2010 Competitiveness Report - Export-Import Bank of the United ...

2010 Competitiveness Report - Export-Import Bank of the United ...

2010 Competitiveness Report - Export-Import Bank of the United ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 4: Major Program Structures<br />

Section B: Project Finance<br />

Introduction<br />

Project Finance (PF) is defined as <strong>the</strong> financing <strong>of</strong> projects whose creditworthiness<br />

depends on <strong>the</strong> project’s cash flow for repayment. With such a structure, <strong>the</strong> lender<br />

cannot access <strong>the</strong> assets or revenue <strong>of</strong> <strong>the</strong> project sponsor to repay <strong>the</strong> debt and only has<br />

recourse to <strong>the</strong> assets and revenue generated by <strong>the</strong> borrower (i.e. <strong>the</strong> project being<br />

financed). PF structures usually cover large, long-term infrastructure and industrial<br />

projects.<br />

In <strong>2010</strong>, total global PF debt issuances again declined to $188 billion after suffering a<br />

decline in 2009 as a result <strong>of</strong> <strong>the</strong> 2008 financial crisis. The fur<strong>the</strong>r decline in global PF<br />

activity in <strong>2010</strong> can be attributed to <strong>the</strong> 1-2 year lagging effect <strong>the</strong> 2008 financial crisis<br />

had on <strong>the</strong> suppliers <strong>of</strong> large projects within <strong>the</strong> industry. The major ECAs supported 25<br />

project finance deals in <strong>2010</strong>, signifying an increase from <strong>the</strong> 2009 figure <strong>of</strong> 21 total<br />

ECA supported PF deals. However, preliminary information indicates <strong>the</strong> total dollar<br />

amount <strong>of</strong> <strong>2010</strong> ECA-supported PF transactions was only roughly $10.2 billion, a<br />

decrease from <strong>the</strong> $11.1 billion portfolio <strong>of</strong> PF business that received ECA support in<br />

2009.<br />

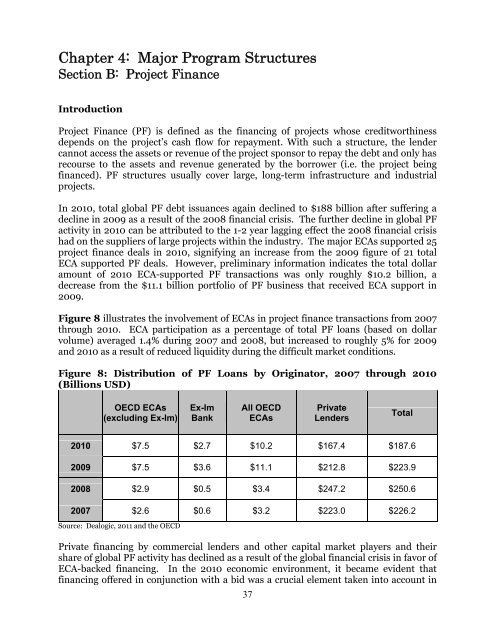

Figure 8 illustrates <strong>the</strong> involvement <strong>of</strong> ECAs in project finance transactions from 2007<br />

through <strong>2010</strong>. ECA participation as a percentage <strong>of</strong> total PF loans (based on dollar<br />

volume) averaged 1.4% during 2007 and 2008, but increased to roughly 5% for 2009<br />

and <strong>2010</strong> as a result <strong>of</strong> reduced liquidity during <strong>the</strong> difficult market conditions.<br />

Figure 8: Distribution <strong>of</strong> PF Loans by Originator, 2007 through <strong>2010</strong><br />

(Billions USD)<br />

OECD ECAs<br />

(excluding Ex-Im)<br />

Ex-Im<br />

<strong>Bank</strong><br />

All OECD<br />

ECAs<br />

Private<br />

Lenders<br />

Total<br />

<strong>2010</strong> $7.5 $2.7 $10.2 $167.4 $187.6<br />

2009 $7.5 $3.6 $11.1 $212.8 $223.9<br />

2008 $2.9 $0.5 $3.4 $247.2 $250.6<br />

2007 $2.6 $0.6 $3.2 $223.0 $226.2<br />

Source: Dealogic, 2011 and <strong>the</strong> OECD<br />

Private financing by commercial lenders and o<strong>the</strong>r capital market players and <strong>the</strong>ir<br />

share <strong>of</strong> global PF activity has declined as a result <strong>of</strong> <strong>the</strong> global financial crisis in favor <strong>of</strong><br />

ECA-backed financing. In <strong>the</strong> <strong>2010</strong> economic environment, it became evident that<br />

financing <strong>of</strong>fered in conjunction with a bid was a crucial element taken into account in<br />

37