A&D Watch December 2005 - Oil and Gas Investor

A&D Watch December 2005 - Oil and Gas Investor

A&D Watch December 2005 - Oil and Gas Investor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

'<br />

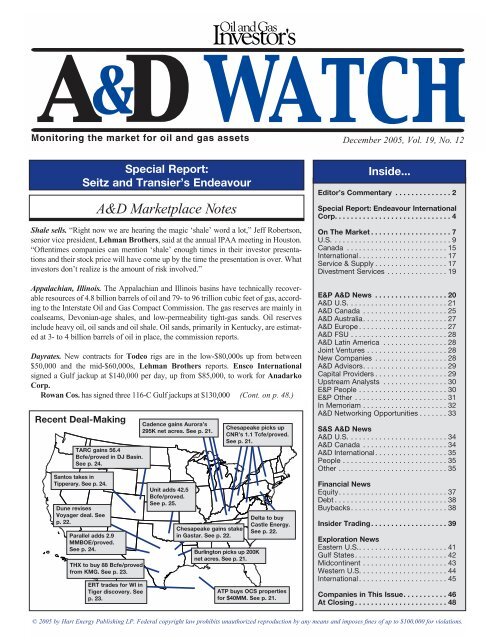

<strong>December</strong> <strong>2005</strong>, Vol. 19, No. 12<br />

Shale sells. “Right now we are hearing the magic ‘shale’ word a lot,” Jeff Robertson,<br />

senior vice president, Lehman Brothers, said at the annual IPAA meeting in Houston.<br />

“Oftentimes companies can mention ‘shale’ enough times in their investor presentations<br />

<strong>and</strong> their stock price will have come up by the time the presentation is over. What<br />

investors don’t realize is the amount of risk involved.”<br />

Appalachian, Illinois. The Appalachian <strong>and</strong> Illinois basins have technically recoverable<br />

resources of 4.8 billion barrels of oil <strong>and</strong> 79- to 96 trillion cubic feet of gas, according<br />

to the Interstate <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Compact Commission. The gas reserves are mainly in<br />

coalseams, Devonian-age shales, <strong>and</strong> low-permeability tight-gas s<strong>and</strong>s. <strong>Oil</strong> reserves<br />

include heavy oil, oil s<strong>and</strong>s <strong>and</strong> oil shale. <strong>Oil</strong> s<strong>and</strong>s, primarily in Kentucky, are estimated<br />

at 3- to 4 billion barrels of oil in place, the commission reports.<br />

Dayrates. New contracts for Todco rigs are in the low-$80,000s up from between<br />

$50,000 <strong>and</strong> the mid-$60,000s, Lehman Brothers reports. Ensco International<br />

signed a Gulf jackup at $140,000 per day, up from $85,000, to work for Anadarko<br />

Corp.<br />

Rowan Cos. has signed three 116-C Gulf jackups at $130,000 (Cont. on p. 48.)<br />

Recent Deal-Making<br />

Special Report:<br />

Seitz <strong>and</strong> Transier’s Endeavour<br />

A&D Marketplace Notes<br />

TARC gains 56.4<br />

Bcfe/proved in DJ Basin.<br />

See p. 24.<br />

Santos takes in<br />

Tipperary. See p. 24.<br />

Dune revises<br />

Voyager deal. See<br />

p. 22.<br />

Parallel adds 2.9<br />

MMBOE/proved.<br />

See p. 24.<br />

THX to buy 88 Bcfe/proved<br />

from KMG. See p. 23.<br />

ERT trades for WI in<br />

Tiger discovery. See<br />

p. 23.<br />

Cadence gains Aurora’s<br />

295K net acres. See p. 21.<br />

Unit adds 42.5<br />

Bcfe/proved.<br />

See p. 25.<br />

Chesapeake gains stake<br />

in <strong>Gas</strong>tar. See p. 22.<br />

Chesapeake picks up<br />

CNR’s 1.1 Tcfe/proved.<br />

See p. 21.<br />

Burlington picks up 200K<br />

net acres. See p. 21.<br />

Delta to buy<br />

Castle Energy.<br />

See p. 22.<br />

ATP buys OCS properties<br />

for $40MM. See p. 21.<br />

Inside...<br />

Editor’s Commentary . . . . . . . . . . . . . . 2<br />

Special Report: Endeavour International<br />

Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4<br />

On The Market . . . . . . . . . . . . . . . . . . . . 7<br />

U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9<br />

Canada . . . . . . . . . . . . . . . . . . . . . . . . . 15<br />

International . . . . . . . . . . . . . . . . . . . . . . 17<br />

Service & Supply . . . . . . . . . . . . . . . . . . 17<br />

Divestment Services . . . . . . . . . . . . . . . 19<br />

E&P A&D News . . . . . . . . . . . . . . . . . . 20<br />

A&D U.S. . . . . . . . . . . . . . . . . . . . . . . . . 21<br />

A&D Canada . . . . . . . . . . . . . . . . . . . . . 25<br />

A&D Australia. . . . . . . . . . . . . . . . . . . . . 27<br />

A&D Europe . . . . . . . . . . . . . . . . . . . . . . 27<br />

A&D FSU . . . . . . . . . . . . . . . . . . . . . . . . 28<br />

A&D Latin America . . . . . . . . . . . . . . . . 28<br />

Joint Ventures . . . . . . . . . . . . . . . . . . . . 28<br />

New Companies . . . . . . . . . . . . . . . . . . 28<br />

A&D Advisors. . . . . . . . . . . . . . . . . . . . . 29<br />

Capital Providers . . . . . . . . . . . . . . . . . . 29<br />

Upstream Analysts . . . . . . . . . . . . . . . . 30<br />

E&P People . . . . . . . . . . . . . . . . . . . . . . 30<br />

E&P Other . . . . . . . . . . . . . . . . . . . . . . . 31<br />

In Memoriam . . . . . . . . . . . . . . . . . . . . . 32<br />

A&D Networking Opportunities . . . . . . . 33<br />

S&S A&D News<br />

A&D U.S. . . . . . . . . . . . . . . . . . . . . . . . . 34<br />

A&D Canada . . . . . . . . . . . . . . . . . . . . . 34<br />

A&D International. . . . . . . . . . . . . . . . . . 35<br />

People . . . . . . . . . . . . . . . . . . . . . . . . . . 35<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . 35<br />

Financial News<br />

Equity. . . . . . . . . . . . . . . . . . . . . . . . . . . 37<br />

Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38<br />

Buybacks . . . . . . . . . . . . . . . . . . . . . . . . 38<br />

Insider Trading. . . . . . . . . . . . . . . . . . . 39<br />

Exploration News<br />

Eastern U.S.. . . . . . . . . . . . . . . . . . . . . . 41<br />

Gulf States. . . . . . . . . . . . . . . . . . . . . . . 42<br />

Midcontinent . . . . . . . . . . . . . . . . . . . . . 43<br />

Western U.S. . . . . . . . . . . . . . . . . . . . . . 44<br />

International . . . . . . . . . . . . . . . . . . . . . . 45<br />

Companies in This Issue. . . . . . . . . . . 46<br />

At Closing . . . . . . . . . . . . . . . . . . . . . . . 48<br />

© <strong>2005</strong> by Hart Energy Publishing LP. Federal copyright law prohibits unauthorized reproduction by any means <strong>and</strong> imposes fines of up to $100,000 for violations.

Editor’s<br />

Commentary<br />

Insurance Sea Change<br />

New Premiums For Gulf-Asset Insurance Are Quadrupling Or More For Some Owners<br />

From the desk of<br />

A&D <strong>Watch</strong>’s<br />

Nissa Darbonne<br />

Several Gulf of Mexico operators may be visiting their insurance brokers in London in the coming months in meetings that will decide<br />

whether these producers have to give up in the region. Word on the street is that post-KatRita insurance costs may force several Gulf independents<br />

to call it quits. One producer reports that insurance costs alone now represent a third of his lease operating expenses.<br />

New premiums are projected to cost four times more for production assets <strong>and</strong> 400% more for pipelines. Also, underwriters may begin<br />

to require separate, large windstorm deductibles, <strong>and</strong> cap this liability.<br />

“All in all, we expect our premium to increase by 110% <strong>and</strong> we might be one of the lucky ones,” another Gulf operator says.<br />

At press time, some 50% of oil production <strong>and</strong> 40% of gas production from the Gulf of Mexico remained offline, <strong>and</strong> a portion of it may<br />

never flow again. An ab<strong>and</strong>onment-services firm reports that 2006 orders to decommission destroyed or damaged platforms alone may<br />

exceed all the expected 2006 orders, pre-storms. Insurers estimate market losses for KatRita at more than $11 billion, <strong>and</strong> business-interruption<br />

claims remain open.<br />

“It is likely that no one will be fully covered anymore; rather, the producers will live with 50% to 60% of the assets under coverage <strong>and</strong><br />

simply hope that no group of storms in a 12-month period will ever destroy more than that percentage,” the operator says.<br />

The smallest of operators are most exposed, while larger producers have premium caps <strong>and</strong> they have other assets—onshore <strong>and</strong> abroad—<br />

that insurers want to underwrite, “so my best guess is that the end of the market (in the Gulf) that will suffer is middle <strong>and</strong> down.”<br />

As for the supply of Gulf assets on the market, affected producers may carry on at least until their new premium is due. “If you renewed<br />

in June, for example, you got a decent rate…However, you just might consider selling once the production is restored <strong>and</strong> before the next<br />

renewal date comes around…The producer might as well take insurance proceeds (from KatRita) <strong>and</strong> fix the damage <strong>and</strong> restore as much<br />

as possible.”<br />

Tim Sullivant, chief operating officer of Madison Energy Advisors, says, “I think everybody is concerned. Right now, it’s not going to<br />

push operators out of the Gulf unless commodity prices fall.”<br />

The Houston Exploration Co., Kerr-McGee Corp., Forest <strong>Oil</strong> Corp. <strong>and</strong> Pioneer Natural Resources are among producers divesting<br />

in the Gulf. But these plans were under way prior to this year’s major hurricanes. “Gulf properties are harder to sell,” Sullivant adds.<br />

“There are only so many players in the Gulf.”<br />

Insurance for Gulf of Mexico assets has been relatively inexpensive over the years, says Bill Martin, a Houston-based representative of<br />

Benfield Corporate Risk, which focuses on marine, energy <strong>and</strong> other areas for London-based reinsurer <strong>and</strong> risk intermediary Benfield, “It<br />

has been sold below cost…The market had been very soft.”<br />

Estimates are that, for each $1 paid in premiums for coverage of Gulf assets during the past four years, between $4 <strong>and</strong> $4.50 in loss<br />

claims have been paid, he says. “That’s not going to work.” One of the largest reinsurers, Munich Re, has already reported that its rates will<br />

go up 400%.<br />

Please photocopy <strong>and</strong> send to: Hart Energy Publishing LP, 4545 Post Oak Place, Ste 210, Houston, TX 77027<br />

D03143<br />

Phone: 713-993-9320 x129 or 800-874-2544; Fax: 713-840-1449<br />

Please: ❐ enter ❐ renew the following subscriptions:<br />

❐ A&D <strong>Watch</strong>: 1 year for $697 ❐ <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> <strong>Investor</strong>: 1 year for $297<br />

❐ <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> <strong>Investor</strong> This Week: 1 year for $597 ❐ Energy Markets: 1 year for $89<br />

❐ MasterCard ❐ VISA ❐ AmEx ❐ Discover<br />

Card No. _______________________________________ Exp. Date ___________________________________________<br />

Signature __________________________________________________________________________________________________<br />

Name ______________________________________________________ Phone ______________________________________________<br />

Title _______________________________________________________ Fax ________________________________________________<br />

Organization ________________________________________________ E-mail _____________________________________________<br />

Address ____________________________________________________________________________________________________________<br />

City ________________________________________ State ______________________________ Zip ______________________________<br />

2 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

Editor’s Commentary<br />

During the soft market, insurance was a commodity—asset-owners didn’t look hard at<br />

how much they needed <strong>and</strong> on what assets because the premium was affordable to cover<br />

everything. “Everyone will take a look now at how much insurance they need.”<br />

Also, insurers will look harder at the assets to be covered. “There are a lot of old assets<br />

in the Gulf of Mexico that, due to reservoir technology, are still being used.” Coverage<br />

costs may have been in the past for old platforms at the same rate as for newer structures—<br />

like assigning the same cost to insure a Gulf Coast mobile home <strong>and</strong> a fixed, inl<strong>and</strong> home.<br />

Consideration will be given too to “air gap” or the difference in elevation between water<br />

<strong>and</strong> platform. “The underwriting will become much more technical.”<br />

There will likely be caps on windstorm coverage, so each producer will have to consider<br />

how to h<strong>and</strong>le this. “The board of directors doesn’t want to hear you’ve had a loss that<br />

has blown through your coverage.”<br />

One producer, whose coverage expired Nov. 1, received a 700% bigger invoice. That<br />

producer has insurance right now “but he’s not particularly happy with it…,” Martin says.<br />

“It’s a crisis when it sneaks up <strong>and</strong> bites you…That’s going to happen to people…This<br />

is going to be a hot topic.” The London insurance market is in turmoil right now, while<br />

many loss claims are still open, such as for business-interruption <strong>and</strong> pollution, he adds.<br />

Generally, he says, “higher premiums alone probably will not force the smallest operators<br />

out of the Gulf…but it may affect what you pay for assets.”<br />

Smaller Gulf operators may also encounter lowered credit ratings, thus a higher cost of<br />

capital. St<strong>and</strong>ard & Poor’s Ratings Services says restoration of Gulf production is taking<br />

longer post-KatRita than after Ivan, which affected the easternmost Central Gulf producing<br />

region <strong>and</strong> was most noted for causing Gulf shelf mudslides that rearranged pipelines like<br />

Pick-Up-Sticks game pieces. Katrina also affected most of the eastern-central Gulf region,<br />

<strong>and</strong> Rita affected all of the Central Gulf as well as some of the Western Gulf.<br />

“This is a fairly fresh story <strong>and</strong> the markets haven’t even settled yet....”<br />

—Bill Martin,<br />

Benfield Corporate Risk<br />

If there are credit downgrades, the likely targets will be small <strong>and</strong> midsize operators<br />

rather than large, diversified ones. “Strong realized commodity prices on (other) producing<br />

properties <strong>and</strong> healthy liquidity levels are expected to help offset near-term production<br />

disruptions <strong>and</strong> support ratings,” S&P reports.<br />

Already beaten down by reserve revisions, Stone Energy Corp., whose assets are nearly<br />

wholly in the Gulf <strong>and</strong> on the Gulf Coast, has been hurt not carrying business-interruption<br />

insurance, “which could cause concern if meaningful levels of production remain<br />

offline for any significant period of time,” S&P reports.<br />

New entrants will assume liabilities, such as Mariner Energy Inc., which will exp<strong>and</strong><br />

in the Gulf soon by taking in Forest <strong>Oil</strong> Corp.’s assets there in a deal that was announced<br />

post-Katrina but before Rita. As of Nov. 9, some 100 million cubic feet equivalent of Forest’s<br />

daily Gulf output remained offline, reduced from 180 million offline on Oct. 1, shortly<br />

after Rita. What remains offline is waiting for third-party processing <strong>and</strong> infrastructure<br />

repairs.<br />

The deal is a bit of a bonus to Mariner, however: at least 10 billion cubic feet equivalent<br />

of Forest’s proved, developed, producing Gulf reserves weren’t produced since Katrina.<br />

This easy revenue will go to Mariner’s balance sheet, instead, post-closing.<br />

Martin at Benfield says, “The key to senior management is to underst<strong>and</strong> this (insurance-cost)<br />

change <strong>and</strong> get in front of it in your thinking <strong>and</strong> business planning with financial<br />

<strong>and</strong> operational personnel to determine your risk profile…<br />

“This is a fairly fresh story <strong>and</strong> the markets haven’t even settled yet…This is a sea<br />

change, if you will, in terms of the offshore insurance market…I don’t suspect this will be<br />

a one-year deal <strong>and</strong> the markets will go back to where they were before.”<br />

Hart Energy Publishing LP<br />

Phone: 713-993-9320 • Fax: 713-840-0923<br />

Editor<br />

Nissa Darbonne<br />

Ext. 165, ndarbonne@hartenergy.com<br />

Associate Editor<br />

Taryn Maxwell<br />

Ext. 133, tmaxwell@hartenergy.com<br />

Contributing Editors<br />

Peggy Williams, Don Lyle,<br />

Brian A. Toal, Bertie Taylor<br />

Art Advisor, Marc Conly<br />

Graphic Designer, Lisa Dodd<br />

Advisory Board<br />

George Solich, Cordillera Energy Partners<br />

Binney Williamson, Peoples Energy<br />

Anne McConville, Five States Energy<br />

Alan Smith, Chalker Energy Partners<br />

John Walker, EnerVest Management Partners<br />

Clint Wetmore, Shell E&P<br />

Marty Searcy, Sawtooth Energy Partners LLC<br />

Leah D. Smith, Pogo Producing Co.<br />

Bryan Dullye, Hunt Petroleum Corp.<br />

Steve Herod, Petrohawk Energy Corp.<br />

Doug Brooks, Marathon <strong>Oil</strong> Co.<br />

Doug Jacobson, Chesapeake Energy Corp.<br />

Vice President <strong>and</strong> Group Publisher<br />

Robert C. Jarvis<br />

Group Editor, Leslie Haines<br />

Group Publisher, Electronic Content<br />

Cliff Johnson<br />

Corporate Marketing Director<br />

Jeff Miller<br />

Marketing, Abbey Morrow<br />

Production Manager, Jo Pool<br />

New Orders/Client Services: 800-874-2544<br />

CEO, Hart Energy Publishing LP<br />

Richard A. Eichler<br />

Subscriptions: $697 per year, non-North American add $50 for air mail.<br />

The material <strong>and</strong> data in this newsletter have been compiled from a number<br />

of sources by the editors for the sole use of newsletter subscribers.<br />

A&D <strong>Watch</strong> newsletter believes the data to be accurate <strong>and</strong> its sources<br />

reliable, but does not warrant the accuracy <strong>and</strong> the information herein.<br />

Reproduction of this newsletter in whole, or in part, without prior consent<br />

of Hart Energy Publishing LP is prohibited. Federal copyright law prohibits<br />

unauthorized reproduction by any means <strong>and</strong> imposes fines up to<br />

$100,000 for violations. Subscriptions: 4545 Post Oak Place, Ste. 210,<br />

Houston, Texas 77027. Phone: 713-993-9320. Fax: 713-840-8585.<br />

A&D <strong>Watch</strong> (ISSN 1073-0263) is published monthly by Hart Energy<br />

Publishing LP. Address editorial inquiries to: 4545 Post Oak Place<br />

Suite 210, Houston, TX 77027. Phone: 713-993-9325 Ext.165. Fax:<br />

713-840-0923. Copyright <strong>2005</strong> Hart Energy Publishing LP. All<br />

rights reserved.<br />

'<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 3

Special Report<br />

To The North Sea<br />

Bill Transier And John Seitz Are Applying Their International E&P Acumen To A Start-Up<br />

Interview by Taryn Maxwell<br />

When John Seitz left the president <strong>and</strong> chief executive officer post at<br />

Anadarko Petroleum Corp. in 2003, he called old friend Bill Transier.<br />

As chief financial officer <strong>and</strong> executive vice president of Ocean<br />

Energy Inc., Transier was in the throes of overseeing the sale of<br />

Ocean to Devon Energy Corp., but was already looking toward the<br />

next venture.<br />

The pair considered prospects all around the globe, <strong>and</strong> narrowed<br />

their focus to one area in particular: the North Sea, which<br />

they view as having the potential to become the next Gulf of Mexico<br />

for U.S. independents. Together they formed North Sea New Ventures<br />

(NSNV).<br />

To attract the capital they would need for such an enterprise, they<br />

decided to tap public-capital markets. Continental Southern<br />

Resources, a small publicly held E&P company with assets scattered<br />

throughout the U.S. <strong>and</strong> some in Thail<strong>and</strong>, had been recruiting<br />

Transier to head a restructuring. Instead, Transier <strong>and</strong> Seitz merged<br />

NSNV into Continental Southern through a reverse-merger in February<br />

2004, <strong>and</strong> turned it into Endeavour International Corp.<br />

(Amex: END).<br />

Today, Endeavour has amassed working interests in 18 blocks in<br />

the U.K. <strong>and</strong> various fields in Norway. Its proved reserves total some<br />

2.7 million barrels equivalent <strong>and</strong> it will drill four wells in the North<br />

Sea this year, counting on one to bring Endeavour its first exploration<br />

success.<br />

Seitz <strong>and</strong> Transier both hold the title of co-chief executive officer,<br />

an arrangement they say represents the partnership they have forged<br />

<strong>and</strong> helps them be in two places at once. Looking at what they have<br />

achieved in the past 18 months, it’s obvious they have been.<br />

A&D <strong>Watch</strong> Why form Endeavor as a public company?<br />

Transier We had a concept about bringing people together to compete<br />

effectively in the North Sea. We wanted to attract very senior<br />

people who had significant North Sea experience. But to do that, we<br />

wanted to offer them an ownership interest in the company.<br />

Of course, we also realized that to establish a company with the<br />

size <strong>and</strong> scope needed to compete effectively in the North Sea, we<br />

would need access to the type of funding sources that only a publicly<br />

traded company can access.<br />

We had lots of venture capitalists, or private-equity firms, that<br />

were willing to give us a lot of capital to get started, but they wanted<br />

too much control over the business strategy, the board <strong>and</strong> the<br />

management. John <strong>and</strong> I felt like we had the experience to run an<br />

E&P company.<br />

With the reverse-merger we raised $50 million of new equity, part<br />

of which was from our management team. The management team,<br />

including John <strong>and</strong> I, bought 10% of the offering.<br />

A&DW How did you proceed?<br />

Seitz The very first thing we did with that funding was put a technical<br />

team together. We already had a very large 3-D seismic database<br />

that we acquired within North Sea New Ventures called the<br />

MegaMerge. It’s a vast 3-D seismic program of about 94,500 square<br />

kilometers.<br />

We went to the 22nd Seaward Licensing Round in the U.K. <strong>and</strong><br />

won 18 blocks, which provides strong evidence that we have the<br />

right technical tools <strong>and</strong> people.<br />

“Our egos are in check <strong>and</strong> the only objective we<br />

have is to create value for the shareholders.”<br />

—John Seitz<br />

A&DW Does your team consist mainly of former Ocean <strong>and</strong><br />

Anadarko personnel?<br />

Seitz The entire technical team is really recruited from highly experienced<br />

North Sea personnel <strong>and</strong> their entire experience base is North<br />

Sea. The geosciences <strong>and</strong> the operating people at the executive level<br />

came from Anadarko <strong>and</strong> the finance <strong>and</strong> accounting people at the<br />

higher levels came from Ocean.<br />

A&DW Why the North Sea?<br />

Seitz It is a world-class petroleum province that has been ignored for<br />

a significant amount of time by the majors, mostly because of past<br />

low oil prices.<br />

4 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

Special Report<br />

A&DW What is your prior experience with operating in the North<br />

Sea?<br />

Seitz In the oil <strong>and</strong> gas business, most often you earn the highest<br />

returns when you’re relatively early—not the first, but when you’re<br />

early. If you look at the Gulf of Mexico 20 or 25 years ago, the independents<br />

pretty much took it over from the majors because they were<br />

focused on somewhere else in the world. We saw the same situation<br />

occurring in the North Sea. We’re in a very stable environment politically<br />

<strong>and</strong> I can’t think of anywhere else in the world I’d rather be.<br />

A&DW What potential does the North Sea hold for a start-up, U.S.<br />

independent?<br />

Transier It would be very tough to try to start Endeavour today <strong>and</strong><br />

do what we’ve done in the North Sea. The barriers to entry have gotten<br />

a lot more difficult, so our timing could not have been better.<br />

Now there are a number of companies on the scene, but we are<br />

pleased that we are recognized as a partner of choice in the region.<br />

We have more data <strong>and</strong> more exploration people focused on the<br />

North Sea than anyone.<br />

A&DW Have you experienced any difficulties operating in the<br />

North Sea?<br />

Transier It sounds odd, but the increase in commodity prices has<br />

actually worked against us. If you’re trying to build a solid E&P<br />

company over time, you have to have a balanced approach <strong>and</strong> when<br />

we went into this, we actually thought we would be doing a lot more<br />

M&A than we have.<br />

In February 2004, oil prices were $28 a barrel. We sit here today<br />

with $65 oil, so that’s made it tough for companies to want to do<br />

transactions. They all should be selling at these prices.<br />

On the flip side, the one transaction we completed has really<br />

worked well for us. It was a small company in Norway that has a<br />

producing base of a couple thous<strong>and</strong> barrels a day. With the increase<br />

in prices, the revenue from that production is covering our worldwide<br />

general <strong>and</strong> administrative costs.<br />

A&DW In what parts of the North Sea are you interested?<br />

Seitz We were U.K.-driven initially because of the licensing round,<br />

but with the acquisition of our production base in Norway, we’re<br />

gearing up for exploration there. We’ve also put together additional<br />

seismic data in the Netherl<strong>and</strong>s <strong>and</strong> we’re undertaking studies there<br />

now.<br />

A&DW Has funding been easy to find?<br />

Transier There has been a lot of interest in the energy business for<br />

the last several years. When we put our original deal together, we<br />

sold it on the basis of the strength of our management team <strong>and</strong> the<br />

business concept. It was very easy to sell—we were five times oversubscribed<br />

for our initial offering. At the end of the first year, we<br />

used part of that capital to buy the company in Norway.<br />

In January, the convertible markets were as hot as they’ve ever<br />

been historically, <strong>and</strong> hotter for energy issuances than for anything<br />

else. So we were able to raise another $81 million in convertible<br />

equity.<br />

We’re generating cash now from Norway, <strong>and</strong> we sold our<br />

Thail<strong>and</strong> assets that were carried over from the purchase of Continental<br />

Southern. Today we have about $100 million in cash on the<br />

balance sheet. That allows us a lot of flexibility to execute our business<br />

strategy.<br />

A&DW How does the partnership of co-CEOs work?<br />

Seitz Bill <strong>and</strong> I can do either role, the operating side or the financial.<br />

Obviously our individual strengths are greater in one area than the<br />

other, but the best part is we can be in two places at one time. It<br />

extends our visibility <strong>and</strong> our ability to h<strong>and</strong>le issues. We think<br />

amazingly alike on all issues.<br />

Transier This is a risk business, <strong>and</strong> John <strong>and</strong> I have a very similar<br />

view about how to build an E&P company. We also have a common<br />

impatience—we want to get there as quickly as we possibly can.<br />

Seitz Our egos are in check <strong>and</strong> the only objective we have is to create<br />

value for the shareholders.<br />

Transier It actually is an interesting position to be able to walk next<br />

door <strong>and</strong> discuss business issues with your co-CEO <strong>and</strong> not feel that<br />

you ultimately have to make these decisions all on your own.<br />

Seitz Sometimes it’s very hard to get an impartial or objective point<br />

of view from someone who is working for you, but since we’re<br />

working together, we don’t hold anything back.<br />

“The industry will continue to consolidate, <strong>and</strong> at<br />

some point we will consolidate with someone else.”<br />

—Bill Transier<br />

A&DW Will you exit eventually?<br />

Transier The industry will continue to consolidate, <strong>and</strong> at some<br />

point we will consolidate with someone else. The question is: will<br />

we run it, or will they? Either way, we’ll do what’s best for our<br />

shareholders. We’re not in this for the jobs, we’re in this to find oil<br />

<strong>and</strong> gas <strong>and</strong> create value for the equity-holders. Since our management<br />

team holds a large sum of equity, we are fully aligned with the<br />

interests of the stockholders.<br />

A&DW Even though making an acquisition has been difficult<br />

because of high commodity prices, do you expect to do that this<br />

year?<br />

Transier Yes. It’s more difficult right now with high commodity<br />

prices. But building a balanced E&P company means not shying<br />

away from transactions. For now, our best shot is to exp<strong>and</strong> our<br />

exploration inventory <strong>and</strong> drill some of these excellent prospects our<br />

technical team is generating. Our goal is to become a several-billiondollar<br />

company <strong>and</strong> with the right acquisition we could make that<br />

happen very quickly.<br />

Seitz Whatever you see us do will make a lot of sense.<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 5

On The Market<br />

—United States<br />

—Canada<br />

—International<br />

Location Seller Agent Deal #<br />

For more information on each deal, see the text that follows this chart.<br />

U.S.<br />

Alabama Medallion Exploration The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 26<br />

California Chevron Corp. EnergyNet 5<br />

Gulf of Mexico Pioneer Natural Resources Co. R<strong>and</strong>all & Dewey 30<br />

Gulf of Mexico Shell Exploration & Production Co. IndigoPool 35<br />

Gulf of Mexico The Houston Exploration Co. Wachovia Securities 36<br />

Kansas NA Black Gold Trading LLC 2<br />

Louisiana Kaiser-Francis <strong>Oil</strong> Co. The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 22<br />

Louisiana Kilrush Petroleum Inc. Burks <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Properties Inc. 23<br />

Louisiana Lamar <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Inc. PetroSales 24<br />

Louisiana Main Energy Inc. The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 25<br />

Louisiana Mid-America Resources Corp. Burks <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. 27<br />

Louisiana Reef <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Partners LLC The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 32<br />

Louisiana Will-Drill Resources Inc. Tristone Capital 37<br />

Louisiana Winwell Resources Inc., Nemours Energy Albrecht & Associates Inc. 39<br />

Mississippi Will-Drill Resources Inc. Tristone Capital 37<br />

Montana Citation The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 10<br />

Montana Main Energy Inc. The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 25<br />

New Mexico Bettis Brothers LP Riviera Energy Corp. 1<br />

New Mexico Chevron Corp. EnergyNet 5<br />

New Mexico Chi Energy Inc. et al. Scotia Waterous Inc. 7<br />

New Mexico Cimarron Exploration Co. Riviera Energy Corp. 9<br />

New Mexico Primexx Energy Partners Energy Spectrum Advisors Inc. 31<br />

New Mexico SDX Resources Energy Capital Solutions LP 34<br />

Oklahoma Chevron Corp. EnergyNet 5<br />

Oklahoma Chevron Corp. EnergyNet 5<br />

Oklahoma NA Energy Listings 17<br />

Oklahoma K&M <strong>Oil</strong> Co. EnergyNet 21<br />

Oklahoma Orion Energy Resources LLC Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. 28<br />

Oklahoma Primexx Energy Partners Energy Spectrum Advisors Inc. 31<br />

Texas Black Stone Minerals Co. LP The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 3<br />

Texas Buckeye Energy Inc. Riviera Energy Corp. 4<br />

Texas Chevron Corp. EnergyNet 5<br />

Texas Chief <strong>Oil</strong> & <strong>Gas</strong> Lehman Brothers 6<br />

Texas Cimarex Energy Co. Tristone Capital 8<br />

Texas Cimarron Exploration Co. Riviera Energy Corp. 9<br />

Texas Compass <strong>Oil</strong> & <strong>Gas</strong> LP Albrecht & Associates Inc. 11<br />

Texas David H. Arrington Lehman Brothers 12<br />

Texas Denton Partners Ltd. PLS 13<br />

Texas Dominion Exploration & Production Inc. The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 14<br />

Texas Eagle <strong>Oil</strong> & <strong>Gas</strong> Co. Energy Spectrum Advisors Inc. 15<br />

Texas Encon Services Inc. Tristone Capital 16<br />

Texas Entre Energy Partners LP Tristone Capital 18<br />

Texas Lamar <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Inc. PetroSales 24<br />

Texas Main Energy Inc. The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse 25<br />

Texas NA PetroSales 29<br />

Texas Primexx Energy Partners Energy Spectrum Advisors Inc. 31<br />

Texas Scythian Ltd. R<strong>and</strong>all & Dewey Inc. 33<br />

Texas Will-Drill Resources Inc. Tristone Capital 37<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 7

On the Market<br />

Location Seller Agent Deal #<br />

Utah J-W Operating Co. Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. 20<br />

Wyoming <strong>Gas</strong>Tech Inc. Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. 19<br />

Wyoming Williams Production RMT Co. Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. 38<br />

Canada<br />

Western Canada Acclaim Energy Trust, StarPoint Energy Trust NA 40<br />

Alberta Duna Resources Ltd. EnergyNet 41<br />

Alberta Grizzly Resources Ltd. Collins Barrow Securities Inc. 42<br />

Alberta, B.C., Sask. Imperial <strong>Oil</strong> Resources IndigoPool 43<br />

Alberta Innova Exploration Ltd. Sayer Securities Ltd. 44<br />

New Brunswick Innova Exploration Ltd. Sayer Securities Ltd. 45<br />

Alberta Ketch Resources Ltd. Canaccord Enermarket 46<br />

Alberta Ledge Resources Ltd. Canaccord Enermarket 47<br />

B.C., Alberta Northpoint Energy Ltd. Canaccord Enermarket 48<br />

Alberta Penn West Petroleum Ltd. Scotia Waterous Inc. 49<br />

Saskatchewan Profico Energy Management Ltd. Tristone Capital 50<br />

Alberta, B.C. Samson Canada Ltd. Scotia Waterous, BMO Nesbitt Burns 51<br />

Alberta Sawtooth International Resources Inc. Haywood Securities Inc. 52<br />

Alberta Solex Exploration Ltd. Tristone Capital Inc. 53<br />

Alberta NA Tiverton Petroleums Ltd. 54<br />

Alberta Vista Resources Inc. Sayer Securities Ltd. 55<br />

International<br />

Colombia Empresa Nacional del Petróleo Scotia Waterous Inc. 56<br />

Spain, Mediterranean Sea Petroleum <strong>Oil</strong> & <strong>Gas</strong> Espana SA Scotia Waterous 57<br />

Argentina Pioneer Natural Resources Scotia Waterous Inc., TD Securities 58<br />

Service & Supply<br />

Oklahoma Southeast Transmission & Compression Co. Inc. PetroSales 59<br />

U.S.<br />

1. Bettis Brothers LP has retained Riviera<br />

Energy Corp. to sell nonoperated interests<br />

in the Ingle Wells Field, Eddy County, New<br />

Mexico.<br />

The package includes 30 producing wells<br />

with gross production of 1,016 barrels of oil<br />

<strong>and</strong> 1.8 million cubic feet of gas per day (16<br />

barrels <strong>and</strong> 32,000 cubic feet per day, net).<br />

For more information, contact Monty Fields,<br />

432-686-9400.<br />

2. Black Gold Trading LLC has been<br />

retained by an undisclosed company to sell<br />

conventional- <strong>and</strong> coalbed-gas development<br />

properties in southeast Kansas.<br />

The package includes 27,000 acres with<br />

40 completed wells <strong>and</strong> eight wells on production.<br />

For more information, contact Tom<br />

Smart, 405-478-0404.<br />

3. Black Stone Minerals Co. LP has<br />

retained The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse’s<br />

mid-value negotiated unit to sell<br />

interests in certain nonoperated producing<br />

properties in Tyler County, Texas, in a single<br />

divestment package.<br />

The sale includes net production of 115<br />

barrels of oil <strong>and</strong> 750,000 cubic feet of gas<br />

per day, varied working <strong>and</strong> net revenue<br />

interests, upside potential <strong>and</strong> development<br />

drilling. For more information, contact John<br />

Young, 218-873-4600.<br />

4. NEW—Buckeye Energy Inc. has<br />

retained Riviera Energy Corp. to sell its<br />

operated interest in the W.G. McMeans<br />

lease in Kent County, Texas.<br />

The sale includes one producing well,<br />

four inactive wells <strong>and</strong> one saltwater-disposal<br />

well on approximately 640 acres. For<br />

more information, contact Jeffrey Longbotham,<br />

432-686-9400.<br />

5. NEW—Chevron Corp. will offer properties<br />

via EnergyNet.com in Los Angeles<br />

<strong>and</strong> Orange counties, California; Leon <strong>and</strong><br />

Shackelford counties, Texas; Lea County,<br />

New Mexico; Ellis, Seminole, Harper <strong>and</strong><br />

Beaver counties, Oklahoma; <strong>and</strong> White <strong>and</strong><br />

Crawford counties, Illinois.<br />

6. NEW—Chief <strong>Oil</strong> & <strong>Gas</strong> reports it will<br />

put itself up for sale. At press time, the Barnett<br />

Shale producer was in the final stages of<br />

hiring an investment bank to represent it<br />

through the selling process. Sources report<br />

the banker will be Lehman Brothers.<br />

Chief is the No. 3 producer in the Barnett<br />

Shale. The company is expected to sell for<br />

between $1- <strong>and</strong> $1.2 billion. Bidders are<br />

expected to be Burlington Resources, The<br />

Williams Cos., Chesapeake Energy Corp.<br />

<strong>and</strong> Shell <strong>Oil</strong>.<br />

Devon Energy Corp. is the No. 1 producer<br />

in the Barnett; XTO Energy Inc. is<br />

No. 2.<br />

7. Chi Energy Inc. et al. have retained Scotia<br />

Waterous Inc. to sell certain producing<br />

assets in the Permian Basin.<br />

The package includes the company’s<br />

interest in certain producing assets in Eddy<br />

County, New Mexico, with forecast fourthquarter<br />

<strong>2005</strong> net production of approximately<br />

1,700 barrels of oil equivalent per day<br />

(70% oil).<br />

Net proved reserves on the properties are<br />

some 15.4 million barrels of oil equivalent.<br />

Major fields in the offering include the Benson<br />

Delaware, South Carlsbad, Happy Valley,<br />

HG <strong>and</strong> Turkey Track.<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 9

On the Market<br />

For more information, contact Adrian<br />

Goodisman, 713-437-5050.<br />

8. Cimarex Energy Co. has retained Tristone<br />

Capital to sell certain oil <strong>and</strong> gas assets<br />

in the Permian Basin <strong>and</strong> North Texas three<br />

packages.<br />

The properties are in the Walnut Bend,<br />

Westbrook, Levell<strong>and</strong>, Slaughter, Abell <strong>and</strong><br />

P&P fields. They are waterflood properties<br />

that are geographically focused with cash<br />

flow that has been substantial <strong>and</strong> predictable<br />

to the owner.<br />

For more information, contact Miles<br />

Redfield, 832-601-7690.<br />

9. Cimarron Exploration Co. has retained<br />

Riviera Energy Corp. to sell operated<br />

properties in Cochran County, Texas, <strong>and</strong><br />

Lea County, New Mexico.<br />

The Cochran County package includes<br />

33 producing wells on 7,520 acres with<br />

gross production of approximately 56 barrels<br />

of oil <strong>and</strong> 93,000 cubic feet of gas per<br />

day.<br />

The Lea County package includes seven<br />

producing wells on 1,674 acres with current<br />

gross production of approximately 90 barrels<br />

of oil <strong>and</strong> 45,000 cubic feet of gas per day.<br />

For more information, contact Jeffrey<br />

Longbotham, 432-686-9400.<br />

10. NEW—Citation will offer its interests<br />

in the Big Wall Field, Musselshell County,<br />

Montana, via The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse<br />

auction Dec. 14-15. For more<br />

information, go to ogclearinghouse.com.<br />

11. Compass <strong>Oil</strong> & <strong>Gas</strong> LP has retained<br />

Albrecht & Associates Inc. to sell its interests<br />

in the Jameson (Strawn) Field, Coke<br />

County, Texas.<br />

The sale includes total proved reserves of<br />

2.5 million barrels of oil equivalent, properties<br />

that are 100% operated <strong>and</strong> 51 proved<br />

undeveloped locations. For more information,<br />

contact Robert Albrecht, 713-951-<br />

9586.<br />

12. NEW—David H. Arrington, a private<br />

operator in the Barnett Shale, is for<br />

sale. The company is being represented<br />

by Lehman Brothers.<br />

13. NEW—Denton Partners Ltd. has<br />

retained PLS to sell its Denton County,<br />

Texas, package.<br />

The sale includes nine vertical gas wells<br />

on 500 acres in the Fort Worth Basin. The<br />

properties had production in September of<br />

57 barrels of oil <strong>and</strong> 3.6 million cubic feet of<br />

gas per day. For more information, contact<br />

Ronyld Wise, 713-753-1212.<br />

14. NEW—Dominion Exploration & Production<br />

Inc. has retained The <strong>Oil</strong> & <strong>Gas</strong><br />

Asset Clearinghouse’s mid-value negotiated<br />

unit to sell certain operated producing<br />

properties in the NE Thompsonville Field,<br />

Jim Hogg County, Texas.<br />

Net production is 600,000 cubic feet of<br />

gas per day from the Wilcox formation. The<br />

sale includes a working interest of 69% <strong>and</strong><br />

a net-royalty interest of 50%.<br />

For more information, contact John Dyer,<br />

281-873-4600.<br />

15. NEW—Eagle <strong>Oil</strong> & <strong>Gas</strong> Co. has<br />

10 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

On the Market<br />

retained Energy Spectrum Advisors Inc.<br />

to sell certain interests in the Pittsburg Field,<br />

Camp County, Texas.<br />

The sale includes 65 active producing<br />

wells, 35 active injection wells <strong>and</strong> three disposal<br />

wells on 6,234 gross acres. The properties<br />

have current net production of 313<br />

barrels of oil per day.<br />

For more information, contact Ch<strong>and</strong>ler<br />

Phillips, 214-987-6120.<br />

16. Encon Services Inc. has retained Tristone<br />

Capital to sell oil <strong>and</strong> gas assets in the<br />

Westhoff Ranch Field, Jackson County,<br />

Texas.<br />

The package includes 15 wells with current<br />

production of approximately 2.1 million<br />

cubic feet of gas <strong>and</strong> 450 barrels of oil per<br />

day. All properties are operated by Encon,<br />

which has 100% working interest.<br />

For more information, contact Christopher<br />

Simon, 832-601-7606.<br />

17. NEW—EnergyListings.com is offering<br />

an oil <strong>and</strong> gas package in Muskogee<br />

County, Oklahoma.<br />

The package includes two leases on 160<br />

acres with five producing wells. The leases<br />

are 100% operated <strong>and</strong> produce three barrels<br />

of oil <strong>and</strong> 3,000 cubic feet of gas per day.<br />

18. Entre Energy Partners LP has retained<br />

Tristone Capital to sell all of its assets in<br />

the El Campo Field, Wharton County,<br />

Texas.<br />

The properties are in the Yegua Trend of<br />

the Texas Gulf Coast <strong>and</strong> include a total of<br />

10 wells producing approximately 1.6 million<br />

cubic feet of gas <strong>and</strong> 112 barrels of oil<br />

per day. Entre controls operations on 99% of<br />

the production.<br />

For more information, contact Christopher<br />

Simon, 832-601-7606.<br />

19. NEW—<strong>Gas</strong>Tech Inc. has retained<br />

Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties Inc. to sell<br />

the Bend acreage block in the Greater Green<br />

River Basin, Sweetwater County, Wyoming.<br />

The sale includes a 100% working interest<br />

in 48,740 acres with an intense surface<br />

fault swarm with fracture haloes to provide<br />

fracture permeability for upward gas migration.<br />

For more information, contact Julia<br />

Foster at 303-721-6354, ext. 229.<br />

20. NEW—J-W Operating Co. has<br />

retained Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties<br />

Inc. to sell its Uinta Basin, operated,<br />

coalbed-methane Soldier Creek prospect.<br />

The project has the potential for 80 horizontal<br />

coal wells. The prospect includes<br />

15,000 gross acres (14,300 net) <strong>and</strong> a 100%<br />

working interest on a majority of the leases.<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 11

On the Market<br />

For more information, contact Julia Foster,<br />

303-721-6354, ext. 229.<br />

21. NEW—K&M <strong>Oil</strong> Co. will offer properties<br />

via auction at EnergyNet.com in Canadian<br />

<strong>and</strong> Kingfisher counties, Oklahoma.<br />

22. NEW—Kaiser-Francis <strong>Oil</strong> Co. has<br />

retained The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse’s<br />

mid-value negotiated unit to sell<br />

certain operated, producing properties in<br />

Lafayette Parish, Louisiana.<br />

Net production is 120 barrels of oil per<br />

day <strong>and</strong> prove, developed, nonproducing<br />

upside potential. For more information, contact<br />

John Dyer, 281-873-4600.<br />

23. Kilrush Petroleum Inc. has retained<br />

Burks <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Properties Inc. to sell<br />

its interests in the Edgerly <strong>and</strong> Barnes Creek<br />

fields in southwestern Louisiana.<br />

The Edgerly Field has five new producing<br />

completions in four wellbores with net<br />

production of approximately 75 barrels<br />

of oil <strong>and</strong> 60,000 cubic feet of gas per day.<br />

Net proven reserves are some 276,000 barrels<br />

of oil <strong>and</strong> 328 million cubic feet of gas<br />

on 800 gross acres.<br />

The Barnes Creek Field has one new gasproducing<br />

well, net production of approximately<br />

192,000 cubic feet of gas <strong>and</strong> 17 barrels<br />

of oil per day <strong>and</strong> net proven reserves of<br />

some 416 million cubic feet of gas <strong>and</strong><br />

32,000 barrels of oil on approximately 320<br />

gross acres.<br />

For more information, contact Don<br />

Burks, 281-580-4590.<br />

24. NEW—Lamar <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Inc. has<br />

retained PetroSales to sell its Texas <strong>and</strong><br />

Louisiana Gulf Coast properties.<br />

The sale includes 72 completions on 36<br />

properties with 6,056 operated gross acres<br />

<strong>and</strong> 14,257 nonoperated gross acres. The<br />

properties have net daily production of 2.2<br />

million cubic feet of gas <strong>and</strong> 150 barrels of<br />

oil <strong>and</strong> proved reserves of 1.06 million barrels<br />

of oil <strong>and</strong> 4.31 billion cubic feet of gas.<br />

For more information, contact Anthony<br />

Schroeder, 281-468-9510.<br />

25. Main Energy Inc. has retained The <strong>Oil</strong><br />

& <strong>Gas</strong> Asset Clearinghouse’s mid-value<br />

negotiated unit to sell the company, including<br />

properties in Louisiana, Texas <strong>and</strong> Montana,<br />

in a single divestment package.<br />

The properties are 71% operated <strong>and</strong><br />

include net production of 1.1 million cubic<br />

feet of gas equivalent per day, total proved<br />

reserves of 6.5 billion cubic feet of gas<br />

equivalent <strong>and</strong> proved upside in each area.<br />

For more information, contact John<br />

Young, 281-873-4600.<br />

26. NEW—Medallion Exploration will<br />

offer its interests in Fernbank <strong>and</strong> Yellow<br />

Creek fields in Lamar <strong>and</strong> Pickens counties,<br />

Alabama, via The <strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse<br />

auction Dec. 14-15.<br />

For more information, go to ogclearinghouse.com.<br />

27. Mid-America Resources Corp. has<br />

retained Burks <strong>Oil</strong> & <strong>Gas</strong> Properties Inc.<br />

to sell its interest in the Sorrento Field,<br />

Ascension Parish, Louisiana.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

12 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

On the Market<br />

The package includes a 100% interest in<br />

three wells, which are currently shut in.<br />

Net proved reserves are 65,000 barrels of<br />

oil <strong>and</strong> 152 million cubic feet of gas.<br />

For more information, contact Don<br />

Burks, 281-580-4590.<br />

28. Orion Energy Resources LLC has<br />

retained Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties<br />

Inc. to sell its interests in the Lake<br />

McAlester, Big Mac <strong>and</strong> Buffalo Creek<br />

prospects, all in Pittsburg County, Oklahoma.<br />

The sale includes 22,720 gross acres<br />

(13,542 net) with 14 producing wells <strong>and</strong><br />

total proved reserves of 17 billion cubic feet<br />

of gas. For more information, contact Teri<br />

Williams, 918-481-5900, ext. 303.<br />

29. PetroSales has been retained to sell a<br />

Biel Field, northeast Webb County, Texas,<br />

oil package.<br />

The package includes 100% working<br />

interest (70% net revenue interest) in 10<br />

wells of which three are producing 270 net<br />

barrels of oil per month. For more information,<br />

contact David Smart, 281-468-9053.<br />

30. Pioneer Natural Resources Co., Dallas<br />

(NYSE: PXD) has retained R<strong>and</strong>all &<br />

Dewey to sell its deepwater Gulf of Mexico<br />

assets where it has drilled 33 successful<br />

wells since 1998.<br />

Pioneer has working interests in three<br />

producing deepwater projects, owns interests<br />

in several discoveries that are being considered<br />

for commercialization, <strong>and</strong> has interests<br />

in 90 deepwater blocks with exploration<br />

opportunities.<br />

For more information, contact Joe Gladbach,<br />

281-774-2000.<br />

31. NEW—Primexx Energy Partners has<br />

retained Energy Spectrum Advisors Inc.<br />

to sell certain interests in New Mexico,<br />

Oklahoma <strong>and</strong> Texas in a Permian package<br />

<strong>and</strong> a Midcontinent package. The majority<br />

of the properties are operated.<br />

The Midcontinent properties are concentrated<br />

in Woodward, Noble <strong>and</strong> Oklahoma<br />

counties, Oklahoma. The properties include<br />

91 wells with average daily production of<br />

1.2 million cubic feet of gas equivalent.<br />

The Permian properties are concentrated<br />

in Andrews <strong>and</strong> Kent counties, Texas, <strong>and</strong><br />

Eddy <strong>and</strong> Lea counties, New Mexico. The<br />

properties have 63 wells with average production<br />

of 203 barrels of oil per day.<br />

For more information, contact Ch<strong>and</strong>ler<br />

Phillips, 214-987-6120.<br />

32. NEW—Reef <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Partners<br />

LLC will offer its interests in the Cadeville<br />

Field, Ouachita Parish, Louisiana, via The<br />

<strong>Oil</strong> & <strong>Gas</strong> Asset Clearinghouse auction<br />

Dec. 14-15. For more information, go to<br />

ogclearinghouse.com.<br />

33. Scythian Ltd. has retained R<strong>and</strong>all<br />

& Dewey Inc. to sell all of its operated<br />

properties.<br />

The package includes approximately 335<br />

wells in the Permian Basin in Texas in 40<br />

fields with net production of some 1,200<br />

barrels of oil equivalent per day (86% oil)<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 13

On the Market<br />

<strong>and</strong> preliminary proved developed producing<br />

reserves of 6.4 million barrels of oil<br />

equivalent.<br />

For more information, contact Steve<br />

Smith, 281-774-2000.<br />

34. NEW—SDX Resources has retained<br />

Energy Capital Solutions LP to sell its operated<br />

properties near Artesia, New Mexico.<br />

The sale includes two major operating<br />

areas, the East Artesia Area <strong>and</strong> the West<br />

Redlake Artesia Area, both in Eddy County,<br />

New Mexico. East Artesia currently has 19<br />

producing wells on five leases with 10 identified<br />

proved undeveloped locations, while<br />

West Redlake has 65 producing wells on 15<br />

leases with 32 proved, developed nonproducing<br />

<strong>and</strong> 42 proved, undeveloped locations.<br />

Production is approximately 476 barrels<br />

of oil equivalent per day, while net proved<br />

reserves are estimated to be 4.9 million barrels<br />

of oil <strong>and</strong> 15.6 billion cubic feet of gas<br />

with a reserves-production ratio of more<br />

than 20 years.<br />

For more information, contact Scott Trulock<br />

at 214-219-8204.<br />

35. NEW—Shell Exploration & Production<br />

Co. has retained IndigoPool to offer<br />

farm-in positions on prospects in the Gulf of<br />

Mexico.<br />

Most are in deep water with individual<br />

reserve potentials of up to 100 million barrels<br />

of oil equivalent. The farm-in offer<br />

includes a total of 27 prospects. For more<br />

information, contact Greg Mowlds, 713-<br />

513-1513.<br />

36. NEW—The Houston Exploration Co.,<br />

Houston, (NYSE: THX) has retained<br />

Wachovia Securities to sell its entire Gulf<br />

of Mexico asset base.<br />

Historically, the company’s Gulf of Mexico<br />

production has accounted for some 40%<br />

of its total production. This sale will shift<br />

Houston Exploration’s operations to<br />

onshore U.S. gas. Year-end 2004 offshore<br />

reserves totaled some 291 billion cubic feet<br />

of gas equivalent, or 37% of total proved.<br />

The company plans to use sale proceeds<br />

to acquire additional assets in U.S. onshore<br />

basins, pay for a recently announced $163-<br />

million acquisition in South Texas from<br />

Kerr-McGee Corp., decrease bank debt<br />

<strong>and</strong> potentially purchase common stock.<br />

“For several years we have been building<br />

our onshore business…We are taking<br />

advantage of the current favorable market<br />

conditions for offshore properties…<strong>and</strong><br />

focus our people <strong>and</strong> capital on longer-lived<br />

opportunities in the Lower 48,” says<br />

William G. Hargett, chairman <strong>and</strong> chief<br />

executive.<br />

After the sale, Houston Exploration’s<br />

reserve life would grow from six years to<br />

eight.<br />

St<strong>and</strong>ard & Poor’s lowered its corporate<br />

credit rating on Houston Exploration to<br />

BB- from BB after the Kerr-McGee assetpurchase<br />

announcement. THX had about<br />

$350 million of debt as of Sept. 30.<br />

“The rating action incorporates execution<br />

WELLS FARGO ENERGY ADVISORS<br />

Tom Hedrick<br />

Senior Vice President<br />

(713) 319-1614<br />

Kevin Neeley<br />

Senior Vice President<br />

(713) 319-1621<br />

Results-driven <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> advisory<br />

services for Acquisitions <strong>and</strong> Divestitures,<br />

tailored to maximize the value of each<br />

transaction <strong>and</strong> grow our client’s companies.<br />

1000 Louisiana, Suite 600 Houston, TX 77002<br />

www.WFEnergyAdvisors.com<br />

14 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

On the Market<br />

risk associated with the planned sales <strong>and</strong><br />

necessary reinvestment at a time when oil<br />

<strong>and</strong> gas properties are trading at very high<br />

prices, combined with the company’s<br />

announced $200-million share repurchase<br />

program,” says S&P credit analyst Brian<br />

Janiak.<br />

“Moreover, the company’s significant<br />

drilling-expenditure plans, increasing finding<br />

<strong>and</strong> development cost structure, <strong>and</strong><br />

need for more acquisitions pressures the<br />

company’s overall financial profile, which is<br />

viewed as more commensurate with its peers<br />

at a BB- rating level.”<br />

37. NEW—Will-Drill Resources Inc. has<br />

retained Tristone Capital to sell properties<br />

involving 34 fields in North Louisiana, East<br />

Texas <strong>and</strong> Mississippi.<br />

The sale includes net proved reserves of<br />

143 billion cubic feet of gas equivalent <strong>and</strong> net<br />

proved upside of 49 proved, developed, nonproducing<br />

locations <strong>and</strong> 250 proved, undeveloped<br />

locations. The properties include 140<br />

producing wells, 107 of which are operated by<br />

Will-Drill Production Co. Inc.<br />

For more information, contact Terrence<br />

Manning, 832-601-7652.<br />

38. NEW—Williams Production RMT<br />

Co. has retained Meagher <strong>Oil</strong> & <strong>Gas</strong> Properties<br />

Inc. to sell operated properties in the<br />

Riley Ridge area of the Green River Basin,<br />

Sublette County, Wyoming.<br />

The sale includes three producing wells<br />

from two units with net production of<br />

175,000 cubic feet of gas <strong>and</strong> two barrels of<br />

oil per day on 4,887 net acres (15,600 gross).<br />

Upside potential exists with one identified<br />

proved, undeveloped location, 12 probable<br />

locations <strong>and</strong> 27 possible locations.<br />

Proved reserves on the property are estimated<br />

to be some 646 million cubic feet of<br />

gas <strong>and</strong> 11,600 barrels of oil.<br />

For more information, contact Julia Foster,<br />

303-721-6354, ext. 229.<br />

39. Winwell Resources Inc. <strong>and</strong> Nemours<br />

Energy have retained Albrecht & Associates<br />

Inc. to sell their interests in the Elm<br />

Grove <strong>and</strong> Caspiana fields in North<br />

Louisiana.<br />

The package includes 162 billion cubic<br />

feet of gas equivalent of net proved reserves,<br />

299 proved undeveloped infill locations,<br />

27,400 gross acres <strong>and</strong> 14.1 million cubic<br />

feet of gas equivalent per day in net sales.<br />

For more information, contact Harrison<br />

Williams, 713-951-9586.<br />

Canada<br />

40. Following the merger of Acclaim Energy<br />

Trust, Calgary, (Toronto: AE.UN) <strong>and</strong><br />

Calgary-based StarPoint Energy Trust<br />

(Toronto: SPN.UN), the new trust plans to<br />

consider selling noncore assets in western<br />

Canada involving production of 2,000 to<br />

3,000 barrels of oil equivalent per day.<br />

41. NEW—Duna Resources Ltd. will offer<br />

properties via auction at EnergyNet.com in<br />

the Coutts, Provost, Snowfall, Mitsue <strong>and</strong><br />

Turner Valley areas, Alberta.<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 15

On the Market<br />

42. Grizzly Resources Ltd. has retained<br />

Collins Barrow Securities Inc. to sell its<br />

Tony Creek, Alberta, gas property <strong>and</strong> plant.<br />

The Tony Creek property currently produces<br />

approximately 1,200 barrels of oil<br />

equivalent per day on four contiguous sections<br />

of 100%-working-interest l<strong>and</strong> with a<br />

10-year proved-plus-probable reserve life.<br />

The property has an estimated 5 million<br />

barrels of oil equivalent of remaining proved<br />

<strong>and</strong> probable reserves.<br />

For more information, contact Darryl<br />

Derouin, 403-298-1515.<br />

43. Imperial <strong>Oil</strong> Resources has retained<br />

IndigoPool to sell properties in Alberta,<br />

British Columbia <strong>and</strong> Saskatchewan. The<br />

properties are oil <strong>and</strong> gas-producing. For<br />

more information, contact Greg Mowlds,<br />

713-5513-1513.<br />

44. Innova Exploration Ltd. has retained<br />

Sayer Securities Ltd. to sell its Ukalta,<br />

Alberta, gas property.<br />

The sale includes an 80% working interest<br />

in approximately 10.5 sections of Crown<br />

<strong>and</strong> freehold l<strong>and</strong>s. The property is currently<br />

not producing, though it contains five wells<br />

<strong>and</strong> reserves of 2.55 billion cubic feet.<br />

For more information, contact Tom<br />

Pavic, 403-266-6133.<br />

45. Innova Exploration Ltd. has retained<br />

Sayer Securities Ltd. to sell three exploration<br />

licenses in New Brunswick.<br />

This package includes a 50% working<br />

interest in three exploration licenses held<br />

jointly with Corridor Resources Inc. The<br />

licenses cover 106,700 acres.<br />

For more information, contact Tom<br />

Pavic, 403-266-6133.<br />

46. Ketch Resources Ltd. has retained<br />

Canaccord Enermarket to sell some<br />

20,100 net acres of l<strong>and</strong> in the Camrose area<br />

of central Alberta. Ketch has 100% working<br />

interest in the l<strong>and</strong>s included in the offering.<br />

For more information, contact Stu Venables,<br />

403-537-9836.<br />

47. Ledge Resources Ltd. has retained<br />

Canaccord Enermarket to sell seven sections<br />

of l<strong>and</strong> in the Garrington area of central<br />

Alberta.<br />

The package includes shallow gas potential<br />

from the Edmonton s<strong>and</strong> play <strong>and</strong> 4,480<br />

acres of l<strong>and</strong> at about a 100% working interest.<br />

For more information, contact Stu Venables,<br />

403-537-9836.<br />

48. NEW—Northpoint Energy Ltd. has<br />

retained Canaccord Enermarket to sell its<br />

properties in Bernadet, Inga, Red Creek,<br />

Teal <strong>and</strong> Two Rivers in British Columbia<br />

<strong>and</strong> Boundary Lake, Puskwaskau, Simonette,<br />

Strachan <strong>and</strong> Benton in Alberta.<br />

Northpoint is willing to accept offers on a<br />

single property group or any combination of<br />

property groups. For more information, contact<br />

Martin Peters, 403-537-9829.<br />

49. Penn West Petroleum Ltd. has retained<br />

Scotia Waterous Inc. as its exclusive advisor<br />

to sell certain noncore gas assets in<br />

Psst!<br />

Where is your news?<br />

2250 OIL & GAS PROPERTIES<br />

Properties located in: Alabama, Arkansas, Colorado, Kansas,<br />

Louisiana, Michigan, Mississippi, Montana, New Mexico,<br />

North Dakota, Oklahoma, Texas, Utah, Wyoming<br />

Sellers include: Dominion, ExxonMobil, Citation,<br />

Reef Partners, Total <strong>and</strong> many more<br />

DECEMBER 14-15, <strong>2005</strong><br />

HOUSTON, TEXAS<br />

Qualified Bidders Only • Advance Registration Required<br />

PHONE (281) 873-4600 FAX (281) 873-0055<br />

K.R. OLIVE, JR., PRESIDENT<br />

Call 713-993-9325 Ext.165 <strong>and</strong> let<br />

us tell the marketplace.<br />

It’s free!<br />

TX License No. 10777<br />

This notice is not an offer to sell or a solicitation of buyers<br />

in states where prohibited by law.<br />

16 • A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong>

On the Market<br />

northern Alberta in two packages but a single<br />

transaction is preferred.<br />

Preference will be given to exchange proposals;<br />

however, Penn West will consider<br />

cash offers.<br />

The assets involve 100% working interest<br />

with infrastructure control <strong>and</strong> an undeveloped<br />

l<strong>and</strong> position of 377,000 net acres<br />

September <strong>2005</strong> sales averaged 11.9 million<br />

cubic feet of gas per day. Proved reserves<br />

are 3.22 million barrels of oil equivalent;<br />

proved-plus-probable reserves total 4.14 million.<br />

The reserve life is 4.6 years for proved<br />

<strong>and</strong> 5.9 years for proved plus probable.<br />

The assets are in the Hotchkiss/Vista<br />

Creek area <strong>and</strong> the Mega/Gutah area. For<br />

more information, contact Hilary Foulkes,<br />

403-261-4241.<br />

50. NEW—Profico Energy Management<br />

Ltd. has retained Tristone Capital to sell<br />

the company.<br />

Profico’s assets are 97% gas in western<br />

Saskatchewan with a concentration in the<br />

Shackleton area. The company’s properties<br />

produce approximately 18,000 barrels of oil<br />

equivalent per day. The sale also includes an<br />

undeveloped l<strong>and</strong> position of 750,000 net<br />

acres <strong>and</strong> 3,000 identified step-out <strong>and</strong> infill<br />

locations.<br />

For more information, contact Ian van<br />

Staalduinen, 403-303-8660.<br />

51. NEW—Samson Canada Ltd. has<br />

retained Scotia Waterous <strong>and</strong> BMO Nesbitt<br />

Burns to evaluate strategic alternatives<br />

for its assets. The company’s producing<br />

properties are in central <strong>and</strong> northern Alberta<br />

<strong>and</strong> British Columbia.<br />

Further information is expected in the<br />

first quarter of 2006.<br />

52. Sawtooth International Resources<br />

Inc., Calgary, (Toronto Venture: SAW) has<br />

retained Haywood Securities Inc. as its<br />

financial advisor to assist in identifying <strong>and</strong><br />

evaluating strategic alternatives.<br />

Sawtooth has approximately 90% of<br />

its operations in the Redwater area,<br />

northeast of Edmonton, Alberta. It has<br />

interests in some 32 sections of l<strong>and</strong> with<br />

an average working interest of 90%, an<br />

extensive gas- <strong>and</strong> oil-gathering system<br />

<strong>and</strong> operates 100% of production.<br />

53. Solex Exploration Ltd. has retained<br />

Tristone Capital Inc. to sell the company,<br />

which was formed in 2002 <strong>and</strong> has a single<br />

asset at Princess in southeastern Alberta.<br />

The asset is producing approximately<br />

1.77 million cubic feet of sweet gas <strong>and</strong> two<br />

barrels of condensate per day net to Solex<br />

from the Basal Colorado <strong>and</strong> Lower Mannville.<br />

For more information, contact Leslie F.<br />

Kende, 403-539-4353.<br />

54. NEW—Tiverton Petroleums Ltd.,<br />

Calgary, (Toronto: TIV) has initiated a<br />

process to examine strategic alternatives that<br />

may include acquisitions or the sale, merger,<br />

takeover or restructuring of the company.<br />

Tiverton operates largely in southeastern<br />

Alberta with production <strong>and</strong> exploration<br />

concentrated in the core area of the Western<br />

Canadian Sedimentary Basin, primarily in<br />

Alberta.<br />

55. NEW—Vista Resources Inc. has<br />

retained Sayer Securities Ltd. to sell its<br />

Valhalla, Alberta, property.<br />

The package includes high working interests<br />

in 10 producing wells, six of which are<br />

operated by Vista. Net production is approximately<br />

58 barrels of oil <strong>and</strong> 35,000 cubic<br />

feet of gas per day. The property has a<br />

reserve life of 14.4 years.<br />

For more information, contact Tom<br />

Pavic, 403-266-6133.<br />

International<br />

56. Empresa Nacional del Petróleo<br />

(ENAP) has retained Scotia Waterous Inc.<br />

to sell its Colombian subsidiary, Sipetrol<br />

SA, Sucursal, Colombia.<br />

Sipetrol Colombia owns a 90.6% operated<br />

interest in the Dindal <strong>and</strong> Rio Seco blocks<br />

containing the producing Guaduas Field <strong>and</strong><br />

a 27.27% nonoperated interest in the Caguan<br />

Block containing the producing Rio Ceibas<br />

Field, both in the Upper Magdalena Basin.<br />

The package includes current production<br />

of 3,000 barrels per day from the Guaduas<br />

<strong>and</strong> Río Ceibas fields <strong>and</strong> 7.2 million barrels<br />

of estimated total proved reserves.<br />

For more information, contact Chris Slubicki,<br />

403-261-4242.<br />

57. NEW—Petroleum <strong>Oil</strong> & <strong>Gas</strong> Espana<br />

SA has retained Scotia Waterous to evaluate<br />

strategic alternatives.<br />

The company’s assets are in Spain within<br />

the Guadalquivir Basin <strong>and</strong> offshore in<br />

the Catalono-Balearic Basin in the northwest<br />

Mediterranean <strong>and</strong> produce approximately<br />

8.9 million cubic feet of gas equivalent<br />

per day.<br />

For more information, contact Doug De<br />

Filippi, +44 20 7569 1312.<br />

58. Pioneer Natural Resources has<br />

retained Scotia Waterous Inc. <strong>and</strong> TD<br />

Securities to sell its 35% working interest in<br />

the Union Transitoria de Empresas-Tierra<br />

del Fuego (UTE TDF) <strong>and</strong> its 50% operating<br />

working interest in the Lago Fuego Field.<br />

Both properties are in the Austral Basin,<br />

Tierra del Fuego, Argentina.<br />

Production is 12,460 barrels of oil equivalent<br />

per day (82% gas) <strong>and</strong> proved reserves<br />

are some 51.75 million barrels of oil equivalent.<br />

Some production is exported to Chile.<br />

The package also includes 715,605 gross<br />

acres.<br />

For more information, contact Byron<br />

Bahnsen, 403-261-2375.<br />

Service & Supply<br />

59. Southeast Transmission & Compression<br />

Co. Inc. has retained PetroSales to sell<br />

the ongoing operations of its southeast Oklahoma<br />

gas-compression business in Pittsburg<br />

County in the Arkoma Basin area.<br />

The company’s compression plant<br />

includes a fleet of Ajax two-stage compressors<br />

<strong>and</strong> two additional field compressors.<br />

Corporate assets include the compression<br />

plant, surplus compressors, operating agreements,<br />

office buildings, real estate, shop<br />

facilities <strong>and</strong> a residence on the property.<br />

The compressed gas is “dry gas” derived<br />

largely from Hartshorne coalbed-methane<br />

reserves.<br />

For more information, contact David<br />

Smart, 281-468-9053.<br />

—Taryn Maxwell<br />

A&D <strong>Watch</strong> • <strong>December</strong> <strong>2005</strong> • 17

On the Market<br />

<strong>Oil</strong> & <strong>Gas</strong> Asset-Divestment Services<br />

Company Contact Region Phone Website<br />

Albrecht & Associates Harrison Williams or Bob Albrecht U.S. 713-951-9586 albrechtai.com<br />

American Energy Advisors Stephen Liberman U.S. 303-674-7759 NA<br />

Bainbridge Capital Brian Miller U.S. 858-410-0917 bainbridge-capital.com<br />

Banks Petroleum Inc. Roy Jackson U.S. 512-478-0059 banksinfo.com<br />

Baxter Bold & Co. Scott Baxter or Jim Bold Global 212-682-4601 baxterbold.com<br />

Black Gold Trading Paul Smart U.S. 405-478-0404 blackgoldtrading.com<br />

Blackstone Group Raffiq Nathoo Global 212-583-5820 blackstone.com<br />

Buckley & Boots Martin Buckley or Myron Boots U.S. 713-468-4888 buckleyboots.com<br />

Burks <strong>Oil</strong> & <strong>Gas</strong> Properties Don Burks U.S. 281-580-4590 burksoil<strong>and</strong>gas.com<br />

CB Securities Darryl S. Derouin Canada 403-298-1515 cbsecurities.com<br />

CEC Energy Consultants Mike Cherry U.S. 281-298-9961 cecenergyconsultants.com<br />

CIBC World Markets John Koyanagi Canada 403-216-3013 cibcwm.com<br />