2011 Comprehensive Annual Financial Report - City of Moreno Valley

2011 Comprehensive Annual Financial Report - City of Moreno Valley

2011 Comprehensive Annual Financial Report - City of Moreno Valley

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

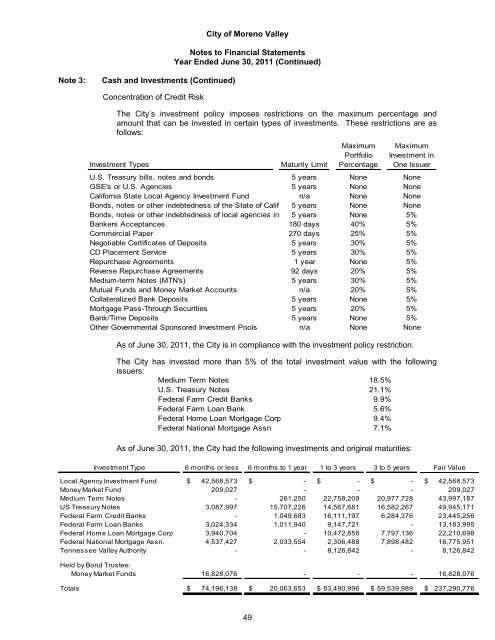

<strong>City</strong> <strong>of</strong> <strong>Moreno</strong> <strong>Valley</strong><br />

Notes to <strong>Financial</strong> Statements<br />

Year Ended June 30, <strong>2011</strong> (Continued)<br />

Note 3:<br />

Cash and Investments (Continued)<br />

Concentration <strong>of</strong> Credit Risk<br />

The <strong>City</strong>’s investment policy imposes restrictions on the maximum percentage and<br />

amount that can be invested in certain types <strong>of</strong> investments. These restrictions are as<br />

follows:<br />

Investment Types<br />

Maturity Limit<br />

Maximum<br />

Portfolio<br />

Percentage<br />

Maximum<br />

Investment in<br />

One Issuer<br />

U.S. Treasury bills, notes and bonds 5 years None None<br />

GSE's or U.S. Agencies 5 years None None<br />

California State Local Agency Investment Fund n/a None None<br />

Bonds, notes or other indebtedness <strong>of</strong> the State <strong>of</strong> Califo 5 years None None<br />

Bonds, notes or other indebtedness <strong>of</strong> local agencies in 5 years None 5%<br />

Bankers Acceptances 180 days 40% 5%<br />

Commercial Paper 270 days 25% 5%<br />

Negotiable Certificates <strong>of</strong> Deposits 5 years 30% 5%<br />

CD Placement Service 5 years 30% 5%<br />

Repurchase Agreements 1 year None 5%<br />

Reverse Repurchase Agreements 92 days 20% 5%<br />

Medium-term Notes (MTN's) 5 years 30% 5%<br />

Mutual Funds and Money Market Accounts n/a 20% 5%<br />

Collateralized Bank Deposits 5 years None 5%<br />

Mortgage Pass-Through Securities 5 years 20% 5%<br />

Bank/Time Deposits 5 years None 5%<br />

Other Governmental Sponsored Investment Pools n/a None None<br />

As <strong>of</strong> June 30, <strong>2011</strong>, the <strong>City</strong> is in compliance with the investment policy restriction.<br />

The <strong>City</strong> has invested more than 5% <strong>of</strong> the total investment value with the following<br />

issuers:<br />

Medium Term Notes 18.5%<br />

U.S. Treasury Notes 21.1%<br />

Federal Farm Credit Banks 9.9%<br />

Federal Farm Loan Bank 5.6%<br />

Federal Home Loan Mortgage Corp 9.4%<br />

Federal National Mortgage Assn 7.1%<br />

As <strong>of</strong> June 30, <strong>2011</strong>, the <strong>City</strong> had the following investments and original maturities:<br />

Investment Type<br />

Local Agency Investment Fund<br />

Money Market Fund<br />

Medium Term Notes<br />

US Treasury Notes<br />

Federal Farm Credit Banks<br />

Federal Farm Loan Banks<br />

Federal Home Loan Mortgage Corp<br />

Federal National Mortgage Assn.<br />

Tennessee <strong>Valley</strong> Authority<br />

6 months or less 6 months to 1 year 1 to 3 years 3 to 5 years Fair Value<br />

$ 42,568,573 $ - $ - $ - $ 42,568,573<br />

209,027 - - - 209,027<br />

- 261,250 22,758,209 20,977,728 43,997,187<br />

3,087,997 15,707,226 14,567,681 16,582,267 49,945,171<br />

- 1,049,683 16,111,197 6,284,376 23,445,256<br />

3,024,334 1,011,940 9,147,721 - 13,183,995<br />

3,940,704 - 10,472,858 7,797,136 22,210,698<br />

4,537,427 2,033,554 2,306,488 7,898,482 16,775,951<br />

- - 8,126,842 - 8,126,842<br />

Held by Bond Trustee:<br />

Money Market Funds 16,828,076 - - - 16,828,076<br />

Totals<br />

$ 74,196,138 $ 20,063,653 $ 83,490,996 $ 59,539,989 $ 237,290,776<br />

49