Green Energy Solution Industries, Inc. Name change ... - OTC Markets

Green Energy Solution Industries, Inc. Name change ... - OTC Markets

Green Energy Solution Industries, Inc. Name change ... - OTC Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

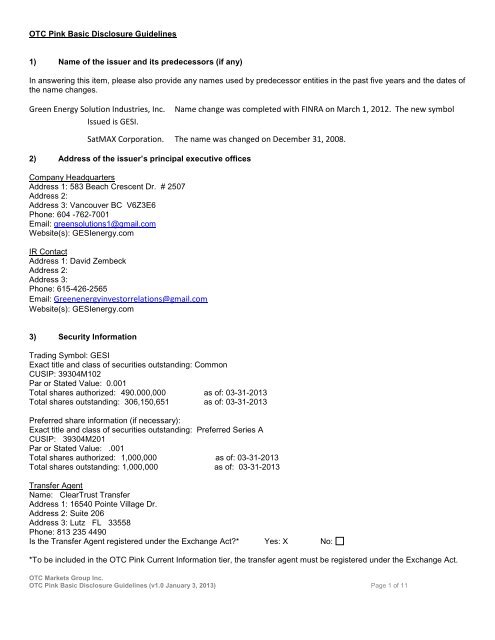

<strong>OTC</strong> Pink Basic Disclosure Guidelines<br />

1) <strong>Name</strong> of the issuer and its predecessors (if any)<br />

In answering this item, please also provide any names used by predecessor entities in the past five years and the dates of<br />

the name <strong>change</strong>s.<br />

<strong>Green</strong> <strong>Energy</strong> <strong>Solution</strong> <strong>Industries</strong>, <strong>Inc</strong>.<br />

Issued is GESI.<br />

<strong>Name</strong> <strong>change</strong> was completed with FINRA on March 1, 2012. The new symbol<br />

SatMAX Corporation. The name was <strong>change</strong>d on December 31, 2008.<br />

2) Address of the issuer’s principal executive offices<br />

Company Headquarters<br />

Address 1: 583 Beach Crescent Dr. # 2507<br />

Address 2:<br />

Address 3: Vancouver BC V6Z3E6<br />

Phone: 604 -762-7001<br />

Email: greensolutions1@gmail.com<br />

Website(s): GESIenergy.com<br />

IR Contact<br />

Address 1: David Zembeck<br />

Address 2:<br />

Address 3:<br />

Phone: 615-426-2565<br />

Email: <strong>Green</strong>energyinvestorrelations@gmail.com<br />

Website(s): GESIenergy.com<br />

3) Security Information<br />

Trading Symbol: GESI<br />

Exact title and class of securities outstanding: Common<br />

CUSIP: 39304M102<br />

Par or Stated Value: 0.001<br />

Total shares authorized: 490.000,000 as of: 03-31-2013<br />

Total shares outstanding: 306,150,651 as of: 03-31-2013<br />

Preferred share information (if necessary):<br />

Exact title and class of securities outstanding: Preferred Series A<br />

CUSIP: 39304M201<br />

Par or Stated Value: .001<br />

Total shares authorized: 1,000,000 as of: 03-31-2013<br />

Total shares outstanding: 1,000,000 as of: 03-31-2013<br />

Transfer Agent<br />

<strong>Name</strong>: ClearTrust Transfer<br />

Address 1: 16540 Pointe Village Dr.<br />

Address 2: Suite 206<br />

Address 3: Lutz FL 33558<br />

Phone: 813 235 4490<br />

Is the Transfer Agent registered under the Ex<strong>change</strong> Act?* Yes: X No:<br />

*To be included in the <strong>OTC</strong> Pink Current Information tier, the transfer agent must be registered under the Ex<strong>change</strong> Act.<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 1 of 11

List any restrictions on the transfer of security:<br />

None<br />

Describe any trading suspension orders issued by the SEC in the past 12 months.<br />

None<br />

Within the past year please list any past, pending or anticipated stock split, stock dividend, recapitalization, merger,<br />

acquisition, spin-off, or reorganization:<br />

None<br />

4) Issuance History<br />

List below any events, in chronological order, that resulted in <strong>change</strong>s in total shares outstanding by the issuer in the past<br />

two fiscal years and any interim period. The list shall include all offerings of securities, whether private or public, and all<br />

shares or any other securities or options to acquire such securities issued for services, describing (1) the securities, (2)<br />

the persons or entities to whom such securities were issued and (3) the services provided by such persons or entities.<br />

The list shall indicate:<br />

A. The nature of each offering (e.g., Securities Act Rule 504, intrastate, etc.);<br />

June 2012 Rule D 504 offering<br />

B. Any jurisdictions where the offering was registered or qualified;<br />

None<br />

C. The number of shares offered;<br />

40,000,000<br />

D. The number of shares sold;<br />

37,060,000<br />

E. The price at which the shares were offered, and the amount actually paid to the issuer;<br />

.005<br />

F. The trading status of the shares; and<br />

Restricted<br />

G. Whether the certificates or other documents that evidence the shares contain a legend (1) stating that the shares<br />

have not been registered under the Securities Act and (2) setting forth or referring to the restrictions on<br />

transferability and sale of the shares under the Securities Act.<br />

Stamped front and back with Restrictive Legend showing none transferability and one year hold.<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 2 of 11

With respect to private offerings of securities, the list shall also indicate the identity of the persons who purchased<br />

securities in such private offering; provided, however, that in the event that any such person is an entity, the list shall also<br />

indicate (a) the identity of each natural person beneficially owning, directly or indirectly, more than ten percent (10%) of<br />

any class of equity securities of such entity and (b) to the extent not otherwise disclosed, the identity of each natural<br />

person who controlled or directed, directly or indirectly, the purchase of such securities for such entity.<br />

GESI PPM<br />

Listing<br />

100 Drew Frandy 3.4M 101 Jeffrey Kaser 800K<br />

102 Eric Frandy 700K 103 David Gadwood 500K<br />

104 Jessica Zembek 300K 105 Eric Odendahl 1M<br />

106 Emily White 260K 107 Joseph Sluder 2M<br />

108 RESERVED 109 Stuart Kerr 1M<br />

110 Tom Cechulski 1M 111 Bill Filippo 2.4M<br />

112 Brett Peterson 1 M 113 NOT TO BE USED<br />

114 Peter de Graune 1.5 M 115 Ron Zembek 200K<br />

116 Hubert Shaw 1 M 117 Rob Moore III 400K<br />

118 Shari Zembek 600K 119 David Blanco 600K<br />

120 David Zembek 800K 121 Michael Bradshaw 200K<br />

122 Ron Parsons 3M 123 Billy Parker 200K<br />

124 Ed Rizk 1M 125 Robert Horry 6M Individual owning more than 10 %<br />

126 Blue Corn Productions 3M 127 Sandy Arnett 200K<br />

128 Alliance Investments 4M Entity owning more than 10 %, Julian Brown principal.<br />

5) Financial Statements<br />

Provide the financial statements described below for the most recent fiscal year end or quarter end to maintain<br />

qualification for the <strong>OTC</strong> Pink Current Information tier. For the initial disclosure statement (qualifying for Current<br />

Information for the first time) please provide reports for the two previous fiscal years and any interim periods.<br />

A. Balance sheet;<br />

B. Statement of income;<br />

C. Statement of cash flows;<br />

D. Financial notes; and<br />

E. Audit letter, if audited<br />

Attached to Last Page of Filing.<br />

The financial statements requested pursuant to this item shall be prepared in accordance with US GAAP by persons with<br />

sufficient financial skills.<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 3 of 11

You may either (i) attach/append the financial statements to this disclosure statement or (ii) post such financial statements<br />

through the <strong>OTC</strong> Disclosure & News Service as a separate report using the appropriate report name for the applicable<br />

period end. (“Annual Report,” “Quarterly Report” or “Interim Report”).<br />

If you choose to publish the financial reports separately as described in part (ii) above, you must state in the<br />

accompanying disclosure statement that such financial statements are incorporated by reference. You may reference the<br />

document(s) containing the required financial statements by indicating the document name, period end date, and the date<br />

that it was posted to otciq.com in the field below.<br />

Information contained in a Financial Report is considered current until the due date for the subsequent Financial Report.<br />

To remain in the <strong>OTC</strong> Pink Current Information tier, a company must post its Annual Report within 90 days from its fiscal<br />

year-end date and Quarterly Reports within 45 days of its fiscal quarter-end date.<br />

6) Describe the Issuer’s Business, Products and Services<br />

Describe the issuer’s business so a potential investor can clearly understand the company. In answering this item, please<br />

include the following:<br />

A. a description of the issuer’s business operations;<br />

The company has a selection of certain technologies which can be used for the production of electricity from<br />

waste rail ties. The company has secured a long term large feedstock supply of waste rail ties. GESI has also<br />

secured the land and placement for the waste to energy plant to be developed.<br />

B. Date and State (or Jurisdiction) of <strong>Inc</strong>orporation:<br />

Nevada August 2011<br />

C. the issuer’s primary and secondary SIC Codes;<br />

22118 Other Electric Power Generation<br />

D. the issuer’s fiscal year end date;<br />

December 31,<br />

E. principal products or services, and their markets;<br />

Electrical Power Generation from the burning of waste materials, specifically wooden rail road ties for the benefit of<br />

the Western Canadian Power Grid systems.<br />

7) Describe the Issuer’s Facilities<br />

The goal of this section is to provide a potential investor with a clear understanding of all assets, properties or facilities<br />

owned, used or leased by the issuer.<br />

In responding to this item, please clearly describe the assets, properties or facilities of the issuer, give the location of the<br />

principal plants and other property of the issuer and describe the condition of the properties. If the issuer does not have<br />

complete ownership or control of the property (for example, if others also own the property or if there is a mortgage on the<br />

property), describe the limitations on the ownership.<br />

If the issuer leases any assets, properties or facilities, clearly describe them as above and the terms of their leases.<br />

GESI leases offices in Vancouver Canada; the space is 1200 square feet, and the cost is $ 1,000 US Dollars per month.<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 4 of 11

GESI has further secured the rights to raw land in which the power generation plant is to be built and operated. This<br />

operation is the planning and permitting stage of development.<br />

8) Officers, Directors, and Control Persons<br />

The goal of this section is to provide an investor with a clear understanding of the identity of all the persons or entities that<br />

are involved in managing, controlling or advising the operations, business development and disclosure of the issuer, as<br />

well as the identity of any significant shareholders.<br />

A. <strong>Name</strong>s of Officers, Directors, and Control Persons. In responding to this item, please provide the names of each<br />

of the issuer’s executive officers, directors, general partners and control persons (control persons are beneficial<br />

owners of more than five percent (5%) of any class of the issuer’s equity securities), as of the date of this<br />

information statement.<br />

Executive Officers<br />

Gordon MacKay, President and CEO, is owner of more than 5 % of the shares.<br />

Chris Wentworth, COO is owner of more than 5% of Shares.<br />

Tom Law, Secretary,<br />

B. Legal/Disciplinary History. Please identify whether any of the foregoing persons have, in the last five years, been<br />

the subject of:<br />

1. A conviction in a criminal proceeding or named as a defendant in a pending criminal proceeding (excluding<br />

traffic violations and other minor offenses);<br />

None<br />

2. The entry of an order, judgment, or decree, not subsequently reversed, suspended or vacated, by a court of<br />

competent jurisdiction that permanently or temporarily enjoined, barred, suspended or otherwise limited such<br />

person’s involvement in any type of business, securities, commodities, or banking activities;<br />

None<br />

3. A finding or judgment by a court of competent jurisdiction (in a civil action), the Securities and Ex<strong>change</strong><br />

Commission, the Commodity Futures Trading Commission, or a state securities regulator of a violation of<br />

federal or state securities or commodities law, which finding or judgment has not been reversed, suspended,<br />

or vacated; or<br />

None<br />

4. The entry of an order by a self-regulatory organization that permanently or temporarily barred suspended or<br />

otherwise limited such person’s involvement in any type of business or securities activities.<br />

None<br />

C. Beneficial Shareholders. Provide a list of the name, address and shareholdings or the percentage of shares<br />

owned by all persons beneficially owning more than ten percent (10%) of any class of the issuer’s equity<br />

securities. If any of the beneficial shareholders are corporate shareholders, provide the name and address of the<br />

person(s) owning or controlling such corporate shareholders and the resident agents of the corporate<br />

shareholders.<br />

One shareholder PLC Capital owns 16% of total authorized shares.<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 5 of 11

9) Third Party Providers<br />

Please provide the name, address, telephone number, and email address of each of the following outside providers that<br />

advise your company on matters relating to operations, business development and disclosure:<br />

Legal Counsel<br />

<strong>Name</strong>: Craig Huffman<br />

Firm: Securus Law Group<br />

Address 1: 13046 Racetrack Rd # 243<br />

Address 2: Tampa FL 33626<br />

Phone: 888 914 4144<br />

Email: Craig@Securuslaw.com<br />

Accountant or Auditor<br />

<strong>Name</strong>:<br />

Firm:<br />

Address 1:<br />

Address 2:<br />

Phone:<br />

Email:<br />

Investor Relations Consultant<br />

<strong>Name</strong>: David Zembeck<br />

Firm:<br />

Address 1: 804 Summerwood Dr.<br />

Address 2: Arlington, TX 76017<br />

Phone: 615-426-2565<br />

Email: dmzembeck@gmail.com<br />

Other Advisor: Any other advisor(s) that assisted, advised, prepared or provided information with respect to this<br />

disclosure statement.<br />

<strong>Name</strong>:<br />

Firm:<br />

Address 1:<br />

Address 2:<br />

Phone:<br />

Email:<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 6 of 11

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 7 of 11

Cash Flow<br />

Period Ending March 31, 2013<br />

Non Cummulative<br />

OPERATING ACTIVITIES<br />

Net <strong>Inc</strong>ome -2,107.26<br />

Net cash provided by Operating<br />

Activities -2,107.26<br />

Net cash increase for period -2,107.26<br />

Cash at beginning of period 68,130.27<br />

Cash at end of period 66,023.01<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 8 of 11

Profit and Loss<br />

Period January 1, 2013 to March 31, 2013<br />

Non Cummulative<br />

<strong>Inc</strong>ome<br />

Other <strong>Inc</strong> 5,600.00<br />

Total <strong>Inc</strong>ome 5,600.00<br />

Expense<br />

Ads 812.52<br />

Bank Charge 55.85<br />

Dining 140.85<br />

Dues and<br />

Subscriptions 263.73<br />

Legal 2,603.42<br />

Office 16.49<br />

Prof and Legal Fees 1,680.00<br />

Rent 2,000.00<br />

Travel 134.40<br />

Total Expense 7,707.26<br />

Net <strong>Inc</strong>ome -2,107.26<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 9 of 11

Balance Sheet for<br />

Period<br />

January 1, 2013 to March 31, 2013<br />

Non Cummulative<br />

Mar 31, 13<br />

ASSETS<br />

Current Assets<br />

Checking/Savings<br />

Bank Account 26,173.37<br />

Credit Line - 39,849.64<br />

Total Checking/Savings 66,023.01<br />

Total Current Assets 66,023.01<br />

Other Assets<br />

Deposit for Finance Package 200,000.00<br />

Total Other Assets 200,000.00<br />

TOTAL ASSETS 266,023.01<br />

LIABILITIES & EQUITY<br />

Equity<br />

Investor PPM Direct 226,300.00<br />

Opening Balance Equity -10,141.21<br />

Retained Earnings 51,971.48<br />

Net <strong>Inc</strong>ome -2,107.26<br />

Total Equity 266,023.01<br />

TOTAL LIABILITIES & EQUITY 266,023.01<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 10 of 11

<strong>Green</strong> <strong>Energy</strong> <strong>Solution</strong> <strong>Industries</strong>, <strong>Inc</strong>.<br />

Statement of Shareholders' Equity (Deficit)<br />

Additional Retained<br />

$.001 Par Value Paid-In Earnings<br />

Shares Amount Capitial Deficit Total<br />

Balance at December 31. 2012 285,070,651 285070 1,093,442 (2,081,654) (703,142)<br />

*Stock Issued for Debt 7,625,000 7625 7,625<br />

Restricted Shares Issued 13,455,000 0<br />

Net <strong>Inc</strong>ome (Loss) 306,150,651 292695 1,093,442 (2,081,654) (695,517)<br />

Preferred Stock<br />

Balance at December 2011 1,000,000 1000 1,000<br />

Balance for December 2012 1,000,000 1000 1,000<br />

*numbers are whole rounded numbers.<br />

** numbers do include negative paid in capital<br />

attributed to Prior Owners<br />

<strong>OTC</strong> <strong>Markets</strong> Group <strong>Inc</strong>.<br />

<strong>OTC</strong> Pink Basic Disclosure Guidelines (v1.0 January 3, 2013) Page 11 of 11