Underwater mortgages and mortgage default risk in a recourse market

Underwater mortgages and mortgage default risk in a recourse market

Underwater mortgages and mortgage default risk in a recourse market

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

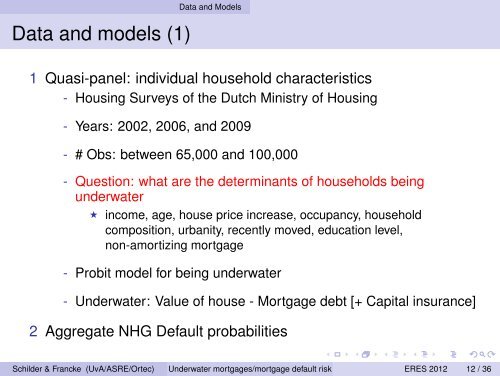

Data <strong>and</strong> models (1)<br />

Data <strong>and</strong> Models<br />

1 Quasi-panel: <strong>in</strong>dividual household characteristics<br />

- Hous<strong>in</strong>g Surveys of the Dutch M<strong>in</strong>istry of Hous<strong>in</strong>g<br />

- Years: 2002, 2006, <strong>and</strong> 2009<br />

- # Obs: between 65,000 <strong>and</strong> 100,000<br />

- Question: what are the determ<strong>in</strong>ants of households be<strong>in</strong>g<br />

underwater<br />

⋆ <strong>in</strong>come, age, house price <strong>in</strong>crease, occupancy, household<br />

composition, urbanity, recently moved, education level,<br />

non-amortiz<strong>in</strong>g <strong>mortgage</strong><br />

- Probit model for be<strong>in</strong>g underwater<br />

- <strong>Underwater</strong>: Value of house - Mortgage debt [+ Capital <strong>in</strong>surance]<br />

2 Aggregate NHG Default probabilities<br />

Schilder & Francke (UvA/ASRE/Ortec) <strong>Underwater</strong> <strong><strong>mortgage</strong>s</strong>/<strong>mortgage</strong> <strong>default</strong> <strong>risk</strong> ERES 2012 12 / 36