IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

IMPORTANT INFORMATION About Your ELIGIBILITY For HEALTH ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

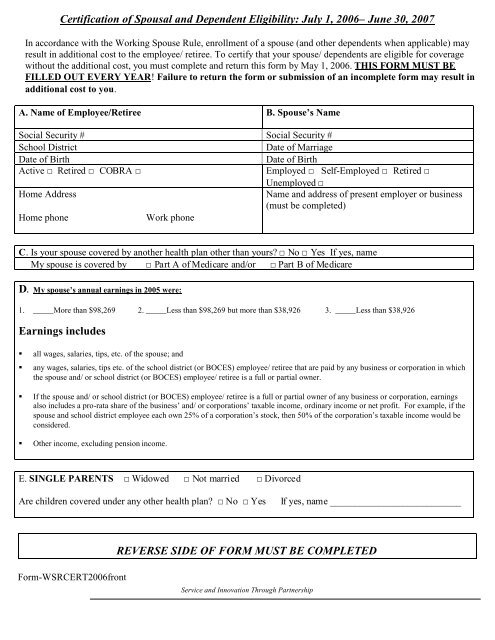

Certification of Spousal and Dependent Eligibility: July 1, 2006– June 30, 2007<br />

In accordance with the Working Spouse Rule, enrollment of a spouse (and other dependents when applicable) may<br />

result in additional cost to the employee/ retiree. To certify that your spouse/ dependents are eligible for coverage<br />

without the additional cost, you must complete and return this form by May 1, 2006. THIS FORM MUST BE<br />

FILLED OUT EVERY YEAR! Failure to return the form or submission of an incomplete form may result in<br />

additional cost to you.<br />

A. Name of Employee/Retiree B. Spouse’s Name<br />

Social Security # Social Security #<br />

School District<br />

Date of Marriage<br />

Date of Birth<br />

Date of Birth<br />

Active □ Retired □ COBRA □<br />

Employed □ Self-Employed □ Retired □<br />

Unemployed □<br />

Home Address<br />

Name and address of present employer or business<br />

(must be completed)<br />

Home phone<br />

Work phone<br />

C. Is your spouse covered by another health plan other than yours? □No □Yes If yes, name<br />

My spouse is covered by □Part A of Medicare and/or □Part B of Medicare<br />

D. My spouse’s annual earnings in 2005 were:<br />

1. _____More than $98,269 2. _____Less than $98,269 but more than $38,926 3. _____Less than $38,926<br />

Earnings includes<br />

• all wages, salaries, tips, etc. of the spouse; and<br />

• any wages, salaries, tips etc. of the school district (or BOCES) employee/ retiree that are paid by any business or corporation in which<br />

the spouse and/ or school district (or BOCES) employee/ retiree is a full or partial owner.<br />

• If the spouse and/ or school district (or BOCES) employee/ retiree is a full or partial owner of any business or corporation, earnings<br />

also includes a pro-rata share of the business’ and/ or corporations’ taxable income, ordinary income or net profit. <strong>For</strong> example, if the<br />

spouse and school district employee each own 25% of a corporation’s stock, then 50% of the corporation’s taxable income would be<br />

considered.<br />

• Other income, excluding pension income.<br />

E. SINGLE PARENTS □Widowed □Not married □Divorced<br />

Are children covered under any other health plan? □No □Yes<br />

If yes, name ___________________________<br />

REVERSE SIDE OF FORM MUST BE COMPLETED<br />

<strong>For</strong>m-WSRCERT2006front<br />

Service and Innovation Through Partnership