IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Putnam/Northern Westchester<br />

BOARD OF COOPERATIVE EDUCATIONAL SERVICES<br />

200 BOCES Drive, Yorktown Heights, NY 10598-4399<br />

(914) 248-2455 FAX (914) 962-6819<br />

March, 2006<br />

<strong>IMPORTANT</strong> <strong>INFORMATION</strong> <strong>About</strong><br />

<strong>Your</strong> <strong>ELIGIBILITY</strong> <strong>For</strong> <strong>HEALTH</strong> INSURANCE<br />

Annual Certification of Spousal and Dependent Eligibility<br />

<strong>For</strong> July 2006– June 2007<br />

In accordance with your district’s Working Spouse Rule, each employee/ retiree with<br />

family coverage must complete the enclosed Certification of Spousal Earnings form<br />

annually if your district is providing primary coverage (hospital, medical or<br />

prescription drug benefits) for your spouse (and/or children depending upon the<br />

birthday rule). This form does not need to be completed if your spouse (and children<br />

when applicable) is covered by another insurance plan provided by his/her own<br />

employer that is primary.<br />

If your district is providing primary coverage for your spouse (and children when<br />

applicable), then your contribution towards the premium will be increased by the<br />

“buy-in” amount unless the conditions specified on the enclosed Summary<br />

Explanation are met. If the conditions are met, then the “buy-in” will not be<br />

assessed.<br />

Certification of Spousal Earnings forms must be returned to the Office of Risk<br />

Management at BOCES, 200 BOCES Drive, Yorktown Heights, NY 10598 NO<br />

LATER THAN May 1, 2006. Failure to return the form or submission of an<br />

incomplete form may result in assessment of the “buy-in”, or delayed or<br />

suspended enrollment. Please remember that this form must be filled out every<br />

year if your spouse receives primary coverage (hospital, medical or prescription<br />

drug benefits) from your school district!<br />

ALL members with family coverage should receive this mailing. IF YOU ARE A<br />

SINGLE PARENT THIS FORM MUST BE COMPLETED. If you believe that it<br />

is not applicable to you, please disregard.<br />

Note:<br />

The PNW BOCES administers the working spouse rule on behalf of<br />

your school district or BOCES.<br />

Enclosures:<br />

Working Spouse Rule Summary Explanation (2 sided)<br />

Working Spouse Rule Certification <strong>For</strong>m (2 sided)<br />

Service and Innovation Through Partnership

Certification of Spousal and Dependent Eligibility: July 1, 2006– June 30, 2007<br />

In accordance with the Working Spouse Rule, enrollment of a spouse (and other dependents when applicable) may<br />

result in additional cost to the employee/ retiree. To certify that your spouse/ dependents are eligible for coverage<br />

without the additional cost, you must complete and return this form by May 1, 2006. THIS FORM MUST BE<br />

FILLED OUT EVERY YEAR! Failure to return the form or submission of an incomplete form may result in<br />

additional cost to you.<br />

A. Name of Employee/Retiree B. Spouse’s Name<br />

Social Security # Social Security #<br />

School District<br />

Date of Marriage<br />

Date of Birth<br />

Date of Birth<br />

Active □ Retired □ COBRA □<br />

Employed □ Self-Employed □ Retired □<br />

Unemployed □<br />

Home Address<br />

Name and address of present employer or business<br />

(must be completed)<br />

Home phone<br />

Work phone<br />

C. Is your spouse covered by another health plan other than yours? □No □Yes If yes, name<br />

My spouse is covered by □Part A of Medicare and/or □Part B of Medicare<br />

D. My spouse’s annual earnings in 2005 were:<br />

1. _____More than $98,269 2. _____Less than $98,269 but more than $38,926 3. _____Less than $38,926<br />

Earnings includes<br />

• all wages, salaries, tips, etc. of the spouse; and<br />

• any wages, salaries, tips etc. of the school district (or BOCES) employee/ retiree that are paid by any business or corporation in which<br />

the spouse and/ or school district (or BOCES) employee/ retiree is a full or partial owner.<br />

• If the spouse and/ or school district (or BOCES) employee/ retiree is a full or partial owner of any business or corporation, earnings<br />

also includes a pro-rata share of the business’ and/ or corporations’ taxable income, ordinary income or net profit. <strong>For</strong> example, if the<br />

spouse and school district employee each own 25% of a corporation’s stock, then 50% of the corporation’s taxable income would be<br />

considered.<br />

• Other income, excluding pension income.<br />

E. SINGLE PARENTS □Widowed □Not married □Divorced<br />

Are children covered under any other health plan? □No □Yes<br />

If yes, name ___________________________<br />

REVERSE SIDE OF FORM MUST BE COMPLETED<br />

<strong>For</strong>m-WSRCERT2006front<br />

Service and Innovation Through Partnership

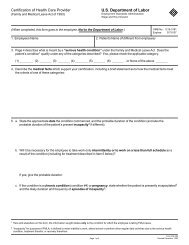

BLOCK “F” MUST BE COMPLETED BY THE SPOUSE’S EMPLOYER.<br />

(If self-employed, unemployed or retired, disregard block “F”.)<br />

BLOCK “G” MUST BE SIGNED BY EMPLOYEE/RETIREE<br />

F (1) The spouse named in block B is not covered by a health plan offered through his/ her own<br />

employer that provides hospital, medical/ surgical and prescription drug benefits.<br />

Please check the applicable box:<br />

S/he selected alternative benefits or cash, such as through a cafeteria plan;<br />

S/he failed to elect health benefits during an initial or open enrollment period;<br />

Next open enrollment date is______________;<br />

S/he is a new hire still in a waiting period. S/he will be eligible_________________.<br />

Health benefits are not offered to any employee in his/her employment category;<br />

Other; please explain.____________________________________________________<br />

F (2) If s/he did elect benefits, would s/he be required to make a contribution toward the premium?<br />

Yes No<br />

If yes,<br />

F (3) How much is the total premium? (total premium is employer share + employee contribution)<br />

___________________<br />

F (4) How much would the employee have to contribute for a single plan? ___________________<br />

F (5) How much would the employee have to contribute for a family plan?___________________<br />

___________________________________________<br />

Print name of spouse’s employer’s representative<br />

_________________________<br />

Date<br />

_____________________________________________________________________________<br />

Signature of spouse’s employer’s representative<br />

________________________________________<br />

Title<br />

__________________________<br />

Phone number<br />

Don’t <strong>For</strong>get to<br />

sign Block<br />

“G”<br />

G. Employee’s/ Retiree’s certification<br />

I hereby certify that the information contained in blocks A-E on the reverse side is true<br />

and complete. I understand that filing a statement to defraud is a criminal act. Block F<br />

has been completed by my spouse’s employer, if applicable.<br />

__________________________________________________________<br />

Employee’s/ Retiree’s signature / ________________ Date<br />

Return this form no later than<br />

May 1, 2006 to:<br />

Office of Risk Management,<br />

Putnam/ North. West. BOCES<br />

200 BOCES Drive, Yorktown Heights, NY 10598<br />

Service and Innovation Through Partnership