2010 Competitiveness Report - Export-Import Bank of the United ...

2010 Competitiveness Report - Export-Import Bank of the United ...

2010 Competitiveness Report - Export-Import Bank of the United ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Unlike most o<strong>the</strong>r ECAs, Ex-Im <strong>Bank</strong> does not require a formal bilateral framework<br />

agreement before considering co-financing transactions. In <strong>2010</strong>, Ex-Im <strong>Bank</strong><br />

supported two co-financing deals under a one-<strong>of</strong>f co-financing agreement that involved<br />

reinsurance from HEXIM (Hungary) to support power plants in Turkey and <strong>the</strong> Slovak<br />

Republic. Additionally, recognizing <strong>the</strong> shift away from <strong>the</strong> typical structure <strong>of</strong> a c<strong>of</strong>inancing<br />

transaction in which <strong>the</strong>re is a single export contract, Ex-Im has created,<br />

specific criteria that allows co-financing coverage to include wholly-foreign contracts<br />

under its co-financing program as a carefully parametered “Associated Contracts”<br />

structure. The “Associated Contracts” structure allows foreign buyers, arrangers or<br />

financiers - in addition to U.S. exporters – to package multiple contracts that are<br />

associated to a project (but may be functionally unrelated) into a single ECA financing<br />

package. In <strong>2010</strong>, Ex-Im <strong>Bank</strong> supported one co-financing deal under an Associated<br />

Contract structure to support a power plant in Turkey. Ex-Im <strong>Bank</strong> is unique in <strong>of</strong>fering<br />

this structure; competitor ECAs require <strong>the</strong> foreign ECA-supported portion to be<br />

explicitly included as part <strong>of</strong> <strong>the</strong> main, single export contract.<br />

G-7 ECAs’ Policies and Practices<br />

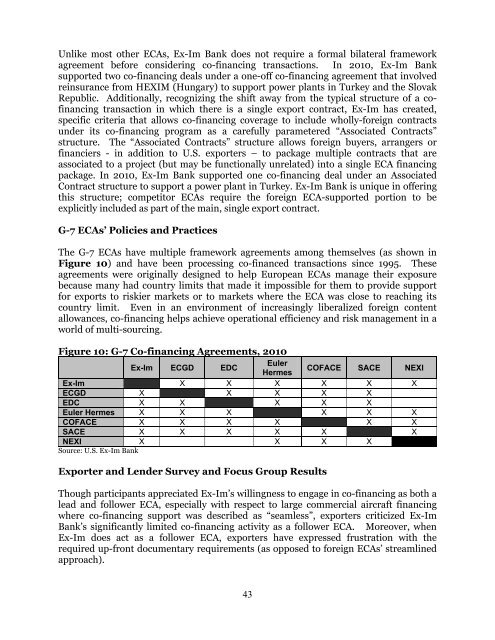

The G-7 ECAs have multiple framework agreements among <strong>the</strong>mselves (as shown in<br />

Figure 10) and have been processing co-financed transactions since 1995. These<br />

agreements were originally designed to help European ECAs manage <strong>the</strong>ir exposure<br />

because many had country limits that made it impossible for <strong>the</strong>m to provide support<br />

for exports to riskier markets or to markets where <strong>the</strong> ECA was close to reaching its<br />

country limit. Even in an environment <strong>of</strong> increasingly liberalized foreign content<br />

allowances, co-financing helps achieve operational efficiency and risk management in a<br />

world <strong>of</strong> multi-sourcing.<br />

Figure 10: G-7 Co-financing Agreements, <strong>2010</strong><br />

Euler<br />

Ex-Im ECGD EDC<br />

COFACE SACE NEXI<br />

Hermes<br />

Ex-Im X X X X X X<br />

ECGD X X X X X<br />

EDC X X X X X<br />

Euler Hermes X X X X X X<br />

COFACE X X X X X X<br />

SACE X X X X X X<br />

NEXI X X X X<br />

Source: U.S. Ex-Im <strong>Bank</strong><br />

<strong>Export</strong>er and Lender Survey and Focus Group Results<br />

Though participants appreciated Ex-Im’s willingness to engage in co-financing as both a<br />

lead and follower ECA, especially with respect to large commercial aircraft financing<br />

where co-financing support was described as “seamless”, exporters criticized Ex-Im<br />

<strong>Bank</strong>’s significantly limited co-financing activity as a follower ECA. Moreover, when<br />

Ex-Im does act as a follower ECA, exporters have expressed frustration with <strong>the</strong><br />

required up-front documentary requirements (as opposed to foreign ECAs’ streamlined<br />

approach).<br />

43