OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

OEFFA and OEFFA Certification Board Meetings 10 October 2010 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

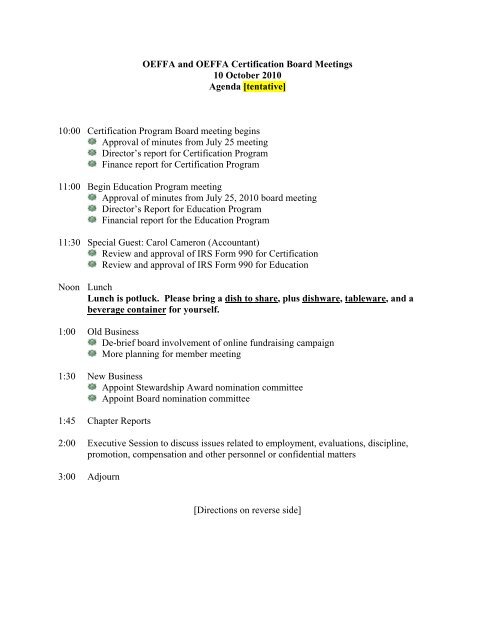

<strong>OEFFA</strong> <strong>and</strong> <strong>OEFFA</strong> <strong>Certification</strong> <strong>Board</strong> <strong>Meetings</strong><br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong><br />

Agenda [tentative]<br />

<strong>10</strong>:00 <strong>Certification</strong> Program <strong>Board</strong> meeting begins<br />

Approval of minutes from July 25 meeting<br />

Director’s report for <strong>Certification</strong> Program<br />

Finance report for <strong>Certification</strong> Program<br />

11:00 Begin Education Program meeting<br />

Approval of minutes from July 25, 20<strong>10</strong> board meeting<br />

Director’s Report for Education Program<br />

Financial report for the Education Program<br />

11:30 Special Guest: Carol Cameron (Accountant)<br />

Review <strong>and</strong> approval of IRS Form 990 for <strong>Certification</strong><br />

Review <strong>and</strong> approval of IRS Form 990 for Education<br />

Noon Lunch<br />

Lunch is potluck. Please bring a dish to share, plus dishware, tableware, <strong>and</strong> a<br />

beverage container for yourself.<br />

1:00 Old Business<br />

De-brief board involvement of online fundraising campaign<br />

More planning for member meeting<br />

1:30 New Business<br />

Appoint Stewardship Award nomination committee<br />

Appoint <strong>Board</strong> nomination committee<br />

1:45 Chapter Reports<br />

2:00 Executive Session to discuss issues related to employment, evaluations, discipline,<br />

promotion, compensation <strong>and</strong> other personnel or confidential matters<br />

3:00 Adjourn<br />

[Directions on reverse side]

2<br />

DIRECTIONS – Granville, Ohio<br />

(Barney-Davis Hall, Denison University)<br />

FROM THE NORTH<br />

If coming from the north, you should exit Interstate 71 at Bellville <strong>and</strong> take State Route 13 south<br />

into Mt. Vernon. From there, Route 661 south will bring you the 23 miles into Granville. At the<br />

stop sign at College Street, turn right <strong>and</strong> drive approx. 2 blocks to the front entrance to Denison,<br />

where you will make a right turn to enter (then see below).<br />

FROM EAST, WEST, OR SOUTH<br />

The college is less than <strong>10</strong> miles north of Interstate 70 (Exit 126) on Route 37. Take 37 north<br />

into Granville <strong>and</strong> stay on it to the front entrance to Denison (then see below).<br />

From the west you can also take 161 into Granville which becomes Route 37. Follow it to the<br />

second Granville exit – turn left at the end of the ramp <strong>and</strong> continue to the front entrance to<br />

Denison (then see below).<br />

ONCE YOU ARE AT THE FRONT ENTRANCE TO DENISON<br />

Drive up the driveway which is the front entrance to Denison. At the top (where the yield sign<br />

is) turn left. You will pass two salmon-colored buildings which sit near the roadway. The first is<br />

the “Doane Administration Building.” The second is the McPhail Center for Environmental<br />

Studies/Barney-Davis Building. That’s where we’ll be meeting. After you have driven by our<br />

building you will find slant-style parking spots on your right (behind Denison’s library).<br />

If there are no spots there, keep going, <strong>and</strong> then circle to the backside of campus by turning right<br />

at every stop sign that you come to. This will lead you to the parking garage. Follow the signs<br />

to enter the garage.<br />

Park <strong>and</strong> exit the garage through the Slayter Student Union door. By stairs or elevator, go up to<br />

the “Campus Commons” level. Exit onto the ‘academic quad’ – the door is opposite the<br />

elevator. You are looking for the Barney-Davis building, which would be approximately at 1:00<br />

as you exit onto the quad. We will meet on the 1 st floor of the building.<br />

For a map of Denison’s campus: http://www.denison.edu/campus/denison_campus_map.pdf<br />

I’ll have my cell phone on, if you get lost <strong>and</strong> can call: (740) 398-9099.

3<br />

***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT<br />

<strong>OEFFA</strong> 501 (c) 5 - <strong>Certification</strong><br />

<strong>Board</strong> Meeting Minutes<br />

July 25, 20<strong>10</strong><br />

Granville, Ohio<br />

Present: Amy Bodiker, Mary Ida Compton, Darren Malhame, Joan Richmond, John Sowder, <strong>and</strong><br />

Carol Gol<strong>and</strong> (staff).<br />

Present, not voting: Dave Benchoff, Gary Cox, Steve Edwards, Mike Laughlin, Harv Roehling,<br />

Ed Snavely, <strong>and</strong> Mardy Townsend.<br />

Absent: Tom Redfern.<br />

Darren called the meeting to order at <strong>10</strong>:00am.<br />

Minutes from meetings in 20<strong>10</strong> on January 24 <strong>and</strong> April 25 were approved with minor edits.<br />

Carol began with the Director’s Report. NOP pesticide residue testing requirements have been<br />

put on hold. Applications for certification outside the core area were discussed. Staff is able to<br />

accommodate this, but questions surround training needed regarding the new pasture rules for<br />

both existing <strong>and</strong> new clients, as well as any new requirements that arise from increased food<br />

safety attention. The number of certification applications is below expectations. The <strong>Board</strong><br />

discussed the need to maintain high quality inspections <strong>and</strong> timely certification. Non-renewing<br />

farmers will be contacted by staff. We reviewed the timing of inspections, paperwork<br />

processing, <strong>and</strong> fee setting <strong>and</strong> collection. The <strong>Board</strong> expects to move up the timing for fee<br />

setting to the <strong>October</strong> meeting to allow for earlier application processing.<br />

Darren reviewed the financial reports. Our outside auditors are completing their audit,<br />

adjusting some of the figures in the reports. They don’t anticipate any cash flow needs in the<br />

coming year, but if there are any, the timings of cash flows for the education <strong>and</strong> certification<br />

arms are complementary. The two organizations may lend to each other using a competitive<br />

interest rate (currently about 4%) if needed. Darren reviewed staffing changes, which apply to<br />

the <strong>OEFFA</strong> education as well (see those minutes for details). Our next formal audit should be<br />

for fiscal year ended March 31, 2011.<br />

The meeting was adjourned at <strong>10</strong>:30.<br />

Respectfully submitted by Mary Ida Compton, Secretary.

4<br />

Ohio Ecological Food & Farm Association<br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong><br />

Director’s Report for the <strong>Certification</strong> Program<br />

Applications In <strong>and</strong> Out:<br />

As of <strong>October</strong> 4, 20<strong>10</strong>:<br />

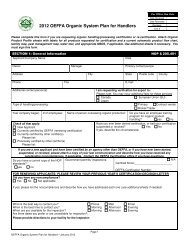

We have received a total of 594 applications, comprised of:<br />

‣ 560 grower applications<br />

‣ 34 h<strong>and</strong>ler applications<br />

These 594 include 77 new clients (65 growers, 12 processors) this year.<br />

NB: Our budget for this FY was based on 645 growers <strong>and</strong> 50 processors.<br />

We estimate 32 more h<strong>and</strong>lers will come in this year (we accept those year-round) along with <strong>10</strong>-20 all-year<br />

greenhouses, maple syrup operations, <strong>and</strong> late renewals.<br />

FYI: we contacted 98 of the grower clients certified with us in 2009 whom we had not heard from yet.<br />

Here is the response we received:<br />

No contact (message left if phone #, others no phone) 56<br />

Going with another agency KDA 3<br />

GOA 1<br />

MOSA 2 (EU CERT.)<br />

UNKNOWN 6<br />

Plans to certify in future but no need for it now 5<br />

Plans to renew this year (this # also included above) 4<br />

No market 4<br />

No reason cited 3<br />

Not growing anything organically this year 3<br />

Sold farm & moved/rented farm/retiring 3<br />

Crop destroyed 2<br />

Wants to sell raw milk & there is a conflict with his milk company 1<br />

Organics was a ‘hobby’—no reason to renew 1<br />

Now farming with another certified organic family member 1<br />

Client having difficulty with pasture rule 1<br />

Market does not rely on organic seal (customer knows practices) 1<br />

Didn’t want to deal with inspector when he was trying to work 1<br />

Unhappy with service 1

52<br />

All growers listed in the table have received a notice of non-renewal letter, which gives them the<br />

opportunity to renew within 30 days or surrender their certificate.<br />

As of Oct 4:<br />

‣ 150 growers have received their certificates <strong>and</strong> decision letters<br />

‣ 45 more certificates (totaling 195) have been issued for growers, but they have not yet been mailed<br />

out (waiting letters)<br />

‣ 71 applications have been completed through inspection <strong>and</strong> are waiting for post-review/decision<br />

‣ 172 applications are with inspectors<br />

‣ 122 are still incomplete/non-compliant (Remember that some applications get hung up in the pipeline as we<br />

wait for additional information from our client.)<br />

‣ 5 h<strong>and</strong>ler applications <strong>and</strong> zero grower applications are waiting for pre-review<br />

Livestock Pasture Rule<br />

Paul has held a number of trainings on the Livestock Pasture Rule via conference call. His impression, <strong>and</strong><br />

that of our inspectors, is that most people are h<strong>and</strong>ling the new rule <strong>and</strong> the documentation it requires well.<br />

We may do some in-person trainings, in collaboration with Organic Valley, with Amish communities<br />

targeted as high priority. These would happen after the first of the new year.<br />

News from the NOP: Pesticide Residue Testing!<br />

I reported last time that we’d received word from the NOP that we will be required to collect samples of<br />

edible plant parts <strong>and</strong> submit these to a USDA lab for testing for pesticide residues. We’ve received<br />

additional word that this is being postponed, but we will probably want to assume that this will be a<br />

requirement in 2011 <strong>and</strong> budget for it accordingly.<br />

Staffing<br />

Kelli Natale, who joined our staff as a <strong>Certification</strong> Program Assistant in June, is settling in well. Michelle<br />

Gregg-Skinner gave notice – her final day of work with <strong>OEFFA</strong> was Sept. <strong>10</strong> th . Lexie <strong>and</strong> I are in process<br />

of reviewing applications for Michelle’s replacement <strong>and</strong> interviewing them. We hope to have the new<br />

person on-board asap.<br />

NOP Visit<br />

In early August I had a call from an administrator in the NOP (“ not a compliance or regulatory phone call,”<br />

he quickly assured me). Miles McEvoy <strong>and</strong> two other NOP representatives decided that they needed to take<br />

a field trip to see how things are playing out on the ground <strong>and</strong> decided that their first trip would be to<br />

Ohio. They asked us to arrange several farm visits, focusing on livestock. Their visit was August 18 th , <strong>and</strong><br />

most of our certification staff was able to accompany them.<br />

While they really were interested in the on-farm implementation of NOP regulations, they also used this as<br />

an opportunity to informally assess our program, <strong>and</strong> provide feedback to us. They were pleased with our<br />

implementation of the Livestock Pasture Rule <strong>and</strong> the overall quality of our review process, but noted that<br />

we need to work on our timeliness. They plan to submit a visit assessment to us in the upcoming weeks<br />

(again, this will not be regulatory in nature nor affect our accreditation/compliance).<br />

See attached report (<strong>and</strong> future newsletter article) by Kate Schmidt.

63<br />

Looking ahead to 2011<br />

For a variety of reasons (chief among them: evening out workload <strong>and</strong> cash flow through the year) we<br />

would like to explore having certification forms available earlier in the year than has been the practice until<br />

now. Ground Hog Day has always been the target date, <strong>and</strong> we’ve used the January <strong>Board</strong> meeting to<br />

finalize certification budget <strong>and</strong> set certification fees so that the applications can be printed <strong>and</strong> sent out.<br />

To move to an earlier date for those applications to be available would mean moving up significantly the<br />

budget-setting piece (or at least the fee-setting piece, but we cannot responsibly set fees without the financial<br />

context provided by the budget. However, doing all of that for early <strong>October</strong> (this <strong>Board</strong> meeting) was not<br />

possible.<br />

Action Item: I would like the <strong>Board</strong> to designate a committee that can be authorized to approve a<br />

preliminary budget <strong>and</strong> set certification fees prior to our January meeting so that we can move forward with<br />

earlier availability of applications, if this proves feasible <strong>and</strong> advisable.<br />

To Core or Not to Core<br />

The issue of not accepting clients outside our core region, yet continuing to certify existing clients, has<br />

affected the coordination of 20<strong>10</strong> inspections.<br />

Action Item: Staff recommends a decision be made on the issue of defining our region (as Ohio <strong>and</strong> the<br />

five surrounding states or as the states in which we currently certify) so that we may either:<br />

1. Let folks who are calling about 2011 know definitively the region from which we will accept<br />

applications; or<br />

2. Start transitioning folks outside the ‘core’ to other agencies in 2011 if necessary.

74<br />

NOP Representatives Tour <strong>OEFFA</strong>-<br />

Certified Organic Livestock Operations<br />

Six months have now passed since the<br />

USDA’s National Organic Program (NOP)<br />

issued the Livestock Access to Pasture Rule,<br />

further substantiating the requirements<br />

regarding the active management of certified<br />

organic livestock on pasture. In an effort to<br />

gather information on how certifiers <strong>and</strong><br />

organic livestock producers are working to<br />

implement the new rule, NOP<br />

representatives from Washington, D.C.<br />

came to Ohio to visit three of <strong>OEFFA</strong>’s own<br />

certified organic farms on August 19, 20<strong>10</strong>.<br />

Kate Schmidt, Lexie Stoia Pierce, Kelli Natale, <strong>and</strong><br />

Michelle Gregg-Skinner of <strong>OEFFA</strong> <strong>Certification</strong> “put<br />

out to pasture” on the Weaver Family Farm.<br />

At the end of the day, the NOP indicated<br />

that <strong>OEFFA</strong> had developed a strong system<br />

for equipping its certified producers with<br />

information <strong>and</strong> tools for underst<strong>and</strong>ing the<br />

new rule <strong>and</strong> developing successful pasturemanagement<br />

plans.<br />

Melissa Bailey, Mark Keating, <strong>and</strong> Miles McEvoy of<br />

the NOP with Verlin Weaver on his family’s certified<br />

organic dairy farm in Dalton, OH.<br />

Members of the <strong>OEFFA</strong> <strong>Certification</strong> staff<br />

accompanied Miles McEvoy, NOP Deputy<br />

Administrator, Melissa Bailey, NOP<br />

St<strong>and</strong>ards Division Director, <strong>and</strong> Mark<br />

Keating, NOP Agricultural Marketing<br />

Specialist, for the day’s farm tours. The<br />

group observed both ruminant livestock <strong>and</strong><br />

poultry on these farms, walked the pastures,<br />

<strong>and</strong> discussed pasture-management <strong>and</strong><br />

recordkeeping strategies with each of the<br />

producers.<br />

Melissa Bailey & Mark Keating of the NOP discuss<br />

pasture-management plans with <strong>OEFFA</strong><br />

<strong>Certification</strong>’s Livestock Specialist, Paul Dutter.<br />

The NOP will use the information collected<br />

during their visit to Ohio to develop further<br />

guidance to help <strong>OEFFA</strong> <strong>and</strong> the other<br />

accredited certifiers fully <strong>and</strong> consistently<br />

implement the Livestock Access to Pasture<br />

Rule.

8<br />

Ohio Ecological Food & Farm Association <strong>Certification</strong><br />

Statement of Financial Position (Balance Sheet)<br />

August 31, 20<strong>10</strong><br />

ASSETS<br />

Current Assets<br />

Checking/Savings<br />

1-1<strong>10</strong>0 · Cash<br />

1-11<strong>10</strong> · UBS (PW) -009<strong>10</strong> 84 2,844.61<br />

1-1150 · Fifth Third 176,470.88 1<br />

1-1155 · Fifth Third MM 75,795.81<br />

1-1160 · Chase Bank 3,446.65<br />

Total 1-1<strong>10</strong>0 · Cash 258,557.95<br />

Accounts Receivable<br />

1200 · Accounts Receivable 12,815.96<br />

12<strong>10</strong> · Due from <strong>OEFFA</strong> Education 13,677.49<br />

Total Accounts Receivable 26,493.45<br />

Total Current Assets 285,051.40<br />

Fixed Assets<br />

1-2<strong>10</strong>0 · Computer Equipment & Software 464.40<br />

Total Fixed Assets 464.40<br />

Other Assets<br />

1300 · Inventory 2,293.00<br />

Total Other Assets 2,293.00<br />

TOTAL ASSETS 287,808.80<br />

LIABILITIES & NET ASSETS<br />

Liabilities<br />

Current Liabilities<br />

Accounts Payable<br />

2-7000 · Accounts Payable 4,827.85<br />

Total Accounts Payable 4,827.85<br />

Other Current Liabilities<br />

2-1300 · Payroll Penalties & Interest Payab <strong>10</strong>,<strong>10</strong>9.06 2<br />

2-1400 · Payroll Tax Liabilities<br />

2-1420 · Accrued Payroll Liability 5,211.58 3<br />

2-1420 · FICA Payable 990.78<br />

2-1430 · Fed Withholding 496.48<br />

2-1450 · State Income Tax Payable 403.04<br />

2-1460 · School District Withheld 6.20<br />

2-1470 · City Income Tax Payable 303.08<br />

2-1480 · ODJFS Payable 34.87<br />

2-1485 · BWC Payable 184.20<br />

2-1495 · Medical Insurance Payable 287.17<br />

Total 2-1400 · Payroll Tax Liabilities 7,917.40<br />

Total Other Current Liabilities 18,026.46<br />

Total Liabilities 22,854.31<br />

Net Assets<br />

3-8001 · *Retained Earnings 26,838.65<br />

Net Income 238,115.84<br />

Total Net Assets 264,954.49<br />

TOTAL LIABILITIES & NET ASSETS 287,808.80

9<br />

Notes to the Financials dated August 31, 20<strong>10</strong><br />

1<br />

$176,470.88 represents the cleared balance in the Fifth Third checking account <strong>and</strong> corresponds to the actual bank balance.<br />

Numerous entries had to be entered into the accounting records in order to reconcile with the bank statements. These<br />

have been completed through August 31, 20<strong>10</strong>, but many remain under investigation.<br />

2<br />

Please see the attached Schedule of Past Due Taxes. Prior period taxes paid are currently recorded<br />

Penalties <strong>and</strong> interest due on unpaid amounts were recorded as expenses for the reporting period<br />

ending March 31, 20<strong>10</strong>. These penalties are currently under appeal with the various taxing

<strong>10</strong><br />

Ohio Ecological Food & Farm Association <strong>Certification</strong><br />

Statement of Activity (Income Statement)<br />

For the Five-Month Period Ended August 31, 20<strong>10</strong><br />

Actual<br />

Budgeted<br />

Apr - Aug <strong>10</strong> Apr - Aug <strong>10</strong> (Under)Over<br />

Income<br />

5000 · <strong>Certification</strong> Fees<br />

5000-<strong>10</strong> · Crop Fees 359,050.00<br />

5000-11 · Dairy Fee 33,250.00<br />

5000-12 · Livestock Fees (Non-Dairy) 5,700.00<br />

5000-13 · Processor App Fee 8,525.00<br />

5000-14 · On-Farm H<strong>and</strong>ling 3,325.00<br />

5000-15 · Late Fees <strong>10</strong>0.00<br />

5000-16 · New Applicant Fee 1,025.00<br />

5000-17 · Spot Inspection Fee 1,300.00<br />

Total 5000 · <strong>Certification</strong> Fees 412,275.00<br />

50<strong>10</strong> · Other Certif. Income<br />

50<strong>10</strong>-<strong>10</strong> · Transaction Certificates 1,000.00<br />

50<strong>10</strong>-11 · Signs 1,250.00<br />

50<strong>10</strong>-12 · Stickers 336.00<br />

50<strong>10</strong>-14 · Misc. Income 5,049.62<br />

Total 50<strong>10</strong> · Other Certif. Income 7,635.62<br />

5020 · Processor Inspection Fees<br />

5020-<strong>10</strong> · Processor Inspector Fees 1,575.00<br />

5020-11 · Processor Inspector Expenses 819.20<br />

5020 · Processor Inspector Fees Other 1,579.60<br />

Total 5020 · Processor Inspection Fees 3,973.80<br />

5030 · Interest Income 235.58<br />

Total Income 424,120.00 524,734.61 (<strong>10</strong>0,614.61)<br />

Expense<br />

7000-<strong>10</strong> · Salaries 68,992.02<br />

7000-40 · FICA 5,236.13<br />

7000-20 · Health Insurance <strong>10</strong>,<strong>10</strong>6.33<br />

7000-30 · BWC 169.63<br />

6-1550 · Workers Compensation 952.83<br />

85,456.94 96,191.49 (<strong>10</strong>,734.55)<br />

8200 · Processor Insp Fees<br />

8200-<strong>10</strong> · Processor Inspector Fees 3,160.00<br />

8200-20 · Processor Inspector Expenses 833.97<br />

8000-Processor Inspector Fees, Other 675.00<br />

8000-31 · Integrity Inspection Fees 200.00<br />

8000-32 · Spot Inspection Fee 150.00<br />

8000-33 · Livestock Inspection Fee 4,400.00<br />

8000-34 · H<strong>and</strong>ler Inspection Fee 350.00<br />

8000-35 · Expedited Service Fee 50.00<br />

8000-30 · Producer Inspector Fees - Other 36,250.00<br />

8360-20 · Inspector Travel Expenses<br />

8360-21 · Mileage-Inspectors <strong>10</strong>,588.78<br />

8360-22 · Lodging-Inspectors 2,040.98<br />

58,698.73 63,871.88 (5,173.15)

11<br />

Ohio Ecological Food & Farm Association <strong>Certification</strong><br />

Statement of Activity (Income Statement)<br />

For the Five-Month Period Ended August 31, 20<strong>10</strong><br />

Actual<br />

Budgeted<br />

Apr - Aug <strong>10</strong> Apr - Aug <strong>10</strong> (Under)Over<br />

Other Expense<br />

8000-<strong>10</strong> · Accounting 4,265.50<br />

8000-20 · Contract Labor 2,095.59<br />

6560 · Payroll Expenses 5,156.11<br />

8360-<strong>10</strong> · Staff Travel<br />

8360-11 · Mileage-Staff 251.39<br />

8360-12 · Lodging-Staff 269.21<br />

8360-13 · Meals-staff 306.47<br />

6500-1 · Sponsorships 250.00<br />

8000-70 · Payroll Fees 722.62<br />

6000 · Allocated Expenses Other 154.50<br />

6000-<strong>10</strong> · Rent Expense 5,308.00<br />

6000-20 · Software & Equipment 332.22<br />

6000-50 · Communication 1,267.22<br />

8<strong>10</strong>0-<strong>10</strong> · Postage & Shipping 2,334.82<br />

8<strong>10</strong>0-20 · Printing 2,162.00<br />

8<strong>10</strong>0-30 · Leased Equipment 993.74<br />

8300-<strong>10</strong> · Prior Period Expense Adjustment 6,991.45<br />

8300-30 · Dues & Subscriptions 5,152.19<br />

8300-40 · Office Supplies 1,520.48<br />

8300-50 · CC Processing & Bank Fees 2,188.69<br />

8300-80 · Misc. 126.29<br />

Total Other Expense 41,848.49 80,604.99 (38,756.50)<br />

Total Expense 186,004.16 240,668.36<br />

Net Income 238,115.84 284,066.25 -45,950.41

12<br />

C5 <strong>Certification</strong> Delinquent Taxes<br />

IRS-941's IRS INTEREST Assessments<br />

OHIO 52-<br />

332929 OH ASSMTS ODJFS CITY<br />

CITY<br />

PENALTIES BWC<br />

BWC<br />

PENALTIES<br />

2007 3rd QTR 250.01<br />

4th QTR 145.06 500.00<br />

2008 1st QTR 398.21<br />

2nd QTR 2,620.87 674.95 466.25<br />

3rd QTR 651.11<br />

4th QTR 6,991.40 752.56 500.00<br />

2009 1st QTR 6,254.48 2,903.03 651.78 53.04<br />

2nd QTR 8,114.68 3,580.59 922.80 72.24 245.93<br />

3rd QTR 9,421.50 268.14 2,590.90 1,097.56 76.46<br />

4th QTR 7,234.96 2,753.29 765.05 598.74 3,664.71 2,850.63 74.62 212.61 129.70<br />

##### 990 8.00 58.46 (32.28)<br />

20<strong>10</strong> 1st QTR 9,111.24 999.52 3,446.49 1,005.43<br />

2nd QTR -<br />

April only 2,706.35 292.59 229.89<br />

2nd QTR 650.29 301.53<br />

Total 50,084.62 268.14 14,456.68 7,351.19 1,598.74 8,227.74 4,157.59 276.36 746.89 97.42<br />

Paid 50,084.62 268.14 5,219.77 7,351.19 598.74 8,227.74 4,157.59 276.36 746.89 97.42<br />

Bal Due - 9,236.91 - 1,000.00 - - - - -<br />

FYE 3/31/20<strong>10</strong> FYE 3/31/2009 FYE 3/31/2008<br />

TOTAL excluding 4th<br />

qtr 2007 & April 20<strong>10</strong><br />

Penalties &<br />

Interest<br />

Fed<br />

Breakout 12/31/2008 12/31/2009<br />

Fed AP 33,882.38 6,254.48 250.01 40,386.87 14,724.82 Withheld 250.01 <strong>10</strong>,631.00<br />

State W/H AP 3,784.93 2,730.40 398.21 6,913.54 1,598.74 SS 16,528.96<br />

City W/H AP 3,856.06 ‐ ‐ 3,856.06 276.36 Medicare 3,865.64<br />

ODJFS 3,446.49 3,664.71 466.25 7,577.45 250.01 31,025.60<br />

BWC 517.00 517.00 97.42<br />

45,486.86 12,649.59 1,114.47 59,250.92 16,697.34 40,386.83

13<br />

***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT***DRAFT<br />

<strong>OEFFA</strong> 501 (c) 3<br />

<strong>Board</strong> Meeting Minutes<br />

July 25, 20<strong>10</strong><br />

Granville, Ohio<br />

Present: Dave Benchoff, Amy Bodiker, Mary Ida Compton, Gary Cox, Steve Edwards, Mike<br />

Laughlin, Darren Malhame, Joan Richmond, Harv Roehling, Ed Snavely, John Sowder, Mardy<br />

Townsend, <strong>and</strong> Carol Gol<strong>and</strong>. Absent: Steve Daugherty, Tom Redfern.<br />

Darren called the meeting to order at <strong>10</strong>:45am.<br />

Minutes from meetings in 20<strong>10</strong> on January 24, February 13 (Annual <strong>OEFFA</strong> Business meeting),<br />

March 7, <strong>and</strong> April 25 were approved with minor edits.<br />

Darren began with a review of the financial statements, <strong>and</strong> noted that <strong>OEFFA</strong> now has 2 new<br />

hires for part time work: Carol Cameron in an accounting role, <strong>and</strong> Jami Woodruff as our<br />

bookkeeper. Our former bookkeeper, Angie Kemp, resigned in April. We reviewed both the<br />

cash flow statement, with monthly data projections through March, 2011, <strong>and</strong> the balance sheet<br />

with data through June 30, 20<strong>10</strong>. The cash flow projections show <strong>OEFFA</strong> at its lowest point (in<br />

terms of cash available) during the late fall months before conference deposits are expected.<br />

During all months, we anticipate having sufficient cash on h<strong>and</strong> to run the organization. If there<br />

is a time during which we need additional funds, we may borrow from the certification (c(5))<br />

arm of <strong>OEFFA</strong>, with a competitive interest rate at the time. These are intended to be<br />

conservative estimates, as they don’t include: 1) expected cash from the University of Maryl<strong>and</strong>,<br />

<strong>and</strong> 2) cash due to <strong>OEFFA</strong> c(3) for membership fees collected as part of the certification fee<br />

from the c(5) arm of <strong>OEFFA</strong>. All expected tax liabilities are included in these statements. We<br />

expect to file our annual 990 tax form at the completion of the current audit, possibly requiring<br />

an extension beyond the August deadline.<br />

Lunch was supplied <strong>and</strong> enjoyed by all.<br />

Carol presented the Director’s Report. <strong>OEFFA</strong> has had significant exposure <strong>and</strong> representation<br />

in newspaper editorials, radio programs, <strong>and</strong> social media networks of Facebook <strong>and</strong> Twitter.<br />

She reviewed the status of grants pending <strong>and</strong> the likelihood of success. Membership is much<br />

higher, due to certification clients having membership bundled into their certification fees. In an<br />

effort to continue to reduce expenses, we won’t be publishing the membership directory (last<br />

published in the fall of 2009) or the Good Earth Guide (available online). Also, the next 2<br />

conferences will be held at our 2009 location, the Granville High School. Carol <strong>and</strong> others<br />

explored possible alternatives, which proved to be much more expensive. Our date for the 2011<br />

conference, titled Inspiring Farms, Sustaining Communities, is February 19-20. We discussed<br />

having a post-conference event on Monday, rather than a pre-conference event on Friday.

14<br />

Carol reviewed the status of the compromise reached between HSUS <strong>and</strong> the Livestock Care<br />

St<strong>and</strong>ards <strong>Board</strong>, which resulted in taking the initiative off the November ballot, while accepting<br />

several policies vital to <strong>OEFFA</strong> members. <strong>OEFFA</strong> members <strong>and</strong> staff have worked tirelessly to<br />

educate the Livestock Care St<strong>and</strong>ards <strong>Board</strong> (<strong>and</strong> the public) about issues surrounding small<br />

scale organic agriculture, <strong>and</strong> have actively participated on subcommittees for animal groups.<br />

She went on to describe the void in the state of Ohio in the area of groups actively promoting<br />

policies supporting sustainable agriculture. This seems a place where <strong>OEFFA</strong> should be a<br />

leader. The <strong>Board</strong> discussed time <strong>and</strong> resource limits to this while maintaining our 501 (c)3<br />

status. Carol was given authority to explore <strong>and</strong> act on any requirements needed by our<br />

regulators.<br />

The Employee H<strong>and</strong>book is being rewritten <strong>and</strong> updated. <strong>Board</strong> members volunteered to work<br />

with staff on the Personnel Policies <strong>and</strong> Financial Policies sections.<br />

The <strong>Board</strong> moved into Executive Session.<br />

Old Business centered on Amy Bodiker’s review of the progress on the Grass-Grazed label.<br />

Warren Taylor of Snowville Creamery will gather an advisory group <strong>and</strong> work with Amy to<br />

develop the criteria. The hope is that <strong>OEFFA</strong> would be a certifier for this label.<br />

New Business began with a discussion of a fall member meeting, suggested for November,<br />

which would have as a focus for discussion <strong>OEFFA</strong>’s institutional objectives. Carol reviewed<br />

staff participation in a webinar by the Institute for Conservation Leadership, where they learned<br />

about membership involvement over the internet, both for education <strong>and</strong> fundraising. The <strong>Board</strong><br />

agreed to initiate a “matching grant”, with a <strong>Board</strong> match of up to $6,950 from the members<br />

present.<br />

The meeting was adjourned at 3:15.<br />

Respectfully submitted by Mary Ida Compton, Secretary.

15<br />

Ohio Ecological Food & Farm Association<br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong><br />

Director’s Report for the Education Program<br />

COMMUNICATIONS AND PUBLIC RELATIONS<br />

On the newsletter front, it has been a relatively quiet summer, as we’ve enjoyed the first longer gap as<br />

we’ve moved to a quarterly newsletter. The first of these should be arriving in your mailboxes sometime<br />

around the end of the month.<br />

Please see Lauren’s report on subscribers to our social media networks (Facebook <strong>and</strong> Twitter) <strong>and</strong><br />

listserves (<strong>OEFFA</strong>direct).<br />

STATUS OF GRANTS<br />

Beginning Farmers <strong>and</strong> Ranchers Development Program (BFRDP)<br />

Received word that we were not successful with this one. We expect to continue trying . . .<br />

Ohio Department of Agriculture Specialty Crop Funding.<br />

All of the “i’s” have now been dotted <strong>and</strong> the “t’s” crossed, so we will begin the work represented by this<br />

grant in earnest. To recap: In partnership with the Countryside Conservancy, we received funding for our<br />

specialty crop proposal ($67,588 over two years for the two organizations). The grant will provide support<br />

for: that portion of an organic educator’s position which focuses on specialty crop production, <strong>and</strong> an<br />

<strong>OEFFA</strong> conference track for beginning/transitioning specialty crop producers. This year we will also be<br />

hosting several webinars on advanced specialty crop production topics <strong>and</strong> season extension.<br />

Farm Aid Grant<br />

We have submitted a new request to Farm Aid for continued funding of our Farm Policy Matters<br />

program. We should hear towards the end of the year.<br />

North Central SARE Research & Education Pre-proposal<br />

The pre-proposal I submitted to the North Central SARE Program, focused on educational programming<br />

related to organic livestock production was not invited to submit a full proposal. I am still waiting to<br />

receive reviewers comments to underst<strong>and</strong> the issues.<br />

Easton Community Foundation Center Change for Charity<br />

Each year, the Foundation selects 6 charities; each receives 2 months worth of parking meter change from<br />

Easton Town Center. This is a long-shot for us, but worth a try. If selected, the organization also benefits<br />

with signage at Easton that brings attention to it.<br />

.<br />

MEMBERSHIP<br />

We currently have 2,602 members. See attached report for fuller statistics.

<strong>OEFFA</strong> C3 Director’s 16 Report<br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong> – page 2<br />

OTHER DEVELOPMENT EFFORTS<br />

Online fundraising campaign<br />

You may recall that Lauren, Phil (“the web guy”) <strong>and</strong> I participated in a 6-week webinar on online<br />

fundraising <strong>and</strong> designed an online fundraising campaign, which I described to you at our last board<br />

meeting. At that time, the <strong>Board</strong> took a very bold step in offering a match challenge for our efforts. We<br />

received $3,769 in donations; with the <strong>Board</strong> match, we were able to raise a total of $7,538!!<br />

Annual Appeal<br />

The annual appeal is just around the corner. This year we plan to write a simple appeal, printed on<br />

letterhead <strong>and</strong> mailed in a business size envelope.<br />

CoSMO (Community Shares of Mid-Ohio)<br />

CoSMO has kicked off the workplace giving season, <strong>and</strong> so this is a good time to remind you that you<br />

can support <strong>OEFFA</strong>’s work through Community Shares of Mid Ohio.<br />

Community Shares connects workplaces to community-based nonprofits, like <strong>OEFFA</strong>, where<br />

employees can easily support <strong>OEFFA</strong> <strong>and</strong> other nonprofits by making a paycheck donation in their<br />

workplace giving campaign.<br />

Community Shares’s sixty member agencies, including <strong>OEFFA</strong>, will be participating in many<br />

workplace campaigns in 20<strong>10</strong>, including public/governmental workplaces <strong>and</strong> private workplaces<br />

You can help by remembering Community Shares <strong>and</strong> your favorite member agencies, like <strong>OEFFA</strong>, in<br />

your workplace giving campaign. It’s easy to give <strong>and</strong> easy to help when you give through payroll<br />

deduction. You can direct your campaign gift to one or several specific nonprofits.<br />

Then, please encourage your family, friends <strong>and</strong> coworkers to consider giving to Community Shares<br />

<strong>and</strong> <strong>OEFFA</strong> at the workplace. Contact us at the office if you would like Community Shares brochures<br />

to distribute. If your company does not include Community Shares <strong>and</strong> <strong>OEFFA</strong>, please consider asking<br />

that they are included.<br />

PROGRAM WORK<br />

<strong>OEFFA</strong> Conference (from Renee Hunt)<br />

Mary-Howell <strong>and</strong> Klaas Martens <strong>and</strong> Joan Gussow are lined up as keynote speakers. Overall, we’re on<br />

schedule with the conference work. Save the Date postcards were mailed out to approximately 4,000<br />

people on Sept. 28. A great portion of the workshops have been lined up <strong>and</strong> staff is working out the<br />

details. We’ll be offering more than 70 workshops this year – an all time high for <strong>OEFFA</strong>. Exhibitor<br />

<strong>and</strong> sponsor outreach will begin in <strong>October</strong>. The food committee has established this year’s meals, has<br />

begun lining up food donors, <strong>and</strong> has some modest food preservation efforts underway.<br />

The food committee is also interested in working with the board to hold a pre-conference fundraising<br />

event in January in Columbus. This would be an opportunity to raise money – through ticket sales <strong>and</strong><br />

a silent auction – for the organization while offering a fun evening for foodie-types in the Columbus<br />

area to mingle <strong>and</strong> network. <strong>Board</strong> help is needed with planning <strong>and</strong> carrying out the event, including<br />

lining up silent auction items.

<strong>OEFFA</strong> C3 Director’s 17 Report<br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong> – page 3<br />

Plans are underway to offer high tunnel <strong>and</strong> CSA pre-conference workshops on Friday, Feb. 18.<br />

Farm Tours<br />

Wrapping up for the summer. Full report available at the next board meeting.<br />

POLICY WORK<br />

Dairy Labeling<br />

As you know, after Ohio instituted the new rule regarding labeling of dairy products, which included the<br />

most restrictive language in the country, the International Dairy Foods Association (IDFA) <strong>and</strong> Organic<br />

Trade Association (OTA) sued to stop it. We (<strong>OEFFA</strong>), with national partners, submitted an amici cuarea<br />

(“Friends of the Court”) brief in their support. The plaintiffs lost the lawsuit, <strong>and</strong> then appealed the<br />

ruling. After mediation failed, they went back to Court. <strong>OEFFA</strong> again signed on to the Amicus Brief,<br />

along with the Center for Food Safety (whose staff attorneys prepared the brief), Food <strong>and</strong> Water Watch,<br />

<strong>and</strong> Physicians for Social Responsibility Oregon Chapter (all of whom were on the original Amicus brief),<br />

<strong>and</strong> were joined on this with new amici Organic Consumers Association <strong>and</strong> Institute for Responsible<br />

Technology.<br />

On September 30, 20<strong>10</strong>, the U.S. Appeals Court reversed much of the original decision <strong>and</strong> rem<strong>and</strong>ed the<br />

case back to the lower court. In particular, the appeals court found that:<br />

<br />

<br />

<br />

the labeling claim “rbGH-free” (or equivalent) was not untruthful <strong>and</strong> misleading <strong>and</strong> thus should<br />

be allowed (because logically if the milk comes from a cow not treated, there’s no way for it to get<br />

into the milk, therefore the milk must be rbGH free);<br />

that the so-called “FDA disclaimer” that “the FDA has found no significance difference between<br />

milk from cows treated with rbGH <strong>and</strong> those which have not been treated” may not be<br />

appropriate as the situation more accurately stated is that there is not yet a test which can detect<br />

the presence of rbGH in milk from cows treated with artificial growth hormones;<br />

that there is no reason why that disclaimer must appear contiguous to the main claim (“rbGH<br />

free”) but rather an asterism after the main claim can lead the consumer elsewhere on the package<br />

for additional information.<br />

Further, the Court accepted that there are compositional differences, that milk from cows treated with<br />

rbGH has increased levels if IGF-1, during certain periods of the cows lactation cycle the rbGH-treated<br />

cow’s milk will be of inferior quality nutritionally (because the cow is in negative-energy balance), <strong>and</strong><br />

because of increased somatic cell (pus) content in rbGH-treated cows’ milk. This ruling could thus open<br />

the way to get the FDA to re-examine rbGH, since it is still relying on its original determination from 1990<br />

or so, when there was much less data available.<br />

We don’t know yet what direction the State will take with this. I’ll keep you posted, but for the moment,<br />

this is a great win after three years of fight.<br />

Livestock Care <strong>Board</strong> (from Renee Hunt)<br />

Species subcommittees to develop care st<strong>and</strong>ards are underway. Staff has been attending multiple<br />

meetings <strong>and</strong> working with farmers to feed into this process. <strong>OEFFA</strong>, by offering comments through<br />

this process, is having an impact. For example, our recommendation that euthanasia trainings only be

<strong>OEFFA</strong> C3 Director’s 18 Report<br />

<strong>10</strong> <strong>October</strong> 20<strong>10</strong> – page 4<br />

m<strong>and</strong>atory following a violation was accepted by the board (instead of m<strong>and</strong>ating every livestock<br />

producer to receive training). We anticipate public hearings on proposed st<strong>and</strong>ards on euthanasia,<br />

non-ambulatory livestock, civil penalties, <strong>and</strong> veal (perhaps also swine) to be held this fall, which we’ll<br />

be organizing our members to attend. The LCSB may also try to wrap up layers st<strong>and</strong>ards this fall<br />

(<strong>and</strong> thus hit the main areas of the HSUS/Governor-OFB agreement), but given that the first meeting<br />

of this subcommittee was Sept. 27, it is not clear that there’s enough time. The LCSB expects to take a<br />

break in November <strong>and</strong> pick up after the new year. With <strong>10</strong> species subcommittees, it will take the<br />

board well into 2011 before all st<strong>and</strong>ards are complete.<br />

Thanksgiving Boxes<br />

No boxes this year – only turkeys.<br />

ADMINISTRATION<br />

Paychex<br />

In May we began using PayChex as our payroll services provider. In the months since, we have been<br />

concerned about (1) the increasing price of this service; <strong>and</strong> (2) occasional errors which require our time<br />

<strong>and</strong> attention to correct. For that reason, we were receptive when ADP approached us about becoming<br />

our payroll services provider. With a greater array of services, very competitive pricing, <strong>and</strong> aggressive<br />

promotions, we’ve decided to switch over to ADP.<br />

990s<br />

Our accountants have completed our 990s <strong>and</strong> they await your approval.<br />

Action Needed: Please make sure to review these prior to the <strong>Board</strong> meeting; forward me any questions<br />

you have so we can have answers for you by the meeting.<br />

Review & Revision of Employee H<strong>and</strong>book <strong>and</strong> Financial Procedures<br />

I have completed a first draft of a revised <strong>and</strong> exp<strong>and</strong>ed Employee H<strong>and</strong>book <strong>and</strong> am working on a<br />

comprehensive review <strong>and</strong> revision of our Financial Policies <strong>and</strong> Procedures Manual. I am awaiting<br />

comments <strong>and</strong> a second draft on the former before presenting this to the board for approval.

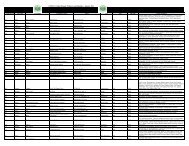

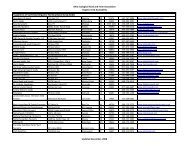

May 15‐July 15, 2009 11<br />

July 16‐September 15, 2009 45<br />

September 16‐November 15, 2009 25<br />

November 16‐January 1, 20<strong>10</strong> 25<br />

January 1‐February 1, 20<strong>10</strong> 122<br />

February 2‐March 15, 20<strong>10</strong> 191<br />

March 16‐May 17, 20<strong>10</strong> 54<br />

May 18‐August 30, 20<strong>10</strong> 260<br />

Renewal Rate<br />

MEMBERSHIP/COMMUNICATIONS STATISTICS<br />

New Members (Not Previously Members)<br />

Expirations<br />

Non‐renewals (after<br />

6 months) Percent Who Renewed<br />

Oct‐09 55 15 73%<br />

Nov‐09 33 13 61%<br />

Dec‐09 62 19 69%<br />

Jan‐<strong>10</strong> 113 51 55%<br />

Feb‐<strong>10</strong> 184 77 58%<br />

Mar‐<strong>10</strong> 64 21 67%<br />

Apr‐<strong>10</strong> 26 8 69%<br />

Average Renewal Rate 62%<br />

Total Contacts in Database<br />

<strong>10</strong>/6/09 5997<br />

2/1/<strong>10</strong> 6266<br />

6/<strong>10</strong>/<strong>10</strong> 6483<br />

7/14/<strong>10</strong> 6554<br />

8/12/<strong>10</strong> 6727<br />

9/29/<strong>10</strong> 6844<br />

Percentage Growth 15.9%<br />

Total Current Members (Households)*<br />

19<br />

<strong>10</strong>/6/09 1616<br />

2/1/<strong>10</strong> 1729<br />

6/<strong>10</strong>/<strong>10</strong> 2122<br />

7/14/<strong>10</strong> 2245<br />

8/12/<strong>10</strong> 2324<br />

9/29/<strong>10</strong> 2602<br />

Percentage Growth 61.0%<br />

<strong>Certification</strong> Members (Complimentary Membership as <strong>Certification</strong> Client)<br />

6/<strong>10</strong>/<strong>10</strong> 290<br />

7/14/<strong>10</strong> 382<br />

8/12/<strong>10</strong> 433<br />

9/29/<strong>10</strong> 585<br />

<strong>OEFFA</strong> Direct<br />

<strong>10</strong>/6/09 590<br />

2/1/<strong>10</strong> 616<br />

6/<strong>10</strong>/<strong>10</strong> 643<br />

9/29/<strong>10</strong> 667<br />

Percentage Growth 13.8%

Percent Fans Female<br />

Percent Fans by Age Category<br />

18‐24<br />

25‐34<br />

35‐44<br />

45‐54<br />

55+<br />

Number of Fans by City<br />

Columbus<br />

Dayton<br />

Toledo<br />

Cincinnati<br />

Clevel<strong>and</strong><br />

Akron<br />

Athens<br />

Newark<br />

Facebook<br />

9/16/09 213<br />

20<br />

2/1/<strong>10</strong> 707<br />

6/<strong>10</strong>/<strong>10</strong> 1134<br />

9/29/<strong>10</strong> 1305<br />

9/29/20<strong>10</strong> 66%<br />

9/29/20<strong>10</strong> 6%<br />

9/29/20<strong>10</strong> 30%<br />

9/29/20<strong>10</strong> 31%<br />

9/29/20<strong>10</strong> 16%<br />

9/29/20<strong>10</strong> 12%<br />

9/29/20<strong>10</strong> 309<br />

9/29/20<strong>10</strong> 90<br />

9/29/20<strong>10</strong> 29<br />

9/29/20<strong>10</strong> 159<br />

9/29/20<strong>10</strong> 79<br />

9/29/20<strong>10</strong> 14<br />

9/29/20<strong>10</strong> 11<br />

9/29/20<strong>10</strong> 15<br />

Twitter<br />

<strong>10</strong>/6/09 114<br />

2/1/<strong>10</strong> 258<br />

6/<strong>10</strong>/<strong>10</strong> 338<br />

9/29/<strong>10</strong> 405<br />

* Includes "members," "certification," <strong>and</strong> "complimentary." Families <strong>and</strong> family farms are counted twice.

21<br />

<strong>OEFFA</strong> Education<br />

Balance Sheet<br />

As of June 30, 20<strong>10</strong><br />

Ohio Ecological Food & Farm Association Education<br />

Statement of Financial Position (Balance Sheet)<br />

August 31, 20<strong>10</strong><br />

ASSETS<br />

Current Assets<br />

Checking/Savings<br />

1-1<strong>10</strong>0 · Cash & Cash Equivalents<br />

1-<strong>10</strong>00 · Kemba Savings 260.66<br />

1-11<strong>10</strong> · Kemba Financial Credit Union 65,612.45 1<br />

1-1120 · Wells Fargo 64171156 5,728.71<br />

1-1121 · Wells Fargo Mutual Fund 14,411.05 2<br />

Total 1-1<strong>10</strong>0 · Cash & Cash Equivalents 86,012.87<br />

Accounts Receivable<br />

1200 · *Accounts Receivable<br />

1202 · SARE - Univ of MN <strong>10</strong>,192.21<br />

Total 1200 · *Accounts Receivable <strong>10</strong>,192.21<br />

Other Current Assets<br />

1-1600 · Due To/From <strong>OEFFA</strong> (C-5) 1,342.08<br />

1300· Inventory 204.48<br />

Total Other Current Assets 1,546.56 1,546.56<br />

Fixed Assets<br />

1-3<strong>10</strong>0 · Computer Equipment 1,999.00<br />

1-3300 · Computer Software/Website 600.00<br />

1-4<strong>10</strong>0 · Accumulated Depreciation (2,599.00)<br />

Total Fixed Assets - -<br />

TOTAL ASSETS 97,751.64<br />

LIABILITIES & NET ASSETS<br />

Liabilities<br />

Current Liabilities<br />

Accounts Payable<br />

2-<strong>10</strong>00 · Accounts Payable 7,287.05<br />

Total Accounts Payable 7,287.05<br />

Other Current Liabilities<br />

2-1300 · Tax Penalties & Interest Payable 33,479.44 3<br />

Total 2-1300 · Total Tax Penalties & Interest Payable 33,479.44<br />

Page 1 of 5

22<br />

<strong>OEFFA</strong> Education<br />

Balance Sheet<br />

As of June 30, 20<strong>10</strong><br />

Ohio Ecological Food & Farm Association Education<br />

Statement of Financial Position (Balance Sheet)<br />

August 31, 20<strong>10</strong><br />

2-1400 · Payroll Liabilities<br />

2-14<strong>10</strong> · Accrued Payroll Liability 6,472.76 4<br />

2-1420 · FICA Payable 1,251.32<br />

2-1430 · Fed Withholding Payable 283.78<br />

2-1450 · State Income Tax Payable 185.56<br />

2-1470 · City Income Tax Payable 207.79<br />

2-1475 · School District Tax 6.80<br />

2-1480 · ODJFS 51.67<br />

2-1485 · BWC 86.33<br />

2-1490 · 401K 425.80<br />

2-1495 · Employee Health Insurance 111.57<br />

Total 2-1400 · Payroll Liabilities 9,083.38<br />

Total 2-2200 · Sales Tax Payable 0.34 0.34<br />

TOTAL LIABILITIES 49,850.21<br />

Net Assets<br />

3-3300 · Unrealized Gain/Loss on Investment (6,341.58) 2<br />

3-3900 · Retained Earnings <strong>10</strong>2,916.84<br />

Net Income (48,673.83)<br />

Total Net Assets 47,901.43 47,901.43<br />

TOTAL LIABILITIES & NET ASSETS 97,751.64<br />

Page 2 of 5

23<br />

Notes to the Financials dated August 31, 20<strong>10</strong><br />

1<br />

$65.612.45 represents the cleared balance in the Kemba checking account <strong>and</strong> corresponds to the actual bank balance.<br />

Numerous entries had to be entered into the accounting records in order to reconcile with Kemba statements. These<br />

have been completed through August 31, 20<strong>10</strong>, but many remain under investigation.<br />

2<br />

The Wells Fargo Mutual Fund has been adjusted for a net unrealized loss as of March 31, 20<strong>10</strong>. As of August 31, 20<strong>10</strong><br />

the account value is $14,267.21.<br />

3<br />

Please see the attached Schedule of Past Due Taxes. Prior period taxes paid are currently recorded<br />

Penalties <strong>and</strong> interest due on unpaid amounts were recorded as expenses for the reporting period<br />

ending March 31, 20<strong>10</strong>. These penalties are currently under appeal with the various taxing<br />

authorities. Any amounts forgiven will be recorded as income for this fiscal year.<br />

4<br />

Payroll liability has been accrued for payroll due on September 3, 20<strong>10</strong>.

24<br />

Ohio Ecological Food & Farm Association Education<br />

Statement of Activity (Income Statement)<br />

For the Five-Month Period Ended August 31, 20<strong>10</strong><br />

Actual<br />

Budgeted<br />

Apr - Aug <strong>10</strong> Apr - Aug <strong>10</strong> (Under)Over<br />

Income Totals Budgeted<br />

4-<strong>10</strong>00 · Program Service Revenue<br />

4-1800 · Registration 19,404.68<br />

4-1860 · Conference Exhibit Booth 0.00<br />

Total 4-<strong>10</strong>00 · Program Service Revenue 19,404.68 14,371.76 5,032.92<br />

4-3000 · Grant Funds<br />

4-41<strong>10</strong> · SARE Outreach 29,840.36<br />

Total 4-3000 · Grant Funds 29,840.36 36,751.89 (6,911.53)<br />

4-4000 · Direct Public Support<br />

4-4<strong>10</strong>0 · Memberships 24,175.00<br />

4-4200 · Subscriptions 160.00<br />

4-4500 · Donation 20,754.03<br />

Total 4-4000 · Direct Public Support 45,089.03 45,000.00 89.03<br />

4-5000 · Sale of Items<br />

4-51<strong>10</strong> · Book Sales 146.<strong>10</strong><br />

4-5115 · Signs 150.00<br />

Total 4-5<strong>10</strong>0 · Sales 296.<strong>10</strong> 2,601.46 (2,305.36)<br />

4-6000 · Other Misc Income<br />

4-6<strong>10</strong>0 · Newsletter/Ads 1,350.63<br />

4-6800 · Honorariums 150.00<br />

4-6000 · Other Misc Income - Other 265.58<br />

4-8000 · Interest Income 73.63<br />

Total 4-6000 · Other Misc Income 1,839.84 1,565.79 274.05<br />

Total Income 96,470.01 <strong>10</strong>0,290.90 (3,820.89)<br />

Expense<br />

6-<strong>10</strong>00 · Program Service Expenses<br />

6-1<strong>10</strong>0 · Employees<br />

6-1150 · Salaries & Wages - Other 79,028.42<br />

6-1190 · FICA Expense 6,247.28<br />

6-1195 · ODJFS 186.13<br />

6-15<strong>10</strong> · BWC 395.11<br />

6-1520 · Health Insurance 4,962.88<br />

6-1525 · 401K Expense 216.00<br />

Total 6-1<strong>10</strong>0 · Employees 91,035.82 69,748.07 21,287.75<br />

6-2020 · Supplies 521.80<br />

6-2030 · Telephone 1,632.62<br />

6-2035 · Web Expenses 1,651.28<br />

6-2039 · Leased Equipment 342.12<br />

6-2040 · Shipping & Postage 2,329.81<br />

6-2050 · Rent Expense 3,765.50<br />

6-2060 · Equipment Rental & Maintenance 988.20<br />

6-2061 · Software/Equipment Purchases 337.00<br />

6-2071 · Printing - Publications 5,708.00<br />

6-2081 · Staff Travel 153.40<br />

6-2080 · Travel Expenses - Other 1.65<br />

6-2095 · Food & Beverages 3,618.00<br />

6-2<strong>10</strong>0 · Staff Development 385.00<br />

6-2200 · Contract Labor, incl. Speakers 17,859.08<br />

6-2500 · Membership Fees 875.00<br />

6-5050 · Liability Insurance 2,643.00<br />

6-5071 · Premiums for Membership 25.00<br />

6-6<strong>10</strong>0 · Accounting Fees 4,092.80<br />

6-6<strong>10</strong>1 · Payroll Fees 828.32<br />

Total 6-<strong>10</strong>00 · Program Service Expenses 47,757.58 34,684.76 13,072.82<br />

7-<strong>10</strong>00 · Administrative Expenses<br />

7-3500 · Prior Period Expense 3,855.05<br />

7-5015 · Bank & Credit Card Fees 722.63<br />

7-7000 · Other Admin Expenses 475.66<br />

Total 7-<strong>10</strong>00 · Administrative Expenses 5,053.34 818.60 4,234.74<br />

Total Expense 143,846.74 <strong>10</strong>5,251.43 38,595.31<br />

Net Income -47,376.73

25<br />

IRS-941's Interest Paid IRS INT & PEN<br />

C3 Education - Delinquent Taxes<br />

2008 1st QTR $ 9,445.80<br />

$ 5,664.21 $ 1,251.03<br />

OHIO<br />

53-011131 OH ASSMTS ODJFS CITY<br />

CITY<br />

PENALTIES<br />

BWC<br />

2nd QTR 8,687.24 $ 4,911.96 1,003.09 826.67 488.34 332.93<br />

3rd QTR 8,113.74 $ 4,320.95 932.44<br />

4th QTR 9,384.46 $ 4,681.21 1,115.55 73.77<br />

990<br />

2009 1st QTR 9,574.18 567.23 $ 3,833.80 1,090.62 90.27<br />

2nd QTR 7,732.34 358.49 $ 2,988.39 1,038.66 86.23 363.54<br />

3rd QTR 7,846.86 263.73 $ 3,985.35 946.12 86.32<br />

4th QTR 12,839.16 259.53 $ 1,761.51 1,549.63 463.97 4,192.03 282.57 311.78<br />

900 500.00<br />

20<strong>10</strong> 1st QTR 11,321.12 46.<strong>10</strong> 1,416.25 1,478.43<br />

2nd QTR -<br />

April only 2,957.77 366.97 159.51 308.78<br />

2nd QTR 1,434.01<br />

Total $ 87,902.67 $ 1,495.08 $ 32,647.38 $ <strong>10</strong>,7<strong>10</strong>.36 $ 537.74 $ ‐ $ 7,931.14 $ 1,193.24 <strong>10</strong>08.25<br />

Paid 87,902.67 1,495.08 500.00 <strong>10</strong>,7<strong>10</strong>.36 537.74 7,931.14 1,193.24 <strong>10</strong>08.25<br />

Bal Due - - 32,147.38 - - - - - -<br />

TOTAL<br />

excluding<br />

Penalties &<br />

Fed<br />

FYE 3/31/20<strong>10</strong> FYE 3/31/2009 FYE 3/31/2008 April 20<strong>10</strong><br />

Interest<br />

Breakout 12/31/20<strong>10</strong><br />

Fed AP 39,739.48 35,759.62 9,445.80 84,944.90 34,142.46 Withheld 2,273.00<br />

State W/H AP 4,950.66 4,141.70 1,251.03 <strong>10</strong>,343.39 537.74 SS 7,333.<strong>10</strong><br />

City W/H AP 5,670.46 826.67 6,497.13 1,193.24 Medicare 1,715.00<br />

ODJFS 154.39 675.32 829.71 11,321.<strong>10</strong><br />

BWC 1,008.25 1,008.25 381.26<br />

51,523.24 41,403.31 <strong>10</strong>,696.83 <strong>10</strong>3,623.38 36,254.70<br />

Forms 843 mailed 08/18/<strong>10</strong> for each Fed 941 filing period 2008, 2009 <strong>and</strong> 20<strong>10</strong> (1st qtr)<br />

requesting abatement of penalties <strong>and</strong> additional interest charged on penalties<br />

Also mailed $500 penalty for non filing of 990's with Voluntary Compliance Checklist <strong>and</strong><br />

990's for 3/31/08 <strong>and</strong> 3/31/09. Also sent copy of extension app for 03/31/<strong>10</strong>.

Caution: Forms printed from within Adobe Acrobat products 26<br />

may not meet IRS or state taxing agency<br />

specifications. When using Acrobat 5.x products, uncheck the "Shrink oversized pages to paper size" <strong>and</strong><br />

uncheck the "Exp<strong>and</strong> small pages to paper size" options, in the Adobe "Print" dialog. When using Acrobat<br />

6.x <strong>and</strong> later products versions, select "None" in the "Page Scaling" selection box in the Adobe "Print" dialog.<br />

2009 Tax Return(s)<br />

Prepared for<br />

OHIO ECOLOGICAL FOOD AND FARM<br />

CERTIFICATION<br />

CLIENT CODE: <strong>OEFFA</strong>C5<br />

Account Number<br />

Release Number<br />

795380<br />

2009.03051<br />

Prepared by<br />

OTTINGER & ASSOCIATES, LLC<br />

P.O. BOX 185<br />

GALENA, OH<br />

43021-0185<br />

740-965-6853<br />

Processing<br />

Date:<br />

Time:<br />

<strong>10</strong>/01/20<strong>10</strong><br />

14:07:58<br />

Special<br />

Instructions<br />

Messages<br />

900071 05-20-09<br />

EFG

CAUTION<br />

27<br />

Return Information<br />

Form: 990 Pg 11<br />

{ Form 990. Page 11, Part X. The ending cash amount includes a<br />

rounding adjustment of $ -1. (20051)<br />

INFORMATIONAL<br />

Form: 990-6 Sheet: 1 Box: 50<br />

{ Form 990, Page 5, Part V, line 4a. The question regarding a<br />

financial account in a foreign country has defaulted to an<br />

answer of "No." This should be reviewed to determine if this is<br />

the correct response. If instead this question should be<br />

answered as "Yes," make an entry on Interview Form 990-6, Box 50<br />

<strong>and</strong> recalculate the return. (3<strong>10</strong>02)<br />

Form: 990 Page 1<br />

{ Form 990. Page 1. The preparer’s social security number <strong>and</strong>/or<br />

employer identification number have been left blank in<br />

accordance with the official IRS instructions. Only Section<br />

4947(a)(1) nonexempt charitable trusts that are filing Form 990<br />

in lieu of Form <strong>10</strong>41 are instructed to complete this<br />

information. If desired, an entry on Interview Form 9, Box 50,<br />

may be used to force this information to print. Please note,<br />

however, that forcing this information to print when it is not<br />

required will disqualify the return from electronic filing.<br />

(30<strong>10</strong>2)<br />

Form: 990 Page 7<br />

{ Form 990, Page 7, Part VII. One or more entry for the<br />

officers, directors, trustees, key employees, etc., on Interview<br />

Form 990-9 contains an address. It is not necessary to provide<br />

the address for these individuals unless they cannot be<br />

contacted at the organization’s address. In this case the<br />

contact address information must be listed on Schedule O. The<br />

complete address must be entered on Interview Form 990-<strong>10</strong> using<br />

the Officer Number field to match the corresponding information<br />

on Interview Form 990-9. An entry must also be made on<br />

Interview Form 990-9, Box 179 to list the address of the<br />

officer, director, etc., on Schedule O, if required.<br />

Otherwise the corresponding address will not be reflected<br />

anywhere on the federal return. (36053)<br />

17<strong>10</strong>0930 795380 <strong>OEFFA</strong>C5 2009.03051 OHIO ECOLOGICAL FOOD AND FA <strong>OEFFA</strong>C51

<strong>OEFFA</strong>C5 Field Override Report <strong>10</strong>/01/<strong>10</strong><br />

28<br />

Form Description Amount\Text<br />

990 Page 1 Admin - 09/30/<strong>10</strong> 04:05PM P00642528<br />

990 Page 1 Admin - 09/30/<strong>10</strong> 04:05PM 31-1621273<br />

17<strong>10</strong>0930 795380 <strong>OEFFA</strong>C5 2009.03051 OHIO ECOLOGICAL FOOD AND FA <strong>OEFFA</strong>C51

29<br />

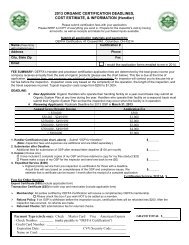

2009 Return Summary<br />

OHIO ECOLOGICAL FOOD AND FARM<br />

CERTIFICATION 34-1324238<br />

FORM 990:<br />

TOTAL REVENUE 516,464.<br />

TOTAL EXPENSES 557,469.<br />

EXCESS <br />

BEGINNING NET ASSETS 67,089.<br />

CHANGES IN NET ASSETS 0.<br />

ENDING NET ASSETS 26,086.<br />

BALANCE SHEET ANALYSIS<br />

ENDING TOTAL ASSETS <strong>10</strong>9,706.<br />

ENDING TOTAL LIABILITIES 83,620.<br />

ENDING TOTAL NET ASSETS OR FUND BALANCES 26,086.<br />

ENDING TOTAL ASSETS MINUS LIABILITIES AND NET ASSETS 0.<br />

ENDING NET ASSETS DIFFERENCE BETWEEN PAGE 1 AND PAGE 11 0.<br />

9263<strong>10</strong> 04-24-09

09X:<strong>OEFFA</strong>C5:V1 Input Listing Page 1<br />

30<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1, Sheet #1, Entity 1 Box Cnt 15<br />

30: "OH", 35: "OHIO ECOLOGICAL FOOD AND FARM ", 36: "CERTIFICATION"<br />

37: "41 CROSWELL ROAD", 39: "COLUMBUS", 40: "OH", 41: "43214"<br />

42: "34-1324238", 44: "614-421-2022", 47: "WWW.<strong>OEFFA</strong>.ORG", 50: 4/ 1/09<br />

51: 3/31/<strong>10</strong>, 55: "1", 66: "5", 74: "X"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

2, Sheet #1, Entity 1 Box Cnt 6<br />

40: "N", 41: "Y", 42: "Y", 43: "Y", 56: "Y", 57: "Y"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

3, Sheet #1, Entity 1 Box Cnt 3<br />

78: 1435, 83: "COURTESY DISCOUNT", 84: -435<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

8, Sheet #1, Entity 1 Box Cnt 8<br />

30: "OH", 50: "CAROL GOLAND, EXECUTIVE DIRECTOR", 51: "41 CROSWELL ROAD"<br />

52: "COLUMBUS", 53: "OH", 54: "43214", 55: "614-421-2022", 58: "X"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

<strong>10</strong>, Sheet #1, Entity 1 Box Cnt 8<br />

70: "CAROL GOLAND", 71: "EXECUTIVE DIRECTOR", 72: "614-421-2022"<br />

73: "41 CROSWELL", 74: "CGOLAND@<strong>OEFFA</strong>.ORG", 75: "COLUMBUS", 76: "OH"<br />

77: "43214"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-1, Sheet #1, Entity 1 Box Cnt 4<br />

30: "TO PROVIDE CERTIFICATION FOR ORGANIC FARMS IN OHIO, WHICH PROVIDES<br />

TIMELY, RELIABLE, AND ACCESSIBLE ORGANIC CERTIFICATION SERVICES IN ACCORDANCE<br />

WITH PRODUCTION, STORAGE, AND HANDLING STANDARDS AS OUTLINED BY THE US DEPT OF<br />

AGRICULTURE’S NATIONAL ORGANIC PROGRAM."<br />

, , 41: "1", 43: "1980", 44: "OH"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-2, Sheet #1, Entity 1 Box Cnt 3<br />

30: "<strong>OEFFA</strong> CERTIFICATION’S PURPOSE IS TO CREATE AND PROMOTE A HEALTHFUL,<br />

ECOLOGICAL, ACCOUNTABLE AND SUSTAINABLE AGRICULTURE IN OHIO AND ELSEWHERE WITH<br />

CERTIFICATION AND IN PARTNERSHIP WITH <strong>OEFFA</strong>."<br />

, , 51: 468163<br />

54: "PROVIDE INFORMATION TO BE "CERTIFIED ORGANIC" AND INSPECTION PROGREAMS TO<br />

VERIFY A FARM IS "CERTIFIED ORGANIC"."<br />

,

09X:<strong>OEFFA</strong>C5:V1 Input Listing Page 2<br />

31<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-5, Sheet #1, Entity 1 Box Cnt 3<br />

62: "X", 63: "X"<br />

70: "THE ORGAINZATION MAKES THIS INFORMATION AVAILABLE UPON REQUEST"<br />

,<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-6, Sheet #1, Entity 1 Box Cnt 5<br />

30: 14, 33: 5, 34: "X", 79: "N", 80: "N"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-7, Sheet #1, Entity 1 Box Cnt 9<br />

50: "X", 51: "X", 52: "X", 53: "X", 54: "X", 55: "X", 56: "X"<br />

70: "MEMBERS OF THE BOARD REVIEW AND COMPLETE A BOARD QUESTIONNAIRE REGARDING<br />

THE POLICY AND ANY POSSIBLE ACTIVITIES THAT WOULD BE CONFLICTS OF INTEREST."<br />

,<br />

75: "THE BOARD RESEARCHES COMPARABILITY DATA AND DOCUMENT THEIR DELIBERATIONS<br />

REGARDING OFFICER COMPENSATION, IN THE THE MINUTES FROM THAT MEETING."<br />

,<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-8, Sheet #1, Entity 1 Box Cnt 7<br />

30: 8, 31: 8, 39: "X", 40: "X", 52: "X", 60: "11"<br />

65: "THE 990 WAS DISTRIBUTED AND REVIEWED AT THE BOARD MEETING."<br />

,<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-9, Sheet #1, Entity 1 Box Cnt 15<br />

30: "JOHN SOWDER", 31: "PRESIDENT", 32: 5.0, 33: "JOAN RICHMOND"<br />

34: "SECRETARY", 35: 5.0, 36: "DARREN MALHAME", 37: "TREASURER", 38: 5.0<br />

39: "TOM REDFERN", 40: "VICE PRESIDENT", 41: 5.0, 42: "CAROL GOLAND"<br />

43: "EXECUTIVE DIRECTOR", 44: 40.0<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-<strong>10</strong>, Sheet #1, Entity 1 Box Cnt 21<br />

31: "246 LELAND", 32: "COLUMBUS", 33: "OH", 34: "43214"<br />

36: "6991 RENIE ROAD", 37: "BELLVILLE ", 38: "OH", 39: "44813"<br />

41: "1939 WYANDOTTE ROAD", 42: "COLUMBUS", 43: "OH", 44: "43212"<br />

46: "6916 LONG RUN ROAD", 47: "ATHENS ", 48: "OH", 49: "45701"<br />

51: "41 CROSWELL ", 52: "COLUMBUS", 53: "OH", 54: "43214", <strong>10</strong>0: "X"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-13, Sheet #1, Entity 1 Box Cnt <strong>10</strong><br />

30: "CERTIFICATION FEES", 33: "541300", 37: 486875<br />

38: "PROCESSOR INSPECTION FEES", 41: "541300", 45: 18784, 82: 3291<br />

120: "OTHER CERTIFICATION INCOME", 123: "541300", 127: 7514

09X:<strong>OEFFA</strong>C5:V1 Input Listing Page 3<br />

32<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-14, Sheet #1, Entity 1 Box Cnt 19<br />

37: 164099, 46: 18448, 49: 18686, 59: 852, 75: 2621, 78: 5607, 84: 15798<br />

86: 49230, <strong>10</strong>7: 2415, 113: "PROFESSIONAL FEES", 115: 16<strong>10</strong>65<br />

118: "PRINTING, POSTAGE AND SHIPPING", 120: 19829<br />

123: "PROCESSOR INSP FEES", 125: 18070, 128: "STAFF TRAINING AND SEMINARS"<br />

130: 2451, 133: "MISCELLANEOUS", 136: 38268<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-14, Sheet #2, Entity 1 Box Cnt <strong>10</strong><br />

113: "CREDIT CARD AND BANK FEES", 116: 3349, 118: "OFFICE SUPPLIES"<br />

121: 4548, 123: "DUES AND SUBSCRIPTIONS", 126: 1566<br />

128: "STATE CERT REGISTRATION FEES", 130: 200, 133: "PENALTIES AND INTEREST"<br />

136: 16697<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-14, Sheet #3, Entity 1 Box Cnt 6<br />

113: "SOFTWARE AND EQUIPMENT", 115: 3317, 118: "RESOURCE MATERIALS "<br />

120: 7978, 123: "PAYROLL EXPENSE", 125: 2375<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-16, Sheet #1, Entity 1 Box Cnt 4<br />

30: 65956, 31: <strong>10</strong>3856, 36: 7060, 37: 5851<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-17, Sheet #1, Entity 1 Box Cnt 6<br />

30: 5927, 31: 7751, 70: "PAYROLL TAX LIABILITIES", 73: 59172<br />

74: "PENALTIES AND INTEREST PAYABLE", 77: 16697<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-18, Sheet #1, Entity 1 Box Cnt 3<br />

30: "X", 40: 67089, 41: 26086<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990-19, Sheet #1, Entity 1 Box Cnt 1<br />

90: "X"<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

990O-1, Sheet #1, Entity 1 Box Cnt 2<br />

30: "11"<br />

55: "TAX RETURN IS DISTRIBUTED AT THE BOARD MEETING"<br />

,

09X:<strong>OEFFA</strong>C5:V1 Input Listing Page 4<br />

33<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

X-8, Sheet #1, Entity 1 Box Cnt 2<br />

30: "1", 33: 11/15/<strong>10</strong>

34<br />

Ottinger & Associates<br />

P.O. Box 185, 11660 Gorsuch Rd.<br />

Galena, OH 43021-0185<br />

(740) 965-6853<br />

September 30, 20<strong>10</strong><br />

Ohio Ecological Food <strong>and</strong> Farm<br />

<strong>Certification</strong><br />

41 Croswell Road<br />

Columbus, OH 43214<br />

Ohio Ecological Food <strong>and</strong> Farm <strong>Certification</strong>:<br />

Enclosed is the organization’s 2009 Exempt Organization<br />

return. The return should be signed, dated, <strong>and</strong> mailed.<br />

Specific filing instructions are as follows.<br />

FORM 990 RETURN:<br />

Please sign <strong>and</strong> mail on or before November 15, 20<strong>10</strong>.<br />

Mail to - Department of the Treasury<br />

Internal Revenue Service Center<br />

Ogden, UT 84201-0027<br />

A copy of the return is enclosed for your files. We suggest<br />

that you retain this copy indefinitely.<br />

Thank you for your business,<br />

Ottinger & Associates, LLC

35<br />

Ottinger & Associates<br />

P.O. Box 185, 11660 Gorsuch Rd.<br />

Galena, OH 43021-0185<br />

(740) 965-6853<br />

September 30, 20<strong>10</strong><br />

Ohio Ecological Food <strong>and</strong> Farm<br />

<strong>Certification</strong><br />

41 Croswell Road<br />

Columbus, OH 43214<br />

Ohio Ecological Food <strong>and</strong> Farm <strong>Certification</strong>:<br />

Enclosed are the original <strong>and</strong> one copy of the 2009 Exempt<br />

Organization return, as follows...<br />

2009 FORM 990<br />

Each original should be dated, signed <strong>and</strong> filed in accordance<br />

with the filing instructions. The copy should be retained<br />

for your files.<br />

Thank you for your business,<br />

Ottinger & Associates, LLC

Filing Instructions<br />

Prepared for:<br />

36<br />

Prepared by:<br />

OHIO ECOLOGICAL FOOD AND FARM<br />

CERTIFICATION<br />

OTTINGER & ASSOCIATES, LLC<br />

41 CROSWELL ROAD P.O. BOX 185<br />

COLUMBUS, OH 43214 GALENA, OH 43021-0185<br />

2009 FORM 990<br />

Please sign <strong>and</strong> mail on or before November 15, 20<strong>10</strong>.<br />

Mail to - Department of the Treasury<br />

Internal Revenue Service Center<br />

Ogden, UT 84201-0027<br />

900061<br />

<strong>10</strong>-03-09

Form<br />

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung<br />

benefit trust or private foundation)<br />

Department of the Treasury<br />

Internal Revenue Service | The organization may have to use a copy of this return to satisfy state reporting requirements.<br />

A For the 2009 calendar year, or tax year beginning APR 1, 2009 <strong>and</strong> ending MAR 31, 20<strong>10</strong><br />

OMB No. 1545-0047<br />

Open to Public<br />

Inspection<br />

B Check if<br />

applicable:<br />

Please C Name of organization<br />

D Employer identification number<br />

use IRS OHIO ECOLOGICAL FOOD AND FARM<br />

Address label or<br />

change print or<br />

CERTIFICATION<br />

Name type.<br />

change<br />

Doing Business As<br />

34-1324238<br />

Initial<br />

return See Number <strong>and</strong> street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number<br />

Terminated<br />

Instruc-<br />

Specific<br />

41 CROSWELL ROAD 614-421-2022<br />

Amended tions.<br />

return City or town, state or country, <strong>and</strong> ZIP + 4<br />

G Gross receipts $<br />

516,464.<br />

Application<br />

COLUMBUS, OH 43214<br />

H(a) Is this a group return<br />

pending<br />

F Name <strong>and</strong> address of principal officer: CAROL GOLAND<br />

for affiliates?<br />

Yes X No<br />

41 CROSWELL, COLUMBUS, OH 43214<br />

H(b) Are all affiliates included? Yes No<br />

I Tax-exempt status: X 501(c) ( 5 ) § (insert no.) 4947(a)(1) or 527<br />

If "No," attach a list. (see instructions)<br />

J Website: | WWW.<strong>OEFFA</strong>.ORG<br />

H(c) Group exemption number |<br />

K Form of organization: X Corporation Trust Association Other |<br />

L Year of formation: 1980 M State of legal domicile: OH<br />

Part I Summary<br />

1 Briefly describe the organization’s mission or most significant activities: TO PROVIDE CERTIFICATION FOR<br />