Chuanliang Jiang - Boston College

Chuanliang Jiang - Boston College

Chuanliang Jiang - Boston College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

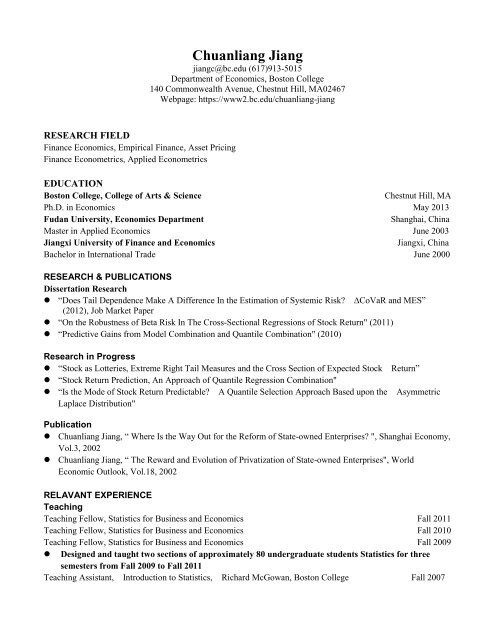

<strong>Chuanliang</strong> <strong>Jiang</strong><br />

jiangc@bc.edu (617)913-5015<br />

Department of Economics, <strong>Boston</strong> <strong>College</strong><br />

140 Commonwealth Avenue, Chestnut Hill, MA02467<br />

Webpage: https://www2.bc.edu/chuanliang-jiang<br />

RESEARCH FIELD<br />

Finance Economics, Empirical Finance, Asset Pricing<br />

Finance Econometrics, Applied Econometrics<br />

EDUCATION<br />

<strong>Boston</strong> <strong>College</strong>, <strong>College</strong> of Arts & Science<br />

Chestnut Hill, MA<br />

Ph.D. in Economics May 2013<br />

Fudan University, Economics Department<br />

Shanghai, China<br />

Master in Applied Economics June 2003<br />

<strong>Jiang</strong>xi University of Finance and Economics<br />

<strong>Jiang</strong>xi, China<br />

Bachelor in International Trade June 2000<br />

RESEARCH & PUBLICATIONS<br />

Dissertation Research<br />

• “Does Tail Dependence Make A Difference In the Estimation of Systemic Risk? ∆CoVaR and MES”<br />

(2012), Job Market Paper<br />

• “On the Robustness of Beta Risk In The Cross-Sectional Regressions of Stock Return" (2011)<br />

• “Predictive Gains from Model Combination and Quantile Combination" (2010)<br />

Research in Progress<br />

• “Stock as Lotteries, Extreme Right Tail Measures and the Cross Section of Expected Stock Return”<br />

• “Stock Return Prediction, An Approach of Quantile Regression Combination"<br />

• “Is the Mode of Stock Return Predictable? A Quantile Selection Approach Based upon the Asymmetric<br />

Laplace Distribution"<br />

Publication<br />

• <strong>Chuanliang</strong> <strong>Jiang</strong>, “ Where Is the Way Out for the Reform of State-owned Enterprises? ", Shanghai Economy,<br />

Vol.3, 2002<br />

• <strong>Chuanliang</strong> <strong>Jiang</strong>, “ The Reward and Evolution of Privatization of State-owned Enterprises", World<br />

Economic Outlook, Vol.18, 2002<br />

RELAVANT EXPERIENCE<br />

Teaching<br />

Teaching Fellow, Statistics for Business and Economics Fall 2011<br />

Teaching Fellow, Statistics for Business and Economics Fall 2010<br />

Teaching Fellow, Statistics for Business and Economics Fall 2009<br />

• Designed and taught two sections of approximately 80 undergraduate students Statistics for three<br />

semesters from Fall 2009 to Fall 2011<br />

Teaching Assistant, Introduction to Statistics, Richard McGowan, <strong>Boston</strong> <strong>College</strong> Fall 2007

<strong>Chuanliang</strong> <strong>Jiang</strong>’s CV (Page 2)<br />

Research<br />

Fixed Income Group of SSgA<br />

<strong>Boston</strong>, MA<br />

Full Time Intern June 2010 -September 2010<br />

• Set up a database for 20 years' bond and equity data got from Bloomsburg and FactSet separately.<br />

• Programed using Matlab to calculate a large number of key financial ratio variables. Estimate financial<br />

factors' impact on returns in support of portfolio managers' decision on assets rebalancing<br />

<strong>Boston</strong> <strong>College</strong><br />

Chestnut Hill, MA<br />

Research Assistant for professor Zhijie Xiao Spring 2009-Spring 2010<br />

• Research Assistant for the paper “Conditional Quantile Estimation for GARCH Models” by Zhijie Xiao &<br />

Roger Koenker<br />

Conduct Monte Carlo experiment designed to examine the performance of the proposed estimation procedures in<br />

the paper and compared them with existing models.<br />

• Research Assistant for the paper “Efficient Regressions via Optimally Combining Quantile Information" by<br />

Zhibiao Zhao & Zhijie Xiao<br />

Programed using Matlab to conduct Monte Carlo Simulation on the performance of Quantile Combination<br />

Estimation<br />

• Provide matlab codes to illustrate the empirical and simulation studies in the chapter of “time regression<br />

analysis” in the “Handbook of Econometrics”<br />

Research Assistant for professor Zhijie Xiao, Summer Research Grant Summer 2009<br />

• Worked extensively with professor Zhijie Xiao to design and prepare for the lecture notes of the Advanced<br />

Time Series Analysis for the first year graduate student in Ph.D program, which were presented in the<br />

summer school of Tsinghua University, China<br />

Research Assistant for professor Arthur Lewbel, Summer Research Grant Summer 2008<br />

Served as Research Assistant for the research project “Non-parametrics Estimation of Return to<br />

Education”.<br />

Programed using STATA to estimate the parameters of non-parametric estimation in the above Paper.<br />

HONORS AND AWARDS<br />

• Full Tuition Remission and Stipend, <strong>Boston</strong> <strong>College</strong> Fall 2007 ~ Spring 2011<br />

• Summer Research Award, Department of Economics, <strong>Boston</strong> <strong>College</strong>, 2007, 2008<br />

• Distinguished Graduated Student in FuDan University, Spring 2003<br />

• National Second Prize of China Undergraduate Mathematical Contest in Modeling, Summer 1999<br />

SKILLS<br />

• Computer: Matlab, R, Gauss, STATA, SAS, LATEX, Parallel Computing(Cluster)<br />

• Language: Chinese(Native), English (Fluent)<br />

2

<strong>Chuanliang</strong> <strong>Jiang</strong>’s CV (Page 2)<br />

REFERENCE<br />

Professor Zhijie Xiao (Chair) Professor Kit Baum Professor Arthur Lewbel<br />

Department of Economics Department of Economics Department of Economics<br />

<strong>Boston</strong> <strong>College</strong> <strong>Boston</strong> <strong>College</strong> <strong>Boston</strong> <strong>College</strong><br />

140 Commonwealth Avenue 140 Commonwealth Avenue 140 Commonwealth Avenue<br />

Chestnut Hill, MA, 02467-2308 Chestnut Hill, MA, 02467-2308 Chestnut Hill, MA, 02467-2308<br />

Email:Zhijie.Xiao@bc.edu Email: Kit.baum@bc.edu Email: lewbel@bc.edu<br />

Tel: +1(617)552-1709 Tel: +1(617)552-3673 Tel: +1(617)552-3678<br />

3