2009, Third Quarter - Mark Pankin Home Page

2009, Third Quarter - Mark Pankin Home Page

2009, Third Quarter - Mark Pankin Home Page

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong> <strong>Third</strong> <strong>Quarter</strong> Volume 15.1<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed<br />

Accounts Newsletter<br />

Please Note<br />

I will be contacting clients for my more or less annual or more frequent follow-up discussions<br />

about your investment objectives and overall financial picture. The default method will be over the<br />

phone, possibly using e-mail to determine good times for me to call you. If you prefer, we can do it<br />

all via e-mail or not at all if nothing significant has changed. Just drop me an e-mail at<br />

“mdp2@pankin.com”.<br />

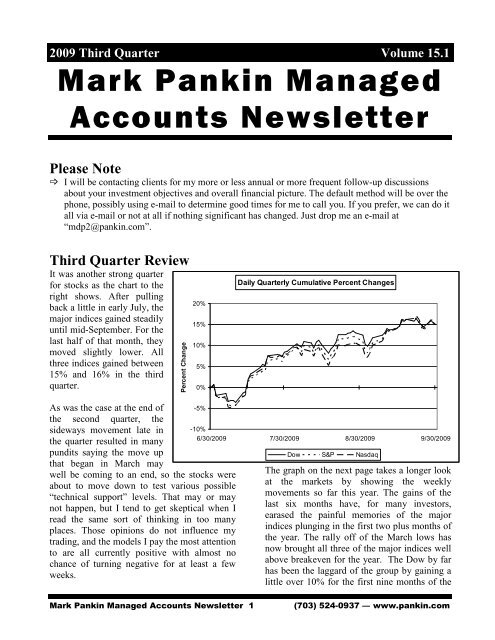

<strong>Third</strong> <strong>Quarter</strong> Review<br />

It was another strong quarter<br />

for stocks as the chart to the<br />

right shows. After pulling<br />

back a little in early July, the<br />

major indices gained steadily<br />

until mid-September. For the<br />

last half of that month, they<br />

moved slightly lower. All<br />

three indices gained between<br />

15% and 16% in the third<br />

quarter.<br />

Percent Change<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Daily <strong>Quarter</strong>ly Cumulative Percent Changes<br />

As was the case at the end of -5%<br />

the second quarter, the<br />

sideways movement late in -10%<br />

the quarter resulted in many<br />

pundits saying the move up<br />

that began in March may<br />

well be coming to an end, so the stocks were<br />

about to move down to test various possible<br />

“technical support” levels. That may or may<br />

not happen, but I tend to get skeptical when I<br />

read the same sort of thinking in too many<br />

places. Those opinions do not influence my<br />

trading, and the models I pay the most attention<br />

to are all currently positive with almost no<br />

chance of turning negative for at least a few<br />

weeks.<br />

6/30/<strong>2009</strong> 7/30/<strong>2009</strong> 8/30/<strong>2009</strong> 9/30/<strong>2009</strong><br />

Dow S&P Nasdaq<br />

The graph on the next page takes a longer look<br />

at the markets by showing the weekly<br />

movements so far this year. The gains of the<br />

last six months have, for many investors,<br />

earased the painful memories of the major<br />

indices plunging in the first two plus months of<br />

the year. The rally off of the March lows has<br />

now brought all three of the major indices well<br />

above breakeven for the year. The Dow by far<br />

has been the laggard of the group by gaining a<br />

little over 10% for the first nine months of the<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 1<br />

(703) 524-0937 — www.pankin.com

year. The S&P is doing<br />

considerably better being up<br />

17%, but the real star has 40%<br />

been the Nasdaq Composite,<br />

30%<br />

which has more than<br />

doubled the gains of the<br />

20%<br />

S&P by climbing almost<br />

35% for the first three<br />

quarters. It is typical that the<br />

10%<br />

0%<br />

Nasdaq, which is heavily -10%<br />

influenced by high tech<br />

stocks, moves up faster than<br />

the other two. However, the<br />

-20%<br />

-30%<br />

extent of the difference this<br />

year is unusually large,<br />

which might suggest that the<br />

market is getting a bit “frothy” and may be due<br />

for a “correction” in the not too distant future.<br />

The traditional seasonal patterns have not held<br />

so far in <strong>2009</strong>. January saw the S&P fall by<br />

over 8%, so according to the “barometer” based<br />

on that month, the remainder of the year did not<br />

figure to be a good one for stocks. The fourth<br />

quarter would have to see a substantial pullback<br />

for that to be true. One old saw is “sell in May<br />

and go away” to take advantage of the<br />

historical pattern of the November through<br />

April six months being much stronger than the<br />

May through October period. Clearly that has<br />

not been so this year. The November-January<br />

period is historically the best three months for<br />

stocks although that was not the case last year.<br />

It will interesting to see if that behavior<br />

resumes later this year or if the pattern of antipatterns<br />

1 continues.<br />

Managed accounts did well in the third<br />

quarter and for the year to date:<br />

The active management style I use for<br />

managing accounts is designed to manage risk<br />

by avoiding large drawdowns in account values<br />

as well as generating substantial profits in<br />

favorable market conditions. For the most part<br />

that has been the case so far this year.<br />

1 Am I trying to write my own Wall Street Gibberish?!<br />

Percent Change<br />

Weekly Cumulative Percent Changes for <strong>2009</strong><br />

12/31/2008 3/31/<strong>2009</strong> 6/30/<strong>2009</strong> 9/30/<strong>2009</strong><br />

Dow S&P Nasdaq<br />

All of the returns shown below are based on<br />

trading in typical accounts. With the exception<br />

of the model for trading real estate funds, the<br />

values include the effects of my management<br />

fees.<br />

Selects Switching: My oldest managed<br />

account program, which began in late 1994,<br />

trades the Fidelity Selects group of sector<br />

funds. All accounts began the third quarter<br />

fully invested holding two Select funds. The<br />

weakness of stocks in early July resulted in our<br />

moving to being entirely in cash by the middle<br />

of that month. Later in the month, accounts<br />

were half in a single sector fund and half in<br />

cash. After Labor Day, they were again fully<br />

invested by holding two Select funds, which<br />

was the position at the end of the quarter.<br />

For the third quarter, accounts gained 6.7%,<br />

and they are virtually even for <strong>2009</strong>.<br />

Performance for the year was hurt by not being<br />

able to buy a fund in April that Fidelity was<br />

closing in June. That was discussed in the last<br />

editions of this and the program specific<br />

newsletter.<br />

Rydex Sector Trading: I have two methods I<br />

use in managed accounts. One, which I call<br />

Sector Trading Adverse to Risk (STAR), places<br />

more emphasis on risk reduction than<br />

exceptional profits. With the weak markets for<br />

the first two months of the year, the accounts<br />

were totally in cash far more often than they<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 2<br />

(703) 524-0937 — www.pankin.com

nibbled at attractive sector funds. Trading<br />

activity picked up in the second quarter and<br />

continued through the third quarter. However,<br />

much of the time there were partial holdings of<br />

the money market fund. One reason is that the<br />

method requires a pullback before buying a<br />

fund, and in very strong markets such actions<br />

may not occur very often. Nonetheless, the<br />

cautious approach has worked well this year as<br />

the typical account gained 12.8% in the third<br />

quarter, which brought <strong>2009</strong> gains up to 27.5%.<br />

The other method is called Aggressive Rydex<br />

Trading (ART). While STAR may own up to<br />

three sector funds at a time and will be partially<br />

or fully in money market more often than not,<br />

ART normally owns just one sector fund at a<br />

time and will be out of the market only when I<br />

judge that the risks of stock ownership in<br />

general and trading sector funds are too high<br />

relative to the potential rewards. Also, ART<br />

may own Rydex Precious Metals instead of or<br />

in addition to one other sector fund. That fund<br />

has been owned for more than two years.<br />

Originally about 20% of assets were placed into<br />

the gold fund, and in January 2008 those<br />

positions were increased.<br />

ART accounts had stopped trading sector funds<br />

in mid-January as the weak markets made the<br />

risks of aggressive sector fund trading too high<br />

relative to the potential profits. Trading of<br />

sector funds resumed in early April and has<br />

continued through the end of third quarter<br />

except for a few days in July. For the third<br />

quarter, the sector fund trading gained 6.5%,<br />

which moved it ahead 3.1% for the nine<br />

months. The gold fund has showed nice gains,<br />

although with a considerable amount of<br />

volatility, so far this year. For the last quarter,<br />

the fund was up 23%, and for the year so far it<br />

is up almost 45%. The combination of the two<br />

trading types gained 10.1% in the third quarter,<br />

and ART accounts are up 10.4% for the year so<br />

far.<br />

Dow Turnarounds: Unlike those above, this<br />

managed account program can buy individual<br />

stocks instead of or in addition to mutual funds.<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 3<br />

Some accounts may also employ options<br />

strategies, usually fairly conservative ones. All<br />

the stocks it buys are in the Dow Jones<br />

Industrial Average when they have been beaten<br />

down enough. The plan is holding them for two<br />

or three years until their prices recover.<br />

Sometimes, the recovery comes in less than a<br />

year.<br />

Up until this past year, my thinking was those<br />

Dow components and other “blue chip” stocks<br />

that had seen their prices drop significantly<br />

could be considered as relatively low-risk<br />

investments. However, we have seen too many<br />

of them—AIG, Citigroup, and GM in<br />

particular—have virtually all of their value<br />

wiped out, and they are unlikely to see any<br />

meaningful recovery in their worth for years if<br />

at all. All three of those have been removed<br />

from the Dow. I still think beaten down Dow<br />

stocks can be outstanding investments, but in<br />

the current market environment, the risks of<br />

owning them are far higher than they have been<br />

historically.<br />

It is fortunate that the one remaining Dow<br />

Turnarounds account has never been invested<br />

entirely in Dow stocks. It currently also holds<br />

positions in an index fund, a gold fund, and a<br />

real estate fund. For the third quarter it gained<br />

12.8% and for the year it is ahead 18.4%.<br />

Tactical Asset Allocation: These accounts<br />

sold their equity fund holdings in December<br />

2007 and were out of stocks until early June<br />

except for a one-week whipsaw trade in an<br />

S&P index fund in late May 2008. The S&P<br />

index fund purchased at the beginning of June<br />

was sold in late July, and bought again in late<br />

August. It is still held at the end of the quarter.<br />

There is no “pure” TAA account, but the TAA<br />

newsletter has examples of how such an<br />

account might have performed.<br />

The typical managed account in this program<br />

holds a gold stock fund and also trades<br />

according to non-TAA models, such as the one<br />

for real estate funds. This program provides a<br />

wide range of options in the conservative-to-<br />

(703) 524-0937 — www.pankin.com

aggressive spectrum. The choice of target<br />

allocations and possible trading according to<br />

other models is customized to fit client needs in<br />

order to achieve financial goals within the<br />

anticipated investment time frame and at<br />

acceptable risk levels.<br />

The gold stock fund has done well as discussed<br />

under Rydex sectors as has the real estate fund,<br />

which is discussed below. Combined with the<br />

index fund trading, the typical account gained<br />

almost 15% for the quarter and is ahead 23.5%<br />

for the year so far.<br />

Some of these managed account programs have<br />

separate newsletters that provide details and<br />

additional commentary. Please request any of<br />

interest.<br />

Real Estate Fund Model: About three years<br />

ago I developed a trend following model based<br />

on the Fidelity Real Estate Investment Fund<br />

(ticker symbol FRESX). That fund has the<br />

longest history of any fund in the sector, and I<br />

base my research on historical performance,<br />

which is why I used it. Funds from some other<br />

companies perform quite similarly as does at<br />

least one exchange traded real estate fund.<br />

The model I developed had been negative since<br />

November 2007 as real estate property values<br />

fell sharply as part of the financial crisis in<br />

2008. In late April, the model gave a buy<br />

signal. The fund gained 41% in the third<br />

quarter bringing the open trade profit to about<br />

50% at the end of September.<br />

As is the case with gold stock funds, real estate<br />

funds can be quite volatile, so trading them<br />

entails a significant level of risk. Consequently,<br />

it is best to limit ones exposure to such funds.<br />

Depending on how risk tolerant one is, 10-20%<br />

of the portfolio would be an appropriate<br />

maximum exposure.<br />

As always, you should not assume that any of<br />

the investment performance discussed here will<br />

be achieved in the future. Also, there can be no<br />

assurances that any of the trading methods or<br />

client accounts will be profitable in the future.<br />

Stock <strong>Mark</strong>et Perspective: Is the Secular Bear Losing Its Claws?<br />

Conventional “wisdom” defines a bear market<br />

as a 20% drop from a previous high, and also<br />

uses a gain of that size to establish a bull<br />

market. 2 The size of the gains since early<br />

March has generated a lot of talk and writing<br />

about whether the March lows will be the<br />

ultimate lows of the secular bear market that<br />

began in 2000. If so, we may now be in a<br />

secular bull market.<br />

historically low levels. For example, in late<br />

1974, the price-to-earnings ratio for the S&P<br />

500 fell to about 8, and in late 1979 and early<br />

1980 is was around 7. Currently, its P/E based<br />

on estimated earnings for the next 12 months is<br />

in the 15-17 range. Bullish pundits say that is a<br />

“fair value” because it is close to some<br />

historical average or another depending on the<br />

period of the average.<br />

My guess is that the secular bear is still on the<br />

prowl, so the current rise is a cyclical bull<br />

market rather than the start of a very long<br />

period of rising markets. I say that because<br />

secular bear markets in the past have not been<br />

over until valuations are beaten down to<br />

2 Since it takes a 25% gain to recover a 20% loss, the<br />

definition of a bull market should require that much of a<br />

gain. Wisdom is in quotes due to “thinking” that a fixed<br />

percentage can define a change in the animalistic nature<br />

of the stock market.<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 4<br />

There are a couple of problems with that<br />

reasoning. Since current earnings are<br />

depressed, the current P/E based on trailing<br />

earnings is quite high, over 70 according to The<br />

Wall Street Journal. Since earnings are almost<br />

certain to improve, it makes sense to use<br />

estimates, but earnings estimates are<br />

notoriously inaccurate. Even if a P/E around 15<br />

is some sort of “fair” value for stocks, markets<br />

typically overshoot “correct” valuations in both<br />

directions. If prior secular bear markets are any<br />

(703) 524-0937 — www.pankin.com

guide, we are going to see a P/E based on real,<br />

not estimated, earnings much lower than 15.<br />

In order to get some idea of how the current<br />

secular bear may play out, I will compare what<br />

we have seen so far with the last full one in the<br />

1966-82 period. That will at best provide a<br />

rough idea. One prior comparison has no<br />

statistical significance. Moreover, the end of<br />

the period was more than a quarter century ago<br />

and its beginning was more than four decades<br />

in the past when LBJ was the President and<br />

Obama was starting elementary school.<br />

The approach is looking at the changes in<br />

percentage terms of the S&P 500 from the high<br />

points in 1966 and 2000. I use close of the<br />

week data to keep the graphs from becoming<br />

too messy. In 1966 the weekly high of 93.81<br />

was made on February 11. In <strong>2009</strong> dollars,<br />

using the Consumer Price Index (CPI) to make<br />

the adjustment, that value is 626.93. That is less<br />

than ten percent lower than the low the S&P<br />

made this past March, 43 years later, which<br />

shows how secular bear markets can be<br />

devastating to longer term investment returns.<br />

The highest weekly close in 2000 was on<br />

March 24. The index was at 1527.46, or<br />

1908.04 in constant <strong>2009</strong> dollars.<br />

The graph below is based on the inflation<br />

adjusted weekly index values. The longer solid<br />

line tracks the index in the 1966-82 secular<br />

bear market. The chart goes through the end of<br />

1982 even though the market bottomed out in<br />

August. The shorter dashed line shows the<br />

index changes since March 24, 2000, the start<br />

of the current secular bear market, which is<br />

now more than nine years old.<br />

There are some striking similarities and<br />

differences. The actual S&P made new highs in<br />

the 1969 and again in early 1973. Adjusting for<br />

inflation, the movement was essentially<br />

sideways, which is not unusual in a secular bear<br />

market. In contrast, the index lost about half of<br />

its “real” value in the first three years after<br />

2000. About seven years into the periods, the<br />

Inflation Adjusted S&P 500 from Start of Secular Bear <strong>Mark</strong>ets<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

-60%<br />

-70%<br />

0 3 6 9 12 15<br />

Years Since High<br />

Feb. 11, 1966 - Dec. 31, 1962 Mar. 24, 2000 - Oct. 2, <strong>2009</strong><br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 5<br />

(703) 524-0937 — www.pankin.com

index topped out and fell sharply. In the older<br />

one, it almost reached the 1966 high. However,<br />

when it made new nominal highs in 2007, the<br />

S&P was still almost 20% lower in constant<br />

dollars than it was at the start of the secular<br />

bear market. After those peaks, the sell offs in<br />

the next year to two years were quite severe<br />

leading to drawdowns of around 60% in<br />

inflation adjusted terms.<br />

The cyclical bull<br />

market that began in<br />

late 1974 had its peak<br />

about 15 months later about 43% above the low<br />

in constant dollars. That rise is not as great as<br />

in the current cyclical bull market and it took<br />

quite a bit longer. After that, the overall trend<br />

down resumed for nearly another six years.<br />

The graph on the previous page suggests that<br />

we are about half way through the current<br />

secular bear market. Such is consistent with<br />

bear periods historical length of 15-20 years.<br />

One significant difference between the current<br />

one and the last half of the prior one is the rate<br />

of inflation. After pushing above 5% for a few<br />

months in the summer of 2008, the year-overyear<br />

change in the CPI is now negative and<br />

figures to remain quite low for at least another<br />

year. The greater concern now is avoiding a<br />

prolonged and deep deflation that could lead to<br />

a very severe recession or a full depression.<br />

The annual change in the CPI climbed steadily<br />

in the early 1970s and peaked over 12% in late<br />

1974 3 when the drop in stocks from the early<br />

1973 peak bottomed out. Inflation dropped<br />

briefly under 5% in 1976 before soaring to<br />

about 14% in 1980. Those high values pull<br />

down the inflation adjusted S&P shown in the<br />

chart.<br />

Another major difference between the current<br />

environment and the 1966-82 period is the<br />

dividend yield on the S&P. Back then the yield<br />

level rarely got much below 3%, which was<br />

The secular bear market is now over nine<br />

years old. Have we seen the low point as<br />

we did by one measure in the last one?<br />

sometimes considered an indication that stocks<br />

were overvalued. By late 1974, the yield was<br />

over 5%. It fell to under 4% later in that decade<br />

before rising to a peak of 6.4% 4 in June 1982, a<br />

couple of months before the low at the end of<br />

the secular bear market. In contrast, the S&P’s<br />

yield in 2000 at the end of the long secular bull<br />

market fell to just a bit<br />

over one percent, and<br />

is still below 2.5%.<br />

Dividend policies of<br />

most corporations have<br />

changed considerably, so it is unlikely that the<br />

higher level of yields will be seen any time in<br />

the foreseeable future. One factor in the 1970s<br />

was that the high inflation often enabled<br />

companies to raise their prices, which resulted<br />

in increased nominal earnings and the<br />

capability to pay higher dividends. To improve<br />

the comparison between the two periods’<br />

market movements, the graph on the next page<br />

shows the total return of the S&P 500 adjusted<br />

for inflation. The total return lines assume<br />

reinvestment of the dividends, which is<br />

normally what happens with an index tracking<br />

mutual fund. There were no index funds in<br />

1966; Vanguard started the first one in 1976. A<br />

very low expense ratio fund such as that one,<br />

ones offered by some other fund companies,<br />

and the exchanged traded “spiders” fund will<br />

closely track the total return of the S&P 500.<br />

We can see that when looking at the total<br />

return, the drop in late 1974 was reduced quite<br />

a bit, from almost 60% below the start of the<br />

secular bear to a little over 40%. The drop since<br />

2000 also is reduced, but not by a whole lot,<br />

from somewhat over 60% to a bit under that<br />

level.<br />

The high dividend yields resulted in the total<br />

return inflation adjusted low point during the<br />

prior secular bear being in late 1974. In<br />

November 1980, the purchasing power of the<br />

total return index was back to where it was in<br />

3 You may remember President Ford wearing a WIN<br />

button standing for whip inflation now.<br />

4 Data downloaded from the web site of the American<br />

Association of Individual Investors (AAII).<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 6<br />

(703) 524-0937 — www.pankin.com

February 1966 for a couple of weeks. At least<br />

the “buy and hope” investor in a hypothetical<br />

S&P index fund with a zero expense ratio<br />

lower, which would result in the dashed line<br />

falling substantially. Another reason the current<br />

market may not keep up with the late 1970s is<br />

Inflation Adjusted S&P 500 Total Return from Start of Secular Bear <strong>Mark</strong>ets<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

-40%<br />

-50%<br />

-60%<br />

0 3 6 9 12 15<br />

would briefly have preserved his or her<br />

purchasing power over an almost fifteen year<br />

period. 5 That assumes the investor could stand<br />

seeing the fund lose almost half of its<br />

purchasing power and could hold on and not<br />

sell the fund.<br />

The chart suggests that the worst of the current<br />

bear market may be over. As long as inflation<br />

remains very low, even today’s meager<br />

dividend yields will enhance the inflation<br />

adjusted total return of the index. Due to<br />

current corporate dividend policies, it is<br />

unlikely that the yield on the S&P will rise<br />

significantly unless stock prices move sharply<br />

5 The fund would need to have been held in a<br />

hypothetical IRA or 401(K) type account, which did not<br />

exist in 1966, or there would have been taxes to be paid<br />

on the fund’s distributions. Even in such an account the<br />

taxes due when money was withdrawn would bring the<br />

real after-tax returns to less than breakeven.<br />

Years Since High<br />

Feb. 11, 1966 - Dec. 31, 1962 Mar. 24, 2000 - Oct. 2, <strong>2009</strong><br />

that inflation may well pick up if the economy<br />

starts growing again. There has been a lot of<br />

money pumped in by the Fed. Although it<br />

claims it will be able to drain liquidity to<br />

prevent high inflation when the time comes,<br />

that is a daunting task requiring precise timing<br />

to avoid severely hurting the economy. Based<br />

on the uncertainties and difficulties involved,<br />

the past Fed performance suggests that it will<br />

not be able to achieve its goals all that well.<br />

Another reason I am not optimistic about the<br />

chances of the future course of the dashed line<br />

following the solid one is the P/E ratios<br />

discussed at the beginning of this section. In<br />

other words, despite the two deep drops we<br />

have seen since 2000, I don’t think the level of<br />

fear among the investing public has yet reached<br />

the capitulation point where it takes an<br />

immense amount of courage to continue<br />

owning stocks, much less buy more. That is the<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 7<br />

(703) 524-0937 — www.pankin.com

sort of pessimism that marks secular bear<br />

market lows. Please note that these views do<br />

not affect my management of your accounts as<br />

well as my personal ones because it is done<br />

using thoroughly tested formulas that tell me<br />

when I should or should not be in stocks.<br />

(Not Quite) Wall Street Gibberish<br />

Normally I use this occasional feature to<br />

expose spoken or written “wisdom” that is<br />

technically correct, but is also misleading and<br />

potentially harmful to investors’ financial well<br />

being. This time I was motivated by a Wall<br />

Street Journal article about a woman in<br />

England who has been on a thirty year<br />

campaign for “Plain English” to make business<br />

and government writing understandable and to<br />

eliminate confusing and ambiguous text. For<br />

example, instead of a bank talking about a<br />

“maximum debit balance,” they should say the<br />

“most that can be owed.” Or the Fed and<br />

Britain’s central bank say they will be doing<br />

“quantitative easing” when it would be clearer<br />

to say they are adding money to the economy.<br />

In that spirit, I found a humorous list of famous<br />

book titles and what they might be if written in<br />

today’s hype filled environment:<br />

Questions and Answers<br />

To make sure I answer the right ones, be sure to ask them.<br />

Original: The Wealth of Nations<br />

Revised: Invisible Hands: The Mysterious<br />

<strong>Mark</strong>et Forces That Control Our Lives and<br />

How to Profit from Them<br />

Original: Walden<br />

Revised: Camping with Myself: Two Years in<br />

American Tuscany<br />

Original: The Theory of the Leisure Class<br />

Revised: Buying Out Loud: The Unbelievable<br />

Truth About What We Consume and What It<br />

Says About Us<br />

Original: The Prince<br />

Revised: The Prince (Foreword by Oprah<br />

Winfrey)<br />

How to Contact Me<br />

Questions, comments, requests for information, or anything else you feel like talking about:<br />

<strong>Mark</strong> D. <strong>Pankin</strong><br />

1018 N. Cleveland St.<br />

Arlington, VA 22201<br />

(703) 524-0937 (voice and fax)<br />

E-mail: mdp2@pankin.com<br />

Internet web site: http://www.pankin.com<br />

<strong>Mark</strong> <strong>Pankin</strong> Managed Accounts Newsletter 8<br />

(703) 524-0937 — www.pankin.com