The Impact of Global International Informal Banking on Canada

The Impact of Global International Informal Banking on Canada

The Impact of Global International Informal Banking on Canada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

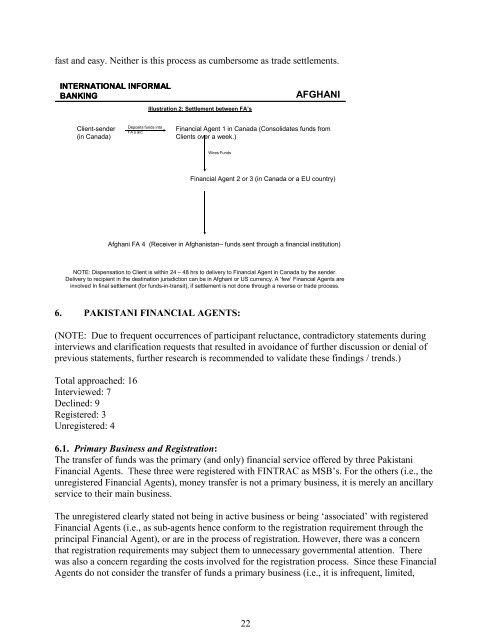

fast and easy. Neither is this process as cumbersome as trade settlements.<br />

INTERNATIONAL INFORMAL<br />

BANKING<br />

Illustrati<strong>on</strong> 2: Settlement between FA’s<br />

AFGHANI<br />

Client-sender<br />

(in <strong>Canada</strong>)<br />

Deposits funds into<br />

FA’s a/c.<br />

Financial Agent 1 in <strong>Canada</strong> (C<strong>on</strong>solidates funds from<br />

Clients over a week.)<br />

Wires Funds<br />

Financial Agent 2 or 3 (in <strong>Canada</strong> or a EU country)<br />

Afghani FA 4 (Receiver in Afghanistan– funds sent through a financial instituti<strong>on</strong>)<br />

NOTE: Dispensati<strong>on</strong> to Client is within 24 – 48 hrs to delivery to Financial Agent in <strong>Canada</strong> by the sender.<br />

Delivery to recipient in the destinati<strong>on</strong> jurisdicti<strong>on</strong> can be in Afghani or US currency. A ‘few’ Financial Agents are<br />

involved In final settlement (for funds-in-transit), if settlement is not d<strong>on</strong>e through a reverse or trade process.<br />

6. PAKISTANI FINANCIAL AGENTS:<br />

(NOTE: Due to frequent occurrences <str<strong>on</strong>g>of</str<strong>on</strong>g> participant reluctance, c<strong>on</strong>tradictory statements during<br />

interviews and clarificati<strong>on</strong> requests that resulted in avoidance <str<strong>on</strong>g>of</str<strong>on</strong>g> further discussi<strong>on</strong> or denial <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

previous statements, further research is recommended to validate these findings / trends.)<br />

Total approached: 16<br />

Interviewed: 7<br />

Declined: 9<br />

Registered: 3<br />

Unregistered: 4<br />

6.1. Primary Business and Registrati<strong>on</strong>:<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> transfer <str<strong>on</strong>g>of</str<strong>on</strong>g> funds was the primary (and <strong>on</strong>ly) financial service <str<strong>on</strong>g>of</str<strong>on</strong>g>fered by three Pakistani<br />

Financial Agents. <str<strong>on</strong>g>The</str<strong>on</strong>g>se three were registered with FINTRAC as MSB’s. For the others (i.e., the<br />

unregistered Financial Agents), m<strong>on</strong>ey transfer is not a primary business, it is merely an ancillary<br />

service to their main business.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> unregistered clearly stated not being in active business or being ‘associated’ with registered<br />

Financial Agents (i.e., as sub-agents hence c<strong>on</strong>form to the registrati<strong>on</strong> requirement through the<br />

principal Financial Agent), or are in the process <str<strong>on</strong>g>of</str<strong>on</strong>g> registrati<strong>on</strong>. However, there was a c<strong>on</strong>cern<br />

that registrati<strong>on</strong> requirements may subject them to unnecessary governmental attenti<strong>on</strong>. <str<strong>on</strong>g>The</str<strong>on</strong>g>re<br />

was also a c<strong>on</strong>cern regarding the costs involved for the registrati<strong>on</strong> process. Since these Financial<br />

Agents do not c<strong>on</strong>sider the transfer <str<strong>on</strong>g>of</str<strong>on</strong>g> funds a primary business (i.e., it is infrequent, limited,<br />

22