Annual Report Annual Report - NZX

Annual Report Annual Report - NZX

Annual Report Annual Report - NZX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

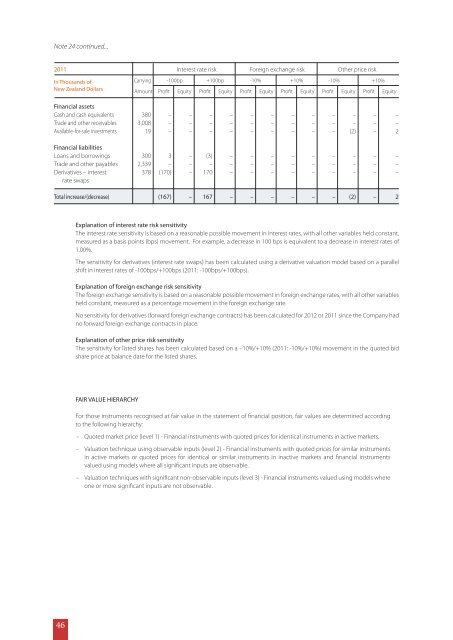

Note 24 continued...<br />

2011 Interest rate risk Foreign exchange risk Other price risk<br />

In Thousands of Carrying -100bp +100bp -10% +10% -10% +10%<br />

New Zealand Dollars Amount Profit Equity Profit Equity Profit Equity Profit Equity Profit Equity Profit Equity<br />

Financial assets<br />

Cash and cash equivalents 380 – – – – – – – – – – – –<br />

Trade and other receivables 3,008 – – – – – – – – – – – –<br />

Available-for-sale investments 19 – – – – – – – – – (2) – 2<br />

Financial liabilities<br />

Loans and borrowings 300 3 – (3) – – – – – – – – –<br />

Trade and other payables 2,339 – – – – – – – – – – – –<br />

Derivatives – interest 378 (170) – 170 – – – – – – – – –<br />

rate swaps<br />

Total increase/(decrease) (167) – 167 – – – – – – (2) – 2<br />

Explanation of interest rate risk sensitivity<br />

The interest rate sensitivity is based on a reasonable possible movement in interest rates, with all other variables held constant,<br />

measured as a basis points (bps) movement. For example, a decrease in 100 bps is equivalent to a decrease in interest rates of<br />

1.00%.<br />

The sensitivity for derivatives (interest rate swaps) has been calculated using a derivative valuation model based on a parallel<br />

shift in interest rates of -100bps/+100bps (2011: -100bps/+100bps).<br />

Explanation of foreign exchange risk sensitivity<br />

The foreign exchange sensitivity is based on a reasonable possible movement in foreign exchange rates, with all other variables<br />

held constant, measured as a percentage movement in the foreign exchange rate.<br />

No sensitivity for derivatives (forward foreign exchange contracts) has been calculated for 2012 or 2011 since the Company had<br />

no forward foreign exchange contracts in place.<br />

Explanation of other price risk sensitivity<br />

The sensitivity for listed shares has been calculated based on a –10%/+10% (2011: -10%/+10%) movement in the quoted bid<br />

share price at balance date for the listed shares.<br />

FAIR VALUE HIERARCHY<br />

For those instruments recognised at fair value in the statement of financial position, fair values are determined according<br />

to the following hierarchy:<br />

– Quoted market price (level 1) - Financial instruments with quoted prices for identical instruments in active markets.<br />

– Valuation technique using observable inputs (level 2) - Financial instruments with quoted prices for similar instruments<br />

in active markets or quoted prices for identical or similar instruments in inactive markets and financial instruments<br />

valued using models where all significant inputs are observable.<br />

– Valuation techniques with significant non-observable inputs (level 3) - Financial instruments valued using models where<br />

one or more significant inputs are not observable.<br />

46