Using this guide - Georgia Tech Office of Human Resources

Using this guide - Georgia Tech Office of Human Resources

Using this guide - Georgia Tech Office of Human Resources

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

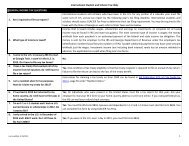

USING THIS GUIDE<br />

This <strong>guide</strong> is intended to provide you with<br />

an overview <strong>of</strong> <strong>Georgia</strong> <strong>Tech</strong>’s benefit plan<br />

<strong>of</strong>ferings. For a more detailed description<br />

<strong>of</strong> all benefits plan options and programs,<br />

please visit the <strong>Office</strong> <strong>of</strong> <strong>Human</strong> <strong>Resources</strong><br />

website at www.ohr.gatech.edu/benefits.<br />

The <strong>Georgia</strong> <strong>Tech</strong> Benefits Team is happy<br />

to assist you with any questions you may<br />

have regarding your benefit plan elections<br />

and/or options. The team can be contacted<br />

at benefits@ohr.gatech.edu.<br />

Glossary<br />

A glossary <strong>of</strong> benefit terms has been<br />

developed to help you understand the<br />

terminology used in <strong>this</strong> booklet. Please<br />

see page 12 for the list <strong>of</strong> benefit terms.

THE 2012 GEORGIA TECH BENEFITS 1<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers a comprehensive benefits program<br />

designed to meet your needs and those <strong>of</strong> your eligible<br />

dependents. As an eligible <strong>Georgia</strong> <strong>Tech</strong> employee, you<br />

may participate in a combination <strong>of</strong> plans <strong>of</strong>fered through<br />

the Board <strong>of</strong> Regents (BOR) University System <strong>of</strong><br />

<strong>Georgia</strong> as well as plans specifically designed and<br />

<strong>of</strong>fered by <strong>Georgia</strong> <strong>Tech</strong>. Following is a listing <strong>of</strong> the<br />

various benefits <strong>of</strong>fered:<br />

YOUR HEALTH:<br />

• Medical Insurance Page 2<br />

• Dental Insurance Page 4<br />

• Vision Insurance Page 4<br />

• Flexible Spending Accounts (Health Care & Dependent Care) Page 5<br />

YOUR INCOME:<br />

• Life Insurance Page 6<br />

• Short & Long-Term Disability Insurance Page 7<br />

• Long-Term Care Insurance Page 7<br />

• Critical Illness Insurance (available only during Open Enrollment) Page 8<br />

• Bank at Work Programs Page 8<br />

YOUR RETIREMENT:<br />

• Core Retirement Plans Page 9<br />

• Supplemental Retirement Savings Plans Page 9<br />

RESOURCES:<br />

• Benefits Provider Directory Page 10<br />

• 2012 Monthly Rates Page 11<br />

• Glossary <strong>of</strong> Benefit Terms Page 12<br />

OTHER BENEFITS 1 AVAILABLE TO YOU AS AN ELIGIBLE GEORGIA TECH EMPLOYEE INCLUDE:<br />

• 529 <strong>Georgia</strong> Higher Education Savings Plans<br />

• Will Preparation<br />

• Pre-Tax Transportation Passes<br />

• Employee Assistance Program (EAP)<br />

• Childcare Center<br />

• Tuition Assistance<br />

• Donated Sick Leave<br />

• Vacation, Sick & Holiday Pay<br />

1 Additional information on these programs and policies is located on our website at www.ohr.gatech.edu/benefits.<br />

Note: This <strong>guide</strong> is intended to summarize the benefits you receive from <strong>Georgia</strong> <strong>Tech</strong>. The actual determination <strong>of</strong> your benefits is based<br />

solely on the plan documents provided by the carrier for each plan. This <strong>guide</strong> is not legally binding, is not a contract, and does not<br />

alter any original plan documents. For additional information, including plan details, please contact the <strong>Office</strong> <strong>of</strong> <strong>Human</strong> <strong>Resources</strong>.

MEDICAL INSURANCE<br />

2<br />

As a <strong>Georgia</strong> <strong>Tech</strong> eligible employee, you have two<br />

comprehensive medical plans to choose from, the<br />

Open Access Point <strong>of</strong> Service (POS) and the Health<br />

Savings Account (HSA) Open Access POS. Both plans<br />

utilize the Open Access POS network, however the<br />

HSA POS plan is a Qualified High Deductible Health<br />

Plan (HDHP) that <strong>of</strong>fers lower premiums in exchange<br />

for a higher deductible. You may reference the<br />

comparison chart at the right to determine which plan<br />

best meets your needs and those <strong>of</strong> your eligible<br />

dependents. Additionally, you may search for<br />

participating providers on the Blue Cross Blue Shield<br />

(BCBS) <strong>of</strong> <strong>Georgia</strong> website at www.bcbsga.com/bor.<br />

All employees covered by a medical plan through<br />

<strong>Georgia</strong> <strong>Tech</strong> must certify whether or not they are<br />

tobacco users. Tobacco use is classified as smoking<br />

tobacco in such forms as cigarette, pipe or cigar, or<br />

using smokeless tobacco, such as snuff or chewing<br />

tobacco (nicotine chewing gum is excluded). If an<br />

employee does not certify they are a tobacco user<br />

and it is determined they are a tobacco user, they<br />

will be subject to penalties including, but not limited<br />

to, payment <strong>of</strong> a $50 surcharge plus an additional<br />

10% for each month since certification. Smoking<br />

cessation programs are <strong>of</strong>fered through BCBS <strong>of</strong><br />

<strong>Georgia</strong>. You may obtain more information related<br />

to the tobacco surcharge online at<br />

www.usg.edu/hr/benefits/health_insurance.<br />

Open Access POS A<br />

This plan is administered by BCBS <strong>of</strong> <strong>Georgia</strong> and<br />

utilizes the Open Access POS network. Employees<br />

have the flexibility to choose doctors both in or<br />

out-<strong>of</strong>-network. In-network care will typically cost less.<br />

HSA POS members may open an HSA which is an<br />

individually owned, portable, pre-tax savings account.<br />

You may contribute up to $3,100 for individual<br />

coverage and up to $6,250 for family coverage to <strong>this</strong><br />

account on a pre-tax basis and then use <strong>this</strong> money<br />

to satisfy the deductible or other qualified medical<br />

expenses. Employees age 55 or older may contribute<br />

an additional $1,000 per year.<br />

You may contribute to an HSA if you:<br />

• are covered under a Qualified HDHP;<br />

• are not covered by another plan that is not a<br />

Qualified HDHP;<br />

• are not currently enrolled in Medicare or TRICARE;<br />

• have not received medical benefits through the<br />

Department <strong>of</strong> Veterans Affairs during the preceding<br />

three months; and,<br />

• may not be claimed as a dependent on another<br />

person’s tax return.<br />

HSA Advantages:<br />

• Participants receive a $ for $ match <strong>of</strong> up to $375<br />

annually for single coverage and up to $750 annually<br />

for family coverage and all other tiers.<br />

• You own the funds; they roll over from year to year.<br />

• Funds grow through investment earnings once you<br />

reach a balance <strong>of</strong> $2,500.<br />

• You may adjust your contribution levels during the<br />

year.<br />

• You enjoy triple tax savings: (1) tax-free deductions<br />

when you contribute, (2) tax-free earnings through<br />

investment, and (3) tax-free withdrawals for qualified<br />

expenses.<br />

• Penalty-free withdrawals are available for any reason<br />

at age 65 (taxed as ordinary income).<br />

HSA Open Access POS B<br />

This is a Qualified High Deductible Health Plan (HDHP).<br />

This plan is administered by BCBS <strong>of</strong> <strong>Georgia</strong> and also<br />

utilizes the Open Access POS network. Employees have<br />

the flexibility to choose doctors both in or out-<strong>of</strong>-network.<br />

In-network care will typically cost less.<br />

NOTE: Board <strong>of</strong> Regents plan details can be found at www.usg.edu/hr/benefits/health_insurance.

MEDICAL INSURANCE<br />

3<br />

Board <strong>of</strong> Regents<br />

Open Access Plan Options<br />

Open Access POS<br />

In-Network<br />

Open Access POS<br />

Out-<strong>of</strong>-Network<br />

Pre-Existing Conditions None None<br />

Max Lifetime Benefits Unlimited Unlimited<br />

Max Annual Deductible $300-Indiv/$900-Fam $400-Indiv/$1,200-Fam<br />

Max Annual Out-<strong>of</strong>-Pocket $1,000-Indiv/$2,000-Fam $2,000-Indiv/$4,000-Fam<br />

A<br />

HSA Open Access POS<br />

In-Network<br />

None<br />

Unlimited<br />

$1,500-Indiv/$3,000-Fam<br />

$3,000-Indiv/$6,000-Fam<br />

B<br />

HSA Open Access POS<br />

Out-<strong>of</strong>-Network<br />

None<br />

Unlimited<br />

$1,500-Indiv/$3,000-Fam<br />

$6,000-Indiv/$12,000-Fam<br />

Physician Services<br />

Provided in <strong>Office</strong><br />

Physician<br />

<strong>Office</strong> Visit<br />

Wellness Care<br />

& Preventive<br />

Health Care<br />

100%<br />

$20 co-pay per visit<br />

60%<br />

nonsurgical services<br />

90% 70%<br />

100% 60% 100% 70%<br />

Laboratory Services 90% 60% 90% 70%<br />

Maternity Care<br />

90%<br />

initial visit co-pay <strong>of</strong> $20 60% 90% 70%<br />

Outpatient Surgery 90% 60% 90% 70%<br />

Allergy Shots<br />

& Serum<br />

100% 60% 90% 70%<br />

Inpatient<br />

Hospital Services<br />

Physician Services 90% 60% 90% 70%<br />

Hospital Services<br />

(other than those<br />

for ER care)<br />

Maternity Care<br />

(delivery)<br />

90%<br />

limited to semi-private room<br />

60% 90% 70%<br />

90% 60% 90% 70%<br />

Physician Services 90% 60% 90% 70%<br />

Facility Selected by<br />

a Treating Physician<br />

Care in a<br />

Hospital ER<br />

Urgent Care<br />

Services<br />

90% 60% 90% 70%<br />

90% after a $75 co-pay per visit<br />

(co-pay waived if admitted within 24 hours)<br />

90% 70%<br />

90%<br />

$20 co-pay per visit 60% 90% 70%<br />

Outpatient Hospital<br />

and Facility Services<br />

Home Nursing Care<br />

Extended Care<br />

Facilit y<br />

90%<br />

(limited to 2 hrs <strong>of</strong><br />

care in a 24-hr day)<br />

90%<br />

Maximum <strong>of</strong> 30 days<br />

60%<br />

(limited to 2 hrs <strong>of</strong> care<br />

in a 24-hr day)<br />

60%<br />

Maximum <strong>of</strong> 30 days<br />

90% 70%<br />

90%<br />

Maximum <strong>of</strong> 30 days<br />

70%<br />

Maximum <strong>of</strong> 30 days<br />

Hospice Care 100% 60% 100% 100%<br />

Ambulance Services 90% 90% 90% 70%<br />

Outpatient<br />

Short-Term<br />

Rehab Services<br />

90%<br />

Provides up to 40 days<br />

per incident<br />

60%<br />

Provides up to 40 days<br />

per incident<br />

90%<br />

Visit limits may apply<br />

70%<br />

Visit limits may apply<br />

Chiropractic Care<br />

90%<br />

Maximum <strong>of</strong> 40 visits<br />

60%<br />

Maximum <strong>of</strong> 40 visits<br />

90%<br />

Maximum <strong>of</strong> 20 visits<br />

70%<br />

Maximum <strong>of</strong> 20 visits<br />

Prescription<br />

Prescription<br />

30-day<br />

supply<br />

90-day<br />

supply<br />

Generic: $10 co-pay<br />

Preferred Brand Name: $30 co-pay<br />

Nonpreferred Brand Name: 20% co-pay,<br />

(minimum $40/maximum up to $100)<br />

Provided by mail order program at cost <strong>of</strong><br />

two and one half months co-pay<br />

Open Formulary – Subject to quantity limits and<br />

pre-authorization review. Other exclusions apply.<br />

90% <strong>of</strong> the lower discounted<br />

rate or actual charge<br />

subject to deductible<br />

90% <strong>of</strong> network rate<br />

subject to deductible<br />

Annual deductible, annual out-<strong>of</strong>-pocket limits (stop loss), and annual visit limitations will be based on a January 1 to December 31 plan year. Member costs incurred for balance billing will<br />

NOT apply toward the annual deductible(s) nor toward the maximum annual out-<strong>of</strong>-pocket (stop-loss) limit(s). Percentages listed above are generally applied to the network rate and may<br />

be subject to a deductible and co-pays. Percentages shown under the HSA POS out-<strong>of</strong>-network benefits are generally applied to Usual and Customary R eimbursement (UCR) amounts.

DENTAL INSURANCE<br />

4<br />

In an effort to <strong>of</strong>fer eligible employees and their eligible<br />

dependents dental options that meet individual and family<br />

needs, <strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers a choice <strong>of</strong> the following three<br />

dental plans:<br />

• BOR MetLife PPO Plan<br />

• GT <strong>Human</strong>a CompBenefits Access Plan<br />

• GT <strong>Human</strong>a CompBenefits PPO Plan<br />

Per the below comparison chart <strong>of</strong> in-network benefits, you<br />

will notice these three dental options are each unique in<br />

terms <strong>of</strong> design, network and coverage levels. All three<br />

plans allow for out-<strong>of</strong>-network coverage. If you obtain<br />

services from an out-<strong>of</strong>-network dentist, you will be<br />

required to pay up front for your services. You must then<br />

submit a claim form with detailed receipts to the carrier for<br />

reimbursement up to plan limits. Please carefully review<br />

your options and select the plan that best meets your<br />

needs. Always try to use an in-network dentist to help<br />

lower your out-<strong>of</strong>-pocket expenses.<br />

Dental Options: In-Network Benefits<br />

Benefit Highlights BOR MetLife Dental GT <strong>Human</strong>a CompBenefits Access GT <strong>Human</strong>a CompBenefits PPO<br />

<strong>Office</strong> Visit for Preventive/Diagnostic Procedures 100% benefit $5 co-pay<br />

100% benefit<br />

Annual Deductible $50 N/A<br />

$50<br />

Annual Plan Maximum $1,200 Unlimited $1,500<br />

Preventive Services: Oral Exam, Cleaning,<br />

Topical Fluoride, X-Rays<br />

Basic Services: Simple Restorative, Non-surgical<br />

Tooth Extractions, Non-surgical Periodontics<br />

Major Restorative Services: Major Restorative<br />

(crowns/ inlays/onlays), Bridge, Denture Repair,<br />

Oral Surgery, Endontics (Root Canals)<br />

Orthodontic Services:<br />

Ortho Appliances<br />

Lifetime Ortho Max $1,000<br />

Waiting Period<br />

100% benefit 100% benefit 100% benefit<br />

80% benefit<br />

subject to deductible<br />

80% benefit<br />

subject to deductible<br />

80% benefit<br />

subject to deductible<br />

6 month waiting period for<br />

Ortho Services, 24 month waiting<br />

period for Replacement and<br />

Restorative Dental Care<br />

Member co-pay varies<br />

Member co-pay varies<br />

Co-pay Evaluation: $35<br />

Co-pay Treatment Planning: $250<br />

Ortho Co-pay Age 19: $2,500<br />

N/A - member co-pay varies<br />

based on service<br />

N/A<br />

80% benefit<br />

subject to deductible<br />

50% benefit<br />

subject to deductible<br />

50% benefit<br />

subject to deductible<br />

$1,000 for 18 years or younger;<br />

no adult ortho<br />

12 month waiting period<br />

for Major and Ortho Services;<br />

waived with Certificate <strong>of</strong><br />

Credible Coverage<br />

VISION INSURANCE<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers a comprehensive vision plan through EyeMed that provides employees access to a nationwide<br />

network <strong>of</strong> private practice optometrists and ophthalmologists, as well as retail chain providers.<br />

Benefit Highlights EyeMed In-Network EyeMed Out-<strong>of</strong>-Network Allowance<br />

Comprehensive Vision Exam<br />

100% coverage after $10 co-pay<br />

Once every 12 months<br />

up to $40<br />

Pair <strong>of</strong> Lenses<br />

Standard single vision<br />

Standard lined bifocal<br />

Standard lined trifocal<br />

Standard lenticular<br />

Frames<br />

Contact Lenses (in lieu <strong>of</strong> eyeglasses)<br />

Lens Options<br />

UV Treatment<br />

Tint (Solid & Gradient)<br />

Standard Plastic Scratch Coating<br />

Standard Polycarbonate (Adults)<br />

Standard Polycarbonate (under 19)<br />

Standard Anti-Reflective Coating<br />

Polarized<br />

Laser Vision Correction<br />

100% coverage after $20 co-pay<br />

Once every 12 months<br />

$150 allowance and 20% discount on balance<br />

over $150, Once every 24 months<br />

$150 allowance and 15% discount on balance<br />

over $150, Once every 12 months<br />

$15 Co-pay<br />

$15 Co-pay<br />

$0 Co-pay<br />

$40 Co-pay<br />

$0 Co-pay<br />

$45 Co-pay<br />

20% <strong>of</strong>f retail price<br />

15% <strong>of</strong> retail price or 5% <strong>of</strong>f promotional price<br />

less $1,000 allowance<br />

up to $45<br />

up to $65<br />

up to $85<br />

up to $85<br />

up to $50<br />

Elective up to $125<br />

Medically necessary up to $210<br />

N/A<br />

N/A<br />

$11<br />

N/A<br />

$28<br />

N/A<br />

N/A<br />

$1,000 allowance

FLEXIBLE SPENDING ACCOUNTS (FSA) 5<br />

An FSA is an IRS-<strong>guide</strong>d plan that enables you to reduce<br />

your taxable income by allocating pre-tax dollars to an<br />

individual account that will be used to reimburse you for<br />

eligible out-<strong>of</strong>-pocket health and dependent care expenses.<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers two types <strong>of</strong> FSA’s, a Dependent Care<br />

FSA and a Health Care FSA.<br />

NOTE THE FOLLOWING:<br />

• You decide how much to set aside for health care and/or<br />

dependent care expenses.<br />

• Contributions are deducted on a pre-tax basis in equal<br />

installments each month during the calendar year.<br />

• Plan carefully, <strong>this</strong> is a USE IT OR LOSE IT benefit; IRS<br />

regulations require that you forfeit any money remaining<br />

in your account after the claims submission deadline<br />

(90 days after the end <strong>of</strong> the plan year or 90 days after<br />

the date you are no longer eligible to participate.)<br />

• Dependent Care FSA claims may be submitted for<br />

reimbursement via a claim form or by U.S. Bank<br />

issued debit card.<br />

• Health Care FSA claims may be submitted for<br />

reimbursement via claim form or by utilizing a health<br />

care debit card enrollees will receive from our FSA<br />

Administrator, U.S. Bank.<br />

• You may not participate in the Health Care FSA if you<br />

are enrolled in the HSA POS Medical Plan and have<br />

established a Health Savings Account (HSA).<br />

• For a comprehensive list <strong>of</strong> eligible FSA expenses,<br />

visit www.irs.gov.<br />

Federal, State and FICA taxes are not deducted on the<br />

amount you contribute to your Health Care FSA and/or<br />

Dependent Care FSA. Our plan allows you to contribute up<br />

to $5,000 annually for your Health Care FSA and up to<br />

$5,000 annually for your Dependent Care Account ($2,500<br />

if married filing separately).<br />

Plan<br />

Annual Maximum<br />

Contribution<br />

Examples <strong>of</strong><br />

Eligible Expenses<br />

Reimbursement/Payment<br />

Method<br />

Health Care Flexible<br />

Spending Account<br />

$5,000<br />

Co-pays, deductibles, orthodontia, certain OTC<br />

medications with a doctor’s prescription<br />

Debit card issued by U.S. Bank<br />

or by claim form<br />

Dependent Care Flexible<br />

Spending Account<br />

$5,000<br />

Day care, nursery school,<br />

elder care expenses, etc.<br />

Debit card issued by U.S. Bank<br />

or by claim form<br />

Example Savings – Health Care FSA<br />

Employee – No FSA Election<br />

Employee – FSA Election <strong>of</strong> $1,000<br />

Single Employee earning $35,000<br />

Health Care Expenses (pre-tax)<br />

Less Estimated Taxes – 36% (25% Federal, 8% FICA, 3% State)<br />

Earnings (after taxes)<br />

Health Care Expenses (after tax)<br />

Take Home Pay (after health care expenses)<br />

Total $’s Saved<br />

Example Savings – Dependent Care FSA<br />

Married Employee filing jointly earning $35,000<br />

Dependent Care Expenses (pre-tax)<br />

Less Estimated Taxes – 36% (25% Federal, 8% FICA, 3% State)<br />

Earnings (after taxes)<br />

Dependent Care Expenses (after tax)<br />

Take Home Pay (after health care expenses)<br />

Total $’s Saved<br />

$ 35,000<br />

-0-<br />

($12,600)<br />

$ 22,400<br />

$ 1,000<br />

$ 21,400<br />

$ 0<br />

$ 35,000<br />

$ 1,000<br />

($12,240)<br />

$ 21,760<br />

-0-<br />

$ 21,760<br />

$ 360<br />

Employee – No FSA Election<br />

$ 35,000<br />

-0-<br />

($12,600)<br />

$ 22,400<br />

$ 5,000<br />

$ 17,400<br />

$ 0<br />

Employee – FSA Election <strong>of</strong> $5,000<br />

$ 35,000<br />

$ 5,000<br />

($10,800)<br />

$ 19,200<br />

-0-<br />

$ 19,200<br />

$ 1,800

LIFE INSURANCE AND ACCIDENTAL DEATH & DISMEMBERMENT<br />

6<br />

<strong>Georgia</strong> <strong>Tech</strong> provides all eligible employees an Institute<br />

paid Basic Life and Accidental Death & Dismemberment<br />

(AD&D) benefit in the amount <strong>of</strong> $25,000. Additionally,<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers the following four supplemental employee<br />

and dependent life insurance plans to help ensure employees<br />

have options to meet their family’s needs.<br />

• BOR CIGNA Supplemental Term Life and AD&D<br />

• GT Unum Supplemental Term Life<br />

• GT Unum Supplemental AD&D<br />

• GT Unum Permanent Whole Life Insurance –<br />

Available Only During Open Enrollment<br />

NOTE THE FOLLOWING:<br />

• New hires may enroll in supplemental employee and<br />

dependent life insurance during the initial eligibility period up<br />

to the Guaranteed Issue (GI) limits without having to complete<br />

Evidence <strong>of</strong> Insurability (EOI) requirements.<br />

• EOI is required if you elect coverage over the GI limit or if you<br />

elect or increase coverage during open enrollment, but after<br />

your initial eligibility.<br />

• There is no limit to the number <strong>of</strong> employee or dependent<br />

supplemental plans you may enroll in. NOTE: GT Unum<br />

supplemental plans do require you to elect employee<br />

supplemental life in order to participate in supplemental<br />

dependent life.<br />

• If both spouses are employed by <strong>Georgia</strong> <strong>Tech</strong>, each spouse<br />

must enroll in the employee only coverage and may not also<br />

enroll in spousal coverage.<br />

Plan<br />

Features<br />

BOR CIGNA<br />

Basic Life & AD&D<br />

BOR CIGNA Supplemental<br />

Term Life & AD&D<br />

GT Unum Supplemental<br />

Term Life<br />

GT Unum Supplemental<br />

AD&D<br />

Permanent Whole Life<br />

(AVAILABLE DURING OPEN<br />

ENROLLMENT ONLY)<br />

Employee<br />

Coverage<br />

Automatically<br />

enrolled<br />

$25,000 Employee<br />

Basic Life<br />

$25,000 Employee<br />

Basic AD&D<br />

Up to 5X annual<br />

salary or up to a max <strong>of</strong><br />

$975,000; EOI is required<br />

for any elections exceeding<br />

3X annual salary.<br />

Up to lesser <strong>of</strong> 3X annual<br />

salary or $500,000 in<br />

increments <strong>of</strong> $10,000<br />

without EOI. Additional<br />

amounts up to the lesser<br />

<strong>of</strong> 6X annual salary or<br />

$1M with EOI.<br />

Up to the lesser <strong>of</strong><br />

6X annual salary or $1M<br />

in increments <strong>of</strong> $10,000<br />

without EOI requirements<br />

Employees hired in 2011<br />

are eligible to elect <strong>this</strong><br />

coverage during the<br />

2012 Open Enrollment<br />

period. Employees hired<br />

in 2012 may elect <strong>this</strong><br />

coverage during the<br />

2013 Open Enrollment<br />

period. Coverage limits<br />

and rates must be<br />

obtained from UNUM<br />

Benefit<br />

Reduction<br />

Due to Age<br />

Basic Life – N/A<br />

AD&D cancelled<br />

at Age 70 or at<br />

retirement if prior<br />

to age 70<br />

Reduction begins<br />

at age 67; AD&D is<br />

cancelled at age 70<br />

Reduction<br />

begins at age 70<br />

Reduction<br />

begins at age 70<br />

N/A<br />

Spouse &<br />

Dependent<br />

Coverage<br />

Requirements<br />

N/A<br />

Employees may elect<br />

dependent coverage (<strong>this</strong><br />

plan includes both spouse<br />

& children) without electing<br />

employee supplemental life<br />

Employees must be<br />

enrolled in employee<br />

supplemental life to elect<br />

spouse life and/or<br />

child(ren) life<br />

Employees must be<br />

enrolled in employee<br />

supplemental AD&D to<br />

elect spouse AD&D<br />

and/or child(ren) AD&D<br />

Employees may elect<br />

spouse life and/or<br />

child(ren) life<br />

without electing employee<br />

permanent whole life<br />

Spouse &<br />

Dependent<br />

Coverage<br />

Limits<br />

$10,000 for each<br />

eligible dependent<br />

(spouse and<br />

children).<br />

Spouse and children ages<br />

6 months to 19 years are<br />

eligible for $10,000 <strong>of</strong><br />

protection; $2,000 for<br />

children ages 14 days<br />

but less than 6 months<br />

GI for spouse <strong>of</strong> new<br />

hires is up to $50,000;<br />

max benefit with EOI is<br />

lesser <strong>of</strong> $250,000 or<br />

100% <strong>of</strong> employee<br />

election; max benefit for<br />

dependent children is<br />

$10,000 ($2,000 for ages<br />

2 weeks to 6 months) in<br />

$2,000 increments<br />

Spouse max is lesser <strong>of</strong><br />

100% <strong>of</strong> employee<br />

amount <strong>of</strong> AD&D or<br />

$250,000; you may<br />

elect $10,000 for<br />

dependent child as long<br />

as employee has some<br />

level <strong>of</strong> AD&D coverage<br />

Coverage limits and rates<br />

must be obtained from<br />

Unum only during Open<br />

Enrollment by calling<br />

866-441-6973<br />

Life Insurance<br />

Conversion &<br />

Portability<br />

You may convert to a<br />

higher cost individual<br />

policy upon loss <strong>of</strong><br />

coverage<br />

You may convert to a<br />

higher cost individual<br />

policy upon loss<br />

<strong>of</strong> coverage<br />

Portable upon loss<br />

<strong>of</strong> coverage except for<br />

serious illness<br />

Portable upon loss<br />

<strong>of</strong> coverage except for<br />

serious illness<br />

Portable<br />

Note: Premiums for BOR CIGNA Supplement Term Life & AD&D are based on salary and age as <strong>of</strong> December 31, 2012; premiums for GT Unum Supplemental Term Life are based<br />

on salary and age as <strong>of</strong> January 1, 2012.

DISABILITY 7<br />

A disabling injury or illness that keeps you out <strong>of</strong> work<br />

could have a devastating impact on your income,<br />

jeopardizing your ability to cover normal household<br />

expenses. To supplement your income during a time away<br />

from work due to a non-occupational injury, illness or<br />

maternity leave, <strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers Short-Term Disability<br />

(STD) and Long-Term Disability (LTD) through Unum.<br />

New coverage will be subject to a pre-existing condition<br />

exclusion; you may have a pre-existing condition if you<br />

received medical treatment, consultation, care or services<br />

including diagnostic measures, or took prescribed drugs or<br />

medicines in the 3 months just prior to your effective date <strong>of</strong><br />

coverage and the disability begins in the first 12 months after<br />

your effective date <strong>of</strong> coverage.<br />

Plan Feature<br />

Elimination Period before<br />

payment begins<br />

Maximum Benefit Payable<br />

Deduction Type<br />

% <strong>of</strong> earnings covered<br />

Benefit Period<br />

Enrollment/EOI Requirements<br />

Short-Term Disability<br />

14 calendar days<br />

Up to a maximum <strong>of</strong> $ 2,000 per week<br />

After-tax<br />

60% <strong>of</strong> base earnings; tax-free benefit<br />

11 weeks following elimination period<br />

Enrollment within first 30 days <strong>of</strong> employment requires<br />

no EOI; you may enroll during Open Enrollment,<br />

but EOI will be required<br />

Long-Term Disability<br />

90 calendar days<br />

Up to a maximum <strong>of</strong> $ 10,000 per month<br />

After-tax<br />

60% <strong>of</strong> base earnings; tax-free benefit<br />

To normal retirement age following elimination period<br />

Enrollment within first 30 days <strong>of</strong> employment requires<br />

no EOI; you may enroll during Open Enrollment,<br />

but EOI will be required<br />

LONG-TERM CARE INSURANCE<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers Long-Term Care Insurance through<br />

John Hancock Life & Health Insurance Company. This<br />

plan can help provide protection against the high costs<br />

<strong>of</strong> Long-Term Care that result from the effects <strong>of</strong> aging,<br />

illness, or a serious accident. Long-Term Care Insurance<br />

<strong>of</strong>fers important coverage that is generally not available<br />

under medical and long-term disability benefits, nor is it<br />

fully covered by government programs like Medicare or<br />

Medicaid.<br />

Plans are available for you and your spouse/qualified<br />

domestic partner* as well as parents and parents-in-law<br />

<strong>of</strong> eligible employees, grandparents and grandparents-inlaw<br />

<strong>of</strong> eligible employees, siblings and their spouses <strong>of</strong><br />

eligible employees, and adult children and their spouses<br />

<strong>of</strong> eligible employees.<br />

Payroll deductions are available for employee and spouse<br />

coverage; all others, however, will be billed directly.<br />

Newly hired employees who enroll within the first 60<br />

days <strong>of</strong> employment do not have to provide evidence <strong>of</strong><br />

insurability. Family members must provide evidence <strong>of</strong><br />

insurability regardless <strong>of</strong> when they apply as well as<br />

those eligible employees applying after their 60-day<br />

eligibility period.<br />

To enroll and/or obtain additional information related to<br />

plan provisions, benefit levels, costs, and enrollment<br />

instructions, please visit the <strong>Georgia</strong> <strong>Tech</strong> Long-Term<br />

Care website at: http://gatech.jhancock.com<br />

(username: gatech; password: mybenefit) or call the<br />

John Hancock Long-Term Care Customer Service Center<br />

at 1-888-354-6498 weekdays between 8:30 a.m. and<br />

6:30 p.m. EST.<br />

*Domestic partners residing in Louisiana are not eligible for coverage.

CRITICAL ILLNESS INSURANCE AVAILABLE ONLY DURING OPEN ENROLLMENT 8<br />

Critical Illness insurance is designed to protect your income<br />

and personal assets when your out-<strong>of</strong>-pocket expenses<br />

increase as a result <strong>of</strong> a qualifying serious illness. While<br />

your health insurance will cover a majority <strong>of</strong> your medical<br />

bills, it may not cover all <strong>of</strong> the unforeseen expenses<br />

associated with a serious medical condition such as a heart<br />

attack or cancer.<br />

PLAN FEATURES<br />

• Pays a lump sum benefit, once covered, upon initial<br />

diagnosis <strong>of</strong> a covered illness.<br />

• Only conditions first diagnosed after the effective date<br />

are covered.<br />

• Coverage options are available for your spouse and<br />

children as riders to your coverage.<br />

• A $75 Health Screening Benefit Rider is included.<br />

This rider provides a benefit per insured per calendar<br />

year for covered health screening tests. Coverage is<br />

portable – you may maintain your policy if you retire<br />

or change jobs.<br />

• This plan covers many out-<strong>of</strong>-pocket expenses not<br />

covered by other benefit plans such as: travel<br />

expenses, time <strong>of</strong>f from work, lost income, deductibles<br />

and co-pays.<br />

• You will have a choice between two plans:<br />

Base covered conditions<br />

Base covered conditions including cancer<br />

Newly eligible employees may enroll in coverage with no<br />

evidence <strong>of</strong> insurability up to Guaranteed Issue limits <strong>of</strong><br />

$15,000. For amounts above the Guaranteed Issue limits,<br />

evidence <strong>of</strong> insurability is required.<br />

Available only during Open Enrollment. A Unum<br />

enrollment counselor can help you select a benefit<br />

amount and calculate the cost. You may reach a Unum<br />

enrollment counselor at 1-866-441-6973 on weekdays<br />

between 8:00 a.m. – 8:00 p.m. EST.<br />

Base Covered Illnesses<br />

Percentage Paid <strong>of</strong> Your<br />

Lump Sum Benefit Amount<br />

Heart Attack 100%<br />

Stroke 100%<br />

Major Organ Transplant 100%<br />

End Stage Renal (Kidney) Failure 100%<br />

Paralysis 100%<br />

Coronary Artery Bypass Surgery** 25%<br />

(Cancer and Carcinoma in Situ* coverage is available as an optional rider.)<br />

*This rider is not available in New York.<br />

**The coverage pays 25% <strong>of</strong> the face amount <strong>of</strong> the policy once per lifetime for<br />

coronary bypass surgery and carcinoma in situ.<br />

The policy/certificate <strong>of</strong> coverage or its provisions, as well as covered illnesses, may<br />

vary or be unavailable in some states. In New York, a Specified Disease product is<br />

<strong>of</strong>fered. The policy/certificate <strong>of</strong> coverage has exclusions and limitations which may<br />

affect any benefits payable.<br />

BANK AT WORK<br />

<strong>Georgia</strong> <strong>Tech</strong> <strong>of</strong>fers a Bank at Work Program consisting <strong>of</strong><br />

four participating banks; Bank <strong>of</strong> America, <strong>Georgia</strong> United<br />

Credit Union, State Bank and Trust, and Wells Fargo. The<br />

Bank at Work Program was designed to <strong>of</strong>fer <strong>Georgia</strong> <strong>Tech</strong><br />

eligible employees a variety <strong>of</strong> discounted and/or premier<br />

services. In order to participate in the Bank at Work<br />

Program, you must be an active <strong>Georgia</strong> <strong>Tech</strong> employee at<br />

the time <strong>of</strong> enrollment and be enrolled in direct deposit.<br />

Since the services <strong>of</strong> each participating bank vary greatly, we<br />

encourage you to carefully consider which program may<br />

best meet your needs. A few <strong>of</strong> the highlights <strong>of</strong> each bank<br />

are listed below.<br />

Bank <strong>of</strong> America <strong>of</strong>fers <strong>Georgia</strong> <strong>Tech</strong> employees no monthly maintenance fees on checking and savings accounts, one<br />

free order <strong>of</strong> checks, and access to their “Keep the Change” program.<br />

<strong>Georgia</strong> United Credit Union is a member-owned, not-for-pr<strong>of</strong>it financial institution <strong>of</strong>fering financial services to<br />

members for over 50 years. <strong>Georgia</strong> <strong>Tech</strong> employees can save on everything from savings to checking, loans, and more.<br />

Some benefits include money <strong>of</strong>f <strong>of</strong> origination fees on new mortgage loans, a free first order <strong>of</strong> checks, and discounted<br />

APR’ s on auto, boat, and RV loans.<br />

Featuring their new <strong>Tech</strong>Check totally free checking program, State Bank & Trust <strong>of</strong>fers <strong>Georgia</strong> <strong>Tech</strong> employees no<br />

monthly maintenance fees on checking, free <strong>Tech</strong> brand checks, first time overdraft fee waived, nationwide free ATM<br />

services, free safe deposit box (subject to availability), and loan discounts<br />

With a physical branch across from the GT Student Center, Wells Fargo features no monthly maintenance fees on<br />

checking, discount checks, and one year free safe deposit box for accounts with no minimum balance requirement; as<br />

well as even greater savings and <strong>of</strong>fers for accounts with minimum balances.

CORE RETIREMENT PLANS 9<br />

Building a healthy financial future is just as important as<br />

taking care <strong>of</strong> your health needs. As such, all employees <strong>of</strong><br />

<strong>Georgia</strong> <strong>Tech</strong> must participate in one <strong>of</strong> the following two<br />

core retirement plans:<br />

• Teachers Retirement System <strong>of</strong> <strong>Georgia</strong> (TRS)<br />

• Optional Retirement Plan (ORP)<br />

NOTE THE FOLLOWING<br />

• The retirement plan options you have are determined by<br />

your employment classification as noted in the “Plan<br />

Attributes” section <strong>of</strong> the chart below.<br />

• You must elect the plan in which you will participate within<br />

your first 60 days <strong>of</strong> employment. If you do not make an<br />

election, you will automatically default into the TRS plan.<br />

• Your Core Retirement Plan election is irrevocable.<br />

Name <strong>of</strong> Plan<br />

Teachers Retirement<br />

System <strong>of</strong> <strong>Georgia</strong> (TRS)<br />

Optional Retirement Plan (ORP)<br />

Plan Attributes<br />

• Employment Classification: Regular Faculty and both Exempt and Non Exempt Staff<br />

• Defined benefit plan<br />

• Employee contribution is 5.53% currently; will increase to 6.00% effective July 1, 2012<br />

• Employer contribution is 10.28% currently; will increase to 11.41% effective July 1, 2012<br />

• 10 Year vesting period, 2% per year income replacement<br />

• Disability Retirement at 10 years <strong>of</strong> service at any age<br />

• Employment Classification: Regular Faculty and Exempt Staff<br />

• Defined contribution plan<br />

• Requires 5% employee contribution<br />

• Currently 9.24% employer match<br />

• Immediate vesting<br />

• Service providers include Fidelity, TIAA CREF & VALIC; may change providers on a quarterly basis<br />

SUPPLEMENTAL RETIREMENT SAVINGS PLANS<br />

In addition to the core retirement plans, eligible faculty and<br />

staff may also enroll in the following two supplemental<br />

retirement saving plans:<br />

• 403(b) Tax Sheltered Annuity<br />

• 457(b) Deferred Compensation Plan<br />

NOTE THE FOLLOWING<br />

• Access to two supplemental retirement plans is a highly<br />

unique benefit <strong>of</strong> <strong>Georgia</strong> <strong>Tech</strong>.<br />

• You may start, stop, or change your enrollment in these<br />

plans subject to pay period calendar restraints.<br />

• In addition to your contributions to your elected core<br />

retirement plan (TRS & ORP), you may also contribute<br />

to both supplemental plans up to the IRS maximums<br />

for each plan.<br />

Name <strong>of</strong> Plan<br />

403(b)<br />

Tax Sheltered Annuity<br />

457(b)<br />

Deferred Compensation Plan<br />

Plan Attributes<br />

• Employment Classification: Temporary, Regular Faculty and both Exempt and Non Exempt Staff<br />

• For 2012, employees may contribute up to $16,500 (additional $5,500 to age 50 or over)<br />

• Enrollment and/or changes to your election is allowed at any time<br />

• Roth 403(b) is available for after-tax contributions<br />

• Service providers are Fidelity and TIAA CREF<br />

• Employment Classification: Regular Faculty and both Exempt and Non Exempt Staff<br />

• For 2012, employee may contribute up to $16,500 (additional $5,500 if age 50 or over)<br />

• Enrollment and/or changes to your election are allowed at any time<br />

• Elections are effective the first <strong>of</strong> the month following enrollment<br />

• Service providers are Fidelity, TIAA CREF and VALIC

2012 BENEFITS PROVIDER DIRECTORY 10<br />

HEALTH & WELFARE<br />

Benefit Vendor Phone Number Web Site Group #<br />

Medical Open Access POS Blue Cross Blue Shield 1-800-424-8950 www.bcbsga.com/bor BOR0030<br />

Medical HSA Open Access POS Blue Cross Blue Shield 1-800-424-8950 www.bcbsga.com/bor BOR0030<br />

Medical - Pharmacy Medco Pharmacy 1-877-300-5139 www.medcohealth.com 001BOR00EF<br />

Flexible Spending U.S. Bank 1-877-470-1771 www.mycdh.usbank.com P02023<br />

Health Savings Account U.S. Bank 1-877-407-1771 www.mycdh.usbank.com P02023<br />

Dental CompBenefits <strong>Human</strong>a 1-800-342-5209 www.compbenefits.com 64232/V115<br />

Dental CompBenefits PPO <strong>Human</strong>a 1-800-342-5209 www.compbenefits.com CD1156/P405<br />

Dental BOR MetLife 1-866-832-5759 www.metlife.com 307601<br />

Vision EyeMed 1-866-800-5457 www.eyemedvisioncare.com 9826603<br />

Life Insurance: Term Life/AD&D CIGNA 1-800-238-2125 www.cigna.com FLX-980017<br />

Life Insurance: Permanent Life Unum 1-800-635-5597 www.unum.com Individual<br />

Life Insurance: Term Life/AD&D Unum 1-800-445-0402 www.unum.com 38882/001<br />

Disability: Short and Unum 1-800-858-6843 www.unum.com 501232/101<br />

Long-Term Disability<br />

Critical Illness Unum 1-800-635-5597 www.unum.com Individual<br />

Long-Term Care John Hancock Life & 1-888-354-6498 http://gatech.jhancock.com 60005<br />

Health Insurance Company<br />

username: gatech<br />

password: mybenefit<br />

RETIREMENT PLANNING<br />

Benefit Vendor Phone Number Web Site Group #<br />

Optional Retirement Fidelity Investments 1-800-343-0860 www.fidelity.com/atwork 95401<br />

Plan (ORP) TIAA-CREF 1-877-518-9161 www.tiaa-cref.org 102046<br />

VALIC 1-888-569-7065 www.valic.com 25002001<br />

Teachers Retirement Teachers Retirement System 1-800-352-0650 www.trsga.com 5030<br />

System (TRS)<br />

403(b) Tax TIAA-CREF 1-877-518-9161 www.tiaa-cref.org 100386<br />

Sheltered Annuity Fidelity 1-800-343-0860 www.fidelity.com/atwork 50097<br />

457(b) Deferred Fidelity Investments 1-800-343-0860 www.fidelity.com/atwork 08192<br />

Compensation Plan TIAA-CREF 1-877-518-9161 www.tiaa-cref.org 100387<br />

VALIC 1-888-569-7065 www.valic.com 4263<br />

BANK AT WORK<br />

Vendor Phone Number Web Site<br />

Bank <strong>of</strong> America 1-800-782-2265 http://bankatwork.bank<strong>of</strong>america.com/georgiatech<br />

<strong>Georgia</strong> United 1-888-493-4328 https://www.georgiaunitedcu.org/interior/membership/gt.asp<br />

State Bank and Trust 404-266-4333 http://techcheck.statebt.com/<br />

404-266-4334<br />

Wells Fargo 1-866-245-3452 https://www.wellsfargo.com/jump/membership/membership_<br />

welcome.jhtml?employerCode=009815

2012 MONTHLY RATES 11<br />

Medical Open Access POS HSA Open Access POS<br />

Employee<br />

Employee + Child<br />

Employee + Spouse<br />

Family<br />

Employee Tobacco Surcharge<br />

$175.34<br />

$315.62<br />

$368.22<br />

$508.46<br />

$50 MONTHLY SURCHARGE FOR TOBACCO USERS<br />

$43.70<br />

$76.38<br />

$88.62<br />

$121.30<br />

Dental BOR MetLife GT <strong>Human</strong>a CompBenefits Access GT <strong>Human</strong>a CompBenefits PPO<br />

Employee<br />

Employee + Child<br />

Employee + Spouse<br />

Family<br />

Vision<br />

$30.84<br />

$58.58<br />

$61.66<br />

$98.66<br />

$18.80 $22.30<br />

$39.24 $45.50<br />

$37.80 $46.82<br />

$63.14 $75.74<br />

Eye Med<br />

Employee<br />

$6.44<br />

Employee + Child<br />

$13.02<br />

Employee + Spouse<br />

$12.40<br />

Family<br />

$19.70<br />

Long-Term Care<br />

John Hancock Life & Health Insurance Company<br />

Contact John Hancock at 1-888-354-6498 within 60 days <strong>of</strong> hire to enroll without evidence <strong>of</strong> insurability.<br />

CIGNA Basic Term Life and AD&D<br />

Maximum <strong>of</strong> $25,000 – 100% Institute Paid<br />

Voluntary<br />

Supplemental<br />

Term Life<br />

Employee<br />

Spouse<br />

Note:<br />

• BOR Spouse Rates see<br />

Dependent Term Life below<br />

• GT Spouse Rates are the same<br />

as Employee, but are based<br />

upon spouse’s age.<br />

BOR CIGNA Supplemental Term Life and AD&D GT Unum Supplemental Term Life GT Unum AD&D<br />

Age Rate per $1,000 <strong>of</strong> Age Rate per $1,000 <strong>of</strong> Coverage:<br />

as <strong>of</strong> 12/31/12 Coverage: as <strong>of</strong> 1/1/12 Non-Tobacco Tobacco<br />

Rate <strong>of</strong> Coverage:<br />

Under 25 $0.09 Under 25 $0.05 $0.07<br />

25-29 $0.10 25-29 $0.06 $0.08<br />

30-34 $0.12 30-34 $0.08 $0.10<br />

35-39 $0.13 35-39 $0.10 $0.14 $0.02 per $1,000 <strong>of</strong><br />

40-44 $0.15 40-44 $0.12 $0.17 coverage for<br />

45-49 $0.20 45-49 $0.17 $0.26 Employee, Spouse,<br />

50-54 $0.29 50-54 $0.27 $0.44 and Children<br />

55-59 $0.52 55-59 $0.52 $0.80<br />

60-64 $0.80 60-64 $0.77 $1.00<br />

65-69 $1.55 65-69 $1.52 $1.88<br />

70+ $2.46 70+ $2.46 $3.05<br />

Dependent Term Life $10,000 <strong>of</strong> Coverage Per Dependent Child: Increments <strong>of</strong> $2,000 up to $10,000<br />

Spouse and/or Child $4.70 total covers all dependents $0.18/$2,000<br />

Short-Term Disability<br />

Unum<br />

60% income replacement (tax-free) up to $2,000 per week up to 11 weeks<br />

.0019 times covered monthly earnings<br />

Long-Term Disability<br />

Unum<br />

60% income replacement (tax-free) up to $10,000 per month up to Normal retirement age<br />

.0039 times covered monthly earnings<br />

Flexible Spending Accounts<br />

U.S. Bank<br />

Health Care<br />

Dependent Care<br />

Health Savings Account<br />

Maximum annual deferral for Health Care FSA is $5,000;<br />

Maximum annual deferral for Dependent Care FSA is $5,000<br />

U.S. Bank<br />

One time set-up fee <strong>of</strong> $10.00; monthly maintenance fee <strong>of</strong> $2.75.<br />

Monthly maintenance fees are waived if you maintain a balance <strong>of</strong> $2,500 or more.

GLOSSARY OF BENEFIT TERMS<br />

12<br />

Co-insurance – Agreement between the insured and the insurance company where a payment is shared for claims above the<br />

deductible covered by the policy. For example, under a “90/10” plan, the insurance company pays 90% and the insured pays<br />

10% after the deductible is met.<br />

Co-payment – A payment made by an individual who has health insurance, usually at the time a service is received, to <strong>of</strong>fset<br />

some <strong>of</strong> the cost <strong>of</strong> care. Co-payments are a common feature <strong>of</strong> health plans. Co-payment size may vary depending on the<br />

service, generally with lower co-payments required for visits to a regular medical provider and higher payments for services<br />

received in the emergency room. Co-payments do not accumulate toward a plan’s deductible nor out-<strong>of</strong>-pocket maximum.<br />

Co-payments are generally not required for care deemed to be “preventive”.<br />

Deductible – Amount the covered insured must pay up front before the plan will pay any expenses.<br />

Health Care Flexible Spending Account (FSA) – A Health Care FSA allows you to set aside pre-tax money via payroll<br />

deduction to pay for certain out-<strong>of</strong>-pocket health care expenses not covered by your insurance plan(s). Some examples <strong>of</strong><br />

expenses you can pay with your Health Care FSA include co-payments, deductibles, orthodontia, hearing aids, chiropractic<br />

treatment, laboratory fees, mental health counseling, etc. Not eligible if participating in an HSA.<br />

Dependent Care Flexible Spending Account (FSA) – A dependent care FSA allows you to set aside pre-tax money via payroll<br />

deduction to pay for eligible dependent care expenses for a qualifying dependent. A qualifying dependent includes a tax<br />

dependent <strong>of</strong> yours who is under age 13, any other tax dependent <strong>of</strong> yours, such as an elderly parent or spouse who is<br />

physically or mentally incapable <strong>of</strong> self-care and has the same principle residence as you.<br />

Formulary Drugs – Prescription medications, as maintained by your health plan, which are determined to be safe and<br />

effective. These drugs are regularly reviewed and the formulary is updated to reflect current medical standards <strong>of</strong> drug<br />

therapy. Generally, there are three types <strong>of</strong> drugs on the formulary: generic (lowest cost), preferred brand (mid-range cost)<br />

and non-preferred brand (highest cost).<br />

Guaranteed Issue Amount – The amount <strong>of</strong> coverage a newly eligible employee may obtain regardless <strong>of</strong> health conditions.<br />

Health Savings Account (HSA) – A tax-advantaged medical savings account available to employees enrolled in a Qualified<br />

High Deductible Health Plan (HDHP). The funds contributed to an HSA are not subject to federal income tax at the time <strong>of</strong><br />

deposit and unused funds roll over and accumulate year to year if not spent.<br />

In Network Provider – A contracted provider <strong>of</strong> health care (physicians, hospitals, testing centers, etc.) that has negotiated<br />

discounted fees for their services in return for higher anticipated patient volume.<br />

Life Insurance Conversion – The right to exchange/convert your term life insurance policy to a higher cost, permanent<br />

contract without evidence <strong>of</strong> insurability requirements.<br />

Life Insurance Portability – Portability <strong>of</strong> life insurance allows eligible insureds to continue the life insurance at affordable<br />

term life rates.<br />

Open Enrollment – The annual period during which you may choose to make changes in your benefits for the next plan year.<br />

Please note, various eligibility rules may apply.<br />

Out <strong>of</strong> Network Provider – A doctor, hospital or other provider which is not under a negotiated contract with the insurance<br />

carrier for the plan in which you are enrolled.<br />

Out-<strong>of</strong>-Pocket Maximum – The maximum amount an insured is required to pay on a calendar year basis under a plan or<br />

insurance contract.<br />

Permanent Whole Life Insurance – A life insurance policy which provides protection for the “whole” <strong>of</strong> your life, as long as<br />

the required premium payment is made in a timely manner. In addition to the guaranteed death benefit and level premiums,<br />

the policy will earn a cash value and typically generate dividends.<br />

Pre-existing Condition – A condition or diagnosis which existed (or for which treatment was received) before coverage<br />

began under a current plan or contract and for which benefits are not available or are limited.<br />

Term Life Insurance – Provides a stated benefit upon the death <strong>of</strong> the insured. Typically the term life insurance contract runs<br />

for a stated period/term <strong>of</strong> time and does not provide any cash value and/or dividend or returns beyond the stated death benefit.