Facilitator's Guide - PBS

Facilitator's Guide - PBS

Facilitator's Guide - PBS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

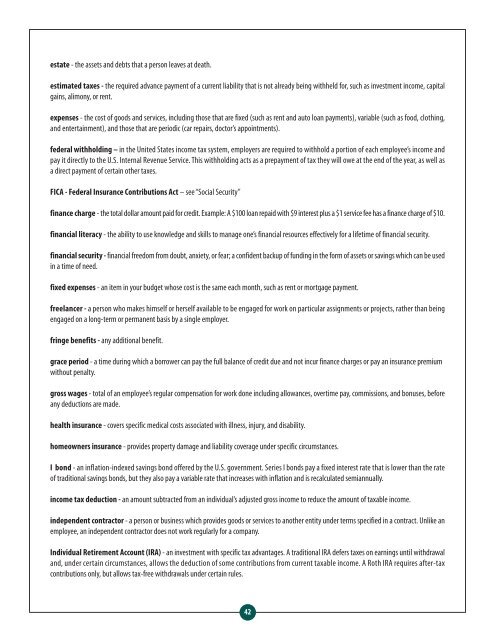

estate - the assets and debts that a person leaves at death.<br />

estimated taxes - the required advance payment of a current liability that is not already being withheld for, such as investment income, capital<br />

gains, alimony, or rent.<br />

expenses - the cost of goods and services, including those that are fixed (such as rent and auto loan payments), variable (such as food, clothing,<br />

and entertainment), and those that are periodic (car repairs, doctor’s appointments).<br />

federal withholding – in the United States income tax system, employers are required to withhold a portion of each employee’s income and<br />

pay it directly to the U.S. Internal Revenue Service. This withholding acts as a prepayment of tax they will owe at the end of the year, as well as<br />

a direct payment of certain other taxes.<br />

FICA - Federal Insurance Contributions Act – see “Social Security”<br />

finance charge - the total dollar amount paid for credit. Example: A $100 loan repaid with $9 interest plus a $1 service fee has a finance charge of $10.<br />

financial literacy - the ability to use knowledge and skills to manage one’s financial resources effectively for a lifetime of financial security.<br />

financial security - financial freedom from doubt, anxiety, or fear; a confident backup of funding in the form of assets or savings which can be used<br />

in a time of need.<br />

fixed expenses - an item in your budget whose cost is the same each month, such as rent or mortgage payment.<br />

freelancer - a person who makes himself or herself available to be engaged for work on particular assignments or projects, rather than being<br />

engaged on a long-term or permanent basis by a single employer.<br />

fringe benefits - any additional benefit.<br />

grace period - a time during which a borrower can pay the full balance of credit due and not incur finance charges or pay an insurance premium<br />

without penalty.<br />

gross wages - total of an employee’s regular compensation for work done including allowances, overtime pay, commissions, and bonuses, before<br />

any deductions are made.<br />

health insurance - covers specific medical costs associated with illness, injury, and disability.<br />

homeowners insurance - provides property damage and liability coverage under specific circumstances.<br />

I bond - an inflation-indexed savings bond offered by the U.S. government. Series I bonds pay a fixed interest rate that is lower than the rate<br />

of traditional savings bonds, but they also pay a variable rate that increases with inflation and is recalculated semiannually.<br />

income tax deduction - an amount subtracted from an individual’s adjusted gross income to reduce the amount of taxable income.<br />

independent contractor - a person or business which provides goods or services to another entity under terms specified in a contract. Unlike an<br />

employee, an independent contractor does not work regularly for a company.<br />

Individual Retirement Account (IRA) - an investment with specific tax advantages. A traditional IRA defers taxes on earnings until withdrawal<br />

and, under certain circumstances, allows the deduction of some contributions from current taxable income. A Roth IRA requires after-tax<br />

contributions only, but allows tax-free withdrawals under certain rules.<br />

42