years of workforce reductions, CSFB is a lean shop. There are five job<br />

levels:<br />

1. Analyst<br />

2. Associate<br />

3. Vice president<br />

4. Director<br />

5. Managing director<br />

Insiders say that they do not have problems gaining access to senior level<br />

management and have good rapport with the VPs and MDs in their groups.<br />

19

“As with any investment bank, there are bound to be egos, but on the whole,<br />

the senior guys are approachable, and CSFB doesn’t have a strict hierarchical<br />

structure,” says one insider.<br />

The Firm<br />

20

On the Job<br />

• Investment Banking<br />

• Trading<br />

• Sales<br />

• Research<br />

On the Job<br />

21

Investment Banking<br />

On the Job<br />

Life for a CSFB investment banker is fast paced, rigorous, and intellectually<br />

challenging. As an associate or analyst, you will join one of IBD’s product or<br />

industry groups. Either way, you’ll be exposed to a growing array of investment<br />

and commercial capabilities. CSFB is gradually adjusting its activities to reflect<br />

the one-stop-shop model to which it aspires. Although you work on small<br />

teams while a deal is in progress, CSFB seems to purposely test its junior-level<br />

professionals by running a lean business. IBD encourages and respects<br />

individual achievement, and analysts and associates are given a great deal of<br />

responsibility in a short amount of time.<br />

Deal flow varies from one group to another and one business cycle to the next.<br />

The groups that have consistently experienced strong deal flows in the late<br />

1990s and early 2000s are M&A, retailing/apparel, media/telecommunications,<br />

natural resources, utilities, technology, and health care.<br />

Analyst<br />

The analyst position in IBD is pretty similar to the Street norm, although a few<br />

differences do stand <strong>out</strong>. Insiders feel that the hours at CSFB are among the<br />

harshest on the Street. “You get killed,” says one insider. But you receive a<br />

unique amount of responsibility and exposure at this most humble of levels.<br />

Analysts are thrown in headfirst and must teach themselves how to swim. The<br />

more you prove yourself, the faster you’re put in front of a client or asked to<br />

write, instead of just edit, a pitch. That kind of exposure isn’t available<br />

everywhere on the Street, and it’s one of the reasons undergrads are attracted<br />

to CSFB.<br />

22

Usually, analysts are staffed permanently on certain<br />

“ ”<br />

client accounts and assigned to new accounts as the<br />

need arises. Many analysts develop contacts and<br />

build client relationships that will continue well<br />

beyond their time in IBD. Typical duties include:<br />

• Putting together a pitch book for a client<br />

presentation, such as <strong>out</strong>lining the client’s debt<br />

flow with respect to pricing and maturing levels<br />

and structure<br />

• Valuation modeling<br />

As an IBD analyst,<br />

the more you prove<br />

yourself, the faster<br />

you’re put in front of<br />

a client or asked to<br />

write, instead of just<br />

edit, a pitch.<br />

• Meeting with salespeople to develop selling points for road shows<br />

• Pricing instruments for a deal<br />

• Sitting in on conference calls with CFOs, CEOs, and other executives of the<br />

client firm<br />

• Helping lawyers draft legal documents on deals to ensure financial accuracy<br />

• Client contact and relationship building<br />

On the Job<br />

Day in the Life of an Investment Banking Analyst<br />

7:00 Wake up, shower, and get <strong>out</strong> the door. Grab some bread and fruit on<br />

the way <strong>out</strong>—sounds kind of weird, but hey, it’s healthy.<br />

8:00 Arrive at work.<br />

8:30 Start catching up. Check voice mail and e-mail. Answer anything that has<br />

to do with the project I’m working on. Coordinate early on with the<br />

people I’m going to need in order to get my work done for today. Set up<br />

the schedule for the rest of day. Look at CNN Financial Network to see<br />

what the markets are doing. See if any major equity offerings or M&A<br />

deals are <strong>out</strong> there. Shoot off e-mail on a hot deal to the deal team. Sent<br />

something <strong>out</strong> last night, and it’s back in, so I’m fixing it up—preparing<br />

analysis for an M&A call with the client. Also prepping some internal<br />

stuff for the negotiations.<br />

23

On the Job<br />

10:30 Gather in the MD’s office and sit around the table for an hour-long<br />

conference call with the deal team. The associate and I are there for<br />

backup just in case we need to answer any questions ab<strong>out</strong> our numbers.<br />

The call involves a discussion ab<strong>out</strong> how to structure the particular<br />

transaction based on the client’s needs and ends with next steps. Make<br />

sure everyone’s on the same page for a meeting scheduled for tomorrow<br />

morning.<br />

11:30 Client hangs up. Talk ab<strong>out</strong> the call. Go over what needs to happen and<br />

who’s going to do what.<br />

12:00 Run <strong>out</strong> to grab something to eat. Today it’s a sandwich. Have to eat<br />

light so I won’t fall asleep. Read the Wall Street Journal and watch CNN<br />

Financial Network while eating at my desk. Also read some research and<br />

<strong>check</strong> the stock again (did it in the morning, too) for the company I’m<br />

focusing on.<br />

1:00 Sit down with the MD, my team lead, to work <strong>out</strong> what to include in the<br />

analysis we’ll be showing to the client. Talk over what our position is,<br />

then sketch <strong>out</strong> all of the nuances depending on the nature of the deal.<br />

If it’s for internal use, we show a ton of information. If it’s for the<br />

client, we simplify. In this case, it’s going to be a book [PowerPoint<br />

presentation with lots of Excel tables] for the client.<br />

2:30 Put the book together.<br />

5:00 MD goes over the book. Gives comments and feedback. More work<br />

required. So much for hitting the gym for my one work<strong>out</strong> a week!<br />

6:00 Pick something up at a new Mexican restaurant that just opened up. Not<br />

bad, and it’s within my $15 dinner allotment—we don’t have a cafeteria<br />

like they do in New York. Hang <strong>out</strong> in conference room with fellow<br />

analysts and associates. Blow off steam with a good vent session. This<br />

client’s been a pain in the ass—keeps on asking for more data, which<br />

means more work for us.<br />

7:00 Prioritize what needs to get done. Work on book.<br />

10:00 Send the book <strong>out</strong> by messenger to the MD, who’s been at home for a<br />

few hours already. Remind myself that I’ve gotta pay my dues. Anyway,<br />

the book is for a presentation tomorrow morning, so I have to stick<br />

around for MD’s comments. That means I’ve got a good hour to work<br />

on another project.<br />

24

11:00 Comments are in. Turn them around; put finishing touches on book.<br />

12:00 Drop book off to get copies made.<br />

1:00 Copies are done. Give them a final once-over to make sure nothing<br />

crazy’s going on. Hold on to them since it’s a local meeting, which<br />

means I’ll be attending.<br />

1:10 Pick up a cab. Go straight to bed.<br />

Associate<br />

The associate position is similar to that of the analyst except that the hours are<br />

slightly better, responsibilities are heightened, client interaction occurs almost<br />

immediately, and, most important, due diligence and other unappealing, r<strong>out</strong>ine<br />

tasks can be passed on to analysts. Associates are assigned a list of client<br />

accounts, which are also usually staffed by an analyst and overseen by a senior<br />

officer. The work of an associate includes:<br />

On the Job<br />

• Ensuring accuracy of all quantitative and qualitative analyses<br />

• Maintaining client accounts<br />

• Interacting with clients during meetings, conference calls, and road shows<br />

• Working on pitch books<br />

• Developing offering brochures for sell-side M&A assignments<br />

• Building valuation and forecasting models with which to analyze client<br />

financials<br />

On average, associates in IBD spend almost half of each day managing deals in<br />

progress. One associate can participate in several projects simultaneously. That<br />

means regular and frequent contact with lots of lawyers, accountants, and other<br />

investment bankers. Plus, associates manage the work that analysts are doing for<br />

those projects and must monitor quality control. Ab<strong>out</strong> a third of an associate’s<br />

day is spent on the phone with clients or at clients’ offices reviewing information<br />

(a real bonus if the client is based somewhere sunny). Associates also write<br />

25

memos and summarize new offerings that are distributed to CSFB’s sales force<br />

and other internal groups. Occasionally, associates eat, sleep, and talk to a friend<br />

or two.<br />

On the Job<br />

26

Trading<br />

Traders at CSFB work in either fixed income or equities. Each trading desk<br />

covers a different product and consists of three- to 50-person teams. CSFB’s<br />

trading strengths lie in asset-backed securities, Western European equity, and<br />

emerging markets, which include the Asian, Latin American, and Eastern<br />

European regional desks. Like most other trading floors, the work environment<br />

is fast paced, dynamic, and stressful . . . on a good day. Trading is not as<br />

project-based as IBD. Instead, it’s a continuous series of transactions based on<br />

understanding and processing market information very quickly.<br />

A trader’s work is affected by a huge number of factors: political turmoil,<br />

interest rate fluctuations, currency exchange values—even the weather. Most of<br />

a CSFB trader’s work demands preparation for tomorrow’s news by doing<br />

background reading today (yes, that means bedtime reading). Traders must<br />

respond to constantly changing market conditions and to sales requests from<br />

CSFB salespeople and clients. One insider states that traders are under<br />

persistent, and often frustrating, pressure to reconcile the needs and expectations<br />

of the sales division with those of the trading desk, even though the two are<br />

not always in accord. You must be mentally agile and personable, since you will<br />

interact with fellow desk members constantly.<br />

On the Job<br />

Unless you’re in originations on the equity side, there is occasional travel<br />

involved in trading. As for the traders themselves, they come from a diversity of<br />

backgrounds. One insider says the atmosphere on the trading floor can range<br />

from laid-back to very intense depending on the time of year or the volatility of<br />

the market. On the whole, the slower periods tend to be around Christmas<br />

time, during the summer months, and on Fridays.<br />

27

The one constant in trading is that you are tied to your desk, with your eyes on<br />

a multitude of screens flashing everything from business news to LIBOR bidoffer<br />

rates, and with the phone on your ear, as you make the trades happen. Of<br />

course, these days CSFB also relies on electronic trading. The work of a trader<br />

includes:<br />

On the Job<br />

• Keeping tabs on markets that directly and indirectly affect your trades<br />

• Transmitting information to the sales force so it can advise CSFB clients<br />

• Generating trading ideas for your desk<br />

• Maintaining constant contact with your counterparts in London, Moscow, or<br />

Hong Kong if you’re on the international desk<br />

• Monitoring booking positions<br />

• Putting in orders for trades<br />

28

Sales<br />

A CSFB salesperson works in fixed income, equities, or more specific areas<br />

such as mortgage loans and other collateralized assets. Salespeople are the<br />

conduit between clients, both institutional and retail, and traders, research<br />

analysts, bankers, and the originations group. Most sales work is done by phone,<br />

constantly filling client orders and pitching new ideas. Sometimes you’ll even<br />

find yourself teaching investors ab<strong>out</strong> the finer points of securities (but with<strong>out</strong><br />

making it sound even the tiniest bit like teaching).<br />

Again, because CSFB is a lean shop, analysts and associates in sales have the<br />

responsibility of several accounts and an enormous opportunity for client<br />

interaction. Many salespeople mention that some of the CSFB sales desks offer<br />

significant career opportunities.<br />

On the Job<br />

29

Research<br />

If you couldn’t get enough of college micro- and macroeconomics, the research<br />

analyst position is for you. The job title terminology is the reverse of that for<br />

other CSFB divisions. Undergrads enter as research associates who work under<br />

a senior analyst and focus on an industry. One insider says it’s important to find<br />

someone with whom you get along. Older, more established analysts may be<br />

more set in their ways. Younger analysts may still be looking to leave their mark.<br />

On the Job<br />

MBAs come in as industry analysts, assigned to cover their own areas. Such<br />

autonomy is unlike other firms on the Street, where MBAs typically follow the<br />

lead of senior analysts. The work involves a steep learning curve and an<br />

emphasis on working independently. The associate and senior analyst work<br />

together, but the senior analyst runs the show, and the associate provides a<br />

support structure.<br />

Compared to other divisions, equity research is the least Ivy-centric when it<br />

comes to recruiting associates and analysts. Equity research works most closely<br />

with sales and trading. One change stemming from recent scandals: Analysts are<br />

no longer allowed to work with investment bankers. This holds true through<strong>out</strong><br />

the investment banking community.<br />

The research team is highly respected within CSFB. Much of the work involves<br />

modeling and forecasting earnings, analyzing competition, and writing company<br />

and industry reports. According to one insider, it’s one of the best ways to<br />

build expertise in an industry. CSFB has become adept at using the CSFB<br />

HOLT method for valuation of client deals and stock recommendations.<br />

30

Day in the Life of a Research Analyst<br />

7:00 Get into the office. (On my way to the office, read the newspaper. Look<br />

for articles that are related to our group. Grab a bagel and coffee from a<br />

street vendor.) It’s usually expected for first or second years to be in the<br />

office by 7 a.m. In the office, I look for further articles that might<br />

impact our group. Check Bridge Station, which has continuous pricing<br />

of stocks and data links and pulls in information from Reuters and Dow<br />

Jones news services. As soon as a press release comes <strong>out</strong>, it shows up<br />

there.<br />

7:15 Attend morning call, where each of the analysts in our group talks<br />

ab<strong>out</strong> companies where stories may have come <strong>out</strong> or ab<strong>out</strong> recurring<br />

stories and possible trading positions. This usually lasts ab<strong>out</strong> 45<br />

minutes. There are three people in our group.<br />

8:15 Clients call, wanting to know ab<strong>out</strong> a news item related to a company.<br />

They want to know ab<strong>out</strong> the item’s impact on the company’s stock, if I<br />

believe anything has changed structurally, and where the company stands<br />

next to other companies in the sector. They want to know what kind of<br />

impact there will be on the stock. This is the part I really enjoy. I do so<br />

much work on companies. It’s one of the only times I get to discuss the<br />

issues in depth. It gives me insight into what types of projects clients<br />

might be interested in and that I might want to work on. This is the<br />

opportunity to communicate ideas in more depth than I might have the<br />

opportunity to write ab<strong>out</strong> in a paper. I might spend just a few minutes<br />

with a client or an hour.<br />

9:00 Start working on an individual project. Typically, I might initiate coverage<br />

on a company I haven’t covered before or an upcoming event, such as<br />

earnings or industry data that comes <strong>out</strong> every month. Have to be very<br />

organized but very flexible in my schedule to drop what I’m doing to<br />

take a client’s call or to react to a piece of information that’s come<br />

across the news.<br />

9:30 Phone rings. This time someone from our internal sales force has a<br />

question on one of my group’s companies. Give him my two cents on<br />

the company. He thanks me. That’s the essence of a good sales force.<br />

They’re very appreciative.<br />

9:45 Back to researching.<br />

On the Job<br />

31

On the Job<br />

10:30 Down to the cafeteria for coffee. Usually stick to two cups a day—<br />

industry average seems to be ab<strong>out</strong> three cups or more—and an energy bar.<br />

10:45 Back to my desk and researching.<br />

11:00 Big news comes across the newswire. Receive a press release. Call my<br />

trader to give him my insights into what’s happening, how the stock<br />

might react in the short term and long term. Start writing a brief note<br />

for clients on the same points—what occurred, what my conclusions<br />

are. Let the clients know that I’m still working through the analysis and<br />

am waiting for the company’s conference call in an hour.<br />

12:00 Dial into the conference call. Listen to what the CEO and CFO have to<br />

say related to points that aren’t necessarily on the press release. Also<br />

listen to questions from my group’s head analyst.<br />

1:00 Lunchtime. It has to be quick because clients want to hear what my<br />

thoughts are on the conference call. Some days I don’t get lunch until<br />

2 p.m. Go down to the cafeteria and grab a sandwich—turkey and<br />

Swiss, barbecue chips, and a soft drink. I usually eat at my desk when<br />

the market is open.<br />

1:15 Back at my desk. Monitor the market while I eat.<br />

1:30 Start taking calls for the next couple of hours, mostly from institutional<br />

investors and hedge funds.<br />

3:30 Place a call to the company’s management. Talk to the head of investor<br />

relations ab<strong>out</strong> my assumptions and any additional insights I have. Try<br />

to get some more details for them to explain further.<br />

4:30 Start putting my assumptions and thoughts into a model that looks at<br />

the valuation of a company. Project earnings growth and what sort of<br />

things will drive the company’s future earnings and the EPS number. Is<br />

there a higher volume of sales? Is there anything that will change one of<br />

the key drivers of revenue?<br />

6:30 Whew! Get my second wind. Start drafting a report related to the<br />

company and the event it announced. I have fun drafting this report.<br />

This is my chance to pull my thoughts together for clients. It’s a fourpage<br />

report.<br />

8:30 Dinner. The cafeteria closes down. Order take<strong>out</strong> from a coffee shop.<br />

Have a chicken sandwich with fries and a Coke—a little caffeine boost.<br />

32

Over dinner, I usually sit down at a conference table and discuss the<br />

report and anything my colleagues might want to add.<br />

9:00 Review my report and submit it to legal and compliance for disclosure<br />

approval. In a half hour, the report is approved. Sometimes I don’t wait<br />

for approval but go home and arrive extra early the next morning to<br />

receive approval.<br />

9:30 Submit the report via e-mail to my clients.<br />

9:45 Meet friends for an hour and unwind.<br />

11:30 In bed.<br />

On the Job<br />

33

The Workplace<br />

• Lifestyle and Hours<br />

• Culture<br />

• Workplace Diversity<br />

• Civic Involvement<br />

• Compensation<br />

• Travel<br />

• Training<br />

• Career Path<br />

The Workplace<br />

• Insider Scoop<br />

35

Lifestyle and Hours<br />

The party’s over, kid. Hours in IBD are some of the most grueling on Wall<br />

Street, especially at the analyst level. Analysts work an average of 90 hours a<br />

week, with 60 hours on the low end and 120 on the high end. Although by your<br />

second year, you can start delegating tasks to incoming analysts, insiders say you<br />

should be prepared to cancel trips to visit family, lose touch with your friends,<br />

give up your weekends, and basically give up 2 years of your life. “I had a week<br />

where Monday through Friday I was in every day at 8:30 a.m. and left at 5 in<br />

the morning,” says one analyst. “I got 15 hours of sleep.”<br />

The Workplace<br />

Social life? Count on becoming close with the people in your group. They’re<br />

your social <strong>out</strong>let during those hurry-up-and-wait hours late at night or on the<br />

weekends. But those long, caffeinated evenings make for strong bonds. Says<br />

one insider, “I know I’ve got to put in my 2 years and pay my dues to get<br />

ahead. It’s a trade-off.”<br />

Associates have somewhat more time for themselves. They work 70 hours a<br />

week on average (some groups, like leveraged finance, tend to have steeper<br />

hours than others do), with 50 on the low end and 100 on the high end. They<br />

can heap more work on analysts.<br />

Equity Research<br />

Positions in equity research generally require 65- to 75-hour workweeks.<br />

“There’s always something coming up,” says one analyst. “One of your<br />

companies issues a press release after business hours, in the middle of the<br />

night. You have to be ready to provide clients with useful information.” But the<br />

36

analyst says most bosses are reasonable ab<strong>out</strong> their employees taking time off—<br />

as long as the vacation doesn’t occur during earnings season: “Late in the<br />

summer is more convenient.”<br />

Sales and Trading<br />

For those in sales and trading, you can expect to devote 60 to 65 hours to<br />

CSFB, with an occasional 80-hour week. Regardless of which division you’re in,<br />

your schedule depends on the market, the deal, the report, and your coworkers,<br />

so flexibility and a willingness to pitch in are essential. One insider says that<br />

people “shouldn’t assume working on the sales side is a 9-to-5 job. A 12-hour<br />

day is the norm, and you can expect to take home reading every night and on<br />

the weekends.”<br />

The Workplace<br />

37

Culture<br />

Is CSFB your typical Wall Street bulge-bracket bank? Or is it more like a Swiss<br />

bank, conservative and discreet? Insiders seem to feel it’s neither. CSFB, in its<br />

post-1997 merger state, is a unique hybrid of two culturally distinct parents.<br />

“You get a lot of different types here,” says one insider. Yet the insider adds<br />

that despite the differences, there’s a team-first attitude. The firm’s CEO John<br />

Mack has instilled the firm with that belief since taking over 3 years ago. He<br />

wanted CSFB to distance itself from the days when some of the firm’s biggest<br />

hitters had more leeway. “We don’t have a lot of really difficult individuals to<br />

work with here,” says one insider. “Obviously, the work is very demanding, but<br />

there’s no yelling or hazing going on.”<br />

The Workplace<br />

Just as there is no stereotypical CSFB employee, there is also no formulaic<br />

method of doing things. According to one insider, “You have to be pretty<br />

responsible with managing your own time. It’s up to you to get things done.<br />

You are usually managing several things at once, and no one is looking over<br />

your shoulder. Instead, there is significant communication—both formal and<br />

informal—since deal teams are small. Obviously, if you’re overstretched,<br />

management will try to ease the load a bit.”<br />

If anything, the culture is defined at the group level, mostly by senior officers.<br />

Social events are organized by product area, and the folks working within these<br />

groups determine their frequency and type. One insider tells us that most of<br />

the groups are fairly social with <strong>out</strong>ings that range from Friday night happy<br />

hours to softball trips <strong>out</strong>side the city. (Keep in mind that the culture of the<br />

foreign offices will vary depending on where you are.)<br />

38

To claim that any investment bank has an open<br />

culture may be a stretch, but many analysts say that<br />

they have found senior people to be surprisingly<br />

approachable. “Junior-level guys do get a fair<br />

amount of experience and interaction with seniorlevel<br />

guys,” says one insider.<br />

“ ”<br />

You have to be<br />

pretty responsible<br />

with managing your<br />

own time. It’s up to<br />

you to get things<br />

done. ...No one is<br />

looking over your<br />

shoulder.<br />

That doesn’t mean that CSFB lacks formality. In all<br />

divisions, there is a formal 360-degree evaluation<br />

process every year. These reviews affect bonuses,<br />

so they are taken seriously. Insiders say that they<br />

have been able to build good working relationships with senior officers. On the<br />

other hand, as with any organization, there are unwritten rules and policies.<br />

One insider says, “An analyst does not go to an MD and say ‘I have issues.’”<br />

CSFBers know their status and boundaries. If an issue arises, insiders say they<br />

go to the group staffer. If they have a more serious beef, they would contact a VP.<br />

The Workplace<br />

39

Workplace Diversity<br />

CSFB has been largely successful in fulfilling John Mack’s wishes to hire more<br />

Latinos, African-Americans, and Native Americans. The company has a<br />

Diversity Advisory Board dedicated to attracting, retaining, developing, and<br />

promoting women and minorities. CSFB also has a diversity recruiting department<br />

that drives a wide number of initiatives, including the CSFB MBA Diversity<br />

Fellowship Program, the Sophomore Rotational Program, the United Negro<br />

College Fund (UNCF) Scholarship, the MBA and BA Explorer programs, and<br />

partnerships and alliances with nonprofit organizations such as the Robert<br />

Toigo Foundation, the Forte Foundation, and Sponsors for Educational<br />

Opportunity.<br />

The Workplace<br />

The Explorer program selects diversity undergraduates to attend a 3-day event<br />

in New York, where they learn ab<strong>out</strong> career possibilities in business. The MBA<br />

Diversity Fellowship Program awards merit-based fellowships to black and<br />

Hispanic MBA students, who are then given early access to CSFB. CSFB<br />

annually awards a 3-year UNCF scholarship to two students, who are then<br />

invited to work at CSFB for the summer. “Diversity is on everyone’s mind, and<br />

better yet, we’re doing something ab<strong>out</strong> it,” one recruiter says. Insiders say<br />

CSFB is a lot more cosmopolitan and diverse than other Street firms. The<br />

company hires a large number of Asians and Europeans.<br />

Opportunities for Women<br />

Men continue to greatly <strong>out</strong>number women at CSFB, but no more than at other<br />

Street firms. CSFB remains predominantly male at all levels, most significantly<br />

in senior management. Of course, the ratios do differ from group to group.<br />

40

Some product and industry groups such as leveraged finance or oil and energy<br />

are largely male. Others such as consumer products, health care, and media<br />

have more women, according to one insider.<br />

Still, the number of women has increased in recent years. In the securities<br />

division, a formal women’s network has been formed to focus on developing<br />

women and encouraging leadership qualities in them. CSFB also staged a Take<br />

Our Daughters to Work Day this year, which involved volunteers and senior<br />

executive women at the firm’s Madison Avenue headquarters.<br />

The Workplace<br />

41

Civic Involvement<br />

The CSFB Foundation’s core mission is the education of inner-city y<strong>out</strong>h. The<br />

Foundation provides financial support to organizations that sponsor communitybased<br />

and after-school education programs, including those that incorporate art,<br />

music, sports, recreation, and community building. In addition, the Foundation<br />

works with these organizations to develop volunteer opportunities for CSFB<br />

employees. Individual and team volunteer projects are offered on a wide range<br />

of commitment levels so that every employee can find a way to help. Employees<br />

find that these projects give them an opportunity to make a difference in the<br />

communities where they work and live.<br />

The Workplace<br />

The Foundation also supports other causes and organizations in which CSFB<br />

employees are personally involved. For example, it has developed partnerships<br />

to improve the lives of nursing-home residents; beautify public schools, city<br />

parks, and gardens; deliver food to the homeless and needy; and through<br />

Habitat for Humanity build homes for low-income families.<br />

Finally, the CSFB Foundation administers the Employee Mini-Grant Program:<br />

Employees who are volunteers or serve on boards of qualifying nonprofit<br />

organizations may apply for mini-grants for those organizations.<br />

The CSFB Foundation primarily supports organizations in New York City, but<br />

it also helps groups in Atlanta, Baltimore, <strong>Boston</strong>, Chicago, Houston, Los<br />

Angeles, Miami, Palo Alto, Philadelphia, San Francisco, and Washington, D.C.<br />

42

Compensation<br />

Salary and Bonuses<br />

Based on market estimates for the Wall Street firms, first-year analysts can<br />

expect a base salary of ab<strong>out</strong> $55,000 with a performance bonus that comprises<br />

30 to 40 percent of the base salary. The year-end bonus may be a significant<br />

portion of total compensation, but it will depend on several factors: individual<br />

achievement, and the department’s and company’s performance.<br />

Compensation for associates has risen as CSFB tries to woo top talent and<br />

retain top employees in an improving economy. Based on Street estimates, IBD<br />

associates can expect roughly $85,000 as a base, plus bonuses. However,<br />

according to a Bloomberg News story, the firm is promising first-year<br />

associates “at least $200,000.”<br />

Vacations<br />

Analysts and associates are entitled to 15 vacation days, which they spread <strong>out</strong><br />

carefully. “I don’t think you can take a week at a time,” says one insider. “But<br />

you can take a long weekend here or there.” The number of days increases with<br />

length of service as well as title, but even senior people find it difficult to plan<br />

extended vacations. (Exceptions are made for special events such as honeymoons.)<br />

“The biggest challenge is taking the vacation, not scheduling it,” says another<br />

insider. “If a big deal is coming up and you take off, it could really hurt your<br />

reputation.”<br />

The Workplace<br />

43

Other Benefits and Perks<br />

CSFB employees enjoy a full range of benefit programs, including health,<br />

dental, and life insurance; pension and savings plans; and a profit-sharing plan.<br />

Insiders commend CSFB’s 401(k) plan, because it gives them a choice of more<br />

than 100 different investment funds in which to invest up to 10 percent of each<br />

pay<strong>check</strong> and bonus. The real charm of the plan is that CSFB invests a<br />

percentage of an employee’s base salary and bonus each year in the plan, no<br />

matter how much the employee is investing. This is a real benefit when you<br />

consider that most plans will only match a percentage of what an employee<br />

actually contributes, if they match anything at all.<br />

Dress for CSFB employees at the vice president level and below is business<br />

casual, says an insider. More senior executives wear suits and ties. Product areas<br />

plan social events—from happy hours to sporting events—on a frequent basis.<br />

Every month, the firm schedules guest speakers on such subjects as healthrelated<br />

issues, how to get a mortgage, time management, and other issues of<br />

interest to CSFBers.<br />

The Workplace<br />

At the New York “campus” (three buildings located on different corners),<br />

employees live very well—some would say like royalty, though that description<br />

is better suited to the London office, which boasts an indoor pool. CSFB-NY is<br />

a one-stop shop in more ways than one. Within a stone’s throw, there’s a dry<br />

cleaner, shoeshine stand, and hair salon. The Madison Avenue location boasts a<br />

large cafeteria for its employees. To top it off, there is a gym called the Fitness<br />

Club, complete with the latest fitness equipment, aerobics programs, and<br />

personal trainers. This is the one place in the company where everyone sweats<br />

equally, with<strong>out</strong> regard to corporate rank.<br />

44

CSFBers are also given a wide range of discounts at various retail stores from<br />

clothing to cosmetics. And they enjoy reduced fees at a number of museums,<br />

Broadway, and off-Broadway shows, thanks to the <strong>Credit</strong> <strong>Suisse</strong> Foundation’s<br />

philanthropic contributions to the arts.<br />

The Workplace<br />

45

Travel<br />

In IBD, travel depends entirely on the group, the deal, and the client location. A<br />

typical IBD analyst may travel domestically two or three times annually.<br />

Analysts can also find themselves taking a trip to London, Hong Kong, or<br />

another international destination some time during their 2-year tenure. Or they<br />

might not travel at all. Says one analyst in the San Francisco office, “I don’t<br />

really do much traveling now, especially recently since all of the cutbacks.<br />

Traveling does get intensive when we have to do a pitch or go on a road show.<br />

But usually it’s the senior guys who do them.” Occasionally, deals will involve<br />

significant international travel. One insider, for example, says he traveled to<br />

Europe several times over the past year because his client was based there.<br />

The Workplace<br />

For an IBD associate, most travel is to client meetings within the United States,<br />

with possibly a few international assignments thrown in. Research analysts will<br />

do a significant amount of travel. According to one, “I traveled every week this<br />

summer, doing marketing, research, and meeting clients. I was in San Francisco,<br />

San Diego, Wisconsin, Miami, Orlando, Toronto. ...”Traders, on the other<br />

hand, almost never leave their desks. For salespeople, the amount of travel<br />

varies. On the domestic front, a salesperson may travel once a month or more<br />

depending on the number of road shows in progress. “Travel is pretty limited<br />

on the sales and trading desks,” says a recruiter.<br />

46

Training<br />

In general, the training programs for both analysts and associates include<br />

introductions to CSFB’s products and services, presentations by senior<br />

management, seminars with external experts (NYU and Columbia Business<br />

School professors as well as individuals from leading training consulting<br />

companies), and preparation for the Series 7 and other regulatory exams.<br />

Undergraduates<br />

If you thought you were finished with studying and taking exams, think again.<br />

Analysts in all areas attend a mandatory 4- to 6-week training program in New<br />

York City or London. Sales and trading analysts who are U.S. nationals receive<br />

additional training for the Series 7 and 63 exams. The analyst training program<br />

includes classes on accounting and financial statement analysis, financial<br />

applications and modeling, corporate finance, and computer and online services<br />

orientation. Expect to be tested at regular intervals. The tests are graded. The<br />

few people scoring below a minimum standard receive tutoring from a secondyear<br />

analyst. “Everyone we bring in the door we have every intention of<br />

making successful,” says an insider.<br />

The Workplace<br />

Analysts in IBD are usually hired into a generalist pool, and a big segment of<br />

training involves meeting with representatives of CSFB’s different product and<br />

industry groups after each has made a presentation to the incoming analyst<br />

class. Subsequent training from inside and <strong>out</strong>side experts covers a range of<br />

topics to help analysts hone their skills. There’s also an online program available<br />

to anyone at the firm.<br />

47

MBAs<br />

The associate training program varies according to the division into which<br />

you’re hired. In IBD, the course begins in August and lasts 3 weeks. The<br />

training course resembles a mini-MBA, and insiders say these refresher courses<br />

on debt and capital markets, forecasting, valuation, and accounting don’t hurt.<br />

You’ll be learning from people who are on the front lines, executing deals with<br />

the latest financial tools everyday.<br />

Those in equity and fixed income attend a 10-week training program. In<br />

addition to the basic courses, there are sales and trading simulations as well as<br />

senior management presentations and training in sales and presentation skills.<br />

Like analysts, associates have opportunities for ongoing training.<br />

Midcareer Candidates<br />

The Workplace<br />

CSFB’s Leadership Institute develops training and development programs from<br />

the analyst to the managing director level. Regular events feature internal and<br />

<strong>out</strong>side experts.<br />

48

Career Path<br />

CSFB makes career development and training a priority. Over the past few<br />

years, the company has also increasingly emphasized the importance of<br />

retaining its most talented employees. To wit, 70 percent of the analysts who<br />

were hired in 2001 have been invited back for a third year. “There’s an even<br />

more concentrated effort on retention that’s going to get even stronger. We<br />

intend to promote people through the ranks,” says an insider, who adds, “The<br />