comprehensive annual financial report - Orlando International Airport

comprehensive annual financial report - Orlando International Airport

comprehensive annual financial report - Orlando International Airport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GREATER ORLANDO AVIATION AUTHORITY<br />

NOTES TO FINANCIAL STATEMENTS<br />

Years Ended September 30, 2009 and 2008<br />

5. CASH DEPOSITS AND INVESTMENTS (continued)<br />

On December 21, 2007, Standard and Poor's Ratings Services assigned its "AAAm" principal stability fund rating to<br />

LGIP. Fund B is not rated by any nationally recognized statistical rating agency. Additional information regarding<br />

the LGIP and Fund B may be obtained from the SBA.<br />

Custodial Credit Risk: For an investment, custodial risk is the risk that, in the event of the failure of the<br />

counterparty, the Authority will not be able to recover the value of its investments or collateral securities that are in<br />

the possession of an outside party. All of the Authority’s investments are either held in the name of the Authority or<br />

held in trust under the Authority’s name.<br />

Concentration of Credit Risk: At September 30, 2009, the Authority held investments exceeding 5% of the total<br />

investment portfolio with two issuers; Federal Home Loan Bank (5.75%) and Federal Home Loan Mortgage<br />

Corporation (6.80%). At September 30, 2008, the Authority held investments exceeding 5% of the total investment<br />

portfolio with three issuers; Federal Home Loan Bank (34.0%), Federal Home Loan Mortgage Corporation (15.5%),<br />

and Federal National Mortgage Association (10.2%). Each of the investments are rated either AAA by S&P or Aaa<br />

by Moody’s rating agency. Standard practice limits the maximum investment in any one issuer of commercial paper<br />

to $5 million dollars.<br />

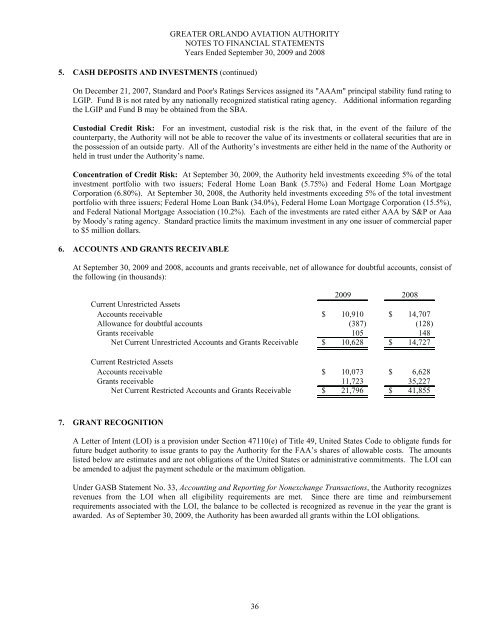

6. ACCOUNTS AND GRANTS RECEIVABLE<br />

At September 30, 2009 and 2008, accounts and grants receivable, net of allowance for doubtful accounts, consist of<br />

the following (in thousands):<br />

2009 2008<br />

Current Unrestricted Assets<br />

Accounts receivable $ 10,910 $ 14,707<br />

Allowance for doubtful accounts (387) (128)<br />

Grants receivable 105 148<br />

Net Current Unrestricted Accounts and Grants Receivable $ 10,628 $ 14,727<br />

Current Restricted Assets<br />

Accounts receivable $ 10,073 $ 6,628<br />

Grants receivable 11,723 35,227<br />

Net Current Restricted Accounts and Grants Receivable $ 21,796 $ 41,855<br />

7. GRANT RECOGNITION<br />

A Letter of Intent (LOI) is a provision under Section 47110(e) of Title 49, United States Code to obligate funds for<br />

future budget authority to issue grants to pay the Authority for the FAA’s shares of allowable costs. The amounts<br />

listed below are estimates and are not obligations of the United States or administrative commitments. The LOI can<br />

be amended to adjust the payment schedule or the maximum obligation.<br />

Under GASB Statement No. 33, Accounting and Reporting for Nonexchange Transactions, the Authority recognizes<br />

revenues from the LOI when all eligibility requirements are met. Since there are time and reimbursement<br />

requirements associated with the LOI, the balance to be collected is recognized as revenue in the year the grant is<br />

awarded. As of September 30, 2009, the Authority has been awarded all grants within the LOI obligations.<br />

36