Report (Public Version) - Philippine Tariff Commission

Report (Public Version) - Philippine Tariff Commission

Report (Public Version) - Philippine Tariff Commission

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1. TERMS OF REFERENCE<br />

1. INTRODUCTION<br />

1.1 The Initial Application of Definitive Safeguard Measure<br />

The petitioner United Pulp and Paper Corporation (UPPC), representing<br />

the domestic testliner board industry, submitted to the Department of Trade<br />

and Industry (DTI) an application for the imposition of safeguard measure<br />

against imports of testliner boards from various countries (AHTN Code Nos.<br />

4805.24.00, 4805.25.10 and 4805.25.90). The Secretary of Trade and<br />

Industry (hereinafter referred to as the “Secretary”) officially accepted the<br />

application on 09 November 2009 and endorsed the same to the <strong>Tariff</strong><br />

<strong>Commission</strong> (hereinafter referred to as the “<strong>Commission</strong>”) for formal<br />

investigation on 25 May 2010. The <strong>Commission</strong>’s investigation report was<br />

submitted to the Secretary on 24 November 2010.<br />

The Secretary, following the positive findings of the <strong>Commission</strong>, issued<br />

a Department Order dated 15 July 2011 imposing a definitive general<br />

safeguard duty against imports of testliner boards for a period of three (3)<br />

years. The effective period of the safeguard measure, unless it is extended, is<br />

up to 14 June 2013.<br />

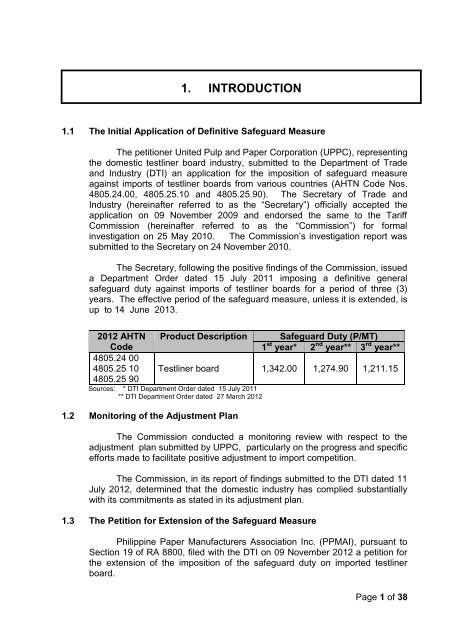

2012 AHTN<br />

Code<br />

4805.24 00<br />

4805.25 10<br />

4805.25 90<br />

Product Description<br />

Safeguard Duty (P/MT)<br />

1 st year* 2 nd year** 3 rd year**<br />

Testliner board 1,342.00 1,274.90 1,211.15<br />

Sources: * DTI Department Order dated 15 July 2011<br />

** DTI Department Order dated 27 March 2012<br />

1.2 Monitoring of the Adjustment Plan<br />

The <strong>Commission</strong> conducted a monitoring review with respect to the<br />

adjustment plan submitted by UPPC, particularly on the progress and specific<br />

efforts made to facilitate positive adjustment to import competition.<br />

The <strong>Commission</strong>, in its report of findings submitted to the DTI dated 11<br />

July 2012, determined that the domestic industry has complied substantially<br />

with its commitments as stated in its adjustment plan.<br />

1.3 The Petition for Extension of the Safeguard Measure<br />

<strong>Philippine</strong> Paper Manufacturers Association Inc. (PPMAI), pursuant to<br />

Section 19 of RA 8800, filed with the DTI on 09 November 2012 a petition for<br />

the extension of the imposition of the safeguard duty on imported testliner<br />

board.<br />

Page 1 of 38

Reasons cited for the petition were as follows:<br />

i) to prevent or remedy the serious injury inflicted by imported testliner<br />

board on the domestic industry; and<br />

ii)<br />

for the domestic industry to continue and/or complete the positive<br />

adjustment it has undertaken to gain competitiveness vis-à-vis imports.<br />

The petition for extension was endorsed by the Secretary to the<br />

<strong>Commission</strong> for formal investigation on 29 January 2013.<br />

1.4 Period Under Review<br />

The period under review is the period when the safeguard measure was<br />

put in place, i.e., starting from 2010 up to the present or where latest data is<br />

available.<br />

The <strong>Commission</strong>, in its evaluation, will compare the prevailing condition<br />

of the domestic industry during the period under review with its condition under<br />

the original period of investigation (POI).<br />

Page 2 of 38

2. SAFEGUARD ACTION<br />

2.1 The Safeguard Measures Act of 2000<br />

Republic Act (RA) No. 8800, also known as the “The Safeguard<br />

Measures Act”, provides for general safeguard measures to afford relief to<br />

domestic industries suffering from serious injury or the threat thereof as a<br />

result of increased imports.<br />

Section 5 of RA 8800 states:<br />

“The Secretary shall apply a general safeguard measure upon a<br />

positive final determination of the <strong>Commission</strong> that a product is being<br />

imported into the country in increased quantities, whether absolute or<br />

relative to the domestic production, as to be a substantial cause of<br />

serious injury or threat thereof to the domestic industry; however, in the<br />

case of non-agricultural products, the Secretary shall first establish that<br />

the application of such safeguard measures will be in the public<br />

interest.”<br />

Section 15 provides:<br />

“The duration of the period of an action taken under the General<br />

Safeguard Provisions of this Act shall not exceed four (4) years. Such<br />

period shall include the period, if any, in which provisional safeguard<br />

relief under Section 8 was in effect.<br />

The effective period of any safeguard measure, including any<br />

extensions thereof under Section 19 may not, in the aggregate, exceed<br />

ten (10) years.”<br />

2.2 The World Trade Organization (WTO) Agreement on Safeguards<br />

Article 2 of the WTO Agreement on Safeguards provides that:<br />

“A Member may apply a safeguard measure to a product only if that<br />

Member has determined, pursuant to the provisions set out below, that<br />

such product is being imported into its territory in such increased quantities,<br />

absolute or relative to domestic production, and under such conditions as<br />

to cause or threaten to cause serious injury to the domestic industry that<br />

produces like or directly competitive products.”<br />

Further, Article 7 of the same Agreement stipulates that:<br />

“1. A member shall apply safeguard measure only for such period of<br />

time as may be necessary to prevent or remedy serious injury and to<br />

Page 3 of 38

facilitate adjustment. The period shall not exceed four years, unless<br />

it is extended under paragraph 2.<br />

2. The period mentioned in paragraph 1 may be extended provided that<br />

the competent authorities of the importing Member have determined,<br />

in conformity with the procedures set out in Articles 2, 3, 4 and 5 that<br />

the safeguard measure continues to be necessary to prevent or<br />

remedy serious injury and that there is evidence that the industry is<br />

adjusting, and provided that the pertinent provisions of Articles 8 and<br />

12 are observed.”<br />

In order that a substantially equivalent level of WTO concessions and<br />

other obligations to affected WTO Members is maintained, a country imposing<br />

safeguard measures may offer “adequate means of trade compensation” to<br />

affected exporting countries. If agreement is not reached on such<br />

compensation, said exporting countries are given an opportunity to suspend<br />

“substantially equivalent” concessions or obligations under GATT 1994 after<br />

the measures have been in place for three (3) years, or immediately if the<br />

safeguard action is taken against imports which have not increased in absolute<br />

terms and the measure does not conform to the provisions of the Agreement<br />

on Safeguards.<br />

Disputes arising from the application of safeguard measures are subject<br />

to WTO dispute settlement procedures.<br />

Safeguard measures, if imposed, must be liberalized progressively. A<br />

measure extended shall not be more restrictive than it was at the end of the<br />

initial period, and should continue to be liberalized.<br />

The Uruguay Round of Multilateral Trade Negotiations resulted in a new<br />

Agreement on Safeguards which interprets and elaborates Article XIX.<br />

Article XIX of GATT 1994 stipulates that an emergency action is<br />

permissible only where the increase in imports (and the consequent serious<br />

injury or threat thereof) is due to unforeseen developments and the effect of<br />

GATT-WTO obligations, including tariff concessions. The Agreement on<br />

Safeguards, when it provides for the conditions for the application of safeguard<br />

measures (i.e., increased importation, serious injury or threat thereof, and<br />

causal link) is, however, silent on the circumstances prescribed by Article XIX.<br />

As mentioned in the original investigation, the circumstances provided<br />

in Article XIX of GATT 1994 need not be demonstrated since testliner board<br />

are not subject of any <strong>Philippine</strong> obligation or tariff concession under the WTO<br />

Agreement. Nonetheless, such investigation is governed by the national<br />

legislation (RA 8800) and the terms and conditions of the Agreement on<br />

Safeguards.<br />

Page 4 of 38

2.3 Association of Southeast Asian Nations Trade in Goods Agreement<br />

(ATIGA)<br />

Article 86 of the ATIGA provides that:<br />

“Each Member State which is a WTO member retains its rights and<br />

obligations under Article XIX of GATT 1994, and the Agreement on<br />

Safeguards or Article 5 of the Agreement on Agriculture.”<br />

Further, Article 11 of the same Agreement states that:<br />

“1. Unless otherwise provided in this Agreement, Member States shall<br />

notify any action or measure that they intend to take:<br />

(a) which may nullify or impair any benefit to other Member States,<br />

directly or indirectly under this Agreement; or<br />

(b) when the action or measure may impede the attainment of any<br />

objective of this Agreement.<br />

2. x x x<br />

3. A Member State shall make a notification to Senior Economic<br />

Officials Meeting (SEOM) and the ASEAN Secretariat before<br />

effecting such action or measure referred to in paragraph 1 of this<br />

Article. Unless otherwise provided in this Agreement, notification<br />

shall be made at least sixty (60) days before such an action or<br />

measure is to take effect. A Member State proposing to apply an<br />

action or measure shall provide adequate opportunity for prior<br />

discussion with those Member States having an interest in the action<br />

or measure concerned.”<br />

Considering that testliner boards are covered by the ATIGA, notice of<br />

any safeguard action shall be given to the Senior Economic Officials Meeting<br />

(SEOM) and the ASEAN Secretariat before effecting any such action or<br />

measure and adequate opportunity for consultation shall be accorded the<br />

governments of the affected ASEAN Member States.<br />

2.4 Other Free Trade Agreements (FTAs)<br />

ASEAN-China Free Trade Area (ACFTA)<br />

Article 9 of the ACFTA provides that:<br />

“Each Party, which is a WTO member, retains its rights and obligations<br />

under Article XIX of the GATT 1994 and the WTO Agreement on<br />

Safeguards.”<br />

Page 5 of 38

ASEAN-Korea Free Trade Area (AKFTA)<br />

Article 9 of the AKFTA states that:<br />

“Each Party which is a WTO member retains its rights and obligations<br />

under Article XIX of GATT 1994 and the WTO Agreement on<br />

Safeguards. Actions taken pursuant to Article XIX of GATT 1994 and<br />

the WTO Agreement on Safeguards shall not be subject to the<br />

Agreement on Dispute Settlement Mechanism under the Framework<br />

Agreement.”<br />

ASEAN-Australia-New Zealand Free Trade Area (AANZFTA)<br />

Article 9 (Relationship to the WTO Agreement) of the AANZFTA<br />

provides that:<br />

1. Each Party retains its rights and obligations under Article XIX of<br />

GATT 1994, the Safeguards Agreement and Article 5 of the<br />

Agreement on Agriculture. This Agreement does not confer any<br />

additional rights or obligations on the Parties with regard to global<br />

safeguard measures.<br />

2. A party shall not apply a safeguard measure or provisional measure,<br />

as provided in Article 6 (Scope and Duration of Transitional<br />

Safeguard Measures) or Article 7 (Provisional Safeguard Measures)<br />

on a good that is subject to a measure that the Party has applied<br />

pursuant to Article XIX of GATT 1994 and the Safeguards<br />

Agreement, the Agreement on Agriculture or any other relevant<br />

provisions in the WTO Agreement, nor shall a Party continue to<br />

maintain a safeguard measure or provisional measure on a good<br />

that becomes subject to a measure that the party applies pursuant<br />

to Article XIX of GATT 1994 and the Safeguards Agreement, the<br />

Agreement on Agriculture or any other relevant provisions in the<br />

WTO Agreement.<br />

3. A party considering the imposition of a global safeguard measure on<br />

an originating good of another Party or Parties shall initiate<br />

consultations with that Party or Parties as far in advance of taking<br />

such measure as practicable.”<br />

ASEAN-Japan Comprehensive Economic Partnership Agreement<br />

(AJCEPA)<br />

Article 20 of the AJCEPA provides that:<br />

“1. A Party which is a member of the World Trade Organization may<br />

apply a safeguard measure to an originating good of the other<br />

Parties in accordance with Article XIX of GATT 1994 and the<br />

Agreement on Safeguards in Annex 1A to the WTO Agreement<br />

(hereinafter referred to as “the Agreement on Safeguards”), or<br />

Page 6 of 38

Article 5 of the Agreement on Agriculture in Annex 1A to the WTO<br />

Agreement (hereinafter referred to as “Agreement on Agriculture”).<br />

Any action taken pursuant to Article XIX of GATT 1994 and the<br />

Agreement on Safeguards, or Article 5 of the Agreement on<br />

Agriculture, shall not be subject to Chapter 9 of this Agreement.”<br />

<strong>Philippine</strong>s-Japan Economic Partnership Agreement (PJEPA)<br />

Article 11 (Relation to Other Agreements) of the PJEPA reads:<br />

1. The parties reaffirm their rights and obligations under the WTO<br />

Agreement or any other agreements to which both parties are<br />

parties.<br />

2. In the event of any inconsistency between this Agreement and the<br />

WTO Agreement, the WTO Agreement shall prevail to the extent of<br />

the inconsistency.<br />

ASEAN-India Free Trade Area (AIFTA)<br />

Article 10(1) of the AIFTA states that:<br />

“Each Party, which is a WTO member, retains its rights and obligations<br />

under Article XIX of GATT 1994 and the Agreement on Safeguards in<br />

Annex 1A to the WTO Agreement (Agreement on Safeguards) and<br />

Article 5 of the Agreement on Agriculture in Annex 1A to the WTO<br />

Agreement (Agreement on Agriculture). Any action taken pursuant to<br />

Article XIX of GATT 1994 and the Agreement on Safeguards or Article 5<br />

of the Agreement on Agriculture shall not be subject to the Agreement<br />

on Dispute Settlement Mechanism under the Framework Agreement<br />

(ASEAN-India DSM Agreement).”<br />

Page 7 of 38

3. THE INVESTIGATION PROCESS<br />

Section 19 of RA 8800 provides the legal basis for the <strong>Commission</strong> to conduct<br />

formal investigations of petitions for extension of safeguard measure, to wit:<br />

“1. Subject to the review under Rule 16, an extension of the measure may be<br />

requested by the petitioner if the action continues to be necessary to<br />

prevent or remedy the serious injury and there is evidence that the<br />

domestic industry is making positive adjustment to import competition.<br />

2. The petitioner may appeal to the Secretary at least ninety (90) days before<br />

the expiration of the measure for an extension of the period by stating<br />

concrete reasons for the need thereof and a description of the industry’s<br />

adjustment performance and future plan. The Secretary shall immediately<br />

refer the request to the <strong>Commission</strong>. Following the procedures required<br />

under Section 9, the <strong>Commission</strong> shall then submit a report to the<br />

Secretary not later than sixty (60) days from receipt of the request. Within<br />

seven (7) days from receipt of the report, the Secretary shall issue an order<br />

granting or denying the petition. In case an extension is granted, the same<br />

shall be more liberal than the initial application.”<br />

3.1 Notifications<br />

In the course of its investigation, the <strong>Commission</strong> issued to<br />

representatives of PPMAI and other concerned parties the following notices,<br />

namely:<br />

Commencement of Formal Investigation and Invitation to the Preliminary<br />

Conference<br />

Notice was published on 06 February 2013 in Manila Standard Today<br />

and The Manila Times (Annexes “A” and “A-1”) and posted at the<br />

<strong>Commission</strong>’s website http://www.tariffcommission.gov.ph. Individual notices<br />

were sent to all identified interested parties (Annex “B”).<br />

Schedule of <strong>Public</strong> Hearing<br />

Notice was published on 22 March 2013 in The Manila Times and<br />

Manila Standard Today (Annexes “C” and “C-1”) and posted on the<br />

<strong>Commission</strong>’s website http://www.tariffcommission.gov.ph. Individual notices<br />

were sent to all identified interested parties.<br />

3.2 Preliminary Conference<br />

The preliminary conference was held on 12 February 2013 at the <strong>Tariff</strong><br />

<strong>Commission</strong> to apprise the parties on the nature and procedure of the<br />

investigation. In attendance were the counsel and/or representatives from<br />

Page 8 of 38

the petitioner, Embassy of Malaysia, Taipei Economic and Cultural Office,<br />

Indonesian Embassy and DTI-BIS.(Annex “D”).<br />

On 14 February 2013, the <strong>Commission</strong> issued an Order (Annex “E”)<br />

containing the matters taken and agreed upon by the parties during the<br />

conference. All concerned parties were furnished a copy of said Order.<br />

3.3 Ocular Inspection/Data Verification<br />

The <strong>Commission</strong>, in the furtherance of its investigation, conducted<br />

ocular inspection/data verification at UPPC’s plant located at Calumpit,<br />

Bulacan on 20 February 2013 to confirm the accuracy of the information<br />

submitted as well as to obtain further details vital to the investigation<br />

(Annex “F”).<br />

3.4 Issuance of Staff <strong>Report</strong><br />

Prior to the scheduled public hearing, the <strong>Commission</strong> issued on 11<br />

March 2013 its Staff <strong>Report</strong> containing its initial findings on the determination<br />

of volume of imports and serious injury or threat thereof. All concerned parties<br />

were provided a copy of said report and were given until 22 March 2013 to<br />

submit their comments and/or issues they want explored during the public<br />

consultation.<br />

3.5 <strong>Public</strong> Consultation<br />

<strong>Public</strong> consultations were held on 01-02 April 2013 at the <strong>Tariff</strong><br />

<strong>Commission</strong> for parties to present their evidence, elaborate on their<br />

submissions, and respond and seek clarifications on the presentations and<br />

submissions of the other parties.<br />

Attendees to the consultations are listed in Annex “G”.<br />

3.6 Submission of Investigation <strong>Report</strong><br />

Under the law, the <strong>Commission</strong> has sixty (60) days from receipt of the<br />

records of the case to complete its investigation and submit report to the<br />

Secretary who will then make a decision based on the <strong>Commission</strong>’s<br />

recommendation.<br />

The <strong>Commission</strong>, after submission of its report to the Secretary, will<br />

make said report available to the public sans confidential information and<br />

publish a summary in two (2) newspapers of general circulation.<br />

Page 9 of 38

4. THE PARTIES’ SUBMISSIONS<br />

All position papers, affidavits and other documentary evidence submitted to<br />

the <strong>Commission</strong> are tabulated in Annex “H”. A public file containing non-confidential<br />

information/submissions is available in the <strong>Commission</strong>.<br />

4.1 The Petitioner<br />

<strong>Philippine</strong> Paper Manufacturers Association (PPMAI)<br />

PPMAI made the following claims:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Safeguard measure has been effective in reducing the volume of<br />

imports that causes serious injury to the industry.<br />

The reduction in import volumes of testliner board benefitted the<br />

industry in terms of increased market share; sales; production;<br />

capacity utilization and productivity. These benefits, however, did<br />

not translate to immediate profitability or financial improvement.<br />

Reasons for the industry’s inability to gain financially from the<br />

aforementioned benefits were beyond its control.<br />

(a) UPPC was forced to sell its testliner boards at a price lower<br />

than its cost to produce and sell<br />

(b) Cost to produce testliner board increased, primarily due to a<br />

substantial increase in the cost of raw materials<br />

The adverse effect on the industry of adopting import parity<br />

pricing policy and selling below cost as imported counterpart are<br />

imported and sold at prices lower than petitioner’s cost to<br />

produce and sell would have been graver were it not for the<br />

safeguard measure and the adjustments made to global<br />

competition initiated by the industry.<br />

The industry invested time and resources to reduce the<br />

difference between the price of imported testliner board and its<br />

cost to produce and sell under its original adjustment plan.<br />

These adjustments were not enough to fully close this gap. The<br />

industry realized that further adjustments are necessary. The<br />

industry implemented or planned further adjustments not<br />

included in its original adjustment plan to further narrow the gap<br />

– new investments were made; new products/applications were<br />

introduced/developed; capacity utilization and cost<br />

competitiveness were improved.<br />

The industry needs more time to implement and complete these<br />

further adjustments. It will not be able to complete these<br />

adjustments without the benefit of the safeguard measure. It<br />

would not be financially feasible.<br />

The industry would not be able to afford to continue with its<br />

adjustment without the safeguard – the industry would suffer<br />

more losses.<br />

Page 10 of 38

In the event that safeguard measure is terminated price<br />

reduction of the imported testliner board would follow. The<br />

industry would be forced to also lower its price to retain its<br />

customers.<br />

There exists the threat of serious injury from imported testliner<br />

board to the industry – the landed cost with the safeguard is now<br />

below the selling price of the industry. This gap would be even<br />

larger if the safeguard measure is removed.<br />

The current global oversupply of testliner board causes further<br />

serious injury to the industry. Foreign manufacturers are facing<br />

depressed prices in their own countries due to oversupply and<br />

shall seek to export to get rid of their excess supply.<br />

Also included in its submission is the adjustment plan the<br />

industry has committed to be operational in 2013 and those<br />

projects/efficiency measures that are under study or in the planning<br />

stage which are scheduled for implementation in 2014 -2016.<br />

4.2 The Oppositors/Other Interested Parties<br />

Oppositors/other interested parties to the application for safeguard<br />

action submitted the following arguments to support their positions:<br />

4.2.1 Corrugators/Importers<br />

No representative attended the preliminary conference and<br />

public hearing nor was there submission of position paper despite<br />

notices/invitations.<br />

4.2.2 Foreign Governments<br />

Department of Foreign Trade (DFT), Ministry of Commerce of Thailand<br />

<br />

In its letter dated 20 March 2013, DFT requested for extension<br />

on the submission of its position paper until 5 April 2013.<br />

Embassy of Australia<br />

The Embassy submitted its comments to the <strong>Commission</strong>’s Staff<br />

<strong>Report</strong> on 18 March 2013. The following views were indicated:<br />

<br />

<br />

The Australian Government’s Department of Industry, Innovation,<br />

Science, Research and Tertiary Education (DIISRTE) does not<br />

consider Australian export volumes to be significant enough to<br />

be a major contributor to cause or threaten serious damage to<br />

the industry<br />

AANZFTA commitments on testliner board are not as liberal as<br />

the commitments in ASEAN’s internal agreements or those with<br />

other ASEAN + 1 partners. Australian exports of testliner board<br />

are currently subject to a 5% duty which will be eliminated only in<br />

2020.<br />

Page 11 of 38

Australia’s historic exports of testliner board are comparatively<br />

low, accounting only for 2.76% of total imports into the<br />

<strong>Philippine</strong>s over the period 2004-2012. In addition, Australian<br />

exports have been sporadic, taking place in only four of the last<br />

nine years.<br />

Australian exports should be excluded from the measure.<br />

Embassy of Indonesia /Government of Indonesia (GOI)<br />

The <strong>Commission</strong> on 21 February 2013 and 26 March 2013<br />

received an e-mailed position paper from the Embassy and GOI which<br />

contained the following declarations:<br />

<br />

<br />

<br />

The Embassy would like to draw the <strong>Philippine</strong> <strong>Tariff</strong><br />

<strong>Commission</strong>’s attention in regard to the notification by the<br />

<strong>Philippine</strong>s to WTO dated 20 April 2012 that Indonesia was one<br />

of the countries excluded from the measure.<br />

Several Indonesian exporters of testliner board stated that they<br />

no longer export said commodity to the <strong>Philippine</strong>s because of<br />

the measure. Based on the data from the Indonesian Bureau of<br />

Statistics, no exports were made on 6-digit code (480524 and<br />

480525), however under 4-digit lines, there were exports to the<br />

<strong>Philippine</strong>s which shows drastic declines.<br />

GOI will continue its cooperation in the remaining process of the<br />

investigation and hope that the exclusion of Indonesia from the<br />

measure shall be maintained until the conclusion of the case.<br />

Embassy of Malaysia (Trade Office)<br />

<br />

In its e-mail dated 15 February 2013, the Embassy simply<br />

acknowledged receipt of the Preliminary Conference Order<br />

furnished by the <strong>Commission</strong>.<br />

Ministry of International Trade and Industry Malaysia (MITI)<br />

<br />

In its e-mail dated 14 February 2013, MITI informed the<br />

<strong>Commission</strong> of its interest in participating in the case.<br />

Embassy of the Republic of Singapore<br />

<br />

Singapore’s share of <strong>Philippine</strong>s’ imports falls within the “de<br />

minimis” threshold for the period under review.<br />

Taipei Economic and Cultural Office (TECO)<br />

<br />

TECO, in its e-mail dated 15 February 2013, requested for<br />

extension on the submission of its position paper as the office<br />

will be closed for Chinese New Year. However, no submission<br />

was made to the <strong>Commission</strong>.<br />

Page 12 of 38

4.2.3 Exporters<br />

Confederation of European Paper Industries (CEPI)<br />

CEPI submitted to the <strong>Commission</strong> on 01 April 2013 its<br />

comments/arguments against the extension of the Safeguad Measure<br />

on testliner board imports:<br />

The application was filed by only one company – UPPC.<br />

Although this company represents about 63% of domestic<br />

production (compared to 71% in 2008), one can wonder why<br />

other companies did not join this initiative as “co-petitioners”.<br />

Imports from EU since 2006 have decreased dramatically and<br />

represents only 2% of the total imports in 2008. In 2010,<br />

European countries did not export to the <strong>Philippine</strong>s.<br />

During the original investigation and since the safeguard<br />

measure was imposed, there has been some suspicion of<br />

dumping by domestic producers: “UPPC was forced to sell its<br />

testliner boards at a price lower than its cost to produce and sell”.<br />

One should note that before the safeguard measure was<br />

imposed, EU exporters already faced tariff barriers – 7% tariff is<br />

applied for testliner board imports. This provided protection to<br />

the local industry. EU markets have been fully open to imports<br />

since 2004 at zero tariffs.<br />

Foreign exporters are accused of dumping practices without<br />

providing any evidence, while local producers have<br />

acknowledged they have adopted this unfair practice.<br />

Between 2010 and 2012, the domestic industry increased its<br />

share of the local market from 87% to 95% and sales by 17%.<br />

However, the industry’s low capacity utilization rate (75% to<br />

80%) has contributed to financial losses.<br />

The <strong>Philippine</strong>s testliner board industry is structurally<br />

uncompetitive. As noted in the context of the initial investigation,<br />

most of the raw materials used are imported. This constitutes a<br />

serious handicap in terms of competitiveness, which most<br />

probably explains part or most of current difficulties faced by the<br />

industry. The adjustment plan described and implemented by<br />

the domestic producer (profitability improvement, strengthened<br />

manufacturing capability and marketing improvements)<br />

demonstrates its weakness due to uncompetitive situation.<br />

Despite the implementation of the safeguard measure, CEPI is of<br />

the opinion that the local industry has not been able to restore its<br />

competitiveness, mainly because of structural factors. The lack<br />

of supporting elements in the alleged injury and causality<br />

analysis should be filled in. Any extension of the measure would<br />

not help the local industry, particularly UPPC, to return to a<br />

profitable situation. Hence, safeguard measure should not be<br />

extended.<br />

Page 13 of 38

5. THE DOMESTIC INDUSTRY AND MARKET<br />

5.1 Domestic Industry Requirement<br />

PPMAI is composed of twenty (20) paper manufacturers of which four<br />

(4) produce testliner boards (Container Corporation of the <strong>Philippine</strong>s, Liberty<br />

Paper Mills, Bataan 2020, and UPPC). UPPC accounted for 75% of the total<br />

domestic production in 2012 which satisfies the domestic industry requirement<br />

under the law.<br />

5.2 Market Participants<br />

5.2.1 Other Domestic Producers (Non-PPMAI Members)<br />

Name of Company<br />

Milestone Paper Products, Inc.<br />

Cascade Paper Corp. (formerly Trans-National Paper)<br />

Plant Location<br />

Cabuyao, Laguna<br />

Tanza, Cavite<br />

Year /<br />

Rank*<br />

5.2.2 Importers/Users<br />

The major users of testliner board are companies engaged in<br />

box making. The top importers/users of testliner boards for 2010 to<br />

2012 are listed below:<br />

Table 1. Top Importers/Users of Testliner Board 2010 – 2012<br />

Names of Importer/User<br />

Volume<br />

(MT)<br />

%<br />

Share<br />

Source Country<br />

2010<br />

1 Cavite Packaging Corporation 4,030 27 Korea and Thailand<br />

2 Superior Packaging Corporation 2,195 15 Thailand<br />

3 Jennson Packaging Corporation 1,911 13 Indonesia, Korea and Thailand<br />

2011<br />

1 Corbox Corporation 1,963 33 Australia, China and Chinese Taipei<br />

2 United Container Corporation 1,340 22 Malaysia<br />

3 S.P. Mamplasan Packaging Corporation 897 15 Malaysia and Thailand<br />

2012<br />

1 Jennson Packaging Corporation 3,073 45 Saudi Arabia<br />

2 Corbox Corporation 1,120 16 Australia and Chinese Taipei<br />

3 Central Corrugated Box Corporation 654 10 Saudi Arabia<br />

Source: Bureau of Customs-Electronic Import Entry Declarations (BOC-EIED)<br />

* In terms of Volume<br />

Relative to the total volume of <strong>Philippine</strong> imports, the above<br />

named importers/users of testliner board collectively constituted 55% in<br />

2010 and 70% in 2011 and 2012.<br />

Page 14 of 38

6. PRODUCT COVERAGE<br />

2012<br />

AHTN<br />

Code<br />

The application for extension of definitive safeguard duty covers imports of<br />

testliner boards, one of the raw materials for the production of container board<br />

structures. Made from 100% recycled paper, testliner board is the outside and inside<br />

paper lining of the combined board structures, classified under 2012 ASEAN<br />

Harmonized <strong>Tariff</strong> Nomenclature (AHTN) Heading Nos. 4805.24 00, 4805.25 10 and<br />

4805.25 90 regardless of the weight in grams per square meter (gsm).<br />

MFN<br />

WTO<br />

Bound<br />

Rate<br />

Table 2. <strong>Tariff</strong> Schedule on Testliner Board (2013)<br />

Rate of Duty (%)<br />

ATIGA ACFTA AKFTA PJEPA AJCEPA AANZFTA AIFTA<br />

4805.24 00 7 U 0 0 0 0 0 5 7<br />

4805.25 10 7 U 0 0 0 0 0 5 7<br />

4805.25 90 7 U 0 0 0 0 0 5 7<br />

AHTN - ASEAN Harmonized <strong>Tariff</strong> Nomenclature<br />

MFN - Most Favored Nation<br />

WTO World Trade - World Trade Organization<br />

ATIGA - ASEAN Trade in Goods Agreement<br />

ACFTA - ASEAN-China Free Trade Area<br />

AKFTA - ASEAN-Korea Free Trade Area<br />

PJEPA - <strong>Philippine</strong>s-Japan Economic Partnership Agreement<br />

AJCEPA - ASEAN-Japan Comprehensive Economic Partnership Agreement<br />

AANZFTA - ASEAN-Australia New Zealand Free Trade Area<br />

AIFTA - ASEAN-India Free Trade Area<br />

U - Unbound<br />

Page 15 of 38

7. VOLUME OF IMPORTS<br />

7.1 Volume of Imports in Absolute Terms<br />

In the original investigation, the <strong>Commission</strong> concluded that testliner<br />

boards are being imported in increased quantities, both in absolute terms and<br />

relative to domestic production. The surge in imports started in the year 2005<br />

and imports increased steadily through 2008.<br />

Table 3. Import Volumes of Testliner Board: 2004 – Jan.- March 2013<br />

Year Volume (MT) Growth Rate (%)<br />

2004 850 -<br />

2005 4,804 465<br />

2006 9,446 97<br />

2007 11,952 27<br />

2008 18,305 53<br />

2009 5,333 (71)<br />

2010 14,893 179<br />

2011 6,015 (60)<br />

2012 6,909 15<br />

Jan- March 2012 858<br />

Jan-March 2013 2,306 169<br />

Source: BOC-EIEDs<br />

In 2009, when the domestic industry filed a petition for safeguard<br />

measure with the DTI, imports of testliner board dropped significantly by 71%.<br />

The substantial reduction in imports was brought about by the chilling effect on<br />

imports from the filing of a safeguard petition by the domestic industry as well<br />

as the effect of the global economic slowdown and the resultant decline in<br />

demand.<br />

In 2010, however, imports soared by 179% over the 2009 level. This<br />

upsurge in imports was attributable to the preferential zero duties applicable to<br />

testliner board sourced from Korea and from ASEAN Member States, under<br />

the AKFTA effective 07 July 2009 (EO 812) and the ATIGA effective<br />

01 January 2010 (EO 850), respectively. Imports during this period were<br />

dominated by Korea (43%) and five (5) ASEAN member countries (55%).<br />

It was further observed that around 80% of imports in the first 4 months<br />

of 2010 came in prior to the implementation of the provisional measure on<br />

05 May 2010 and only about 20% during the period of relief. Prompted by<br />

the 1 st year imposition of definitive safeguard duty, the declining movement of<br />

imports towards the later months of 2010 continued in 2011 as volume of<br />

imports waned by 60%.<br />

Imports increased by about 15% in 2012. Contributory to the growth<br />

were low-priced testliner board from Saudi Arabia (a new entrant), which<br />

accounted for 54% of total <strong>Philippine</strong> imports. Traditional exporters of testliner<br />

Page 16 of 38

oard to the <strong>Philippine</strong>s accounted for 46% of total <strong>Philippine</strong> imports during<br />

the same period which include South Korea, Australia, Malaysia, Chinese<br />

Taipei and Thailand.<br />

As a consequence of cheaper prices from the source countries as well<br />

as the reduced definitive safeguard duty for the 3 rd year, the 1st quarter of<br />

2013 showed total testliner board exports to the <strong>Philippine</strong>s of 2,306 MT<br />

which is about 34% of total imports in 2012 and 169% higher than the 858<br />

MT of testliner board imported in the 1st quarter of the same year. It is likely<br />

that imports in 2013 will either equal or surpass the 2012 level.<br />

Figure 1. Actual Increase/Decrease in the Volume of Imports of<br />

Testliner Board (MT): 2004 – 2012<br />

Source: BOC-EIEDs<br />

7.2 Volume of Imports Relative to Domestic Production<br />

Throughout the POI, import volumes of testliner board relative to<br />

domestic production were fluctuating (Table 4).<br />

Table 4. Share of Imports to Domestic Production: 2004 - 2012<br />

Year<br />

Imports*<br />

(MT)<br />

Actual Production**<br />

(MT)<br />

Share of Imports to<br />

Total Production (%)<br />

2004 850 125,765 0.68<br />

2005 4,804 121,635 3.95<br />

2006 9,446 131,237 7.20<br />

2007 11,952 141,506 8.45<br />

2008 18,305 138,468 13.22<br />

2009 5,333 86,510 6.16<br />

2010 14,893 120,352 12.37<br />

2011 6,015 128,766 4.67<br />

2012 6,909 120,095 5.75<br />

Source: */ - BOC-EIEDs<br />

**/ - UPPC<br />

Page 17 of 38

Country of<br />

Origin<br />

The share of testliner board imports to domestic production fell from<br />

12% in 2010 to almost 5% in 2011 brought about by the initial imposition of the<br />

safeguard measure. This gave an opportunity for the local industry to<br />

introduce new lightweight testliner grades (KR 125), and continue<br />

implementing efficiency measures to increase production. However the arrival<br />

of low-priced testliner board from Saudi Arabia, combined with a decline in<br />

production, caused the share of imports to increase slightly in 2012.<br />

7.3 Country Suppliers of Imported Testliner Board<br />

During the POI (2010-2012), South Korea was the top country supplier<br />

of testliner board accounting for 30% followed by Thailand, Malaysia and<br />

Saudi Arabia with 19%, 15% and 13% shares, respectively (Table 5).<br />

Table 5. Imports of Testliner Board by Country of Origin (MT): 2004 – 2012<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

Total<br />

%<br />

Share<br />

to Total<br />

2010-<br />

2012<br />

Jan.-<br />

March<br />

2013<br />

Thailand 538 3,964 6,208 8,978 13,178 202 4,684 601 21 38,374 5,306 19.07 24<br />

South Korea - - - - - 3,592 6,380 726 1,296 11,994 8,402 30.20 303<br />

Chinese<br />

Taipei 72 101 517 930 1,123 144 642 1,461 527 5,517 2,630 9.45 349<br />

Malaysia - - 399 100 - 648 1,619 2,038 538 5,342 4,195 15.08<br />

Indonesia - 589 1,803 - 1,744 52 811 - - 4,999 811 2.92<br />

Saudi Arabia - - - - - - - - 3,727 3,727 3,727 13.40 1,625<br />

Germany 240 100 249 948 383 487 - - - 2,407 -<br />

Australia - - 270 - 787 - - 306 800 2,163 1,106 3.98 5<br />

China - - - - 736 52 49 346 - 1,183 395 1.42<br />

Japan - - - 695 113 156 - - - 964 -<br />

Viet Nam - - - - - - 708 - - 708 708 2.55<br />

Singapore - - - - 90 - - 537 - 627 537 1.93<br />

2004 -<br />

2012<br />

2010 -<br />

2012<br />

Hong Kong - - - 259 - - - - - 259 -<br />

New<br />

Zealand - - - - 151 - - - - 151 -<br />

United<br />

Kingdom - 50 - - - - - - - 50 -<br />

South Africa - - - 42 - - - - - 42 -<br />

Total 850 4,804 9,446 11,952 18,305 5,333 14,893 6,015 6,909 78,507 27,817 100 2,306<br />

Source: BOC-EIEDs<br />

In 2012, Saudi Arabia supplied the bulk of country’s imports. This may<br />

be attributable to its cheaper average landed cost which is about 24% lower<br />

vis-à-vis UPPC’s selling price, aside from the fact that Saudi Arabia was<br />

exempted from the imposition of safeguard measure during the original<br />

investigation.<br />

For the 1 st quarter of 2013, Saudi Arabia’s exports is almost 71% of<br />

total <strong>Philippine</strong> imports.<br />

Page 18 of 38

7.4 De Minimis Import Volumes<br />

Rule 13.1(d) of the IRR of RA 8800 provides that “a general safeguard<br />

measure shall not be applied to a product originating from a developing<br />

country if its share to total <strong>Philippine</strong> imports of the said product is less than<br />

three percent (3%): Provided, however, that developing countries with less<br />

than three percent (3%) share collectively account for not more than nine<br />

percent (9%) of the total <strong>Philippine</strong> imports of the product concerned.”<br />

Based on the available data (i.e., 2010- 2012), volume of imports from<br />

Indonesia, Viet Nam, Singapore and China were found to be de minimis<br />

(Table 5). Their imports collectively accounted for less than 9% of the total<br />

<strong>Philippine</strong> imports of testliner board.<br />

7.5 Findings<br />

The <strong>Commission</strong> finds that:<br />

<br />

<br />

<br />

The imposition of the safeguard measure proved to be effective in<br />

significantly reducing the entry of imported testliner board over the POI.<br />

A new country supplier, Saudi Arabia, has emerged, supplying<br />

testlinerboard that is 24% cheaper than the domestic industry’s testliner<br />

board.<br />

Imports started to increase anew in 2012 (as compared to 2011) with bulk<br />

of imports coming from new entrant Saudi Arabia. Based on the volume<br />

of imports for the 1 st quarter of 2013, there is a good likelihood that<br />

imports in 2013 will either equal or surpass the 2012 level.<br />

Page 19 of 38

8. DETERMINATION OF SERIOUS INJURY<br />

OR THREAT THEREOF<br />

Rule 19.1 of the IRR of RA 8800 provides for the requirements for an<br />

application for extension of safeguard measure, to wit:<br />

“Subject to the review under Rule 16, an extension of the measure may<br />

be requested by the petitioner if the action continues to be necessary to<br />

prevent or remedy the serious injury and there is evidence that the<br />

domestic industry is making positive adjustment to import competition.”<br />

Likewise, Rule 9.4(c) requires the determination of the presence and extent of<br />

serious injury or the threat thereof to the domestic industry that produces like or<br />

directly competitive product.<br />

The <strong>Commission</strong>, in its evaluation, shall compare the condition of the domestic<br />

industry during the period under review against its condition during the original period<br />

of investigation to determine if the action continues to be necessary to prevent or<br />

remedy the serious injury and there is evidence that the domestic industry is making<br />

positive adjustments to import competition.<br />

8.1 Serious Injury Factors<br />

8.1.1 Market Share<br />

Prior to the imposition of the safeguard measure, the domestic<br />

industry’s market share ranged from 88% to 99%.<br />

Table 6. Apparent Domestic Consumption and Market Shares: 2004 – 2012<br />

Year<br />

Apparent Domestic Market Share (%)<br />

Domestic<br />

Consumption<br />

Sales * Imports **<br />

(MT)<br />

% Domestic Imports<br />

(MT) (MT)<br />

Change<br />

2004 122,368 850 123,218 - 99.31 0.69<br />

2005 115,204 4,804 120,008 (2.61) 96.00 4.00<br />

2006 109,379 9,446 118,825 (0.99) 92.05 7.95<br />

2007 130,512 11,952 142,464 19.89 91.61 8.39<br />

2008 128,306 18,305 146,611 2.91 87.51 12.49<br />

2009 77,250 5,333 82,583 (43.67) 93.54 6.46<br />

2010 103,344 14,893 118,237 43.17 87.40 12.60<br />

2011 113,644 6,015 119,659 1.20 94.97 5.03<br />

2012 120,608 6,909 127,517 6.57 94.58 5.42<br />

Sources: * UPPC<br />

**BOC- EIEDs<br />

In 2010, notwithstanding the imposition of the safeguard measure, the<br />

domestic industry’s market share fell to its lowest. This can be explained by<br />

the pattern of importation during the year, with a mere 20% coming in<br />

Page 20 of 38

Year<br />

subsequent to the application of the safeguard measure in May, indicating the<br />

effectiveness of said measure in regulating the influx of imports.<br />

With safeguard measure in place coupled with the marketing strategies<br />

undertaken by the domestic industry in 2011, market share of the domestic<br />

industry almost reverted to the level sans import surge.<br />

The implementation of customer relationship marketing (CRM)<br />

programs and the introduction of lightweight testliner board (i.e., KR 140 and<br />

KR 125) in 2010 and 2011, respectively, as part of its marketing improvement<br />

initiatives contributed to the industry’s increased domestic sales and market<br />

share.<br />

These efforts have been instrumental in improving the industry’s<br />

competitiveness. Domestic sales improved by almost the same rate as the<br />

expansion in demand, allowing the domestic industry to maintain its market<br />

share at 95%.<br />

8.1.2 Production and Sales<br />

The market shrank in 2009 due to the global economic slowdown. The<br />

imposition of the safeguard measure in 2010 coincided with the recovery of<br />

the market. However, production did not return to the levels of previous years<br />

before the crisis as imports surged before May 2010 in anticipation of the<br />

imposition of a provisional safeguard measure. With growing domestic<br />

demand and the imposition of a definitive safeguard measure in November<br />

2010, domestic sales subsequently recovered registering growth of 10% and<br />

6% in 2011 and 2012, respectively.<br />

Production<br />

Volume<br />

(MT)<br />

%<br />

Total<br />

Table 7. Production and Sales: 2004 – 2012<br />

Sales Volume<br />

(MT)<br />

Change<br />

%<br />

%<br />

%<br />

Domestic<br />

Exports<br />

Total<br />

Change<br />

Change<br />

Change<br />

2004 125,765 - 122,368 - 1,685 - 124,053 -<br />

2005 121,635 (3.28) 115,204 (5.85) 17,861 960 133,065 7.26<br />

2006 131,237 7.89 109,379 (5.06) 19,740 10.52 129,119 (2.97)<br />

2007 141,506 7.82 130,512 19.32 12,916 (34.57) 143,428 11.08<br />

2008 138,468 (2.15) 128,306 (1.69) 7,890 (38.91) 136,196 (5.04)<br />

2009 86,510 (37.52) 77,250 (39.79) 12,349 56.51 89,599 (34.21)<br />

2010 120,352 39.12 103,344 33.78 16,585 34.30 119,929 33.85<br />

2011 128,766 6.99 113,644 9.97 10,092 (39.15) 123,736 3.17<br />

2012 120,095 (6.73) 120,608 6.13 2,641 (73.83) 123,249 (0.39)<br />

Source: UPPC<br />

The domestic industry also undertook efficiency enhancing measures<br />

such as installation of new generator and shredder machine and construction<br />

of coal warehouse. They also introduced a lightweight testliner board to<br />

augment its marketing initiatives during the period under review.<br />

Page 21 of 38

8.1.3 Finished Goods Inventory<br />

Due to a 56% increase in export sales relative to the previous year’s<br />

level, the industry accumulated low inventory prior to the global economic<br />

slowdown. Were it not for this circumstance, ending inventory levels could<br />

have been greater.<br />

Table 8. Finished Goods Inventory of Testliner Board: 2004 – 2012<br />

Year Ending Inventory (MT) % Change<br />

2004 13,475 -<br />

2005 2,045 (84.82)<br />

2006 4,163 103.57<br />

2007 2,241 (46.17)<br />

2008 4,513 101.38<br />

2009 1,424 (68.45)<br />

2010 1,847 29.71<br />

2011 6,877 272.33<br />

2012 3,723 (45.86)<br />

Source: UPPC<br />

The industry has managed to keep to its policy of maintaining a<br />

monthly ending inventory of not more than 9,000 MT.<br />

8.1.4 Capacity Utilization<br />

The imposition of safeguard measure in 2010 enabled the domestic<br />

industry to improve its utilization rate after this dropped to 54% in 2009 and<br />

track changes in domestic market size. In 2012, however, utilization eased to<br />

75% due to scheduled shutdown for the installation/fine-tuning of fractionation<br />

system and substantially lower export sales.<br />

Table 9. Capacity Utilization: 2004 – 2012<br />

Year<br />

Rated<br />

Capacity<br />

Actual<br />

Production<br />

Utilization<br />

Rate % Change<br />

(MT)<br />

(MT)<br />

(%)<br />

2004 160,000 125,765 78.60 -<br />

2005 160,000 121,635 76.02 (3.28)<br />

2006 160,000 131,237 82.02 7.89<br />

2007 160,000 141,506 88.44 7.83<br />

2008 160,000 138,468 86.54 (2.15)<br />

2009 160,000 86,510 54.07 (37.52)<br />

2010 160,000 120,352 75.22 39.11<br />

2011 160,000 128,766 80.48 6.99<br />

2012 160,000 120,095 75.06 (6.73)<br />

Source: UPPC<br />

Page 22 of 38

8.1.5 Cost of Production (COP)<br />

COP steadily increased for the period 2009-2011 due to higher prices of<br />

major cost components, i.e., direct raw materials and coal/fuel (Tables 10 and<br />

11). These price increases were beyond the control of the domestic industry<br />

and reduced the effectiveness of the safeguard measure imposed in 2010.<br />

Table 10. % Changes on Cost of Production of Testliner Board: 2009 - 2012<br />

Cost Components<br />

% Change<br />

(P /MT)<br />

2009-2010 2010-2011 2011-2012<br />

Direct Raw Materials 41.26 10.16 (10.11)<br />

Direct Labor 0.24 (6.87) 2.80<br />

Manufacturing Overhead 16.17 4.50 (1.52)<br />

Cost of Production 28.70 7.48 (6.43)<br />

Selling, Admin & Gen. Exp 12.38 0.52 (19.47)<br />

Cost to Produce and Sell 27.48 7.02 (7.24)<br />

Source: UPPC<br />

In 2012, the reduction in prices of direct raw materials and coal/fuel<br />

together with the initiatives/projects undertaken to reduce paper rejects and<br />

production downtimes and the establishment of nine (9) baling stations<br />

resulted to an overall decline of 6% in COP. UPPC’s dependence on imported<br />

waste paper was reduced by the additional baling stations as these generated<br />

additional tons of waste paper at competitive prices (Table 12).<br />

Table 11. % Changes on the Purchase Price of Direct Raw Materials<br />

and Coal/Fuel: 2009-2012<br />

Direct Raw Materials<br />

% Change<br />

(P /MT)<br />

2009-2010 2010-2011 2011-2012<br />

AOCC* 36.50 8.98 (25.19)<br />

LDLK** 37.27 13.09 (26.18)<br />

Trimmings 72.35 7.60 (8.00)<br />

Mixed Waste 69.91 (1.31) (35.20)<br />

LOCC*** 68.39 1.78 (17.32)<br />

Coal/Fuel:<br />

(P /BDT) (18.61) 26.26 (5.17)<br />

Source: UPPC<br />

BDT is Bone Dry Ton<br />

*American Old Corrugated Cartons<br />

**Local Double Lined Kraft<br />

***Local Old Corrugated Cartons<br />

Page 23 of 38

Table 12. Relative Share of Domestic and Imported Recycled Paper<br />

to Total Requirements: 2009-2012<br />

Total<br />

Recycled<br />

% Share to Total<br />

Source<br />

Year Paper<br />

Requirements<br />

Requirements Domestic* Imported<br />

(MT)<br />

(MT)<br />

(MT)<br />

Domestic Imported<br />

2009 204,008 185,916 18,092 91.13 8.87<br />

2010 208,730 193,150 15,580 92.54 7.46<br />

2011 221,170 203,960 17,210 92.22 7.78<br />

2012 222,887 215,468 7,419 96.67 3.33<br />

Source: UPPC<br />

*From baling stations<br />

8.1.6 Employment and Labor Productivity<br />

While there was improvement in labor productivity in 2010 and 2011,<br />

these were significantly lower than productivity levels attained before the<br />

global economic crisis.<br />

Year<br />

Table 13. Employment and Labor Productivity: 2004 – 2012<br />

Increase/ Actual Labor<br />

Number of<br />

Decrease Production Productivity<br />

Employees<br />

(Number) (MT) (MT/Employee)<br />

%<br />

Change<br />

2004 377 n.a 125,765 334 n.a.<br />

2005 393 16 121,635 310 (7.19)<br />

2006 404 11 131,237 325 4.84<br />

2007 415 11 141,506 341 4.92<br />

2008 416 1 138,468 333 (2.35)<br />

2009 411 (5) 86,510 210 (36.94)<br />

2010 413 2 120,352 291 38.57<br />

2011 410 (3) 128,766 314 7.90<br />

2012 418 8 120,095 287 (8.60)<br />

Source: UPPC<br />

In 2012, the same dropped as a result of the decline in production due<br />

to scheduled shutdown for the installation/fine-tuning of fractionation system<br />

and slight increase in manpower.<br />

8.1.7 Financial Performance/Profitability<br />

Despite increasing net sales in 2009-2011, losses from operations were<br />

incurred. To protect market share, domestic industry adopted an import parity<br />

pricing strategy while efficiency measures are being completed.<br />

Page 24 of 38

Table 14. % Changes on the Profit and Loss on Testliner Board Operations: 2009-2012<br />

Particulars<br />

% Change<br />

(In Million P)<br />

2009-2010 2010-2011 2011-2012<br />

Net Sales 70.24 10.59 (0.87)<br />

Cost of Sales 73.91 19.73 (1.79)<br />

Gross Profit(Loss) 27.27 (135.71) (50.00)<br />

Operating Expenses 29.27 10.69 6.25<br />

Income/(Loss) from Operations 46.15 1,089 (6.19)<br />

Other Income/(Expenses) Net (144.44) (183.33) (190.00)<br />

Income/(Loss) Before Income Tax (82.50) 3,271 (14)<br />

Provision for Income tax - (75.00) (100)<br />

Net Income (Loss) (72.50) 2,055 (14)<br />

Return on Sales (%) (13.98) 973.75 (5.36)<br />

Source: UPPC<br />

In 2012, loss from operations was lower despite continued adoption of a<br />

competitive pricing strategy (which ranges from import pricing parity to selling<br />

below cost) impacting on profitability. Loss from operations was lessened as a<br />

result of lower cost of production (COP) due to some of the efficiency<br />

measures going on stream.<br />

Return on sales declined significantly in 2011 and 2012 brought about<br />

by higher operating losses in a conscious effort to stave off erosion in market<br />

share.<br />

8.2 Recurrence of Increased Imports and Injury<br />

There is a need to determine whether there is sufficient freely<br />

disposable, or an imminent substantial increase in, production capacity of<br />

foreign exporters, including access conditions they face in third country<br />

markets, that would indicate likelihood of substantially increased exports to the<br />

<strong>Philippine</strong>s and would thence justify extending the general safeguard measure<br />

given to the domestic industry pursuant to RA 8800.<br />

8.2.1 Foreign Industry Developments<br />

Global market for paper packaging materials is forecast to reach 223.88<br />

million metric tons by the year 2015, spurred by increase in demand from enduse<br />

markets and penetration into new applications areas. Significant<br />

technological developments in paper packaging converting and manufacturing<br />

processes will provide an added boost to growth prospects. 1<br />

The economic situation is not as bleak as it was in 2008 when<br />

companies were not prepared for the downturn in the market. However, there<br />

are still uncertain times ahead in 2013, but market players made necessary<br />

adjustments to face the challenges as the world economy is slowly returning<br />

to growth path, many of the projects are being reactivated and new projects<br />

are planned. 2<br />

1 http://www.strategyr.com/Paper_Packaging_Materials_Market_<strong>Report</strong>.asp.<br />

2<br />

Global forest, paper, and packaging sector outlook<br />

Page 25 of 38

Some of the new developments in the Asian region and other countries<br />

are summarized below:<br />

China 3<br />

Long Chen Paper has unveiled its expansion plans to install a 250,000<br />

tons per year of recycled linerboard machine at its mill in Wuxi City,<br />

Jiangsu province, China. Its start-up operation is scheduled for October<br />

2013. The company also aims to build another two recycled<br />

containerboard machines with a planned combined capacity of 800,000<br />

tons per year at the Pinghu facility in Zhejiang province.<br />

<br />

<br />

<br />

<br />

<br />

Shandong Guihe Xianxing Paper has commissioned a 300,000 tons per<br />

year of recycled testliner unit at its sole mill in Zibo City, Shandong<br />

province. The unit, dubbed PM 5, was fired up on July 24 2012 and is still<br />

being fine-tuned.<br />

Henan Shengyuan Paper is carrying out civil engineering work for a new<br />

400,000 tons per year recycled linerboard machine at a greenfield site in<br />

Luoyang City, Henan province. Startup is scheduled for early 2014<br />

Liansheng Paper Industry has commissioned the new 7.25 meter wide PM<br />

5 at their Longhai site in Fujian province in China The machine has an<br />

annual production capacity of approximately 350,000 tons of recycled<br />

testliner on the basis weight range of 100 to 140 g/m2.<br />

Anhui Shanying Paper Industry Co. is installing two (2) new<br />

containerboard machines worth EUR 100 to 150 million in Anhui Province.<br />

PM 5 will be equipped with three headboxes. The production speed will be<br />

1,100 m/min. The line will produce kraftliner and testliner grades in the<br />

basis weight range of 90-175 gsm. The daily production capacity will be<br />

approximately 1,380 metric tons. Operation is set to begin in the third<br />

quarter of 2013. PM 6, will be equipped with two winders. It utilizes gap<br />

technology which enables a new, higher production speed category for<br />

board. The production speed will be 1,500 m/min. PM 6 will produce<br />

fluting and testliner grades in the basis weight range of 50-110 gsm. The<br />

daily production capacity will be approximately 1,540 metric tons. Startup<br />

operation is scheduled in the second quarter of 2013.<br />

Dongguan Jianhui Paper Mill and Dongguan Jinzhou Paper commissioned<br />

two (2) new recycled containerboard units each in Dongguan City,<br />

Guangdong province. All four PMs were started up in March. Each<br />

machine has a wire width of 4.8 meters and a design speed of 800 meters<br />

per minute. Both make recycled linerboard and capacity of 200,000 tons<br />

per annum.<br />

3 www.pulpapernews.com<br />

Page 26 of 38

Jiangsu Changfeng Paper has invested on new containerboard machine<br />

at its mill in Zhenjiang City. Jiangsu Changfeng’s new unit, PM 3, will<br />

produce 300,000 tons per annum of linerboard in the basis weight range<br />

of 110-220 g/m². Start up will commence in July 2013.<br />

Nine Dragons Paper (Holdings) is set to take over medium-sized recycled<br />

containerboard manufacturer Hebei Yongxin Paper. Nine Dragons inked<br />

an agreement with Hong Kong-based firm Wing Fat Printing to acquire its<br />

78.13% stake in Hebei Yongxin for RMB 564 million ($85 million). Hebei<br />

Yongxin operates four recycled containerboard machines at its mill in<br />

Tangshan City, Hebei province, with a total capacity of 530,000 tons per<br />

annum. The location is near Beijing and Tianjin. Nine Dragons is the<br />

largest packaging producer in China, having a total recycled<br />

containerboard capacity of 7.6 million tons per annum.<br />

Indonesia 4<br />

<br />

Indonesian packaging producer Fajar Surya Wisesa (Fajar Paper) is<br />

moving forward with an investment in a 350,000 tons per annum recycled<br />

containerboard machine. The company has decided to build the machine,<br />

PM 6, at a greenfield mill in the vicinity of Surabaya, the provincial capital<br />

city of East Java. The installation work for the scheme is expected to<br />

begin in the second half of 2013, with startup scheduled for the second<br />

quarter of 2015.<br />

Vietnam 5<br />

<br />

Lee & Man Paper Manufacturing will build a 400,000 tons per year<br />

recycled linerboard machine at a greenfield mill in Hau Giang province,<br />

Vietnam. The startup of the machine is scheduled for the end of 2013.<br />

Australia 6<br />

<br />

Amcor Packaging (Australia) has inaugurated a new $500 million recycled<br />

paper machine at Botany Mill in Australia. The paper machine has the<br />

capacity to produce about 400,000 tons of high-quality 100% recycled<br />

testliner and fluting grades in the basis weight range of 80 to 200 g/m2.<br />

The machine came on stream on Oct. 16, 2012. The production line was<br />

officially opened in an inauguration ceremony held on February 1, 2013.<br />

Thailand 7<br />

<br />

Siam Kraft Industry Co., Ltd. in its Ban Pong Mill in Ratchaburi, Thailand<br />

will have a 7.25-meter-wide PM 16 which have a design speed of 1,300<br />

meter per minute and utilize a new sizing method to provide better<br />

strength properties. Start-up of the new machine is scheduled for 2014.<br />

The production capacity is approximately 400,000 tons of recycled board.<br />

4 Pulp and Paper International-Asia, 2013<br />

5<br />

http://www.euwid-paper.com/news/singlenews/Artikel/lee-man-paper-increases-net-profit-continues-expansion.html<br />

6<br />

http://www.pulpapernews.com/2013/02/new-recycled-paper-machine-inaugurated-at-botany-mill-australia<br />

7<br />

http://www.fao.org/docrep/014/i2285t/i2285t00.pdf<br />

Page 27 of 38

The firm’s parent company, Siam Cement, earmarked Baht 6,700 million<br />

($229 million) for the expansion late last year.<br />

The State of Kuwait 8<br />

<br />

United Paper Industries Co., located in Shuaiba Industrial Area in Kuwait<br />

have commissioned the 2.6 meter wide machine that produces sack kraft,<br />

fluting and testliner mainly using local OCC. The project is expected to<br />

improve production capacity . The start up of this project is scheduled for<br />

the 4th quarter of 2013.<br />

Kingdom of Saudi Arabia 9<br />

<br />

There are three major expansion projects taking place in Saudi Arabia's<br />

packaging sector this year. Firstly, Waraq (also known as Arab Paper<br />

Manufacturing Company) is installing a new 100,000 ton per year<br />

linerboard PM at its mill in Dammam. Secondly, Obeikan is building a<br />

150,000 ton per year greenfield cartonboard plant in Riyadh. Thirdly,<br />

Middle East Paper Company (MEPCO) is constructing a 100,000 ton per<br />

year greenfield linerboard mill in Jeddah, by the Red Sea. MEPCO aims<br />

to get the mill up and running by the end of July 2013.<br />

Poland 10<br />

<br />

Stora Enso is set to build a new lightweight recycled containerboard<br />

machine at its Ostroleka mill in northeastern Poland. The Euro 285 million<br />

($371 million) investment will see a 455,000 tons per year output to start<br />

in the first quarter of 2013. The PM will be able to produce brown testliner<br />

and fluting in a basis weight of 107 g/m².<br />

8.2.2 Reduced FTA <strong>Tariff</strong> Rate<br />

Reduction of tariffs under the various regional trade agreements<br />

can pose further threats of injury to the industry. In addition to ATIGA,<br />

ACFTA and AKFTA, imports of testliner board under the AJCEPA and<br />

PJEPA are levied 0% effective 1 January 2013.<br />

8.2.3 Price Comparison<br />

The removal of the safeguard duty would widen the price gap<br />

between the average landed cost and the average domestic selling<br />

price of testliner board which may result to adverse effects on domestic<br />

industry’s financial viability. Without the safeguard duty, domestic<br />

selling prices will fall below levels not enough to recover cost to produce<br />

and sell.<br />

8 http://www.papnews.com/pmt-italia-to-upgrade-pm-1-at-united-paper-mill-kuwait/<br />

9 http://www.risiinfo.com/<br />

10<br />

http://www.ksh.ca/en/news/<br />

Page 28 of 38

8.3 Findings<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The domestic testliner board industry, following the imposition of the<br />

safeguard measure in May 2010, has shown improvements in its market<br />

share, production, domestic sales, capacity utilization, employment and<br />

labor productivity.<br />

Without the safeguard duty, imported testliner board would have a price<br />

advantage over the domestically produced product. The removal of the<br />

safeguard duty will make it difficult for the domestic industry to price its<br />

products at a level to even recover cost to produce and sell.<br />

Leading exporters of testliner board to the <strong>Philippine</strong>s have established<br />

and continue to upgrade their capacities i.e., Thailand, Korea, Malaysia,<br />

among others. These countries are major exporters to the <strong>Philippine</strong>s.<br />

There is reason to believe that the <strong>Philippine</strong>s will continue to be a target<br />

export market by these countries considering their proximity and the trade<br />

relations established and strengthened under FTAs. Moreover, the<br />

reactivation of other Asian countries’ investment plans/expansion and<br />

implementation of new projects will likely increase exports to the<br />

<strong>Philippine</strong>s if and when the safeguard measure is terminated.<br />

Kingdom of Saudi Arabia, an emerging exporter, poses a real threat to<br />

the domestic market.<br />

While the safeguard measure has proven to be effective, the threat of<br />

increased imports remains.<br />

Discontinuance of the safeguard measure will likely lead to the influx of<br />

cheap imports which will cause the recurrence of significant impairment<br />

on the overall market position, production and domestic sales, capacity<br />

utilization, employment, productivity and profitability of the domestic<br />

industry.<br />

Threat of serious injury is imminent if the safeguard measure is<br />

terminated at this time when the industry continues to implement the<br />

efficiency enhancing measures in its adjustment plans to make itself<br />

competitive.<br />

Page 29 of 38

9. EFFORTS OF THE INDUSTRY TO ADJUST<br />

TO IMPORT COMPETITION<br />

Section 19 of RA 8800 provides that subject to the review under Section 16,<br />

extension of the measure may be requested by the petitioner if the action continues<br />

to be necessary to prevent or remedy the serious injury and there is evidence that the<br />

domestic industry is making adjustments to import competition.<br />

In case one or more firms of the benefiting industry which applied for<br />

safeguard measure fails to comply with their commitments as reflected in the<br />

approved adjustment plan, the safeguard measure shall continue to be in effect,<br />

provided, however, that the firms which complied with their commitments constitute<br />

the majority in accordance with the definition of the domestic industry under Section 4<br />

of paragraph (f) of RA 8800.<br />

9.1 Adjustment Plans<br />

9.1.1 Original Petition<br />

The <strong>Commission</strong>, in its monitoring report submitted to the Secretary on<br />

11 July 2012, determined that the domestic testliner board industry had<br />

complied substantially with its commitments as stated in its adjustment plan.<br />

Among the specific efforts the domestic industry had undertaken to adjust to<br />

import competition were the following:<br />

1. Setting up an additional ten (10) baling stations nationwide which<br />

assured reliability of supply of waste paper and generated additional<br />

employment as well. These stations helped minimize the impact of<br />

increasing raw material prices through sourcing of waste paper and<br />

paperboard at competitive prices, making these readily available for<br />

production. Additional wastepaper generated in 2010-2011 totaled<br />

7,400 MT per month.<br />

2. Sourcing of cheaper alternative raw materials (i.e., Local Double Lined<br />

Kraft cartons and its trimmings) from Davao baling station which<br />

reduced UPPC’s dependence on imports of American Old Corrugated<br />

Carton (AOCC) from U.S.A. In 2011, total LDLK collected was more<br />

than 2,000 MT. This measure reduced raw material and production<br />

costs.<br />

3. Bulk procurement of locally produced coal, accounting for about 80% of<br />

the coal requirements for UPPC’s power plant, resulting in lower coal<br />

prices and power cost.<br />

Page 30 of 38

4. Installation of shredder equipment to shred the plastic rejects at Waste<br />

Plant 2 to be fed to the Co-generation Plant as alternative fuel for power<br />

generation. With this P 13 million project, consumption of coal was<br />

reduced by close to 2,000 MT, equivalent to more than P 9 million<br />

savings for the company in 2011.<br />

5. Construction of coal warehouse that can store up to 4,000 MT of coal<br />

for boiler fuel that resulted in the reduction of maintenance and<br />

operating cost.<br />

6. Installation of new generator which contributed to the improvement of<br />

plant and power efficiency in 2011 as contribution loss for the purchase<br />

of electricity from the grid was avoided.<br />

7. Introduction of new products (i.e., KR 125 and KR 140), which led to<br />

increased domestic sales, actual production, capacity utilization and<br />

market share in 2011 and 2012.<br />

8. Implementation of Customer Relationship Marketing (CRM) programs<br />

such as conduct of technical trainings/seminars and other technical<br />

support programs for customers. This efficiency measure helped UPPC<br />

maintain market leadership. Average annual expenses for these<br />

programs amounted to P 200,000.<br />

9. Required the opening of Standby Letter of Credit (SBLC) to majority of<br />

its customers. This initiative/effort was undertaken to achieve its goal of<br />

minimizing credit risk exposure, reduce receivables and to have better<br />

control of overdue sales. SBLC is for UPPC’s protection in case of<br />

payment default. Customers who can open an SBLC can have the<br />

advantage of increased monthly sales allocation due to higher credit<br />

limit and some pricing advantage. On the other hand, customers who<br />

cannot open SBLC due to their bank credit status are offered other<br />

payment scheme such as cash advance and cash on delivery sales.<br />

9.1.2 Additional Efficiency Measure/Projects<br />

New Product Lines<br />

UPPC has introduced new grades of testliner boards, the<br />

Testliner Maximum Strength (TM) and Testliner Excellent Strength (TX)<br />

grades, which they are currently producing as a replacement to their<br />

former KR and KV grades. TM grades have gsm of 140, 175 and 200<br />

while TX grades have gsm of 125, 140, 150, 175 and 200. The new<br />

product specifications have higher ring crush and bursting resistance,<br />

respectively.<br />

Page 31 of 38

9.2 Findings<br />

Equipment, Parts and Accessories<br />

To further enhance efficiency in its production processes, UPPC<br />

has infused huge investments on projects/efficiency measures<br />

committed to be operational by 2013. These include among others<br />

machine improvements to optimize production.<br />

Aside from these initiatives, several efficiency measures are<br />

under study or in the planning stage for possible implementation in<br />

2014-2016. These measures not only aimed at increasing machine<br />

speed and reducing paper rejects that will result to increased production<br />

output but also to reduce steam consumption and fibrous and chemical<br />

costs to lower production cost of testliner board.<br />

The <strong>Commission</strong> finds that the domestic testliner board industry is<br />

making positive adjustment to import competition.<br />

The positive impact of the efficiency measures was negated in 2011<br />

due to the escalation in costs of external factors that are beyond the control of<br />

the industry (i.e., prices of waste paper and coal/fuel). Without the<br />

initiatives/efforts that the industry undertook, the increase in production cost<br />

would have been higher.<br />

Through improvements in production processes, the industry was able<br />

to achieve economies of scale, maximize output, and reduce cost of<br />

production in 2012.<br />

Page 32 of 38

10. CONCLUSION<br />

The <strong>Commission</strong>, in accordance with RA 8800 and the WTO Agreement on<br />

Safeguards, concludes that:<br />

1. The production output of the domestic industry, represented by UPPC,<br />