Baker Tilly Dutch Caribbean | Edition 1 2014

The digital information source from Baker Tilly Dutch Caribbean.

The digital information source from Baker Tilly Dutch Caribbean.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

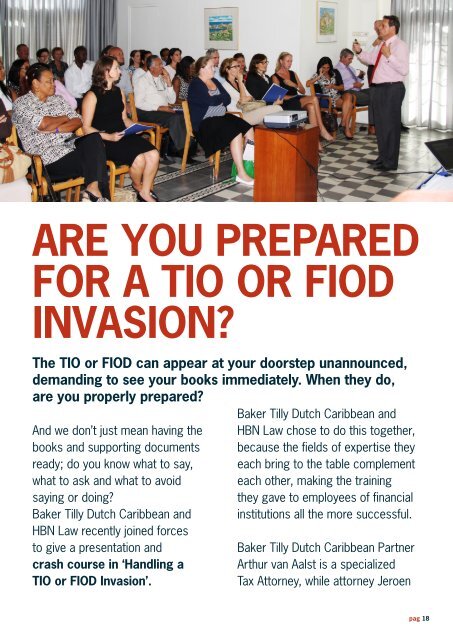

ARE YOU PREPARED<br />

FOR A TIO OR FIOD<br />

INVASION?<br />

The TIO or FIOD can appear at your doorstep unannounced,<br />

demanding to see your books immediately. When they do,<br />

are you properly prepared?<br />

And we don’t just mean having the<br />

books and supporting documents<br />

ready; do you know what to say,<br />

what to ask and what to avoid<br />

saying or doing?<br />

<strong>Baker</strong> <strong>Tilly</strong> <strong>Dutch</strong> <strong>Caribbean</strong> and<br />

HBN Law recently joined forces<br />

to give a presentation and<br />

crash course in ‘Handling a<br />

TIO or FIOD Invasion’.<br />

<strong>Baker</strong> <strong>Tilly</strong> <strong>Dutch</strong> <strong>Caribbean</strong> and<br />

HBN Law chose to do this together,<br />

because the fields of expertise they<br />

each bring to the table complement<br />

each other, making the training<br />

they gave to employees of financial<br />

institutions all the more successful.<br />

<strong>Baker</strong> <strong>Tilly</strong> <strong>Dutch</strong> <strong>Caribbean</strong> Partner<br />

Arthur van Aalst is a specialized<br />

Tax Attorney, while attorney Jeroen<br />

Eichhorn of HBN Law has in-depth<br />

knowledge of Civil Law.<br />

Tax Attorney Arthur van Aalst: “When<br />

seven TIO or FIOD investigators<br />

suddenly show up at your doorstep,<br />

the first person they see is the<br />

receptionist. This receptionist must<br />

display a strong footing and be able<br />

to quickly switch to asking the right<br />

questions, redirect the investigators’<br />

questions and diligently inform<br />

superiors of the situation at<br />

hand.” During the presentation,<br />

Jeroen Eichhorn of HBN Law and<br />

<strong>Baker</strong> <strong>Tilly</strong>’s Van Aalst provided<br />

receptionists, assistants and<br />

managers of several local financial<br />

institutions with clear instructions<br />

on how to handle an unexpected<br />

tax invasion.<br />

Financial institutions such as<br />

banks and trust companies are<br />

often dependent on the input of<br />

their clients. If these clients of<br />

the financial institution in question<br />

generate ‘black market’ revenue and<br />

keep a shadow administration that<br />

the institution does not know about,<br />

the institution may involuntarily<br />

be called as a witness, or even<br />

worse, also become a suspect in<br />

a criminal investigation. Eichhorn:<br />

“When subsequently a tax invasion<br />

by an investigation authority follows,<br />

you had better be prepared.”<br />

Common financial crimes include<br />

fraud, forgery, and participation in a<br />

criminal organization or intentional<br />

false tax returns. In addition to heavy<br />

fines, these offenses can result in<br />

several years of incarceration.<br />

Although all of the attendees of<br />

the seminar were aware of the<br />

possibility of a tax invasion, many<br />

didn’t consider the situation in which<br />

they could be involuntarily involved<br />

in a criminal investigation into a<br />

third party, such as a client or a<br />

stakeholder. Besides this valuable<br />

awareness, the attendees also<br />

appreciated the tips and tricks<br />

for handling the moment when<br />

the investigators are already at<br />

the doorstep. <strong>Baker</strong> <strong>Tilly</strong> <strong>Dutch</strong><br />

<strong>Caribbean</strong> and HBN Law are<br />

satisfied with the turnout and glad<br />

that they were able to be help some<br />

of their clients, but also the financial<br />

sector in general to be better<br />

prepared.<br />

“It’s better to be safe than sorry, and<br />

in the end we all benefit from a clean<br />

and ethical economy”, according to<br />

Arthur van Aalst.<br />

pag 18 pag 19