From the Office of Gift Planning Legacy Circle Welcomes New ...

From the Office of Gift Planning Legacy Circle Welcomes New ...

From the Office of Gift Planning Legacy Circle Welcomes New ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Perspective<br />

^ • Semi-Annual <strong>New</strong>sletter <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong> • winter 2009<br />

<strong>From</strong> <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong><br />

Dear Friends,<br />

Welcome to <strong>the</strong> inaugural issue <strong>of</strong> Perspective.<br />

The goal <strong>of</strong> this newsletter is to bring you <strong>the</strong><br />

latest news from <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong> at<br />

LACMA and provide you with an up-to-date<br />

resource for planned giving information.<br />

Since its inception, <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong><br />

<strong>Planning</strong> has come to encompass an array<br />

<strong>of</strong> charitable giving techniques and<br />

opportunities. Our purpose has always been<br />

to provide you with information on how<br />

you might incorporate <strong>the</strong>se techniques<br />

into a sound and beneficial financial strategy<br />

and at <strong>the</strong> same time support LACMA in<br />

a very important way.<br />

Whe<strong>the</strong>r through a bequest to LACMA, a gift<br />

<strong>of</strong> securities, a charitable gift annuity,<br />

or a gift <strong>of</strong> art to <strong>the</strong> permanent collection—<br />

to name but a few—all <strong>of</strong> <strong>the</strong>se gift planning<br />

options share a common thread: individuals<br />

who are willing to take that extra step to<br />

create a legacy <strong>of</strong> support for LACMA which<br />

will help fortify its continued status as one <strong>of</strong><br />

<strong>the</strong> preeminent art institutions in <strong>the</strong> world.<br />

Each issue <strong>of</strong> Perspective will pay tribute to<br />

<strong>the</strong> individuals who embrace this unique<br />

brand <strong>of</strong> philanthropy by pr<strong>of</strong>iling members<br />

<strong>of</strong> LACMA’s <strong>Legacy</strong> <strong>Circle</strong> as well as highlighting<br />

recent gifts <strong>of</strong> art to <strong>the</strong> museum.<br />

We will also bring you news on <strong>the</strong> latest<br />

legislation and trends in <strong>the</strong> field <strong>of</strong> planned<br />

giving and art donations, as well as updates<br />

on LACMA’s continuing Transformation and<br />

how gift planning can be employed to<br />

support this critical campaign.<br />

It is our hope that Perspective will evolve so<br />

that it best reflects your needs and interests,<br />

and we welcome your suggestions on how<br />

we might improve with each issue. We also<br />

encourage you to pass this newsletter along<br />

to friends and colleagues once you are<br />

finished. In <strong>the</strong> meantime, many thanks for<br />

your continued patronage. LACMA’s mission<br />

to serve <strong>the</strong> public through <strong>the</strong> collection,<br />

conservation, exhibition, and interpretation<br />

<strong>of</strong> significant works <strong>of</strong> art would not be<br />

possible without <strong>the</strong> commitment and<br />

dedication <strong>of</strong> supporters like you.<br />

Yours sincerely,<br />

Diana Veach<br />

ASSOCIATE VICE PRESIDENT OF DEVELOPMENT<br />

OPERATIONS AND GIFT PLANNING<br />

<strong>Legacy</strong> <strong>Circle</strong><br />

<strong>Welcomes</strong><br />

<strong>New</strong> Members<br />

The <strong>Legacy</strong> <strong>Circle</strong> at LACMA grew<br />

terrifically this past year, welcoming<br />

thirty-two new members. These new<br />

additions engaged a variety <strong>of</strong><br />

planned giving vehicles to support<br />

<strong>the</strong>ir philanthropic goals here at<br />

LACMA as well as streng<strong>the</strong>n <strong>the</strong>ir<br />

own long-term financial strategies.<br />

For our debut issue, we believe that<br />

two new members’ stories were<br />

indicative <strong>of</strong> <strong>the</strong> wonderful character<br />

and spirit which all our <strong>Legacy</strong> <strong>Circle</strong><br />

members share.<br />

Washington-born Jan Dudley is no<br />

stranger to public service. After<br />

raising a family in <strong>the</strong> Pacific<br />

Northwest, Jan, a graduate <strong>of</strong> <strong>the</strong><br />

University <strong>of</strong> Washington, went<br />

back to school to get her Master’s<br />

degree in Public Health. Shortly<br />

<strong>the</strong>reafter, Jan relocated to Sou<strong>the</strong>rn<br />

California where she put her new<br />

degree to work administering<br />

epidemiologic studies in a variety <strong>of</strong><br />

fields including multiple sclerosis,<br />

effects <strong>of</strong> smog, and HIV/AIDS for <strong>the</strong><br />

UCLA School <strong>of</strong> Public Health.<br />

Jan recalls her first visit to LACMA<br />

during <strong>the</strong>se early days in L.A. “There<br />

was an exhibit with Ed Kienholz’s<br />

Back Seat Dodge, and <strong>the</strong>n I spied<br />

Magritte’s Ceci n’est pas une pipe<br />

and oh, I was hooked!”<br />

Continued on page 2

<strong>Legacy</strong> <strong>Circle</strong> continued from page 1<br />

Over <strong>the</strong> years Jan slowly, and frugally, began<br />

supporting those cultural activities that gave<br />

her pleasure: LACMA, MOCA, NPR, <strong>the</strong> L.A.<br />

Phil. “My gratitude for <strong>the</strong> cultural nurturing<br />

L.A. has given me is boundless. I wanted to<br />

show that gratitude but still had discomfort<br />

about large donations.”<br />

When Jan received a<br />

postcard describing<br />

LACMA’s Charitable <strong>Gift</strong><br />

Annuity program, she<br />

knew she had her<br />

answer. “I could<br />

establish an annuity with<br />

LACMA that produced income for me with<br />

tax benefits and still express my love <strong>of</strong> this<br />

great institution. It fit my need to protect my<br />

assets while giving at a comfortable level.”<br />

Jan encourages o<strong>the</strong>rs <strong>of</strong> all means to<br />

investigate ways <strong>of</strong> contributing to <strong>the</strong> legacy<br />

<strong>of</strong> future Angelenos and visitors whose lives<br />

will be enriched by having access to such a<br />

magnificent museum.<br />

Like Jan, new <strong>Legacy</strong><br />

<strong>Circle</strong> member Eve<br />

Kilger has always been<br />

committed to serving<br />

her community,<br />

especially in <strong>the</strong> area <strong>of</strong><br />

<strong>the</strong> arts. Born in <strong>New</strong><br />

York City, Eve and her family relocated to<br />

<strong>the</strong> Long Beach area when Eve was thirteen<br />

years old. After graduating from Cal State<br />

Long Beach with a Bachelors in marketing,<br />

Eve embarked upon a twenty-eight-year<br />

career working for IBM. During this time she<br />

also worked in wholesale travel and hotels.<br />

Later, Eve bought into a Seal Beach travel<br />

agency as a silent partner. This allowed her<br />

to see <strong>the</strong> world and feed her growing interest<br />

in <strong>the</strong> arts.<br />

“My gratitude for <strong>the</strong> cultural nurturing L.A.<br />

has given me is boundless. I wanted to show<br />

that gratitude but still had discomfort about<br />

large donations.”—Jan Dudley<br />

Coincidentally, Eve recalls an early visit to<br />

LACMA similar to Jan’s to see Kienholz’s<br />

infamous Back Seat Dodge ’38, and has<br />

enjoyed periodic visits to <strong>the</strong> Miracle Mile for<br />

LACMA exhibitions ever since. In addition,<br />

Eve has engaged an active leadership role in<br />

<strong>the</strong> Long Beach arts community, having just<br />

finished a nine-year tenure on <strong>the</strong> Long<br />

Beach Museum <strong>of</strong> Art’s Board <strong>of</strong> Directors<br />

and recently joined its Honorary Board.<br />

When Eve decided a few years back to<br />

formally incorporate charitable giving into<br />

her long-term financial strategy, she opted<br />

for a charitable remainder trust. Eve wanted<br />

to share her good fortune with a variety <strong>of</strong><br />

charities including LACMA, and chose <strong>the</strong><br />

California Community Foundation to assist<br />

her in establishing <strong>the</strong> trust. “A charitable<br />

remainder trust worked best for me… for<br />

anyone having stock, real estate, etc. that<br />

has grown considerably, this is <strong>the</strong> perfect<br />

vehicle to avoid huge capital gains. I also<br />

get a nice quarterly income payment, and<br />

<strong>the</strong> remainder will benefit non-pr<strong>of</strong>its like<br />

LACMA when I go on.”<br />

Jump-Start your LACMA <strong>Legacy</strong> (and Get Great Tax Savings Too)<br />

If you are 70 or older, recent Federal legislation benefits you! The IRA Charitable Rollover included in <strong>the</strong> Pension Protection Act <strong>of</strong><br />

2006 has been extended to include tax year 2009 in <strong>the</strong> newly signed-into-law Emergency Economic Stabilization Act <strong>of</strong> 2008. As such,<br />

you can continue to make an outright gift to LACMA via a direct transfer from your IRA without paying taxes on your distribution.<br />

Contact <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong> at 323 932-5816 for more information, or visit lacma.org/give and click on “IRA Charitable Rollover.”<br />

2

<strong>Legacy</strong> <strong>Circle</strong> Members Enjoy<br />

a Summer Evening at LACMA<br />

On August 6, LACMA opened its doors and<br />

galleries to members <strong>of</strong> <strong>the</strong> <strong>Legacy</strong> <strong>Circle</strong><br />

and President’s <strong>Circle</strong> for an exclusive<br />

special event, Summer Evening at LACMA.<br />

Over 1,200 special guests <strong>of</strong> <strong>the</strong> museum<br />

attended what has become a favorite event<br />

among LACMA VIPs and <strong>the</strong>ir families.<br />

Attendees enjoyed live music, a barbeque<br />

picnic, art-making and storytelling for <strong>the</strong><br />

children, and special viewings <strong>of</strong> <strong>the</strong><br />

Broad Contemporary Art Museum and<br />

LACMA’s newly reinstalled pre-Columbian<br />

collection with a gallery installation<br />

designed by Jorge Pardo.<br />

Summer Evening at LACMA is just one <strong>of</strong><br />

<strong>the</strong> exciting benefits <strong>the</strong> museum extends<br />

with great appreciation to members <strong>of</strong> <strong>the</strong><br />

<strong>Legacy</strong> <strong>Circle</strong> at LACMA. Be sure to check<br />

future issues <strong>of</strong> Perspective for upcoming<br />

<strong>Legacy</strong> <strong>Circle</strong> events or visit our website<br />

at lacma.org/give.<br />

Left: <strong>Legacy</strong> <strong>Circle</strong> member Aleta Knight with<br />

guest Brian Ouzounian. Right: <strong>Legacy</strong> <strong>Circle</strong><br />

member Dr. Evalyn Michaelson<br />

For more information on <strong>the</strong> <strong>Legacy</strong> <strong>Circle</strong>,<br />

please fill out <strong>the</strong> enclosed reply card, or<br />

contact <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong> at<br />

LACMA at 323 932-5816.<br />

<strong>Gift</strong>s <strong>of</strong> Art:<br />

A First Comes<br />

to LACMA<br />

LACMA is thrilled to have recently added<br />

to <strong>the</strong> permanent collection a wonderful<br />

late-nineteenth century Orientalist<br />

painting, The Rug Merchant (Le<br />

Marchand de Tapis) by Rodolphe Ernst,<br />

thanks to <strong>the</strong> extreme generosity <strong>of</strong><br />

Gordon and Lizzy Anderson. Although<br />

<strong>the</strong> Andersons have visited LACMA many<br />

times over <strong>the</strong> years, this was <strong>the</strong>ir first<br />

foray into <strong>the</strong> field <strong>of</strong> art donations.<br />

Recalls Mr. Anderson, “We had quite a<br />

bit to learn on <strong>the</strong> subject, but from that<br />

initial call to LACMA’s <strong>Office</strong> <strong>of</strong> <strong>Gift</strong><br />

<strong>Planning</strong>, through meeting with LACMA’s<br />

curators to show <strong>the</strong>m <strong>the</strong> painting, right<br />

up to meeting with our own financial<br />

advisor armed with <strong>the</strong> knowledge and<br />

all <strong>the</strong> appropriate documentation<br />

which LACMA had provided, it was a very<br />

enjoyable, informative, and beneficial<br />

experience. We are very pleased to<br />

support LACMA in this way, and that <strong>the</strong><br />

public will be able to enjoy this painting<br />

as much as we have.”<br />

This is <strong>the</strong> first work by Rodolphe Ernst<br />

acquired by LACMA. “This painting will<br />

augment LACMA’s small group <strong>of</strong><br />

Orientalist works significantly,” says<br />

LACMA European Painting Curator,<br />

Claudia Einecke. Ernst belonged to a<br />

group <strong>of</strong> academic Orientalists who<br />

traveled extensively in search <strong>of</strong> motifs<br />

and ethnic types to depict in <strong>the</strong>ir<br />

paintings, but who invariably composed<br />

<strong>the</strong>ir works in <strong>the</strong> studio using props,<br />

costumed models, and photographs.<br />

In Le Marchand de Tapis, Ernst fills<br />

<strong>the</strong> picture space with objects and<br />

colorful textiles (not rugs as <strong>the</strong> title<br />

suggests) <strong>of</strong> <strong>the</strong> type favored by tourists<br />

<strong>of</strong> <strong>the</strong> era who visited nor<strong>the</strong>rn Africa<br />

and <strong>the</strong> Middle East. No doubt, Ernst<br />

acquired many <strong>of</strong> <strong>the</strong>se on his own<br />

travels, and <strong>the</strong>y serve to lend credibility<br />

to his picturesque evocation <strong>of</strong> an<br />

exotic world.<br />

3

Support Support LACMA With LACMA With<br />

A Life-Income A Life-Income Arrangement Arrangement<br />

Diana Veach Diana Veach<br />

Life Income Arrangements Life Income such as as Arrangements Charitable <strong>Gift</strong> such Annuities as Charitable and Charitable <strong>Gift</strong> Annuities Remainder and Charitable Remainder<br />

ASSOCIATE VICE PRESIDENT OF ASSOCIATE OF DEVELOPMENT VICE PRESIDENT<br />

OPERATIONS AND AND GIFT PLANNING OPERATIONS AND GIFT PLANN<br />

Trusts are are excellent ways Trusts to to support are excellent LACMAways in in a a to significant support LACMA way and in at at a <strong>the</strong> significant <strong>the</strong> same time way and at <strong>the</strong> same<br />

323<br />

time<br />

323 857-6207 323 857-6207<br />

provide you with a a variety provide <strong>of</strong> <strong>of</strong> tax tax you and with financial a variety benefits. <strong>of</strong> tax and financial benefits.<br />

dveach@lacma.org dveach@lacma.org<br />

Patrick Morrow Patrick Morrow<br />

A A Charitable <strong>Gift</strong> Annuity A Charitable with LACMA <strong>Gift</strong> guarantees Annuity with that LACMA you and/or guarantees o<strong>the</strong>r beneficiaries<br />

that you and/or o<strong>the</strong>r beneficiaries<br />

GIFT PLANNING OFFICER GIFT PLANNING OFFICER<br />

will receive a a fixed income will receive payment a for fixed for life life income exchange payment for for for an an life irrevocable in exchange gift gift <strong>of</strong> for <strong>of</strong> cash an or irrevocable or gift <strong>of</strong> 323 323 cash 932-5816 or<br />

323 932-5816<br />

pmorrow@lacma.org pmorrow@lacma.org<br />

marketable securities to to marketable LACMA (minimum securities $5,000 to LACMA for for (minimum one life, $10,000 $5,000 for for two one lives). life, $10,000 for two lives).<br />

Payout rates for for gift gift annuities Payout are are rates generally for gift annuities higher <strong>the</strong>n are o<strong>the</strong>r generally income-producing higher <strong>the</strong>n o<strong>the</strong>r vehicles, income-producing vehicles,<br />

such as as CDs, and are are fixed such <strong>the</strong> as <strong>the</strong> CDs, moment and are you fixed make <strong>the</strong> <strong>the</strong> moment gift, so so volatility you make in in <strong>the</strong> <strong>the</strong> gift, financial so volatility in <strong>the</strong> financial<br />

^ ^<br />

markets have no no effect. markets You also have enjoy no an an effect. immediate You also and enjoy sizable an immediate income tax tax and charitable sizable income tax charitable<br />

Los Angeles county Museum Los Angeles <strong>of</strong> <strong>of</strong> Artcounty Mu<br />

deduction <strong>the</strong> <strong>the</strong> year you deduction establish <strong>the</strong> <strong>the</strong> annuity, year you and establish a a good <strong>the</strong> portion annuity, <strong>of</strong> <strong>of</strong> every and a annuity good portion payment <strong>of</strong> every annuity payment<br />

<strong>Office</strong> <strong>of</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong> <strong>Office</strong> <strong>of</strong> <strong>Gift</strong> <strong>Planning</strong><br />

5905 Wilshire Boulevard 5905 Wilshire Boulevar<br />

you receive is is considered you tax-free receive income is considered for for <strong>the</strong> <strong>the</strong> tax-free anticipated income life life <strong>of</strong> for <strong>of</strong> <strong>the</strong> <strong>the</strong> anticipated annuity. life <strong>of</strong> <strong>the</strong> annuity.<br />

Los Angeles California Los 90036 Angeles California<br />

lacma.org/give lacma.org/give<br />

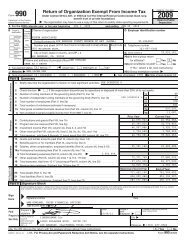

Selected <strong>Gift</strong> Selected Annuity Rates <strong>Gift</strong> Annuity Rates<br />

ONE LIFE<br />

ONE LIFE<br />

TWO LIVES<br />

TWO LIVES<br />

Age Payout Rate Age <strong>of</strong> <strong>of</strong> Return Payout Rate Ages <strong>of</strong> Return Payout Rate Ages <strong>of</strong> <strong>of</strong> Return Payout Rate <strong>of</strong> Return<br />

65 65 5.3% 65 5.3% 60/65 60/65 4.8%<br />

4.8%<br />

70 70 5.7% 70 5.7% 70/75 70/75 5.3%<br />

5.3%<br />

75 75 6.3% 75 6.3% 75/80 75/80 5.8%<br />

5.8%<br />

80 80 7.1% 80 7.1% 80/85 80/85 6.5%<br />

6.5%<br />

85 85 8.1% 85 8.1% 85/90 85/90 7.5%<br />

7.5%<br />

90+ 9.5% 90+ 90/95+ 9.5% 90/95+ 9.0%<br />

9.0%<br />

For For more information on on For planned more information giving on<br />

or or donating art art to to LACMA, or donating please art to LACM<br />

contact <strong>the</strong> <strong>the</strong> <strong>Office</strong> <strong>of</strong> <strong>of</strong> <strong>Gift</strong> contact <strong>Planning</strong>: <strong>the</strong> <strong>Office</strong> <strong>of</strong> G<br />

The The financial and and tax tax aspects The <strong>of</strong> <strong>of</strong> any financial any gift gift to<br />

and to tax aspec<br />

LACMAare are determined by by each LACMA donor’s are determined by ea<br />

personal circumstances. We We personal recommend circumstances. We<br />

consulting appropriate pr<strong>of</strong>essional consulting advisors appropriate pr<strong>of</strong>e<br />

before entering into into any any gift gift before arrangement. entering into any gift<br />

LACMA Federal Tax Tax ID ID No: No: 95-2264067<br />

LACMA Federal Tax ID No: 95<br />

Page 1: 1: Chris Burden, Urban Light, Page 2008, 1: Chris made Burden, possible Urban Ligh<br />

by by <strong>the</strong> <strong>the</strong> Gordon Family Foundation’s by <strong>the</strong> gift gift Gordon to<br />

to Family Foundatio<br />

Transformation: The The LACMA Campaign, Transformation: © © Chris Burden The LACMA Camp<br />

Page 2: 2: Edward Keinholz, Back Seat Seat Page Dodge 2: Edward ‘38,<br />

‘38, Keinholz, Back S<br />

1964, purchased with with funds provided 1964, by purchased by <strong>the</strong><br />

<strong>the</strong> with funds prov<br />

Art Art Museum Council Fund, © © Edward Art Museum Kienholz Council EstateFund, © Ed<br />

Page 3: 3: Rodolphe Ernst, The The Rug Rug Page Merchant 3: Rodolphe Ernst, The Ru<br />

(Le (Le Marchand de de Tapis), after 1885, (Le gift Marchand gift <strong>of</strong> <strong>of</strong> Mr. Mr. and<br />

de and Tapis), after 18<br />

Mrs. Mrs. Gordon Anderson Mrs. Gordon Anderson<br />

All All photos © © 2009 2009 Museum Associates/LACMA<br />

All photos © 2009 Museum Asso<br />

For those interested in in For securing those interested fixed income securing down <strong>the</strong> <strong>the</strong> fixed road, income LACMA down <strong>of</strong>fers <strong>the</strong> Deferred road, LACMA <strong>of</strong>fers Deferred<br />

Payment <strong>Gift</strong> Annuities. Payment With <strong>the</strong>se, <strong>Gift</strong> Annuities. payments are are With delayed <strong>the</strong>se, until payments a a specific are delayed date determined until a specific date determined<br />

by by you—your anticipated by you—your year <strong>of</strong> <strong>of</strong> retirement, anticipated for for year instance—<strong>the</strong>reby <strong>of</strong> retirement, for increasing instance—<strong>the</strong>reby <strong>the</strong> <strong>the</strong> initial increasing <strong>the</strong> initial<br />

income tax tax charitable income deduction tax and charitable annuity deduction rate <strong>of</strong> <strong>of</strong> return. and annuity rate <strong>of</strong> return.<br />

A A Charitable Remainder A Charitable Trust also Remainder provides you Trust and/or also o<strong>the</strong>r provides beneficiaries you and/or with o<strong>the</strong>r income beneficiaries with income<br />

for for life life or or a a fixed period for <strong>of</strong> <strong>of</strong> life time, or a and fixed <strong>the</strong>reafter period <strong>of</strong> distributes time, and <strong>the</strong> <strong>the</strong>reafter remaining distributes assets to to <strong>the</strong> LACMA. remaining assets to LACMA.<br />

An An immediate income tax An tax immediate deduction, income equal to to tax <strong>the</strong> <strong>the</strong> deduction, present value equal <strong>of</strong> <strong>of</strong> to what <strong>the</strong> LACMA present can value be<br />

be<strong>of</strong> what LACMA can be<br />

expected to to receive when expected <strong>the</strong> <strong>the</strong> trust to receive terminates, when is is <strong>the</strong> available trust terminates, once <strong>the</strong> <strong>the</strong> trust is available is is established. once <strong>the</strong> trust is established.<br />

A A Charitable Remainder A Charitable Trust gives Remainder you <strong>the</strong> <strong>the</strong> flexibility Trust gives <strong>of</strong> <strong>of</strong> design—you <strong>the</strong> flexibility select <strong>the</strong> <strong>of</strong> <strong>the</strong> design—you beneficiaries,<br />

<strong>the</strong> <strong>the</strong> trustee, and ciaries, <strong>the</strong> <strong>the</strong> distribution <strong>the</strong> trustee, rate. and Trusts <strong>the</strong> distribution can provide rate. a a fixed Trusts payout can provide (annuitya fixed payout (annuity<br />

trust) or or a a variable payment trust) or that a variable changes payment with <strong>the</strong> <strong>the</strong> that value changes <strong>of</strong> <strong>of</strong> <strong>the</strong> <strong>the</strong> trust with assets <strong>the</strong> value (unitrust). <strong>of</strong> <strong>the</strong> trust assets (unitrust).<br />

Charitable <strong>Gift</strong> Annuities Charitable and Charitable <strong>Gift</strong> Annuities Remainder and Charitable Trusts are are Remainder excellent mechanisms Trusts are excellent mechanisms<br />

select <strong>the</strong> benefi-<br />

for for providing both for for for your providing own future both and for <strong>the</strong> <strong>the</strong> your future own <strong>of</strong> <strong>of</strong> future LACMA—<strong>the</strong> and perfect future <strong>of</strong> legacy LACMA—<strong>the</strong> to<br />

to perfect legacy to<br />

satisfy your philanthropic satisfy goals your and philanthropic long-term financial goals and plans. long-term financial plans.<br />

For more information on For on life life more income information arrangements, on life income please fill fill arrangements, out <strong>the</strong> <strong>the</strong> enclosed please reply fill out <strong>the</strong> enclosed reply<br />

card, or or contact <strong>the</strong> <strong>the</strong> <strong>Office</strong> card, <strong>of</strong> <strong>of</strong> or <strong>Gift</strong> contact <strong>Planning</strong> <strong>the</strong> <strong>Office</strong> at at LACMA <strong>of</strong> <strong>Gift</strong> at at 323 <strong>Planning</strong> 932-5816. at LACMA at 323 932-5816.<br />

4<br />

4<br />

4