PASADENA ISD 403(b) Plan - Pasadena Independent School District

PASADENA ISD 403(b) Plan - Pasadena Independent School District

PASADENA ISD 403(b) Plan - Pasadena Independent School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PASADENA</strong> <strong>ISD</strong> <strong>403</strong>(b) <strong>Plan</strong><br />

You must open your account an approved vendor before you set up the<br />

payroll deduction on the JEM website.<br />

<strong>Pasadena</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> offers employees a payroll reduction<br />

plan for the purchase of annuities or other authorized investments as<br />

authorized by the Internal Revenue Code, Section <strong>403</strong>(b). P<strong>ISD</strong> has<br />

contracted with JEM Resource Partners to be our Third Party Administrator<br />

for our <strong>403</strong>(b) <strong>Plan</strong>.<br />

JEM Resource Partners Contact Information is:<br />

JEM Resource Partners<br />

900 S. Capital of Texas Hwy. Suite 350<br />

Austin, Texas 78746<br />

Phone (800) 943-9179 Fax (888) 989-9247<br />

Email at <strong>403</strong>b@jemtpa.com<br />

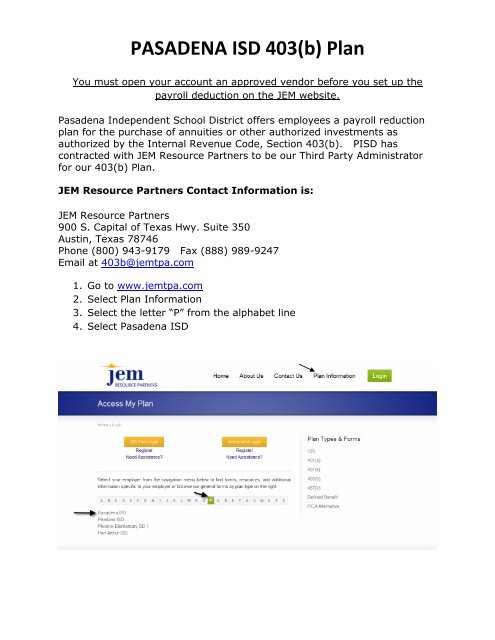

1. Go to www.jemtpa.com<br />

2. Select <strong>Plan</strong> Information<br />

3. Select the letter “P” from the alphabet line<br />

4. Select <strong>Pasadena</strong> <strong>ISD</strong>

The list of approved vendors can be found under <strong>Plan</strong> Description,<br />

then select <strong>403</strong>(b) Texas Approved Vendor List<br />

You need to contact the vendor you choose and open an account<br />

with that company before you set up your payroll deduction on the<br />

JEM website.

Once you have established an account with an approved vendor, you<br />

will log onto the JEM website to set up your payroll deduction.<br />

Select either the Orange Login or the Register button and you will be<br />

directed to the next screen: “The Retirement Solution”<br />

If you currently have a <strong>403</strong>B payroll deduction:<br />

Enter your SSN as<br />

your User ID<br />

Enter the last four<br />

digits of your SSN<br />

as your password

If you do not have a <strong>403</strong>b payroll deduction and have opened an<br />

account with an approved vendor,<br />

Enter your SSN<br />

Enter “pasad<strong>403</strong>”<br />

as the Password,<br />

click on “Begin”<br />

If you have any problems,<br />

please call JEM customer<br />

service at 800-943-9179<br />

To Make Changes to your <strong>403</strong>b Contributions:<br />

If you want to make changes to your contribution amount, you will need to log<br />

onto the JEM website and make your change. Once you have submitted the<br />

change, you will receive a confirmation number. Keep this confirmation number<br />

for your records.<br />

Change to Contribution amount only:<br />

Select the new dollar amount and confirm the change<br />

Change to Vendor:<br />

You must open your account with the vendor before you make the change on the<br />

JEM website. Once you have opened your account, then you make the change of<br />

the vendor name on the JEM website. If the account is not opened with the<br />

vendor before you make the change on the JEM website, the vendor will not

accept the contribution that is deducted from your payroll. Those funds will be<br />

placed in suspense until you open an account with an approved vendor.<br />

JEM <strong>403</strong>(b) <strong>Plan</strong> Distribution, Loan, Exchange, Transfer and Rollover Information<br />

To process a transfer, rollover or withdrawal from your <strong>403</strong>b plan, you will need to complete the<br />

Distribution form for JEM Resource Partners. Your vendor may require additional forms to meet their<br />

company policies. All forms will need to be faxed to JEM Resource Partners using the <strong>403</strong>(b)<br />

Distribution Fax Cover Sheet.<br />

Questions:<br />

Technical questions regarding the JEM website: 1-800-943-9179<br />

General P<strong>ISD</strong> <strong>403</strong>(b) Payroll Deduction questions: 713-740-0263