Value Partners “A” Fund - Offshore-Rebates

Value Partners “A” Fund - Offshore-Rebates

Value Partners “A” Fund - Offshore-Rebates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

Annual Report<br />

For the year ended 31 December 2002<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

1806-08, Tower Two, Lippo Centre,<br />

89 Queensway, Hong Kong.<br />

Tel: (852) 2880 9263 Fax: (852) 2565 7975<br />

Email: vpl@vp.com.hk<br />

Web Site: www.valuepartners.com.hk

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

GENERAL INFORMATION<br />

MANAGER<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

Rooms 1806-08, Tower Two<br />

Lippo Centre<br />

89 Queensway<br />

Hong Kong<br />

The directors of <strong>Value</strong> <strong>Partners</strong> Limited are:<br />

Cheah Cheng Hye<br />

Chung David Kuohsien<br />

V-Nee Yeh<br />

Ho Man Kei, Norman<br />

Brian J. Doyle<br />

Whitney Strategic <strong>Partners</strong> III, L.P. (resigned on 25 March 2002)<br />

TRUSTEE, REGISTRAR, ADMINISTRATOR AND PRINCIPAL OFFICE<br />

Bank of Bermuda (Cayman) Limited<br />

36C Bermuda House, 3rd Floor<br />

P.O.Box 513GT<br />

Dr. Roy’s Drive, George Town<br />

Grand Cayman, Cayman Islands<br />

British West Indies<br />

CUSTODIAN AND REGISTRAR AGENT<br />

Bermuda Trust (Far East) Limited<br />

39/F Edinburgh Tower<br />

The Landmark<br />

15 Queen’s Road Central<br />

Hong Kong<br />

1

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

GENERAL INFORMATION (Continued)<br />

LEGAL ADVISOR<br />

To the Manager as to matters of Hong Kong law:<br />

Johnson Stokes & Master<br />

17/F Prince’s Building<br />

10 Chater Road<br />

Hong Kong<br />

To the Manager as to matters of Cayman Islands law:<br />

Maples and Calder Asia<br />

1504 One International Finance Centre<br />

1 Harbour View Street<br />

Central<br />

Hong Kong<br />

AUDITORS<br />

Moore Stephens (Cayman Islands) Limited<br />

3rd Floor, Block A<br />

West Wind Building<br />

George Town<br />

P.O. Box 1782 GT<br />

Grand Cayman<br />

British West Indies<br />

Information available from:<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

Rooms 1806-8, Tower Two<br />

Lippo Centre<br />

89 Queensway<br />

Hong Kong<br />

Telephone : (852) 2880 9263<br />

Fax : (852) 2565 7975<br />

E-mail : vpl@vp.com.hk<br />

Web site : www.valuepartners.com.hk<br />

2

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

MANAGER’S REPORT<br />

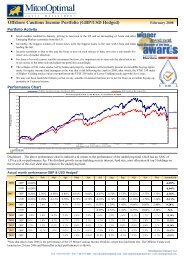

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> gained a net 20.8% in 2002. We’ve been strong and consistent, despite<br />

severe difficulties in Hong Kong, where the stockmarket has dropped for three years in a row, as can<br />

be seen in the following table:<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> Hang Seng Index MSCI Far East Ex-Japan<br />

2002 up 20.8% down 18.2% down 11.0%<br />

2001 up 41.7% down 24.5% down 4.2%<br />

2000 up 14.0% down 11.0% down 37.8%<br />

Source: Bermuda Trust (Far East) Ltd & Bloomberg.<br />

Data computed in US$terms on NAV to NAV basis.<br />

From a longer term perspective, our track record also looks good. From inception on 1 April, 1993 to<br />

the end of 2002, the fund climbed by a net 335.1%, equivalent to an annual return of 16.3%,<br />

compounded, compared to the Hang Seng Index’s annual return of 4.0% during this period of nineand-a-half<br />

years. Separately, in a study of the fund from inception date to 31 October, 2002, Lipper<br />

finds that the <strong>Value</strong> <strong>Partners</strong> fund, as compared to other Hong Kong and China equity funds:<br />

• Has the highest return<br />

• Also has the lowest volatility (i.e. the best risk-return ratio).<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> “is the best performing Hong Kong and China equity fund both in terms of<br />

risk-return ratio and annualized total return during this period,” says the Lipper study, dated 20<br />

November, 2002.<br />

The fund currently enjoys the highest rating of five stars from both Morningstar and Standard &<br />

Poor ’s.<br />

Best-performance awards<br />

We’re glad to report that we achieved tremendous success in the annual competitions to honor the best<br />

funds in the Hong Kong fund management industry. In all three of the competitions, <strong>Value</strong> <strong>Partners</strong><br />

<strong>“A”</strong> <strong>Fund</strong> won best-performance awards, according to results announced in early 2003. The competitions<br />

were conducted by Benchmark/Lipper; South China Morning Post/Standard & Poors; and Morningstar.<br />

In the Morningstar competition, only 10 winners were selected, five for equity funds worldwide and<br />

five for fixed-income funds worldwide; <strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> was named the No. 1 fund for Asia<br />

equities. A list of prizes won by the fund can be found in the table that follows this report.<br />

Consistent advantage<br />

We’ve made our money by sticking to what we know best: rely on bottom-up research to identify<br />

smart and original investments in East Asian markets, particularly those related to China and Hong<br />

Kong. Because we have specialist skills, both in terms of how and where we do our job, we enjoy a<br />

consistent advantage in the marketplace.<br />

3

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

MANAGER’S REPORT (Continued)<br />

The bulk of the fund is currently in shares of China-related small and medium enterprises (SMEs). We<br />

believe these smaller, more dynamic companies are the best way to participate in China’s growth. Our<br />

approach is different from that of the typical institutional fund, which mainly invests in the larger,<br />

mainstream China companies. While the larger companies tend to be state-owned enterprises, the<br />

SMEs are usually privately owned. Of course, to invest in the smaller companies, we need to have our<br />

own original research, as well as deep experience, but that’s what we have. During 2002, our research<br />

team carried out an estimated 500 company visits, across China and in Hong Kong, as well as some<br />

visits in Korea, Taiwan and Southeast Asia.<br />

As was the case a year previously, about three-quarters of our holdings is Hong Kong-listed. The rest<br />

of the portfolio is in China “B” shares; high-yield corporate bonds; and a few value-stocks listed in<br />

other East Asian markets such as Singapore and Taiwan, while about 3% of the fund is in cash.<br />

Although heavily exposed to Hong Kong-listed companies, we didn’t suffer much from Hong Kong’s<br />

troubled economy because we concentrate on companies whose activities are in China, rather than in<br />

the local economy. As explained previously, we are big in three investment categories:<br />

• Companies, many controlled by Hong Kong and Taiwanese entrepreneurs, with factories in<br />

China producing consumer goods for export;<br />

• Companies engaged in China’s domestic consumer market, such as autos;<br />

• Utility and infrastructure stocks and bonds offering high, sustainable yields.<br />

Outlook<br />

As many stockmarket investors have found, it has not been easy to make money from China’s strong<br />

growth, because many of the better known China plays are the wrong sort of investments, i.e. inefficient<br />

state-owned enterprises. Also, the market for China stocks – as well as Hong Kong stocks – tends to<br />

be emotional and momentum-driven, rather than based on fundamental value. Investors get whipsawed<br />

constantly. Furthermore, many of the major funds in the Hong Kong/China markets are reluctant to<br />

invest in stocks not included in such measures as the Hang Seng Index, because their performance is<br />

measured against an index; the result is that they don’t know or don’t care about attractive value<br />

offered by non-index stocks.<br />

Our view is that this is fertile ground for a value-investor with a contrarian approach. For us, the<br />

opportunities have grown because the market currently suffers from poor morale, meaning more<br />

bargains are being overlooked or thrown away. And China’s strong progress is providing numerous<br />

new opportunities, provided one invests based on fundamental analysis rather than speculation or<br />

emotion.<br />

<strong>Value</strong> <strong>Partners</strong> Limited, 17 April 2003<br />

4

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

MANAGER’S REPORT (Continued)<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> has won the following awards:<br />

1994 • <strong>Fund</strong> Manager of the Year 1994<br />

(Hong Kong Equities over 1 year)<br />

– Sunday Morning Post/Micropal<br />

• No. 1 in Micropal One-Year <strong>Offshore</strong> Territories Hong Kong equities<br />

sector out of 28 funds<br />

– Micropal<br />

1995 • No. 1 Hong Kong equity fund over 2 years ended 1995<br />

– Lipper<br />

• No. 1 Far East ex-Japan <strong>Fund</strong> 1995<br />

– <strong>Offshore</strong> Financial Review<br />

1996 • Ranked No. 1 by Micropal over 3 years ended 1996, both for the<br />

biggest gain and for having the lowest volatility<br />

(Hong Kong equities funds sector)<br />

– Micropal<br />

1997 • <strong>Fund</strong> Manager of the Year 1997<br />

(Hong Kong Equities over 3 years)<br />

– South China Morning Post/Micropal<br />

• Best performing Hong Kong Equities <strong>Fund</strong> in terms of risk-return<br />

ratio since its inception in 1993<br />

– Lipper<br />

1998 • “AA”<br />

– Standard & Poor’s Executive Summary*<br />

2001 • <strong>Fund</strong> of the Year 2001<br />

(Hong Kong/China Equities over 3 years)<br />

– Benchmark/Lipper<br />

2002 • <strong>Fund</strong> Manager of the Year 2002<br />

(Asia Equities)<br />

– Morningstar<br />

• <strong>Fund</strong> Manager of the Year 2002<br />

(Hong Kong Equities over 3 years)<br />

– South China Morning Post/Standard & Poor’s<br />

• <strong>Fund</strong> of the Year 2002<br />

(Greater China Equities over 3 years & over 5 years)<br />

– Benchmark/Lipper<br />

* Standard & Poor’s “AA” rating is awarded to “a fund which demonstrates a very strong ability to adhere to consistent<br />

investment processes and provides above-average volatility adjusted returns relative to funds with similar objectives.”<br />

The Reuters Survey 2000, published in September 2000, ranks <strong>Value</strong> <strong>Partners</strong> among the five best fund management<br />

firms for Hong Kong and China stock markets. <strong>Value</strong> <strong>Partners</strong> has consistently ranked among the top 5 in the past<br />

three years, from the inception of the Reuters Survey. Likewise, <strong>Value</strong> <strong>Partners</strong>’ Cheah Cheng Hye has been consistently<br />

ranked among the top 20 individual fund managers for Hong Kong/China over the same period.<br />

5

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

MANAGER’S REPORT (Continued)<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong>: Compared to Hang Seng Index<br />

Year-to-date: 31 December, 2001 to 31 December, 2002<br />

NAV as of 31 December, 2002 = US$43.51 (<strong>“A”</strong> unit)<br />

35%<br />

% change<br />

30% <strong>“A”</strong> <strong>Fund</strong> after performance fee<br />

Hong Kong Hang Seng Index<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

-5%<br />

-10%<br />

-15%<br />

-20%<br />

25%<br />

+20.8%<br />

31/12/2001<br />

8/1/2002<br />

15/1/2002<br />

22/1/2002<br />

29/1/2002<br />

5/2/2002<br />

11/2/2002<br />

19/2/2002<br />

26/2/2002<br />

5/3/2002<br />

12/3/2002<br />

19/3/2002<br />

26/3/2002<br />

2/4/2002<br />

9/4/2002<br />

17/4/2002<br />

24/4/2002<br />

2/5/2002<br />

8/5/2002<br />

15/5/2002<br />

22/5/2002<br />

29/5/2002<br />

5/6/2002<br />

12/6/2002<br />

19/6/2002<br />

26/6/2002<br />

30/6/2002<br />

3/7/2002<br />

10/7/2002<br />

17/7/2002<br />

24/7/2002<br />

31/7/2002<br />

7/8/2002<br />

14/8/2002<br />

21/8/2002<br />

28/8/2002<br />

4/9/2002<br />

11/9/2002<br />

18/9/2002<br />

25/9/2002<br />

2/10/2002<br />

9/10/2002<br />

16/10/2002<br />

23/10/2002<br />

30/10/2002<br />

6/11/2002<br />

13/11/2002<br />

20/11/2002<br />

27/11/2002<br />

4/12/2002<br />

11/12/2002<br />

18/12/2002<br />

27/12/2002<br />

31/12/2002<br />

Since Launch of <strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong>: 1 April, 1993 to 31 December, 2002<br />

-18.2%<br />

Source: BTFE & Bloomberg<br />

400%<br />

350%<br />

300%<br />

250%<br />

200%<br />

150%<br />

100%<br />

50%<br />

% change<br />

<strong>“A”</strong> <strong>Fund</strong> after performance fee<br />

Hong Kong Hang Seng Index<br />

+335.1%<br />

+45.9%<br />

0%<br />

1/4/1993<br />

28/9/1993<br />

29/3/1994<br />

27/9/1994<br />

28/3/1995<br />

26/91995<br />

26/3/1996<br />

24/9/1996<br />

25/3/1997<br />

23/9/1997<br />

31/3/1998<br />

29/9/1998<br />

30/3/1999<br />

28/9/1999<br />

28/3/2000<br />

26/9/2000<br />

27/3/2001<br />

25/9/2001<br />

26/3/2002<br />

25/9/2002<br />

31/12/2002<br />

Source: BTFE & Bloomberg<br />

The price of units may go down as well as up and past performance cannot guarantee future results.<br />

6

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF RESPONSIBILITIES OF THE MANAGER AND THE TRUSTEE<br />

MANAGER ’ S RESPONSIBILITIES<br />

The Manager of the <strong>Fund</strong> is required by The Hong Kong Code on Unit Trusts and Mutual <strong>Fund</strong>s (the<br />

“Code”) to prepare accounts for each annual accounting period which give a true and fair view of the<br />

disposition of the <strong>Fund</strong> at the end of that period and of the transactions for the period then ended. In<br />

preparing these accounts the Manager is required to:<br />

• select suitable accounting policies and then apply them consistently;<br />

• make judgments and estimates that are prudent and reasonable;<br />

• state whether applicable accounting standards have been followed, subject to any material<br />

departure disclosed and explained in the accounts; and<br />

• prepare the accounts on the basis that the <strong>Fund</strong> will continue in operation unless it is<br />

inappropriate to presume this.<br />

The Manager is also required to manage the <strong>Fund</strong> in accordance with the Trust Deed and take reasonable<br />

steps for the prevention and detection of fraud and other irregularities.<br />

Trustee’s responsibilities<br />

The Trustee is required by the Code to:<br />

• ensure that the <strong>Fund</strong> is managed by the Manager in accordance with the Trust Deed and that<br />

the investment and borrowing powers are complied with;<br />

• satisfy itself that sufficient accounting and other records have been maintained;<br />

• safeguard the properties of the <strong>Fund</strong> and rights attaching thereto; and<br />

• report to the unitholders for each annual accounting period on the conduct of the Manager in<br />

the management of the <strong>Fund</strong>.<br />

7

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

REPORT OF THE TRUSTEE TO THE UNITHOLDERS OF VALUE PARTNERS <strong>“A”</strong> FUND<br />

We hereby confirm that, in our opinion, the Manager has, in all material respects, managed the <strong>Fund</strong><br />

in accordance with the provisions of the Trust Deed dated 26 October 1993, as amended, for the year<br />

ended 31 December 2002.<br />

For and on behalf of<br />

BANK OF BERMUDA (CAYMAN) LIMITED<br />

Trustee, 17 April 2003<br />

8

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

AUDITORS’ REPORT TO THE UNITHOLDERS OF VALUE PARTNERS <strong>“A”</strong> FUND<br />

We have audited the accounts on pages 10 to 30 which have been prepared in accordance with<br />

International Accounting Standards.<br />

Respective responsibilities of the Trustee, Manager and Auditors<br />

The responsibilities of the Trustee in connection with the conduct of the management of the <strong>Fund</strong> and<br />

the Trustee’s report to unitholders are set out on pages 7 and 8 respectively.<br />

As described on page 7 the Manager of the <strong>Fund</strong> is responsible for the preparation of accounts which<br />

give a true and fair view. It is our responsibility to form an independent opinion, based on our audit,<br />

on those accounts and to report our opinion to you.<br />

Basis of opinion<br />

We conducted our audit in accordance with International Standards on Auditing. An audit includes<br />

examination, on a test basis, of evidence relevant to the amounts and disclosures in the accounts. It<br />

also includes an assessment of the significant estimates and judgments made by the Manager in the<br />

preparation of the accounts, and of whether the accounting policies are appropriate to the <strong>Fund</strong>’s<br />

circumstances, consistently applied and adequately disclosed.<br />

We planned and performed our audit so as to obtain all the information and explanations which we<br />

considered necessary in order to provide us with sufficient evidence to give reasonable assurance as to<br />

whether the accounts are free from material misstatement. In forming our opinion we also evaluated<br />

the overall adequacy of the presentation of information in the accounts. We believe that our audit<br />

provides a reasonable basis for our opinion.<br />

Opinion<br />

In our opinion the accounts of the <strong>Fund</strong>, which have been properly prepared in accordance with the<br />

relevant provisions of the Trust Deed dated 26 October 1993, as amended, and the Hong Kong Code<br />

on Unit Trusts and Mutual <strong>Fund</strong>s, give, on that basis, a true and fair view of the disposition of the<br />

<strong>Fund</strong> at 31 December 2002 and of the transactions and cash flows for the year then ended.<br />

Moore Stephens (Cayman Islands) Ltd.<br />

George Town<br />

Grand Cayman<br />

17 April 2003<br />

9

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF NET ASSETS<br />

AS AT 31 DECEMBER 2002<br />

Note 2002 2001<br />

US$<br />

US$<br />

ASSETS<br />

Listed and unlisted investments 196,393,650 77,741,590<br />

Dividends and other receivables 578,277 510,417<br />

Amounts due from brokers 355,245 375,182<br />

Prepayments – 1,783<br />

Amount due from connected party 326,317 –<br />

Amounts due from unitholders 1,196,190 –<br />

Bank balances and deposits 10,430,569 5,548,038<br />

209,280,248 84,177,010<br />

LIABILITIES<br />

Accounts payable and other accruals 5,182,101 4,203,394<br />

Amount due to fund manager 2,453 5,286<br />

Amounts due to brokers 1,607,541 303,149<br />

Amounts due to unitholders 479,554 –<br />

7,271,649 4,511,829<br />

NET ASSETS 202,008,599 79,665,181<br />

Representing:<br />

CAPITAL ACCOUNT 188,986,732 68,855,924<br />

ACCUMULATED NET INCOME 13,021,867 10,809,257<br />

202,008,599 79,665,181<br />

UNITS IN ISSUE 6<br />

<strong>“A”</strong> units 2,401,483 2,126,001<br />

“B” units 4,684,714 177,001<br />

NET ASSET VALUE PER UNIT<br />

<strong>“A”</strong> units 43.51 36.03<br />

“B” units 20.82 17.28<br />

For and on behalf of<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

For and on behalf of<br />

Bank of Bermuda (Cayman) Limited<br />

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

Manager<br />

Trustee<br />

The notes and information on pages 14 to 30 form part of these accounts.<br />

10

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF INCOME AND EXPENDITURE<br />

FOR THE YEAR ENDED 31 DECEMBER 2002<br />

Note 2002 2001<br />

US$<br />

US$<br />

INCOME<br />

Dividends on listed investments 7,904,726 3,097,043<br />

Interest on bonds 665,209 232,325<br />

Refund of management fees 5(g) 348,760 –<br />

Interest on deposits 83,963 77,118<br />

Others 692 –<br />

9,003,350 3,406,486<br />

EXPENDITURE<br />

Performance fee 4,907,957 4,062,002<br />

Manager’s fee 1,381,577 511,454<br />

Trustee’s fee 175,966 80,261<br />

Registrar fee 130,806 57,511<br />

Other expenses 106,742 34,207<br />

Accounting and professional fees 30,416 –<br />

Bank charges 24,759 7,719<br />

Transaction handling fees 17,004 13,037<br />

Auditors’ remuneration 13,311 13,115<br />

Stamp duty 1,735 –<br />

Interest expenses 467 286<br />

6,790,740 4,779,592<br />

NET INCOME/(LOSS) FOR THE YEAR 2,212,610 (1,373,106)<br />

The notes and information on pages 14 to 30 form part of these accounts.<br />

11

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN CAPITAL ACCOUNT AND ACCUMULATED NET INCOME<br />

FOR THE YEAR ENDED 31 DECEMBER 2002<br />

2002 2001<br />

US$<br />

US$<br />

Capital account brought forward 68,855,924 38,645,975<br />

Net proceeds on issue of units 129,701,950 12,831,932<br />

Less: Redemption of units (25,062,882) (5,397,280)<br />

173,494,992 46,080,627<br />

Unrealised gain in value of investments<br />

At the beginning of the year 8,437,248 4,506,618<br />

At the end of the year 15,796,554 8,437,248<br />

7,359,306 3,930,630<br />

Realised gain on sale of investments 8,094,323 18,886,470<br />

Exchange gain/(loss) 38,111 (41,803)<br />

Capital account carried forward 188,986,732 68,855,924<br />

Net income/(loss) for the year 2,212,610 (1,373,106)<br />

Accumulated net income brought forward 10,809,257 12,182,363<br />

Accumulated net income carried forward 13,021,867 10,809,257<br />

<strong>Value</strong> of the <strong>Fund</strong> carried forward 202,008,599 79,665,181<br />

The notes and information on pages 14 to 30 form part of these accounts.<br />

12

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

CASH FLOW STATEMENT<br />

FOR THE YEAR ENDED 31 DECEMBER 2002<br />

Note 2002 2001<br />

US$<br />

US$<br />

NET CASH INFLOW FROM OPERATING<br />

ACTIVITIES 8 2,834,201 1,742,216<br />

INVESTING ACTIVITIES<br />

Purchase of investments (193,418,117) (71,893,719)<br />

Sale of investments 91,544,015 67,242,976<br />

NET CASH OUTFLOW FROM<br />

INVESTING ACTIVITIES (101,874,102) (4,650,743)<br />

CASH FLOWS FROM FINANCING ACTIVITIES<br />

Subscription of units 128,505,760 12,831,932<br />

Redemption of units (24,583,328) (5,397,280)<br />

NET CASH INFLOW FROM<br />

FINANCING ACTIVITIES 103,922,432 7,434,652<br />

Increase in cash and bank balances 4,882,531 4,526,125<br />

Cash and bank balances at 31 December 2001 5,548,038 1,021,913<br />

CASH AND BANK BALANCES<br />

31 DECEMBER 2002 10,430,569 5,548,038<br />

The notes and information on pages 14 to 30 form part of these accounts.<br />

13

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND<br />

1 GENERAL<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> was established by the Trust Deed dated 26 October 1993, as amended,<br />

and registered under section 4(3) of the Mutual <strong>Fund</strong>s Laws of the Cayman Islands.<br />

The <strong>Fund</strong> was authorised by the Securities and Futures Commission on 13 July 1994.<br />

On 12 March 2002, <strong>Value</strong> <strong>Partners</strong> Limited issued a notice to notify all unitholders that with<br />

effect from 12 April 2002, the acceptance of application for <strong>“A”</strong> units was suspended.<br />

2 PRINCIPAL ACCOUNTING POLICIES<br />

(a)<br />

Accounting standards<br />

The accounts have been prepared in accordance with International Accounting Standards.<br />

(b)<br />

Accounting convention<br />

The accounts have been prepared under the historical cost convention, as modified by the<br />

revaluation of investments.<br />

(c)<br />

Investments<br />

Listed investments are stated at the last traded price where they are listed on a recognised<br />

Stock Exchange. If no price is available, the <strong>Fund</strong> relies upon one or more brokers for<br />

confirmation of the price. Unlisted investments are stated at fair value as deemed appropriate<br />

by the Manager. Investments in open ended unit trusts and mutual funds are valued at their<br />

respective net asset values.<br />

Dividends on listed investments are stated net of withholding and other taxes and are included<br />

in the Statement of Income and Expenditure when the relevant investments are first listed exdividend.<br />

Other income is recognised on an accrual basis.<br />

Profits and losses on realisation of investments together with the unrealised appreciation and<br />

diminution on revaluation of investments at the balance sheet date are dealt with in the capital<br />

account.<br />

14

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND (Continued)<br />

2 PRINCIPAL ACCOUNTING POLICIES (continued)<br />

(d)<br />

Translation of foreign currencies<br />

Monetary assets and liabilities expressed in foreign currencies at the year end are translated<br />

into United States Dollars at the rates of exchange ruling at the balance sheet date:<br />

US$1 = HK$7.7986<br />

US$1 = AUD1.7668<br />

US$1 = KRW1,186.0000<br />

US$1 = TWD34.7700<br />

US$1 = CAD1.575<br />

US$1 = SGD1.7378<br />

US$1 = JPY118.5250<br />

US$1 = THB43.1400<br />

Transactions in foreign currencies during the year are translated into United States Dollars at<br />

the rates of exchange ruling at the transaction dates. Unrealised and realised gains and losses<br />

on translation of transactions and balances denominated in foreign currencies are dealt with in<br />

the capital account.<br />

(e)<br />

Connected parties<br />

A connected party is a director or a party connected with a director of the Manager of the<br />

<strong>Fund</strong>.<br />

3 DISTRIBUTION<br />

The Manager of the <strong>Fund</strong> recommends that no final distribution be made at 31 December 2002<br />

(2001: Nil) and that the accumulated net income be carried forward.<br />

4 TAXATION<br />

By virtue of the <strong>Fund</strong>’s registration with the Securities and Futures Commission, the <strong>Fund</strong>’s<br />

current source of income is exempt from Hong Kong profits tax under Section 26A(1A) of the<br />

Inland Revenue Ordinance.<br />

The <strong>Fund</strong> is not subject to tax in the Cayman Islands. The <strong>Fund</strong> has obtained from the<br />

Governor-in-Council of the Cayman Islands an undertaking that it will not be chargeable to<br />

tax in the Cayman Islands on its income or its capital gains arising in the Cayman Islands or<br />

elsewhere for a minimum period of fifty years from the date on which the <strong>Fund</strong> is established.<br />

15

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND (Continued)<br />

5 TRANSACTIONS WITH THE MANAGER, TRUSTEE AND CONNECTED PARTIES<br />

The following is a summary of transactions with the Manager, Trustee and connected parties<br />

in the year. All such transactions were entered into the ordinary course of business and on<br />

normal commercial terms.<br />

(a)<br />

Subscriptions and Redemptions of the <strong>Fund</strong><br />

(i)<br />

With the Manager<br />

Unit holdings Subscriptions Redemptions Unit holdings<br />

as at during during as at<br />

31.12.2001 the year the year 31.12.2002<br />

Unit Unit Unit Unit<br />

<strong>“A”</strong> units<br />

<strong>Value</strong> <strong>Partners</strong> Limited 43,295 – – 43,295<br />

(ii)<br />

With connected parties of the Manager<br />

<strong>“A”</strong> units<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

(staff account) 5,595 – – 5,595<br />

Cheah Cheng Hye 90,844 – – 90,844<br />

HC Capital Limited 80,569 – – 80,569<br />

V-Nee Yeh 107,478 – – 107,478<br />

To Hau Yin 6,615 – – 6,615<br />

Chung David Kuohsien – 3,019 – 3,019<br />

“B” units<br />

<strong>Value</strong> <strong>Partners</strong> Limited<br />

(staff account) 5,348 – – 5,348<br />

Ho Man Kei, Norman 4,850 2,450 – 7,300<br />

To Hau Yin 1,992 – – 1,992<br />

Cheah Cheng Hye – 2,571 – 2,571<br />

(b)<br />

For the year ended 31 December 2002, income accruing to the Manager relating to subscription<br />

and redemption charges of the <strong>Fund</strong> amounted to US$38,561 and US$119,621 for <strong>“A”</strong> and<br />

“B” units respectively (2001: US$8,770 and US$6,586 for <strong>“A”</strong> and “B” units respectively).<br />

16

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND (Continued)<br />

5 TRANSACTIONS WITH THE MANAGER, TRUSTEE AND CONNECTED PARTIES<br />

(continued)<br />

(c)<br />

(d)<br />

(e)<br />

(f)<br />

(g)<br />

(h)<br />

Trustee’s fee, comprising fixed amount of US$3,000 per annum and 0.15% per annum for the<br />

first US$10 million, 0.125% per annum for the next US$20 million and the remaining balance<br />

thereafter at 0.1% per annum of the net asset value of the <strong>Fund</strong>, was paid to Bank of Bermuda<br />

(Cayman) Limited.<br />

Accounting fees, valuation fees, registrar and transfer agent fees, handling fees and<br />

administration fees totalling US$147,810 (2001: US$73,606) were paid to Bank of Bermuda<br />

(Cayman) Limited and Bermuda Trust (Far East) Limited.<br />

Performance fee payable to the Manager, <strong>Value</strong> <strong>Partners</strong> Limited, calculated at 15% of the<br />

product of i) the average number of units in issue during the year and ii) the excess of net<br />

asset value per unit between the end of the base year and the current year, was US$4,907,957<br />

(2001: US$4,062,002). The base year is defined as the financial year in which the performance<br />

fee is last paid.<br />

Manager’s fee of 0.75% and 1% per annum on the net asset value of the <strong>Fund</strong> attributable to<br />

the <strong>“A”</strong> and “B” units respectively was paid to <strong>Value</strong> <strong>Partners</strong> Limited.<br />

During the year, the <strong>Fund</strong> acquired 4,432 units in <strong>Value</strong> <strong>Partners</strong> Asia Recovery <strong>Fund</strong><br />

(“VPARF”). At 31 December 2002, the <strong>Fund</strong> held 4,432 units with a market value of<br />

US$6,188,046 (2001: Nil unit) in VPARF. <strong>Value</strong> <strong>Partners</strong> Limited is the fund manager of<br />

VPARF. As <strong>Value</strong> <strong>Partners</strong> Limited would manage units in VPARF held by the <strong>Fund</strong> free of<br />

charge, <strong>Value</strong> <strong>Partners</strong> Limited refunded the relevant portion of performance fee and manager’s<br />

fee in the total of US$348,760 (2001: US$Nil) earned from VPARF to the <strong>Fund</strong>.<br />

During the year, the <strong>Fund</strong> transacted in shares in Leefung-Asco Printers Holdings Limited and<br />

realised a gain of US$20,336 in these transactions. At 31 December 2002, the <strong>Fund</strong> held<br />

7,510,000 shares with a market value of US$857,064 (2001: 7,856,000 shares with a market<br />

value of US$876,640) in this company. Mr. Ho Man Kei, Norman was a director of this<br />

company and resigned on 12 December 2002.<br />

17

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND (Continued)<br />

6 ALLOTMENTS AND REDEMPTIONS<br />

2002 2001<br />

<strong>“A”</strong> Units “B” Units <strong>“A”</strong> Units “B” Units<br />

Total allotments 456,142 5,341,876 361,941 36,353<br />

Total redemptions (180,660) (834,163) (156,344) (24,669)<br />

275,482 4,507,713 205,597 11,684<br />

Nature of Units<br />

Under the Trust Deed the Manager is entitled to issue units of two classes, <strong>“A”</strong> units and “B”<br />

units.<br />

With effect from 12 April 2002, the acceptance of application of <strong>“A”</strong> units was suspended.<br />

29,216 “B” units were first issued on 15 May 1996 at a price of US$10 per unit which was<br />

also the net asset value per unit on that date. The net asset value per unit of <strong>“A”</strong> units on 15<br />

May 1996 was US$20.57. Following the issue of “B” units, the net asset value per unit of each<br />

<strong>“A”</strong> and “B” class units is determined in each week by reference to the net assets of the <strong>Fund</strong><br />

attributable to each class of units and the number of units of each class issued. In determining<br />

the net assets of the <strong>Fund</strong> attributable to the <strong>“A”</strong> units and “B” units, charges such as<br />

management fee, preliminary charges and realisation charges relating to the units of each class<br />

are computed separately in accordance with the rates applicable to each class of units.<br />

<strong>“A”</strong> units are freely transferrable while “B” units may only be transferred with the prior<br />

written consent of the Manager.<br />

7 SOFT COMMISSION ARRANGEMENTS<br />

The <strong>Fund</strong> generally pays brokerages at customary institutional brokerage rates. The Manager<br />

and its connected parties may not retain cash commission rebates from brokers or dealers in<br />

respect of transactions for the <strong>Fund</strong> but may enter into soft commission arrangements for the<br />

provision to the Manager and its connected parties, services and other benefits which are of<br />

demonstrable benefit to the <strong>Fund</strong> as a whole. Execution of transactions are consistent with<br />

best execution standards.<br />

The Manager had received services and benefits from brokers in the form of soft commission<br />

in the year ended 31 December 2002. Nature of such services and benefits are as follows:<br />

• market analysis, data and quotation services;<br />

• computer hardware and software incidental to the above services; and<br />

• investment-related publications.<br />

18

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

NOTES TO THE ACCOUNTS OF THE FUND (Continued)<br />

8 NOTE ON CASH FLOW STATEMENT<br />

Reconciliation of net income/(loss) for the year to net cash inflow from operating activities<br />

2002 2001<br />

US$<br />

US$<br />

Net income/(loss) for the year 2,212,610 (1,373,106)<br />

Adjustment for:<br />

Exchange gain/(loss) 38,111 (41,803)<br />

Interest income (749,172) (309,443)<br />

Interest expenses 467 286<br />

Dividends on listed investments (7,904,726) (3,097,043)<br />

Operating loss before working capital changes (6,402,710) (4,821,109)<br />

Decrease/(increase) in prepayments 1,783 (1,783)<br />

Increase in amount due from connected party (326,317) –<br />

Increase in accounts payable and other accruals 978,707 3,534,231<br />

(Decrease)/increase in amount due to fund manager (2,833) 5,286<br />

Cash used in operations (5,751,370) (1,283,375)<br />

Interest received 838,490 52,213<br />

Interest paid (467) (286)<br />

Dividends on listed investments 7,747,548 2,973,664<br />

Net cash inflow from operating activities 2,834,201 1,742,216<br />

9 APPROVAL OF ACCOUNTS<br />

The accounts were approved and authorised for issue on 17 April 2003.<br />

19

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

INVESTMENT PORTFOLIO AS AT 31 DECEMBER 2002<br />

Market<br />

LISTED AND UNLISTED INVESTMENTS (97.22%) Holdings value % of NAV<br />

Share/Unit US$<br />

EQUITIES (91.10%)<br />

CANADIAN (LISTED) (0.51%)<br />

IVANHOE MINES LTD 493,400 1,024,392 0.51<br />

CAYMAN ISLANDS (UNLISTED) (3.06%)<br />

VALUE PARTNERS ASIA RECOVERY FUND 4,432 6,188,046 3.06<br />

CHINA (LISTED) (1.46%)<br />

CHINA VANKE CO LTD – B SHARE 1,731,745 1,216,880 0.60<br />

FOSHAN ELECTRICAL AND LIGHTING CO LTD<br />

– B SHARE 1,399,838 1,206,231 0.60<br />

SHANGHAI SHANGLING ELECTRIC APPLIANCE<br />

– B SHARE 687,548 519,099 0.26<br />

2,942,210 1.46<br />

GREAT BRITAIN (LISTED) (0.04%)<br />

WORLDSEC LTD 100,000 76,183 0.04<br />

HONG KONG (LISTED) (75.63%)<br />

ALCO HOLDINGS LTD 210,000 31,236 0.01<br />

ANGANG NEW STEEL CO – H SHARE 7,540,000 1,082,861 0.54<br />

ANHUI EXPRESSWAY CO LTD – H SHARE 22,186,000 4,807,830 2.38<br />

APT SATELLITE HOLDINGS LTD 2,050,000 378,529 0.19<br />

ARCONTECH CORPORATION LTD 6,066,000 161,011 0.08<br />

ARTS OPTICAL INTL HOLDINGS LTD 1,894,000 516,086 0.25<br />

ASIA ALUMINUM HOLDINGS LTD 30,536,000 2,466,812 1.22<br />

ASIA SATELLITE TELECOMMUNICATIONS<br />

HOLDINGS LTD 1,107,500 1,299,416 0.64<br />

BANK OF EAST ASIA LTD 445,400 762,456 0.38<br />

BRIGHT INTL GROUP LTD 10,864,000 1,323,417 0.65<br />

BRILLIANCE CHINA AUTOMOTIVE<br />

HOLDINGS LTD 38,700,000 7,046,649 3.49<br />

20

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

INVESTMENT PORTFOLIO AS AT 31 DECEMBER 2002 (Continued)<br />

Market<br />

LISTED AND UNLISTED INVESTMENTS (97.22%) Holdings value % of NAV<br />

Share/Unit US$<br />

HONG KONG (LISTED) (75.63%)<br />

CHEUNG KONG INFRASTRUCTURE HOLDINGS LTD 5,357,000 9,170,358 4.54<br />

CHINA AGROTECH HOLDINGS LTD 1,136,200 69,933 0.03<br />

CHINA PHARMACEUTICAL ENT & INV CORP 9,016,000 1,618,547 0.80<br />

CHUN WO HOLDINGS LTD 16,032,000 505,715 0.25<br />

CITY TELECOM (HK) LTD 8,732,000 1,511,579 0.75<br />

CLP HOLDINGS LTD 771,500 3,106,340 1.54<br />

ELEC & ELTEK INTL HOLDINGS LTD 7,775,000 957,095 0.47<br />

ELEGANCE INTL HOLDINGS LTD 2,564,000 598,374 0.30<br />

EURO-ASIA AGRICULTURAL HOLDINGS CO LTD 19,590,000 477,278 0.24<br />

FAR EAST PHARMACEUTICAL TECH CO LTD 11,352,000 2,576,493 1.27<br />

FIRST MOBILE GROUP HOLDINGS LTD 32,760,000 1,449,260 0.72<br />

FONG’S INDUSTRIES CO LTD 14,306,000 3,989,889 1.98<br />

FOUNTAIN SET (HOLDINGS) LTD 23,918,000 13,187,931 6.53<br />

FOUR SEAS EFOOD HOLDINGS LTD 8,128,000 573,231 0.28<br />

FUJIKON IND HOLDINGS LTD 14,146,000 1,959,029 0.97<br />

GLOBAL BIO-CHEM TECHNOLOGY GROUP CO LTD 3,282,000 873,253 0.43<br />

GLORIOUS SUN ENTERPRISES LTD 18,029,000 3,606,447 1.78<br />

GOLDEN RESOURCES DEV INTL LTD 3,784,000 140,712 0.07<br />

GUANGDONG INVESTMENT LTD 5,308,000 660,216 0.33<br />

GUOCO GROUP LTD 693,000 4,069,884 2.01<br />

HENDERSON INVESTMENT LTD 4,300,000 3,969,943 1.96<br />

HIGH FASHION INTL LTD 250,900 26,381 0.01<br />

HONG KONG AIRCRAFT ENGINEERING CO LTD 599,200 1,767,189 0.87<br />

HOPEWELL HOLDINGS LTD 7,841,000 5,127,728 2.54<br />

HOPSON DEV. HOLDINGS LTD 7,344,000 1,082,964 0.54<br />

HUNG HING PRINTING GROUP LTD 3,780,000 2,423,512 1.20<br />

IDT INTERNATIONAL LTD 17,398,000 1,695,494 0.84<br />

KARRIE INTL HOLDINGS LTD 11,444,000 2,538,676 1.26<br />

KIN YAT HOLDINGS LTD 11,746,000 2,108,635 1.04<br />

LEEFUNG-ASCO PRINTERS HOLDINGS LTD 7,510,000 857,064 0.42<br />

LUK FOOK HOLDINGS INTL LTD 18,654,000 1,913,574 0.95<br />

MIRABELL INTL HOLDINGS LTD 3,932,000 443,690 0.22<br />

NGAI LIK INDUSTRIAL HOLDINGS 6,974,000 1,770,641 0.88<br />

ORIENT POWER HOLDINGS LTD 12,274,000 613,810 0.30<br />

ORIENT OVERSEAS INTL LTD 9,524,000 4,640,730 2.30<br />

PACIFIC ANDES INTL HOLDING LTD 18,676,000 1,939,779 0.96<br />

PACIFIC ANDES INTERNATIONAL HOLDINGS<br />

(WARRANT) 25/3/2004 1,398,800 15,246 0.01<br />

21

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

INVESTMENT PORTFOLIO AS AT 31 DECEMBER 2002 (Continued)<br />

Market<br />

LISTED AND UNLISTED INVESTMENTS (97.22%) Holdings value % of NAV<br />

Share/Unit US$<br />

HONG KONG (LISTED) (75.63%)<br />

PAUL Y-ITC CONSTRUCTION HOLDINGS LTD 5,604,000 215,577 0.11<br />

PETROCHINA CO LTD – H SHARE 63,100,000 12,541,354 6.21<br />

ROAD KING INFRASTRUCTURE LTD 8,581,000 3,933,664 1.95<br />

SHANGHAI INDUSTRIAL HOLDINGS LTD 1,683,000 2,319,936 1.15<br />

SHENZHEN INVESTMENT LTD 20,804,000 2,827,718 1.40<br />

SHUI ON CONSTRUCTION & MATERIALS LTD 388,000 189,060 0.09<br />

SINGAMAS CONTAINER HOLDINGS LTD 90,000 18,465 0.01<br />

SINO GOLF HOLDINGS LTD 4,304,000 496,705 0.25<br />

SINOLINK WORLDWIDE HOLDINGS LTD 28,451,600 1,933,597 0.96<br />

SINOPEC KANTONS HOLDINGS LTD 6,478,000 647,916 0.32<br />

SKYWORTH DIGITAL HOLDINGS LTD 45,298,000 4,762,952 2.36<br />

SUN EAST TECHNOLOGY HOLDINGS LTD 22,606,000 1,797,210 0.89<br />

SUN HING VISION GROUP HOLDINGS LTD 8,582,000 3,108,782 1.54<br />

TOP FORM INTERNATIONAL LTD 24,438,000 1,457,142 0.72<br />

TRAVELSKY TECHNOLOGY LTD – H SHARE 2,850,000 1,973,431 0.98<br />

TUNGTEX HOLDING CO LTD 3,342,000 932,071 0.46<br />

VICTORY CITY INTERNATIONAL HOLDINGS LTD 16,840,000 2,828,764 1.40<br />

VS INTERNATIONAL GROUP 18,758,000 1,106,440 0.55<br />

YUE YUEN INDUSTRIAL (HOLDINGS) LTD 1,783,000 5,784,359 2.86<br />

152,788,066 75.63<br />

SOUTH KOREA (LISTED) (2.04%)<br />

HANDSOME CO LTD 230,000 1,619,309 0.80<br />

HYUNDAI MOTOR CO LTD 61,800 1,445,995 0.72<br />

NONG SHIM CO LTD 17,400 1,056,324 0.52<br />

4,121,628 2.04<br />

SINGAPORE (LISTED) (5.46%)<br />

ELEC & ELTEK INTERNATIONAL CO LTD 474,000 853,200 0.42<br />

IDT HOLDINGS SINGAPORE LTD 649,000 433,214 0.21<br />

JARDINE MATHESON HOLDINGS LTD 875,133 5,469,581 2.71<br />

UNITED FOOD HOLDINGS LTD 21,253,000 4,280,441 2.12<br />

22<br />

11,036,436 5.46

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

INVESTMENT PORTFOLIO AS AT 31 DECEMBER 2002 (Continued)<br />

Market<br />

LISTED AND UNLISTED INVESTMENTS (97.22%) Holdings value % of NAV<br />

Share/Unit US$<br />

TAIWAN (LISTED) (1.48%)<br />

TAINAN ENTERPRISES CO LTD 2,588,950 2,993,264 1.48<br />

THAILAND (LISTED) (1.39%)<br />

COMPASS EAST INDUSTRY (THAILAND)<br />

PUBLIC CO LTD (FOR) 2,335,000 1,474,936 0.73<br />

MBK DEVELOPMENT PUBLIC CO LTD (FOR) 1,689,700 1,331,706 0.66<br />

2,806,642 1.39<br />

UNITED STATES OF AMERICA (LISTED) (0.03%)<br />

ASAT HOLDINGS LTD – ADR 61,921 48,918 0.02<br />

CITY TELECOM (HK) LTD – ADR 3,000 9,300 0.01<br />

58,218 0.03<br />

EQUITIES TOTAL 184,035,085 91.10<br />

FOREIGN CURRENCY OPTION (UNLISTED) (0.09%)<br />

USD CALL/HKD PUT 8.0 06/10/2003 43,000,000 103,200 0.05<br />

USD CALL/HKD PUT 8.2 07/10/2003 48,700,000 85,225 0.04<br />

FOREIGN CURRENCY OPTION TOTAL 188,425 0.09<br />

BONDS (6.03%)<br />

HONG KONG (UNLISTED) (5.74%)<br />

KOWLOON-CANTON RAILWAY 7.25% 270709 1,170,000 1,365,449 0.68<br />

MASS TRANSIT RAILWAY 7.5% 081110 1,340,000 1,596,878 0.79<br />

PCCW-HKT CAPITAL LTD 7.75% 151111 (REG S) 7,000,000 7,533,750 3.73<br />

ROAD KING INFRASTRUCTURE<br />

9.5% 150707 144A 1,000,000 1,085,000 0.54<br />

23<br />

11,581,077 5.74

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

INVESTMENT PORTFOLIO AS AT 31 DECEMBER 2002 (Continued)<br />

Market<br />

LISTED AND UNLISTED INVESTMENTS (97.22%) Holdings value % of NAV<br />

Share/Unit US$<br />

UNITED STATES OF AMERICA (UNLISTED) (0.29%)<br />

ASAT FINANCE LLC 12.5% 011106 1,450,000 589,063 0.29<br />

BONDS TOTAL 12,170,140 6.03<br />

TOTAL LISTED AND UNLISTED<br />

INVESTMENT PORTFOLIO 196,393,650 97.22<br />

NET CURRENT ASSETS 5,614,949 2.78<br />

NET ASSETS 202,008,599 100.00<br />

The cost of listed and unlisted investments as at 31 December 2002 was US$180,597,096 (2001:<br />

US$69,304,342).<br />

24

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS<br />

FOR THE YEAR ENDED 31 DECEMBER 2002<br />

EQUITIES:<br />

CANADIAN (LISTED)<br />

Adjustment<br />

Holdings as at for Holdings as at<br />

1 January 2002 Additions Disposals bonus/splits 31 December 2002<br />

Share/Unit Share/Unit Share/Unit Share/Unit Share/Unit<br />

IVANHOE MINES LTD – 504,400 11,000 – 493,400<br />

CAYMAN ISLANDS (UNLISTED)<br />

TARGET ASIA FUND LTD 10,120 – 10,120 – –<br />

VALUE PARTNERS ASIA RECOVERY FUND – 4,432 – – 4,432<br />

CHINA (LISTED)<br />

CHINA VANKE CO LTD – B SHARE 756,734 1,710,600 735,589 – 1,731,745<br />

FOSHAN ELECTRICAL AND LIGHTING<br />

CO LTD – B SHARE – 1,399,838 – – 1,399,838<br />

GUANGDONG ELECTRIC POWER DEV.<br />

CO LTD – B SHARE 833,000 – 833,000 – –<br />

SHANGHAI SHANGLING ELEC<br />

APPLIANCE – B SHARE 543,244 81,800 – 62,504 687,548<br />

SHENZHEN CHIWAN WHARF HOLDINGS<br />

LTD – B SHARE – 246,800 246,800 – –<br />

GREAT BRITAIN (LISTED)<br />

WORLDSEC LTD 100,000 – – – 100,000<br />

HONG KONG (LISTED)<br />

ALCO HOLDINGS LTD – 210,000 – – 210,000<br />

ALCO HOLDINGS LIMITED WT01/09/2005 – – 21,000 21,000 –<br />

ANGANG NEW STEEL CO LTD – H SHARE – 7,540,000 – – 7,540,000<br />

ANHUI EXPRESSWAY CO LTD – H SHARE 8,626,000 13,560,000 – – 22,186,000<br />

APT SATELLITE HOLDINGS LTD 2,050,000 – – – 2,050,000<br />

ARCONTECH CORPORATION LTD 5,246,000 820,000 – – 6,066,000<br />

ARTS OPTICAL INTL HOLDINGS LTD 8,192,000 862,000 7,160,000 – 1,894,000<br />

ASIA ALUMINUM HOLDINGS LTD – 30,536,000 – – 30,536,000<br />

ASIA SATELLITE TELECOM HOLDINGS LTD – 1,107,500 – – 1,107,500<br />

BANK OF EAST ASIA LTD – 445,400 – – 445,400<br />

BRIGHT INTL GROUP LTD 5,720,000 5,144,000 – – 10,864,000<br />

BRILLIANCE CHINA AUTOMOTIVE<br />

HOLDINGS LTD 12,790,000 26,980,000 1,070,000 – 38,700,000<br />

CAFE DE CORAL HOLDINGS LTD 5,490,000 – 5,490,000 – –<br />

CARRY WEALTH HOLDINGS LTD 7,060,000 – 7,060,000 – –<br />

CHEUNG KONG INFRASTRUCTURE<br />

HOLDINGS LTD – 5,357,000 – – 5,357,000<br />

CHINA AGROTECH HOLDINGS LTD 952,000 – 78,000 262,200 1,136,200<br />

CHINA EASTERN AIRLINES CORP LTD<br />

– H SHARE – 8,584,000 8,584,000 – –<br />

CHINA MERCHANTS HOLDINGS (INTL)<br />

CO LTD – 5,500,000 5,500,000 – –<br />

CHINA MOBILE (HONG KONG) LTD – 670,000 670,000 – –<br />

CHINA OVERSEAS LAND &<br />

INVESTMENT LTD – 1,716,000 1,716,000 – –<br />

CHINA PHARMACEUTICAL ENT &<br />

INV CORP – 9,016,000 – – 9,016,000<br />

CHINA RARE EARTH HOLDINGS LTD 600,000 – 600,000 – –<br />

25

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS<br />

FOR THE YEAR ENDED 31 DECEMBER 2002 (Continued)<br />

EQUITIES:<br />

HONG KONG (LISTED)<br />

Adjustment<br />

Holdings as at for Holdings as at<br />

1 January 2002 Additions Disposals bonus/splits 31 December 2002<br />

Share/Unit Share/Unit Share/Unit Share/Unit Share/Unit<br />

CHINA UNICOM LTD – 1,380,000 1,380,000 – –<br />

CHINA-HONGKONG PHOTO PRODUCTS<br />

HOLDINGS LTD 3,594,000 850,000 4,444,000 – –<br />

CHUN WO HOLDINGS LTD – 16,032,000 – – 16,032,000<br />

CITY TELECOM (HK) LTD – 11,760,000 3,028,000 – 8,732,000<br />

CLP HOLDINGS LTD – 771,500 – – 771,500<br />

COFCO INTL LTD 700,000 7,450,000 8,150,000 – –<br />

DENWAY MOT ORS LTD 2,580,000 10,582,000 13,162,000 – –<br />

ELEC & ELTEK INTL HOLDINGS LTD 13,893,000 – 6,118,000 – 7,775,000<br />

ELEGANCE INTL HOLDINGS LTD 1,838,000 726,000 – – 2,564,000<br />

EURO-ASIA AGRICULTURAL<br />

HOLDINGS CO LTD – 22,000,000 2,410,000 – 19,590,000<br />

FAR EAST PHARMACEUTICAL<br />

TECH CO LTD – 11,352,000 – – 11,352,000<br />

FAR EASTERN POLYCHEM<br />

INDUSTRIES LTD 1,298,000 – 1,298,000 – –<br />

FIRST MOBILE GROUP HOLDINGS LTD – 32,760,000 – – 32,760,000<br />

FIRST TRACTOR COMPANY LTD<br />

– H SHARE – 2,870,000 2,870,000 – –<br />

FONG’S INDUSTRIES CO LTD 4,746,000 9,560,000 – – 14,306,000<br />

FOUNTAIN SET (HOLDINGS) LTD 23,844,000 1,488,000 1,414,000 – 23,918,000<br />

FOUR SEAS EFOOD HOLDINGS LTD 376,000 7,752,000 – – 8,128,000<br />

FOUR SEAS MERCANTILE<br />

HOLDINGS LTD 2,324,000 – 2,324,000 – –<br />

FUJIKON IND HOLDINGS LTD 3,196,000 10,950,000 – – 14,146,000<br />

GLOBAL BIO-CHEM TECHNOLOGY<br />

GROUP CO LTD – 3,282,000 – – 3,282,000<br />

GLOBAL GREEN TECH GROUP LTD – 3,134,000 3,134,000 – –<br />

GLORIOUS SUN ENTERPRISES LTD 8,865,000 9,164,000 – – 18,029,000<br />

GOLDEN RESOURCES DEV. INTL LTD 8,818,000 6,374,000 11,408,000 – 3,784,000<br />

GUANGDONG INVESTMENT LTD – 12,138,000 6,830,000 – 5,308,000<br />

GUANGSHEN RAILWAY CO LTD<br />

– H SHARE – 7,640,000 7,640,000 – –<br />

GUANZHOU INVESTMENT CO LTD 4,220,000 5,780,000 10,000,000 – –<br />

GUOCO GROUP LTD – 693,000 – – 693,000<br />

HENDERSON INVESTMENT LTD – 9,338,000 5,038,000 – 4,300,000<br />

HENGAN INTL GROUP CO LTD 158,000 486,000 644,000 – –<br />

HIGH FASHION INTL LTD 4,934,000 2,456,900 7,140,000 – 250,900<br />

HONG KONG AIRCRAFT ENGINEERING<br />

CO LTD 584,400 161,600 146,800 – 599,200<br />

HOPEWELL HOLDINGS LTD 3,900,000 3,941,000 – – 7,841,000<br />

HOPSON DEV. HOLDINGS LTD 5,916,000 1,428,000 – – 7,344,000<br />

HUNG HING PRINTING GROUP LTD 2,182,000 2,098,000 500,000 – 3,780,000<br />

IDT INTERNATIONAL LTD – 19,558,000 2,160,000 – 17,398,000<br />

IMI GLOBAL HOLDINGS LIMITED – 28,300,000 28,300,000 – –<br />

JUSCO STORES (HK) CO LTD 2,762,000 – 2,762,000 – –<br />

KARRIE INTERNATIONAL HOLDINGS LTD 5,680,000 5,764,000 – – 11,444,000<br />

KERRY PROPERTIES LTD – 814,500 814,500 – –<br />

KIN YAT HOLDINGS LTD 2,036,000 9,710,000 – – 11,746,000<br />

KINGBOARD CHEMICAL HOLDINGS LTD 2,892,000 698,000 3,590,000 – –<br />

KINGMAKER FOOTWEAR HOLDINGS LTD 1,076,400 – 1,076,400 – –<br />

LEEFUNG-ASCO PRINTERS<br />

HOLDINGS LTD 7,856,000 – 346,000 – 7,510,000<br />

LUK FOOK HOLDINGS INTL LTD 14,510,000 4,144,000 – – 18,654,000<br />

26

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS<br />

FOR THE YEAR ENDED 31 DECEMBER 2002 (Continued)<br />

EQUITIES:<br />

HONG KONG (LISTED)<br />

Adjustment<br />

Holdings as at for Holdings as at<br />

1 January 2002 Additions Disposals bonus/splits 31 December 2002<br />

Share/Unit Share/Unit Share/Unit Share/Unit Share/Unit<br />

LUNG KEE (BERMUDA) HOLDINGS LTD 6,322,000 – 6,322,000 – –<br />

MAINLAND HEADWEAR HOLDINGS LTD 2,130,000 – 2,130,000 – –<br />

MIRABELL INTL HOLDINGS LTD 3,692,000 240,000 – – 3,932,000<br />

NGAI LIK INDUSTRIAL HLDG – 6,974,000 – – 6,974,000<br />

ORIENT POWER HOLDINGS LTD – 12,274,000 – – 12,274,000<br />

ORIENT OVERSEAS INTL LTD 1,954,000 7,570,000 – – 9,524,000<br />

ORIENTAL WATCH HOLDINGS LTD 4,800,000 1,948,000 6,748,000 – –<br />

PACIFIC ANDES INTL HOLDING LTD 170,000 18,506,000 – – 18,676,000<br />

PACIFIC ANDES INTERNATIONAL HOLDINGS<br />

(WARRANT) 25/03/2004 – – 1,884,400 3,283,200 1,398,000<br />

PACIFIC CENTURY CYBERWORKS LTD 2,702,000 11,596,000 14,298,000 – –<br />

PAUL Y-ITC CONSTRUCTION HOLDINGS LTD – 23,208,000 17,604,000 – 5,604,000<br />

PEACE MARK (HOLDINGS) LTD – 1,400,000 1,400,000 – –<br />

PEACE MARK (HOLDINGS) LIMITED<br />

NIL PAID RIGHS 20/08/2002 – – 860,000 860,000 –<br />

PETROCHINA CO LTD – H SHARE 18,250,000 44,850,000 – – 63,100,000<br />

QINGLING MOTORS CO LTD – H SHARE 18,028,000 10,674,476 28,702,476 – –<br />

REGAL HOTELS INTL HOLDING LTD 13,346,000 – 13,346,000 – –<br />

ROAD KING INFRASTRUCTURE LTD 3,027,000 5,554,000 – – 8,581,000<br />

SA SA INTERNATIONAL HOLDINGS LTD – 5,516,000 5,516,000 – –<br />

SATELLITE DEVICES CORPORATION – – 539,600 539,600 –<br />

SHANDONG INTL POWER DEV. CO LTD<br />

– H SHARE 6,900,000 10,040,000 16,940.000 – –<br />

SHANGHAI INDUSTRIAL HOLDINGS LTD – 1,805.000 122,000 – 1,683,000<br />

SHENZHEN INVESTMENT LTD 9,896,000 5,248,000 2,596,000 8,256,000 20,804,000<br />

SHANGRI-LA ASIA LTD – 1,608,000 1,608,000 – –<br />

SHAW BROTHERS (HONG KONG) LTD – 355,000 355,000 – –<br />

SHUI ON CONSTRUCTION &<br />

MATERIALS LTD – 388,000 – – 388,000<br />

SINGAMAS CONTAINER HOLDINGS LTD – 90,000 – – 90,000<br />

SIIC MEDICAL SCIENCE AND<br />

TECHNOLOGY (GROUP) LTD 2,473,000 122,000 2,595,000 – –<br />

SINO GOLF HOLDINGS LTD 4,520,000 856,000 1,072,000 – 4,304,000<br />

SINOLINK WORLDWIDE HOLDINGS LTD 9,729,600 22,326,000 3,604,000 – 28,451,600<br />

SINOLINK WORLDWIDE HOLDINGS LTD<br />

(WT 29/11/2003) – – 2,725,760 2,725,760 –<br />

SINOPEC KANTONS HOLDINGS LTD 16,260,000 1,900,000 11,682,000 – 6,478,000<br />

SKYWORTH DIGITAL HOLDINGS LTD – 45,298,000 – – 45,298,000<br />

SUN EAST TECHNOLOGY HOLDINGS LTD – 22,606,000 – – 22,606,000<br />

SUN HING VISION GROUP HOLDINGS LTD 8,362,000 220,000 – – 8,582,000<br />

TCC INTERNATIONAL HOLDINGS LTD – 2,042,000 2,042,000 – –<br />

TECHTRONIC INDUSTRIES CO LTD 10,164,000 – 10,164,000 – –<br />

TIAN AN CHINA INVESTMENTS CO LTD 8,620,000 – 8,620,000 – –<br />

TOP FORM INTERNATIONAL LTD – 24,438,000 – – 24,438,000<br />

TRAVELSKY TECHNOLOGY LTD – H SHARE – 2,850,000 – – 2,850,000<br />

TUNGTEX HOLDING CO LTD – 3,342,000 – – 3,342,000<br />

U-RIGHT INTERNATIONAL HOLDINGS LTD – 9,388,000 9,388,000 – –<br />

VICTORY CITY INTERNATIONAL HOLDINGS LTD – 16,840,000 – – 16,840,000<br />

VS INTERNATIONAL GROUP – 18,758,000 – – 18,758,000<br />

WONG’S INTERNATIONAL (HOLDINGS) LTD – 2,031,000 2,031,000 – –<br />

YANZHOU COAL MINING CO LTD<br />

– H SHARE 2,210,000 238,000 2,448,000 – –<br />

YUE YUEN INDUSTRIAL (HOLDINGS) LTD – 2,015,000 232,000 – 1,783,000<br />

27

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS<br />

FOR THE YEAR ENDED 31 DECEMBER 2002 (Continued)<br />

EQUITIES:<br />

MALAYASIA (LISTED)<br />

Adjustment<br />

Holdings as at for Holdings as at<br />

1 January 2002 Additions Disposals bonus/splits 31 December 2002<br />

Share/Unit Share/Unit Share/Unit Share/Unit Share/Unit<br />

KUALA LUMPUR KEPONG – 1,556,000 1,556,000 – –<br />

PERUSAHAAN OTOMOBIL NASIONAL<br />

BHD (PROTON) – 334,000 334,000 – –<br />

SOUTH KOREA (LISTED)<br />

DAEWOONG CO LTD – 100,000 100,000 – –<br />

HANDSOME CO LTD 264,860 155,140 190,000 – 230,000<br />

HYUNDAI MOTOR CO LTD 40,600 21,200 – – 61,800<br />

NONG SHIM COMPANY LTD – 17,400 – – 17,400<br />

SAMSUNG ELECTRONICS CO LTD – 2,700 2,700 – –<br />

SAMIL PHARMACEUTICAL CO LTD – 33,100 33,100 – –<br />

YOUNGONE CORPORATION – 1,784,210 1,784,210 – –<br />

SINGAPORE (LISTED)<br />

ASIA DEKOR HOLDINGS LTD 3,680,000 – 3,680,000 – –<br />

DAIRY FARM INTL HOLDINGS LTD – 311,400 311,400 – –<br />

ELEC & ELTEK INTL CO LTD 641,000 251,000 418,000 – 474,000<br />

IDT HOLDINGS SINGAPORE LTD – 649,000 – – 649,000<br />

JARDINE STRATEGIC HOLDINGS LTD – 832,500 832,500 – –<br />

JARDINE MATHESON HOLDINGS LTD – 875,133 – – 875,133<br />

UNITED FOOD HOLDINGS LTD 3,652,000 17,601,000 – – 21,253,000<br />

TAIWAN (LISTED)<br />

GLOBE UNION INDUSTRIAL CORP – 287,000 287,000 – –<br />

TAINAN ENTERPRISES CO LTD – 2,466,000 – 122,950 2,588,950<br />

THAILAND (LISTED)<br />

COMPASS EAST INDUSTRY (THAILAND)<br />

PUBLIC CO LTD (FOR) – 233,500 – 2,101,500 2,335,000<br />

COMPASS EAST INDUSTRY (THAILAND)<br />

PUBLIC CO LTD (LOC) – 138,500 138,500 – –<br />

MBK DEVELOPMENT PUBLIC<br />

COMPANY LTD (FOR) – 1,689,700 – – 1,689,700<br />

UNITED STATES OF AMERICA (LISTED)<br />

ASAT HOLDINGS LTD-ADR 49,100 45,145 32,324 – 61,921<br />

CITY TELECOM (HK) LTD-ADR – 3,000 – – 3,000<br />

FOREIGN CURRENCY OPTION (UNLISTED)<br />

USD CALL/HKD PUT 7.8 25/04/2002 3,300,000 – 3,300,000 – –<br />

USD CALL/HKD PUT 8.0 06/10/2003 – 43,000,000 – – 43,000,000<br />

USD CALL/HKD PUT 8.2 07/10/2003 – 48,700,000 – – 48,700,000<br />

28

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

STATEMENT OF MOVEMENTS IN PORTFOLIO HOLDINGS<br />

FOR THE YEAR ENDED 31 DECEMBER 2002 (Continued)<br />

BONDS:<br />

CHINA (UNLISTED)<br />

Adjustment<br />

Holdings as at for Holdings as at<br />

1 January 2002 Additions Disposals bonus/splits 31 December 2002<br />

Share/Unit Share/Unit Share/Unit Share/Unit Share/Unit<br />

GUANGZHOU SHENZHEN<br />

SUPERHIGHWAY 10.25% 150807 1,600,000 – 1,600,000 – –<br />

GUANGZHOU SHENZHEN<br />

SUPERHIGHWAY 9.875% 150804 400,000 – 400,000 – –<br />

QINGLING MOTORS LTD CONV<br />

3.5% 220102 (REG S) 3,000,000 – 3,000,000 – –<br />

HONG KONG (UNLISTED)<br />

KOWLOON-CANTON RAILWAY<br />

7.25% 270709 1,170,000 – – – 1,170,000<br />

MASS TRANSIT RAILWAY 7.5% 081110 1,340,000 – – – 1,340,000<br />

PCCW – HKT CAPITAL LTD<br />

7.75% 151111 (REG S) – 7,000,000 – – 7,000,000<br />

ROAD KING INFRASTRUCTURE<br />

9.5% 150707 144A 1,000,000 – – – 1,000,000<br />

UNITED STATES OF AMERICA (UNLISTED)<br />

ASAT FINANCE LLC 12.5% 011106 – 1,450,000 – – 1,450,000<br />

FUTURE COMMODITIES:<br />

HONG KONG (LISTED)<br />

HANG SENG INDEX FUTURES JAN 2002 (53) 53 – – –<br />

HANG SENG INDEX FUTURES FEB 2002 – 99 99 – –<br />

HANG SENG INDEX FUTURES MAR 2002 – 112 112 – –<br />

HANG SENG INDEX FUTURES APR 2002 – 110 110 – –<br />

HANG SENG INDEX FUTURES MAY 2002 – 44 44 – –<br />

29

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

(A Cayman Islands Unit Trust)<br />

PERFORMANCE RECORD<br />

NET ASSET VALUES<br />

Net asset<br />

Net asset<br />

value per unit<br />

value of<br />

<strong>“A”</strong> unit “B” unit the <strong>Fund</strong><br />

US$ US$ US$<br />

As at<br />

31 December 2002 43.51 20.82 202,008,599<br />

31 December 2001 36.03 17.28 79,665,181<br />

31 December 2000 25.42 12.22 50,828,338<br />

HIGHEST AND LOWEST PRICES<br />

Financial year ended<br />

Highest price<br />

Lowest price<br />

<strong>“A”</strong> unit “B” unit <strong>“A”</strong> unit “B” unit<br />

US$ US$ US$ US$<br />

31 December 2002 47.20 22.61 36.03 17.28<br />

31 December 2001 37.60 18.05 25.12 12.07<br />

31 December 2000 27.26 13.12 21.73 10.47<br />

31 December 1999 22.75 10.97 13.78 6.65<br />

31 December 1998 23.14 11.20 13.49 6.52<br />

31 December 1997 27.26 13.21 20.99 10.17<br />

31 December 1996 23.45 11.38 17.47 10.00<br />

31 December 1995 17.39 – 13.30 –<br />

31 December 1994 16.71 – 14.12 –<br />

31 December 1993 (inception year) 17.09 – 10.00 –<br />

30

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

89 <br />

2 1806-08 <br />

(852) 2880 9263 (852) 2565 7975<br />

vpl@vp.com.hk<br />

www.valuepartners.com.hk

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

89<br />

1806-08<br />

<br />

<br />

<br />

<br />

<br />

Brian J. Doyle<br />

Whitney Strategic <strong>Partners</strong> III, L.P <br />

<br />

Bank of Bermuda (Cayman) Limited<br />

36C Bermuda House, 3rd Floor<br />

P.O. Box 513GT<br />

Dr. Roys Drive, George Town<br />

Grand Cayman, Cayman Islands<br />

British West Indies<br />

<br />

<br />

15<br />

39<br />

1

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

10<br />

17<br />

<br />

Maples and Calder Asia<br />

1<br />

1504<br />

<br />

Moore Stephens (Cayman Islands) Limited<br />

3 rd Floor, Block A<br />

West Wind Building<br />

George Town<br />

P.O. Box 1782 GT<br />

Grand Cayman<br />

British West Indies<br />

<br />

<br />

89<br />

1806-08<br />

(852) 2880 9263<br />

(852) 2565 7975<br />

vpl@vp.com.hk<br />

www.valuepartners.com.hk<br />

2

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong>200220.8%<br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> <br />

2002 20.8% 18.2% 11.0%<br />

2001 41.7% 24.5% 4.2%<br />

2000 14.0% 11.0% 37.8%<br />

Bloomberg<br />

<br />

199341335.1%<br />

16.3%4.1%<br />

200210 31Lipper<strong>Value</strong> <strong>Partners</strong> "A"<br />

<strong>Fund</strong><br />

<br />

<br />

<br />

<br />

20021120<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

Morningstar<br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> A<strong>Fund</strong>Benchmark<br />

MorningstarMorningstar<br />

<br />

<strong>Value</strong> <strong>Partners</strong> A<strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

3

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

2002<br />

500<br />

1276%B<br />

3%<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

4

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> <br />

<br />

Micropal<br />

No. 1 in Micropal One-year <strong>Offshore</strong> Territories Hong Kong equities<br />

sector out of 28 funds<br />

Micropal<br />

<br />

<br />

<br />

<br />

<strong>Offshore</strong> Financial Review<br />

<br />

<br />

Micropal<br />

<br />

Micropal<br />

<br />

<br />

<br />

<br />

<br />

<br />

Executive Summary*<br />

<br />

Benchmark<br />

<br />

Morningstar<br />

<br />

<br />

<br />

<br />

<br />

Benchmark<br />

* AA <br />

<br />

Reuters Survey<br />

Reuters Survey<br />

<br />

<br />

5

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> <br />

<br />

<br />

<br />

43.51<strong>“A”</strong><br />

35%<br />

<br />

30% <strong>“A”</strong> <strong>Fund</strong><br />

<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

-5%<br />

-10%<br />

-15%<br />

-20%<br />

25%<br />

+20.8%<br />

31/12/2001<br />

8/1/2002<br />

15/1/2002<br />

22/1/2002<br />

29/1/2002<br />

5/2/2002<br />

11/2/2002<br />

19/2/2002<br />

26/2/2002<br />

5/3/2002<br />

12/3/2002<br />

19/3/2002<br />

26/3/2002<br />

2/4/2002<br />

9/4/2002<br />

17/4/2002<br />

24/4/2002<br />

2/5/2002<br />

8/5/2002<br />

15/5/2002<br />

22/5/2002<br />

29/5/2002<br />

5/6/2002<br />

12/6/2002<br />

19/6/2002<br />

26/6/2002<br />

30/6/2002<br />

3/7/2002<br />

10/7/2002<br />

17/7/2002<br />

24/7/2002<br />

31/7/2002<br />

7/8/2002<br />

14/8/2002<br />

21/8/2002<br />

28/8/2002<br />

4/9/2002<br />

11/9/2002<br />

18/9/2002<br />

25/9/2002<br />

2/10/2002<br />

9/10/2002<br />

16/10/2002<br />

23/10/2002<br />

30/10/2002<br />

6/11/2002<br />

13/11/2002<br />

20/11/2002<br />

27/11/2002<br />

4/12/2002<br />

11/12/2002<br />

18/12/2002<br />

27/12/2002<br />

31/12/2002<br />

-18.2%<br />

Bloomberg<br />

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong> <br />

400%<br />

350%<br />

300%<br />

250%<br />

200%<br />

150%<br />

100%<br />

50%<br />

<br />

<strong>“A”</strong> <strong>Fund</strong><br />

<br />

+335.1%<br />

+45.9%<br />

0%<br />

1/4/1993<br />

28/9/1993<br />

29/3/1994<br />

27/9/1994<br />

28/3/1995<br />

26/91995<br />

26/3/1996<br />

24/9/1996<br />

25/3/1997<br />

23/9/1997<br />

31/3/1998<br />

29/9/1998<br />

30/3/1999<br />

28/9/1999<br />

28/3/2000<br />

26/9/2000<br />

27/3/2001<br />

25/9/2001<br />

26/3/2002<br />

25/9/2002<br />

31/12/2002<br />

Bloomberg<br />

<br />

6

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

7

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

“” <br />

<br />

<br />

<br />

BANK of BERMUDA (CAYMAN) LIMITED<br />

<br />

<br />

8

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

“” <br />

1030<br />

<br />

78<br />

7<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Moore Stephens (Cayman Islands) Ltd.<br />

George Town<br />

Grand Cayman<br />

<br />

9

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

196,393,650 77,741,590<br />

578,277 510,417<br />

355,245 375, 182<br />

1,783<br />

326,317 <br />

1,196,190 <br />

10,430,569 5,548,038<br />

209,280,248 84,177,010<br />

<br />

5,182,101 4,203,394<br />

2,453 5,286<br />

1,607,541 303,149<br />

479,554 <br />

7,271,649 4,511,829<br />

202,008,599 79,665,181<br />

<br />

188,986,732 68,855, 924<br />

13,021,867 10,809, 257<br />

202,008,599 79,665,181<br />

6<br />

A 2,401,483 2,126,001<br />

B 4,684,714 177,001<br />

<br />

A 43.51 36.03<br />

B 20.82 17.28<br />

<br />

<br />

<br />

Bank of Bermuda (Cayman) Limited<br />

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

<br />

<br />

1430<br />

10

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

7,904,726 3,097,043<br />

665,209 232,325<br />

5(g) 348,760 <br />

83,963 77,118<br />

692 <br />

9,003,350 3,406,486<br />

<br />

4,907,957 4,062,002<br />

1,381,577 511,454<br />

175,966 80,261<br />

130,806 57,511<br />

106,742 34,207<br />

30,416 <br />

24,759 7,719<br />

17,004 13,037<br />

13,311 13,115<br />

1,735 <br />

467 286<br />

6,790,740 4,779, 592<br />

2,212,610 (1,373,106)<br />

1430<br />

11

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

68,855,924 38,645,975<br />

129,701,950 12,831,932<br />

(25,062,882) (5,397,280)<br />

173,494,992 46,080,627<br />

<br />

8,437,248 4,506,618<br />

15,796,554 8,437,248<br />

7,359,306 3,930,630<br />

8,094,323 18,886,470<br />

38,111 (41,803)<br />

188,986,732 68,855,924<br />

2,212,610 (1,373,106)<br />

10,809,257 12,182,363<br />

13,021,867 10,809,257<br />

202,008,599 79,665,181<br />

1430<br />

12

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<br />

8 2,834,201 1,742,216<br />

<br />

(193,418,117) (71,893,719)<br />

91,544,015 67,242,976<br />

(101,874,102) (4,650,743)<br />

<br />

128,505,760 12,831,932<br />

(24,583,328) (5,397,280)<br />

103,922,432 7,434,652<br />

4,882,531 4,526,125<br />

<br />

5,548,038 1,021,913<br />

<br />

10,403,569 5,548,038<br />

1430<br />

13

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

<strong>Value</strong> <strong>Partners</strong> A<strong>Fund</strong> <br />

4(3)<br />

<br />

<br />

A<br />

<br />

<br />

(a)<br />

<br />

<br />

(b)<br />

<br />

<br />

(c)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

14

<strong>Value</strong> <strong>Partners</strong> <strong>“A”</strong> <strong>Fund</strong><br />

<br />

<br />

<br />

<br />

(d)<br />

<br />

<br />

17.7986<br />

11.7668<br />

11,186.0000<br />

134.7700<br />

11.575<br />

11.7378<br />

1118.5250<br />

143.1400<br />

<br />

<br />

(e)<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

26A(1A)<br />

<br />

<br />

<br />

<br />

15