Facilitator's Guide - PBS

Facilitator's Guide - PBS

Facilitator's Guide - PBS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

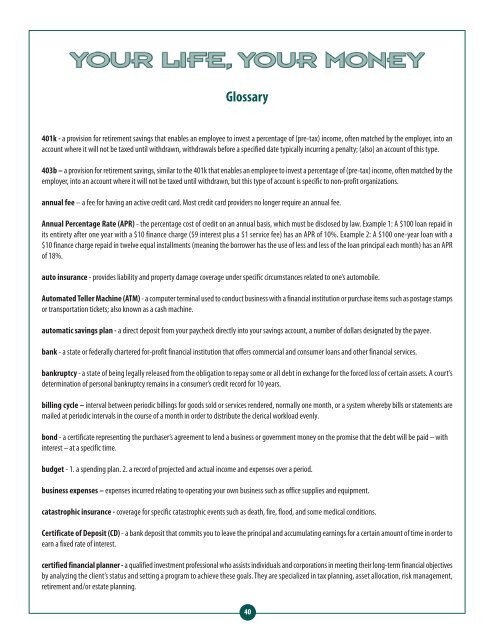

Glossary<br />

401k - a provision for retirement savings that enables an employee to invest a percentage of (pre-tax) income, often matched by the employer, into an<br />

account where it will not be taxed until withdrawn, withdrawals before a specified date typically incurring a penalty; (also) an account of this type.<br />

403b – a provision for retirement savings, similar to the 401k that enables an employee to invest a percentage of (pre-tax) income, often matched by the<br />

employer, into an account where it will not be taxed until withdrawn, but this type of account is specific to non-profit organizations.<br />

annual fee – a fee for having an active credit card. Most credit card providers no longer require an annual fee.<br />

Annual Percentage Rate (APR) - the percentage cost of credit on an annual basis, which must be disclosed by law. Example 1: A $100 loan repaid in<br />

its entirety after one year with a $10 finance charge ($9 interest plus a $1 service fee) has an APR of 10%. Example 2: A $100 one-year loan with a<br />

$10 finance charge repaid in twelve equal installments (meaning the borrower has the use of less and less of the loan principal each month) has an APR<br />

of 18%.<br />

auto insurance - provides liability and property damage coverage under specific circumstances related to one’s automobile.<br />

Automated Teller Machine (ATM) - a computer terminal used to conduct business with a financial institution or purchase items such as postage stamps<br />

or transportation tickets; also known as a cash machine.<br />

automatic savings plan - a direct deposit from your paycheck directly into your savings account, a number of dollars designated by the payee.<br />

bank - a state or federally chartered for-profit financial institution that offers commercial and consumer loans and other financial services.<br />

bankruptcy - a state of being legally released from the obligation to repay some or all debt in exchange for the forced loss of certain assets. A court’s<br />

determination of personal bankruptcy remains in a consumer’s credit record for 10 years.<br />

billing cycle – interval between periodic billings for goods sold or services rendered, normally one month, or a system whereby bills or statements are<br />

mailed at periodic intervals in the course of a month in order to distribute the clerical workload evenly.<br />

bond - a certificate representing the purchaser’s agreement to lend a business or government money on the promise that the debt will be paid -- with<br />

interest -- at a specific time.<br />

budget - 1. a spending plan. 2. a record of projected and actual income and expenses over a period.<br />

business expenses – expenses incurred relating to operating your own business such as office supplies and equipment.<br />

catastrophic insurance - coverage for specific catastrophic events such as death, fire, flood, and some medical conditions.<br />

Certificate of Deposit (CD) - a bank deposit that commits you to leave the principal and accumulating earnings for a certain amount of time in order to<br />

earn a fixed rate of interest.<br />

certified financial planner - a qualified investment professional who assists individuals and corporations in meeting their long-term financial objectives<br />

by analyzing the client’s status and setting a program to achieve these goals. They are specialized in tax planning, asset allocation, risk management,<br />

retirement and/or estate planning.<br />

40